424B3: Prospectus filed pursuant to Rule 424(b)(3)

Published on November 12, 2021

Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-260835

903,072,352 Shares of Class A Common Stock

8,900,000 Warrants to Purchase Shares of Class A Common Stock

This prospectus relates to the registration of the Class A Common Stock, par value $0.00001 per share, of Aurora Innovation, Inc. and warrants to purchase shares of Class A Common Stock as described herein.

This prospectus also relates to the issuance and sale by us of an aggregate of (i) 234,560,193 shares of Class A Common Stock issuable by us upon conversion of the Class B Common Stock, par value $0.00001 per share, of Aurora Innovation, Inc. (the Class B Common Stock), held by certain of our stockholders (the Non-Affiliate Conversion Stock), (ii) 425,722 shares of Class A Common Stock issuable upon the exercise of certain outstanding options to purchase Class A Common Stock held by individuals who terminated their employment with Aurora Innovation, Inc. prior to the closing of the business combination among Reinvent Technology Partners Y, Aurora Innovation, Inc. and RTPY Merger Sub Inc. (the Former Employee Options) and (iii) 12,218,750 shares of Class A Common Stock issuable upon the exercise of 12,218,750 warrants, exercisable on December 3, 2021, at a price of $11.50 per share (the Public Warrants).

This prospectus also relates to the issuance and resale of (i) 246,547,784 shares of Class A Common Stock issuable by us upon conversion of the Class B Common Stock held by certain of our stockholders the (Affiliate Conversion Stock), (ii) 951,098 shares of Class A Common Stock issuable upon the exercise of certain outstanding options to purchase Class A Common Stock (the Affiliate Options) and vesting of certain restricted stock units for Class A Common Stock held by certain of our affiliates and their affiliated entities (the Affiliate RSUs and together with the Affiliate Options, the Affiliate Equity Stock) and (iii) 8,900,000 shares of Class A Common Stock issuable upon the exercise of 8,900,000 Private Placement Warrants.

This prospectus also relates to the resale from time to time by the selling securityholders named in this prospectus or their permitted transferees (the Selling Securityholders) of (i) 4,029,344 shares of Class A Common Stock beneficially owned by certain of our affiliates (the Affiliate Class A Stock), (ii) 6,883,086 shares of Class A Common Stock beneficially owned by Reinvent Sponsor Y LLC (the Sponsor Stock), (iii) 100,000,000 shares of Class A Common Stock purchased at Closing by a number of subscribers pursuant to separate PIPE Subscription Agreements (the PIPE Shares), (iv) 288,556,375 shares of Class A Common Stock beneficially owned by certain stockholders who have been granted registration rights (the Registration Rights Shares) and (v) 8,900,000 Private Placement Warrants purchased by the Sponsor in connection with the RTPY IPO.

The Selling Securityholders may sell any, all or none of the securities and we do not know when or in what amount the Selling Securityholders may sell their securities hereunder following the date of this prospectus. The Selling Securityholders may sell the securities described in this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell their securities in the section titled Plan of Distribution appearing elsewhere in this prospectus.

We will not receive any of the proceeds from the sale of the securities by the Selling Securityholders. We will receive proceeds from the exercise of the Warrants if the Warrants are exercised for cash and from the exercise of the Affiliate Options and the Former Employee Options. We will pay the expenses associated with registering the sales by the Selling Securityholders other than any underwriting discounts and commissions, as described in more detail in the section titled Use of Proceeds appearing elsewhere in this prospectus.

Of the 903,072,352 shares of Class A Common Stock that may be offered or sold by Selling Securityholders identified in this prospectus, 802,952,352 of those shares (the Lock-Up Shares) are subject to certain lock-up restrictions, pursuant to our bylaws and/or other agreements further described in the section titled Certain Relationships and Related Person Transactions appearing elsewhere in this prospectus.

Our Class A Common Stock is listed on The Nasdaq Global Select Market (Nasdaq) under the symbol AUR and the Public Warrants are listed on Nasdaq under the symbol AUROW. On November 2, 2021, the last quoted sale price for our Class A Common Stock as reported on Nasdaq was $9.94 per share and the last quoted sale price for our Public Warrants as reported on Nasdaq was $2.40 per warrant.

We are an emerging growth company, as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in Risk Factors beginning on page 7 of this prospectus.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated November 12, 2021

Table of Contents

| Page | ||||

| iii | ||||

| viii | ||||

| 1 | ||||

| 7 | ||||

| 38 | ||||

| Market Price of the Registrants Common Equity and Related Stockholder Matters |

39 | |||

| Unaudited Pro Forma Condensed Combined Financial Information |

40 | |||

| Managements Discussion and Analysis of Financial Condition and Results of Operations |

58 | |||

| 71 | ||||

| 91 | ||||

| 98 | ||||

| 105 | ||||

| 120 | ||||

| 125 | ||||

| 140 | ||||

| Material U.S. Federal Income Tax Considerations For Non-U.S. Holders of Our Common Stock |

141 | |||

| 145 | ||||

| 149 | ||||

| 149 | ||||

| 150 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any applicable prospectus supplement prepared by us or on our behalf. Neither we nor the Selling Securityholders have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Selling Securityholders are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the SEC) using the shelf registration process. Under this shelf registration process, the selling securityholders hereunder may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such selling securityholders of the securities offered by them described in this prospectus.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus titled Where You Can Find Additional Information.

The Aurora design logo and the Aurora mark appearing in this prospectus are the property of Aurora Innovation, Inc. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders. We have omitted the ® and TM designations, as applicable, for the trademarks used in this prospectus.

-i-

Table of Contents

Within this prospectus, we reference industry and market data obtained from periodic industry publications, third-party studies and surveys, including from the American Automobile Association, American Transportation Research Institute, American Trucking Association, Armstrong & Associates, National Highway Traffic Safety Administration, RAND Corporation, Pitney Bowes, Department of Transportation, Department of Commerce, Bureau of Labor Statistics, Federal Highway Administration and the World Health Organization, as well as from filings of public companies in our industry and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Each publication, study and report is as of its original publication date (and not as of the date of this prospectus). Certain of these publications, studies and reports were published before the COVID-19 pandemic and therefore do not reflect any impact of COVID-19 on any specific market or globally. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. Neither we nor our stockholders can guarantee the accuracy or completeness of any such information contained in this prospectus.

-ii-

Table of Contents

Unless otherwise stated or unless the context otherwise requires, references in this prospectus to (1) Legacy Aurora refers to Aurora Innovation, Inc., a Delaware corporation, prior to the Merger, (2) RTPY refers to Reinvent Technology Partners Y, a Cayman company and our legal predecessor, prior to the Merger, and (3) Aurora, the Company, Registrant, we, us and our refers to Aurora Innovation, Inc., a Delaware corporation formerly known as Reinvent Technology Partners Y, and where appropriate, our wholly owned subsidiaries, following the Merger.

In this document:

2017 Plan are to the Aurora 2017 Equity Incentive Plan.

2021 Plan are to the Aurora Innovation, Inc. 2021 Equity Incentive Plan.

Aggregate Merger Consideration are to the number of shares of Aurora common stock equal to the quotient obtained by dividing (i) $11.0 billion, representing the pre-transaction equity value of Aurora, by (ii) $10.00.

Apparate are to Apparate USA LLC, formerly a subsidiary of Uber Technologies Inc., which was acquired by Aurora on January 19, 2021.

Aurora Founders are to Chris Urmson, Sterling Anderson and James Andrew (Drew) Bagnell.

Aurora Incentive Plans are to the Legacy Aurora 2017 Equity Incentive Plan, the Blackmore Sensors & Analytics, Inc. 2016 Equity Incentive Plan, and the OURS Technology Inc. 2017 Stock Incentive Plan, in each case, as amended.

Aurora common stock are to shares of Class A Common Stock and Class B Common Stock.

Aurora Options are to options to purchase shares of Class A Common Stock.

Aurora RSU Awards are to awards of restricted stock units based on shares of Class A Common Stock.

Aurora are to RTPY after the Business Combination and its name change from Reinvent Technology Partners Y to Aurora Innovation, Inc.

Aurora PIPE Investor are to a PIPE Investor that is a holder of shares of Legacy Aurora capital stock or securities exercisable for or convertible into Legacy Aurora capital stock as of the date of the Merger Agreement and not a Sponsor Related PIPE Investor.

Legacy Aurora preferred stock are to the Series Seed 1 preferred stock, Series Seed 2 preferred stock, Series A preferred stock, Series B preferred stock, Series B-1 preferred stock, Series U-1 preferred stock and Series U-2 preferred stock of Legacy Aurora.

Legacy Aurora restricted stock are to shares of Legacy Aurora common stock, which are subject to a substantial risk of forfeiture (within the meaning of Section 83 of the Code).

Legacy Aurora RSU Awards are to awards of restricted stock units based on shares of Legacy Aurora common stock granted under the Aurora Incentive Plans.

Legacy Aurora Stockholders are to the stockholders of Legacy Aurora and holders of Legacy Aurora Awards prior to the Business Combination.

-iii-

Table of Contents

Available Cash are to the amount as calculated by adding the Trust Amount and the PIPE Investment Amount.

Blackmore are to Blackmore Sensors & Analytics, Inc.

Board means the board of directors of Aurora.

Business Combination are to the Domestication together with the Merger.

Business Combination Agreement means the Agreement and Plan of Merger, dated as of July 14, 2021, by and among RTPY, Merger Sub and Legacy Aurora.

Bylaws are to the bylaws of Aurora.

Cayman Constitutional Documents are to RTPYs Amended and Restated Memorandum of Association (the Existing Memorandum) and RTPYs Amended and Restated Articles of Association (the Existing Articles), each as amended from time to time.

Certificate of Incorporation are to the certificate of incorporation of Aurora.

Class A Common Stock means the shares of Class A Common Stock of Aurora Innovation, Inc., par value $0.00001 per share.

Class B Common Stock means the shares of Class B Common Stock of Aurora Innovation, Inc., par value $0.00001 per share.

Closing means the consummation of the Merger, which occurred on November 3, 2021.

Code means the Internal Revenue Code of 1986, as amended.

Company, we, us and our are to Aurora.

Continental are to Continental Stock Transfer & Trust Company.

DENSO are to DENSO International America, Inc.

DGCL means the Delaware General Corporation Law.

Domestication are to the domestication of RTPY as a corporation incorporated in the State of Delaware.

Exchange Act means the Securities Exchange Act of 1934, as amended.

Exchange Ratio are to the quotient obtained by dividing (a) the Aggregate Merger Consideration by (b) the aggregate fully diluted number of shares of Legacy Aurora common stock issued and outstanding immediately prior to the Merger (which is (i) the aggregate number of shares of Legacy Aurora common stock (A) issued and outstanding immediately prior to the Merger, (B) issuable upon the conversion of the Legacy Aurora preferred stock immediately prior to the Merger in accordance with Auroras Organizational Documents, (C) issuable upon, or subject to, the exercise of Legacy Aurora Options (whether or not then vested or exercisable) that are outstanding immediately prior to the Merger, and (D) subject to Legacy Aurora RSU Awards (whether or not then vested) that are outstanding immediately prior to the Merger, minus (ii) a number of shares of Legacy Aurora common stock equal to (x) the aggregate exercise price of the Legacy Aurora Options described in clause (C) above divided by (y) the Per Share Merger Consideration).

-iv-

Table of Contents

GAAP means United States generally accepted accounting principles.

Investor Rights Agreement means the Investor Rights Agreement, entered into at the Closing, by and among RTPY, Legacy Aurora, and certain persons and entities holding Class A Common Stock.

IRS are to the U.S. Internal Revenue Service.

JOBS Act means the Jumpstart Our Business Startups Act of 2012, as amended.

Legacy Aurora means Aurora Innovation, Inc., prior to the Business Combination.

Legacy Aurora Awards are to Legacy Aurora Options and Legacy Aurora RSU Awards.

Legacy Aurora Class B stock are to shares of Legacy Aurora Class B stock, par value $0.0001 per share.

Legacy Aurora capital stock are to shares of Legacy Aurora common stock and Legacy Aurora Class B stock.

Legacy Aurora common stock are to shares of Legacy Aurora common stock, par value $0.0001 per share.

Legacy Aurora Options are to options to purchase shares of Legacy Aurora common stock granted under the Aurora Incentive Plans

Merger refers to the merging of Merger Sub with and into Legacy Aurora, with Legacy Aurora surviving the Merger as a wholly owned subsidiary of the Company and the other transactions contemplated by the Business Combination Agreement, consummated as of the Closing.

Merger Agreement are to the Agreement and Plan of Merger, dated as of July 14, 2021, by and among RTPY, Merger Sub and Aurora, as amended and modified from time to time.

Merger Sub means RTPY Merger Sub, Inc., a Delaware corporation.

Morgan Stanley are to Morgan Stanley & Co LLC.

Nasdaq means The Nasdaq Global Select Market.

Organizational Documents are to the Certificate of Incorporation and the Bylaws.

PACCAR are to PACCAR Inc.

Per Share Merger Consideration means the product obtained by multiplying (i) the Exchange Ratio by (ii) $10.00.

Person are to any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, joint stock company, governmental authority or instrumentality or other entity of any kind.

PIPE Investment means the purchase of 100,000,000 shares of Class A Common Stock by certain accredited investors pursuant to the PIPE Subscription Agreement in connection with the Closing, for a purchase price of $10.00 per share, in a private placement.

-v-

Table of Contents

PIPE Investment Amount are to the aggregate gross purchase price actually received by RTPY prior to or substantially concurrently with Closing for the shares in the PIPE Investment of $1,000,000,000.

PIPE Shares are to the shares of Class A Common Stock to be issued to PIPE Investors in connection with the PIPE Investment.

PIPE Subscription Agreement means that certain Subscription Agreement between the Company and the PIPE Investors pursuant to which the PIPE Investors agreed to purchase, in the aggregate, 100,000,000 shares of Class A Common Stock at $10.00 per share for an aggregate commitment amount of $1,000,000,000.

Pre-Closing Restructuring are to the Conversion Amendment, Preferred Stock Conversion, and the Exchange, in each case as set forth in the Merger Agreement.

Preferred Stock means the shares of preferred stock of Aurora, par value $0.00001 per share.

Private Placement Warrants means the warrants to purchase shares of Class A Common Stock purchased in a private placement in connection with the RTPY IPO, exercisable for one share of Class A Common Stock at a price of $11.50 per share, subject to adjustments.

pro forma are to giving pro forma effect to the Business Combination.

Public Warrants means the warrants to purchase shares of Class A Common Stock that are publicly traded under the AURW symbol on Nasdaq, exercisable for one share of Class A Common Stock at a price of $11.50 per share, subject to adjustments.

redemption are to each redemption of public shares for cash pursuant to the Cayman Constitutional Documents and the Proposed Organizational Documents.

Registration Statement are to the registration statement of which this prospectus forms a part.

Reinvent Capital are to Reinvent Capital LLC.

RTPY Board are to the board of directors of RTPY.

RTPY Class A ordinary shares are to RTPYs Class A ordinary shares, par value $0.00001 per share.

RTPY Class B ordinary shares are to RTPYs Class B ordinary shares, par value $0.00001 per share.

RTPY Founder Shares are to the RTPY Class B ordinary shares purchased by the Sponsor in a private placement prior to the RTPY IPO.

RTPY IPO means RTPYs initial public offering of Units, consummated on March 18, 2020.

RTPY IPO registration statement are to the Registration Statement on Form S-1 (333-253075) filed by RTPY in connection with its initial public offering, which became effective on March 18, 2021.

RTPY ordinary shares are to RTPY Class A ordinary shares and RTPY Class B ordinary shares.

RTPY units and units are to the units of RTPY, each unit representing one RTPY Class A ordinary share and one-eighth of one redeemable warrant to acquire one RTPY Class A ordinary share, that were offered and sold by RTPY in the RTPY IPO and registered pursuant to the RTPY IPO registration statement (less the number of units that have been separated into the underlying public shares and underlying warrants upon the request of the holder thereof).

-vi-

Table of Contents

RTPY refers to the former Reinvent Technology Partners Y, now known as Aurora Innovation, Inc., a Delaware corporation.

Sarbanes-Oxley Act are to the Sarbanes-Oxley Act of 2002.

SEC means the U.S. Securities and Exchange Commission.

Securities Act means the Securities Act of 1933, as amended.

Sponsor means Reinvent Sponsor Y LLC, a Cayman Islands limited liability company.

Sponsor Agreement are to that certain Sponsor Agreement, dated as of July 14, 2021, by and among the Sponsor, RTPY and Aurora, as amended and modified from time to time.

Sponsor Related PIPE Investor are to Reinvent Technology SPV II LLC, which is a special purpose vehicle formed solely to invest in the PIPE Investment.

Sponsor Shares are to the shares of Class A Common Stock received by the Sponsor upon the conversion of RTPY Class B Ordinary Shares held by the Sponsor in the Domestication.

Sponsor Support Agreement are to that certain Sponsor Support Agreement, dated as of July 14, 2021, by and among the Sponsor, RTPY, the directors and officers of RTPY, and Aurora.

Stockholder Lock-Up Agreement means that Stockholder Lock-Up Agreement entered into at Closing by and among Aurora, the Sponsor, certain affiliates of the Sponsor, and certain Legacy Aurora stockholders.

Subscription Agreements means the PIPE Subscription Agreements and the Sponsor Backstop Subscription Agreement.

Third Party PIPE Investors are to those certain third-party investors who participated in the PIPE Investment.

Treasury Regulations are to the regulations promulgated under the Code by the United States Department of the Treasury (whether in final, proposed or temporary form), as the same may be amended from time to time.

trust account are to the trust account established at the consummation of the RTPY IPO at Morgan Stanley and maintained by Continental, acting as trustee.

Trust Amount are to the amount of cash available in the trust account as of the Closing, after deducting the amount required to satisfy RTPYs obligations to its shareholders (if any) that exercise their redemption rights and after payment of any (x) deferred underwriting commissions being held in the trust account and (y) Aurora transaction expenses or RTPY transaction expenses.

Uber are to Uber Technologies, Inc.

Volvo are to Volvo Group.

Warrant Agreement are to the Warrant Agreement, dated as of March 15, 2021, by and between RTPY and Continental, as warrant agent.

Warrants means the Public Warrants and Private Placement Warrants.

-vii-

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as may, might, possible, will, should, expect, plan, anticipate, could, intend, target, project, contemplate, believe, estimate, predict, potential or continue or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this prospectus include statements about:

| | the Companys ability to recognize anticipated benefits of the Merger, which may be affected by, among other things, the ability of the Company to grow and manage growth profitably following the Closing; |

| | the projected financial information, including but not limited to assumptions around vehicle miles traveled, market penetration and pricing; |

| | our estimated total addressable market, the market for autonomous vehicles, and our market position; |

| | the ability to maintain the listing of our Class A Common Stock and warrants on Nasdaq; |

| | our ability to raise financing in the future; |

| | our ability to effectively manage our growth and future expenses; |

| | the sufficiency of our cash and cash equivalents to meet our operating requirements; |

| | our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| | the impact of the regulatory environment and complexities with compliance related to such environment; |

| | our ability to successfully collaborate with business partners; |

| | our ability to obtain, maintain, protect and enforce our intellectual property; |

| | the impact of the COVID-19 pandemic; and |

| | other factors detailed under the section entitled Risk Factors. |

We caution you that the foregoing list does not contain all of the forward-looking statements made in this prospectus.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, operating results, financial condition and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those described in the section titled Risk Factors and elsewhere in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this prospectus to reflect events or circumstances after the date of this prospectus or to reflect new information or the occurrence of unanticipated events, except as required by law. You should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

-viii-

Table of Contents

The following summary highlights information contained elsewhere in this prospectus. It does not contain all the information you should consider before investing in our Class A Common Stock or Warrants. You should read this entire prospectus carefully, including the sections titled Risk Factors, Business, Managements Discussion and Analysis of Financial Condition and Results of Operations, Where You Can Find Additional Information, Unaudited Pro Forma Condensed Combined Financial Information, and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. In this prospectus, unless the context requires otherwise, all references to we, our, us, Aurora, the Registrant, and the Company refer to Aurora Innovation, Inc. and its consolidated subsidiaries following the Business Combination.

Overview

Auroras mission is to deliver the benefits of self-driving technology safely, quickly, and broadly.

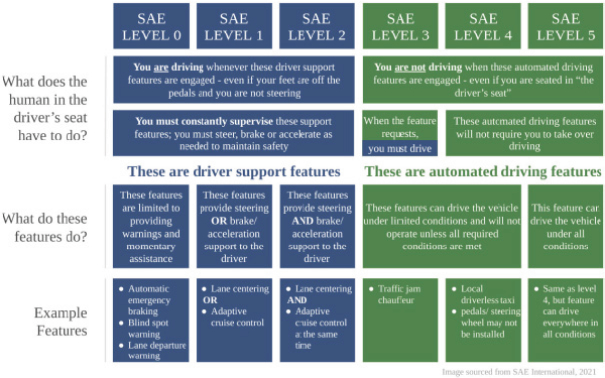

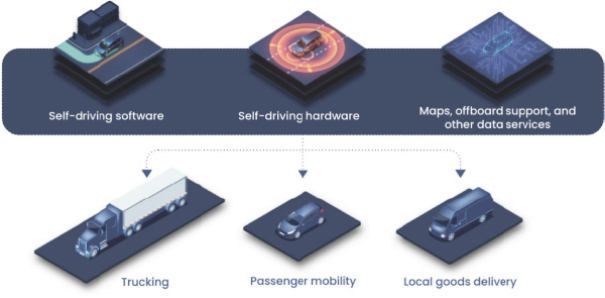

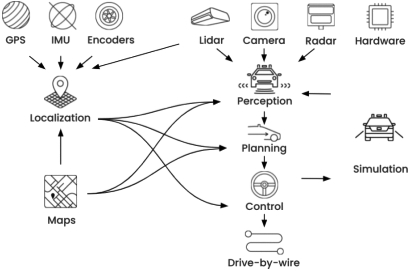

Aurora was founded in 2017 by Chris Urmson, Sterling Anderson, and Drew Bagnell, three of the most prominent leaders in the self-driving space. Led by a team with deep experience, Aurora is developing the Aurora Driver based on what it believes to be the most advanced and scalable suite of self-driving hardware, software, and data services in the world to fundamentally transform the global transportation market. The Aurora Driver is designed as a platform to adapt and interoperate amongst a multitude of vehicle types and applications. As of September 30, 2021, it has been successfully integrated into eight different vehicle platforms: from passenger vehicles to light commercial vehicles to Class 8 trucks. By creating a common driver platform Aurora Driver for multiple vehicle types and use cases, the capabilities Aurora develops in one market reinforce and strengthen its competitive advantages in other areas. For example, the capabilities needed for a truck to move safely at highway speeds would also be critical in ride hailing, when driving a passenger to the airport via a highway. Aurora believes this is the right approach to bring self-driving to market and will enable it to capitalize on a massive opportunity, including what we believe to be a $4 trillion global trucking market, a $5 trillion passenger mobility market, and a $400 billion local goods delivery market.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website at www.sec.gov that contains reports, proxy and information statements and other information about issuers, like us, that file electronically with the SEC. We also maintain a website at www.aurora.tech. We make available, free of charge, on our investor relations website at https://aurora.tech/ir, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports as soon as reasonably practicable after electronically filing or furnishing those reports to the SEC. Information contained on our website is not a part of or incorporated by reference into this prospectus and the inclusion of our website and investor relations website addresses in this prospectus is an inactive textual reference only.

Background

On November 3, 2021, RTPY, our legal predecessor company and a special purpose acquisition company co-founded by Reid Hoffman, Mark Pincus and Michael Thompson that closed its initial public offering in March 2021, consummated the previously announced merger with Aurora Innovation, Inc. and RTPY Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of RTPY. Pursuant to the Merger, Merger Sub merged with and into Aurora Innovation, Inc. the separate corporate existence of Merger Sub ceased, and Aurora Innovation, Inc. continued as the surviving corporation in the Merger and as a wholly owned subsidiary of RTPY. The Merger was approved by RTPYs stockholders at a meeting held on November 2, 2021. On the Closing, RTPY changed its name to Aurora Innovation, Inc.

-1-

Table of Contents

On November 4, 2021, our common stock and warrants, formerly those of RTPY, began trading on The Nasdaq Global Select Market under the ticker symbols AUR and AUROW, respectively.

As a result of the Merger, we raised gross proceeds of $1.2 billion, including the contribution of $0.2 billion of cash held in RTPYs trust account from the RTPY IPO, net of the redemption of RTPY common stock held by RTPYs public stockholders of $0.8 billion and $1 billion private investment in public equity at $10.00 per share of our Class A Common Stock. As a result of the Merger, we received net proceeds of $1.1 billion, net of estimated transaction costs of $0.1 billion. See Unaudited Pro Forma Condensed Combined Financial Information elsewhere in this prospectus for more information.

Risk Factors Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled Risk Factors immediately following this prospectus summary. The following is a summary of the principal risks we face:

| | Self-driving technology is an emerging technology, and we face significant technical challenges to commercialize our technology, and if we cannot successfully overcome those challenges or do so on a timely basis, our ability to grow our business will be negatively impacted. |

| | We are an early stage company with a history of losses, and we expect to incur significant expenses and continuing losses for the foreseeable future. |

| | Auroras limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter. |

| | Aurora operates in a highly competitive market and some market participants have substantially greater resources. If one or more of our competitors commercialize their self-driving technology before we do, develop superior technology, or are perceived to have better technology, it could materially and adversely affect our business, prospects, financial condition and results of operations. |

| | It is possible that our technology will have more limited performance or may take us longer to complete than is currently projected. This could materially and adversely affect our addressable markets, commercial competitiveness, and business prospects. |

| | We expect that our business model will become less capital intensive as we transition our business to our Driver as a Service model and if that transition is delayed or does not occur, we will require significant additional capital investment to run our business. |

| | Our services and technology may not be accepted and adopted by the market at the pace we expect or at all. |

| | We may experience difficulties in managing our growth and expanding our operations. |

| | Our business plans require a significant amount of capital. In addition, our future capital needs may require us to sell additional equity or debt securities that may dilute our stockholders. |

| | We are highly dependent on the services of our senior management team and, specifically, our Chief Executive Officer, and if we are not successful in retaining our senior management team and, in particular, our Chief Executive Officer, and in attracting or retaining other highly qualified personnel, we may not be able to successfully implement our business strategy. |

| | It is possible that Auroras self-driving unit economics do not materialize as expected, in particular as we transition to our Driver as a Service model. This could significantly hinder our ability to generate a commercially viable product and adversely affect our business prospects. |

-2-

Table of Contents

| | As part of growing our business, we have in the past and may in the future make acquisitions. If we fail to successfully select, execute or integrate our acquisitions, it could materially and adversely affect our business, prospects, financial condition and results of operations, and our stock price could decline |

| | Our operating and financial results projections rely in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our projections and our estimates of certain financial metrics may prove inaccurate. |

| | Unauthorized control or manipulation of systems in autonomous vehicles may cause them to operate improperly or not at all, or compromise their safety and data security, which could result in loss of confidence in us and our products and harm our business. |

| | Our future insurance coverage may not be adequate to protect us from all business risks. |

| | Our success is contingent on our ability to successfully maintain, manage, execute and expand on our existing partnerships and obtain new partnerships. |

| | Burdensome regulations, inconsistent regulations, or a failure to receive regulatory approvals of our technology could have a material adverse effect on our business, financial condition and results of operation. |

| | Despite the actions we are taking to defend and protect our intellectual property, we may not be able to adequately protect or enforce our intellectual property rights or prevent unauthorized parties from copying or reverse engineering our solutions. Our efforts to protect and enforce our intellectual property rights and prevent third parties from violating our rights may be costly. |

| | The dual class structure of Aurora common stock has the effect of concentrating voting control with the Aurora Founders. This will limit or preclude your ability to influence corporate matters, including the outcome of important transactions, including a change in control. |

| | The Aurora projected financial information considered by RTPY prior to the Business Combination may not be realized, which may adversely affect the market price of our stock. |

Implications of Being an Emerging Growth Company

We are an emerging growth company as defined in the JOBS Act. As such, we may take advantage of reduced disclosure and other requirements otherwise generally applicable to public companies, including:

| | exemption from the requirement to have our registered independent public accounting firm attest to managements assessment of our internal control over financial reporting; |

| | exemption from compliance with the requirement of the Public Company Accounting Oversight Board, or PCAOB, regarding the communication of critical audit matters in the auditors report on the financial statements; |

| | reduced disclosure about our executive compensation arrangements; and |

| | exemption from the requirement to hold non-binding advisory votes on executive compensation or golden parachute arrangements. |

We will remain an emerging growth company until the earliest to occur of: (1) the last day of the fiscal year in which we have at least $1.07 billion in annual revenue; (2) the date we qualify as a large accelerated filer, with at least $700.0 million of equity securities held by non-affiliates; (3) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period; and (4) the last day of the fiscal year ending after the fifth anniversary of the RTPY IPO.

-3-

Table of Contents

As a result of this status, we have taken advantage of reduced reporting requirements in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. In particular, in this prospectus, we have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies unless it otherwise irrevocably elects not to avail itself of this exemption. We have elected to use this extended transition period for complying with new or revised accounting standards until we are no longer an emerging growth company or until we affirmatively and irrevocably opt out of the extended transition period. As a result, our financial statements may not be comparable to the financial statements of companies that comply with the new or revised accounting pronouncements as of public company effective dates.

Additional Information

Our principal executive offices are located at 50 33rd St, Pittsburgh, PA 15201, and our telephone number is (888) 583-9506.

Our website address is www.aurora.tech. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not consider information contained on our website in deciding whether to purchase shares of our Class A Common Stock.

-4-

Table of Contents

THE OFFERING

Issuance of Class A Common Stock

| Non-Affiliate Conversion Stock |

234,560,193 shares |

| Former Employee Options |

425,722 shares |

| Shares of our Class A Common Stock issuable upon exercise of the Public Warrants |

12,218,750 shares |

| Use of Proceeds |

We will receive up to an aggregate of approximately $244.1 million from the exercise of all Warrants, assuming the exercise in full of such Warrants for cash and from the exercise of the Former Employee Options and Affiliate Options. We expect to use the net proceeds from the exercise of the Warrants and the Former Employee Options for general corporate purposes. See the section of this prospectus titled Use of Proceeds appearing elsewhere in this prospectus for more information. |

Issuance and Resale of Class A Common Stock

| Shares of Class A Common Stock offered by the Selling Securityholders hereunder (representing the Affiliate Conversion Stock and Affiliate Equity Stock |

247,498,882 shares |

| Shares of our Class A Common Stock issuable upon exercise of the Private Placement Warrants |

8,900,000 shares |

Resale of Class A Common Stock

| Shares of Class A Common Stock offered by the Selling Securityholders hereunder (representing the Affiliate Class A Stock, Sponsor Stock, PIPE Shares and Registration Rights Shares) |

399,468,805 shares |

| Warrants Offered by the Selling Securityholders hereunder (representing the Private Placement Warrants) |

8,900,000 warrants |

| Exercise Price of the Warrants |

$11.50 per share, subject to adjustment as described herein. |

| Redemption |

The warrants are redeemable in certain circumstances. See the section of this prospectus titled Description of Capital StockWarrants for further discussion. |

-5-

Table of Contents

| Use of Proceeds |

We will not receive any proceeds from the sale of our Class A Common Stock and Warrants offered by the Selling Securityholders under this prospectus (the Securities). See the section of this prospectus titled Use of Proceeds appearing elsewhere in this prospectus for more information. |

| Risk Factors |

See the section titled Risk Factors beginning on page 7 of this prospectus and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our Class A Common Stock and Warrants. |

| Nasdaq Symbol |

AUR for our Class A Common Stock and AUROW for our Warrants. |

| Lock-Up Restrictions |

Of the 903,072,352 shares of Class A Common Stock that may be offered or sold by Selling Securityholders identified in this prospectus, 802,952,352 of those shares (the Lock-Up Shares), which include shares of Class A Common Stock issuable upon the exercise or vesting of outstanding equity awards and upon conversion of Class B Common Stock, are subject to certain lock-up restrictions, pursuant to our bylaws and/or other agreements further described in the section titled Certain Relationships and Related Person Transactions appearing elsewhere in this prospectus. |

-6-

Table of Contents

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the section titled Managements Discussion and Analysis of Financial Condition and Results of Operations beginning on page 58 of this prospectus and our consolidated financial statements and related notes thereto included elsewhere in this prospectus. Our business, operating results, financial condition or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material. If any of the risks actually occur, our business, operating results, financial condition and prospects could be adversely affected. In that event, the market price of our Class A Common Stock and Public Warrants could decline, and you could lose part or all of your investment.

Risks Related to Our Technology, Business Model and Industry

Self-driving technology is an emerging technology, and we face significant technical challenges to commercialize our technology. If we cannot successfully overcome those challenges or do so on a timely basis, our ability to grow our business will be negatively impacted.

Solving self-driving is one of the most difficult engineering challenges of our generation. The industry can be characterized by a significant number of technical and commercial challenges, including an expectation for better-than-a-human driving performance, large funding requirements, long vehicle development lead times, specialized skills and expertise requirements of personnel, inconsistent and evolving regulatory frameworks, a need to build public trust and brand image, and real world operation of an entirely new technology. If we are not able to overcome these challenges, our business, prospects, financial condition, and results of operations will be negatively impacted and our ability to create a viable business may not materialize at all.

Although we believe that our self-driving systems and supporting technology are promising, we cannot assure you that our technology will succeed commercially. The successful development of our self-driving systems and related technology involves many challenges and uncertainties, including:

| | achieving sufficiently safe self-driving system performance as determined by us, government & regulatory agencies, our partners, customers, and the general public; |

| | finalizing self-driving system design, specification, and vehicle integration; |

| | successfully completing system testing, validation, and safety approvals; |

| | obtaining additional approvals, licenses or certifications from regulatory agencies, if required, and maintaining current approvals, licenses or certifications; |

| | receiving performance by third parties that supports our R&D and commercial activities; |

| | preserving core intellectual property rights, while obtaining rights from third parties for intellectual property that may be critical to our R&D activities; and |

| | continuing to fund and maintain our current technology development activities. |

We are an early stage company with a history of losses, and we expect to incur significant expenses and continuing losses for the foreseeable future.

We have incurred net losses on an annual basis since our inception. We incurred a net loss of $188.6 million for the three-month period ended March 31, 2021 and net losses of $214.5 million and $94.1 million for the years ended December 31, 2020 and 2019, respectively. We believe that we will continue to incur operating and net losses each quarter until at least the time we begin commercial operation of our self-driving technology, which may take longer than we currently expect or may never occur. Even if we successfully develop and sell our self-driving solutions, there can be no assurance that they will be commercially successful. We expect the rate at

-7-

Table of Contents

which we will incur losses to be substantially higher in future periods as we continue to scale our development and commercialize products. Because we will incur the costs and expenses from these efforts before we receive incremental revenues with respect thereto, our losses in future periods will be significant. In addition, we may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in revenues, which would further increase our losses.

Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter.

We began operations in 2017 and have been focused on developing self-driving technology ever since. This relatively limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter. Risks and challenges we have faced or expect to face include our ability to:

| | design, develop, test, and validate our self-driving technology for commercial applications; |

| | produce and deliver our technology at an acceptable level of safety and performance; |

| | properly price our products and services; |

| | plan for and manage capital expenditures for our current and future products; |

| | hire, integrate and retain talented people at all levels of our organization; |

| | forecast our revenue, budget for and manage our expenses; |

| | attract new partners and retain existing partners; |

| | navigate an evolving and complex regulatory environment; |

| | manage our supply chain and supplier relationships related to our current and future products; |

| | anticipate and respond to macroeconomic changes and changes in the markets in which we operate; |

| | maintain and enhance the value of our reputation and brand; |

| | effectively manage our growth and business operations, including the impacts of unforeseen market changes on our business; |

| | develop and protect intellectual property; and |

| | successfully develop new solutions, features, and applications to enhance the experience of partners and end-customers. |

If we fail to address the risks and difficulties that we face, including those associated with the challenges listed above, as well as those described elsewhere in this Risk Factors section, our business, financial condition and results of operations could be adversely affected. Further, because we have limited historical financial data and operate in a rapidly evolving market, any predictions about our future revenue and expenses may not be as accurate as they would be if we had a longer operating history or operated in a more predictable market. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations and our business, financial condition and results of operations could be adversely affected.

It is possible that our technology will have more limited performance or may take us longer to complete than is currently projected. This would adversely impact our addressable markets, commercial competitiveness, and business prospects.

Our products and self-driving system are technical and complex, and commercial application requires that we meet very high standards for technology performance and system safety. We may be unable to timely release

-8-

Table of Contents

new products that meet our intended commercial use cases, and we may therefore experience more limited monetization of our technology. These risks are particularly relevant for factors such as our self-driving systems operational domain (i.e., the conditions under which our system is designed to operate), which includes variables such as traversable road networks, speeds, and weather patterns. It is possible that there may be additional limitations in our operating capabilities depending upon a number of factors, including, for example, vehicle type (e.g. car, truck) and actor density (e.g. pedestrians, cyclists). If that is the case, we may be more restricted in our addressable market opportunities.

Commercial deployment has taken longer in the self-driving industry than anticipated, and it may take us more time to complete our own technology development and commercialization than is currently projected. The achievement of broadly applicable self-driving technology will require further technology improvements including, for example, handling non-compliant or unexpected actor behavior and inclement weather conditions. These improvements may take us longer than expected which would increase our capital requirements for technology development, delay our timeline to commercialization, and reduce the potential financial returns that may be expected from the business.

We operate in a highly competitive market and some market participants have substantially greater resources. If one or more of our competitors commercialize their self-driving technology before we do, develop superior technology, or are perceived to have better technology, our business prospects and financial performance would be adversely affected.

The market for self-driving technology is highly competitive and can be characterized by rapid technological change. Our future success will depend on our ability to develop and commercialize in a timely manner in order to stay ahead of existing and new competitors. Several companies, including, but not limited to, Waymo, GM Cruise, TuSimple, Tesla, Zoox/Amazon, Argo AI, Apple, Motional, Pony.ai, Intel Mobileye, Nuro, and Embark are investing heavily in building this technology. These companies compete with us directly by offering self-driving technology for the same or similar use cases. If our competitors, including those previously mentioned, commercialize their technology before we do, develop superior technology, or are perceived to have better technology, they may capture market opportunities and establish relationships with customers and partners that might otherwise have been available to us.

Material commercialization of self-driving technology first involves pilot deployments and some of our competitors are operating such pilots. Other competitors may initiate similar deployments in various use cases or geographies earlier than we will. Several of these competitors have substantial financial, marketing, R&D, and other resources. In the event that one or many of these competitors broadly commercializes their technology before we do, our business prospects and financial performance would be adversely impacted.

Our services and technology may not be accepted and adopted by the market at the pace we expect or at all.

Self-driving technology is still nascent and is neither generally understood nor universally accepted. We are at risk of adverse publicity that stems from any public incident involving self-driving vehicles (whether involving Aurora or a competitor), which could result in decreased end-customer demand for our technology. Part of our commercialization plan includes public awareness and education campaigns, but this guarantees neither public nor customer acceptance of our services. If we cannot gain sufficient trust in our technology, we will be unable to commercialize as intended. We may also experience adverse publicity that argues self-driving technology is replacing human jobs and disrupting the economy. Such media attention could cause current and future partners to terminate their business with us, which would significantly impact our ability to make future sales.

Further, as the market for self-driving cars develops, the differences in the approaches of Aurora and others will become more widely known to suppliers, insurers, regulators and others. Until these distinctions are known and appreciated, the actions of a single market participant may be imputed to the self-driving industry as a whole. As such, as a result of an action or inaction by a third-party, it is possible that suppliers, insurers, regulators and

-9-

Table of Contents

others may refuse or cease to interact with or conduct business with the self-driving industry as a whole, including Aurora.

If the market does not accept and adopt our services and technology at the pace we expect or at all, it could materially and adversely affect our business, prospects, financial condition and results of operations.

We expect that our business model will become less capital intensive as we transition our business to our Driver as a Service model and if that transition is delayed or does not occur, we will require significant additional capital investment to run our business.

Our business plan envisions a two-phase process for ownership and operation of Aurora-powered self-driving vehicles. Early in our commercialization, we intend to own or lease and operate a limited fleet and will invest in self-driving system hardware, base vehicles, and commercial facilities (such as freight terminals). We believe this firsthand experience will help us to harden our operational processes, service level agreements, and enable a more effective transition to working with external partners on operational activities. After this initial period of Aurora ownership and operation, we expect to transition to a Driver as a Service business model. Under this model, one or more third-party partners would own and operate Aurora-powered vehicles and would also manage activities such as financing, maintenance, cleaning, and fleet facilities.

Since it is more capital-intensive for us to own or lease and operate our own fleet of vehicles, any delay in the transition to the Driver as a Service model will require additional investments of capital and could mean we may not be able to reach scale as quickly as projected. In addition, it is possible that we may be required to fund and operate commercial facilities as part of our product offering, as opposed to partnering with third parties. Although we believe, based on partner discussions, that such a transition will be possible in our intended timeframes, there is no guarantee that third parties will be able or willing to own and operate Aurora-powered vehicles as soon or ramp as quickly as expected at desirable commercial terms. Similarly, we expect to partner with other third parties who will own and operate terminal facilities, but we may determine that we will need to own or operate more of these facilities ourselves. Such difficulties could have adverse impacts on our business, prospects, financial condition, and growth potential. As such, this model may present unpredictable challenges associated with third-party dependency which could materially and adversely affect our business, financial condition and results of operations.

It is possible that Auroras self-driving unit economics do not materialize as expected, in particular as we transition to our Driver as a Service model. This could significantly hinder our ability to generate a commercially viable product and adversely affect our business prospects.

Our business model is premised on our future expectations and assumptions regarding unit economics of the Aurora Driver and our transition, including the timing thereof, to our Driver as a Service model. There are uncertainties in these assumptions and we may not be able to achieve the unit economics we expect for many reasons, including but not limited to:

| | costs of the self-driving system hardware; |

| | other fixed and variable costs associated with self-driving vehicle operation; |

| | useful life; |

| | vehicle utilization; and |

| | product pricing. |

To manage self-driving hardware costs, we must engineer cost-effective designs for our sensors, computers, and vehicles, achieve adequate scale, and freeze hardware specifications while enabling continued software improvements. In addition, we must continuously push initiatives to optimize supporting cost components such

-10-

Table of Contents

as vehicle and SDS maintenance, cloud storage, telecom data feed, facilities, cleaning, operations personnel costs, and useful life. This will require significant coordination with our third-party fleet partners and adequate cost management may not materialize as expected or at all, which would have material adverse effects on our business prospects.

Self-driving technology is a new product and the appropriate price points are still being determined. Additionally, increased competition may result in pricing pressure and reduced margins and may impede our ability to increase the revenue of our technology or cause us to lose market share, any of which could materially and adversely affect our business, financial condition and results of operations. Unfavorable changes in any of these or other unit economics-related factors, many of which are beyond our control, could materially and adversely affect our business, prospects, financial condition and results of operations.

We are highly dependent on the services of our senior management team and, specifically, our Chief Executive Officer, and if we are not successful in retaining our senior management team and, in particular, our Chief Executive Officer, and in attracting or retaining other highly qualified personnel, we may not be able to successfully implement our business strategy.

Our success depends, in significant part, on the continued services of our senior management team, which has extensive experience in the self-driving industry. The loss of any one or more members of our senior management team, for any reason, including resignation or retirement, could impair our ability to execute our business strategy and could materially and adversely affect our business, financial condition and results of operations. In particular, we are highly dependent on Chris Urmson, our Founder, President and Chief Executive Officer, who remains deeply involved in all aspects of our business, including product development. If Mr. Urmson ceased to be involved with Aurora, this would adversely affect our business because his loss could make it more difficult to, among other things, compete with other market participants, manage our R&D activities and retain existing partners or cultivate new ones. Negative public perception of, or negative news related to, Mr. Urmson may adversely affect our brand, relationship with partners or standing in the industry.

Our success similarly hinges on the ability to attract, motivate, develop and retain a sufficient number of other highly skilled personnel, including software, hardware, systems engineering, automotive, safety, operations, design, finance, marketing, and support personnel. Competition for qualified highly skilled personnel can be strong, and we can provide no assurance that we will be successful in attracting or retaining such personnel now or in the future. Employees may be more likely to leave us if the shares of our capital stock they own or the shares of our capital stock underlying their equity incentive awards have significantly reduced in value or the vested shares of our capital stock they own or vested shares of our capital stock underlying their equity incentive awards have significantly appreciated. Many of our employees may receive significant proceeds from sales of our equity in the public markets once the applicable lock-up restrictions expire, which may reduce their motivation to continue to work for us. Further, any inability to recruit, develop and retain qualified employees may result in high employee turnover and may force us to pay significantly higher wages, which may harm our profitability.

Additionally, we do not carry key man insurance for any of our management executives, and the loss of any key employee or our inability to recruit, develop and retain these individuals as needed, could materially and adversely affect our business, financial condition and results of operations.

Risks Related to Our Business and Industry

Our business plans require a significant amount of capital. In addition, our future capital needs may require us to sell additional equity or debt securities that may dilute our stockholders.

The fact that we have a limited operating history means we have limited historical data on the demand for our products and services. As a result, our future capital requirements are uncertain and actual capital

-11-

Table of Contents

requirements may be different from those we currently anticipate. We expect to continue investing in research and development to improve our self-driving technology. We expect we will need to seek equity or debt financing to fund a portion of our future expenditures. Such financing might not be available to us in a timely manner, on terms that are acceptable, or at all.

Our ability to obtain the necessary financing to carry out our business plan is subject to a number of factors, including general market conditions and investor acceptance of our business model. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel our planned activities, or substantially change our corporate structure.

We may experience difficulties in managing our growth and expanding our operations.

We expect to experience significant growth in the scope and nature of our operations. Our ability to manage our operations and future growth will require us to continue to improve our operational, financial and management controls, compliance programs and systems automation. We are currently in the process of strengthening our compliance programs, including in relation to export controls, privacy and cybersecurity and anti-corruption. We will also need to reduce our reliance on manual operations in the areas of billing and reporting and make certain other improvements to support our complex arrangements and the rules governing revenue and expense recognition for our future operations. We may not be able to implement improvements in an efficient or timely manner and may discover deficiencies in existing controls, programs, systems and procedures, which could have an adverse effect on the accuracy of our reporting, business relationships, reputation and financial results.

Our operating and financial results projections rely in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual results of operations may be materially different from our projections and our estimates of certain financial metrics may prove inaccurate.

We use various estimates in formulating our business plans. We base our estimates upon a number of assumptions that are inherently subject to significant business and economic uncertainties and contingencies, many of which are beyond our control. Our estimates therefore may prove inaccurate, causing the actual amount to differ from our estimates. These factors include, without limitation:

| | assumptions around vehicle miles traveled (VMT); |

| | the degree of utilization achieved by our self-driving technology; |

| | the price our customers are willing to pay; |

| | the timing and breadth of our technologys operating domain and product models; |

| | operational costs of our self-driving technology and their useful life; |

| | growth in core development and operating expenses; |

| | which elements of service are delivered by Aurora versus our partners, and associated impact on expenses and capital requirements; |

| | the extent to which our technology is successfully and efficiently operationalized by our fleet partners, and our market penetration more broadly; |

| | the timing of when our partners and end-customers adopt our technology on a commercial basis which could be delayed for regulatory, safety or reliability issues unrelated to our technology; |

| | the timing of future self-driving system hardware generations and vehicle platforms; |

| | competitive pricing pressures, including from established and future competitors; |

-12-

Table of Contents

| | whether we can obtain sufficient capital to continue investing in core technology development and sustain and grow our business; |

| | the overall strength and stability of domestic and international markets, including, but not limited to trucking, passenger mobility, and local goods delivery; and |

| | other risk factors set forth in this prospectus. |

In particular, our total addressable market and opportunity estimates, growth forecasts, pricing, cost, and customer demand included in this registration statement are subject to significant uncertainty and are based on assumptions and estimates that may prove inaccurate. The projections, forecasts and estimates in this registration statement relating to the expected size and growth of the markets for self-driving technology may prove similarly imprecise. We are pursuing prospects in multiple markets that are undergoing rapid changes, including in technological and regulatory areas, and it is difficult to predict the timing and size of the opportunities.

Unfavorable changes in any of the above or other factors, including around the total addressable market and market opportunity, most of which are beyond our control, could materially and adversely affect our business, prospects, financial condition and results of operations.

As part of growing our business, we have in the past and may in the future make acquisitions. If we fail to successfully select, execute or integrate our acquisitions, it could materially and adversely affect our business, financial condition and results of operations, and our stock price could decline.

From time to time, we may undertake acquisitions to add new products and technologies, acquire talent, form new strategic partnerships, or enter into new markets or geographies. In addition to possible stockholder approval, we may need approvals and licenses from relevant government authorities for such future acquisitions and to comply with any applicable laws and regulations, which could result in increased delay and costs, and may disrupt our business strategy if such approvals are ultimately denied. Furthermore, acquisitions and the subsequent integration of new assets, businesses, key personnel, partners and end-customers, vendors and suppliers require significant attention from our management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on our operations. Additionally, acquired assets or businesses may not generate the financial results we expect. Key personnel or large numbers of employees who join Aurora through acquisitions may decide to leave Aurora to work for other businesses or competitors of Aurora, thereby diminishing the value of our acquisitions. Acquisitions could result in the use of substantial amounts of cash, potentially dilutive issuances of equity securities, the occurrence of significant goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business. For example, in January 2021, Aurora acquired Ubers self driving unit, Apparate, an acquisition for which many of the risks outlined above were, and continue to be, present. Apparate has a history of financial losses, which have (and will continue to) lead to increased losses for Aurora (versus if Aurora had not acquired Apparate), and which have and will require increased cash spending by Aurora. There are risks in retaining and integrating key personnel and teams, and risks and delay involved in properly and efficiently aligning and utilizing the teams of the combined entity. Further, Apparate and Aurora have a substantial amount of software, hardware, services and systems that are redundant, or not necessarily complementary. Additionally, the acquisition and integration processes create a risk that management and employees of Aurora become distracted. Finally, the costs of identifying and consummating acquisitions may be significant. Failure to successfully identify, complete, manage and integrate acquisitions could materially and adversely affect our business, prospects, financial condition and results of operations, and could cause our stock price to decline.

-13-

Table of Contents

Our business is subject to the risks of earthquakes, fire, floods and other natural catastrophic events, global pandemics, and interruptions by man-made problems, such as terrorism. Material disruptions of our business or information systems resulting from these events could materially and adversely affect our business, financial condition and results of operations.

A significant natural disaster, such as an earthquake, fire, flood, hurricane or significant power outage or other similar events, such as infectious disease outbreaks or pandemic events, including the COVID-19 pandemic and its aftermath, could materially and adversely affect our business, financial condition and results of operations. The COVID-19 pandemic and its aftermath may have the effect of heightening many of the other risks described in this Risk Factors section, such as the demand for our products, our ability to achieve or maintain profitability and our ability to raise additional capital in the future. We further note we have several offices located in the San Francisco Bay Area, a region known for seismic activity. In addition, natural disasters, acts of terrorism or war could cause disruptions in our remaining operations, our or our partners businesses, our suppliers or the economy as a whole. We also rely on information technology systems to communicate among our workforce and with third parties. Any disruption to our communications, whether caused by a natural disaster or by man-made problems, such as power disruptions, could adversely affect our business. We do not have a formal disaster recovery plan or policy in place and do not currently require that our partners have such plans or policies in place. To the extent that any such disruptions result in development or commercialization delays or impede our partners and suppliers ability to timely deliver product components, or the deployment of our products, this could materially and adversely affect our business, financial condition and results of operations. The spread of COVID-19 caused us to modify our business practices (including reducing employee travel, recommending that all non-essential personnel work from home and cancellation or reduction of physical participation in activities, meetings, events and conferences), and we may take further actions as may be required by government authorities or that we determine are in the best interests of our employees, partners and end-customers, suppliers, and business partners. The COVID-19 pandemic could limit the ability of our partners, suppliers, and business partners to perform, including our ability to conduct on-road and track operations for development testing.

Even after the COVID-19 pandemic has subsided, we may continue to experience an adverse impact to our business as a result of its global economic impact, including any recession that has occurred or may occur in the future. We do not yet know the full extent of COVID-19s impact on our business, our operations, or the global economy as a whole. However, the effects could materially and adversely affect our business, financial condition and results of operations, and we will continue to monitor the situation closely.

Interruption or failure of Amazon Web Services or other information technology and communications systems that we rely upon could materially and adversely affect our business, financial condition and results of operations.

We currently rely on Amazon Web Services, or AWS, to host our technology and support our technology development. The availability and effectiveness of our services depend on the continued operation of AWS, information technology, and communications systems. Our systems will be vulnerable to damage, interruption or any other compromise as the result of, among others, physical theft, fire, terrorist attacks, natural disasters, power loss, war, telecommunications failures, viruses, denial or degradation of service attacks, ransomware, social engineering schemes, insider theft or misuse or other attempts to harm our systems. We utilize reputable third-party service providers or vendors for all of our data other than our source code, and these providers could also be vulnerable to harms similar to those that could damage our systems, including sabotage and intentional acts of vandalism causing potential disruptions. It may become increasingly difficult to maintain and improve our performance, especially during peak usage times, as we expand the usage of our platform. Some of our systems will not be fully redundant, and our disaster recovery planning cannot account for all eventualities. Any problems with our third-party cloud hosting providers could result in lengthy interruptions in our business.

-14-

Table of Contents

We are subject to cybersecurity risks to operational systems, security systems, infrastructure, integrated software and partners and end-customers data processed by us or third-party vendors or suppliers and any material failure, weakness, interruption, cyber event, incident or breach of security could prevent us from effectively operating our business.