EX-99.1

Published on August 3, 2022

1 2 Q 2 2 S H A R E H O LD E R LE T T E R S E C O N D Q U A R T E R 2 0 2 2 S H A R E H O L D E R L E T T E R A U G U S T 3 , 2 0 2 2

2 2 Q 2 2 S H A R E H O LD E R LE T T E R A letter to shareholders We are pleased to report a strong second quarter. We made critical technological progress toward commercial deployment across multiple fronts: we achieved a significant milestone with the launch and successful demonstration of our Fault Management System, and we introduced a suite of new driving capabilities in our Beta 3.0 release that improved the Aurora Driver’s performance on surface streets, ramps, highways, and construction zones. We also expanded our commercial operations with FedEx, launched new pilots with Werner and Schneider, and made significant progress with our OEM partners on their respective driverless platforms. 2 Q 2 2 S H A R E H O LD E R LE T T E R

3 2 Q 2 2 S H A R E H O LD E R LE T T E R L O O K I N G A H E A D A roadmap of critical milestones We see a clear path to a driverless future and recognize the value in providing a more tangible way to measure our progress toward the commercial launch of our autonomous trucking product, Aurora Horizon, for all of our stakeholders. Today we’re introducing our roadmap that outlines progress we have made this year and the work that remains between now and our planned commercial launch across the key components and dependencies of our business - the Aurora Driver, operations, and the vehicle platforms - that are necessary to bring this product to market. For the balance of 2022 and the first quarter of 2023, our technical development work will focus on releasing the remaining capabilities that we expect the Aurora Driver will require on our launch lanes. We expect the Aurora Driver to be feature complete by the end of the first quarter of 2023. This means we will have implemented all of the capabilities necessary for launch and will have removed all policy interventions. As a reminder, we define a policy intervention as an action our operators take to preemptively disengage the Aurora Driver when we know it is not yet capable of confidently navigating a particular scenario. Throughout development and once the Aurora Driver is feature complete, we expect to continue validation and the compilation of evidence for our commercial launch safety case. When the Aurora Driver is feature complete, we expect to begin sharing a quantified measure of the Aurora Driver’s autonomy performance quarterly to show our progress toward achieving the critical milestone of the Aurora Driver being commercial-ready at the end of 2023. We look forward to outlining this autonomy performance framework at our upcoming Analyst & Investor Day in September.

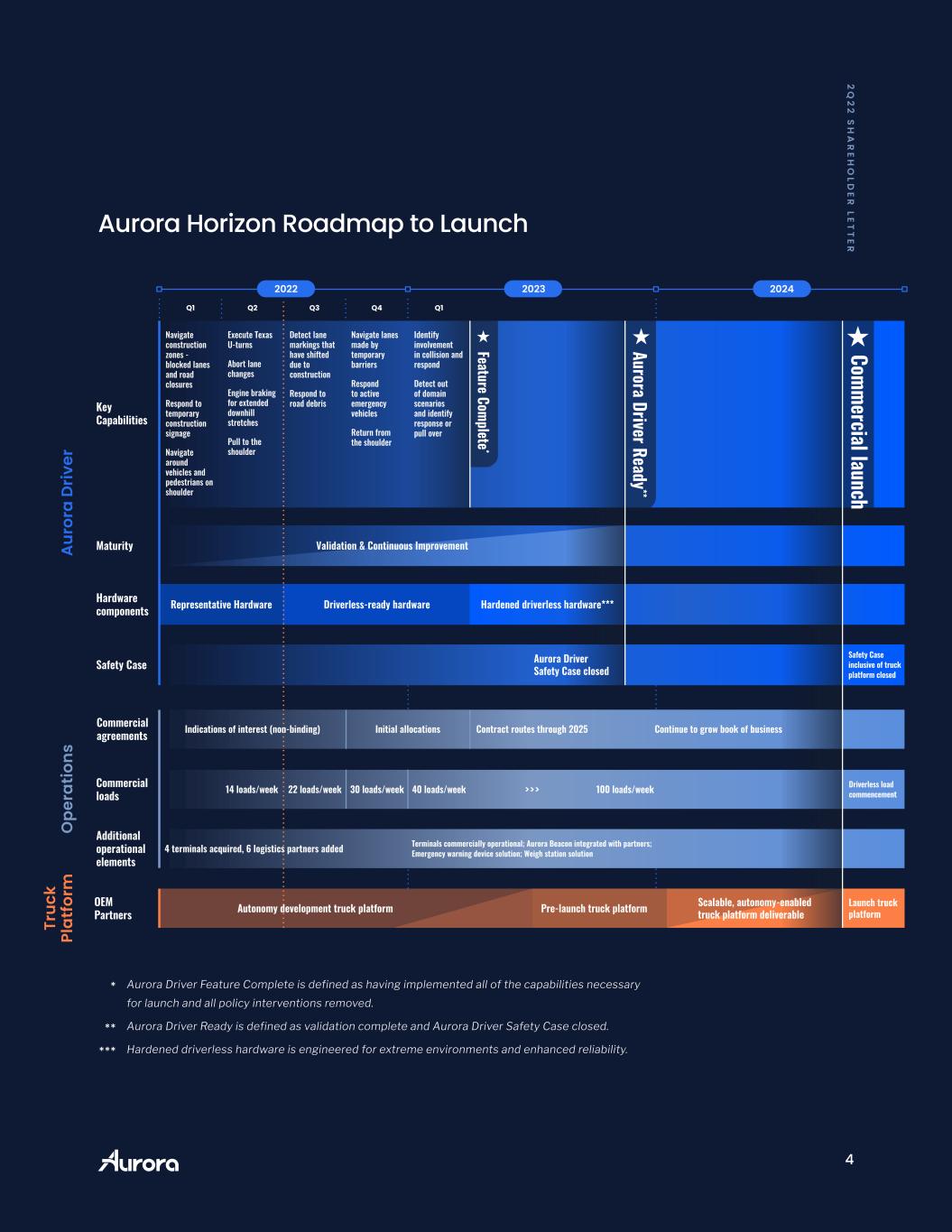

4 2 Q 2 2 S H A R E H O LD E R LE T T E R Aurora Horizon Roadmap to Launch * ** *** Aurora Driver Feature Complete is defined as having implemented all of the capabilities necessary for launch and all policy interventions removed. Aurora Driver Ready is defined as validation complete and Aurora Driver Safety Case closed. Hardened driverless hardware is engineered for extreme environments and enhanced reliability. Aurora Driver Ready ** Commercial launch Feature Complete * Tr uc k Pl at fo rm OEM Partners Autonomy development truck platform Scalable, autonomy-enabled truck platform deliverablePre-launch truck platform Launch truck platform O pe ra tio ns Additional operational elements 4 terminals acquired, 6 logistics partners added Terminals commercially operational; Aurora Beacon integrated with partners; Emergency warning device solution; Weigh station solution Commercial agreements Indications of interest (non-binding) Initial allocations Contract routes through 2025 Continue to grow book of business Commercial loads 14 loads/week 22 loads/week 30 loads/week 40 loads/week 100 loads/week Driverless load commencement>>> A ur or a D ri ve r Navigate construction zones - blocked lanes and road closures Respond to temporary construction signage Navigate around vehicles and pedestrians on shoulder Execute Texas U-turns Abort lane changes Engine braking for extended downhill stretches Pull to the shoulder Detect lane markings that have shifted due to construction Respond to road debris Navigate lanes made by temporary barriers Respond to active emergency vehicles Return from the shoulder Identify involvement in collision and respond Detect out of domain scenarios and identify response or pull over Key Capabilities Maturity Validation & Continuous Improvement Safety Case Safety Case inclusive of truck platform closed Aurora Driver Safety Case closed Hardware components Representative Hardware Driverless-ready hardware Hardened driverless hardware***

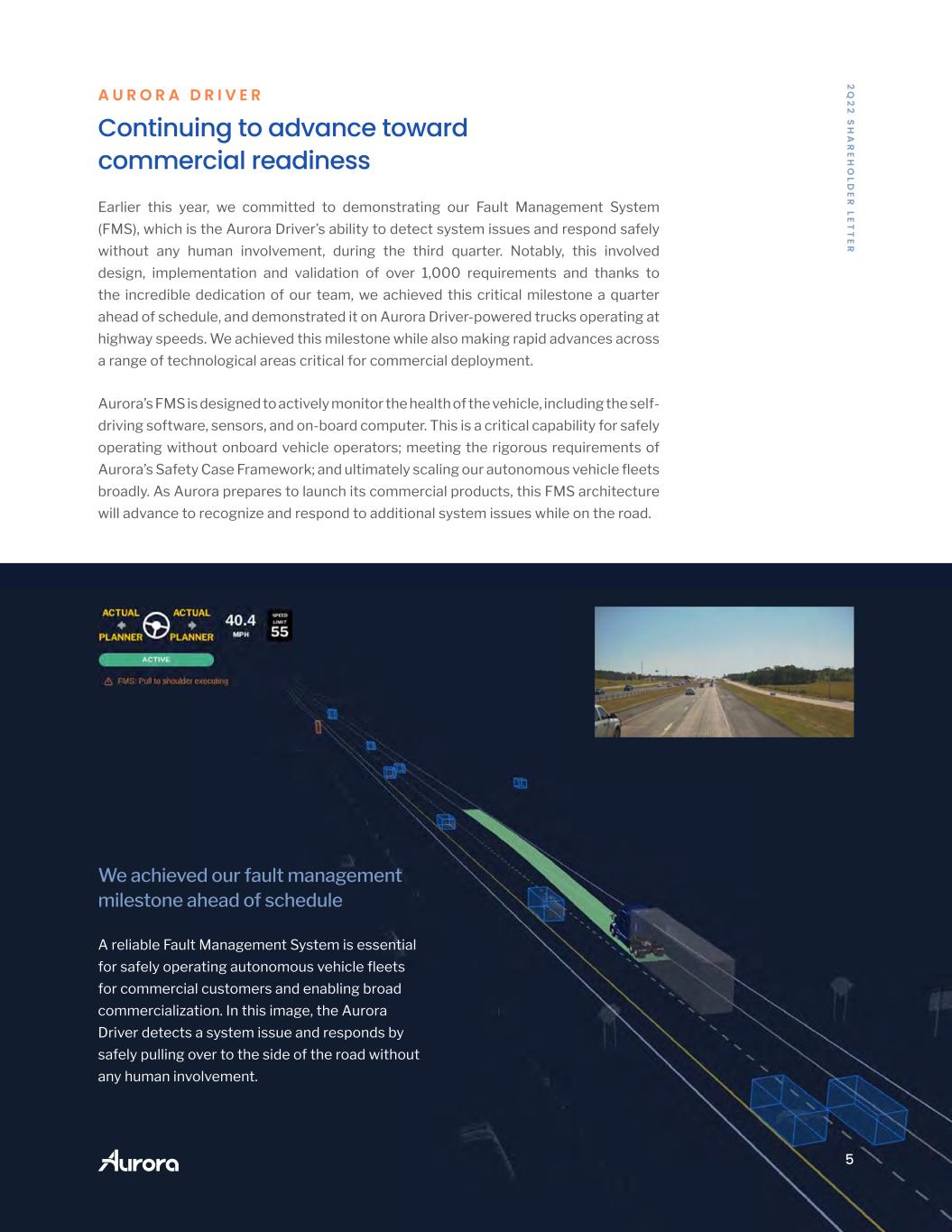

5 2 Q 2 2 S H A R E H O LD E R LE T T E R We achieved our fault management milestone ahead of schedule A reliable Fault Management System is essential for safely operating autonomous vehicle fleets for commercial customers and enabling broad commercialization. In this image, the Aurora Driver detects a system issue and responds by safely pulling over to the side of the road without any human involvement. A U R O R A D R I V E R Continuing to advance toward commercial readiness Earlier this year, we committed to demonstrating our Fault Management System (FMS), which is the Aurora Driver’s ability to detect system issues and respond safely without any human involvement, during the third quarter. Notably, this involved design, implementation and validation of over 1,000 requirements and thanks to the incredible dedication of our team, we achieved this critical milestone a quarter ahead of schedule, and demonstrated it on Aurora Driver-powered trucks operating at highway speeds. We achieved this milestone while also making rapid advances across a range of technological areas critical for commercial deployment. Aurora’s FMS is designed to actively monitor the health of the vehicle, including the self- driving software, sensors, and on-board computer. This is a critical capability for safely operating without onboard vehicle operators; meeting the rigorous requirements of Aurora’s Safety Case Framework; and ultimately scaling our autonomous vehicle fleets broadly. As Aurora prepares to launch its commercial products, this FMS architecture will advance to recognize and respond to additional system issues while on the road.

6 2 Q 2 2 S H A R E H O LD E R LE T T E R During the second quarter, we also released Aurora Driver Beta 3.0, continuing on our commitment to deliver quarterly technical updates that advance the Aurora Driver toward commercial readiness. This update focuses on end-to-end autonomous operations between Aurora’s terminals and shows how the Aurora Driver can safely navigate increasingly complex and critical situations that are necessary for the deployment of our commercial trucking product. Beta 3.0 advancements include navigating complex surface streets between terminals and highways, and safely handling long downhill-grades, using engine braking to avoid excessive wear and the danger that comes from overheating brake pads. During the third quarter, we plan to launch capabilities that include identifying and responding to debris in the roadway and navigating even more complex construction zones, including the detection of lane markings that have shifted. This puts us on the path to complete the balance of capabilities for the Aurora Driver to be feature complete by the end of the first quarter of 2023. While we are bringing new capabilities online, we are simultaneously improving our performance on existing capabilities. Over the course of the second quarter, we drove a significant improvement in required vehicle operator interventions for localization (the ability for the Aurora Driver to know its precise location) issues on the Fort Worth to El Paso lane as depicted in the chart below, with no interventions seen in the final weeks of the quarter. This improvement stemmed from advancements in the Aurora Atlas (our HD mapping system) and the Aurora Driver that enable our vehicles to better adapt between using lane markings and geometric data to precisely position itself. These developments make the Aurora Driver’s performance more robust in construction zones and highway segments with few distinct road features (e.g. signs and off-ramps), as well as long stretches through areas of rapidly growing vegetation. These attributes are common on rural routes like Fort Worth to El Paso. R E Q U I R E D I N T E R V E N T I O N S D U E T O L O C A L I Z A T I O N I S S U E S Week 10 Week 12 Week 14 Week 16 Week 18 Week 20 Week 22

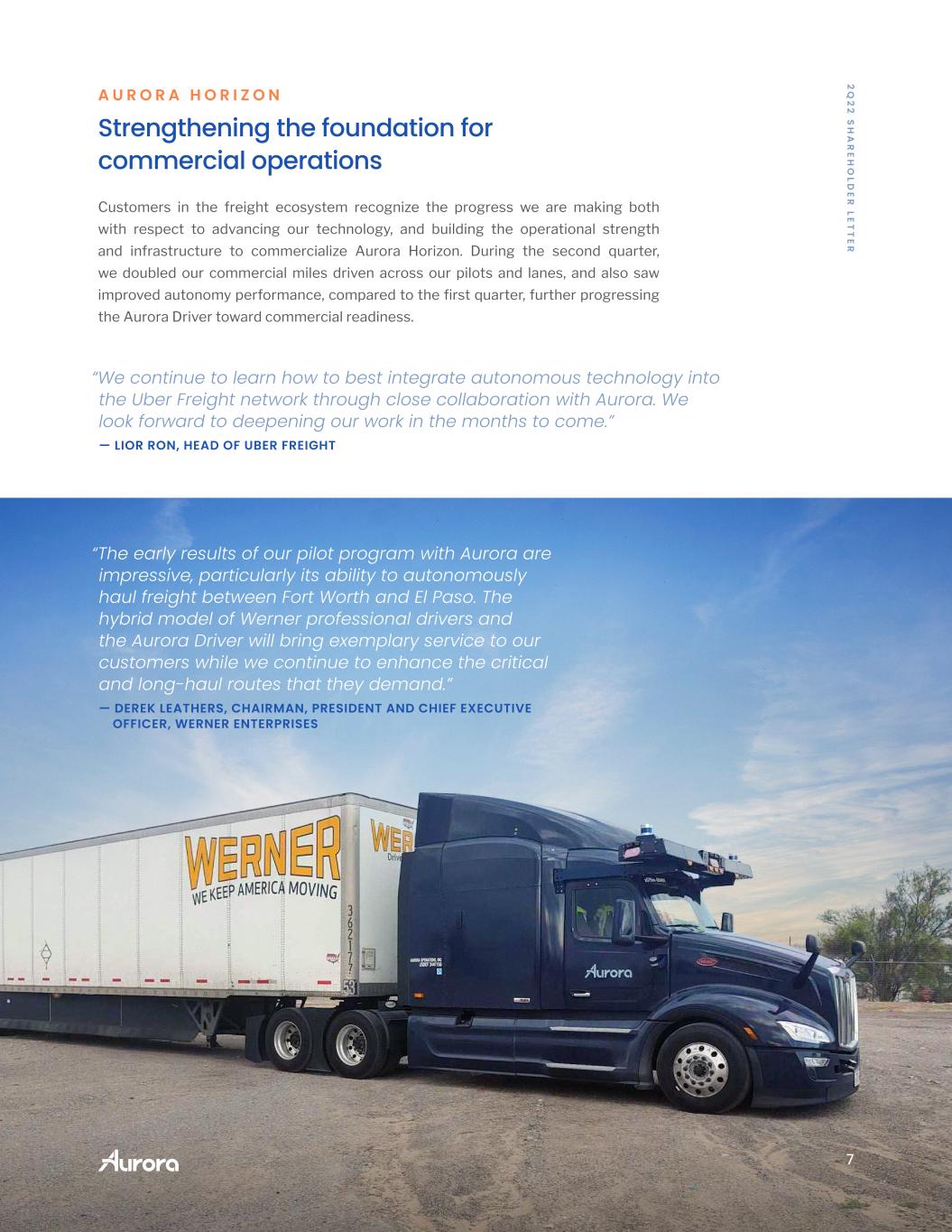

7 2 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A H O R I Z O N Strengthening the foundation for commercial operations Customers in the freight ecosystem recognize the progress we are making both with respect to advancing our technology, and building the operational strength and infrastructure to commercialize Aurora Horizon. During the second quarter, we doubled our commercial miles driven across our pilots and lanes, and also saw improved autonomy performance, compared to the first quarter, further progressing the Aurora Driver toward commercial readiness. “The early results of our pilot program with Aurora are impressive, particularly its ability to autonomously haul freight between Fort Worth and El Paso. The hybrid model of Werner professional drivers and the Aurora Driver will bring exemplary service to our customers while we continue to enhance the critical and long-haul routes that they demand.” — DEREK LEATHERS, CHAIRMAN, PRESIDENT AND CHIEF EXECUTIVE OFFICER, WERNER ENTERPRISES “We continue to learn how to best integrate autonomous technology into the Uber Freight network through close collaboration with Aurora. We look forward to deepening our work in the months to come.” — LIOR RON, HEAD OF UBER FREIGHT

8 2 Q 2 2 S H A R E H O LD E R LE T T E R We launched our multi-phase commercial pilot with FedEx last year, first autonomously hauling FedEx loads (under the supervision of vehicle operators) between Dallas and Houston. Earlier this year, and notably ahead of schedule, we further expanded our collaboration with FedEx, growing our pilot to include the 600-mile Fort Worth to El Paso lane. We’re currently autonomously hauling FedEx loads daily between Dallas and Houston and weekly between Fort Worth and El Paso. Demonstrating our autonomous technology through this pilot is one key aspect. Equally as important, we are operating this pilot in a commercially-representative manner, which means FedEx expects these vehicles to perform to its exacting requirements for scheduling, drop and hook trailer operations, and on-time delivery. We’re pleased to report that across each dimension, our pilot fleet has delivered. To date, this pilot has allowed both Aurora and FedEx to refine our operations and prepare for future growth. We are proud of our performance since the launch of the pilot through the second quarter; we have delivered over 335 loads over 80,000 cumulative miles, 100% on-time with no cancellations*. With each trip, the Aurora Driver is providing thousands of FedEx customers with packages that were autonomously transported. We look forward to our continued work together as FedEx further integrates autonomous technology into their operations to build a robust network of human drivers and autonomous solutions to respond to growing customer demand. * Excludes minimal cancellations due to safety (extreme weather conditions deemed unsafe for any driver). loads cumulative miles across on time Since launch, we’ve delivered: with no cancellations* 335+ 80k 100% “We recently announced the expansion of our autonomous linehaul pilot with Aurora and we look forward to our continued work together as we test the integration of autonomous technology into our operations.” — REBECCA YEUNG, CORPORATE VICE PRESIDENT, OPERATIONS SCIENCE & ADVANCED TECHNOLOGY FEDEX CORPORATION

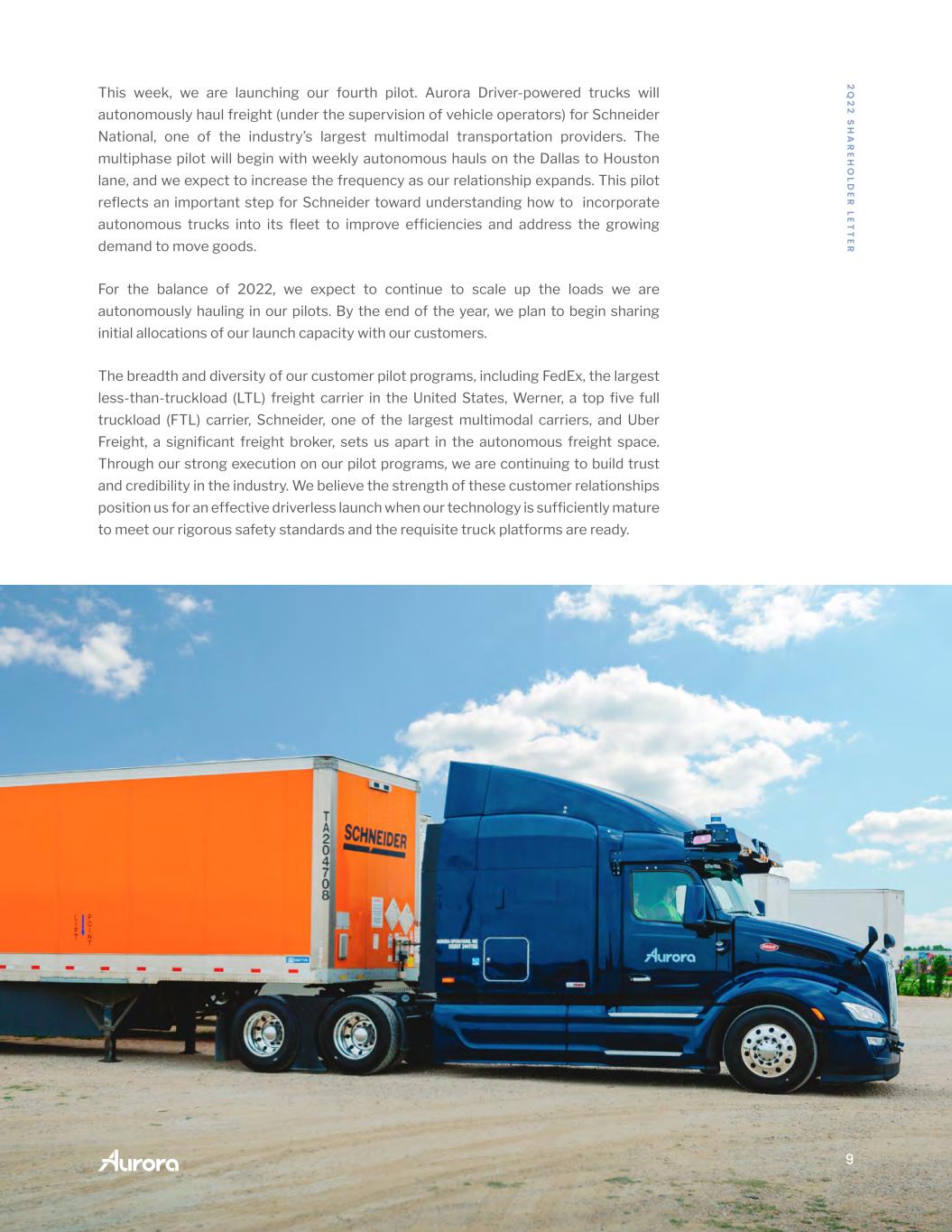

9 2 Q 2 2 S H A R E H O LD E R LE T T E R This week, we are launching our fourth pilot. Aurora Driver-powered trucks will autonomously haul freight (under the supervision of vehicle operators) for Schneider National, one of the industry’s largest multimodal transportation providers. The multiphase pilot will begin with weekly autonomous hauls on the Dallas to Houston lane, and we expect to increase the frequency as our relationship expands. This pilot reflects an important step for Schneider toward understanding how to incorporate autonomous trucks into its fleet to improve efficiencies and address the growing demand to move goods. For the balance of 2022, we expect to continue to scale up the loads we are autonomously hauling in our pilots. By the end of the year, we plan to begin sharing initial allocations of our launch capacity with our customers. The breadth and diversity of our customer pilot programs, including FedEx, the largest less-than-truckload (LTL) freight carrier in the United States, Werner, a top five full truckload (FTL) carrier, Schneider, one of the largest multimodal carriers, and Uber Freight, a significant freight broker, sets us apart in the autonomous freight space. Through our strong execution on our pilot programs, we are continuing to build trust and credibility in the industry. We believe the strength of these customer relationships position us for an effective driverless launch when our technology is sufficiently mature to meet our rigorous safety standards and the requisite truck platforms are ready.

10 2 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A D R I V E R L E S S T R U C K S Vehicle platform progress We continue to make significant progress with both Paccar and Volvo Trucks in the preparation of scalable, autonomy-enabled truck platforms. Working in close partnership, our teams have defined product requirements, aligned on detailed technical requirements, selected and awarded key component suppliers, designed key interfaces between the Aurora Driver and the vehicle platform, and built initial prototypes. While progress has been strong, these programs are not immune to recent industry challenges. Taking into account current supply chain constraints, we now expect the delivery of scalable, autonomy-enabled truck platforms* in the first half of 2024. While this program timing is later than we had originally expected, we see the recent awarding of key supplier contracts as a major point of schedule risk reduction in these programs. With the delivery of the truck platforms, we expect to be able to complete upfit, bring- up, and final validation of the integration of the Aurora Driver with the truck platform in preparation for release of a scalable trucking product by the end of 2024. * Scalable, autonomy-enabled class 8 truck platforms include new or enhanced control interfaces, braking, steering, and power systems to achieve the reliability needed for safe driverless operations.

11 2 Q 2 2 S H A R E H O LD E R LE T T E R Advancing our mission Our first priority, and where we are focusing our capital, is the commercialization of Aurora Horizon. We continue to expect Aurora Connect, our product for the ride- hailing market, to follow the launch of Aurora Horizon. We expect disciplined focus and prioritization to help extend our cash runway to mid-2024. Remaining laser-focused on our plan and executing on what we can control is imperative in the current environment. We look forward to showing the world what the Aurora Driver can do as we remain firmly committed to our mission to deliver the benefits of self-driving technology safely, quickly, and broadly. To our world-class team, partners, and investors who are riding along with us, thank you for your continued support. Chris Urmson CEO & Co-founder

12 2 Q 2 2 S H A R E H O LD E R LE T T E R From the desk of our CFO We recognized approximately $21 million in collaboration revenue during the second quarter of 2022, and $145 million cumulative to-date, for development work associated with our agreement with Toyota. We completed the build of the Toyota Sienna vehicles associated with this agreement, bringing our fleet size to eight Toyota Sienna vehicles, along with 20 trucks. While our first priority is commercialization of Aurora Horizon, we believe this work and other long-lead efforts will springload us for the eventual launch of Aurora Connect. During the second quarter of 2022, our market capitalization declined below our carrying value of net assets, triggering a $1 billion non-cash reduction in the carrying value of goodwill. There is no change to our outlook for the businesses Aurora has acquired nor how we expect them to contribute to our commercialization. Including the reduction in the carrying value of goodwill and $46 million in stock- based compensation (SBC), operating expenses totaled $1.2 billion. Excluding these non-cash expenses, operating expenses were $171 million, reflecting $142 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry- leading autonomy work, and approximately $29 million in SG&A. We used approximately $90 million in operating cash and $4 million in capital expenditures. We ended the second quarter with a very strong balance sheet, including $1.4 billion in cash and short-term investments, enabling us to continue to develop the Aurora Driver for commercial deployment at scale. Richard Tame CFO Q 2 F L E E T 20 8

13 2 Q 2 2 S H A R E H O LD E R LE T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around the timing of availability of an autonomy-enabled truck platform, our ability to achieve certain milestones around the development and commercialization of the Aurora Driver on the timeframe we expect or at all, potential opportunities with our partners and pilot customers, and our expected cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward- looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 12, 2022, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances. This shareholder letter also contains statistical data, estimates and forecasts that are based on independent industry publications, other publicly available information, or our internal sources. This information may be based on many assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified the accuracy or completeness of the data contained in any industry publications or other publicly available information. Aurora does not undertake to update such data after the date of this presentation. All third-party logos appearing in this shareholder letter are trademarks or registered trademarks of their respective holders. Any such appearance does not necessarily imply any affiliation with or endorsement of Aurora.

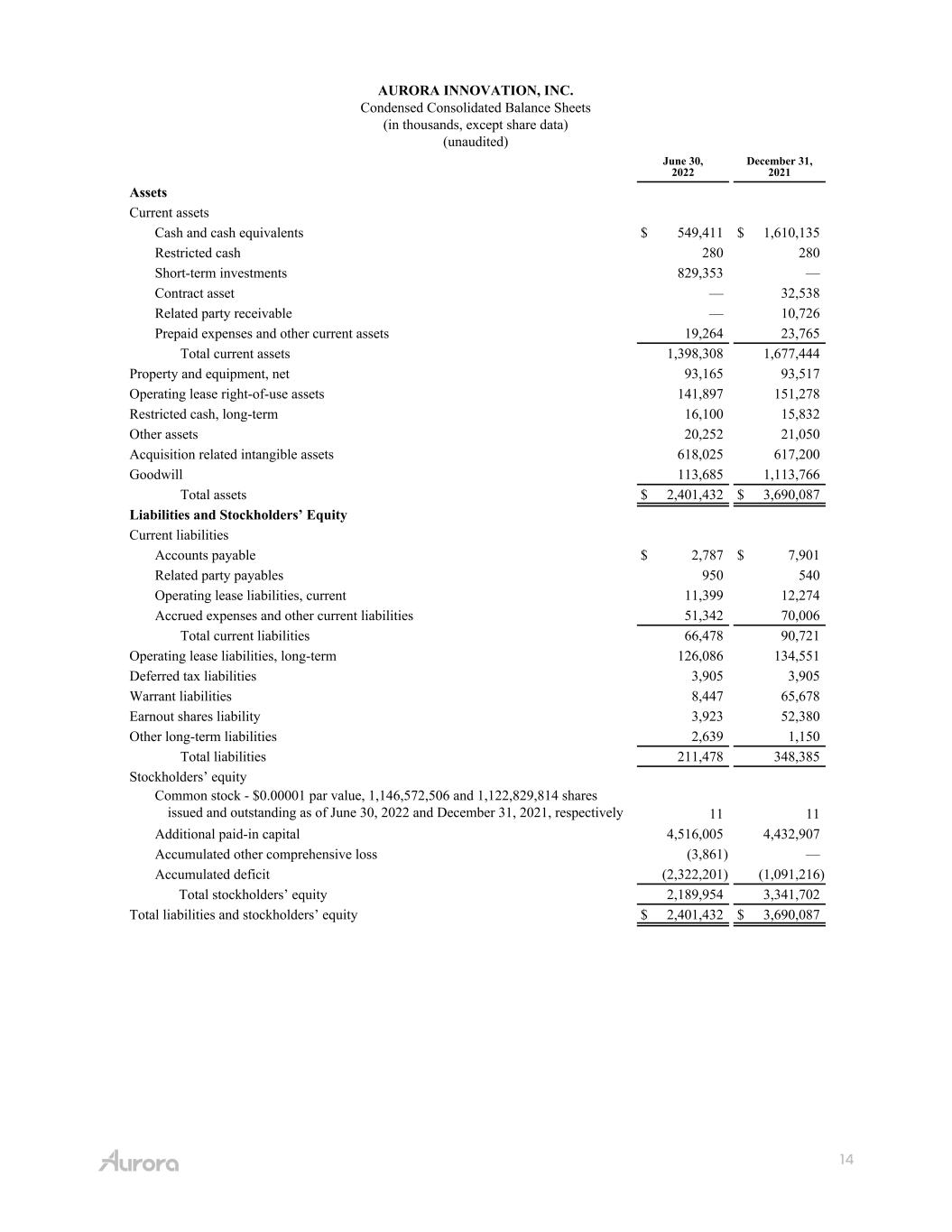

14 AURORA INNOVATION, INC. Condensed Consolidated Balance Sheets (in thousands, except share data) (unaudited) June 30, 2022 December 31, 2021 Assets Current assets Cash and cash equivalents $ 549,411 $ 1,610,135 Restricted cash 280 280 Short-term investments 829,353 — Contract asset — 32,538 Related party receivable — 10,726 Prepaid expenses and other current assets 19,264 23,765 Total current assets 1,398,308 1,677,444 Property and equipment, net 93,165 93,517 Operating lease right-of-use assets 141,897 151,278 Restricted cash, long-term 16,100 15,832 Other assets 20,252 21,050 Acquisition related intangible assets 618,025 617,200 Goodwill 113,685 1,113,766 Total assets $ 2,401,432 $ 3,690,087 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 2,787 $ 7,901 Related party payables 950 540 Operating lease liabilities, current 11,399 12,274 Accrued expenses and other current liabilities 51,342 70,006 Total current liabilities 66,478 90,721 Operating lease liabilities, long-term 126,086 134,551 Deferred tax liabilities 3,905 3,905 Warrant liabilities 8,447 65,678 Earnout shares liability 3,923 52,380 Other long-term liabilities 2,639 1,150 Total liabilities 211,478 348,385 Stockholders’ equity Common stock - $0.00001 par value, 1,146,572,506 and 1,122,829,814 shares issued and outstanding as of June 30, 2022 and December 31, 2021, respectively 11 11 Additional paid-in capital 4,516,005 4,432,907 Accumulated other comprehensive loss (3,861) — Accumulated deficit (2,322,201) (1,091,216) Total stockholders’ equity 2,189,954 3,341,702 Total liabilities and stockholders’ equity $ 2,401,432 $ 3,690,087

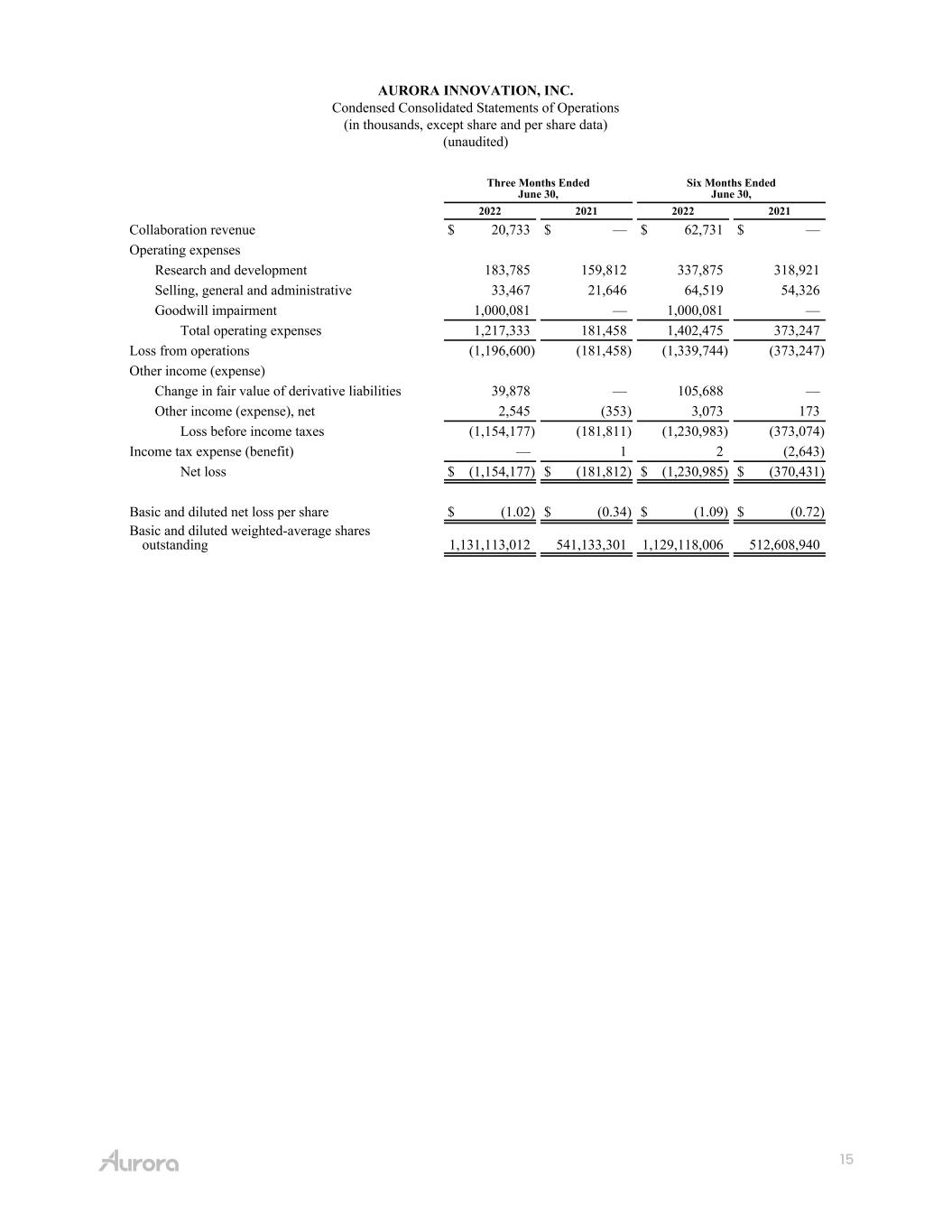

15 AURORA INNOVATION, INC. Condensed Consolidated Statements of Operations (in thousands, except share and per share data) (unaudited) Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 Collaboration revenue $ 20,733 $ — $ 62,731 $ — Operating expenses Research and development 183,785 159,812 337,875 318,921 Selling, general and administrative 33,467 21,646 64,519 54,326 Goodwill impairment 1,000,081 — 1,000,081 — Total operating expenses 1,217,333 181,458 1,402,475 373,247 Loss from operations (1,196,600) (181,458) (1,339,744) (373,247) Other income (expense) Change in fair value of derivative liabilities 39,878 — 105,688 — Other income (expense), net 2,545 (353) 3,073 173 Loss before income taxes (1,154,177) (181,811) (1,230,983) (373,074) Income tax expense (benefit) — 1 2 (2,643) Net loss $ (1,154,177) $ (181,812) $ (1,230,985) $ (370,431) Basic and diluted net loss per share $ (1.02) $ (0.34) $ (1.09) $ (0.72) Basic and diluted weighted-average shares outstanding 1,131,113,012 541,133,301 1,129,118,006 512,608,940

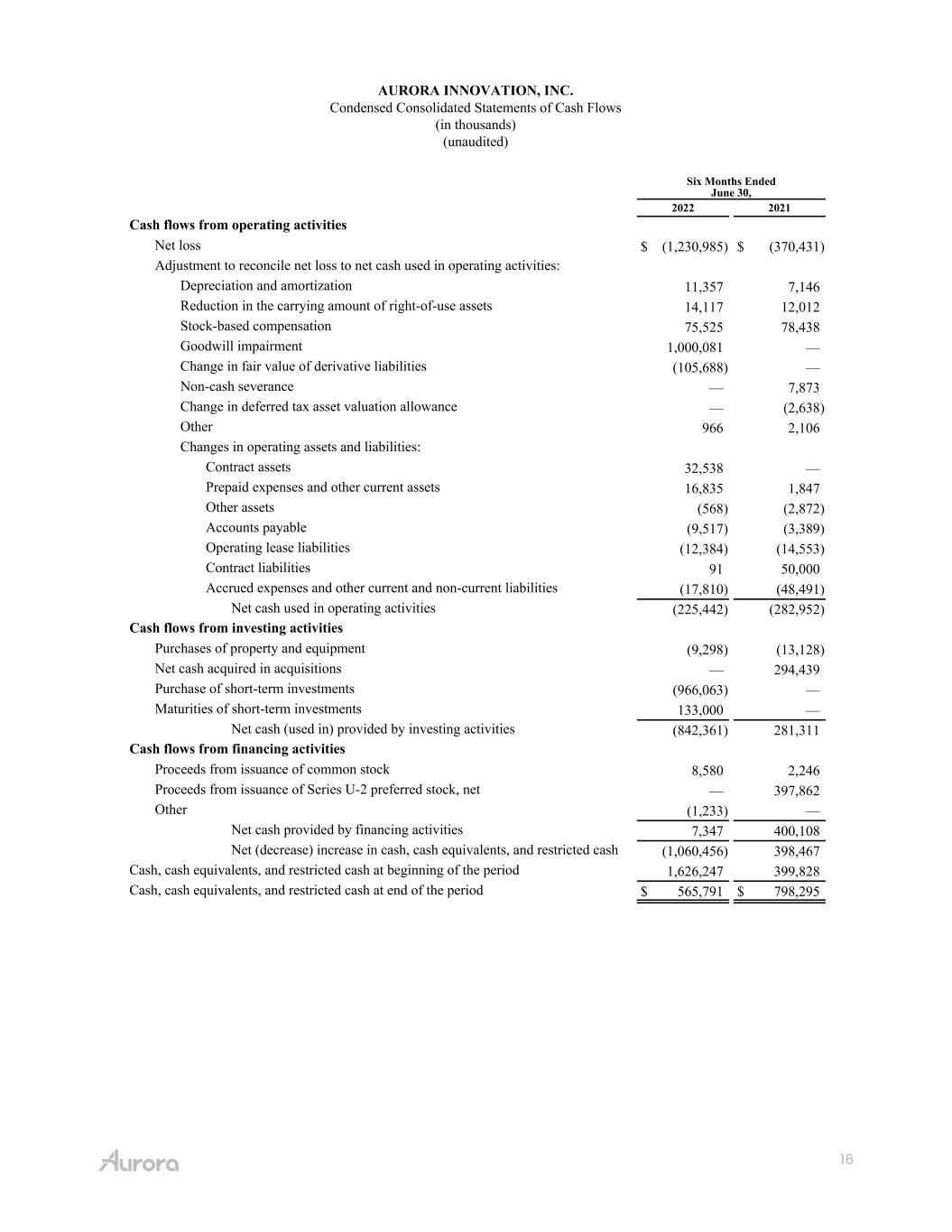

16 AURORA INNOVATION, INC. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Six Months Ended June 30, 2022 2021 Cash flows from operating activities Net loss $ (1,230,985) $ (370,431) Adjustment to reconcile net loss to net cash used in operating activities: Depreciation and amortization 11,357 7,146 Reduction in the carrying amount of right-of-use assets 14,117 12,012 Stock-based compensation 75,525 78,438 Goodwill impairment 1,000,081 — Change in fair value of derivative liabilities (105,688) — Non-cash severance — 7,873 Change in deferred tax asset valuation allowance — (2,638) Other 966 2,106 Changes in operating assets and liabilities: Contract assets 32,538 — Prepaid expenses and other current assets 16,835 1,847 Other assets (568) (2,872) Accounts payable (9,517) (3,389) Operating lease liabilities (12,384) (14,553) Contract liabilities 91 50,000 Accrued expenses and other current and non-current liabilities (17,810) (48,491) Net cash used in operating activities (225,442) (282,952) Cash flows from investing activities Purchases of property and equipment (9,298) (13,128) Net cash acquired in acquisitions — 294,439 Purchase of short-term investments (966,063) — Maturities of short-term investments 133,000 — Net cash (used in) provided by investing activities (842,361) 281,311 Cash flows from financing activities Proceeds from issuance of common stock 8,580 2,246 Proceeds from issuance of Series U-2 preferred stock, net — 397,862 Other (1,233) — Net cash provided by financing activities 7,347 400,108 Net (decrease) increase in cash, cash equivalents, and restricted cash (1,060,456) 398,467 Cash, cash equivalents, and restricted cash at beginning of the period 1,626,247 399,828 Cash, cash equivalents, and restricted cash at end of the period $ 565,791 $ 798,295

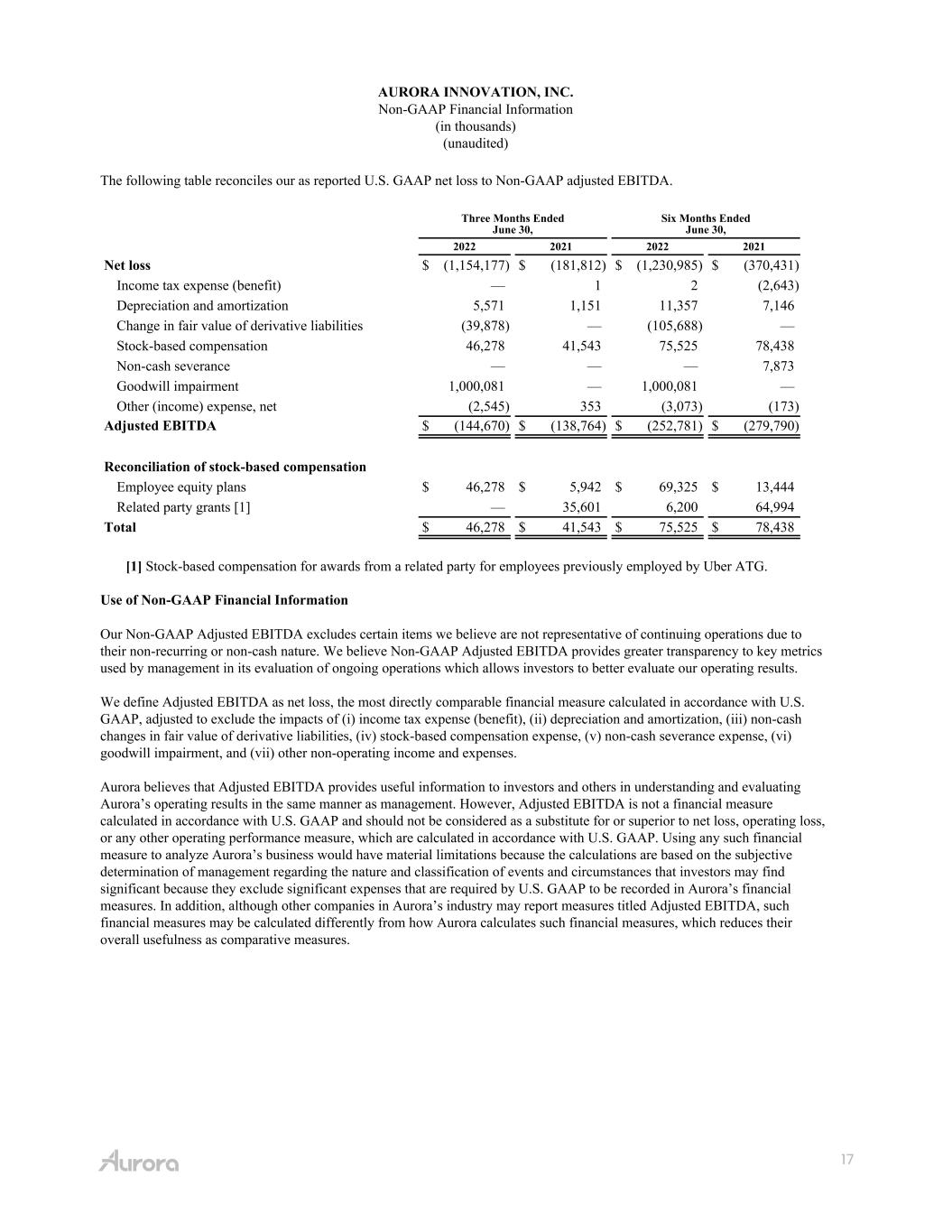

17 AURORA INNOVATION, INC. Non-GAAP Financial Information (in thousands) (unaudited) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 Net loss $ (1,154,177) $ (181,812) $ (1,230,985) $ (370,431) Income tax expense (benefit) — 1 2 (2,643) Depreciation and amortization 5,571 1,151 11,357 7,146 Change in fair value of derivative liabilities (39,878) — (105,688) — Stock-based compensation 46,278 41,543 75,525 78,438 Non-cash severance — — — 7,873 Goodwill impairment 1,000,081 — 1,000,081 — Other (income) expense, net (2,545) 353 (3,073) (173) Adjusted EBITDA $ (144,670) $ (138,764) $ (252,781) $ (279,790) Reconciliation of stock-based compensation Employee equity plans $ 46,278 $ 5,942 $ 69,325 $ 13,444 Related party grants [1] — 35,601 6,200 64,994 Total $ 46,278 $ 41,543 $ 75,525 $ 78,438 [1] Stock-based compensation for awards from a related party for employees previously employed by Uber ATG. Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income tax expense (benefit), (ii) depreciation and amortization, (iii) non-cash changes in fair value of derivative liabilities, (iv) stock-based compensation expense, (v) non-cash severance expense, (vi) goodwill impairment, and (vii) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures.