EX-99.1

Published on August 2, 2023

S E C O N D Q U A R T E R 2 0 2 3 S H A R E H O L D E R L E T T E R A U G U S T 2 , 2 0 2 3

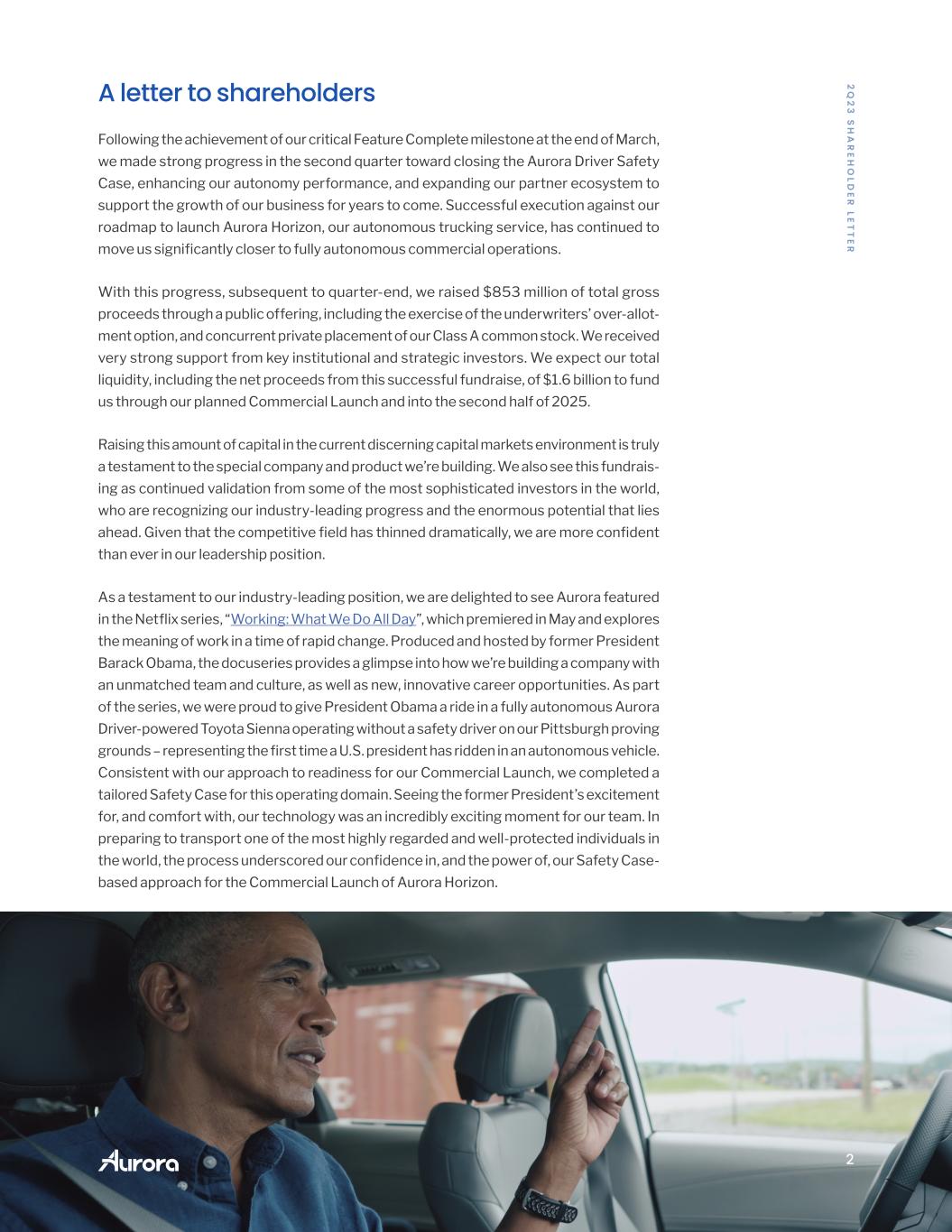

2 2 Q 2 3 S H A R E H O LD E R LE T T E R A letter to shareholders Following the achievement of our critical Feature Complete milestone at the end of March, we made strong progress in the second quarter toward closing the Aurora Driver Safety Case, enhancing our autonomy performance, and expanding our partner ecosystem to support the growth of our business for years to come. Successful execution against our roadmap to launch Aurora Horizon, our autonomous trucking service, has continued to move us significantly closer to fully autonomous commercial operations. With this progress, subsequent to quarter-end, we raised $853 million of total gross proceeds through a public offering, including the exercise of the underwriters’ over-allot- ment option, and concurrent private placement of our Class A common stock. We received very strong support from key institutional and strategic investors. We expect our total liquidity, including the net proceeds from this successful fundraise, of $1.6 billion to fund us through our planned Commercial Launch and into the second half of 2025. Raising this amount of capital in the current discerning capital markets environment is truly a testament to the special company and product we’re building. We also see this fundrais- ing as continued validation from some of the most sophisticated investors in the world, who are recognizing our industry-leading progress and the enormous potential that lies ahead. Given that the competitive field has thinned dramatically, we are more confident than ever in our leadership position. As a testament to our industry-leading position, we are delighted to see Aurora featured in the Netflix series, “Working: What We Do All Day”, which premiered in May and explores the meaning of work in a time of rapid change. Produced and hosted by former President Barack Obama, the docuseries provides a glimpse into how we’re building a company with an unmatched team and culture, as well as new, innovative career opportunities. As part of the series, we were proud to give President Obama a ride in a fully autonomous Aurora Driver-powered Toyota Sienna operating without a safety driver on our Pittsburgh proving grounds – representing the first time a U.S. president has ridden in an autonomous vehicle. Consistent with our approach to readiness for our Commercial Launch, we completed a tailored Safety Case for this operating domain. Seeing the former President’s excitement for, and comfort with, our technology was an incredibly exciting moment for our team. In preparing to transport one of the most highly regarded and well-protected individuals in the world, the process underscored our confidence in, and the power of, our Safety Case- based approach for the Commercial Launch of Aurora Horizon.

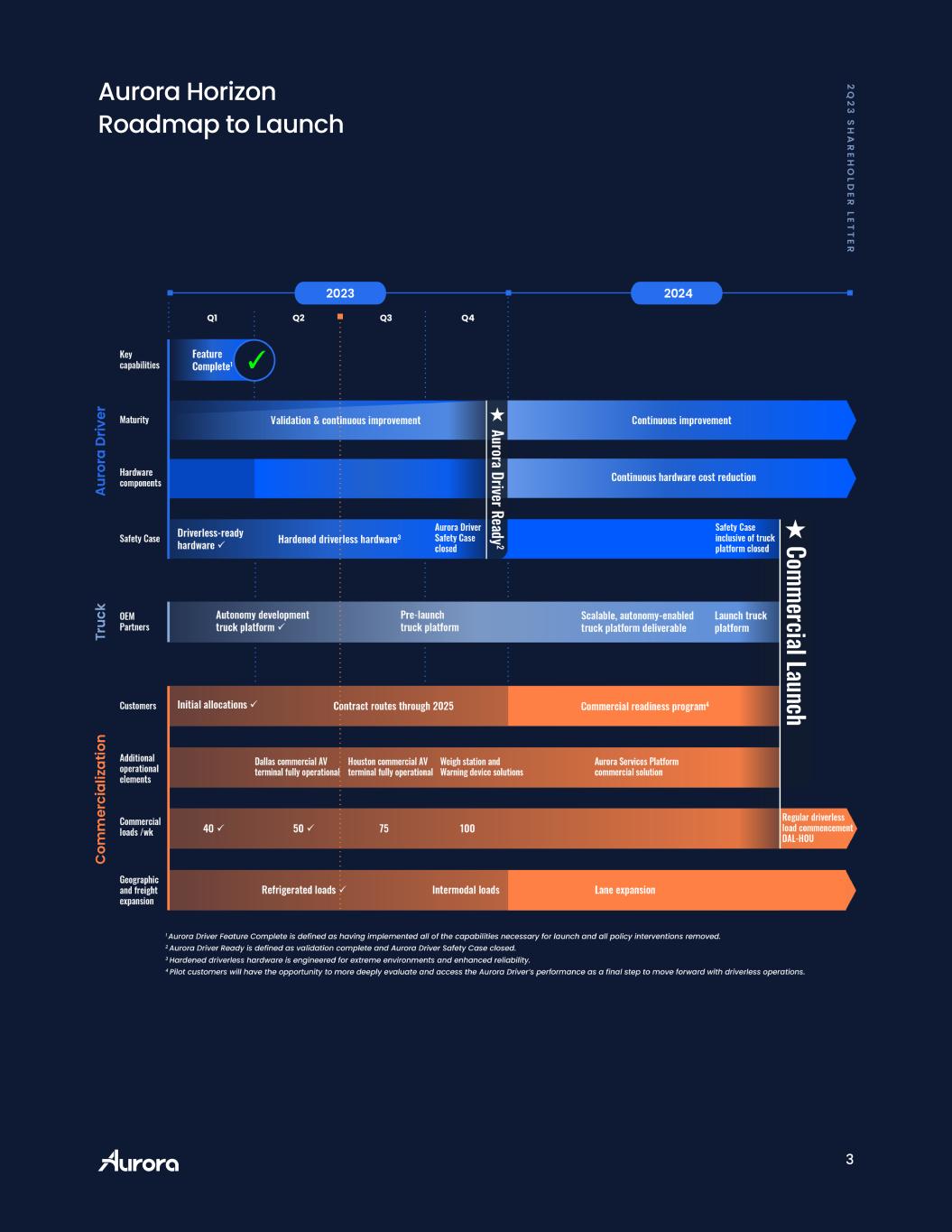

3 4 Q 2 2 S H A R E H O LD E R LE T T E R Aurora Horizon Roadmap to Launch 2 Q 2 3 S H A R E H O LD E R LE T T E R

4 2 Q 2 3 S H A R E H O LD E R LE T T E R Advancing our launch lane Safety Case to achieve the Aurora Driver Ready milestone As we’ve stated, the Aurora Driver will be ready to launch when we have a closed Safety Case for our Dallas to Houston lane. Our Safety Case is a comprehensive, evidence- based approach to confirming our self-driving vehicles are acceptably safe to oper- ate on public roads. It goes beyond just ensuring the vehicle drives well enough for a demo; rather, it demonstrates that our product, and our company, are holistically and sustainably safe. The Autonomy Readiness Measure (ARM) is a weighted measure of completeness across all claims of our Safety Case for the launch lane. It reflects the percentage of work needed to move from Feature Complete to our next critical milestone — Aurora Driver Ready. We have continued to make meaningful progress toward closing our launch Safety Case, achieving an ARM of 65% as of June 30, 2023. This 21 point increase during the second quarter is a strong reflection of our advancement, and keeps us on track to achieve Aurora Driver Ready later this year. Looking to the second half of 2023, much of the remaining work will be focused on completing the final validation to address the claims in the first pillar of our Safety Case Framework – Proficient: The self-driving vehicle is acceptably safe during nominal oper- ation. Or in other words, we drive well when everything is working as intended. While on-road testing is important, an autonomy system’s performance must be validated against a vast number of scenarios, many of which are thankfully rare on public roads.

5 2 Q 2 3 S H A R E H O LD E R LE T T E R Getting adequate exposure to rare, challenging scenarios by accumulating on-road miles alone is infeasible. In turn, a key component of our approach leverages Aurora’s Virtual Testing Suite to amplify exposure to rare events to sufficiently test the Aurora Driver’s performance in those scenarios. We do this in two ways. First, important but rare on-road events the Aurora Driver has encountered are turned into simulation tests and we create variations to further challenge the system’s performance in these scenarios. Second, for events so rare the Aurora Driver has not experienced them on the road, we synthetically generate simulation tests using the established NHTSA collision categorization, which enumer- ates the ways vehicles get into crashes. For these imminent collision scenarios and rare on-road events the Aurora Driver has encountered, we are creating tens of thou- sands of tests. Similar to the expected performance of a human driver, the Aurora Driver is being designed to avoid a collision in these scenarios if possible. If a colli- sion is not avoidable, as in scenarios where another actor’s behavior renders a collision inevitable, the Aurora Driver is designed to mitigate adverse outcomes – for example attempting to dodge or reduce the speed of impact with a vehicle approaching it, just as a human driver is expected to do. Success of these tests will give us the conviction that the Aurora Driver is designed to do the right thing in these rare scenarios. In addition to supporting the closure of the Safety Case for our Dallas to Houston commercial launch lane, we expect this framework to make the incremental validation straightforward for our planned future lane expansion: we will analyze the differences between the existing lane(s) and the new lane and add new validation tests as needed to support the scaling of our business. To further demonstrate our confidence in the Aurora Driver’s expected performance on our Dallas to Houston launch lane specifically, we looked at the available fatal colli- sion details that involved a tractor trailer for the years 2018-2022. We simulated those collisions to understand how the Aurora Driver would have acted under similar circum- stances. Of the 32 collisions, there were 29 where the Aurora Driver could have been operating the initiating vehicle. Based on our analysis, we believe that had the Aurora Driver been driving, the combination of its powerful sensor suite and attentive driving behavior would have prevented these collisions. Said simply, none of these fatal colli- sions would have occurred.

6 2 Q 2 3 S H A R E H O LD E R LE T T E R Aurora Horizon Beta 7.0 As we work toward completing the necessary validation to close the Aurora Driver Safety Case for our commercial launch lane, we are continuing our quarterly prod- uct release cadence. Following the achievement of our Feature Complete milestone for the Aurora Driver at the end of the first quarter, our product releases now focus on delivering the totality of Aurora Horizon. During the second quarter, we released Aurora Horizon Beta 7.0. A few of the notable advancements on our Dallas to Houston launch lane include: • Enhanced on-road autonomy performance; • Standard terminal flow in place, incorporating terminal configuration, commer- cially-representative launching and landing of trucks in autonomy via our termi- nal app, and pre- and post-trip commercial procedures including fueling, on-site weigh stations, and tractor/trailer inspection; • Increased on-site service and maintenance capabilities including repair service for customer trailers, via our partnership with Ryder, to drive higher asset utilization and better network performance; and • Operation of an increasingly-capable Command Center, including our remote assistance support, dispatch functionality, and asset management. Beta 7.0 demonstrates that Aurora Horizon’s performance, commercial scale, and overall readiness are progressing on pace with Aurora Driver Ready and Commercial Launch requirements.

7 2 Q 2 3 S H A R E H O LD E R LE T T E R Scaling operations and driving performance With each advancing product release, we enable our customers to further experience Aurora Horizon as it is designed to operate at launch. During the second quarter, we unlocked the ability to run complete mock driverless runs, incorporating all compo- nents of the driverless process, including pre-mission, on-road, and post-mission elements. Through these mock missions, we are honing various operational and tech- nical elements in advance of Commercial Launch. We have also continued to make strategic operations team hires to expand our inter- nal freight and logistics expertise across systems, scheduling, service, maintenance, and customer support. With significant industry management experience at key play- ers including FedEx, J.B. Hunt, Ryder, Schneider, and UPS, our team’s insights are guid- ing and influencing our operational execution to support smooth integration of Aurora Horizon into our customers’ networks. During the second quarter, our pilot activity exceeded our target to autonomously haul 50 loads per week for our customers. As we continue to scale our operations, we are now logging over 17,000 commercial miles per week and have already hauled over 1,300 loads year-to-date through July 31st, exceeding the number of loads we hauled for the entirety of 2022. Cumulative to-date through July 31st, we have auton- omously delivered (under the supervision of vehicle operators) 2,290 loads, driving more than 630,000 commercial miles, with nearly 100% on-time performance for our pilot customers, including FedEx, Werner, Schneider, and Uber Freight. With increas- ing customer interest to integrate Aurora Horizon into their networks, we continue to expect to be contracted for Commercial Launch by the end of the year. loads miles across on time nearly Cumulative to-date through 07/31/23, we’ve delivered: 2,290 630k 100%

8 2 Q 2 3 S H A R E H O LD E R LE T T E R One way we measure our performance to successfully operate the Aurora Horizon service in a commercially-representative setting is through the on-road Autonomy Performance Indicator (API). This metric allows us to track not just the state of our tech- nology, but the maturity of our processes and procedures in operating our business. The indicator penalizes the use of on-site support, which will be the most expensive support provided to enable the Horizon service. For the second quarter of 2023, the API was 97%, a sequential increase from the first quarter of 2023. Formally, the API is the percentage of total commercially-representative miles driven on our launch lane over the quarter, that include: • Miles driven during the quarter that did not require support, with support mean- ing assistance via a local vehicle operator or other on-site support • Miles driven in autonomy with remote input from the Aurora Services Platform • Miles where the vehicle received support but where it’s determined, through internal analysis including simulation, that the support received was not required by the Aurora Driver None of the support our vehicles received was required to keep the vehicles operat- ing safely; in over 100,000 commercially-representative miles driven on the launch lane in 2023, including over 65,000 commercial miles during the second quarter, we experienced zero safety-critical interventions. Across the commercially-represen- tative loads completed in pilot operations on our launch lane in the second quarter, we saw notable enhancement of autonomy performance versus the first quarter with about half of these loads having an API of 100% and nearly 75% with an API greater than or equal to 99%. As a reminder, we do not anticipate that aggregate API will be 100%, even at launch because certain situations (e.g., flat tires) will always require on-site support. As we look ahead to Commercial Launch and beyond, scalability and ultimately our profitability will be supported by a reduction in the level of on-site support required. We believe it is important to hold our teams accountable to delivering a complete, commercially-representative product and evaluating its performance on that basis. The API is one way we do this.

9 2 Q 2 3 S H A R E H O LD E R LE T T E R Progressing our vehicle platforms and Hardware as a Service partnership Our work with our truck OEM partners, PACCAR and Volvo Trucks, and our new Hardware as a Service partner, Continental, continues to progress as we prepare for Commercial Launch and beyond. During the second quarter, PACCAR completed a 1.5 million equivalent mile durability test of a Kenworth cab with the Aurora Driver hardware installed. The Aurora Driver hardware remained fully functional at the end of the test. Volvo Autonomous Solutions (V.A.S.) and Aurora expect to begin testing an autonomy-enabled prototype Volvo VNL powered by the Aurora Driver in the first quarter of 2024. Separately, V.A.S. has expanded its footprint in North America with the establishment of an office in Texas and started manual operations in preparation for the commercial launch of its autonomous hub-to-hub transport solu- tion, powered by the Aurora Driver. In April, we announced a long-term partnership with Continental to develop, manufacture, and service a commercially-scalable future generation of the Aurora Driver’s hardware kit. Continen- tal has already started development efforts to scale the Aurora Driver. In addition, the partnership’s Hardware as a Service struc- ture will enable Aurora to pay for the hardware on a per mile basis. This structure is a first-of-its-kind for this industry and aligns with and supports our highly capital efficient Driver as a Service business model. The model also drives significant value-alignment among us, Continental, and our customers. We believe industrializing our hardware kit through this partnership will help us achieve the commercial scale and cost structure necessary to support our long-term profit- ability objectives.

10 2 Q 2 3 S H A R E H O LD E R LE T T E R Momentum into the second half of 2023 We are incredibly proud of the powerful ecosystem of partners, customers, and in- vestors we have built to support the Commercial Launch of Aurora Horizon and the growth of our business for years to come. We believe these relationships, coupled with our technology, team, and capital position meaningfully differentiate Aurora in the in- dustry. The competitive landscape in autonomous trucking is also clearing, offering an even more compelling opportunity for those who continue to execute. As we continue our evolution from a research and development company to a product company focused on the near-term commercialization of our autonomous trucking service, we announced a leadership transition in June with David Maday assuming the role of Chief Financial Officer. Before taking on this role, Dave served as Senior Vice President of Business Development and Product Strategy at Aurora and brings deep experience in finance that will benefit us as we approach commercialization. Prior to joining Aurora, Dave spent over 20 years at General Motors, including leading the transformation of GM’s Product Program Finance organization, supporting accelerat- ed growth and resource efficiency across a multi-billion dollar annual CapEx budget. Dave is a highly accomplished finance leader with a proven track record of managing profitable enterprises at scale. With Dave’s strategic acumen and deep familiarity with Aurora’s product, business, and customers, I’m confident we will accelerate our com- mercial performance while simultaneously increasing our financial discipline across the business. On the heels of our recent capital raise and strong technical and commercial advance- ments, we entered the second half of 2023 with strong momentum toward achiev- ing the Aurora Driver Ready milestone by the end of the year. Which, in turn, prepares us for our anticipated Commercial Launch by the end of 2024. Our world-class team, partners, and investors recognize Aurora is well-positioned to commercialize this technology and generate significant value for our customers and shareholders. Thank you for your continued support and we look forward to keeping you updated on our progress during this exciting year for Aurora. Chris Urmson CEO & Co-founder

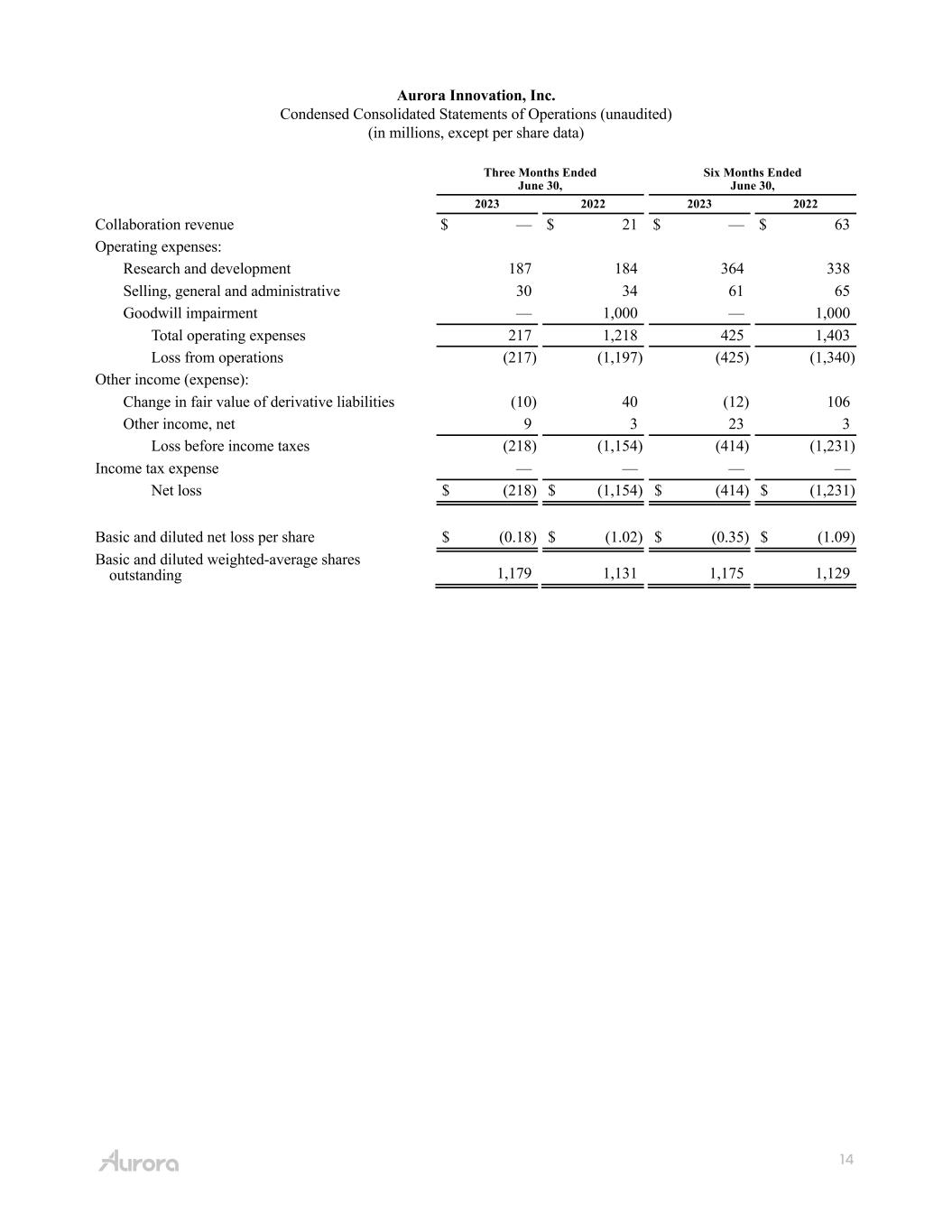

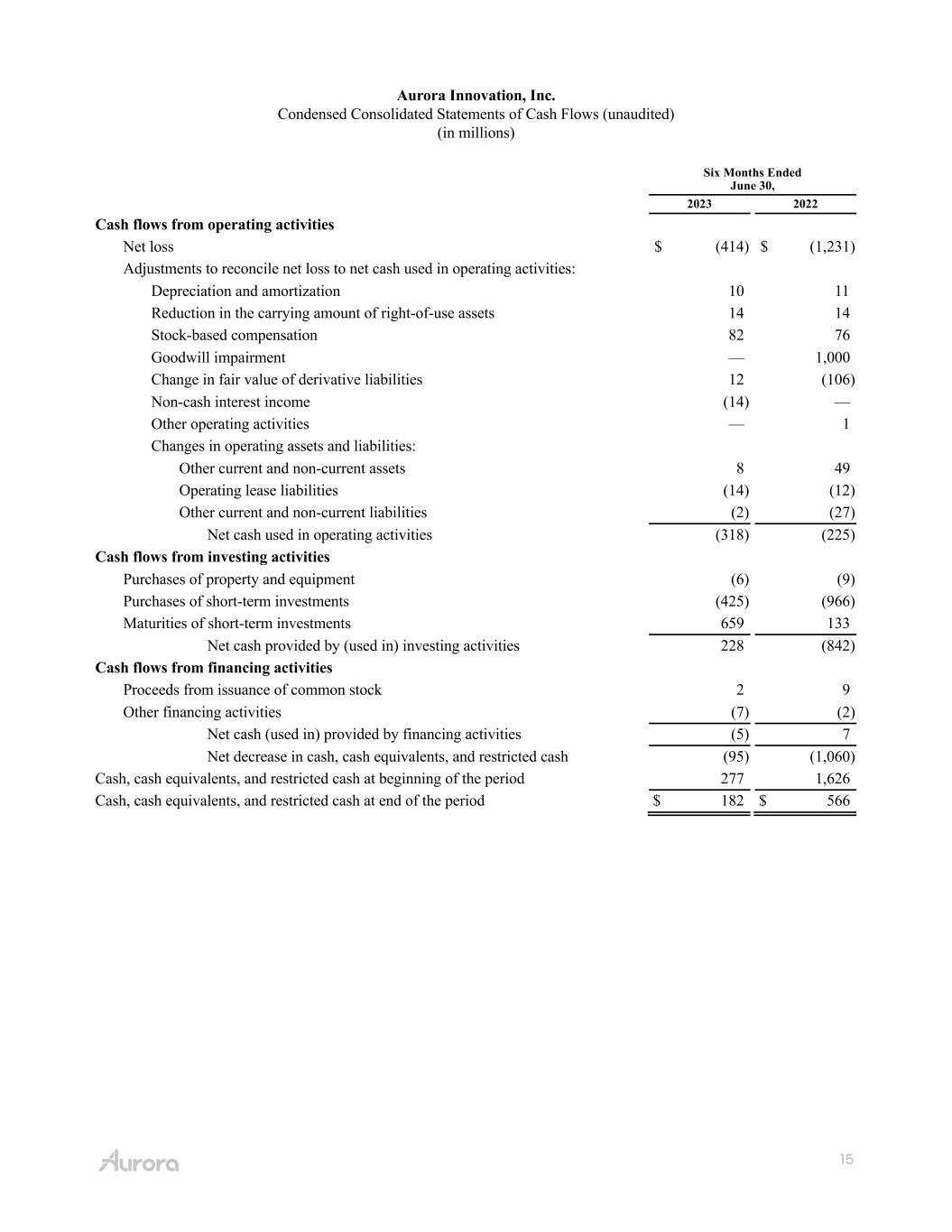

11 2 Q 2 3 S H A R E H O LD E R LE T T E R From the desk of our CFO During the second quarter of 2023, we continued to demonstrate strong fiscal disci- pline while ensuring the team is able to effectively execute our roadmap to launch Aurora Horizon. Second quarter 2023 operating expenses, including stock-based compensation (SBC), totaled $217 million. Excluding SBC of $43 million, operating expenses totaled $174 million, reflecting $150 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technol- ogy, and $24 million in SG&A. With the Aurora Driver in the final phase of refinement and validation, and all revenue under the collaboration framework agreement with Toyota previously recognized, we did not record any revenue during the second quarter of 2023. We used approximately $182 million in operating cash during the second quarter of 2023, which includes $49 million in payments associated with our 2022 annual incentive compensation program. In the prior year, incentive compensation program payments were made during the first quarter. During the second quarter of 2022, we received a cash inflow of $48 million under the collaboration project plan with Toyota. The second quarter of 2023 was not impacted by this cash activity. Capital expendi- tures totaled $4 million in the second quarter of 2023. We ended the second quarter with a very strong balance sheet, including $785 million in cash and short-term investments. Subsequent to quarter-end, we raised $853 million in gross proceeds from the public offering, including the exercise of the under- writers’ over-allotment option, and private placement, further solidifying our balance sheet. This raise reflects roughly half of the incremental capital we estimate needing to become free cash flow positive on a run-rate basis by the end of 2027. With $828 million in net proceeds from the offerings and our cash and short-term investments balance at June 30th, we expect our total liquidity of $1.6 billion to support our planned Commercial Launch by the end of 2024 and fund our operations into the second half of 2025. David Maday CFO

12 2 Q 2 3 S H A R E H O LD E R LE T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufac- turing, scaling, and commercialization of the Aurora Driver and related services on the timeframe we expect or at all, and our expected cash runway. These statements are based on management’s current assumptions and are neither promises nor guaran- tees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 21, 2023, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec. gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023. See our Current Report on Form 8-K filed on July 18, 2023 for key forecast assumptions and estimates underlying the projections. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking state- ments to reflect future events or circumstances.

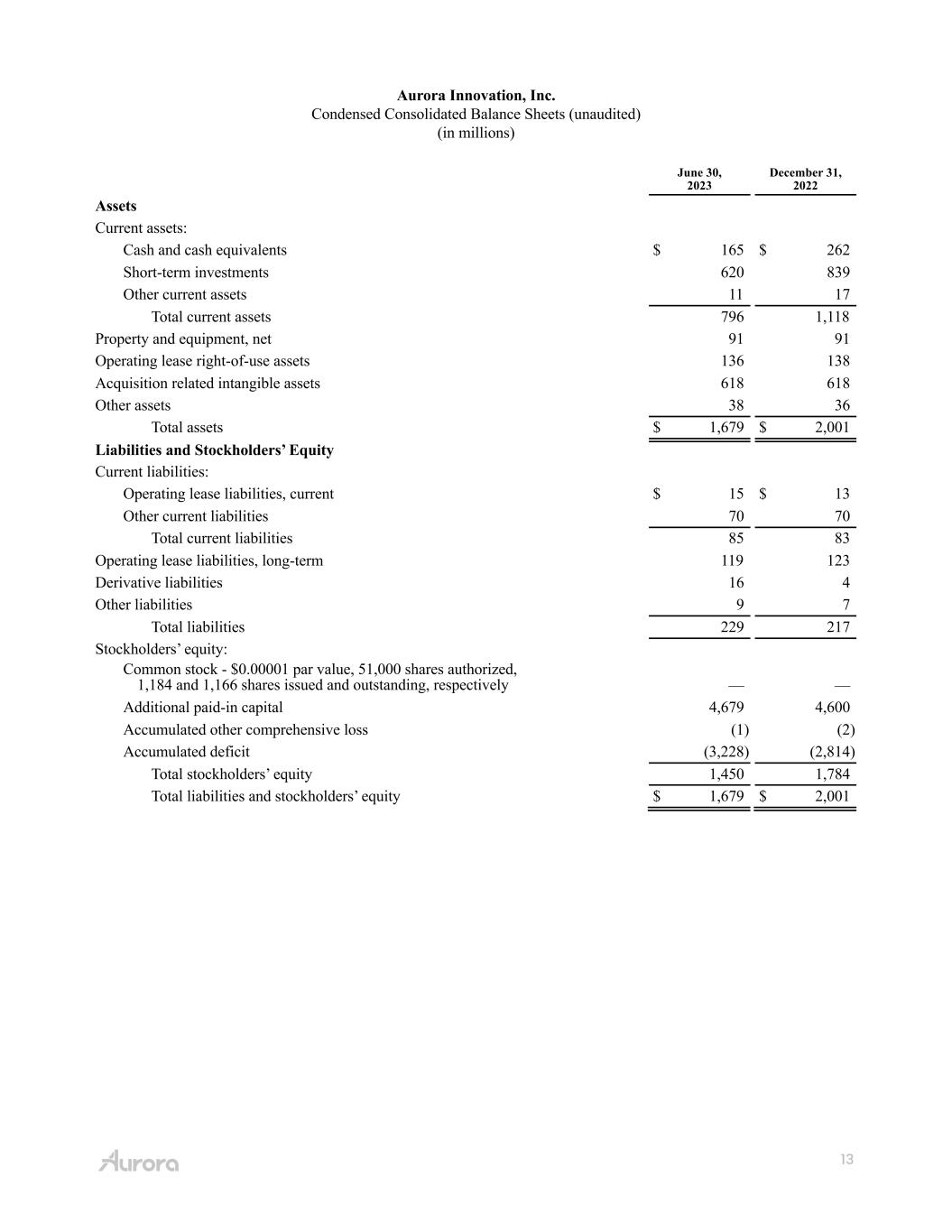

13 Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in millions) June 30, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 165 $ 262 Short-term investments 620 839 Other current assets 11 17 Total current assets 796 1,118 Property and equipment, net 91 91 Operating lease right-of-use assets 136 138 Acquisition related intangible assets 618 618 Other assets 38 36 Total assets $ 1,679 $ 2,001 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 15 $ 13 Other current liabilities 70 70 Total current liabilities 85 83 Operating lease liabilities, long-term 119 123 Derivative liabilities 16 4 Other liabilities 9 7 Total liabilities 229 217 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,184 and 1,166 shares issued and outstanding, respectively — — Additional paid-in capital 4,679 4,600 Accumulated other comprehensive loss (1) (2) Accumulated deficit (3,228) (2,814) Total stockholders’ equity 1,450 1,784 Total liabilities and stockholders’ equity $ 1,679 $ 2,001

14 Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Collaboration revenue $ — $ 21 $ — $ 63 Operating expenses: Research and development 187 184 364 338 Selling, general and administrative 30 34 61 65 Goodwill impairment — 1,000 — 1,000 Total operating expenses 217 1,218 425 1,403 Loss from operations (217) (1,197) (425) (1,340) Other income (expense): Change in fair value of derivative liabilities (10) 40 (12) 106 Other income, net 9 3 23 3 Loss before income taxes (218) (1,154) (414) (1,231) Income tax expense — — — — Net loss $ (218) $ (1,154) $ (414) $ (1,231) Basic and diluted net loss per share $ (0.18) $ (1.02) $ (0.35) $ (1.09) Basic and diluted weighted-average shares outstanding 1,179 1,131 1,175 1,129

15 Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (unaudited) (in millions) Six Months Ended June 30, 2023 2022 Cash flows from operating activities Net loss $ (414) $ (1,231) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 10 11 Reduction in the carrying amount of right-of-use assets 14 14 Stock-based compensation 82 76 Goodwill impairment — 1,000 Change in fair value of derivative liabilities 12 (106) Non-cash interest income (14) — Other operating activities — 1 Changes in operating assets and liabilities: Other current and non-current assets 8 49 Operating lease liabilities (14) (12) Other current and non-current liabilities (2) (27) Net cash used in operating activities (318) (225) Cash flows from investing activities Purchases of property and equipment (6) (9) Purchases of short-term investments (425) (966) Maturities of short-term investments 659 133 Net cash provided by (used in) investing activities 228 (842) Cash flows from financing activities Proceeds from issuance of common stock 2 9 Other financing activities (7) (2) Net cash (used in) provided by financing activities (5) 7 Net decrease in cash, cash equivalents, and restricted cash (95) (1,060) Cash, cash equivalents, and restricted cash at beginning of the period 277 1,626 Cash, cash equivalents, and restricted cash at end of the period $ 182 $ 566

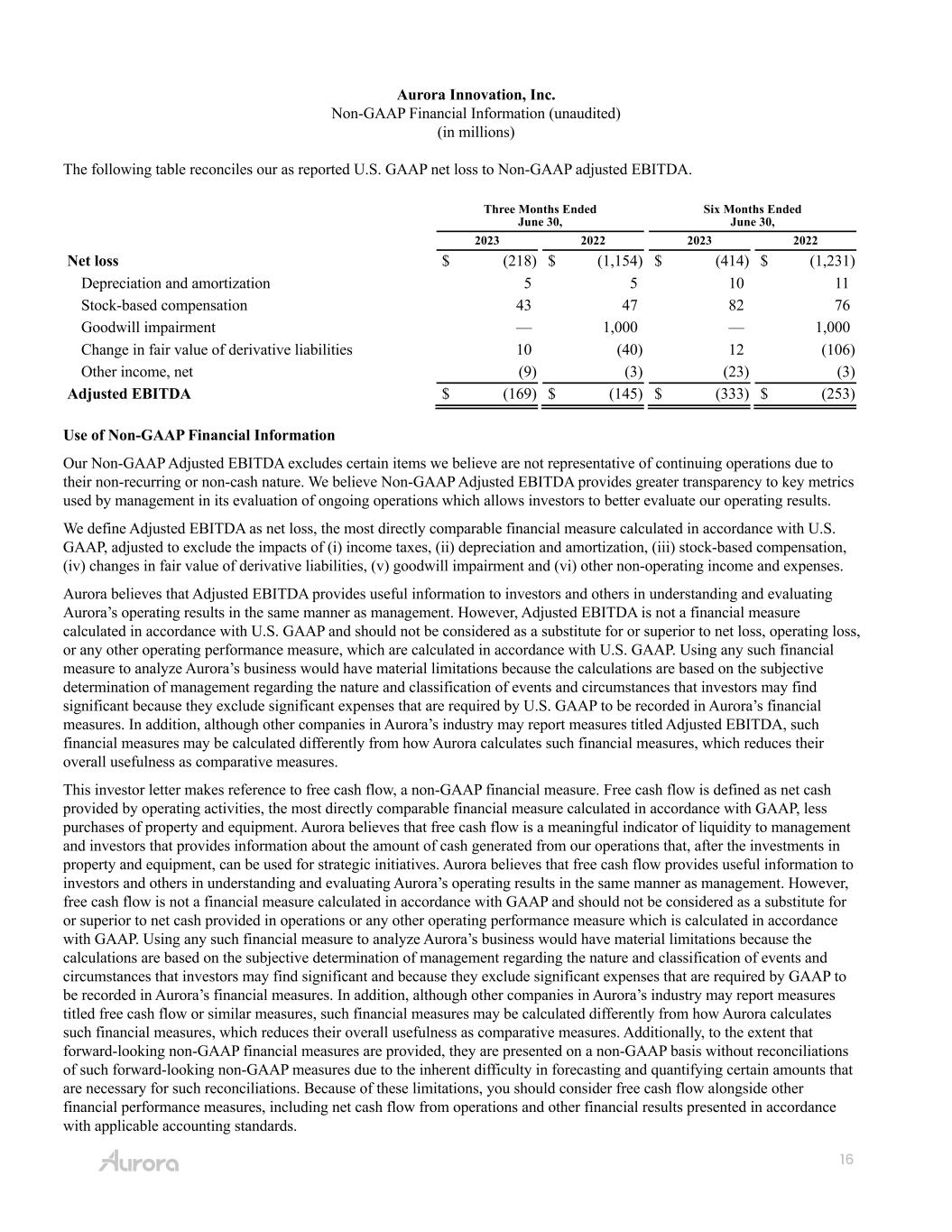

16 Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Net loss $ (218) $ (1,154) $ (414) $ (1,231) Depreciation and amortization 5 5 10 11 Stock-based compensation 43 47 82 76 Goodwill impairment — 1,000 — 1,000 Change in fair value of derivative liabilities 10 (40) 12 (106) Other income, net (9) (3) (23) (3) Adjusted EBITDA $ (169) $ (145) $ (333) $ (253) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures. This investor letter makes reference to free cash flow, a non-GAAP financial measure. Free cash flow is defined as net cash provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, less purchases of property and equipment. Aurora believes that free cash flow is a meaningful indicator of liquidity to management and investors that provides information about the amount of cash generated from our operations that, after the investments in property and equipment, can be used for strategic initiatives. Aurora believes that free cash flow provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, free cash flow is not a financial measure calculated in accordance with GAAP and should not be considered as a substitute for or superior to net cash provided in operations or any other operating performance measure which is calculated in accordance with GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant and because they exclude significant expenses that are required by GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled free cash flow or similar measures, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Because of these limitations, you should consider free cash flow alongside other financial performance measures, including net cash flow from operations and other financial results presented in accordance with applicable accounting standards.