EX-99.1

Published on November 2, 2022

1 3 Q 2 2 S H A R E H O LD E R LE T T E R FPO T H I R D Q U A R T E R 2 0 2 2 S H A R E H O L D E R L E T T E R N O V E M B E R 2 , 2 0 2 2

2 3 Q 2 2 S H A R E H O LD E R LE T T E R A letter to shareholders During the third quarter, we continued to make strong progress across the three elements of our business - the Aurora Driver, operations & service delivery, and the truck platform - on our roadmap to launch Aurora Horizon, our autonomous trucking service. We released the fourth beta version of our flagship product, the Aurora Driver, which includes new capabilities to navigate unexpected obstacles that vehicles can face on roads every day, moving us another step closer to our Feature Complete milestone. We continued to scale our operations - achieving our commercial load booking target and expanding our pilot with Uber Freight. And we built and deployed our next-generation fleet of autonomy-development trucks with the latest generation of the Aurora Driver hardware. We were also honored to host our first Analyst & Investor Day as a public company. We shared our progress toward Aurora Horizon’s commercial launch and attendees experienced Aurora Driver-operated autonomous truck rides along Texas Interstate 45 near Dallas and from Dallas to Houston. 3 Q 2 2 S H A R E H O LD E R LE T T E R

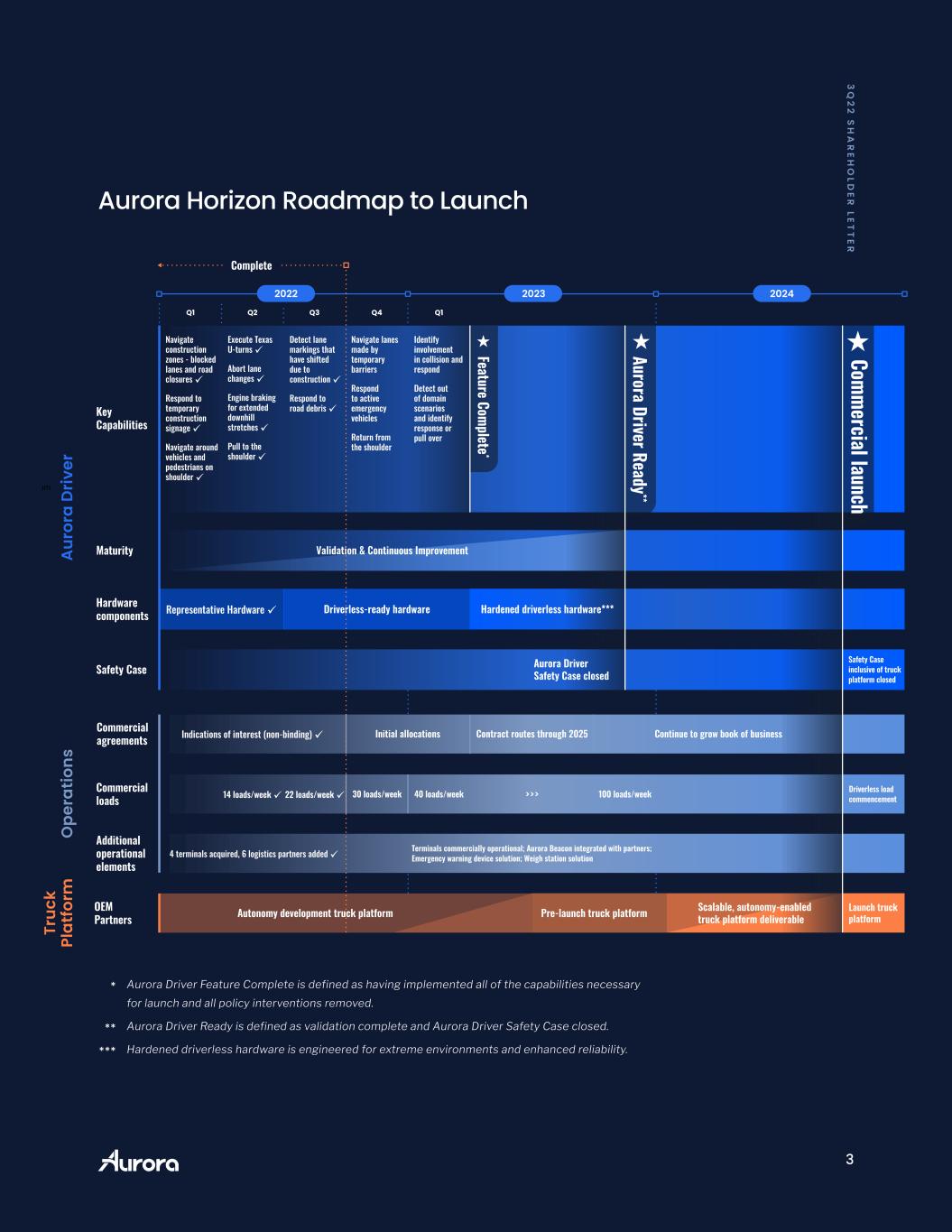

3 3 Q 2 2 S H A R E H O LD E R LE T T E R Aurora Horizon Roadmap to Launch * ** *** Aurora Driver Feature Complete is defined as having implemented all of the capabilities necessary for launch and all policy interventions removed. Aurora Driver Ready is defined as validation complete and Aurora Driver Safety Case closed. Hardened driverless hardware is engineered for extreme environments and enhanced reliability. Aurora Driver Ready ** Commercial launch Feature Complete * Tr uc k Pl at fo rm OEM Partners Autonomy development truck platform Scalable, autonomy-enabled truck platform deliverablePre-launch truck platform Launch truck platform O pe ra tio ns Additional operational elements 4 terminals acquired, 6 logistics partners added Terminals commercially operational; Aurora Beacon integrated with partners; Emergency warning device solution; Weigh station solution Lorem ipsum Commercial agreements Indications of interest (non-binding) Initial allocations Contract routes through 2025 Continue to grow book of business Commercial loads 14 loads/week 22 loads/week 30 loads/week 40 loads/week 100 loads/week Driverless load commencement>>> A ur or a D ri ve r Navigate construction zones - blocked lanes and road closures Respond to temporary construction signage Navigate around vehicles and pedestrians on shoulder Execute Texas U-turns Abort lane changes Engine braking for extended downhill stretches Pull to the shoulder Detect lane markings that have shifted due to construction Respond to road debris Navigate lanes made by temporary barriers Respond to active emergency vehicles Return from the shoulder Identify involvement in collision and respond Detect out of domain scenarios and identify response or pull over Key Capabilities Maturity Validation & Continuous Improvement Safety Case Safety Case inclusive of truck platform closed Aurora Driver Safety Case closed Hardware components Representative Hardware Driverless-ready hardware Hardened driverless hardware*** Complete

4 3 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A D R I V E R On the road to Feature Complete During the third quarter, we released Aurora Driver Beta 4.0, which contains new capabilities and improvements to many of the capabilities we’ve released in past betas. Each of our releases builds on the ones that came before, advancing toward Feature Complete, which we expect to achieve by the end of the first quarter of 2023. As illustrated on our roadmap, we committed to releasing two new collections of capabilities in the third quarter: detecting lane markings that have shifted due to construction and responding to road debris. Construction is common on many of our nation’s major freight corridors, and navigating the variety of types of construction zones autonomously is critical for commercial launch. Because temporary lane lines due to construction zones appear frequently along our commercial routes in Texas, we’ve been working to enable the Aurora Driver to perceive the new lane lines in real-time and understand when it should follow that new path instead of the path that exists in the Aurora Atlas, our HD map. When triggered by the appearance of new alternative lane lines, the Aurora Driver can deviate from the Aurora Atlas and autonomously navigate through the zone.

5 3 Q 2 2 S H A R E H O LD E R LE T T E R We also introduced the ability for the Aurora Driver to detect the road debris we encounter while hauling goods on public roads across Texas for our commercial pilots, such as tire shreds, garbage, fallen boxes, vegetation, and even abandoned furniture. Road debris is extremely common and can be dangerous, especially when vehicles are moving at highway speeds. After establishing initial development in simulation, we exposed the Aurora Driver to over 10,000 virtual road debris tests, then validated its performance on private test tracks before launching on the road. During the fourth quarter, we plan to expand on the shifted lane markings capability to launch another complex construction capability: navigating lanes made by temporary barriers. We also expect to introduce the ability to respond to active emergency vehicles and return from the shoulder after recovering from a fault, which will build on the fault management capabilities we released during the second quarter. As we are advancing our software, we are simultaneously maturing the Aurora Driver’s hardware to support our commercial launch. During the third quarter, we entered the driverless-ready phase of our hardware roadmap and we’re already making rapid progress in hardening both our sensors and computer, meaning we are preparing our hardware for manufacturability and high-reliability in an automotive setting. In the process, we have enabled our hardware to monitor its own health, fall back on key redundancies when needed, and operate in the demanding environments it will be exposed to, all while also improving its performance in measurable ways. Responding to road debris Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. FPO

6 3 Q 2 2 S H A R E H O LD E R LE T T E R FPO Specifically, we have extended the technological lead of our proprietary FirstLight Lidar, which through its use of frequency modulated continuous wave (FMCW) technology is a cornerstone of our perception sensor suite. We have designed the latest generation for increased reliability and ruggedness, incorporated systems that allow it to monitor and report problems with its health, and integrated both liquid cooling and cleaning directly into the unit. In the process, we have not only produced a highly reliable and manufacturable sensor, but also increased its already-extraordinary range and probability of detection. To put this into perspective, our FirstLight Lidar previously had an approximately 7-second lead time in detection relative to traditional time-of- flight lidar sensors at highway speeds. With these improvements, that lead time is now approximately 8.5 seconds, which is the equivalent to being able to see nearly three football fields further than conventional lidar, giving the Aurora Driver even more time to respond. Our next-generation computer not only has redundant processing, self-health monitoring and reporting, and liquid cooling, but has also been designed to meet ISO 16750-3 mechanical reliability targets. We have also upgraded the Aurora Driver’s camera system, including quadrupling its resolution and significantly increasing its dynamic range. 24-bit with previous generation computer & 2MP cameras 32-bit HDR with new computer & 8MP cameras

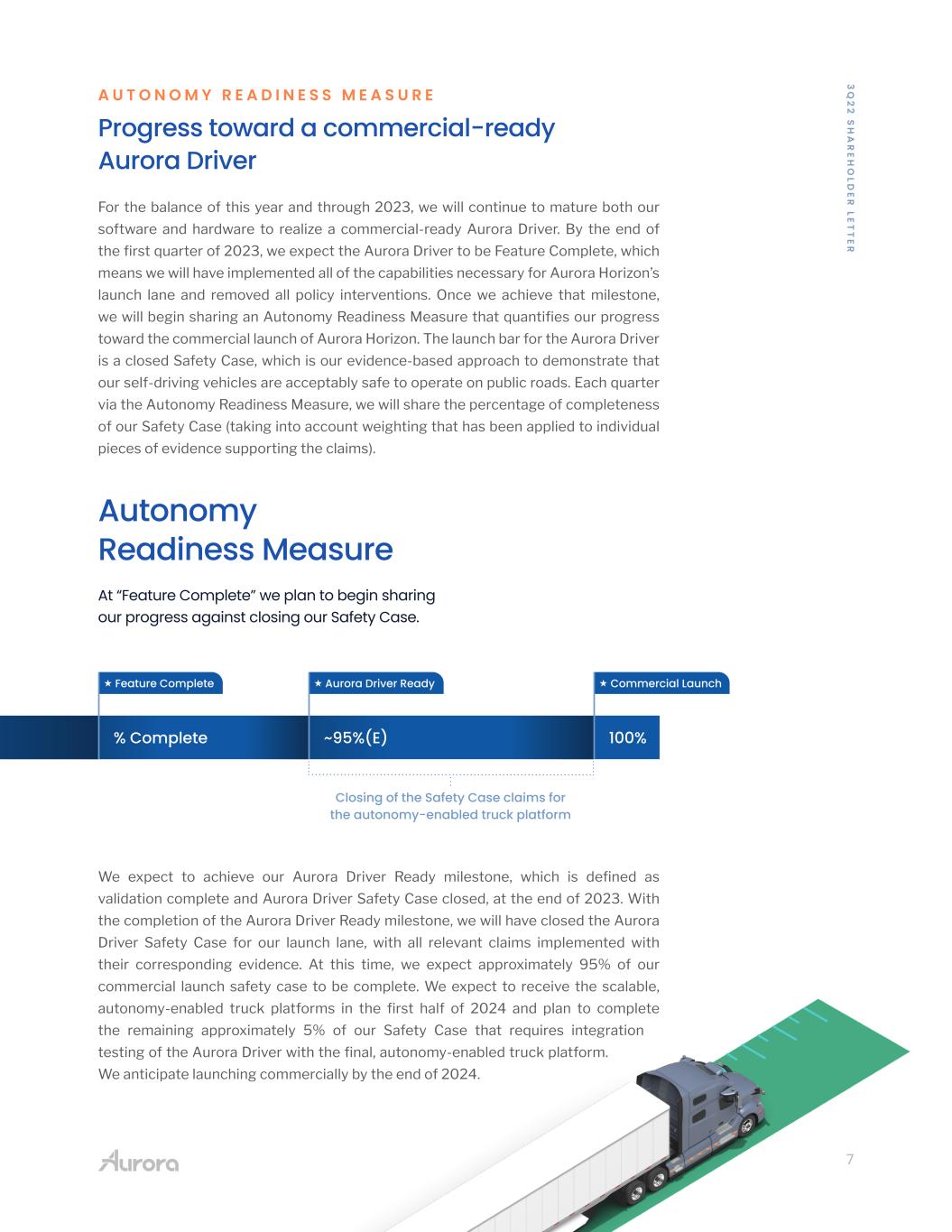

7 3 Q 2 2 S H A R E H O LD E R LE T T E R Autonomy Readiness Measure At “Feature Complete” we plan to begin sharing our progress against closing our Safety Case. A U T O N O M Y R E A D I N E S S M E A S U R E Progress toward a commercial-ready Aurora Driver For the balance of this year and through 2023, we will continue to mature both our software and hardware to realize a commercial-ready Aurora Driver. By the end of the first quarter of 2023, we expect the Aurora Driver to be Feature Complete, which means we will have implemented all of the capabilities necessary for Aurora Horizon’s launch lane and removed all policy interventions. Once we achieve that milestone, we will begin sharing an Autonomy Readiness Measure that quantifies our progress toward the commercial launch of Aurora Horizon. The launch bar for the Aurora Driver is a closed Safety Case, which is our evidence-based approach to demonstrate that our self-driving vehicles are acceptably safe to operate on public roads. Each quarter via the Autonomy Readiness Measure, we will share the percentage of completeness of our Safety Case (taking into account weighting that has been applied to individual pieces of evidence supporting the claims). We expect to achieve our Aurora Driver Ready milestone, which is defined as validation complete and Aurora Driver Safety Case closed, at the end of 2023. With the completion of the Aurora Driver Ready milestone, we will have closed the Aurora Driver Safety Case for our launch lane, with all relevant claims implemented with their corresponding evidence. At this time, we expect approximately 95% of our commercial launch safety case to be complete. We expect to receive the scalable, autonomy-enabled truck platforms in the first half of 2024 and plan to complete the remaining approximately 5% of our Safety Case that requires integration testing of the Aurora Driver with the final, autonomy-enabled truck platform. We anticipate launching commercially by the end of 2024. % Complete ~95%(E) 100% Closing of the Safety Case claims for the autonomy-enabled truck platform Feature Complete Aurora Driver Ready Commercial Launch

8 3 Q 2 2 S H A R E H O LD E R LE T T E R When the Aurora Driver is Feature Complete, we will also provide quarterly a supplemental measure of the Aurora Driver’s on-road autonomy performance as an indicator of its progress in everyday driving scenarios. The Aurora Driver’s autonomy performance indicator will be reflected as a percentage of total commercially-representative miles driven over the quarter, that incorporates three components: ▶ Miles driven during the quarter that did not require support, with support meaning human assistance via a vehicle operator touch or other on-site support ▶ Miles driven in autonomy with remote input from Aurora Beacon ▶ Miles where the vehicle received support but where it is determined, through internal analysis including simulation, that the support received was not required by the Aurora Driver Safety is our top priority across our organization, and we fundamentally believe it is important to build and maintain a strong safety culture. Conducting internal analysis after a vehicle has received support is one of the ways we further this culture, empowering our vehicle operators to intervene in the autonomous system without fear of reprisal, including how such support would affect perceived performance. As we have said previously, we believe there are significant limitations to the data that on-road driving can provide for autonomous development and validation. On-road driving performance alone will not determine when Aurora Horizon launches and we do not anticipate that this indicator will be 100% even at launch, because certain situations (e.g. flat tires) will always require on-site support. To reiterate, the launch bar for the Aurora Driver is a closed Safety Case. Our commitment to safety is reflected in our approach to both autonomy development and our commercial pilot operations.

9 3 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A H O R I Z O N Strengthening our commercial operations To successfully deliver innovative and scalable technology into the logistics industry requires a compelling value proposition and, equally important, the ability to seamlessly integrate this technology into customers’ networks. Through our pilots with our freight customers, including FedEx, Werner, Schneider, and Uber Freight, we continue to develop and employ the operational services, processes, and infrastructure required by both Aurora and our customers to deploy Aurora-powered vehicles at scale. We have deliberately structured our pilot programs to exercise the complete, terminal- to-terminal model we will operate upon commercial launch of Aurora Horizon. By doing so, we refine our product and our joint operational model to best integrate into existing operations at launch. Cumulative to-date through October 31st, we have autonomously delivered (under the supervision of vehicle operators) 660 loads, driving more than 180,000 miles, with nearly 100% on-time performance. We also achieved our end of quarter commercial load booking target of 22 loads/week, up 50% versus the second quarter. loads miles across on time Cumulative to-date through 10/31/22, we’ve delivered: 660 180k+ nearly 100%

10 3 Q 2 2 S H A R E H O LD E R LE T T E R In 2021, we launched our commercial pilot with Uber Freight to not only autonomously haul loads for customers between Dallas and Houston, but also to explore integrating access to Uber Freight’s digital freight network within Aurora Horizon. In October, we expanded our pilot with Uber Freight to also autonomously haul freight on the 600- mile Fort Worth to El Paso lane. The combination of Aurora Horizon and Uber Freight’s digital freight network is expected to provide carriers with powerful tools to further maximize the utilization of their Aurora-powered trucks, broaden opportunities to haul goods, and streamline supply chain operations.

11 3 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A D R I V E R L E S S T R U C K S Vehicle platform progress While we push forward advancing our autonomy development and the infrastructure to support our operations and service delivery, we continue to collaborate closely with our OEM partners, PACCAR and Volvo Trucks, in preparation for the delivery of scalable, autonomy-enabled truck platforms to support our commercial launch. As we shared in our second quarter shareholder letter, key supplier contracts for these truck platforms have been awarded. Since then, we have received a set of vehicles with one of the key systems needed to achieve the reliability necessary for safe driverless operations, integrated by the OEM, and have begun testing in preparation for our pre- launch truck platform that we expect to come online next year.

12 3 Q 2 2 S H A R E H O LD E R LE T T E R In the meantime, we made meaningful progress scaling our fleet during the third quarter. We built, brought up, and integrated 21 new Peterbilt 579 trucks with the latest generation of our commercial hardware. These vehicles include a dual-lane, liquid- cooled computer designed for enhanced levels of ruggedness and reliability, as well as redundancy and fallback capabilities – a critical component of our Fault Management System (FMS), which is the Aurora Driver’s ability to detect system issues and respond safely without any human involvement. These trucks will be integral in scaling up the loads we are autonomously hauling in our pilots and validating the commercial readiness of the Aurora Driver. In addition to our work with PACCAR on the Peterbilt 579, in October we debuted the first autonomous Kenworth T680 prototype designed for the Aurora Driver’s sensor suite, which rounds out PACCAR’s Autonomous Vehicle Platform (AVP). We also began integration testing with a Volvo truck built with critical driverless systems in place. 31 8 Q 3 F L E E T

13 3 Q 2 2 S H A R E H O LD E R LE T T E R Chris Urmson CEO & Co-founder Moving ahead Over the arc of history, we have witnessed incredible evolution in transportation - from walking, to the horse, to the wagon, to the internal combustion engine, and now electric powertrains. We continue to believe autonomous technology will be the next fundamental change in ground transportation and that Aurora is positioned for success in this new market. The enthusiasm for our technology is palpable among our customers and other stakeholders. In fact, we were honored to host U.S. Secretary of Transportation, Pete Buttigieg, and other transportation officials for a test track ride in an Aurora Driver- powered truck at the end of the third quarter. This was a valuable demonstration of Aurora’s commitment to safety and an opportunity to share our mission and roadmap to commercial deployment. To deliver any transformational change in the world, it’s essential to be “all-in.” That’s why Aurora’s position as an independent company is a strategic advantage. It enables us to have a singular focus on our mission and on what we do best. Independence has enabled us to build a differentiated technology stack, a diversified set of incredible partners, and a compelling commercialization strategy. In turn, this has allowed us to raise what we believe to be enough capital to drive through the current storm in the capital markets, positioning Aurora for success in what we view as an incredibly important and valuable space. We remain squarely focused on executing our plan to launch Aurora Horizon by the end of 2024. To our world-class team, partners, and investors who are on this journey with us, thank you for your continued support.

14 3 Q 2 2 S H A R E H O LD E R LE T T E R From the desk of our CFO We recognized approximately $3 million in collaboration revenue during the third quarter of 2022, and $148 million cumulative to-date, for development work associated with our agreement with Toyota. As of September 30, 2022, we have received all cash payments under the collaboration framework agreement with Toyota. While our first priority is commercialization of Aurora Horizon, we continue to believe our work with Toyota and other long-lead efforts will springload us for the eventual launch of Aurora Connect, our subscription service for the ride-hailing market. Third quarter operating expenses, including stock-based compensation (SBC), totaled $203 million. Excluding SBC of $37 million, operating expenses totaled $166 million, reflecting $139 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technology, and $27 million in SG&A. We used approximately $142 million in operating cash and $3 million in capital expenditures. We ended the third quarter with a very strong balance sheet, including over $1.2 billion in cash and short-term investments. We expect this cash runway to fund Aurora through mid-2024, enabling us to continue to develop the Aurora Driver for commercial deployment at scale. Richard Tame CFO

15 3 Q 2 2 S H A R E H O LD E R LE T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around our ability to achieve certain milestones around the development and commercialization of the Aurora Driver and related services on the timeframe we expect or at all, the metrics that we plan to report to the public in the future, and our expected cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, filed with the SEC on August 12, 2022, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec. gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

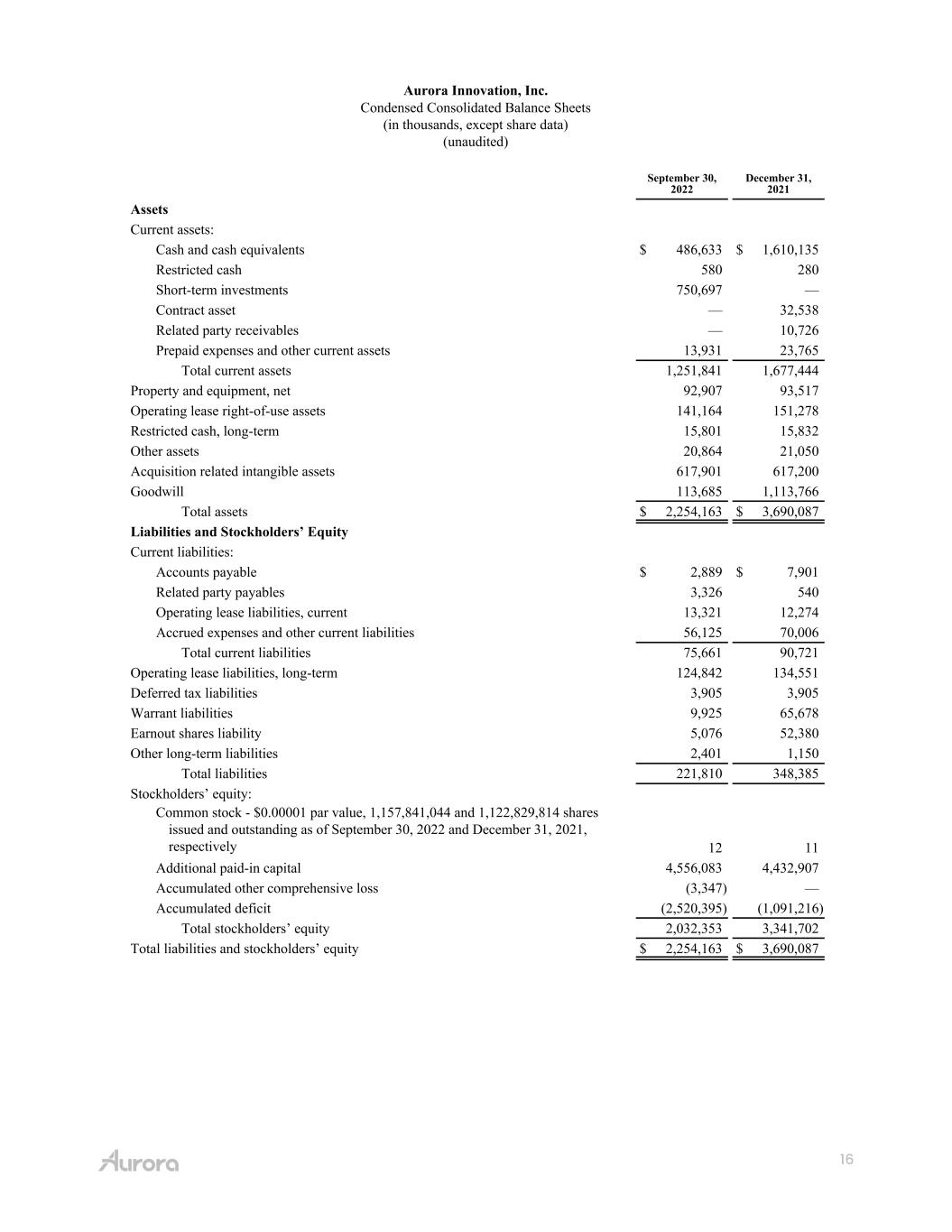

16 Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (in thousands, except share data) (unaudited) September 30, 2022 December 31, 2021 Assets Current assets: Cash and cash equivalents $ 486,633 $ 1,610,135 Restricted cash 580 280 Short-term investments 750,697 — Contract asset — 32,538 Related party receivables — 10,726 Prepaid expenses and other current assets 13,931 23,765 Total current assets 1,251,841 1,677,444 Property and equipment, net 92,907 93,517 Operating lease right-of-use assets 141,164 151,278 Restricted cash, long-term 15,801 15,832 Other assets 20,864 21,050 Acquisition related intangible assets 617,901 617,200 Goodwill 113,685 1,113,766 Total assets $ 2,254,163 $ 3,690,087 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $ 2,889 $ 7,901 Related party payables 3,326 540 Operating lease liabilities, current 13,321 12,274 Accrued expenses and other current liabilities 56,125 70,006 Total current liabilities 75,661 90,721 Operating lease liabilities, long-term 124,842 134,551 Deferred tax liabilities 3,905 3,905 Warrant liabilities 9,925 65,678 Earnout shares liability 5,076 52,380 Other long-term liabilities 2,401 1,150 Total liabilities 221,810 348,385 Stockholders’ equity: Common stock - $0.00001 par value, 1,157,841,044 and 1,122,829,814 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively 12 11 Additional paid-in capital 4,556,083 4,432,907 Accumulated other comprehensive loss (3,347) — Accumulated deficit (2,520,395) (1,091,216) Total stockholders’ equity 2,032,353 3,341,702 Total liabilities and stockholders’ equity $ 2,254,163 $ 3,690,087

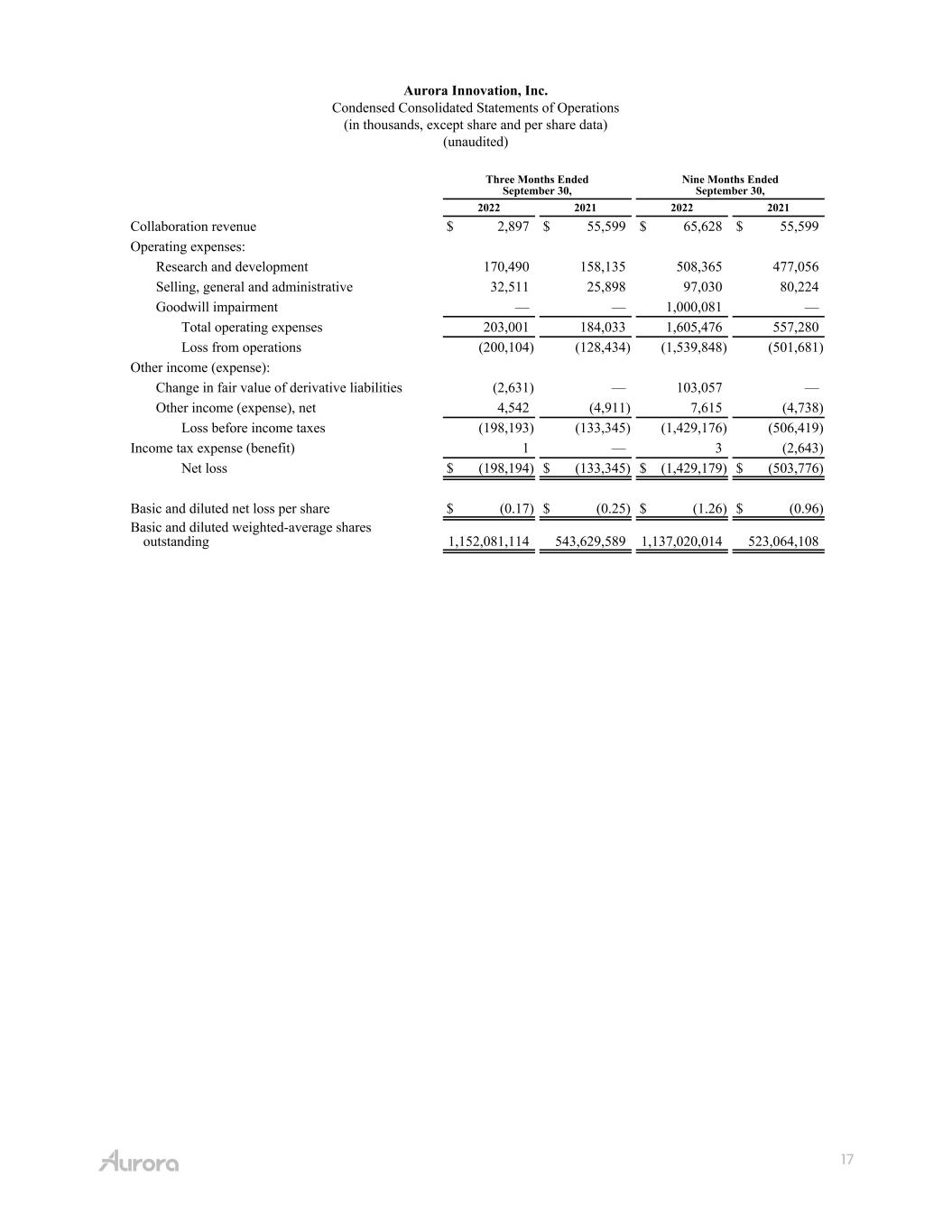

17 Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (in thousands, except share and per share data) (unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Collaboration revenue $ 2,897 $ 55,599 $ 65,628 $ 55,599 Operating expenses: Research and development 170,490 158,135 508,365 477,056 Selling, general and administrative 32,511 25,898 97,030 80,224 Goodwill impairment — — 1,000,081 — Total operating expenses 203,001 184,033 1,605,476 557,280 Loss from operations (200,104) (128,434) (1,539,848) (501,681) Other income (expense): Change in fair value of derivative liabilities (2,631) — 103,057 — Other income (expense), net 4,542 (4,911) 7,615 (4,738) Loss before income taxes (198,193) (133,345) (1,429,176) (506,419) Income tax expense (benefit) 1 — 3 (2,643) Net loss $ (198,194) $ (133,345) $ (1,429,179) $ (503,776) Basic and diluted net loss per share $ (0.17) $ (0.25) $ (1.26) $ (0.96) Basic and diluted weighted-average shares outstanding 1,152,081,114 543,629,589 1,137,020,014 523,064,108

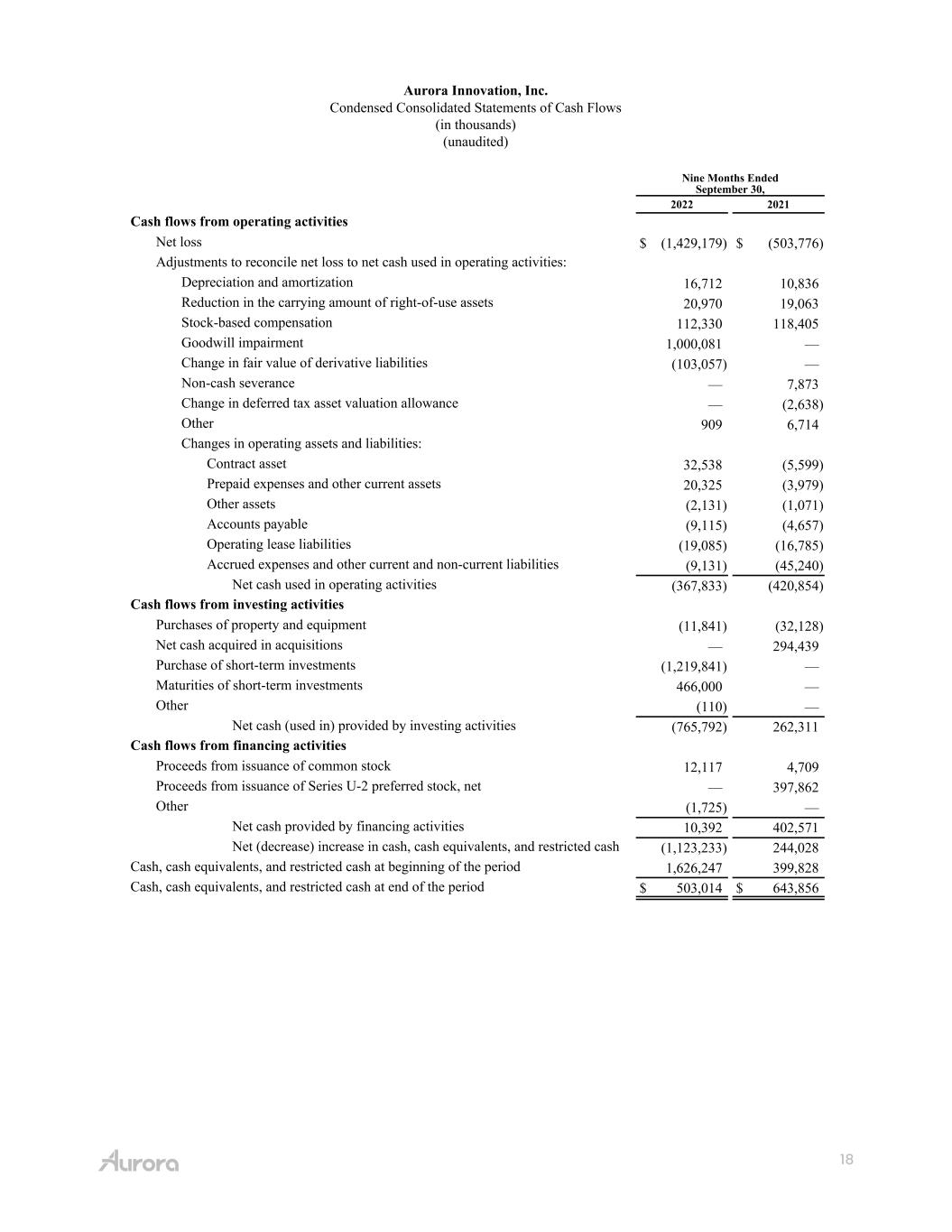

18 Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Nine Months Ended September 30, 2022 2021 Cash flows from operating activities Net loss $ (1,429,179) $ (503,776) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 16,712 10,836 Reduction in the carrying amount of right-of-use assets 20,970 19,063 Stock-based compensation 112,330 118,405 Goodwill impairment 1,000,081 — Change in fair value of derivative liabilities (103,057) — Non-cash severance — 7,873 Change in deferred tax asset valuation allowance — (2,638) Other 909 6,714 Changes in operating assets and liabilities: Contract asset 32,538 (5,599) Prepaid expenses and other current assets 20,325 (3,979) Other assets (2,131) (1,071) Accounts payable (9,115) (4,657) Operating lease liabilities (19,085) (16,785) Accrued expenses and other current and non-current liabilities (9,131) (45,240) Net cash used in operating activities (367,833) (420,854) Cash flows from investing activities Purchases of property and equipment (11,841) (32,128) Net cash acquired in acquisitions — 294,439 Purchase of short-term investments (1,219,841) — Maturities of short-term investments 466,000 — Other (110) — Net cash (used in) provided by investing activities (765,792) 262,311 Cash flows from financing activities Proceeds from issuance of common stock 12,117 4,709 Proceeds from issuance of Series U-2 preferred stock, net — 397,862 Other (1,725) — Net cash provided by financing activities 10,392 402,571 Net (decrease) increase in cash, cash equivalents, and restricted cash (1,123,233) 244,028 Cash, cash equivalents, and restricted cash at beginning of the period 1,626,247 399,828 Cash, cash equivalents, and restricted cash at end of the period $ 503,014 $ 643,856

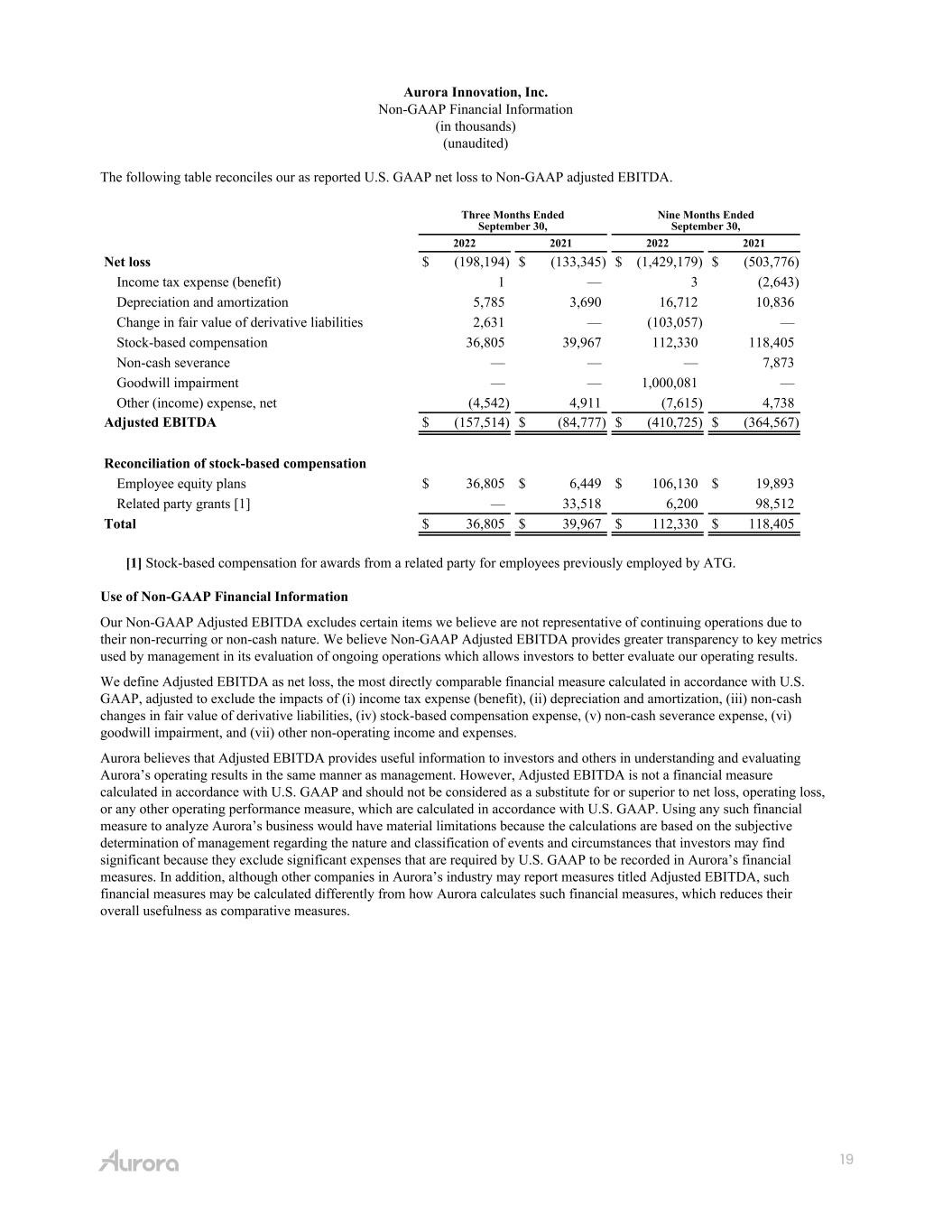

19 Aurora Innovation, Inc. Non-GAAP Financial Information (in thousands) (unaudited) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Net loss $ (198,194) $ (133,345) $ (1,429,179) $ (503,776) Income tax expense (benefit) 1 — 3 (2,643) Depreciation and amortization 5,785 3,690 16,712 10,836 Change in fair value of derivative liabilities 2,631 — (103,057) — Stock-based compensation 36,805 39,967 112,330 118,405 Non-cash severance — — — 7,873 Goodwill impairment — — 1,000,081 — Other (income) expense, net (4,542) 4,911 (7,615) 4,738 Adjusted EBITDA $ (157,514) $ (84,777) $ (410,725) $ (364,567) Reconciliation of stock-based compensation Employee equity plans $ 36,805 $ 6,449 $ 106,130 $ 19,893 Related party grants [1] — 33,518 6,200 98,512 Total $ 36,805 $ 39,967 $ 112,330 $ 118,405 [1] Stock-based compensation for awards from a related party for employees previously employed by ATG. Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income tax expense (benefit), (ii) depreciation and amortization, (iii) non-cash changes in fair value of derivative liabilities, (iv) stock-based compensation expense, (v) non-cash severance expense, (vi) goodwill impairment, and (vii) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures.