424B3: Prospectus filed pursuant to Rule 424(b)(3)

Published on April 7, 2022

| PROSPECTUS SUPPLEMENT NO. 1 | Filed Pursuant to Rule 424(b)(3) | ||||

| (to prospectus dated March 18, 2022) | Registration No. 333-260835 | ||||

903,072,352 Shares of Class A Common Stock

8,900,000 Warrants to Purchase Shares of Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated March 18, 2022 (the “Prospectus”), related to: (1) the issuance and sale by us of an aggregate of (i) 234,560,193 shares of our Class A common stock, par value $0.00001 per share (“Class A Common Stock”), issuable by us upon conversion of our Class B common stock, par value $0.00001 per share (“Class B Common Stock”), held by certain of our stockholders (the “Non-Affiliate Conversion Stock”), (ii) 425,722 shares of Class A Common Stock issuable upon the exercise of certain outstanding options to purchase Class A Common Stock held by individuals who terminated their employment with Aurora Innovation, Inc. prior to the closing of the business combination among Reinvent Technology Partners Y (“RTPY”), Aurora Innovation Holdings, Inc. (formerly Aurora Innovation, Inc.) and RTPY Merger Sub Inc. (the “Former Employee Options”) and (iii) 12,218,750 shares of Class A Common Stock issuable upon the exercise of 12,218,750 warrants, exercisable on December 3, 2021, at a price of $11.50 per share (the “Public Warrants”), (2) the issuance and resale of (i) 246,547,784 shares of Class A Common Stock issuable by us upon conversion of the Class B Common Stock held by certain of our stockholders the (“Affiliate Conversion Stock”), (ii) 951,098 shares of Class A Common Stock issuable upon the exercise of certain outstanding options to purchase Class A Common Stock (the “Affiliate Options”) and vesting of certain restricted stock units for Class A Common Stock held by certain of our affiliates and their affiliated entities (the “Affiliate RSUs” and together with the Affiliate Options, the “Affiliate Equity Stock”) and (iii) 8,900,000 shares of Class A Common Stock issuable upon the exercise of 8,900,000 warrants (the “Private Placement Warrants”) to purchase shares of Class A Common Stock purchased in a private placement in connection with RTPY’s initial public offering of units, consummated on March 18, 2020 (the “RTPY IPO”), and (3) the resale from time to time by the selling securityholders named in the Prospectus or their permitted transferees (the “Selling Securityholders”) of (i) 4,029,344 shares of Class A Common Stock beneficially owned by certain of our affiliates (the “Affiliate Class A Stock”), (ii) 6,883,086 shares of Class A Common Stock beneficially owned by Reinvent Sponsor Y LLC (the “Sponsor Stock”), (iii) 100,000,000 shares of Class A Common Stock purchased at Closing by a number of subscribers pursuant to separate PIPE Subscription Agreements (the “PIPE Shares”), (iv) 288,556,375 shares of Class A Common Stock beneficially owned by certain stockholders who have been granted registration rights (the “Registration Rights Shares”) and (v) 8,900,000 Private Placement Warrants purchased by the Sponsor in connection with the RTPY IPO, with the information contained in the Definitive Proxy Statement on Schedule 14A, filed with the Securities and Exchange Commission on April 7, 2022 (the “Definitive Proxy Statement”). Accordingly, we have attached the Definitive Proxy Statement to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A Common Stock is listed on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “AUR,” and the Public Warrants are listed on Nasdaq under the symbol “AUROW.” On April 5, 2022, the last quoted sale price for our Class A Common Stock as reported on Nasdaq was $6.46 per share and the last quoted sale price for our Public Warrants as reported on Nasdaq was $1.68 per warrant.

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 7 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 7, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| SCHEDULE 14A | ||

|

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

| ||

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

| AURORA INNOVATION, INC. | ||

| (Name of Registrant as Specified in its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check all boxes that apply):

x No fee required.

o Fee paid previously with preliminary materials.

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

1654 Smallman Street

Pittsburgh, Pennsylvania 15222

(888) 583-9506

April 7, 2022

Dear Fellow Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of Aurora Innovation, Inc., to be held on May 20, 2022 at 10:00 a.m., Pacific Time. Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders and employees, the annual meeting will be conducted virtually via live audio webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/AUR2022.

The attached formal meeting notice and proxy statement contain details of the business to be conducted at the annual meeting.

Your vote is important. Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the annual meeting. Therefore, we urge you to vote and submit your proxy promptly via the Internet, telephone or mail.

On behalf of our Board of Directors, we would like to express our appreciation for your continued support of and interest in Aurora.

Sincerely,

Chris Urmson

Co-Founder, Chief Executive Officer and Chairman

--

AURORA INNOVATION, INC.

1654 Smallman Street

Pittsburgh, Pennsylvania 15222

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | 10:00 a.m., Pacific Time, on May 20, 2022 | ||||

| Virtual Location |

The annual meeting will be conducted virtually via live audio webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/AUR2022, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. You will need to have your 16-digit control number included on your proxy card or the instructions that accompanied your proxy materials in order to join the annual meeting.

|

||||

| Items of Business |

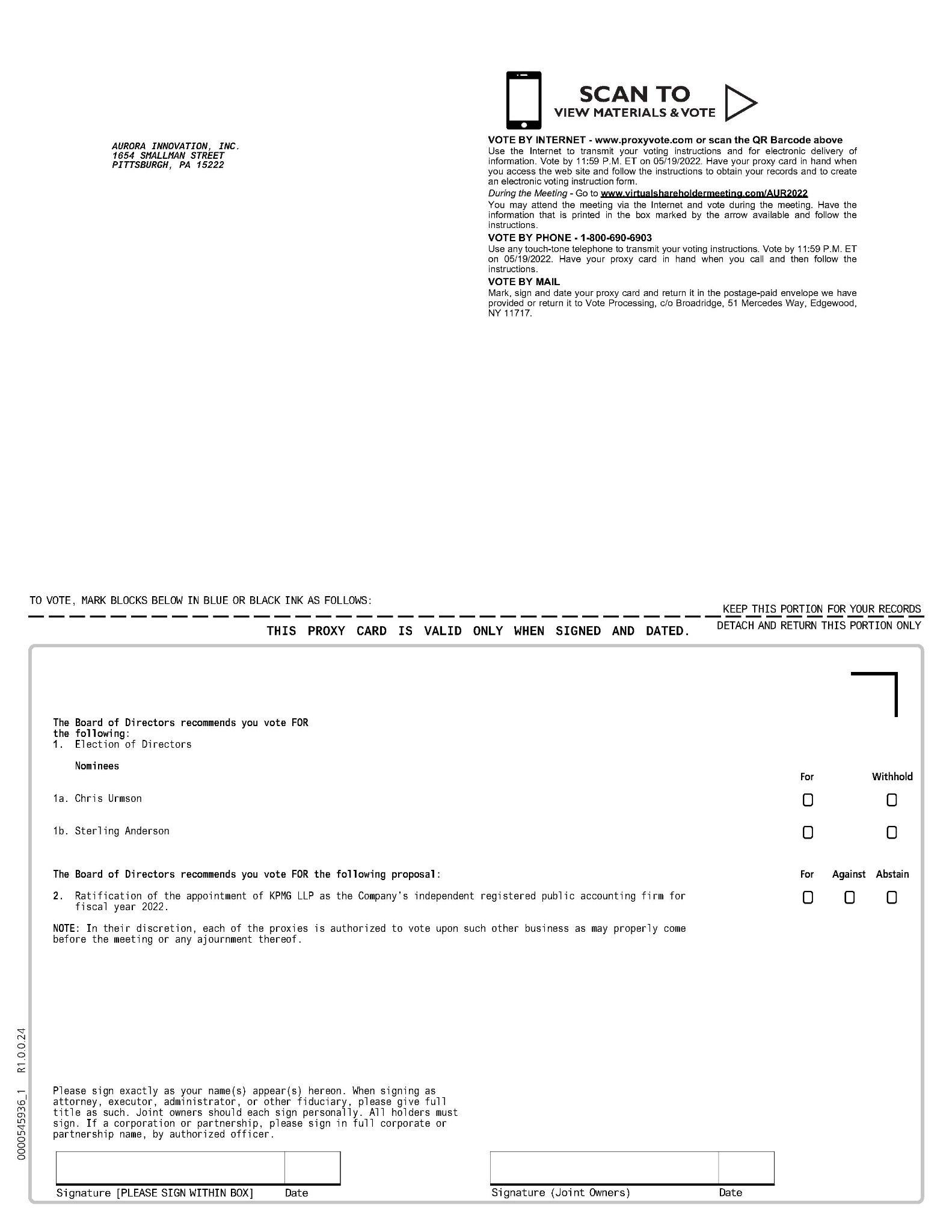

•To elect Chris Urmson and Sterling Anderson as Class I directors to hold office until our 2025 annual meeting of stockholders and until their respective successors are elected and qualified.

•To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

•To transact other business that may properly come before the annual meeting or any adjournments or postponements thereof.

|

||||

| Record Date |

March 29, 2022

Only stockholders of record as of March 29, 2022 are entitled to notice of and to vote at the annual meeting.

A list of stockholders of record will be available for inspection by stockholders of record during normal business hours for ten days prior to the annual meeting for any legally valid purpose at our corporate headquarters at 1654 Smallman Street, Pittsburgh, Pennsylvania 15222. For access to the stockholder list, please contact us at notices@aurora.tech. The stockholder list will also be available during the annual meeting at www.virtualshareholdermeeting.com/AUR2022.

|

||||

| Availability of Proxy Materials |

The Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement, notice of annual meeting, form of proxy and our annual report, is first being sent or given on or about April 7, 2022 to all stockholders entitled to vote at the annual meeting.

The proxy materials and our annual report can be accessed as of April 7, 2022 by visiting www.proxyvote.com.

|

||||

| Voting |

Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible.

|

||||

| By order of the Board of Directors, | |||||

|

|||||

| William Mouat | |||||

| General Counsel | |||||

| Pittsburgh, Pennsylvania | |||||

| April 7, 2022 | |||||

--

--

TABLE OF CONTENTS

--

--

AURORA INNOVATION, INC.

PROXY STATEMENT

FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

To be held at 10:00 a.m., Pacific Time, on May 20, 2022

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

What is Aurora’s relationship to Reinvent Technology Partners Y?

The original Aurora Innovation, Inc., now named Aurora Innovation Holdings, Inc. (“Legacy Aurora”) was founded in 2017. On November 3, 2021, Legacy Aurora consummated a business combination (the “Business Combination”) with Reinvent Technology Partners Y, our legal predecessor and a special purpose acquisition company (“RTPY”), whereby Legacy Aurora became a wholly owned subsidiary of RTPY, and RTPY changed its name to Aurora Innovation, Inc., a Delaware corporation. As used in this proxy statement, references to “Aurora,” “the Company,” “we,” “us,” “our” and other similar terms refer to Legacy Aurora prior to the Business Combination and to Aurora and its consolidated subsidiaries after giving effect to the Business Combination.

Why am I receiving these materials?

This proxy statement and the form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2022 annual meeting of stockholders of the Company and any postponements, adjournments or continuations thereof. The annual meeting will be held on May 20, 2022 at 10:00 a.m., Pacific Time. The annual meeting will be conducted virtually via live audio webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/AUR2022, where you will be able to listen to the meeting live, submit questions and vote online during the meeting.

The Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, containing instructions on how to access this proxy statement, the accompanying notice of annual meeting and form of proxy, and our annual report, is first being sent or given on or about April 7, 2022 to all stockholders of record as of March 29, 2022. The proxy materials and our annual report can be accessed as of April 7, 2022 by visiting www.proxyvote.com. If you receive a Notice of Internet Availability, then you will not receive a printed copy of the proxy materials or our annual report in the mail unless you specifically request these materials. Instructions for requesting a printed copy of the proxy materials and our annual report are set forth in the Notice of Internet Availability.

What proposals will be voted on at the annual meeting?

The following proposals will be voted on at the annual meeting:

•the election of Chris Urmson and Sterling Anderson as Class I directors to hold office until our 2025 annual meeting of stockholders and until their respective successors are elected and qualified; and

•the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

As of the date of this proxy statement, our management and board of directors were not aware of any other matters to be presented at the annual meeting.

4814-6819-3220.9 - 4/22/2021 10:03:07 AM

How does the board of directors recommend that I vote on these proposals?

Our board of directors recommends that you vote your shares:

•“FOR” the election of Chris Urmson and Sterling Anderson as Class I directors; and

•“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

Who is entitled to vote at the annual meeting?

Holders of our Class A common stock and Class B common stock as of the close of business on March 29, 2022, the record date for the annual meeting, may vote at the annual meeting. As of the record date, there were 646,066,716 shares of our Class A common stock outstanding and 481,107,977 shares of our Class B common stock outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of Class A common stock is entitled to one vote on each matter properly brought before the annual meeting and each share of Class B common stock is entitled to ten votes on each matter properly brought before the annual meeting. Our Class A common stock and Class B common stock are collectively referred to in this proxy statement as our common stock.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was sent directly to you by us. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the annual meeting. Throughout this proxy statement, we refer to these holders as “stockholders of record.”

Street Name Stockholders. If your shares are held in a brokerage account or by a broker, bank or other nominee, then you are considered the beneficial owner of shares held in street name, and the Notice of Internet Availability was forwarded to you by your broker, bank or other nominee, which is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank or other nominee sent to you. Beneficial holders who did not receive a 16-digit control number from their broker, bank or other nominee, who wish to attend the meeting should follow the instructions from their broker, bank or other nominee, including any requirement to obtain a legal proxy. Throughout this proxy statement, we refer to these holders as “street name stockholders.”

Is there a list of registered stockholders entitled to vote at the annual meeting?

A list of stockholders of record will be available for inspection by stockholders of record during normal business hours for ten days prior to the annual meeting for any legally valid purpose at our corporate headquarters at 1654 Smallman Street, Pittsburgh, Pennsylvania 15222. For access to the stockholder list, please contact us at notices@aurora.tech. The stockholder list will also be available during the annual meeting at www.virtualshareholdermeeting.com/AUR2022.

Which proposals are considered “routine” or “non-routine”?

Proposal 2, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022, is considered a “routine” proposal. Proposal 1, the election of Chris Urmson and Sterling Anderson as Class I directors, is considered “non-routine”, and if you do not provide voting instructions, your shares will be treated as broker non-votes and, therefore, will have no effect on such proposals, other than having the practical effect of reducing the number of affirmative votes required to achieve a majority for each of such proposals by reducing the total number of shares from which the majority is calculated.

--

How many votes are needed for approval of each proposal?

•Proposal No. 1: Each director is elected by a plurality of the voting power of the shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors. A plurality means that the nominees with the largest number of FOR votes are elected as directors. You may (1) vote FOR the election of each of the director nominees named herein or (2) WITHHOLD authority to vote for each such director nominee. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker non-vote, will have no effect on the outcome of the election.

•Proposal No. 2: The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the annual meeting and entitled to vote thereon. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against this proposal, i.e., will have the same effect as a vote AGAINST this proposal. Because this is a routine proposal, we do not expect any broker non-votes on this proposal.

Do the Company’s directors and officers have an interest in any of the matters to be acted upon at the annual meeting?

Members of our board of directors have an interest in Proposal 1, the election of the two director nominees to the board of directors as set forth herein, as each of the nominees is currently a member of the board of directors. Members of the board of directors and our executive officers do not have any interest in Proposal 2, the ratification of the appointment of our independent registered public accounting firm.

What is the quorum requirement for the annual meeting?

A quorum is the minimum number of shares required to be present or represented at the annual meeting for the meeting to be properly held under our bylaws and Delaware law. The presence, in person or by proxy, of a majority of the voting power of our capital stock issued and outstanding and entitled to vote will constitute a quorum to transact business at the annual meeting. Abstentions, choosing to withhold authority to vote and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairperson of the meeting may adjourn the meeting to another time or place.

What is the difference between holding shares as a record holder and as a beneficial owner (holding shares in street name)?

If your shares are registered in your name with our transfer agent, American Stock Transfer & Trust Company, you are the “record holder” of those shares. If you are a record holder, the Notice of Internet Availability has been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, the Notice of Internet Availability was forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. Because you are not the stockholder of record, you may not vote your shares electronically during the annual meeting unless you request and obtain a valid proxy issued in your name from the broker, bank or other nominee considered the stockholder of record of the shares.

--

How do I vote and what are the voting deadlines?

Stockholder of Record. If you are a stockholder of record, you may vote in one of the following ways:

•by Internet at www.proxyvote.com, 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on May 19, 2022 (have your Notice of Internet Availability or proxy card in hand when you visit the website);

•by toll-free telephone at (800) 690-6903, 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on May 19, 2022 (have your Notice of Internet Availability or proxy card in hand when you call);

•by completing, signing and mailing your proxy card, which must be received prior to the annual meeting; or

•by attending the virtual meeting by visiting www.virtualshareholdermeeting.com/AUR2022, where you may vote and submit questions during the Annual Meeting (have your Notice of Internet Availability or proxy card in hand when you visit the website).

Street Name Stockholders. If you are a street name stockholder and did not receive a 16-digit control number from your broker, bank or other nominee for you to vote your own shares, then you will receive voting instructions from your broker, bank or other nominee. You must follow these instructions, including any requirement to obtain a legal proxy, in order to instruct them on how to vote your shares. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a street name stockholder who did not receive a 16-digit control number, then you may not vote your shares at the annual meeting unless you follow the voting instructions from your broker, bank or other nominee and obtain any legal proxy they may require.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

•“FOR” the election of Chris Urmson and Sterling Anderson as Class I directors; and

•“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

In addition, if any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole routine matter: the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. Your broker, bank or other nominee will not have discretion to vote on any other proposals, which are considered non-routine matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our sole routine matter, but is not able to vote your shares on the non-routine matters, then those shares will be treated as broker non-votes with respect to the non-routine proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

--

Can I change my vote or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy before the annual meeting by:

•entering a new vote by Internet or telephone (subject to the applicable deadlines for each method as set forth above);

•completing and returning a later-dated proxy card, which must be received prior to the annual meeting;

•delivering a written notice of revocation to Aurora Innovation, Inc., 1654 Smallman Street, Pittsburgh, Pennsylvania 15222, Attention: Legal Department, which must be received prior to the annual meeting; or

•attending and voting at the annual meeting (although attendance at the annual meeting will not, by itself, revoke a proxy).

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

Will I be able to participate in the virtual annual meeting on the same basis I would be able to participate in a live annual meeting?

In light of the public health concerns due to the COVID-19 pandemic and to support the health and well-being of our stockholders and employees, our annual meeting will be held in a virtual meeting format only and will be conducted via live audio webcast. The online meeting format for our annual meeting will enable full and equal participation by all our stockholders from any place in the world at little to no cost.

We designed the format of our virtual annual meeting to ensure that our stockholders who attend our annual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting and to enhance stockholder access, participation and communication through online tools. We plan to take the following steps to provide for such an experience:

•providing stockholders with the ability to submit appropriate questions up to 15 minutes in advance of the meeting;

•providing stockholders with the ability to submit appropriate questions real-time via the meeting website, limiting questions to one per stockholder unless time otherwise permits; and

•answering as many questions submitted in accordance with the meeting rules of conduct as appropriate in the time allotted for the meeting.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Richard Tame, our Chief Financial Officer, and William Mouat, our General Counsel, and each of them, with full power of substitution and re-substitution, have been designated as proxy holder for the annual meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above. If any other matters are properly brought before the annual meeting, then the proxy holders will use their own judgment to determine how to vote your shares. If the annual meeting is postponed or adjourned, then the proxy holder can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

--

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspector of election.

How can I contact Aurora’s transfer agent?

You may contact our transfer agent, American Stock Transfer & Trust Company, by telephone at (800) 937-5449, or by writing American Stock Transfer & Trust Company, at 6201 15th Avenue, Brooklyn, New York 11219. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at www.astfinancial.com.

How are proxies solicited for the annual meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the annual meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communications or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation.

Where can I find the voting results of the annual meeting?

We will disclose voting results on a Current Report on Form 8-K that we will file with the U.S. Securities and Exchange Commission (the “SEC”), within four business days after the meeting. If final voting results are not available to us in time to file a Form 8-K, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

Why did I receive a Notice of Internet Availability instead of a full set of proxy materials?

In accordance with the rules of the SEC we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability instead of a paper copy of the proxy materials. The Notice of Internet Availability contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals, how to request printed copies of the proxy materials and our annual report, and how to request to receive all future proxy materials in printed form by mail or electronically by e-mail. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed proxy materials?

If you receive more than one Notice of Internet Availability or more than one set of printed proxy materials, then your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or each set of printed proxy materials, as applicable, to ensure that all of your shares are voted.

--

I share an address with another stockholder, and we received only one copy of the Notice of Internet Availability or proxy statement and annual report. How may I obtain an additional copy of the Notice of Internet Availability or proxy statement and annual report?

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s Notice of Internet Availability or proxy statement and annual report, as applicable, you may contact us as follows:

Aurora Innovation, Inc.

Attention: Investor Relations

1654 Smallman Street

Pittsburgh, Pennsylvania 15222

Tel: (888) 583-9506

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

--

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

--

Composition of the Board

Aurora’s business and affairs are managed under the direction of the board of directors. The board of directors currently consists of eight directors, six of whom are independent under the listing standards of The Nasdaq Stock Market LLC, or Nasdaq. The number of directors is fixed by the board of directors, subject to the terms of our amended and restated certificate of incorporation and amended and restated bylaws. Each of our directors will continue to serve as a director until the election and qualification of his or her successor, or until his or her earlier death, resignation or removal.

Our board of directors is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Thus, at each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring.

The following table sets forth the names, ages as of March 1, 2022, and certain other information for each of our directors and director nominees:

| Name | Class | Age | Position(s) | Director Since |

Current

Term

Expires

|

Expiration of

Term for

Which

Nominated

|

||||||||||||||||||||||||||||||||

Nominees for Director |

||||||||||||||||||||||||||||||||||||||

Chris Urmson |

I | 45 | Chief Executive Officer, Co-Founder and Chairman | March 2017 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

Sterling Anderson |

I | 38 | Chief Product Officer, Co-Founder and Director | January 2018 | 2022 | 2025 | ||||||||||||||||||||||||||||||||

Continuing Directors |

||||||||||||||||||||||||||||||||||||||

Carl Eschenbach(1)(3)

|

II | 55 | Director | March 2019 | 2023 | — | ||||||||||||||||||||||||||||||||

Dara Khosrowshahi(3)

|

II | 52 | Director | January 2021 | 2023 | — | ||||||||||||||||||||||||||||||||

Michelangelo Volpi(1)(2)

|

II | 55 | Director | January 2018 | 2023 | — | ||||||||||||||||||||||||||||||||

Brittany Bagley(1)(2)

|

III | 38 | Director | July 2021 | 2024 | — | ||||||||||||||||||||||||||||||||

Reid Hoffman(2)(3)

|

III | 54 | Director | January 2018 | 2024 | — | ||||||||||||||||||||||||||||||||

Claire Hughes Johnson |

III | 49 | Director | January 2022 | 2024 | — | ||||||||||||||||||||||||||||||||

______________________________

(1)Member of audit committee

(2)Member of compensation committee

(3)Member of nominating and corporate governance committee

--

Nominees for Director

Chris Urmson. Mr. Urmson is a co-founder of Aurora and has served as Chief Executive Officer and a director on the Board at Aurora since its founding in 2017. Prior to founding Aurora, Mr. Urmson helped build Google’s self-driving program from 2009 to 2016 and served as Chief Technology Officer of the group. Mr. Urmson has over 15 years of experience leading automated vehicle programs. He was the Director of Technology for Carnegie Mellon’s DARPA Grand and Urban Challenge Teams, which placed second and third in 2005, and first in 2007. Mr. Urmson earned his Ph.D. in Robotics from Carnegie Mellon University and his BEng in Computer Engineering from the University of Manitoba. Mr. Urmson currently serves on Carnegie Mellon’s School of Computer Science Dean’s Advisory Board. Mr. Urmson also currently serves on the board of directors for Edge Case Research, a company working to assure the safety of autonomous systems for real world deployment. Additionally, he is on the Shell New Energies External Advisory Board. Mr. Urmson has authored over 50 publications and is a prolific inventor.

We believe Mr. Urmson is qualified to serve on our board of directors, given his extensive technical and leadership experience in the self-driving sector, and the unique perspective he brings as one of Aurora’s co-founders and current Chief Executive Officer.

Sterling Anderson. Mr. Anderson is a co-founder of Aurora and has served as our Chief Product Officer since its founding in 2017 and as a director on our board of directors since January 2018. Mr. Anderson has spent over 12 years leading advanced vehicle programs. Prior to founding Aurora, Mr. Anderson led the design, development, and launch of the award-winning Tesla Model X, and led the team that delivered Tesla Autopilot. In the late 2000s, he developed MIT’s Intelligent Co-Pilot, a shared autonomy framework that paved the way for broad advances in cooperative control of human-machine systems. Mr. Anderson holds multiple patents and over a dozen publications in autonomous vehicle systems, and an MS and PhD from MIT.

We believe Mr. Anderson is qualified to serve on our board of directors because of his deep experience in the self-driving industry, strong technical knowledge, and the unique perspective he brings as a co-founder of Aurora.

Continuing Directors

Carl Eschenbach. Mr. Eschenbach currently serves as a director on our Board. Since April 2016, Mr. Eschenbach has been a managing member at Sequoia Capital Operations, LLC, a venture capital firm. Prior to joining Sequoia Capital, Mr. Eschenbach spent 14 years at VMware, Inc., a global virtual infrastructure software provider, most recently as its President and Chief Operating Officer, a role he held from December 2012 to March 2016. Mr. Eschenbach served as VMware’s Co-President and Chief Operating Officer from April 2012 to December 2012, as Co-President, Customer Operations from January 2011 to April 2012, and as Executive Vice President of Worldwide Field Operations from May 2005 to January 2011. Mr. Eschenbach currently serves on the board of directors of UiPath, Inc., Zoom Video Communications, Inc., Snowflake, Inc., Workday, Inc., and Palo Alto Networks, Inc., as well as several private companies. Mr. Eschenbach holds an Electronics Technician diploma from DeVry University.

We believe Mr. Eschenbach is qualified to serve on our board of directors because of his operational and sales experience in the technology industry and knowledge of high-growth companies.

Dara Khosrowshahi. Mr. Khosrowshahi currently serves as a director on our Board. Mr. Khosrowshahi has served as the Chief Executive Officer of Uber and as a member of Uber’s board of directors since September 2017. Prior to joining Uber, Mr. Khosrowshahi served as President and Chief Executive Officer of Expedia, Inc., an online travel company, from August 2005 to August 2017. From August 1998 to August 2005, Mr. Khosrowshahi served in several senior management roles at IAC/InterActiveCorp, a media and internet company, including Chief Executive Officer of IAC Travel, a division of IAC/InterActiveCorp, from January 2005 to August 2005, Executive Vice President and Chief Financial Officer of IAC/InterActiveCorp from January 2002 to January 2005, and as IAC/InterActiveCorp’s Executive Vice President, Operations and Strategic Planning, from July 2000 to January 2002. Mr. Khosrowshahi worked at Allen & Company LLC from 1991

--

to 1998, where he served as Vice President from 1995 to 1998. Mr. Khosrowshahi currently serves on the board of directors of Expedia Group and Grab. Mr. Khosrowshahi previously served as a member of the supervisory board of trivago, N.V., a global hotel search company, from December 2016 to September 2017, and previously served on the board of directors for the following companies: The New York Times Company, a news and media company, from May 2015 to September 2017, and TripAdvisor, Inc., an online travel company, from December 2011 to February 2013. Mr. Khosrowshahi holds a B.S. from Brown University.

We believe Mr. Khosrowshahi is qualified to serve on our board of directors because of his operational and leadership experience in the technology industry and knowledge of the mobility space.

Michelangelo Volpi. Mr. Volpi currently serves as a director on our Board. Mr. Volpi has served as General Partner at Index Ventures since July 2009. Mr. Volpi joined Index to help establish the firm’s San Francisco office. He invests primarily in infrastructure, open-source, and artificial intelligence companies. Mr. Volpi is currently serving on the boards of Cockroach Labs, Confluent, Covariant.ai, Elastic, Kong, Sonos, Starburst, and Wealthfront. He was previously a director of Blue Bottle Coffee, Fiat Chrysler Automobiles, Hortonworks, and Zuora. Mr. Volpi held several executive positions prior to Index, including Chief Strategy Officer and SVP/GM of Cisco’s routing business. While at Cisco, he managed a P&L in excess of $10 billion in revenues, and his team was responsible for the acquisition of over 70 companies, some of which were multi-billion deals. Mr. Volpi has a B.S. in mechanical engineering and an M.S. in manufacturing systems engineering from Stanford, and an M.B.A. from the Stanford Graduate School of Business. He currently serves on the Global Advisory Board of Stanford’s Knight Hennessy Scholars program.

We believe Mr. Volpi is qualified to serve as a member of our board of directors due to his extensive experience in senior leadership positions at technology and other companies.

Brittany Bagley. Ms. Bagley currently serves as a director on our Board. Ms. Bagley has served as the Chief Financial Officer for Sonos since April 2019 and served on their board of directors from September 2017 to April 2019 where she was chair of the Compensation Committee. From December 2017 to April 2019, Ms. Bagley served as a Managing Director of Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, “KKR”), a global investment firm, and previously served in other roles at KKR from July 2007 to December 2017. Prior to joining KKR, Ms. Bagley was an analyst at The Goldman Sachs Group, Inc., an investment banking firm. Ms. Bagley holds a B.A. from Brown University.

We believe Ms. Bagley is qualified to serve on our board of directors because of her financial knowledge and leadership experience in the technology industry.

Reid Hoffman. Mr. Hoffman currently serves as a director on our Board. Mr. Hoffman is a co-founding member of Reinvent Capital. He co-founded LinkedIn, served as its founding Chief Executive Officer, and served as its Executive Chairman until the company’s acquisition by Microsoft for $26.2 billion. Early in his career, he was Chief Operating Officer and Executive Vice President and served on the founding board of directors of PayPal. Mr. Hoffman is a Partner at Greylock (joining Greylock in 2009), a leading Silicon Valley venture capital firm, where he focuses on investing in technology products that can reach hundreds of millions of people. He is also expected to serve as a board observer of RTPX upon the completion of its initial public offering. He also serves on the board of directors of Microsoft and Joby Aviation and as a director or observer for a number of private companies including Apollo Fusion, Blockstream, Coda, Convoy, Entrepreneur First, Nauto, Neeva, and Xapo. Additionally, Mr. Hoffman serves on ten not-for-profit boards, including OpenAI, Kiva, Endeavor, CZI Biohub, Berggruen Institute, Research Bridge Partners, Lever for Change, New America, Do Something, and Opportunity @ Work. Mr. Hoffman also serves on the Visiting Committee of the MIT Media Lab. Over the years, Mr. Hoffman has made early investments in over 100 technology companies, including companies such as Facebook, Ironport, and Zynga. He is the co-author of Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies and two New York Times best-selling books: The Start-up of You and The Alliance. He also hosts the podcast Masters of Scale. Mr. Hoffman earned a master’s degree in philosophy from Oxford University, where he was a Marshall Scholar, and a bachelor’s degree with distinction in symbolic systems from Stanford University. Mr. Hoffman has

--

an honorary doctorate from Babson College and an honorary fellowship from Wolfson College, Oxford University. Mr. Hoffman has received a number of awards, including the Salute to Greatness from the Martin Luther King Center.

We believe Mr. Hoffman is qualified to serve on our board of directors because of his extensive leadership and investing experience in the technology industry and knowledge of high-growth companies.

Claire Hughes Johnson. Ms. Hughes Johnson has served as a director on our board of directors since January 2022. She currently serves as a corporate officer and advisor for the global financial technology company Stripe, where she has spent the last 7 years on the executive team. Ms. Hughes Johnson served as Chief Operating Officer at Stripe from October 2014 to April 2021, where she helped Stripe grow from under 200 employees to more than 4,000 and from 10s of millions in revenue to billions. At various times, she led business operations, sales, marketing, customer support, risk and all of the people functions, including workplace and real estate. Ms. Hughes Johnson also currently serves on the boards of directors of the customer relationship management platform HubSpot, the renewable energy company Ameresco, and the multi-platform magazine The Atlantic. Prior to joining Stripe, Ms. Hughes Johnson spent ten years at Google, leading various business teams including the launch and operations of Gmail and Google Apps. She was also the Vice President responsible for Adwords mid-market revenue globally, Google Offers sales, product and engineering and the business, operations and product teams of their self-driving car project. Ms. Hughes Johnson earned a bachelor’s degree with honors from Brown University and an M.B.A. from the Yale School of Management. She has previously served on the board of Hallmark Cards, Inc. and is also a trustee and Executive Committee member of Milton Academy.

We believe Ms. Hughes Johnson is qualified to serve on our board of directors because of her operational and leadership experience in the technology industry.

Director Independence

Our Class A common stock is listed on Nasdaq. As a company listed on Nasdaq, we are required under Nasdaq listing rules to maintain a board comprised of a majority of independent directors as determined affirmatively by our board. Under Nasdaq listing rules, a director will only qualify as an independent director if, in the opinion of that listed company’s board of directors, the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, the Nasdaq listing rules require that, subject to specified exceptions, each member of our audit, compensation and nominating and corporate governance committees be independent.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Nasdaq listing rules applicable to audit committee members. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and Nasdaq listing rules applicable to compensation committee members.

Our board of directors has undertaken a review of the independence of each of our directors. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that Mr. Hoffman, Mr. Khosrowshahi, Mr. Volpi, Mr. Eschenbach, Ms. Bagley and Ms. Hughes Johnson, representing six of our eight directors, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under the listing standards of Nasdaq. Chris Urmson is not considered an independent director because of such person’s position as our Chief Executive Officer. Sterling Anderson is not considered an independent director because of such person’s position as our Chief Product Officer.

In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances that our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Related Person Transactions.”

--

There are no family relationships among any of our directors, director nominees or executive officers.

Board Leadership Structure

Mr. Urmson serves as our Chief Executive Officer and Chairman. We believe that Mr. Urmson’s combined role enables strong leadership, creates clear accountability and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders. As one of our founders, Mr. Urmson has extensive knowledge of all aspects of our business, industry and our products, and is best positioned to identify strategic priorities, lead critical discussions and execute our business plans. As a major shareholder, Mr. Urmson is also invested in our long-term success. Moreover, we believe that the combined role is both counterbalanced and enhanced with effective oversight by our independent directors and strong independent board committee system. Currently, we do not have a lead independent director, but as a result of our board’s committee system and it being composed of a majority of independent directors, our board maintains effective oversight of our business operations, including independent oversight of our financial statements, executive compensation, selection of director candidates and corporate governance programs. Accordingly, we believe that our current leadership structure is appropriate and enhances the board’s ability to effectively carry out its roles and responsibilities on behalf of our stockholders.

Role of Board in Risk Oversight Process

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. Our board reviews strategic and operational risk in the context of discussions, question and answer sessions, and reports from the management team at each regular board meeting, receives reports on all significant committee activities at each regular board meeting, and evaluates the risks inherent in significant transactions.

In addition, our board has tasked designated standing committees with oversight of certain categories of risk management. Our audit committee assists our board in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, and also, among other things, discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our compensation committee assesses risks relating to our executive compensation plans and arrangements, and whether our compensation policies and programs have the potential to encourage excessive risk taking. Our nominating and corporate governance committee assesses risks relating to our corporate governance practices, the independence of the board and potential conflicts of interest.

Our board of directors believes its current leadership structure supports the risk oversight function of the board.

Corporate Social Responsibility

Achieving our mission—delivering the benefits of self-driving technology safely, quickly, and broadly—is how we aim to make a positive impact in communities. We strive to revolutionize transportation by making roads safer, providing better services for people who currently have difficulty accessing transportation, freeing up time during commutes, and helping goods more efficiently reach those who need them. Successfully achieving our mission also means promoting development across and around the transportation landscape by creating new opportunities and access to the economy.

As part of our commitment to work with communities where Aurora has a presence and to educate them on the benefits of self-driving technology, we partner with local organizations that help bridge the digital divide and promote STEM education. Our Aurora Community Engagement Program works with our local partners to identify opportunities for Aurora employees to volunteer in our community specifically with programs that strengthen and diversify the STEM workforce.

--

Diversity and Inclusion

We are committed to diversity and inclusion. One of our core values—Win Together—is based on bringing together diverse background and perspectives. We celebrate the diversity of the people, experiences, and backgrounds that make up Aurora, and we encourage each other to speak up and share perspectives, respectfully and thoughtfully. We are building technology that will impact all people, so we strive to foster and embrace diversity throughout our business and our teams to bring us closer to those we serve. The nominating and corporate governance committee of our board of directors identifies, reviews and makes recommendations of candidates to serve on our board of directors, and considers director qualifications that include, without limitation, diversity factors such as race, ethnicity, gender, differences in professional background, education, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on our board.

Sustainability

Fostering a sustainable environment is also important to us. Starting in 2019, we offset our estimated annual carbon emissions from our facilities, vehicles and air travel by purchasing carbon credits, and we expect to continue to do this in the future. Longer-term, we believe commercialization of our self-driving technology will contribute to a more sustainable future given the potential to materially reduce fuel consumption and greenhouse gas emissions.

Board Committees

Our board of directors has established the following standing committees of the board: audit committee; compensation committee; and nominating and corporate governance committee. The composition and responsibilities of each of the committees of our board of directors is described below.

Audit Committee

Our audit committee consists of Brittany Bagley, Carl Eschenbach and Michelangelo Volpi. Our board of directors has determined that each of the members of the audit committee meet the requirements for independence under the rules and regulations of the SEC and the listing standards of Nasdaq applicable to audit committee members and also meet the financial literacy requirements of the listing standards of Nasdaq.

Brittany Bagley serves as the chair of the audit committee. Our board of directors has determined that Ms. Bagley qualifies as an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act. In making this determination, our board of directors considered Ms. Bagley’s formal education and previous experience in financial roles. Both our independent registered public accounting firm and management will periodically meet privately with our audit committee.

Our audit committee is responsible for the following duties, among others:

•appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm;

•discussing with our independent registered public accounting firm their independence from management;

•reviewing with our independent registered public accounting firm the scope and results of their audit;

•pre-approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

•overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC;

--

•reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; and

•establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. A copy of the charter of our audit committee is available on our website at ir.aurora.tech/corporate-governance. During 2021, there was only one meeting of our audit committee as the Business Combination was only completed towards the end of that year in November.

Compensation Committee

Our compensation committee consists of Michelangelo Volpi, Reid Hoffman and Brittany Bagley, with Michelangelo Volpi serving as chairperson. Our board of directors has determined that each member of the compensation committee meets the requirements for independence under the rules and regulations of the SEC and the listing standards of Nasdaq applicable to compensation committee members, and that each member of the compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act.

Our compensation committee is responsible for the following duties, among other things:

•reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating the performance of our Chief Executive Officer in light of these goals and objectives and setting or making recommendations to our board of directors regarding the compensation of our Chief Executive Officer;

•reviewing and setting or making recommendations to the board of directors regarding the compensation of our other executive officers;

•making recommendations to the board of directors regarding the compensation of our directors;

•reviewing and approving or making recommendations to the board of directors regarding our incentive compensation and equity-based plans and arrangements; and

•appointing and overseeing any compensation consultants.

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq. A copy of the charter of our compensation committee is available on our website at ir.aurora.tech/corporate-governance. During 2021, our compensation committee did not hold any meetings as the Business Combination was only completed towards the end of that year in November.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Reid Hoffman, Carl Eschenbach and Dara Khosrowshahi, with Reid Hoffman serving as chairperson. Our board of directors has determined that our nominating and corporate governance committee meets the requirements for independence under the listing standards of Nasdaq.

Our nominating and corporate governance committee is responsible for the following duties, among other things:

•identifying individuals qualified to become members of the board of directors, consistent with criteria approved by the board of directors;

--

•recommending to the board of directors the nominees for election to the board of directors at annual meetings of our stockholders;

•overseeing an evaluation of the board of directors and its committees; and

•developing and recommending to the board of directors a set of corporate governance guidelines.

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable listing standards of Nasdaq. A copy of the charter of our nominating and corporate governance committee is available on our website at ir.aurora.tech/corporate-governance. During 2021, our nominating and corporate governance committee did not hold any meetings as the Business Combination was only completed towards the end of that year in November.

--

Attendance at Board and Stockholder Meetings

During our fiscal year ended December 31, 2021, there was only one meeting of our board of directors as the Business Combination was only completed towards the end of that year in November. Each director attended at least 75% of the aggregate of (1) the total number of meetings of the board of directors held during the period for which he or she has been a director and (2) the total number of meetings held by all committees on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our board of directors at the annual meetings of stockholders, we strongly encourage, but do not require, directors to attend. This annual meeting will be our first annual meeting of our stockholders.

Executive Sessions of Non-Employee Directors

To encourage and enhance communication among non-employee directors, and as required under applicable Nasdaq rules, our corporate governance guidelines provide that the non-employee directors will meet in executive sessions without management directors or management present on a periodic basis. In addition, if any of our non-employee directors are not independent directors, then our independent directors will also meet in executive session on a periodic basis.

Compensation Committee Interlocks and Insider Participation

During 2021, the members of our compensation committee were Michelangelo Volpi, Brittany Bagley and Reid Hoffman. None of the members of our compensation committee is or has been an officer or employee of our company. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more executive officers serving on our board of directors or compensation committee.

--

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating potential director nominees. In its evaluation of director candidates, including the current directors eligible for re-election, our nominating and corporate governance committee will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors and other director qualifications. While our board has not established minimum qualifications for board members, some of the factors that our nominating and corporate governance committee considers in assessing director nominee qualifications include, without limitation, issues of character, professional ethics and integrity, judgment, business acumen and experience, proven achievement and competence in one’s field, the ability to exercise sound business judgment, tenure on the board and skills that are complementary to the board, an understanding of our business, an understanding of the responsibilities that are required of a member of the board, other time commitments and diversity, and with respect to diversity, such factors as race, ethnicity, gender, differences in professional background, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on our board. Although our board of directors does not maintain a specific policy with respect to board diversity, our board of directors believes that the board should be a diverse body, and the nominating and corporate governance committee considers a broad range of perspectives, backgrounds and experiences.

If our nominating and corporate governance committee determines that an additional or replacement director is required, then the committee may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, board or management. In determining whether to recommend a director for reelection, our nominating and corporate governance committee also considers the director’s past attendance at meetings, participation in and contributions to the activities of the board and our business and other qualifications and characteristics set forth in the charter of our nominating and corporate governance committee.

After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors and our board of directors has the final authority in determining the selection of director candidates for nomination to our board.

Stockholder Recommendations and Nominations to our Board of Directors

Our nominating and corporate governance committee will consider recommendations and nominations for candidates to our board of directors from stockholders in the same manner as candidates recommended to the committee from other sources, so long as such recommendations and nominations comply with our certificate of incorporation and bylaws, all applicable company policies and all applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our bylaws and corporate governance guidelines and the director nominee criteria described above.

Stockholders holding at least one percent of our fully diluted capitalization continuously for at least twelve months prior to the date of the submission may recommend director nominees for consideration by our nominating and corporate governance committee by writing to the Secretary of the Company. A stockholder that wants to recommend a candidate to our board of directors should direct the recommendation in writing by letter to our corporate secretary at Aurora Innovation, Inc., 1654 Smallman Street, Pittsburgh, Pennsylvania 15222, Attention: Secretary. Such recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and us and evidence of the recommending stockholder’s ownership of our capital stock. Such recommendation must also include a statement from the recommending stockholder in support of the candidate. Stockholder recommendations must be received by December 31st of the year prior to the year in which the recommended candidate(s)

--

will be considered for nomination. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our bylaws and the rules and regulations of the SEC and should be sent in writing to our corporate secretary at the address above. To be timely for our 2023 annual meeting of stockholders, nominations must be received by our corporate secretary observing the deadlines discussed below under “Other Matters—Stockholder Proposals or Director Nominations for 2023 Annual Meeting.”

Communications with the Board of Directors

Stockholders and other interested parties wishing to communicate directly with our non-management directors, may do so by writing and sending the correspondence to our General Counsel by mail to our principal executive offices at Aurora Innovation, Inc., 280 N. Bernardo Avenue, Mountain View, California 94043, Attn: General Counsel. Our General Counsel, in consultation with appropriate directors as necessary, will review all incoming communications and screen for communications that (1) are solicitations for products and services, (2) relate to matters of a personal nature not relevant for our stockholders to act on or for our board to consider and (3) matters that are of a type that are improper or irrelevant to the functioning of our board or our business, for example, mass mailings, job inquiries and business solicitations. If appropriate, our General Counsel will route such communications to the appropriate director(s) or, if none is specified, then to the chairperson of the board or the lead independent director (if one is appointed). These policies and procedures do not apply to communications to non-management directors from our officers or directors who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Policy Prohibiting Hedging or Pledging of Securities

Under our insider trading policy, our employees, including our executive officers, and the members of our board of directors are prohibited from, directly or indirectly, among other things, (1) engaging in short sales, (2) trading in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options, restricted stock units and other compensatory awards issued to such individuals by us), (3) purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted to them by us as part of their compensation or held, directly or indirectly, by them, (4) pledging any of our securities as collateral for any loans and (5) holding our securities in a margin account.

Corporate Governance Guidelines and Code of Conduct and Ethics

Our board of directors has adopted corporate governance guidelines, which address, among other items, the qualifications and responsibilities of our directors and director candidates, the structure and composition of our board of directors and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a code of conduct and ethics that applies to all of our directors, officers and employees, including our chief executive officer, chief financial officer and principal accounting officer, as well as company contractors, consultants, advisors and agents. The full text of our corporate governance guidelines and code of conduct and ethics are available on our website at ir.aurora.tech/corporate-governance/governance-documents. We will post amendments to our code of conduct and ethics on the same website, and will disclose any waivers of our code of conduct and ethics as required by law, regulation, or other applicable rule.

Director Compensation

Prior to November 2021, neither we nor Legacy Aurora had any formal arrangements under which outside directors received compensation for their service on the board of directors or its committees, except for Ms. Bagley, who received a grant of 130,250 restricted stock units upon her appointment.

--

In November 2021, we adopted a compensation program for our non-employee directors that consists of annual retainer fees and long-term equity awards (the “Outside Director Compensation Policy”).

The Outside Director Compensation Policy provides for the compensation of our non-employee directors for their service as directors. The cash and equity components of our compensation policy for non-employee directors are set forth below:

| Position | Annual Cash Retainer | |||||||

| Base Director Fee | $60,000 | |||||||

| Additional Chairperson Fee | ||||||||

| Chair of the Audit Committee | $25,000 | |||||||

| Chair of the Compensation Committee | $20,000 | |||||||

| Chair of the Nominating and Corporate Governance Committee | $10,000 | |||||||

Under our Outside Director Compensation Policy, each non-employee director upon first becoming a non-employee director automatically receives an initial award of restricted stock units having a value of $225,000 (the “Initial Award”). Non-employee directors who first became a non-employee director prior to the Registration Date (as defined below) were granted an Initial Award on the date of our first registration of shares on a Form S-8 Registration Statement (the “Registration Date”). The Initial Award will vest annually over three years, subject to continued service through each applicable vesting date. On the date of each annual meeting of our stockholders, each non-employee director automatically receives an annual restricted stock unit award having a value of $225,000, effective on the date of each annual meeting of stockholders (the “Annual Award”). The Annual Award will vest on the earlier of one year following the grant date or the next annual meeting of stockholders, subject to continued service through the vesting date. All awards under the Outside Director Compensation Policy accelerate and vest upon a change in control.

Director Compensation for Fiscal 2021

The following table sets forth information regarding the total compensation awarded to, earned by or paid to our non-employee directors for their service on our board of directors, for the fiscal year ended December 31, 2021. Directors who are also our employees receive no additional compensation for their service as directors. During 2021, Mr. Urmson was an employee and executive officer of the Company, and Mr. Anderson was an employee of the Company, and therefore, Mr. Urmson and Mr. Anderson did not receive additional compensation for their service as directors. See “Executive Compensation” for additional information regarding Mr. Urmson’s compensation.

Name(1)

|

Fees Paid or

Earned in

Cash ($)

|

Stock

Awards ($)

|

Option

Awards ($)

|

Non-Equity

Incentive Plan

Compensation

($)

|

Nonqualified

Deferred

Compensation

Earnings ($)

|

All Other

Compensation

($)

|

Total ($) | |||||||||||||||||||||||||||||||||||||

Brittany Bagley |

7,391 | 1,114,796 | — | — | — | — | 1,122,187 | |||||||||||||||||||||||||||||||||||||

Carl Eschenbach |

5,217 | — | — | — | — | — | 5,217 | |||||||||||||||||||||||||||||||||||||

Reid Hoffman |

6,087 | — | — | — | — | — | 6,087 | |||||||||||||||||||||||||||||||||||||

Dara Khosrowshahi(3)

|

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

Ian Smith(2)

|

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

Michelangelo Volpi(3)

|

— | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

______________________________

(1)Claire Hughes Johnson joined our board of directors after December 31, 2021 and thus is intentionally omitted from this table.

(2)Mr. Smith resigned from our board of directors effective July 16, 2021.

(3)Declined compensation under the Outside Director Compensation Policy.

The following table lists all outstanding equity awards held by non-employee directors as of December 31, 2021:

| Name |

Number of Shares

Underlying

Outstanding

Stock Awards

|

Number of Shares

Underlying

Outstanding Options

|

||||||||||||

| Brittany Bagley | 130,250 | — | ||||||||||||

--

--

PROPOSAL NO. 1:

ELECTION OF CLASS I DIRECTORS

Our board of directors currently consists of eight directors and is divided into three classes with staggered three-year terms. At the annual meeting, two Class I directors, Chris Urmson and Sterling Anderson, will be elected for a three-year term to succeed the same class whose term is then expiring. Each director’s term continues until the expiration of the term for which such director was elected and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal.

--

Nominees