425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on September 27, 2021

Filed by Reinvent Technology Partners Y Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Aurora Innovation, Inc. Commission File No. 333-257912 Aurora Investment Memo September 2021Filed by Reinvent Technology Partners Y Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Aurora Innovation, Inc. Commission File No. 333-257912 Aurora Investment Memo September 2021

Disclaimer This presentation (this “Presentation”) was prepared by Reinvent Technology Partners Y (“RTPY”) and Aurora Innovation, Inc. (“Aurora”) in connection with their proposed accuracy or completeness of these data. business combination. By accepting this Presentation, you agree to use this Presentation for the sole purpose of evaluating the potential transaction. Any reproduction or distribution of this Presentation, in whole or in part, or the disclosure of its contents, without the prior consent of RTPY and Aurora is prohibited. This Presentation is for FINANCIAL INFORMATION AND NON-GAAP MEASURES informational discussion purposes only and does not constitute an offer to sell or exchange nor a solicitation of an offer to buy or exchange any securities, nor shall there be any This Presentation contains certain estimated preliminary financial results and key operating metrics. This information is preliminary and subject to change. As such, the actual sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. results may differ from the estimated preliminary results presented here. This Presentation includes non-GAAP financial measures. These non-GAAP measures are an addition This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to any law or regulation. performance measures derived in accordance with GAAP. Other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Aurora’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies or transactions. Additionally, to the NO REPRESENTATIONS AND WARRANTIES extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP This Presentation is not intended to form the basis of any investment decision by you and does not constitute investment, tax or legal advice. No representation or warranty, measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. express or implied, is or will be given by RTPY or Aurora or any of its respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this Presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of USE OF PROJECTIONS its evaluation of the proposed transaction and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or This Presentation also contains certain financial forecasts. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of misstatements, negligent or otherwise, relating thereto. You also acknowledge and agree that the information contained in this Presentation is preliminary in nature and is future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, subject to change, and any such changes may be material. RTPY and Aurora disclaim any duty to update the information contained in this Presentation. economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of RTPY’s and Aurora’s control. While all financial projections, estimates and targets are necessarily speculative, RTPY FORWARD LOOKING STATEMENTS and Aurora believe the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between RTPY and extends from the date of preparation. Accordingly, there can be no assurance that the prospective results are indicative of future performance of RTPY, Aurora or the combined Aurora. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” company after the proposed transaction or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “continue,” “likely,” and similar expressions. Forward-looking statements are predictions, projections and prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause information will be achieved. actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the price of RTPY’s securities, (ii) the risk that the proposed transaction may not be completed by RTPY’s IMPORTANT INFORMATION FOR INVESTORS AND STOCKHOLDERS business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by RTPY, (iii) the failure to satisfy the conditions to This document relates to a proposed transaction between RTPY and Aurora. This document is not a proxy, consent or authorization with respect to any securities or in respect of the consummation of the proposed transaction, including the adoption of the Agreement and Plan of Merger, dated as of July 14, 2021 (the “Merger Agreement”), by and the proposed transaction and does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of among RTPY, Aurora and RTPY Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of RTPY, by the shareholders of RTPY, the satisfaction of the securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. RTPY minimum cash condition following redemptions by RTPY’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the inability to complete has filed a registration statement on Form S-4 (333-257912), which includes a preliminary prospectus and proxy statement of RTPY, referred to as a proxy statement/prospectus. the PIPE investment in connection with the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the A final proxy statement/prospectus will be sent to all RTPY shareholders. RTPY also will file other documents regarding the proposed transaction with the SEC. Before making any Merger Agreement, (vi) the effect of the announcement or pendency of the proposed transaction on Aurora’s business relationships, operating results and business generally, voting or investment decision, investors and security holders of RTPY are urged to read the registration statement, the proxy statement/prospectus and all other relevant (vii) risks that the proposed transaction disrupts current plans and operations of Aurora and potential difficulties in Aurora employee retention as a result of the proposed documents filed or that will be filed with the SEC in connection with the proposed transaction because they will contain important information about the proposed transaction. transaction, (viii) the outcome of any legal proceedings or other disputes that may be instituted against Aurora or against RTPY related to the Merger Agreement or the proposed transaction or otherwise, (ix) the ability to maintain the listing of RTPY’s securities on a national securities exchange, (x) the price of RTPY’s securities may be volatile due to a Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will variety of factors, including changes in the competitive and highly regulated industries in which RTPY plans to operate or Aurora operates, variations in operating performance be filed with the SEC by RTPY through the website maintained by the SEC at www.sec.gov. across competitors, changes in laws and regulations affecting RTPY’s or Aurora’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, and (xii) the risk of downturns and a The documents filed by RTPY with the SEC also may be obtained free of charge at RTPY’s website at https://y.reinventtechnologypartners.com or upon written request to 215 changing regulatory landscape in the highly competitive self-driving industry. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors Park Avenue, Floor 11 New York, NY. and the other risks and uncertainties described in the “Risk Factors” section of RTPY’s registration statement on Form S-1 (File No. 333-257912), its Quarterly Reports on Form 10-Q for the periods ended March 31, 2021 and June 30, 2021, respectively, the registration statement on Form S-4 discussed below and other documents filed by RTPY from PARTICIPANTS IN THE SOLICITATION time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those RTPY and Aurora and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from RTPY’s shareholders in connection contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward- with the proposed transaction. A list of the names of the directors and executive officers of RTPY and Aurora and information regarding their interests in the proposed looking statements, and RTPY and Aurora assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, transaction are set forth in the proxy statement/prospectus. You may obtain free copies of these documents as described in the preceding paragraph. future events, or otherwise. Neither RTPY nor Aurora gives any assurance that either RTPY or Aurora or the combined company will achieve its expectations. TRADEMARKS All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners and this Presentation’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, copyrights, logos and other intellectual property. Solely for convenience, trademarks and trade names referred to in this Presentation may appear with the ® or ™ symbols, but such references are not intended to indicate, in any way, that such names and logos are trademarks or registered trademarks of RTPY or Aurora. INDUSTRY AND MARKET DATA This Presentation contains statistical data, estimates and forecasts provided by Aurora and/or based on independent industry publications or other publicly available information, as well as other information based on Aurora’s internal sources. This information involves many assumptions and limitations and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data that has been provided by Aurora and/or contained in these industry publications and other publicly available information. Accordingly, neither RTPY nor Aurora nor any of their affiliates and advisors makes any representations as to the 2Disclaimer This presentation (this “Presentation”) was prepared by Reinvent Technology Partners Y (“RTPY”) and Aurora Innovation, Inc. (“Aurora”) in connection with their proposed accuracy or completeness of these data. business combination. By accepting this Presentation, you agree to use this Presentation for the sole purpose of evaluating the potential transaction. Any reproduction or distribution of this Presentation, in whole or in part, or the disclosure of its contents, without the prior consent of RTPY and Aurora is prohibited. This Presentation is for FINANCIAL INFORMATION AND NON-GAAP MEASURES informational discussion purposes only and does not constitute an offer to sell or exchange nor a solicitation of an offer to buy or exchange any securities, nor shall there be any This Presentation contains certain estimated preliminary financial results and key operating metrics. This information is preliminary and subject to change. As such, the actual sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. results may differ from the estimated preliminary results presented here. This Presentation includes non-GAAP financial measures. These non-GAAP measures are an addition This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to any law or regulation. performance measures derived in accordance with GAAP. Other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Aurora’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies or transactions. Additionally, to the NO REPRESENTATIONS AND WARRANTIES extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP This Presentation is not intended to form the basis of any investment decision by you and does not constitute investment, tax or legal advice. No representation or warranty, measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. express or implied, is or will be given by RTPY or Aurora or any of its respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this Presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of USE OF PROJECTIONS its evaluation of the proposed transaction and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or This Presentation also contains certain financial forecasts. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of misstatements, negligent or otherwise, relating thereto. You also acknowledge and agree that the information contained in this Presentation is preliminary in nature and is future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, subject to change, and any such changes may be material. RTPY and Aurora disclaim any duty to update the information contained in this Presentation. economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of RTPY’s and Aurora’s control. While all financial projections, estimates and targets are necessarily speculative, RTPY FORWARD LOOKING STATEMENTS and Aurora believe the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between RTPY and extends from the date of preparation. Accordingly, there can be no assurance that the prospective results are indicative of future performance of RTPY, Aurora or the combined Aurora. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” company after the proposed transaction or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “continue,” “likely,” and similar expressions. Forward-looking statements are predictions, projections and prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause information will be achieved. actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the price of RTPY’s securities, (ii) the risk that the proposed transaction may not be completed by RTPY’s IMPORTANT INFORMATION FOR INVESTORS AND STOCKHOLDERS business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by RTPY, (iii) the failure to satisfy the conditions to This document relates to a proposed transaction between RTPY and Aurora. This document is not a proxy, consent or authorization with respect to any securities or in respect of the consummation of the proposed transaction, including the adoption of the Agreement and Plan of Merger, dated as of July 14, 2021 (the “Merger Agreement”), by and the proposed transaction and does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of among RTPY, Aurora and RTPY Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of RTPY, by the shareholders of RTPY, the satisfaction of the securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. RTPY minimum cash condition following redemptions by RTPY’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the inability to complete has filed a registration statement on Form S-4 (333-257912), which includes a preliminary prospectus and proxy statement of RTPY, referred to as a proxy statement/prospectus. the PIPE investment in connection with the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the A final proxy statement/prospectus will be sent to all RTPY shareholders. RTPY also will file other documents regarding the proposed transaction with the SEC. Before making any Merger Agreement, (vi) the effect of the announcement or pendency of the proposed transaction on Aurora’s business relationships, operating results and business generally, voting or investment decision, investors and security holders of RTPY are urged to read the registration statement, the proxy statement/prospectus and all other relevant (vii) risks that the proposed transaction disrupts current plans and operations of Aurora and potential difficulties in Aurora employee retention as a result of the proposed documents filed or that will be filed with the SEC in connection with the proposed transaction because they will contain important information about the proposed transaction. transaction, (viii) the outcome of any legal proceedings or other disputes that may be instituted against Aurora or against RTPY related to the Merger Agreement or the proposed transaction or otherwise, (ix) the ability to maintain the listing of RTPY’s securities on a national securities exchange, (x) the price of RTPY’s securities may be volatile due to a Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will variety of factors, including changes in the competitive and highly regulated industries in which RTPY plans to operate or Aurora operates, variations in operating performance be filed with the SEC by RTPY through the website maintained by the SEC at www.sec.gov. across competitors, changes in laws and regulations affecting RTPY’s or Aurora’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, and (xii) the risk of downturns and a The documents filed by RTPY with the SEC also may be obtained free of charge at RTPY’s website at https://y.reinventtechnologypartners.com or upon written request to 215 changing regulatory landscape in the highly competitive self-driving industry. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors Park Avenue, Floor 11 New York, NY. and the other risks and uncertainties described in the “Risk Factors” section of RTPY’s registration statement on Form S-1 (File No. 333-257912), its Quarterly Reports on Form 10-Q for the periods ended March 31, 2021 and June 30, 2021, respectively, the registration statement on Form S-4 discussed below and other documents filed by RTPY from PARTICIPANTS IN THE SOLICITATION time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those RTPY and Aurora and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from RTPY’s shareholders in connection contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward- with the proposed transaction. A list of the names of the directors and executive officers of RTPY and Aurora and information regarding their interests in the proposed looking statements, and RTPY and Aurora assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, transaction are set forth in the proxy statement/prospectus. You may obtain free copies of these documents as described in the preceding paragraph. future events, or otherwise. Neither RTPY nor Aurora gives any assurance that either RTPY or Aurora or the combined company will achieve its expectations. TRADEMARKS All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners and this Presentation’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, copyrights, logos and other intellectual property. Solely for convenience, trademarks and trade names referred to in this Presentation may appear with the ® or ™ symbols, but such references are not intended to indicate, in any way, that such names and logos are trademarks or registered trademarks of RTPY or Aurora. INDUSTRY AND MARKET DATA This Presentation contains statistical data, estimates and forecasts provided by Aurora and/or based on independent industry publications or other publicly available information, as well as other information based on Aurora’s internal sources. This information involves many assumptions and limitations and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data that has been provided by Aurora and/or contained in these industry publications and other publicly available information. Accordingly, neither RTPY nor Aurora nor any of their affiliates and advisors makes any representations as to the 2

Reinvent Team Reid Mark Michael David Daniel Matt Hoffman Pincus Thompson Cohen Urdaneta DeGraw • Non-voting observer on RTPY board of • Director of RTPY• CEO, CFO, and Director of RTPY• Secretary of RTPY• Investment Partner at Reinvent Capital• Principal at Reinvent Capital directors • Founder and Chairman of Zynga• Founder and Portfolio Manager of BHR • Previously Associate General Counsel at • Previously Investor at ValueAct and • Previously Investor at Francisco Partners • Partner at Greylock Capital Zynga and Senior Counsel at Proskauer Warburg Pincus • Founder of Tribe.net, Support.com, and • Board Member at Microsoft FreeLoader• Advisor and board member to several companies • Founder of LinkedIn and founding member of PayPal 3

Reinventing Mobility: Aurora + Reinvent goal: to partner with amazing founders with game Aurora offers opportunity for Venture Capital @Scale changing technologies who are inventing or reinventing industries Reinvent vision for Aurora: world class team and leading technology in pole position to be first to safe, scalable Experience as entrepreneurs, operators, investors, and commercialization of self-driving technology based on their public company board members helping drive execution and team, technology, and partnerships strategy Proposed transaction provides funding to help get through Structurally committed to long-term partnership with Aurora first stages of commercialization and alignment with investors with sponsor economics subject to price and time-based vesting up to 4 years 4Reinventing Mobility: Aurora + Reinvent goal: to partner with amazing founders with game Aurora offers opportunity for Venture Capital @Scale changing technologies who are inventing or reinventing industries Reinvent vision for Aurora: world class team and leading technology in pole position to be first to safe, scalable Experience as entrepreneurs, operators, investors, and commercialization of self-driving technology based on their public company board members helping drive execution and team, technology, and partnerships strategy Proposed transaction provides funding to help get through Structurally committed to long-term partnership with Aurora first stages of commercialization and alignment with investors with sponsor economics subject to price and time-based vesting up to 4 years 4

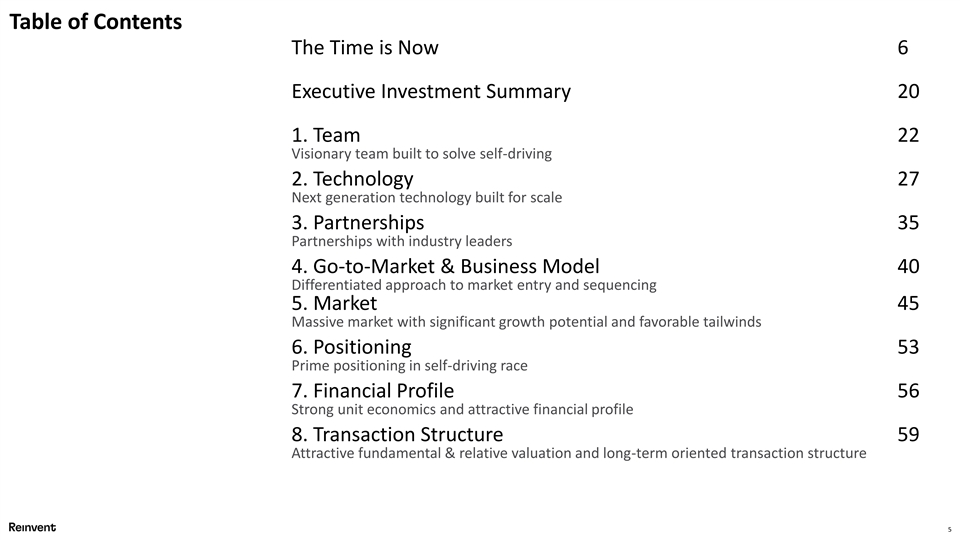

Table of Contents The Time is Now 6 Executive Investment Summary 20 1. Team 22 Visionary team built to solve self-driving 2. Technology 27 Next generation technology built for scale 3. Partnerships 35 Partnerships with industry leaders 4. Go-to-Market & Business Model 40 Differentiated approach to market entry and sequencing 5. Market 45 Massive market with significant growth potential and favorable tailwinds 6. Positioning 53 Prime positioning in self-driving race 7. Financial Profile 56 Strong unit economics and attractive financial profile 8. Transaction Structure 59 Attractive fundamental & relative valuation and long-term oriented transaction structure 5Table of Contents The Time is Now 6 Executive Investment Summary 20 1. Team 22 Visionary team built to solve self-driving 2. Technology 27 Next generation technology built for scale 3. Partnerships 35 Partnerships with industry leaders 4. Go-to-Market & Business Model 40 Differentiated approach to market entry and sequencing 5. Market 45 Massive market with significant growth potential and favorable tailwinds 6. Positioning 53 Prime positioning in self-driving race 7. Financial Profile 56 Strong unit economics and attractive financial profile 8. Transaction Structure 59 Attractive fundamental & relative valuation and long-term oriented transaction structure 5

The Time is Now 6

The Time is Now Compounding Enabling Technology Massive Potential + = Problems Advancements Impact 7The Time is Now Compounding Enabling Technology Massive Potential + = Problems Advancements Impact 7

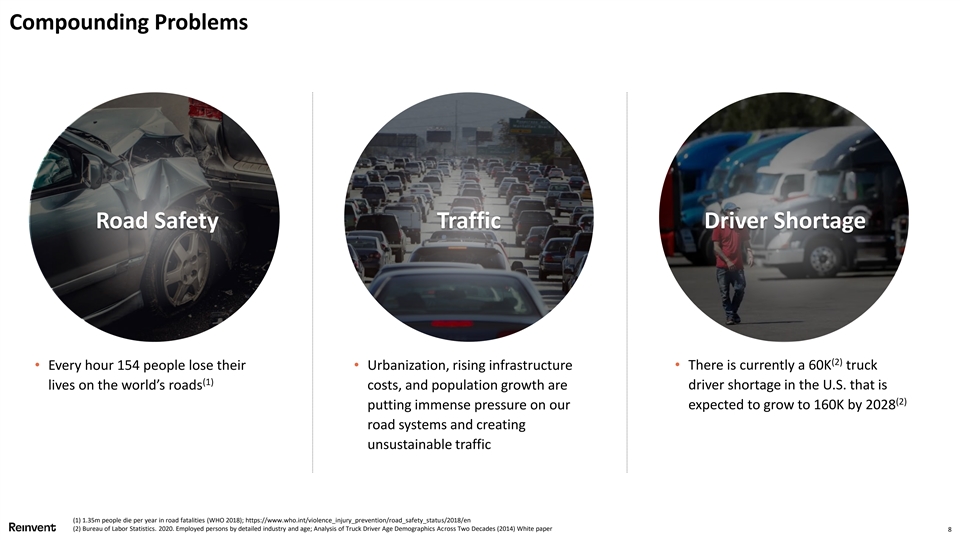

Compounding Problems Road Safety Traffic Driver Shortage (2) • Every hour 154 people lose their • Urbanization, rising infrastructure • There is currently a 60K truck (1) driver shortage in the U.S. that is lives on the world’s roads costs, and population growth are (2) expected to grow to 160K by 2028 putting immense pressure on our road systems and creating unsustainable traffic (1) 1.35m people die per year in road fatalities (WHO 2018); https://www.who.int/violence_injury_prevention/road_safety_status/2018/en (2) Bureau of Labor Statistics. 2020. Employed persons by detailed industry and age; Analysis of Truck Driver Age Demographics Across Two Decades (2014) White paper 8Compounding Problems Road Safety Traffic Driver Shortage (2) • Every hour 154 people lose their • Urbanization, rising infrastructure • There is currently a 60K truck (1) driver shortage in the U.S. that is lives on the world’s roads costs, and population growth are (2) expected to grow to 160K by 2028 putting immense pressure on our road systems and creating unsustainable traffic (1) 1.35m people die per year in road fatalities (WHO 2018); https://www.who.int/violence_injury_prevention/road_safety_status/2018/en (2) Bureau of Labor Statistics. 2020. Employed persons by detailed industry and age; Analysis of Truck Driver Age Demographics Across Two Decades (2014) White paper 8

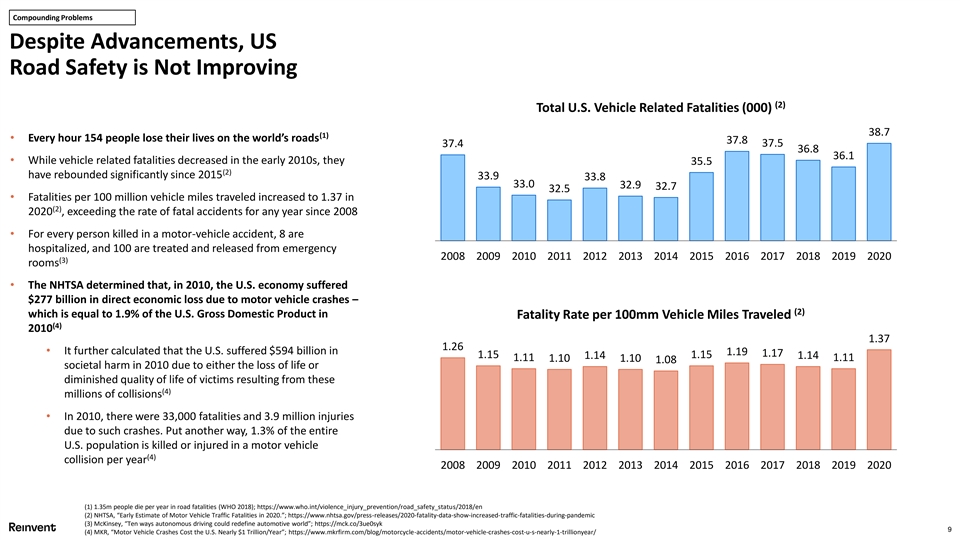

Compounding Problems Despite Advancements, US Road Safety is Not Improving (2) Total U.S. Vehicle Related Fatalities (000) 38.7 (1) • Every hour 154 people lose their lives on the world’s roads 37.8 37.4 37.5 36.8 36.1 • While vehicle related fatalities decreased in the early 2010s, they 35.5 (2) have rebounded significantly since 2015 33.9 33.8 33.0 32.9 32.7 32.5 • Fatalities per 100 million vehicle miles traveled increased to 1.37 in (2) 2020 , exceeding the rate of fatal accidents for any year since 2008 • For every person killed in a motor-vehicle accident, 8 are hospitalized, and 100 are treated and released from emergency 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 (3) rooms • The NHTSA determined that, in 2010, the U.S. economy suffered $277 billion in direct economic loss due to motor vehicle crashes – (2) which is equal to 1.9% of the U.S. Gross Domestic Product in Fatality Rate per 100mm Vehicle Miles Traveled (4) 2010 1.37 1.26 • It further calculated that the U.S. suffered $594 billion in 1.19 1.17 1.15 1.15 1.14 1.14 1.11 1.11 1.10 1.10 1.08 societal harm in 2010 due to either the loss of life or diminished quality of life of victims resulting from these (4) millions of collisions • In 2010, there were 33,000 fatalities and 3.9 million injuries due to such crashes. Put another way, 1.3% of the entire U.S. population is killed or injured in a motor vehicle (4) collision per year 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 (1) 1.35m people die per year in road fatalities (WHO 2018); https://www.who.int/violence_injury_prevention/road_safety_status/2018/en (2) NHTSA, “Early Estimate of Motor Vehicle Traffic Fatalities in 2020.”; https://www.nhtsa.gov/press-releases/2020-fatality-data-show-increased-traffic-fatalities-during-pandemic (3) McKinsey, “Ten ways autonomous driving could redefine automotive world”; https://mck.co/3ue0syk 9 (4) MKR, “Motor Vehicle Crashes Cost the U.S. Nearly $1 Trillion/Year”; https://www.mkrfirm.com/blog/motorcycle-accidents/motor-vehicle-crashes-cost-u-s-nearly-1-trillionyear/Compounding Problems Despite Advancements, US Road Safety is Not Improving (2) Total U.S. Vehicle Related Fatalities (000) 38.7 (1) • Every hour 154 people lose their lives on the world’s roads 37.8 37.4 37.5 36.8 36.1 • While vehicle related fatalities decreased in the early 2010s, they 35.5 (2) have rebounded significantly since 2015 33.9 33.8 33.0 32.9 32.7 32.5 • Fatalities per 100 million vehicle miles traveled increased to 1.37 in (2) 2020 , exceeding the rate of fatal accidents for any year since 2008 • For every person killed in a motor-vehicle accident, 8 are hospitalized, and 100 are treated and released from emergency 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 (3) rooms • The NHTSA determined that, in 2010, the U.S. economy suffered $277 billion in direct economic loss due to motor vehicle crashes – (2) which is equal to 1.9% of the U.S. Gross Domestic Product in Fatality Rate per 100mm Vehicle Miles Traveled (4) 2010 1.37 1.26 • It further calculated that the U.S. suffered $594 billion in 1.19 1.17 1.15 1.15 1.14 1.14 1.11 1.11 1.10 1.10 1.08 societal harm in 2010 due to either the loss of life or diminished quality of life of victims resulting from these (4) millions of collisions • In 2010, there were 33,000 fatalities and 3.9 million injuries due to such crashes. Put another way, 1.3% of the entire U.S. population is killed or injured in a motor vehicle (4) collision per year 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 (1) 1.35m people die per year in road fatalities (WHO 2018); https://www.who.int/violence_injury_prevention/road_safety_status/2018/en (2) NHTSA, “Early Estimate of Motor Vehicle Traffic Fatalities in 2020.”; https://www.nhtsa.gov/press-releases/2020-fatality-data-show-increased-traffic-fatalities-during-pandemic (3) McKinsey, “Ten ways autonomous driving could redefine automotive world”; https://mck.co/3ue0syk 9 (4) MKR, “Motor Vehicle Crashes Cost the U.S. Nearly $1 Trillion/Year”; https://www.mkrfirm.com/blog/motorcycle-accidents/motor-vehicle-crashes-cost-u-s-nearly-1-trillionyear/

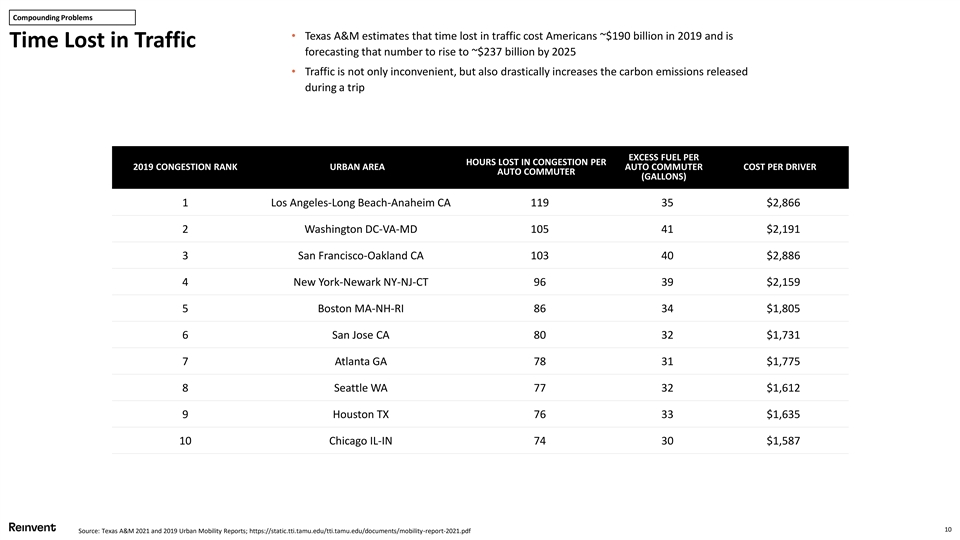

Compounding Problems • Texas A&M estimates that time lost in traffic cost Americans ~$190 billion in 2019 and is Time Lost in Traffic forecasting that number to rise to ~$237 billion by 2025 • Traffic is not only inconvenient, but also drastically increases the carbon emissions released during a trip EXCESS FUEL PER HOURS LOST IN CONGESTION PER 2019 CONGESTION RANK URBAN AREA AUTO COMMUTER COST PER DRIVER AUTO COMMUTER (GALLONS) 1 Los Angeles-Long Beach-Anaheim CA 119 35 $2,866 2 Washington DC-VA-MD 105 41 $2,191 3 San Francisco-Oakland CA 103 40 $2,886 4 New York-Newark NY-NJ-CT 96 39 $2,159 5 Boston MA-NH-RI 86 34 $1,805 6 San Jose CA 80 32 $1,731 7 Atlanta GA 78 31 $1,775 8 Seattle WA 77 32 $1,612 9 Houston TX 76 33 $1,635 10 Chicago IL-IN 74 30 $1,587 10 Source: Texas A&M 2021 and 2019 Urban Mobility Reports; https://static.tti.tamu.edu/tti.tamu.edu/documents/mobility-report-2021.pdfCompounding Problems • Texas A&M estimates that time lost in traffic cost Americans ~$190 billion in 2019 and is Time Lost in Traffic forecasting that number to rise to ~$237 billion by 2025 • Traffic is not only inconvenient, but also drastically increases the carbon emissions released during a trip EXCESS FUEL PER HOURS LOST IN CONGESTION PER 2019 CONGESTION RANK URBAN AREA AUTO COMMUTER COST PER DRIVER AUTO COMMUTER (GALLONS) 1 Los Angeles-Long Beach-Anaheim CA 119 35 $2,866 2 Washington DC-VA-MD 105 41 $2,191 3 San Francisco-Oakland CA 103 40 $2,886 4 New York-Newark NY-NJ-CT 96 39 $2,159 5 Boston MA-NH-RI 86 34 $1,805 6 San Jose CA 80 32 $1,731 7 Atlanta GA 78 31 $1,775 8 Seattle WA 77 32 $1,612 9 Houston TX 76 33 $1,635 10 Chicago IL-IN 74 30 $1,587 10 Source: Texas A&M 2021 and 2019 Urban Mobility Reports; https://static.tti.tamu.edu/tti.tamu.edu/documents/mobility-report-2021.pdf

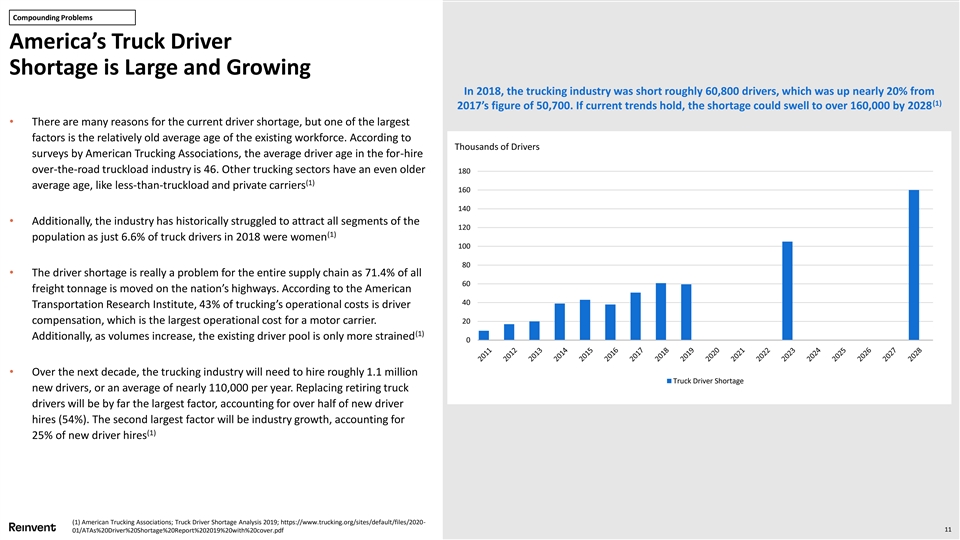

Compounding Problems America’s Truck Driver Shortage is Large and Growing In 2018, the trucking industry was short roughly 60,800 drivers, which was up nearly 20% from (1) 2017’s figure of 50,700. If current trends hold, the shortage could swell to over 160,000 by 2028 • There are many reasons for the current driver shortage, but one of the largest factors is the relatively old average age of the existing workforce. According to Thousands of Drivers surveys by American Trucking Associations, the average driver age in the for-hire over-the-road truckload industry is 46. Other trucking sectors have an even older 180 (1) average age, like less-than-truckload and private carriers 160 140 • Additionally, the industry has historically struggled to attract all segments of the 120 (1) population as just 6.6% of truck drivers in 2018 were women 100 80 • The driver shortage is really a problem for the entire supply chain as 71.4% of all 60 freight tonnage is moved on the nation’s highways. According to the American 40 Transportation Research Institute, 43% of trucking’s operational costs is driver compensation, which is the largest operational cost for a motor carrier. 20 (1) Additionally, as volumes increase, the existing driver pool is only more strained 0 • Over the next decade, the trucking industry will need to hire roughly 1.1 million Truck Driver Shortage new drivers, or an average of nearly 110,000 per year. Replacing retiring truck drivers will be by far the largest factor, accounting for over half of new driver hires (54%). The second largest factor will be industry growth, accounting for (1) 25% of new driver hires (1) American Trucking Associations; Truck Driver Shortage Analysis 2019; https://www.trucking.org/sites/default/files/2020- 11 01/ATAs%20Driver%20Shortage%20Report%202019%20with%20cover.pdf Compounding Problems America’s Truck Driver Shortage is Large and Growing In 2018, the trucking industry was short roughly 60,800 drivers, which was up nearly 20% from (1) 2017’s figure of 50,700. If current trends hold, the shortage could swell to over 160,000 by 2028 • There are many reasons for the current driver shortage, but one of the largest factors is the relatively old average age of the existing workforce. According to Thousands of Drivers surveys by American Trucking Associations, the average driver age in the for-hire over-the-road truckload industry is 46. Other trucking sectors have an even older 180 (1) average age, like less-than-truckload and private carriers 160 140 • Additionally, the industry has historically struggled to attract all segments of the 120 (1) population as just 6.6% of truck drivers in 2018 were women 100 80 • The driver shortage is really a problem for the entire supply chain as 71.4% of all 60 freight tonnage is moved on the nation’s highways. According to the American 40 Transportation Research Institute, 43% of trucking’s operational costs is driver compensation, which is the largest operational cost for a motor carrier. 20 (1) Additionally, as volumes increase, the existing driver pool is only more strained 0 • Over the next decade, the trucking industry will need to hire roughly 1.1 million Truck Driver Shortage new drivers, or an average of nearly 110,000 per year. Replacing retiring truck drivers will be by far the largest factor, accounting for over half of new driver hires (54%). The second largest factor will be industry growth, accounting for (1) 25% of new driver hires (1) American Trucking Associations; Truck Driver Shortage Analysis 2019; https://www.trucking.org/sites/default/files/2020- 11 01/ATAs%20Driver%20Shortage%20Report%202019%20with%20cover.pdf

Enabling Technology Advancements AI / Deep Sensing Learning / Technology – Compute Computer Lidar, Cameras, Power Vision Radar • Almost every part of self-driving wouldn’t • Deep learning breakthroughs in the early • Improvements in lidar, camera, and radar be a possibility today without the 2010s enabled self-driving technology for fidelity and decreases in cost are key to staggering improvements in compute the first time facilitating safe and scalable self-driving power over the last 50 years 12Enabling Technology Advancements AI / Deep Sensing Learning / Technology – Compute Computer Lidar, Cameras, Power Vision Radar • Almost every part of self-driving wouldn’t • Deep learning breakthroughs in the early • Improvements in lidar, camera, and radar be a possibility today without the 2010s enabled self-driving technology for fidelity and decreases in cost are key to staggering improvements in compute the first time facilitating safe and scalable self-driving power over the last 50 years 12

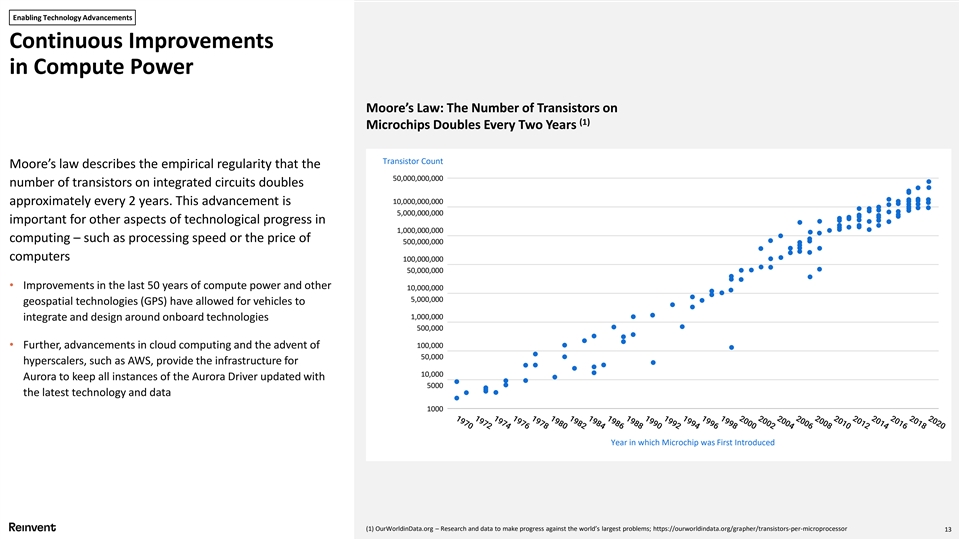

Enabling Technology Advancements Continuous Improvements in Compute Power Moore’s Law: The Number of Transistors on (1) Microchips Doubles Every Two Years Transistor Count Moore’s law describes the empirical regularity that the 50,000,000,000 number of transistors on integrated circuits doubles 10,000,000,000 approximately every 2 years. This advancement is 5,000,000,000 important for other aspects of technological progress in 1,000,000,000 computing – such as processing speed or the price of 500,000,000 computers 100,000,000 50,000,000 • Improvements in the last 50 years of compute power and other 10,000,000 5,000,000 geospatial technologies (GPS) have allowed for vehicles to 1,000,000 integrate and design around onboard technologies 500,000 100,000 • Further, advancements in cloud computing and the advent of 50,000 hyperscalers, such as AWS, provide the infrastructure for 10,000 Aurora to keep all instances of the Aurora Driver updated with 5000 the latest technology and data 1000 Year in which Microchip was First Introduced (1) OurWorldinData.org – Research and data to make progress against the world’s largest problems; https://ourworldindata.org/grapher/transistors-per-microprocessor 13

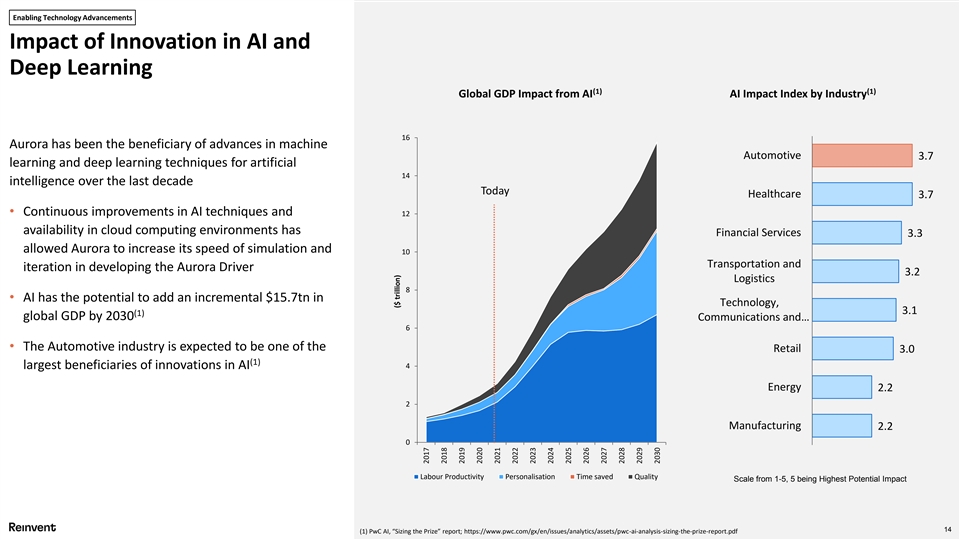

Enabling Technology Advancements Impact of Innovation in AI and Deep Learning (1) (1) Global GDP Impact from AI AI Impact Index by Industry 16 Aurora has been the beneficiary of advances in machine Automotive 3.7 learning and deep learning techniques for artificial 14 intelligence over the last decade Today Healthcare 3.7 • Continuous improvements in AI techniques and 12 availability in cloud computing environments has Financial Services 3.3 allowed Aurora to increase its speed of simulation and 10 Transportation and iteration in developing the Aurora Driver 3.2 Logistics 8 • AI has the potential to add an incremental $15.7tn in Technology, 3.1 (1) global GDP by 2030 Communications and… 6 • The Automotive industry is expected to be one of the Retail 3.0 (1) largest beneficiaries of innovations in AI 4 Energy 2.2 2 Manufacturing 2.2 0 Labour Productivity Personalisation Time saved Quality Scale from 1-5, 5 being Highest Potential Impact 14 (1) PwC AI, “Sizing the Prize” report; https://www.pwc.com/gx/en/issues/analytics/assets/pwc-ai-analysis-sizing-the-prize-report.pdf ($ trillion) 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030Enabling Technology Advancements Impact of Innovation in AI and Deep Learning (1) (1) Global GDP Impact from AI AI Impact Index by Industry 16 Aurora has been the beneficiary of advances in machine Automotive 3.7 learning and deep learning techniques for artificial 14 intelligence over the last decade Today Healthcare 3.7 • Continuous improvements in AI techniques and 12 availability in cloud computing environments has Financial Services 3.3 allowed Aurora to increase its speed of simulation and 10 Transportation and iteration in developing the Aurora Driver 3.2 Logistics 8 • AI has the potential to add an incremental $15.7tn in Technology, 3.1 (1) global GDP by 2030 Communications and… 6 • The Automotive industry is expected to be one of the Retail 3.0 (1) largest beneficiaries of innovations in AI 4 Energy 2.2 2 Manufacturing 2.2 0 Labour Productivity Personalisation Time saved Quality Scale from 1-5, 5 being Highest Potential Impact 14 (1) PwC AI, “Sizing the Prize” report; https://www.pwc.com/gx/en/issues/analytics/assets/pwc-ai-analysis-sizing-the-prize-report.pdf ($ trillion) 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

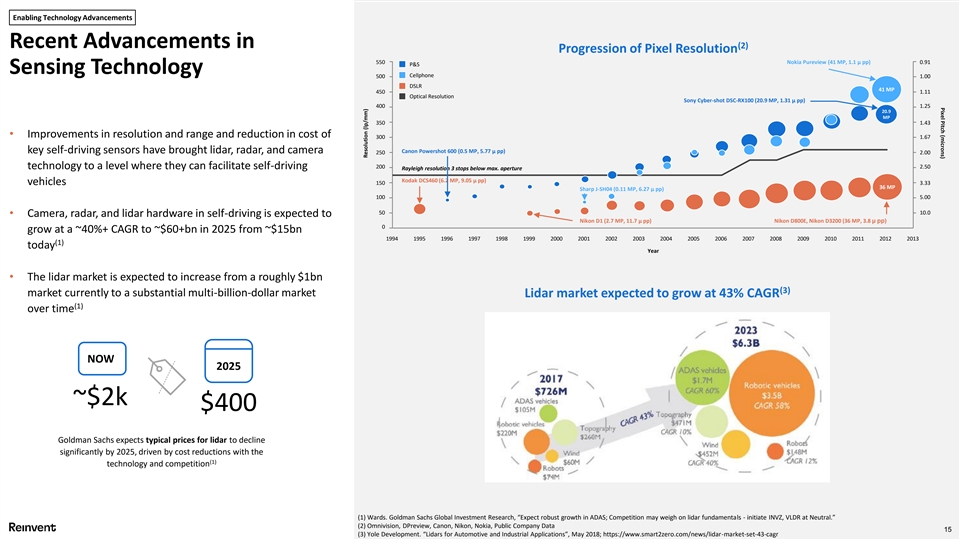

Pixel Pitch (microns) Enabling Technology Advancements Recent Advancements in (2) Progression of Pixel Resolution 550 Nokia Pureview (41 MP, 1.1 µ pp) 0.91 P&S Sensing Technology Cellphone 500 1.00 DSLR 41 MP 450 1.11 Optical Resolution Sony Cyber-shot DSC-RX100 (20.9 MP, 1.31 µ pp) 400 1.25 20.9 MP 350 1.43 • Improvements in resolution and range and reduction in cost of 300 1.67 key self-driving sensors have brought lidar, radar, and camera Canon Powershot 600 (0.5 MP, 5.77 µ pp) 250 2.00 technology to a level where they can facilitate self-driving 200 2.50 Rayleigh resolution 3 stops below max. aperture Kodak DCS460 (6.2 MP, 9.05 µ pp) vehicles 150 3.33 36 MP Sharp J-SH04 (0.11 MP, 6.27 µ pp) 100 5.00 50 10.0 • Camera, radar, and lidar hardware in self-driving is expected to Nikon D1 (2.7 MP, 11.7 µ pp) Nikon D800E, Nikon D3200 (36 MP, 3.8 µ pp) 0 grow at a ~40%+ CAGR to ~$60+bn in 2025 from ~$15bn 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 (1) today Year • The lidar market is expected to increase from a roughly $1bn (3) market currently to a substantial multi-billion-dollar market Lidar market expected to grow at 43% CAGR (1) over time NOW 2025 ~$2k $400 Goldman Sachs expects typical prices for lidar to decline significantly by 2025, driven by cost reductions with the (1) technology and competition (1) Wards. Goldman Sachs Global Investment Research, “Expect robust growth in ADAS; Competition may weigh on lidar fundamentals - initiate INVZ, VLDR at Neutral.” (2) Omnivision, DPreview, Canon, Nikon, Nokia, Public Company Data 15 (3) Yole Development. “Lidars for Automotive and Industrial Applications”, May 2018; https://www.smart2zero.com/news/lidar-market-set-43-cagr Resolution (lp/mm)Pixel Pitch (microns) Enabling Technology Advancements Recent Advancements in (2) Progression of Pixel Resolution 550 Nokia Pureview (41 MP, 1.1 µ pp) 0.91 P&S Sensing Technology Cellphone 500 1.00 DSLR 41 MP 450 1.11 Optical Resolution Sony Cyber-shot DSC-RX100 (20.9 MP, 1.31 µ pp) 400 1.25 20.9 MP 350 1.43 • Improvements in resolution and range and reduction in cost of 300 1.67 key self-driving sensors have brought lidar, radar, and camera Canon Powershot 600 (0.5 MP, 5.77 µ pp) 250 2.00 technology to a level where they can facilitate self-driving 200 2.50 Rayleigh resolution 3 stops below max. aperture Kodak DCS460 (6.2 MP, 9.05 µ pp) vehicles 150 3.33 36 MP Sharp J-SH04 (0.11 MP, 6.27 µ pp) 100 5.00 50 10.0 • Camera, radar, and lidar hardware in self-driving is expected to Nikon D1 (2.7 MP, 11.7 µ pp) Nikon D800E, Nikon D3200 (36 MP, 3.8 µ pp) 0 grow at a ~40%+ CAGR to ~$60+bn in 2025 from ~$15bn 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 (1) today Year • The lidar market is expected to increase from a roughly $1bn (3) market currently to a substantial multi-billion-dollar market Lidar market expected to grow at 43% CAGR (1) over time NOW 2025 ~$2k $400 Goldman Sachs expects typical prices for lidar to decline significantly by 2025, driven by cost reductions with the (1) technology and competition (1) Wards. Goldman Sachs Global Investment Research, “Expect robust growth in ADAS; Competition may weigh on lidar fundamentals - initiate INVZ, VLDR at Neutral.” (2) Omnivision, DPreview, Canon, Nikon, Nokia, Public Company Data 15 (3) Yole Development. “Lidars for Automotive and Industrial Applications”, May 2018; https://www.smart2zero.com/news/lidar-market-set-43-cagr Resolution (lp/mm)

Massive Potential Impact Increase Safety Transform Logistics Every hour 154 people lose In the U.S., trucking accounts (1) their lives on the world’s for 300B miles annually & (3) roads 65% of total goods movement Expand Access Improve Lives (2) 25.5 million people with a The average driver spends 54 (4) disability in the U.S. have a minutes each day difficulty traveling outside of commuting– the equivalent the home of 10 days a year (1) 1.35m people die per year in road fatalities (WHO 2018); https://www.who.int/violence_injury _prevention/road_safety_status/2018/en (2) In the 2017 NHTS, an estimated 25.5 million people report having disabilities that make traveling outside the home difficult. (3-20. USDOT Transportation Statistics Annual Reporet 2018) (3) Trucks moved 65% of Goods by weight in 2017; https//www.bts.gov/topics/freight-transportation/freight-shipments-mode (4) 24 min one-way commute; US Census Bureau 2018 16Massive Potential Impact Increase Safety Transform Logistics Every hour 154 people lose In the U.S., trucking accounts (1) their lives on the world’s for 300B miles annually & (3) roads 65% of total goods movement Expand Access Improve Lives (2) 25.5 million people with a The average driver spends 54 (4) disability in the U.S. have a minutes each day difficulty traveling outside of commuting– the equivalent the home of 10 days a year (1) 1.35m people die per year in road fatalities (WHO 2018); https://www.who.int/violence_injury _prevention/road_safety_status/2018/en (2) In the 2017 NHTS, an estimated 25.5 million people report having disabilities that make traveling outside the home difficult. (3-20. USDOT Transportation Statistics Annual Reporet 2018) (3) Trucks moved 65% of Goods by weight in 2017; https//www.bts.gov/topics/freight-transportation/freight-shipments-mode (4) 24 min one-way commute; US Census Bureau 2018 16

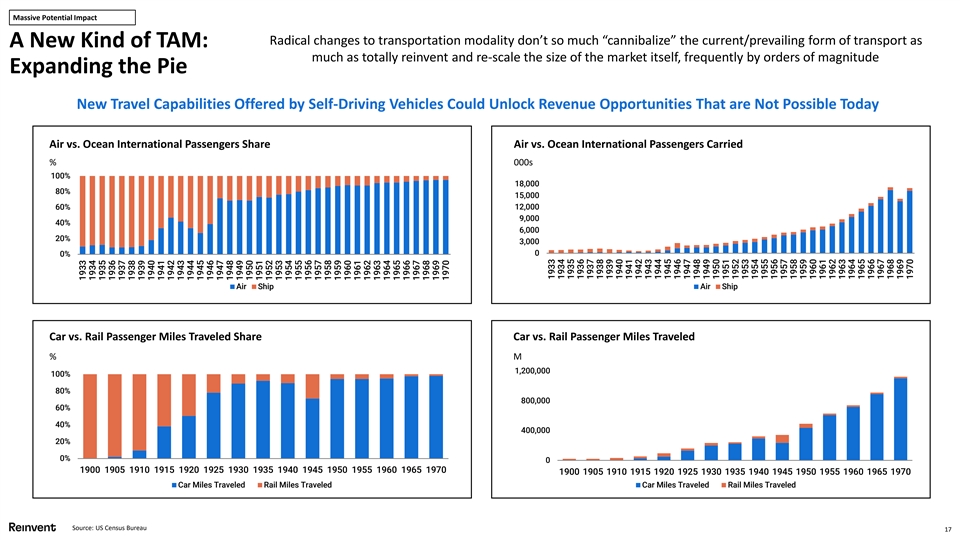

Massive Potential Impact Radical changes to transportation modality don’t so much “cannibalize” the current/prevailing form of transport as A New Kind of TAM: much as totally reinvent and re-scale the size of the market itself, frequently by orders of magnitude Expanding the Pie New Travel Capabilities Offered by Self-Driving Vehicles Could Unlock Revenue Opportunities That are Not Possible Today Air vs. Ocean International Passengers Share Air vs. Ocean International Passengers Carried % 000s 100% 18,000 80% 15,000 60% 12,000 9,000 40% 6,000 20% 3,000 0 0% Air Ship Air Ship Car vs. Rail Passenger Miles Traveled Share Car vs. Rail Passenger Miles Traveled % M 1,200,000 100% 80% 800,000 60% 40% 400,000 20% 0% 0 1900 1905 1910 1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1900 1905 1910 1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 Car Miles Traveled Rail Miles Traveled Car Miles Traveled Rail Miles Traveled Source: US Census Bureau 17 1933 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1933 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970Massive Potential Impact Radical changes to transportation modality don’t so much “cannibalize” the current/prevailing form of transport as A New Kind of TAM: much as totally reinvent and re-scale the size of the market itself, frequently by orders of magnitude Expanding the Pie New Travel Capabilities Offered by Self-Driving Vehicles Could Unlock Revenue Opportunities That are Not Possible Today Air vs. Ocean International Passengers Share Air vs. Ocean International Passengers Carried % 000s 100% 18,000 80% 15,000 60% 12,000 9,000 40% 6,000 20% 3,000 0 0% Air Ship Air Ship Car vs. Rail Passenger Miles Traveled Share Car vs. Rail Passenger Miles Traveled % M 1,200,000 100% 80% 800,000 60% 40% 400,000 20% 0% 0 1900 1905 1910 1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1900 1905 1910 1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 Car Miles Traveled Rail Miles Traveled Car Miles Traveled Rail Miles Traveled Source: US Census Bureau 17 1933 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1933 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970

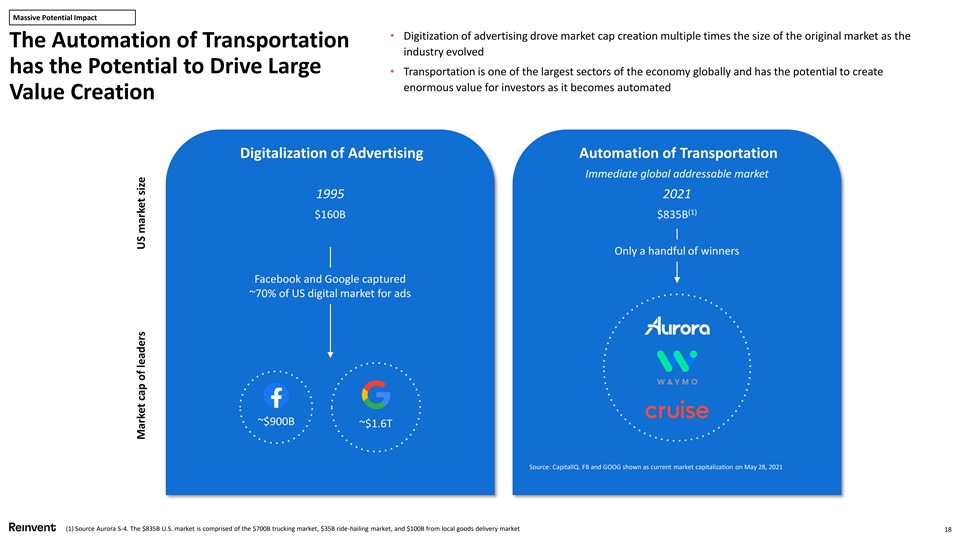

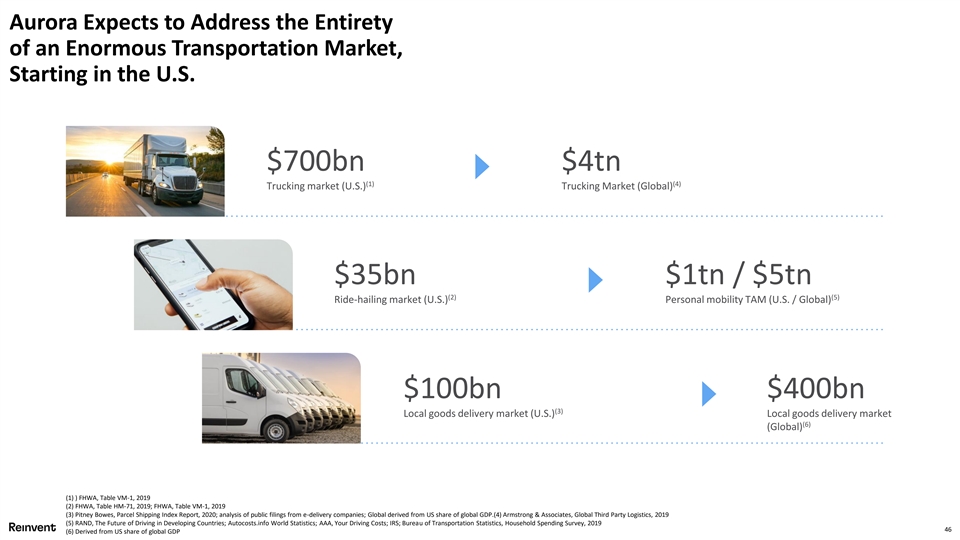

Massive Potential Impact • Digitization of advertising drove market cap creation multiple times the size of the original market as the The Automation of Transportation industry evolved has the Potential to Drive Large • Transportation is one of the largest sectors of the economy globally and has the potential to create enormous value for investors as it becomes automated Value Creation Digitalization of Advertising Automation of Transportation Immediate global addressable market 1995 2021 (1) $160B $835B Only a handful of winners Facebook and Google captured ~70% of US digital market for ads ~$900B ~$1.6T Source: CapitalIQ. FB and GOOG shown as current market capitalization on May 28, 2021 (1) Source Aurora S-4. The $835B U.S. market is comprised of the $700B trucking market, $35B ride-hailing market, and $100B from local goods delivery market 18 Market cap of leaders US market sizeMassive Potential Impact • Digitization of advertising drove market cap creation multiple times the size of the original market as the The Automation of Transportation industry evolved has the Potential to Drive Large • Transportation is one of the largest sectors of the economy globally and has the potential to create enormous value for investors as it becomes automated Value Creation Digitalization of Advertising Automation of Transportation Immediate global addressable market 1995 2021 (1) $160B $835B Only a handful of winners Facebook and Google captured ~70% of US digital market for ads ~$900B ~$1.6T Source: CapitalIQ. FB and GOOG shown as current market capitalization on May 28, 2021 (1) Source Aurora S-4. The $835B U.S. market is comprised of the $700B trucking market, $35B ride-hailing market, and $100B from local goods delivery market 18 Market cap of leaders US market size

Massive Potential Impact Pushing AV Technology Toward the Ubiquity of Elevators “Another related technology, in a lot of ways, is the elevator,” said Chris Urmson. “It’s another technology that had a fairly profound impact on cities.” Urmson’s not the only one to make this comparison. Elon Musk, the CEO of Tesla, has compared driverless cars to elevators, too. Elevators didn’t just change people’s perceptions, they changed how humans physically move through buildings and cities. Whereas it was once more desirable to live and work closer to the ground—as someone who once lived on the seventh floor of a walk-up in New York, I know this to be true elevators made higher floors more desirable. Elevators also enabled architects to build up, up, up. The vertical aesthetic of the modern city, skyscraper-dotted horizons that double as distinct urban signatures, exist because of elevators. They created a new, and often socially awkward, kind of public space—one that feels simultaneously intimate, fleeting, and unpredictable, even as passengers know exactly where they are going. And elevators themselves have changed over time, as The Boston Globe pointed out last year: “Trained operators armed with cranks and levers have been replaced with buttons; motion sensors have made holding the door less of a heroic act.” It’s no mistake that Urmson and Musk, both of whom are dedicated to bringing driverless cars to the masses, would offer a comparison that highlights acutely how technological change and cultural change intersect—and, more specifically, how quickly a technology can go from seeming extraordinary to mundane. “There’s another really interesting parallel in the way they were introduced,” Urmson told me. “The technology was this magic thing that would whisk you up floors. You couldn’t possibly imagine relinquishing your life to this thing. So, it was people’s job to sit in the elevator and press the button for you—because it was so complicated. People grew accustomed to it, and they realized they didn’t really need the person there to press the button.” Source: https://www.theatlantic.com/technology/archive/2015/12/magic-boxes-with-buttons/419841/ 19Massive Potential Impact Pushing AV Technology Toward the Ubiquity of Elevators “Another related technology, in a lot of ways, is the elevator,” said Chris Urmson. “It’s another technology that had a fairly profound impact on cities.” Urmson’s not the only one to make this comparison. Elon Musk, the CEO of Tesla, has compared driverless cars to elevators, too. Elevators didn’t just change people’s perceptions, they changed how humans physically move through buildings and cities. Whereas it was once more desirable to live and work closer to the ground—as someone who once lived on the seventh floor of a walk-up in New York, I know this to be true elevators made higher floors more desirable. Elevators also enabled architects to build up, up, up. The vertical aesthetic of the modern city, skyscraper-dotted horizons that double as distinct urban signatures, exist because of elevators. They created a new, and often socially awkward, kind of public space—one that feels simultaneously intimate, fleeting, and unpredictable, even as passengers know exactly where they are going. And elevators themselves have changed over time, as The Boston Globe pointed out last year: “Trained operators armed with cranks and levers have been replaced with buttons; motion sensors have made holding the door less of a heroic act.” It’s no mistake that Urmson and Musk, both of whom are dedicated to bringing driverless cars to the masses, would offer a comparison that highlights acutely how technological change and cultural change intersect—and, more specifically, how quickly a technology can go from seeming extraordinary to mundane. “There’s another really interesting parallel in the way they were introduced,” Urmson told me. “The technology was this magic thing that would whisk you up floors. You couldn’t possibly imagine relinquishing your life to this thing. So, it was people’s job to sit in the elevator and press the button for you—because it was so complicated. People grew accustomed to it, and they realized they didn’t really need the person there to press the button.” Source: https://www.theatlantic.com/technology/archive/2015/12/magic-boxes-with-buttons/419841/ 19

Executive Investment Summary 20

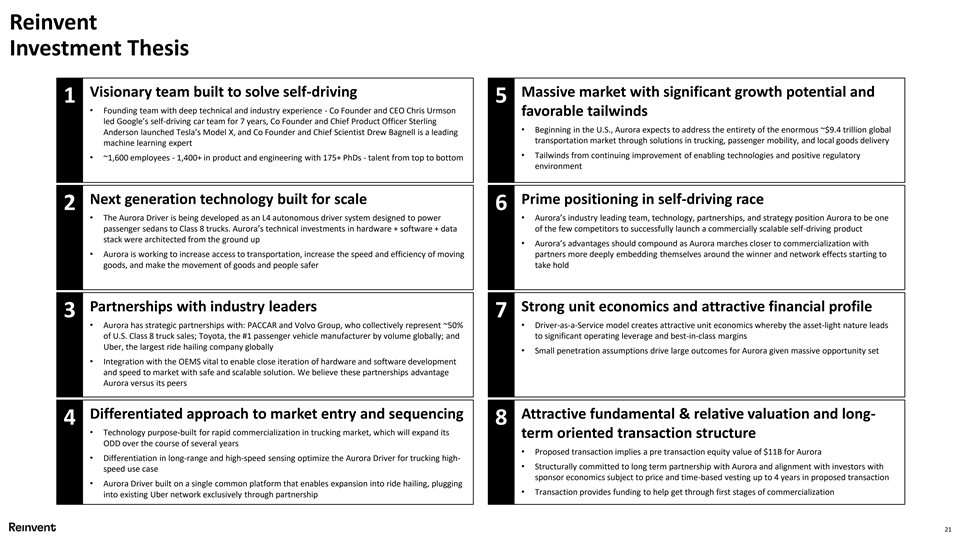

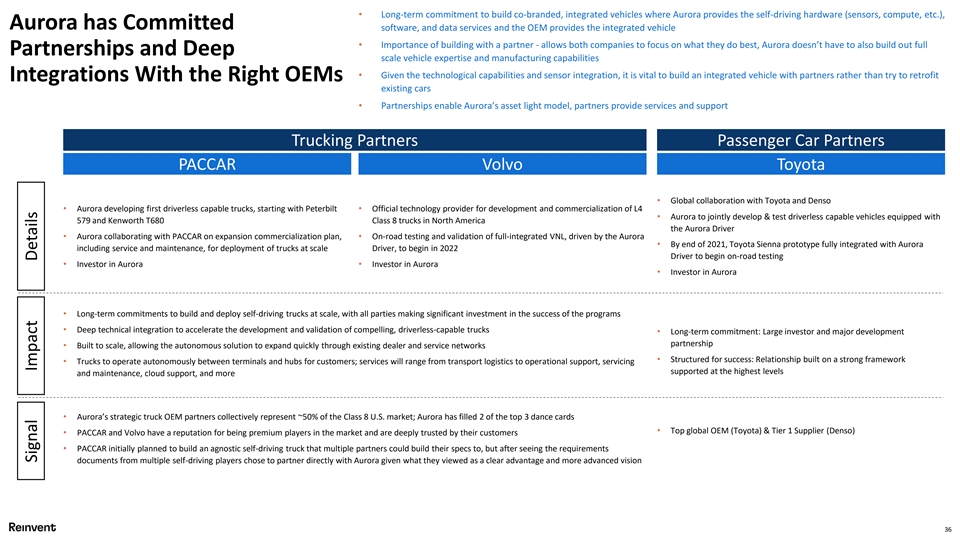

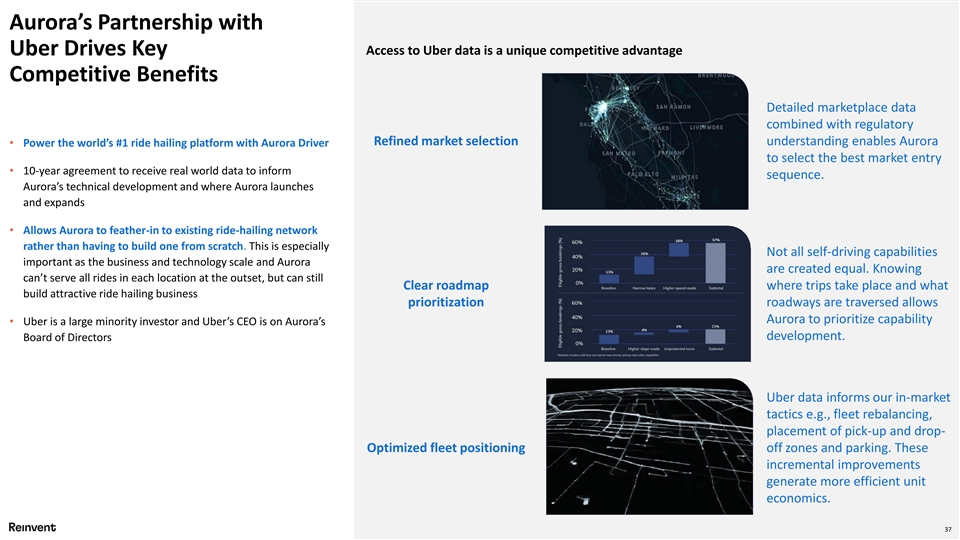

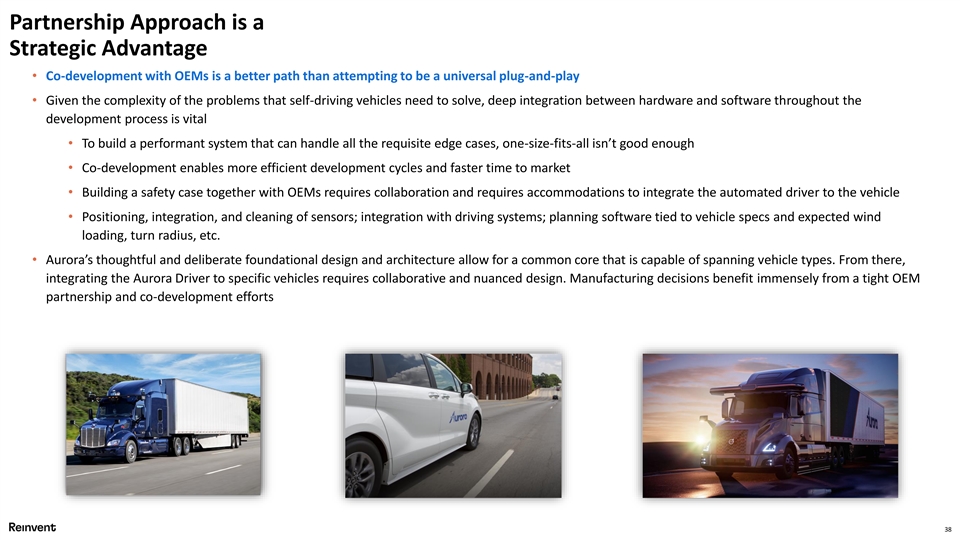

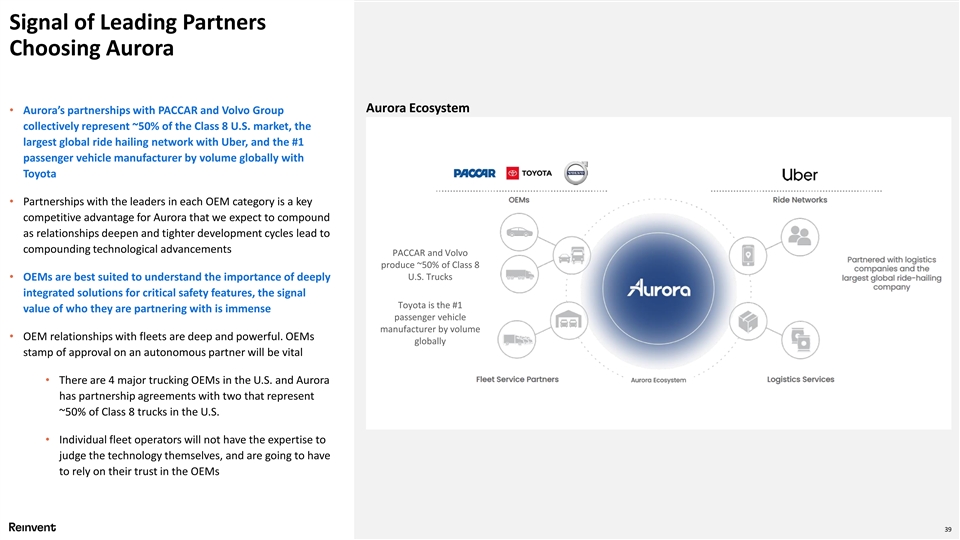

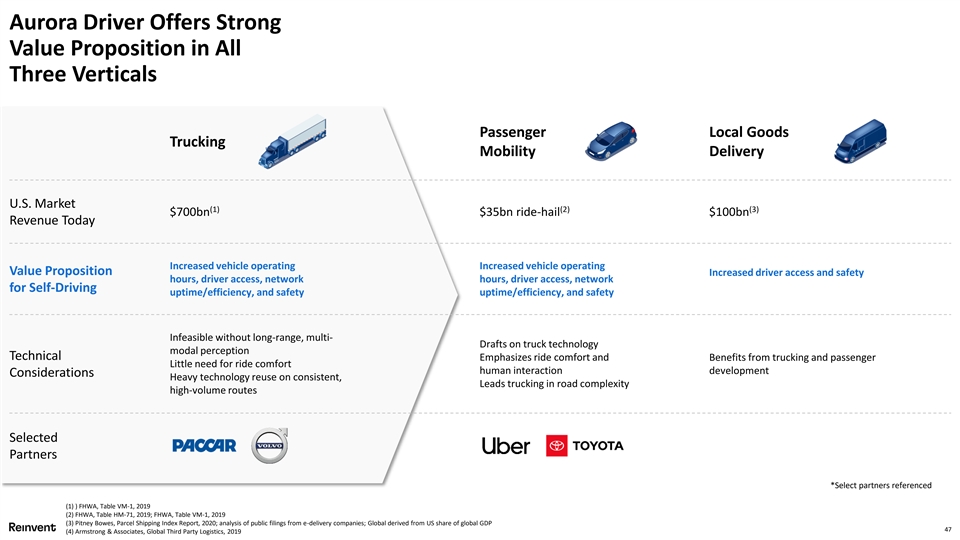

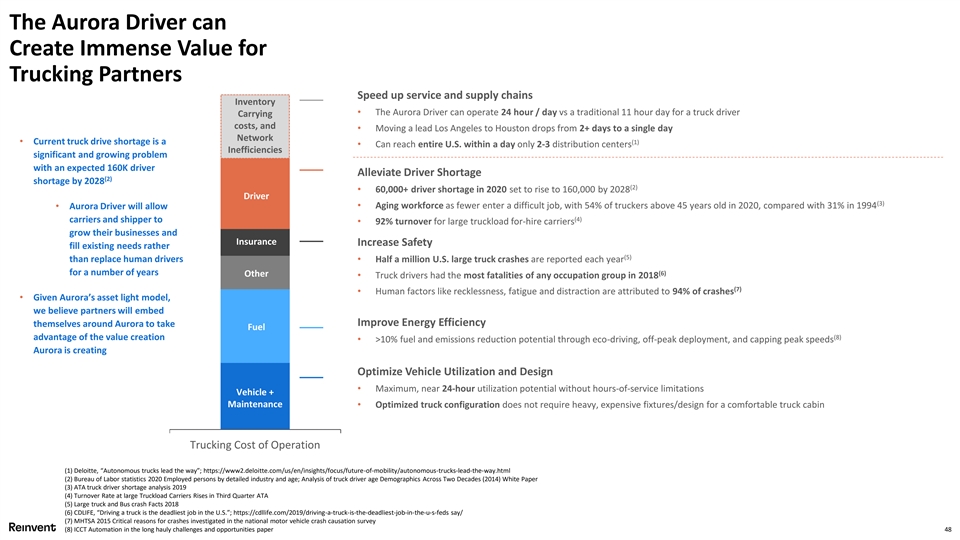

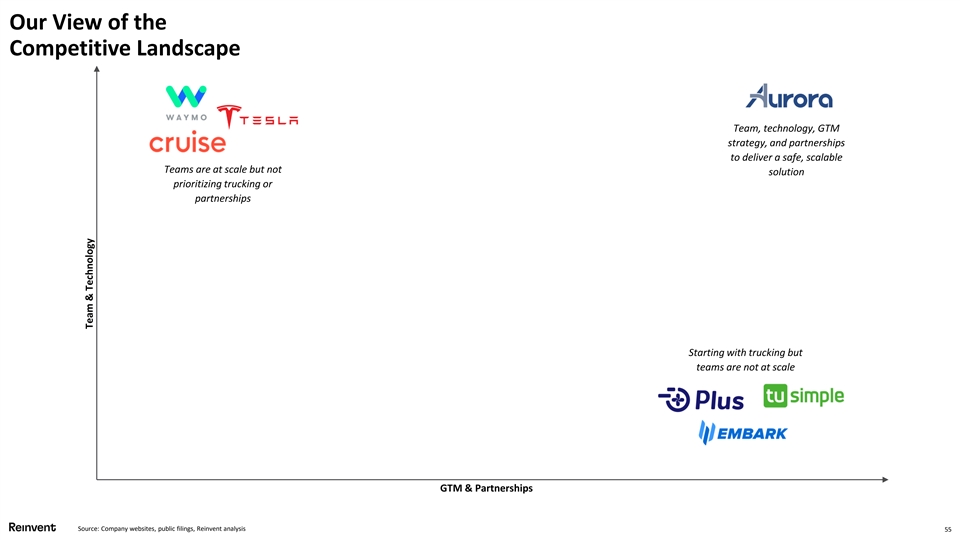

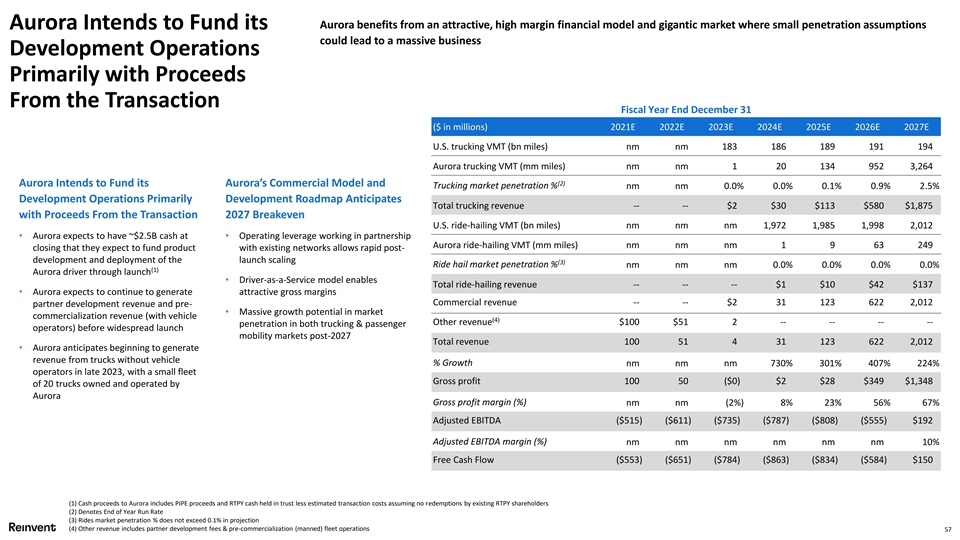

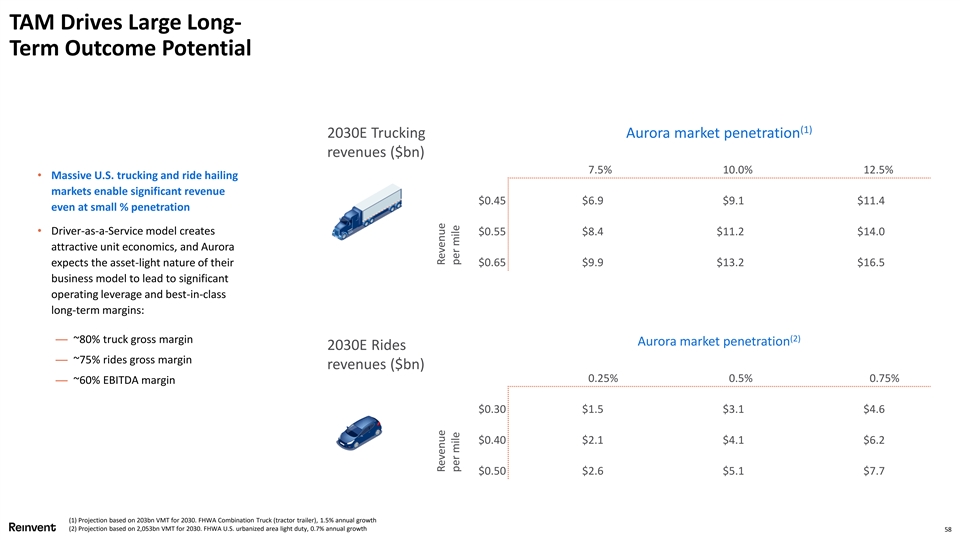

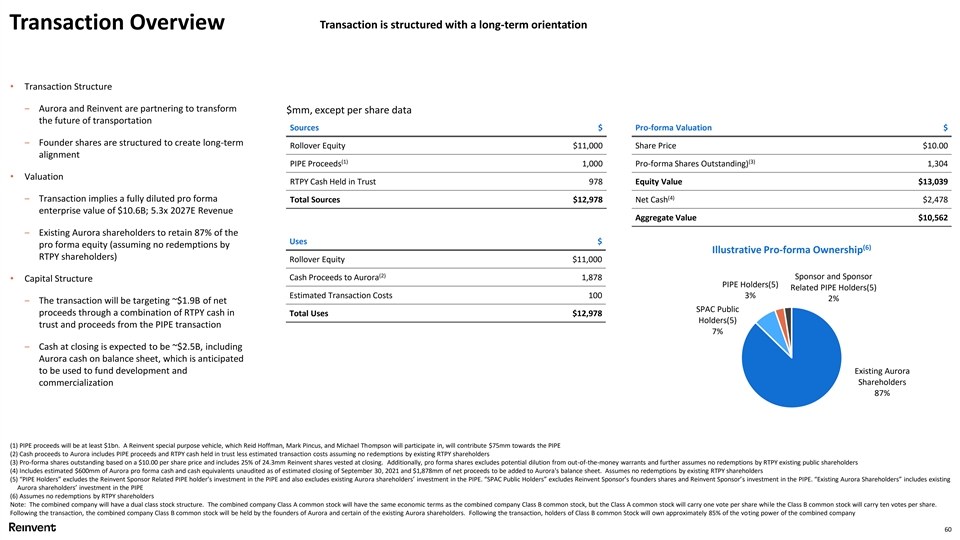

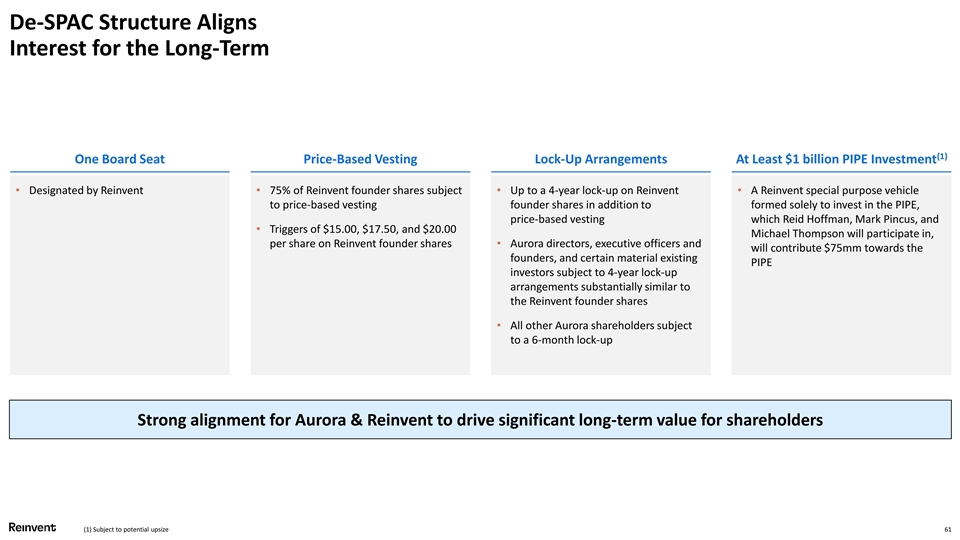

Reinvent Investment Thesis Visionary team built to solve self-driving Massive market with significant growth potential and 1 5 • Founding team with deep technical and industry experience - Co Founder and CEO Chris Urmson favorable tailwinds led Google’s self-driving car team for 7 years, Co Founder and Chief Product Officer Sterling • Beginning in the U.S., Aurora expects to address the entirety of the enormous ~$9.4 trillion global Anderson launched Tesla’s Model X, and Co Founder and Chief Scientist Drew Bagnell is a leading transportation market through solutions in trucking, passenger mobility, and local goods delivery machine learning expert • Tailwinds from continuing improvement of enabling technologies and positive regulatory • ~1,600 employees - 1,400+ in product and engineering with 175+ PhDs - talent from top to bottom environment Next generation technology built for scale Prime positioning in self-driving race 2 6 • The Aurora Driver is being developed as an L4 autonomous driver system designed to power • Aurora’s industry leading team, technology, partnerships, and strategy position Aurora to be one passenger sedans to Class 8 trucks. Aurora’s technical investments in hardware + software + data of the few competitors to successfully launch a commercially scalable self-driving product stack were architected from the ground up • Aurora’s advantages should compound as Aurora marches closer to commercialization with • Aurora is working to increase access to transportation, increase the speed and efficiency of moving partners more deeply embedding themselves around the winner and network effects starting to goods, and make the movement of goods and people safer take hold Partnerships with industry leaders Strong unit economics and attractive financial profile 3 7 • Aurora has strategic partnerships with: PACCAR and Volvo Group, who collectively represent ~50% • Driver-as-a-Service model creates attractive unit economics whereby the asset-light nature leads of U.S. Class 8 truck sales; Toyota, the #1 passenger vehicle manufacturer by volume globally; and to significant operating leverage and best-in-class margins Uber, the largest ride hailing company globally • Small penetration assumptions drive large outcomes for Aurora given massive opportunity set • Integration with the OEMS vital to enable close iteration of hardware and software development and speed to market with safe and scalable solution. We believe these partnerships advantage Aurora versus its peers Differentiated approach to market entry and sequencing Attractive fundamental & relative valuation and long- 4 8 • Technology purpose-built for rapid commercialization in trucking market, which will expand its term oriented transaction structure ODD over the course of several years • Proposed transaction implies a pre transaction equity value of $11B for Aurora • Differentiation in long-range and high-speed sensing optimize the Aurora Driver for trucking high- • Structurally committed to long term partnership with Aurora and alignment with investors with speed use case sponsor economics subject to price and time-based vesting up to 4 years in proposed transaction • Aurora Driver built on a single common platform that enables expansion into ride hailing, plugging • Transaction provides funding to help get through first stages of commercialization into existing Uber network exclusively through partnership 21Reinvent Investment Thesis Visionary team built to solve self-driving Massive market with significant growth potential and 1 5 • Founding team with deep technical and industry experience - Co Founder and CEO Chris Urmson favorable tailwinds led Google’s self-driving car team for 7 years, Co Founder and Chief Product Officer Sterling • Beginning in the U.S., Aurora expects to address the entirety of the enormous ~$9.4 trillion global Anderson launched Tesla’s Model X, and Co Founder and Chief Scientist Drew Bagnell is a leading transportation market through solutions in trucking, passenger mobility, and local goods delivery machine learning expert • Tailwinds from continuing improvement of enabling technologies and positive regulatory • ~1,600 employees - 1,400+ in product and engineering with 175+ PhDs - talent from top to bottom environment Next generation technology built for scale Prime positioning in self-driving race 2 6 • The Aurora Driver is being developed as an L4 autonomous driver system designed to power • Aurora’s industry leading team, technology, partnerships, and strategy position Aurora to be one passenger sedans to Class 8 trucks. Aurora’s technical investments in hardware + software + data of the few competitors to successfully launch a commercially scalable self-driving product stack were architected from the ground up • Aurora’s advantages should compound as Aurora marches closer to commercialization with • Aurora is working to increase access to transportation, increase the speed and efficiency of moving partners more deeply embedding themselves around the winner and network effects starting to goods, and make the movement of goods and people safer take hold Partnerships with industry leaders Strong unit economics and attractive financial profile 3 7 • Aurora has strategic partnerships with: PACCAR and Volvo Group, who collectively represent ~50% • Driver-as-a-Service model creates attractive unit economics whereby the asset-light nature leads of U.S. Class 8 truck sales; Toyota, the #1 passenger vehicle manufacturer by volume globally; and to significant operating leverage and best-in-class margins Uber, the largest ride hailing company globally • Small penetration assumptions drive large outcomes for Aurora given massive opportunity set • Integration with the OEMS vital to enable close iteration of hardware and software development and speed to market with safe and scalable solution. We believe these partnerships advantage Aurora versus its peers Differentiated approach to market entry and sequencing Attractive fundamental & relative valuation and long- 4 8 • Technology purpose-built for rapid commercialization in trucking market, which will expand its term oriented transaction structure ODD over the course of several years • Proposed transaction implies a pre transaction equity value of $11B for Aurora • Differentiation in long-range and high-speed sensing optimize the Aurora Driver for trucking high- • Structurally committed to long term partnership with Aurora and alignment with investors with speed use case sponsor economics subject to price and time-based vesting up to 4 years in proposed transaction • Aurora Driver built on a single common platform that enables expansion into ride hailing, plugging • Transaction provides funding to help get through first stages of commercialization into existing Uber network exclusively through partnership 21

1. Team Visionary team built to solve self- driving 221. Team Visionary team built to solve self- driving 22

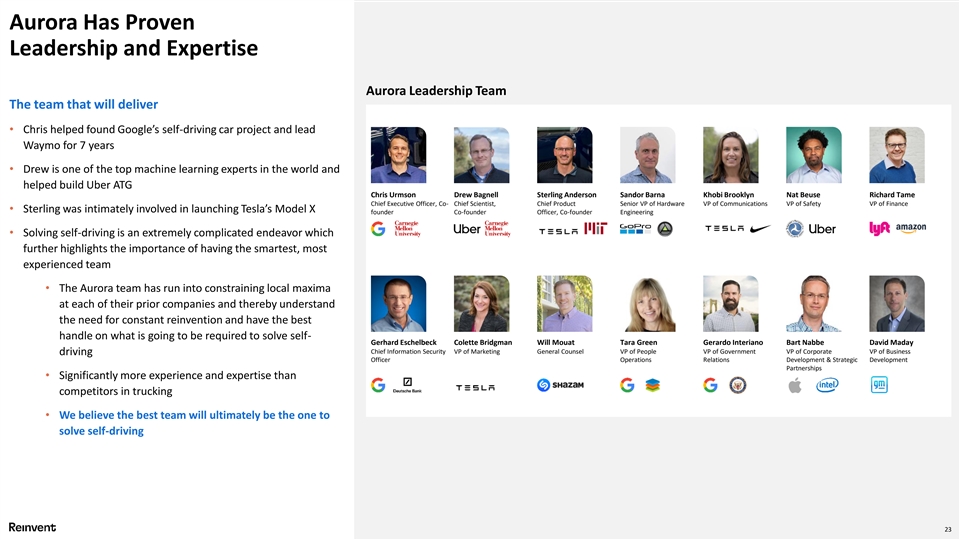

Aurora Has Proven Leadership and Expertise Aurora Leadership Team The team that will deliver • Chris helped found Google’s self-driving car project and lead Waymo for 7 years • Drew is one of the top machine learning experts in the world and helped build Uber ATG Chris Urmson Drew Bagnell Sterling Anderson Sandor Barna Khobi Brooklyn Nat Beuse Richard Tame Chief Executive Officer, Co- Chief Scientist, Chief Product Senior VP of Hardware VP of Communications VP of Safety VP of Finance • Sterling was intimately involved in launching Tesla’s Model X founder Co-founder Officer, Co-founder Engineering • Solving self-driving is an extremely complicated endeavor which further highlights the importance of having the smartest, most experienced team • The Aurora team has run into constraining local maxima at each of their prior companies and thereby understand the need for constant reinvention and have the best handle on what is going to be required to solve self- Gerhard Eschelbeck Colette Bridgman Will Mouat Tara Green Gerardo Interiano Bart Nabbe David Maday Chief Information Security VP of Marketing General Counsel VP of People VP of Government VP of Corporate VP of Business driving Officer Operations Relations Development & Strategic Development Partnerships • Significantly more experience and expertise than competitors in trucking • We believe the best team will ultimately be the one to solve self-driving 23Aurora Has Proven Leadership and Expertise Aurora Leadership Team The team that will deliver • Chris helped found Google’s self-driving car project and lead Waymo for 7 years • Drew is one of the top machine learning experts in the world and helped build Uber ATG Chris Urmson Drew Bagnell Sterling Anderson Sandor Barna Khobi Brooklyn Nat Beuse Richard Tame Chief Executive Officer, Co- Chief Scientist, Chief Product Senior VP of Hardware VP of Communications VP of Safety VP of Finance • Sterling was intimately involved in launching Tesla’s Model X founder Co-founder Officer, Co-founder Engineering • Solving self-driving is an extremely complicated endeavor which further highlights the importance of having the smartest, most experienced team • The Aurora team has run into constraining local maxima at each of their prior companies and thereby understand the need for constant reinvention and have the best handle on what is going to be required to solve self- Gerhard Eschelbeck Colette Bridgman Will Mouat Tara Green Gerardo Interiano Bart Nabbe David Maday Chief Information Security VP of Marketing General Counsel VP of People VP of Government VP of Corporate VP of Business driving Officer Operations Relations Development & Strategic Development Partnerships • Significantly more experience and expertise than competitors in trucking • We believe the best team will ultimately be the one to solve self-driving 23

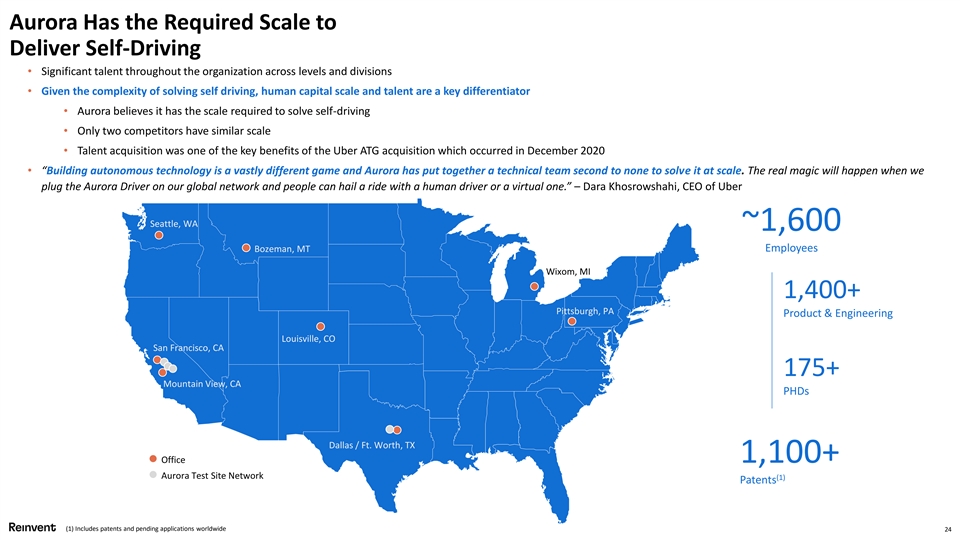

Aurora Has the Required Scale to Deliver Self-Driving • Significant talent throughout the organization across levels and divisions • Given the complexity of solving self driving, human capital scale and talent are a key differentiator • Aurora believes it has the scale required to solve self-driving • Only two competitors have similar scale • Talent acquisition was one of the key benefits of the Uber ATG acquisition which occurred in December 2020 • “Building autonomous technology is a vastly different game and Aurora has put together a technical team second to none to solve it at scale. The real magic will happen when we plug the Aurora Driver on our global network and people can hail a ride with a human driver or a virtual one.” – Dara Khosrowshahi, CEO of Uber Seattle, WA ~1,600 Bozeman, MT Employees Wixom, MI 1,400+ Pittsburgh, PA Product & Engineering Louisville, CO San Francisco, CA 175+ Mountain View, CA PHDs Dallas / Ft. Worth, TX Office 1,100+ Aurora Test Site Network (1) Patents (1) Includes patents and pending applications worldwide 24Aurora Has the Required Scale to Deliver Self-Driving • Significant talent throughout the organization across levels and divisions • Given the complexity of solving self driving, human capital scale and talent are a key differentiator • Aurora believes it has the scale required to solve self-driving • Only two competitors have similar scale • Talent acquisition was one of the key benefits of the Uber ATG acquisition which occurred in December 2020 • “Building autonomous technology is a vastly different game and Aurora has put together a technical team second to none to solve it at scale. The real magic will happen when we plug the Aurora Driver on our global network and people can hail a ride with a human driver or a virtual one.” – Dara Khosrowshahi, CEO of Uber Seattle, WA ~1,600 Bozeman, MT Employees Wixom, MI 1,400+ Pittsburgh, PA Product & Engineering Louisville, CO San Francisco, CA 175+ Mountain View, CA PHDs Dallas / Ft. Worth, TX Office 1,100+ Aurora Test Site Network (1) Patents (1) Includes patents and pending applications worldwide 24

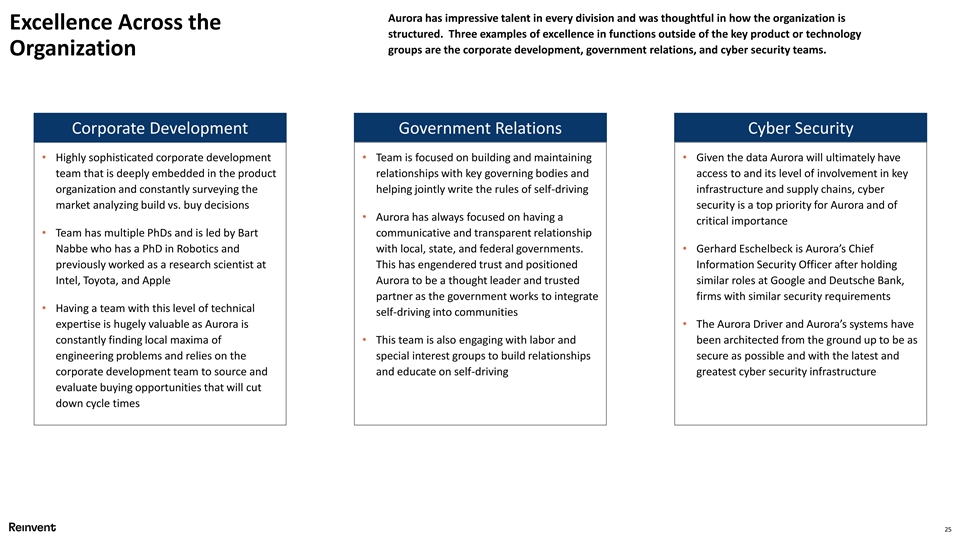

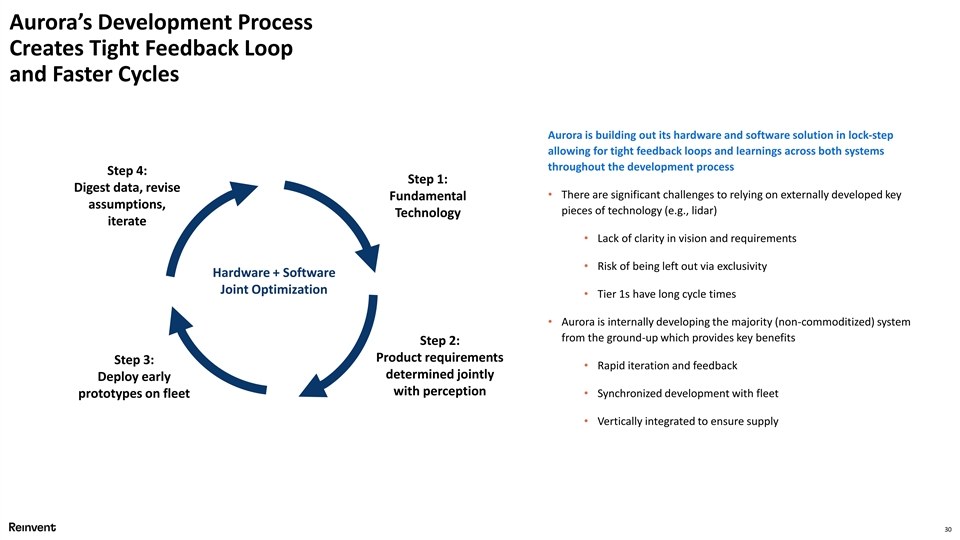

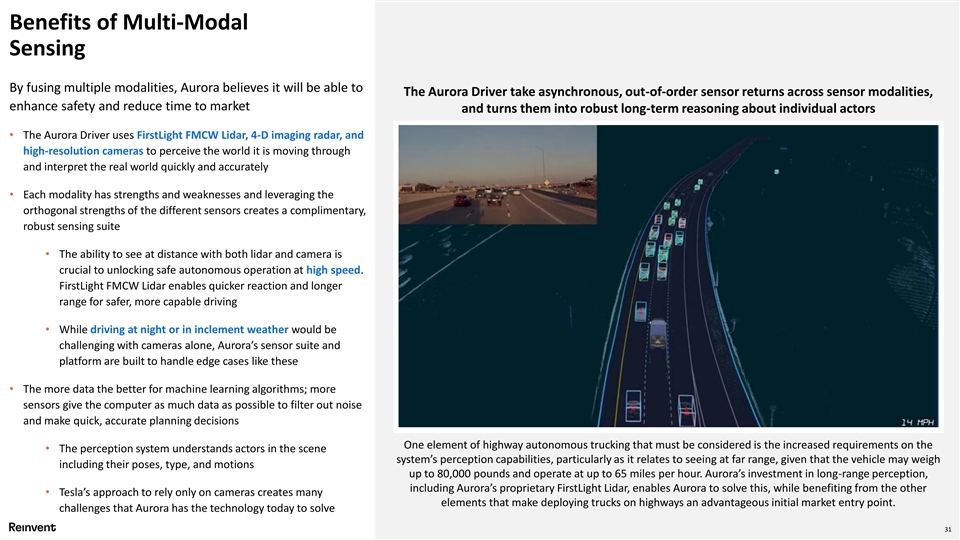

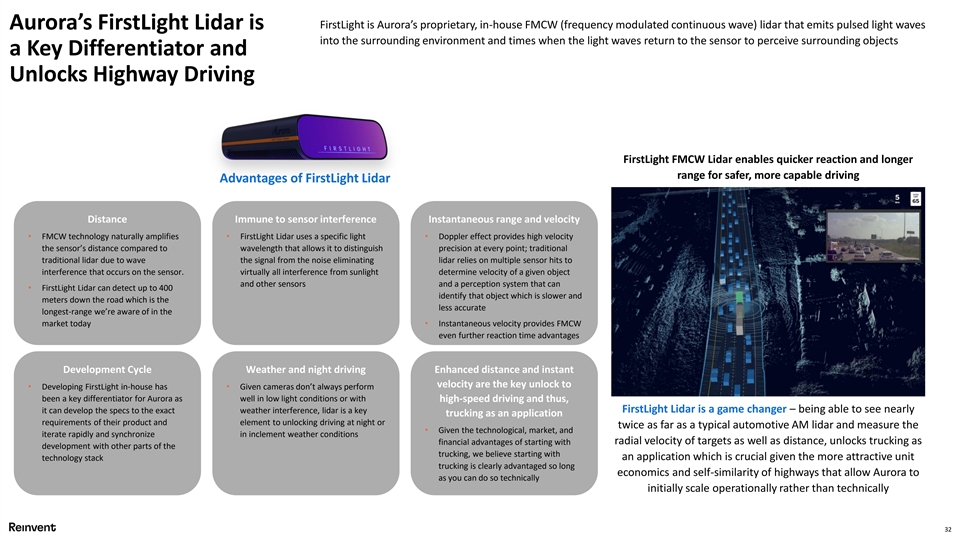

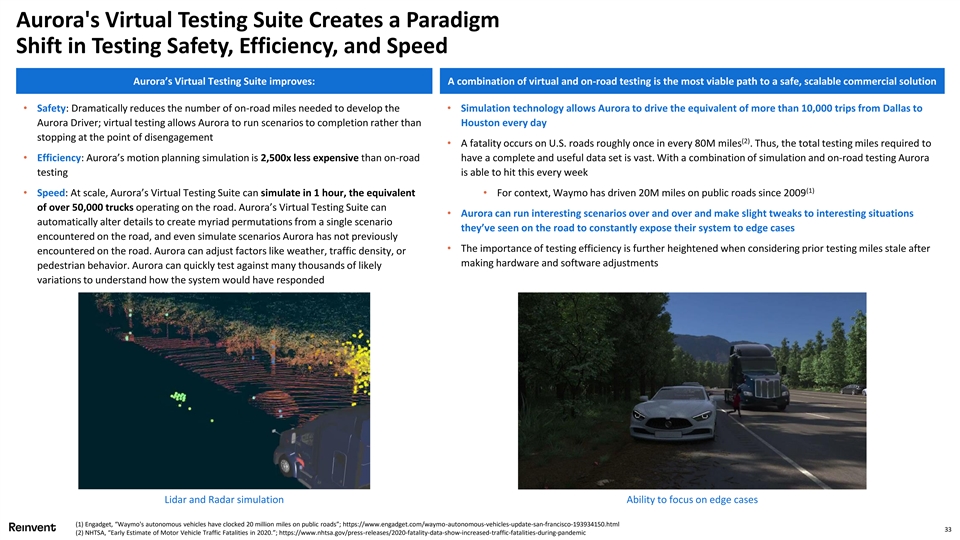

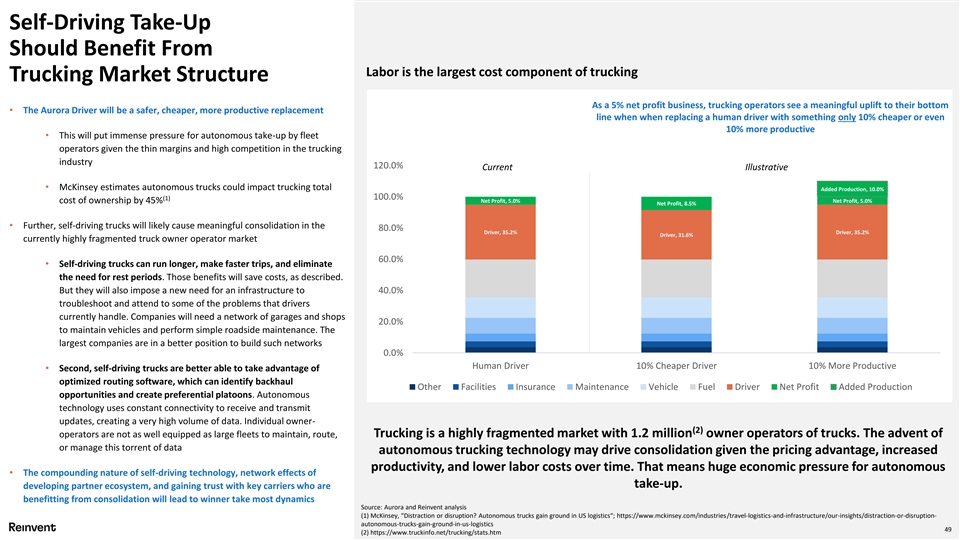

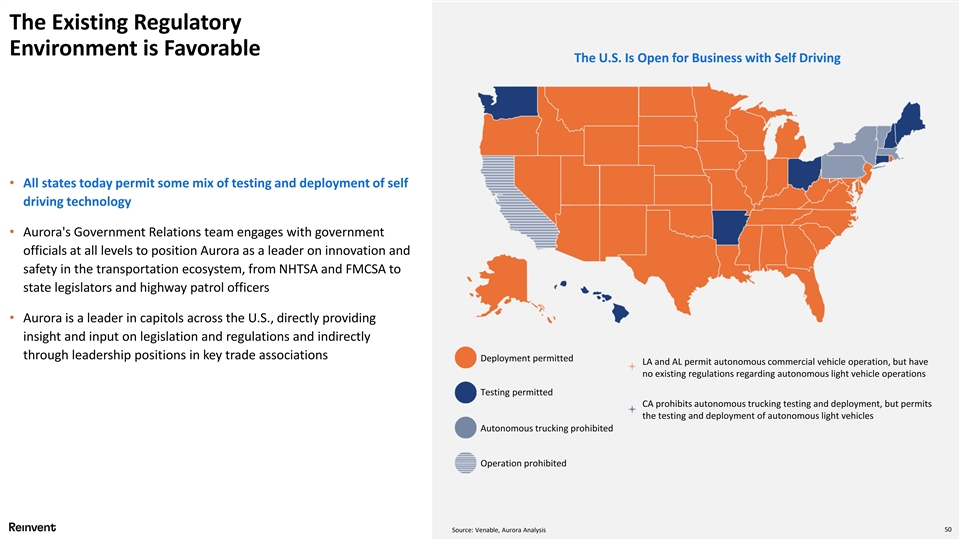

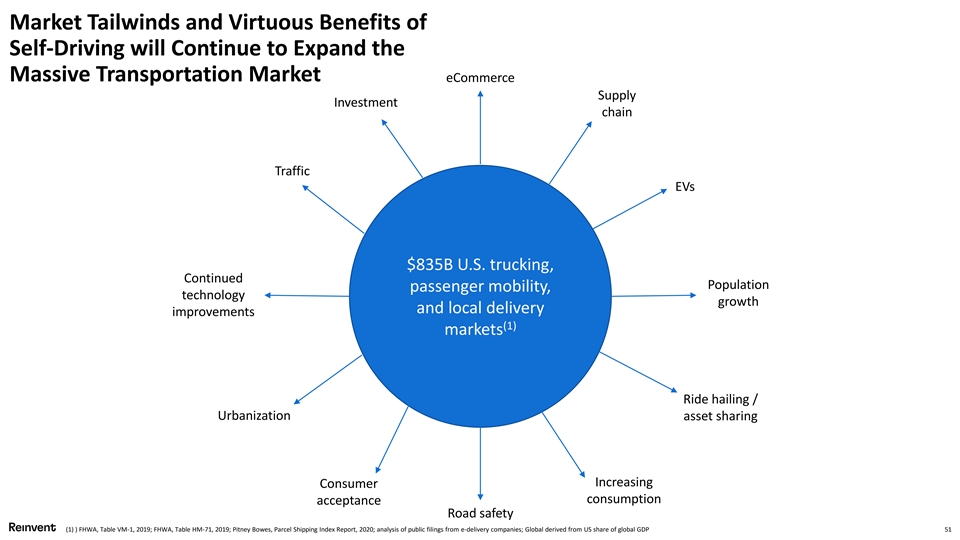

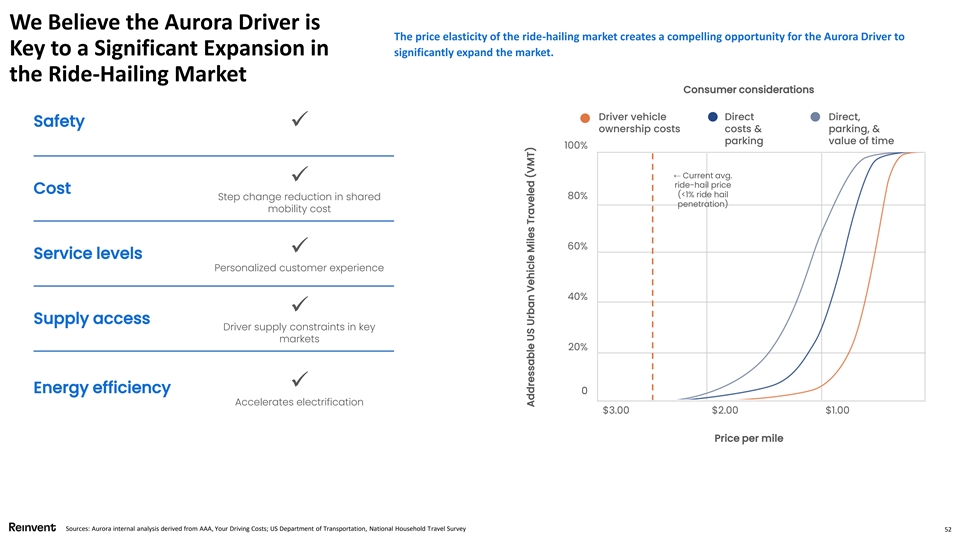

Aurora has impressive talent in every division and was thoughtful in how the organization is Excellence Across the structured. Three examples of excellence in functions outside of the key product or technology groups are the corporate development, government relations, and cyber security teams. Organization Corporate Development Government Relations Cyber Security • Highly sophisticated corporate development • Team is focused on building and maintaining • Given the data Aurora will ultimately have team that is deeply embedded in the product relationships with key governing bodies and access to and its level of involvement in key organization and constantly surveying the helping jointly write the rules of self-driving infrastructure and supply chains, cyber market analyzing build vs. buy decisions security is a top priority for Aurora and of • Aurora has always focused on having a critical importance • Team has multiple PhDs and is led by Bart communicative and transparent relationship Nabbe who has a PhD in Robotics and with local, state, and federal governments. • Gerhard Eschelbeck is Aurora’s Chief previously worked as a research scientist at This has engendered trust and positioned Information Security Officer after holding Intel, Toyota, and Apple Aurora to be a thought leader and trusted similar roles at Google and Deutsche Bank, partner as the government works to integrate firms with similar security requirements • Having a team with this level of technical self-driving into communities expertise is hugely valuable as Aurora is • The Aurora Driver and Aurora’s systems have constantly finding local maxima of • This team is also engaging with labor and been architected from the ground up to be as engineering problems and relies on the special interest groups to build relationships secure as possible and with the latest and corporate development team to source and and educate on self-driving greatest cyber security infrastructure evaluate buying opportunities that will cut down cycle times 25Aurora has impressive talent in every division and was thoughtful in how the organization is Excellence Across the structured. Three examples of excellence in functions outside of the key product or technology groups are the corporate development, government relations, and cyber security teams. Organization Corporate Development Government Relations Cyber Security • Highly sophisticated corporate development • Team is focused on building and maintaining • Given the data Aurora will ultimately have team that is deeply embedded in the product relationships with key governing bodies and access to and its level of involvement in key organization and constantly surveying the helping jointly write the rules of self-driving infrastructure and supply chains, cyber market analyzing build vs. buy decisions security is a top priority for Aurora and of • Aurora has always focused on having a critical importance • Team has multiple PhDs and is led by Bart communicative and transparent relationship Nabbe who has a PhD in Robotics and with local, state, and federal governments. • Gerhard Eschelbeck is Aurora’s Chief previously worked as a research scientist at This has engendered trust and positioned Information Security Officer after holding Intel, Toyota, and Apple Aurora to be a thought leader and trusted similar roles at Google and Deutsche Bank, partner as the government works to integrate firms with similar security requirements • Having a team with this level of technical self-driving into communities expertise is hugely valuable as Aurora is • The Aurora Driver and Aurora’s systems have constantly finding local maxima of • This team is also engaging with labor and been architected from the ground up to be as engineering problems and relies on the special interest groups to build relationships secure as possible and with the latest and corporate development team to source and and educate on self-driving greatest cyber security infrastructure evaluate buying opportunities that will cut down cycle times 25