EX-99.1

Published on February 16, 2022

Exhibit 99.1

F O U R T H Q U A R T E R A N D F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R F E B R U A R Y 1 6 , 2 0 2 2

A letter to shareholders Today, we are pleased to share our fourth quarter and full-year results for the first time as a publicly-traded company. 2021 was an incredible and transformative year for Aurora. With the acquisition of Ubers self-driving vehicle business, solidification of a number of powerful partnerships and pilots, advancements of our technology, and our go-public transaction, we achieved a significant number of meaningful milestones as we continue to work toward the launch of our product for autonomous trucking in late 2023 and our product for ride-hailing in late 2024. Since we founded Aurora five years ago, our goal has been bold we want to build an innovative and scalable product to make our roads safer, increase the accessibility of transportation, transform logistics, and improve the lives of everyday commuters. Developing technology and building a company to achieve this goal of transforming transportation requires a long-term approach and an operational mindset. With the benefit of the unparalleled experience and perspective our team possesses in the self-driving industry, we made foundational technology investments for the Aurora Driver and strategic decisions for our path to market. All in the service of achieving our mission to deliver the benefits of self-driving technology safely, quickly, and broadly. We are excited to share a deeper look into the progress we have made and provide a glimpse into what investors and the public can expect as we continue to execute against our product roadmap and achieve additional critical milestones on our path toward delivering commercial self-driving products at scale. Our mission: Deliver the benefits of self-driving technology safely, quickly, and broadly Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 2

Building our commercial business: Our pilots Pilots are an integral step toward building our commercial business. During this phase of early partnership engagement, we are gaining an understanding of the end customers needs and operational requirements, which enables us to refine the Aurora Driver and ready it for launch. Our approach to partner programs matches that of our development; we make use of the experiences we encounter to build a safe, reliable, and robust product. We build trust with our partners as we regularly autonomously move goods (under the supervision of vehicle operators) while maintaining on-time performance and striving for operational excellence. FedEx & Uber Freight One of the ways we measure our progress is through the product refinement, network integration, and operational learnings we achieve through our pilots. A key example is our industry-first collaboration with FedEx and PACCAR. In our multi-phase commercial pilot with FedEx, which launched during the third quarter of 2021, were using Aurora-powered Peterbilt trucks to autonomously haul FedEx loads between Dallas and Houston a 500-mile round trip. Not only are we executing for our partners, we are also building the operational muscle to scale; a critical component that will serve us in the months and years to come. During the fourth quarter, we launched our second multi-phase commercial pilot with Uber Freight. Were not only autonomously hauling loads for Uber Freights customers, but also working with Uber Freight to explore integrating access to its digital freight network within Aurora Horizon, our autonomous trucking product. The combination of Aurora Horizon and Uber Freights digital freight network is expected to provide carriers with powerful tools to further maximize the utilization of their Aurora-powered trucks, broaden opportunities to haul goods, and streamline supply chain operations. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 3

During the fourth quarter we began pulling loads for our pilot partners 5 days a week. In January we started nighttime hauls, demonstrating the Aurora Drivers capability of operating day and night and increasing our operational learnings. We are proud to announce that while we have increased our operational cadence, we have also maintained a 100% on-time record for the loads we pull for partners. Were currently pulling loads: Day & 5 100% night days a week on-time record U.S. Xpress Earlier this week, we announced a collaboration with U.S. Xpress, broadening our partner ecosystem. Together, we intend to leverage the intelligence of Variant, U.S. Xpresss digitally-enabled fleet, to identify where our autonomous technology can have the greatest impact in terms of both addressing unmet demand and improving operational efficiency and productivity. We intend to explore API integrations into Variants platform to enhance dispatching and dynamic routing upon the launch of Aurora Horizon. Through our collaboration with U.S. Xpress we plan to build a future where goods are transported by both human drivers and autonomous trucks and together have also committed to exploring how autonomous technology can create a positive impact on the labor market by investing in programs that provide opportunities for new jobs. Along with our commercial pilots, our collaborations are expected to provide meaningful learnings as we continue to refine Aurora Horizon for deployment. As we look ahead, we expect to continue to learn, increase operational capabilities, share more on future collaborations and pilots, and expand into new operational design domains (ODDs). Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 4

Driving forward: Our vehicle programs PACCAR Just over a year ago we entered into a strategic and collaborative partnership with PACCAR. We continue to deepen our engagement with them, driving toward delivering our first driverless-capable truck at scale. Beyond the collaboration on the vehicle platform, our commercial pilot with FedEx is enabling us to incorporate critical customer feedback into the product. During the second half of 2021, the Aurora Driver was integrated with Peterbilts New Model 579, and featured at this years Consumer Electronics Show (CES). The New 579, the most technologically advanced truck Peterbilt has ever built, includes greater fuel efficiency, and will be one of the trucks with which we plan to launch Aurora Horizon. We are integrating with, developing on, and iteratively validating key elements of the Aurora Driver and the New Model 579, and look forward to sharing more about this work as we approach its launch. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 5

Volvo Were working with Volvo Trucks to not only build a driverless-capable truck based on the VNL, but also to support the launch of Volvo Autonomous Solutions transport solution in the U.S. We made significant progress with Volvo throughout 2021. We aligned on critical technical and safety requirements for the new driverless-capable VNL platform. We demonstrated our collective speed and investment in mutual success through the debut of a VNL design prototype that we unveiled together last fall. Looking ahead, we are making good progress on the integration of the Aurora Driver hardware as we work toward launching a prototype fleet of Volvo VNLs. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 6

Development growth Our testing and development tools, processes, and partnerships are designed to maximize learning while minimizing operational complexity. In addition to our robust Virtual Testing Suite, we continue to invest in our autonomous fleet, which now comprises 18 trucks; more than double the size of the operational fleet we had in the fourth quarter. Expanding our fleet allows us to test and develop its technical and operational capabilities at larger scales. 100%+ F E B R U A R Y 2 0 2 2 F L E E T Fleet growth vs. Q4 Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 7

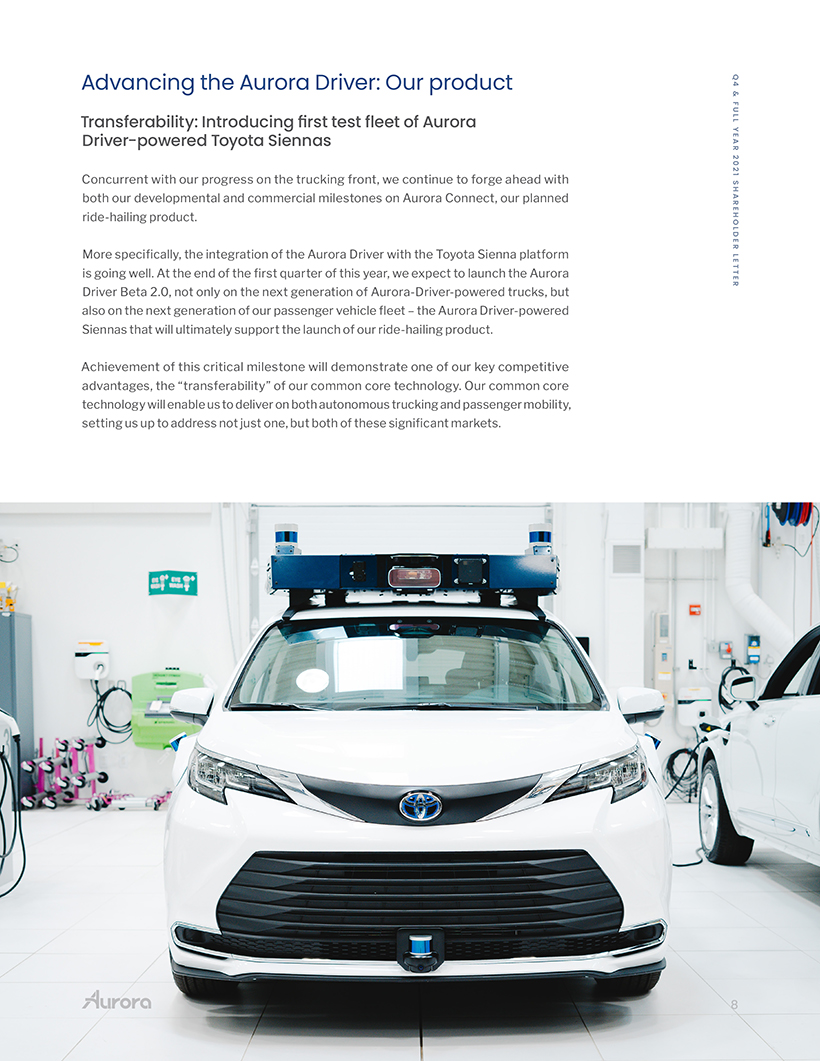

Advancing the Aurora Driver: Our product Transferability: Introducing first test fleet of Aurora Driver-powered Toyota Siennas Concurrent with our progress on the trucking front, we continue to forge ahead with both our developmental and commercial milestones on Aurora Connect, our planned ride-hailing product. More specifically, the integration of the Aurora Driver with the Toyota Sienna platform is going well. At the end of the first quarter of this year, we expect to launch the Aurora Driver Beta 2.0, not only on the next generation of Aurora-Driver-powered trucks, but also on the next generation of our passenger vehicle fleet the Aurora Driver-powered Siennas that will ultimately support the launch of our ride-hailing product. Achievement of this critical milestone will demonstrate one of our key competitive advantages, the transferability of our common core technology. Our common core technology will enable us to deliver on both autonomous trucking and passenger mobility, setting us up to address not just one, but both of these significant markets. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 8

Fueling the rockets: Our technical progress To transform an industry like transportation, it is critical to invest in foundational elements that accelerate development and enable scalability. Guided by our veteran teams broad experience, Aurora has honed a holistic and deeply integrated approach to hardware and software development. We expect this will enable safe and rapid deployment of our products and services powered by the Aurora Driver. Our world-class hardware team has designed and built a multi-modal sensing suite of powerful cameras, radars, and lidars that optimizes range, field of view, data quality, and data processing efficiency. Our integrated hardware kit is intended to be modular, automotive-grade, and transferable across vehicle platforms. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R Lidar Radar Camera Combined modalities 9

Auroras FirstLight Lidar: Sensors designed for performance, reliability, and scale Powered by a state-of-the-art deep learning detection engine, our perception system reasons in 3D and sees the world with exacting precision for hundreds of meters into the distance, providing the Aurora Driver with exceptional situational awareness. The extreme long-range measurement capability of Auroras FMCW FirstLight Lidar has unlocked our ability to deploy our products at highway speeds, where even fractions of a second can affect a vehicles ability to react to unexpected obstacles. FirstLight allows us to directly measure the speed of other people, objects and vehicles on, and around the road, independent of their size. This allows the Aurora Driver to better forecast and react to them. FirstLights novel architecture also eliminates virtually all interference from other sources of light, providing the Aurora Driver with rich, reliable observations regardless of weather conditions or time of day. We continue to advance the performance of FirstLight, enabling us to safely operate in situations that would confuse traditional lidar and other sensors, and make progress in a variety of areas: Detecting and tracking pedestrians at night Observing small objects at long distances Recognizing speeding motorcyclists Driving in sun glare, dust, and dense fog New York City got a behind -the-scenes look at how Auroras self-driving trucks see the world. With an Aurora-powered semi-truck parked in Times Square for its public listing, the company projected a live FirstLight Lidar feed onto the NASDAQ Tower. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 10

Auroras Virtual Testing Suite: Accelerating development and validation through scalable simulation in virtual worlds There is a limit to how much meaningful data can be efficiently gathered from on-road driving, so weve invested heavily in the development of a proprietary, highly accurate, and scalable Virtual Testing Suite. We continue to accelerate our development and validation through simulation in virtual environments, testing at a scale and cost we couldnt achieve in the physical world. We repeatedly and reliably test and train our perception and motion planning systems in our Virtual Testing Suite. This allows us to iterate quickly and continuously equip the Aurora Driver with more advanced capabilities. We build high-fidelity virtual worlds with physically accurate sensor simulation and actor models using data-driven procedural generation. By presenting the Aurora Driver with a large number of variations of events weve seen, imagined, or stochastically created, were able to find edge cases and catch many errors early, well before the software is loaded onto our vehicles. During the fourth quarter, our engineers leveraged our increasingly powerful virtual supercomputer to conduct approximately five million simulations per day. These simulations were used to train and evaluate the Aurora Drivers software stack across a vast range of scenarios and driving conditions, even those that are rare or dangerous to experience in the real world. Our virtual testing is far more operationally efficient than the equivalent on-road testing of a massive fleet, and is the quickest and safest way to train, test, and ready our self-driving technology for deployment at commercial scale. We use our proprietary simulation technology to accurately model how energy and light move through the world, allowing us to build physically accurate sensor simulations for our cameras, conventional lidar, and our FMCW FirstLight lidar. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 11

Transparency and collaboration: Our safety playbook Earlier this month, we had the honor to be the only autonomous vehicle company asked by Congress to present at the House Committee on Transportation & Infrastructure hearing on automated vehicles. This was an incredible opportunity to share our leadership on safety, and a great example of how we work collaboratively with legislators at the federal, state, and local levels, as well as with regulators, safety advocacy groups, and other self-driving companies to bring safe and innovative technology solutions to market. We are committed to transparency as we work to bring the government and public along on this self-driving journey. Aurora defines safety for the Aurora Driver with industry-leading Safety Case Framework We believe that building and executing a safety case is necessary for any company looking to safely deliver commercial-ready self-driving vehicles at scale. Auroras Safety Case Framework serves as our roadmap for removing vehicle operators from Aurora Driver-powered vehicles not just once or in ways that are unwieldy for customers but permanently and at scale. Were proud to have publicly shared Auroras Safety Case Framework for both trucks and passenger vehicles, a critical way for government partners, the public, and our industry partners to follow along with our work, and a guideline for other AV companies looking to achieve high levels of safety for their self-driving products. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 12

Importantly, we have been executing against our framework and have evidence for all of our claims for our vehicle operator reliant safety case. We have compiled and performed a safety review of the evidence for relevant claims in our framework and thus have completed formal safety cases for all of our current on-road operations. Auroras Safety Case Framework is a critical way to ensure that everyone employees, regulators, partners, and the public understand our safety approach. Our Safety Case Framework combines guidance from government organizations, best practices from safety-critical industries, voluntary industry standards and consortia, academic research, and what we learn from our own work. Demonstrating fail-safe capabilities During the third quarter of this year, we expect to demonstrate a major milestone towards satisfying the Fail-Safe core claim of our safety case. We intend to demonstrate the Aurora Drivers ability to respond to system failures at highway speeds by safely pulling over to the shoulder without vehicle operator intervention. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 13

Looking ahead: Delivering at scale Were emboldened and inspired by the tremendous opportunity we see to revolutionize how people and goods move throughout the world making our roads safer and our transportation systems more accessible and efficient. The path to achieving this vision one with the potential for hundreds of thousands of safe and efficient Aurora Driver-powered trucks and cars operating across a variety of use cases is clear and measured, and we continue to execute accordingly. Of course, building a transformative technology and a great company takes time, but we believe the progress our team has achieved in the last five years, and the foundational investments we have made, set us up for exceptional growth. We are proud to have world-class roboticists, engineers, partners, customers, and investors along for the ride. Thank you and we look forward to keeping you abreast of our progress. Chris Urmson CEO & Co-founder Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 14

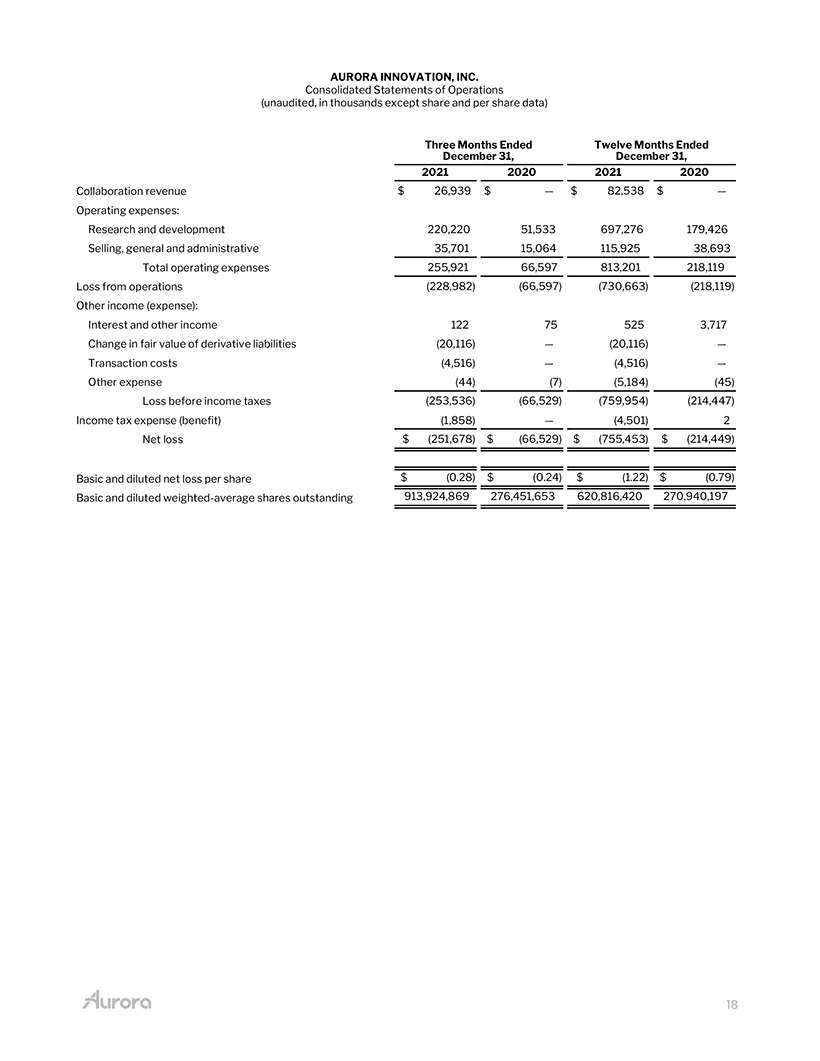

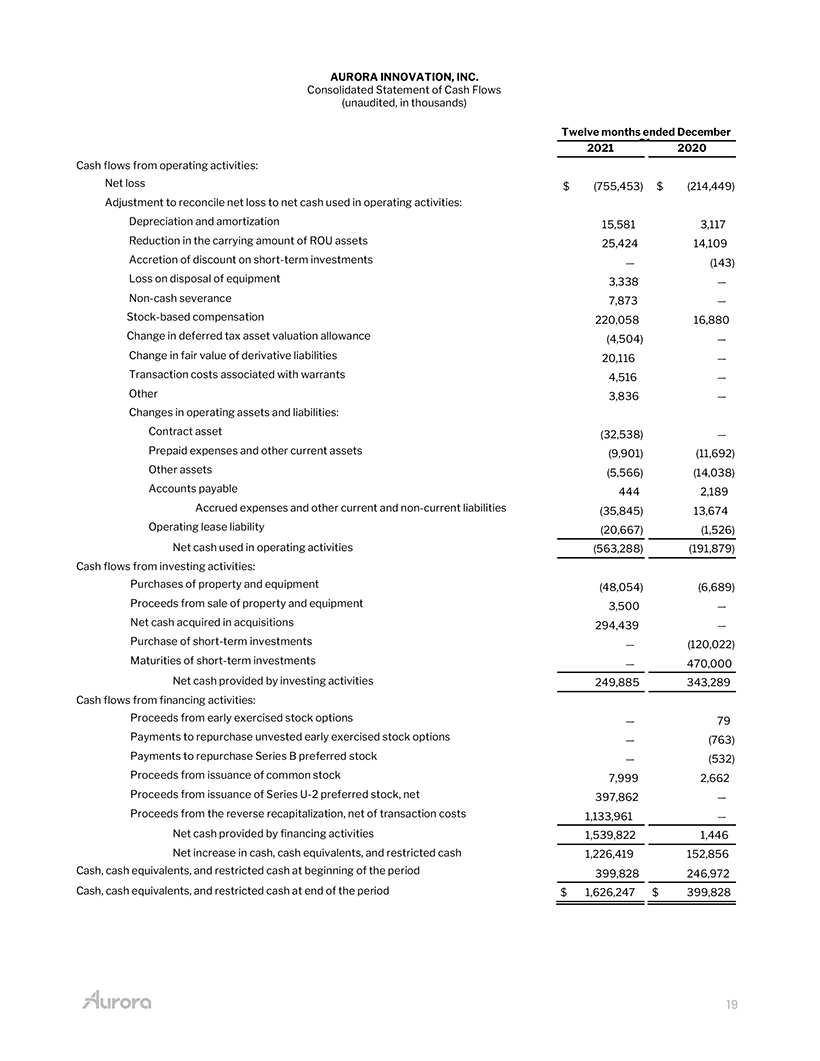

From the desk of our CFO 2021 was a capstone year financially for Aurora. To kick off the year, we acquired ATG, Ubers self-driving vehicle business, which further bolstered our technology stack and gave us the depth and breadth of talent to better tackle the complex challenge of developing a scalable self-driving product. As part of this transaction, we received $400 million when the acquisition closed to capitalize the combined company. During 2021, we had $83 million in collaboration revenue for development work on the Sienna platform associated with our agreement with Toyota. This work will ultimately support the launch of our ride-hailing product. Operating expenses, including stock-based compensation (SBC), totaled $813 million. Excluding both ongoing and acquisition-related SBC of $92 million and $128 million, respectively, operating expenses totaled $593 million, reflecting $491 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy work and $102 million in SG&A, which included costs associated with building our public company infrastructure. We closed our business combination taking Aurora public in November with $1.8 billion in gross proceeds and cash on hand, which we expect to fund Aurora through the commercial launch of our trucking product, Aurora Horizon, and into 2024. In 2021, we used $563 million in operating cash spend and $48 million in capital expenditures. We ended the year with a very strong balance sheet, including $1.6 billion in cash, enabling us to continue to execute our mission of delivering the benefits of self-driving technology safely, quickly, and broadly. Richard Tame CFO Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 15

Available information We announce material information to the public about us, our products and services, and other matters through a variety of means, including filings with the SEC, press releases, public conference calls, webcasts, the investor relations section of our website (ir.aurora.tech), our blog (https://aurora.tech/blog), and our Twitter account (@aurora_inno) in order to achieve broad, non-exclusionary distribution of information to the public and for complying with our disclosure obligations under Regulation FD. Cautionary statement regarding forward-looking statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited, to those statements around our ability to achieve certain milestones around and commercialize the Aurora Driver on the timeframe we expect or at all. In some cases, you can identify forward-looking statements because they contain words such as may, might, possible, will, should, expect, plan, anticipate, could, intend, target, project, contemplate, believe, estimate, predict, potential or continue or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions.These statements are based on managements current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the challenges we face to commercialize our technology, our history of losses, our limited operating history, which makes it difficult to evaluate our future prospects, the highly competitive market in which we operate, the pace at which our services and technology may be accepted and adopted by the market, the additional capital investment required to run our business, our dependence on our senior management team, difficulties in managing our growth and expanding our operations, our ability to successfully select, execute or integrate past and future acquisitions, unauthorized control or manipulation of systems, which may cause them to operate improperly, cybersecurity risks to our operational systems, security systems and infrastructure, our ability to develop and maintain an effective system of internal control over financial reporting, burdensome or inconsistent regulations, or a failure to receive regulatory approvals of our technology, product liability, the volatility of the market price of our common stock, and the dual class structure of our common stock, which has the effect of concentrating voting power with our founders. These risks and uncertainties are described in greater detail under the heading Risk Factors section of the definitive Registration Statement of Aurora Innovation, Inc. (Aurora) on Form S-1 filed with the SEC on November 12, 2021 and our Form 10-K for the full year 2021 that will be filed by March 31, 2022, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances. This shareholder letter also contains statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information may be based on many assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified the accuracy or completeness of the data contained in the industry publications and other publicly available information. Aurora does not undertake to update such data after the date of this presentation. All third-party logos appearing in this shareholder letter are trademarks or registered trademarks of their respective holders. Any such appearance does not necessarily imply any affiliation with or endorsement of Aurora. Q 4 & F U L L Y E A R 2 0 2 1 S H A R E H O L D E R L E T T E R 16

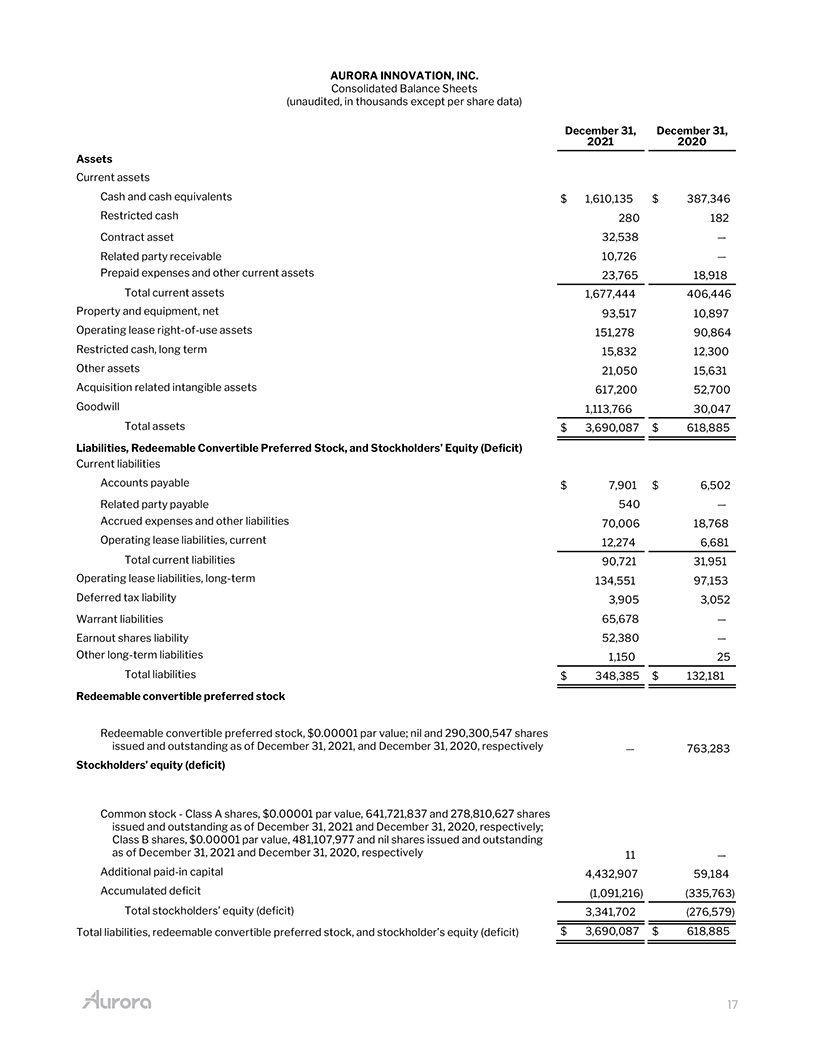

AURORA INNOVATION, INC. Consolidated Balance Sheets (unaudited, in thousands except per share data) December 31, December 31, 2021 2020 Assets Current assets Cash and cash equivalents $ 1,610,135 $ 387,346 Restricted cash 280 182 Contract asset 32,538 Related party receivable 10,726 Prepaid expenses and other current assets 23,765 18,918 Total current assets 1,677,444 406,446 Property and equipment, net 93,517 10,897 Operating lease right-of-use assets 151,278 90,864 Restricted cash, long term 15,832 12,300 Other assets 21,050 15,631 Acquisition related intangible assets 617,200 52,700 Goodwill 1,113,766 30,047 Total assets $ 3,690,087 $ 618,885 Liabilities, Redeemable Convertible Preferred Stock, and Stockholders Deficit Current liabilities Accounts payable $ 7,901 $ 6,502 Related party payable 540 Accrued expenses and other liabilities 70,006 18,768 Operating lease liabilities, current 12,274 6,681 Total current liabilities 90,721 31,951 Operating lease liabilities, long-term 134,551 97,153 Deferred tax liability 3,905 3,052 Warrant liabilities 65,678 Earnout shares liability 52,380 Other long-term liabilities 1,150 25 Total liabilities $ 348,385 $ 132,181 Redeemable convertible preferred stock Redeemable convertible preferred stock, $0.00001 par value; nil and 290,300,547 shares issued and outstanding as of December 31, 2021, and December 31, 2020, respectively 763,283 Stockholders deficit Common stockClass A shares, $0.00001 par value, 641,721,837 and 278,810,627 shares issued and outstanding as of December 31, 2021 and December 31, 2020, respectively; Class B shares, $0.00001 par value, 481,107,977 and nil shares issued and outstanding as of December 31, 2021 and December 31, 2020, respectively 11 Additional paid-in capital 4,432,907 59,184 Accumulated deficit (1,091,216) (335,763) Total stockholders deficit 3,341,702 (276,579) Total liabilities, redeemable convertible preferred stock, and stockholders deficit $ 3,690,087 $ 618,885 17

AURORA INNOVATION, INC. Consolidated Statements of Operations (unaudited, in thousands except share and per share data) Three Months Ended Twelve Months Ended December 31, December 31, 2021 2020 2021 2020 Collaboration revenue $ 26,939 $ $ 82,538 $ Operating expenses: Research and development 220,220 51,533 697,276 179,426 Selling, general and administrative 35,701 15,064 115,925 38,693 Total operating expenses 255,921 66,597 813,201 218,119 Loss from operations (228,982) (66,597) (730,663) (218,119) Other income (expense): Interest and other income 122 75 525 3,717 Change in fair value of derivative liabilities (20,116) (20,116) Transaction costs (4,516) (4,516) Other expense (44) (7) (5,184) (45) Loss before income taxes (253,536) (66,529) (759,954) (214,447) Income tax expense (benefit) (1,858) (4,501) 2 Net loss $ (251,678) $ (66,529) $ (755,453) $ (214,449) Basic and diluted net loss per share $ (0.28) $ (0.24) $ (1.22) $ (0.79) Basic and diluted weighted-average shares outstanding 913,924,869 276,451,653 620,816,420 270,940,197 18

AURORA INNOVATION, INC. Consolidated Statement of Cash Flows (unaudited, in thousands) Twelve months ended December 31, 2021 2020 Cash flows from operating activities: Net loss $ (755,453) $ (214,449) Adjustment to reconcile net loss to net cash used in operating activities: Depreciation and amortization 15,581 3,117 Reduction in the carrying amount of ROU assets 25,424 14,109 Accretion of discount on short-term investments (143) Loss on disposal of equipment 3,338 Non-cash severance 7,873 Stock-based compensation 220,058 16,880 Change in deferred tax asset valuation allowance (4,504) Change in fair value of derivative liabilities 20,116 Transaction costs associated with warrants 4,516 Other 3,836 Changes in operating assets and liabilities: Contract asset (32,538) Prepaid expenses and other current assets (9,901) (11,692) Other assets (5,566) (14,038) Accounts payable 444 2,189 Accrued expenses and other current and non-current liabilities (35,845) 13,674 Operating lease liability (20,667) (1,526) Net cash used in operating activities (563,288) (191,879) Cash flows from investing activities: Purchases of property and equipment (48,054) (6,689) Proceeds from sale of property and equipment 3,500 Net cash acquired in acquisitions 294,439 Purchase of short-term investments (120,022) Maturities of short-term investments 470,000 Net cash provided by investing activities 249,885 343,289 Cash flows from financing activities: Proceeds from early exercised stock options 79 Payments to repurchase unvested early exercised stock options (763) Payments to repurchase Series B preferred stock (532) Proceeds from issuance of common stock 7,999 2,662 Proceeds from issuance of Series U-2 preferred stock, net 397,862 Proceeds from the reverse recapitalization, net of transaction costs 1,133,961 Net cash provided by financing activities 1,539,822 1,446 Net increase in cash, cash equivalents, and restricted cash 1,226,419 152,856 Cash, cash equivalents, and restricted cash at beginning of the period 399,828 246,972 Cash, cash equivalents, and restricted cash at end of the period $ 1,626,247 $ 399,828 19

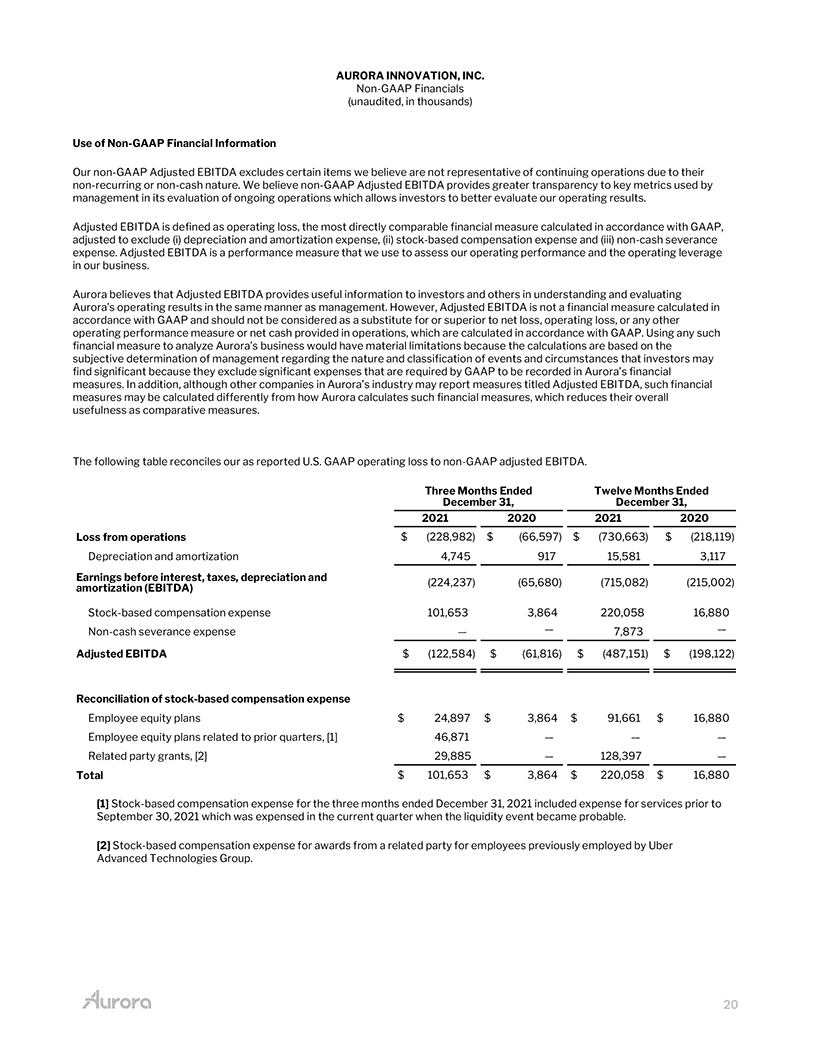

AURORA INNOVATION, INC. Non-GAAP Financials (unaudited, in thousands) Use of Non-GAAP Financial Information Our non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. Adjusted EBITDA is defined as operating loss, the most directly comparable financial measure calculated in accordance with GAAP, adjusted to exclude (i) depreciation and amortization expense, (ii) stock-based compensation expense and (iii) non-cash severance expense. Adjusted EBITDA is a performance measure that we use to assess our operating performance and the operating leverage in our business. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Auroras operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure or net cash provided in operations, which are calculated in accordance with GAAP. Using any such financial measure to analyze Auroras business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that invesptors may find significant because they exclude significant expenses that are required by GAAP to be recorded in Auroras financial measures. In addition, although other companies in Auroras industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures. The following table reconciles our as reported U.S. GAAP operating loss to non-GAAP adjusted EBITDA. Three Months Ended Twelve Months Ended December 31, December 31, 2021 2020 2021 2020 Loss from operations $ (228,982) $ (66,597) $ (730,663) $ (218,119) Depreciation and amortization 4,745 917 15,581 3,117 Earnings before interest, taxes, depreciation and (224,237) (65,680) (715,082) (215,002) amortization (EBITDA) Stock-based compensation expense 101,653 3,864 220,058 16,880 Non-cash severance expense 7,873 Adjusted EBITDA $ (122,584) $ (61,816) $ (487,151) $ (198,122) Reconciliation of stock-based compensation expense Employee equity plans $ 24,897 $ 3,864 $ 91,661 $ 16,880 Employee equity plans related to prior quarters, [1] 46,871 Related party grants, [2] 29,885 128,397 Total $ 101,653 $ 3,864 $ 220,058 $ 16,880 [1] Stock-based compensation expense for the three months ended December 31, 2021 included expense for services prior to September 30, 2021 which was expensed in the current quarter when the liquidity event became probable. [2] Stock-based compensation expense for awards from a related party for employees previously employed by Uber ATG. 20