EX-99.1

Published on May 4, 2022

1 M A Y 4 , 2 0 2 2 F I R S T Q U A R T E R 2 0 2 2 S H A R E H O L D E R L E T T E R E x h i b i t 9 9 . 1

2 A letter to shareholders Our first quarter was a strong start to 2022. We achieved critical milestones, we continued to advance our technology, and we extended our partner ecosystem, providing us with solid momentum continuing into the second quarter. We are pleased to share our progress as we continue to work toward developing the Aurora Driver for deployment at scale, with our first priority being commercialization of our autonomous trucking product. 1Q 2 2 S H A R E H O LD E R LE T T E R

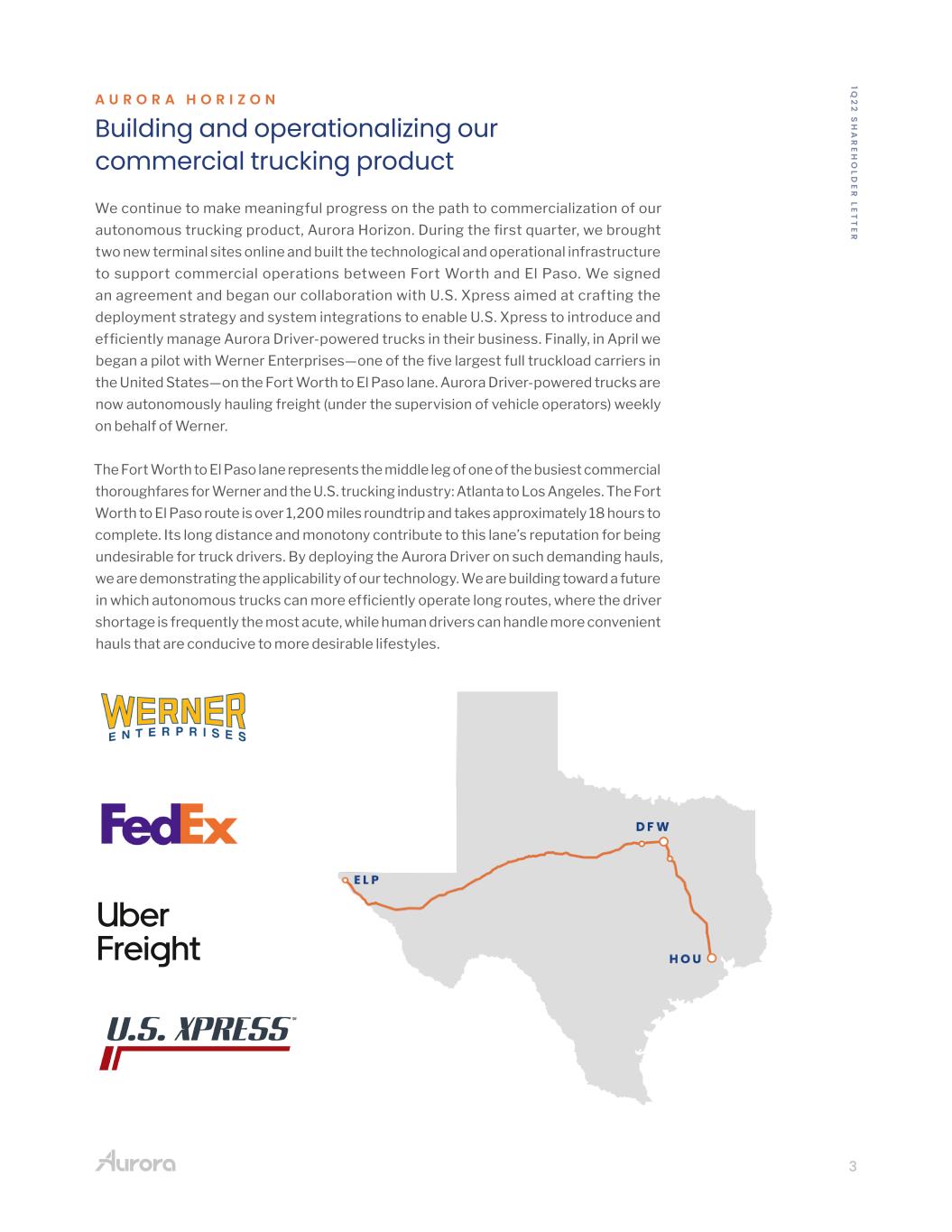

3 A U R O R A H O R I Z O N Building and operationalizing our commercial trucking product We continue to make meaningful progress on the path to commercialization of our autonomous trucking product, Aurora Horizon. During the first quarter, we brought two new terminal sites online and built the technological and operational infrastructure to support commercial operations between Fort Worth and El Paso. We signed an agreement and began our collaboration with U.S. Xpress aimed at crafting the deployment strategy and system integrations to enable U.S. Xpress to introduce and efficiently manage Aurora Driver-powered trucks in their business. Finally, in April we began a pilot with Werner Enterprises—one of the five largest full truckload carriers in the United States—on the Fort Worth to El Paso lane. Aurora Driver-powered trucks are now autonomously hauling freight (under the supervision of vehicle operators) weekly on behalf of Werner. The Fort Worth to El Paso lane represents the middle leg of one of the busiest commercial thoroughfares for Werner and the U.S. trucking industry: Atlanta to Los Angeles. The Fort Worth to El Paso route is over 1,200 miles roundtrip and takes approximately 18 hours to complete. Its long distance and monotony contribute to this lane’s reputation for being undesirable for truck drivers. By deploying the Aurora Driver on such demanding hauls, we are demonstrating the applicability of our technology. We are building toward a future in which autonomous trucks can more efficiently operate long routes, where the driver shortage is frequently the most acute, while human drivers can handle more convenient hauls that are conducive to more desirable lifestyles. 1Q 2 2 S H A R E H O LD E R LE T T E R

4 We are seeing broad demand to apply our technology and strong customer interest in the lanes we have identified in our initial rollout plan. The geographic expansion, coupled with the scaling up of autonomously delivered loads across both of our lanes, demonstrates the confidence carriers have in Aurora’s trucking product and the potential benefits it can bring to their networks. Building a scalable self-driving business requires not only robust technology, but also true operational strength that is built through a deep understanding of our future customers’ needs. The breadth and diversity of our pilot partners, including FedEx, the largest less-than-truckload (LTL) freight carrier in the United States, Werner, a top five full truckload (FTL) carrier, and Uber Freight, a significant freight broker, is by design: we have deliberately structured our pilot programs so that we can learn what will be needed for our product to integrate and be highly performant within our customers’ networks. Year- to-date, we have already doubled both the commercial miles driven and loads delivered by the Aurora Driver compared to 2021, providing our team with invaluable insights. 1Q 2 2 S H A R E H O LD E R LE T T E R

5 Along with the progress we’re making with Aurora Horizon by learning and developing alongside our pilot partners, we also continue to lay the groundwork for our driverless commercial launch with the services we will offer our customers to support their autonomous fleets. Earlier today, we introduced Aurora Beacon, a suite of tools designed to provide fleet managers extraordinary visibility and control over their fleet. Aurora Beacon is planned to integrate with and augment existing transportation management systems to allow for efficient scheduling, dispatch, route guidance, health monitoring, remote observation, and incident response. Our vision is for the Aurora Driver to improve the safety, reliability and operational efficiency of our customers’ fleets. Our remote observation tool will equip fleet managers with a powerful set of observation and guidance tools, allowing them to see what’s happening on the ground for any of their Aurora-powered trucks, receive proactive health and mission status notifications, and provide high-level direction to the trucks. We’re really excited about Aurora Beacon’s potential, and in particular, its ability to capture the collective intelligence of a fleet on the road, and the visibility and control it will provide to our customers. As we have done since the early days of Aurora, we bring in the best experts from across industries to build our company, our technology, and our business. This quarter we expanded our operational prowess with the hiring of Kendra Phillips as our VP of Logistics Partner Programs & Operations. Kendra brings 16 years of experience in the logistics industry, most recently as Chief Technology Officer and Vice President of New Products at Ryder System, Inc. She will spearhead the development and launch of Aurora Shield, our operational tools and support services, including roadside assistance and hardware support, designed to maximize uptime and ensure efficient utilization of fleets powered by the Aurora Driver. Her years of experience working with carriers, fleet managers, shippers, and truck drivers will inform her as she creates the blueprint for Aurora’s service operations, ensuring that all of our processes — from pre-trip inspection to trailer drop and hook to dispatch integration — are smooth and aligned with industry best practices. 1Q 2 2 S H A R E H O LD E R LE T T E R

6 Through our pilot programs and collaborations, and supported by an even stronger team, Aurora continues to build the operational and logistical muscle that we believe will be necessary to launch and scale our self-driving trucking product to seamlessly meet our customers’ needs. We believe our holistic product suite within Aurora Horizon will drive our ability to autonomously move goods for our customers 24 hours a day, seven days a week, and support our Driver-as-a-Service business model. As we see our existing partners increase their commitment to autonomous technology, we are simultaneously developing new relationships with leading carriers. This continued interest from new and existing partners gives us tremendous confidence in the value Aurora Horizon can deliver to the freight ecosystem. 1Q 2 2 S H A R E H O LD E R LE T T E R

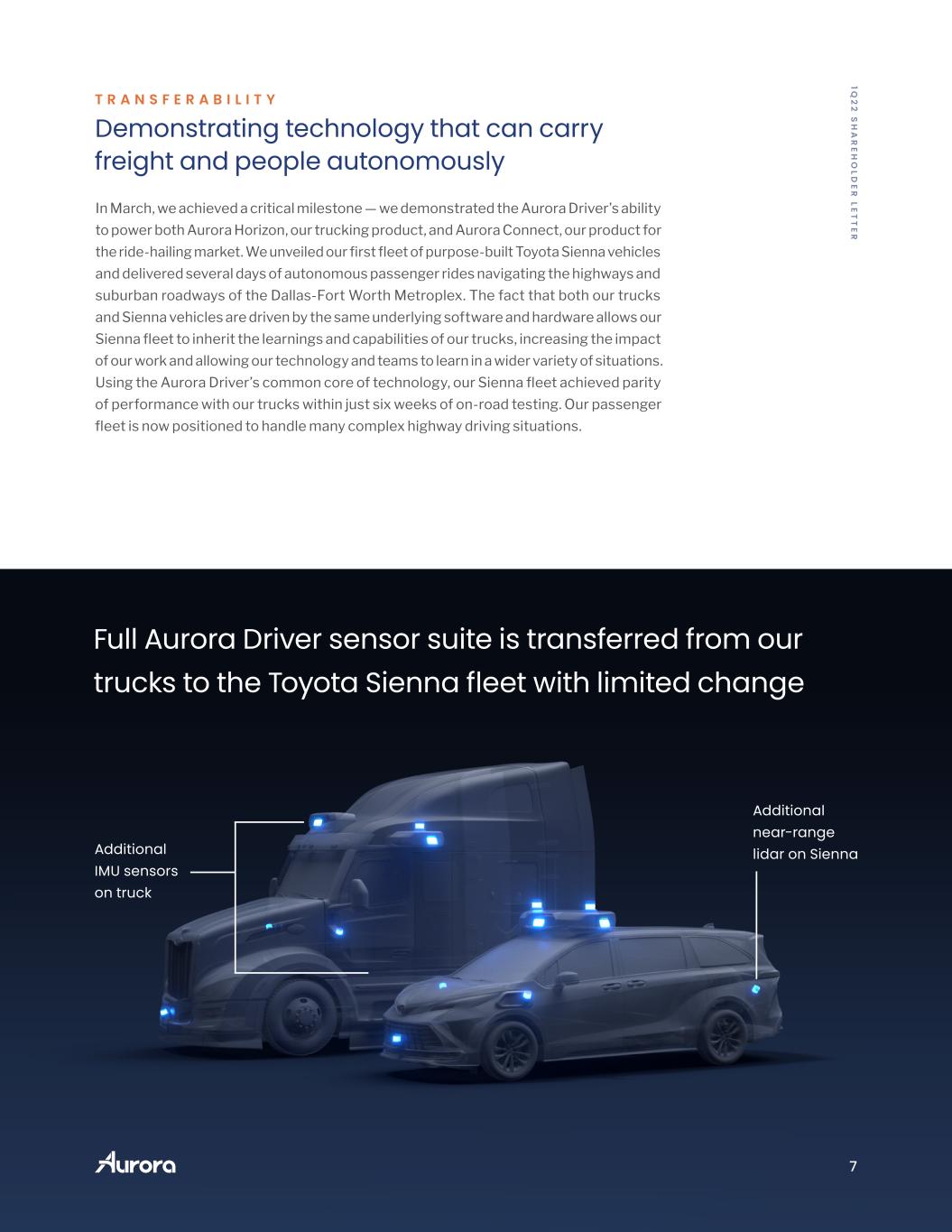

7 Additional IMU sensors on truck Additional near-range lidar on Sienna Full Aurora Driver sensor suite is transferred from our trucks to the Toyota Sienna fleet with limited change T R A N S F E R A B I L I T Y Demonstrating technology that can carry freight and people autonomously In March, we achieved a critical milestone — we demonstrated the Aurora Driver’s ability to power both Aurora Horizon, our trucking product, and Aurora Connect, our product for the ride-hailing market. We unveiled our first fleet of purpose-built Toyota Sienna vehicles and delivered several days of autonomous passenger rides navigating the highways and suburban roadways of the Dallas-Fort Worth Metroplex. The fact that both our trucks and Sienna vehicles are driven by the same underlying software and hardware allows our Sienna fleet to inherit the learnings and capabilities of our trucks, increasing the impact of our work and allowing our technology and teams to learn in a wider variety of situations. Using the Aurora Driver’s common core of technology, our Sienna fleet achieved parity of performance with our trucks within just six weeks of on-road testing. Our passenger fleet is now positioned to handle many complex highway driving situations. 1Q 2 2 S H A R E H O LD E R LE T T E R

8 Our Sienna vehicles are able to operate at highway speeds, creating a key competitive advantage that we believe will allow us to tap into a differentiated and lucrative segment of the passenger mobility market: namely, highway-dominant trips. We believe we are the only autonomous vehicle company pursuing this unique go-to-market approach, and we believe it will enable us to deliver, then more rapidly scale, both autonomous trucking and passenger mobility, while unlocking sizable addressable market opportunities. This achievement underscores the significant work the Aurora and Toyota teams have accomplished together. The teams’ quick and collaborative work culminated in a fleet of six Sienna vehicles produced to our requirements and rapidly upfitted with the Aurora Driver system. Having realized this milestone together, we expect to continue to deepen our partnership as we prepare vehicles and service models for the launch of Aurora Connect. Q 1 F L E E T 1 8 6 It was really impressive how the vehicle merges within heavy traffic. I noticed at times it was speeding up so it could be ahead of oncoming traffic. There was another merge where it actually slowed down to optimize the safety of the merging. I was very impressed that we did the entire trip and there was no disengagement until we forcibly disengaged at the end. Very impressive system.” —Bob Carter, Toyota Motor North America We saw exciting progress from Aurora this quarter. Aurora’s ability to drive the Toyota Sienna at highway speeds on commercially representative routes, like to the airport, is a compelling glimpse into the future.” —Dara Khosrowshahi, Uber “ “

9 A U R O R A D R I V E R B E T A 2 . 0 & F U T U R E R E L E A S E S Increasing vehicle capabilities in complex driving scenarios Marking excellent technological progress toward commercial deployment, we launched Aurora Driver Beta 2.0 during the first quarter. This is the second release of the integrated hardware and software stack that is powering our next-generation trucks and Toyota Sienna test fleet. In this release we debuted new capabilities necessary to operate on our recently launched Fort Worth to El Paso lane, as well as other interstate trucking lanes across the country. The Aurora Driver can now navigate complex construction zones that require changing lanes and nudging around concrete barriers and/or cones. It can identify and react naturally to tempo- rary speed limit and lane closure signs, construction vehicles, trucks hauling over- sized equipment, and other unique vehicles and actors commonly present in long-haul trucking. Together, these and other capability improvements have reduced our policy intervention rate by 85%. We define a policy intervention as an action our operators take to preemptively disengage the Aurora Driver when we know it is not yet capable of confidently navigating a particular scenario. 1Q 2 2 S H A R E H O LD E R LE T T E R R E D U C E D P O L I C Y I N T E R V E N T I O N S B Y 85% In 2021, there were more than 3,100 active construction work zones on Texas roads*. Given the prevalence of construction, it is imperative for the Aurora Driver to be able to navigate these complex driving scenarios. This chart demonstrates the complexity of delivering a feature such as “navigating construction”, which is actually not just one capability, but rather a composite of many underlying capabilities. Through our advancements since late last year, we have driven an 18-fold improvement in construction handling on our Fort Worth to El Paso route, demonstrating meaningful, tangible progress in this operating domain. *Source: Texas Department of Transportation

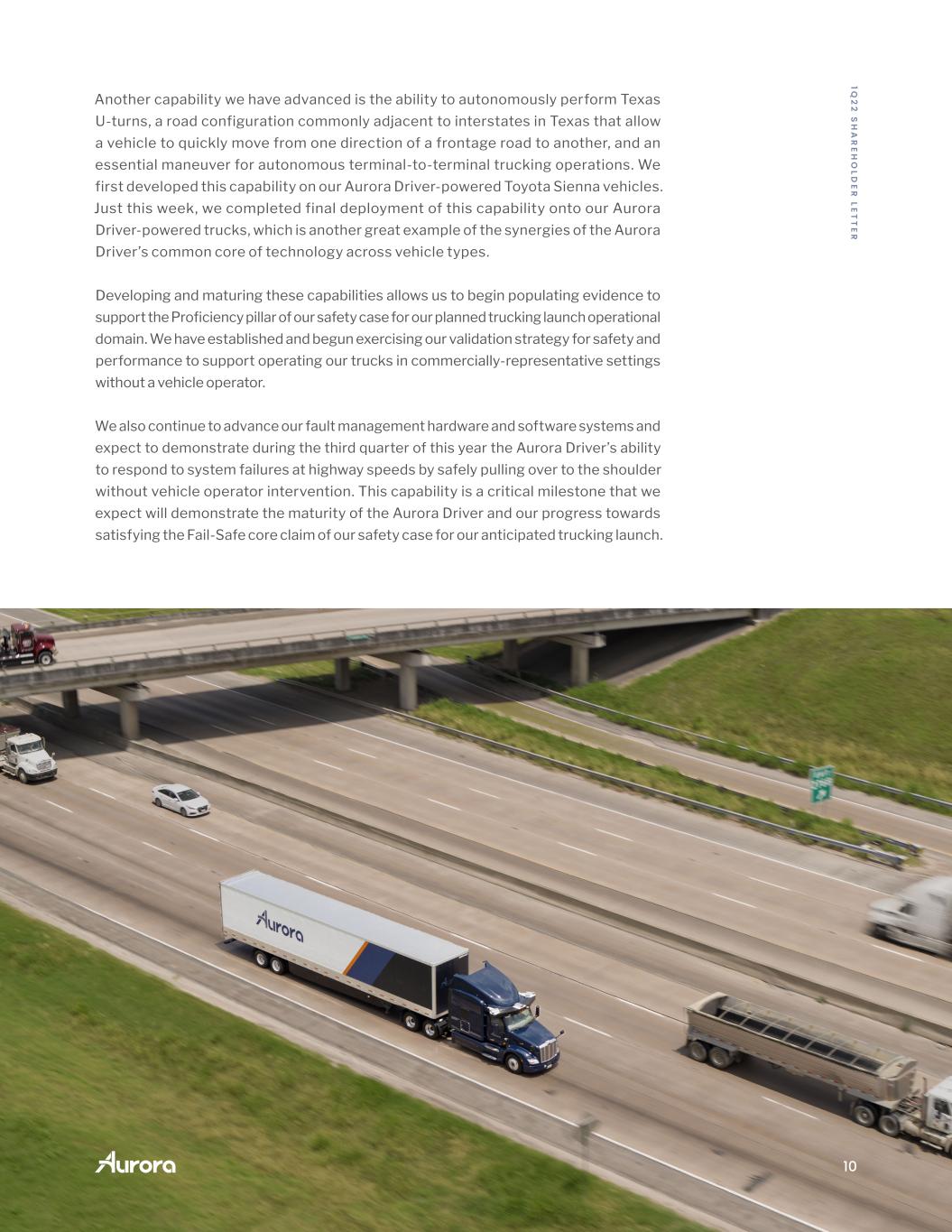

10 Another capability we have advanced is the ability to autonomously perform Texas U-turns, a road configuration commonly adjacent to interstates in Texas that allow a vehicle to quickly move from one direction of a frontage road to another, and an essential maneuver for autonomous terminal-to-terminal trucking operations. We first developed this capability on our Aurora Driver-powered Toyota Sienna vehicles. Just this week, we completed final deployment of this capability onto our Aurora Driver-powered trucks, which is another great example of the synergies of the Aurora Driver’s common core of technology across vehicle types. Developing and maturing these capabilities allows us to begin populating evidence to support the Proficiency pillar of our safety case for our planned trucking launch operational domain. We have established and begun exercising our validation strategy for safety and performance to support operating our trucks in commercially-representative settings without a vehicle operator. We also continue to advance our fault management hardware and software systems and expect to demonstrate during the third quarter of this year the Aurora Driver’s ability to respond to system failures at highway speeds by safely pulling over to the shoulder without vehicle operator intervention. This capability is a critical milestone that we expect will demonstrate the maturity of the Aurora Driver and our progress towards satisfying the Fail-Safe core claim of our safety case for our anticipated trucking launch. 1Q 2 2 S H A R E H O LD E R LE T T E R

11 L O O K I N G A H E A D Progress as a continuum Since we founded Aurora over five years ago, our goal has been bold - we want to build an innovative and scalable product that will make our roads safer, increase the accessibility of transportation, transform logistics, and improve the lives of everyday commuters. In the face of significant uncertainty in the world and volatility in the financial markets, we have focused on what we can control - execution of our plan and remaining squarely focused on our mission to deliver the benefits of self-driving technology safely, quickly, and broadly. I am incredibly proud of the progress we have made thus far in 2022 across all facets of our business, including our technology, partnerships, product suite, and safety case. These advancements position us well to continue to tackle the trucking market first. We continue to believe the size, customer demand, and unit economics of this market make it the best entry point for our self-driving technology and the value the Aurora Driver can provide to our future freight customers is tremendous. Progress in self-driving technology development is a continuum. Each incremental advancement represents a meaningful step towards our objective of commercial deployment at scale. We continue to work toward the launch of Aurora Horizon in late 2023 and look forward to keeping you apprised of our continued progress. To our world-class team, partners, and investors who are riding along with us, thank you for your continued support. 1Q 2 2 S H A R E H O LD E R LE T T E R Chris Urmson CEO & Co-founder

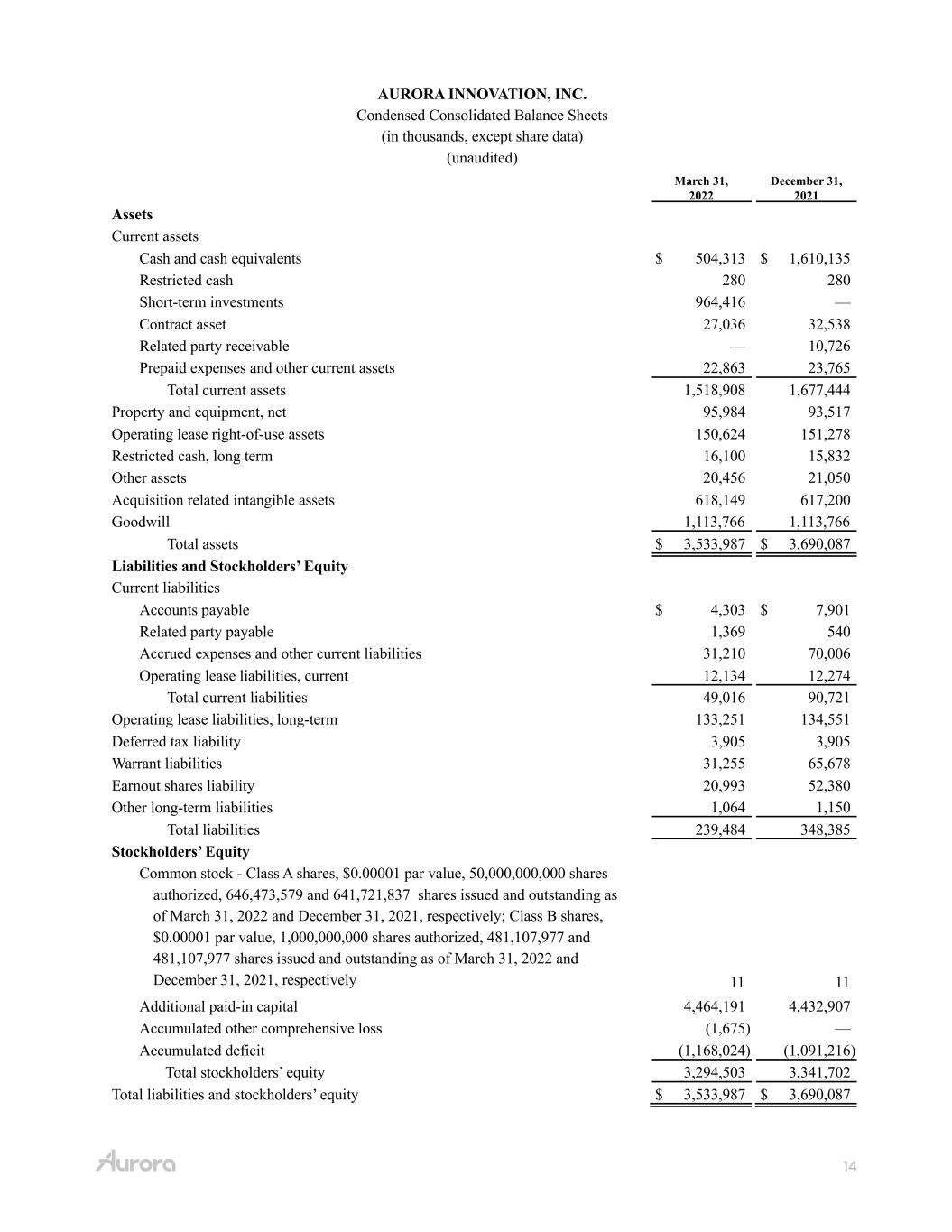

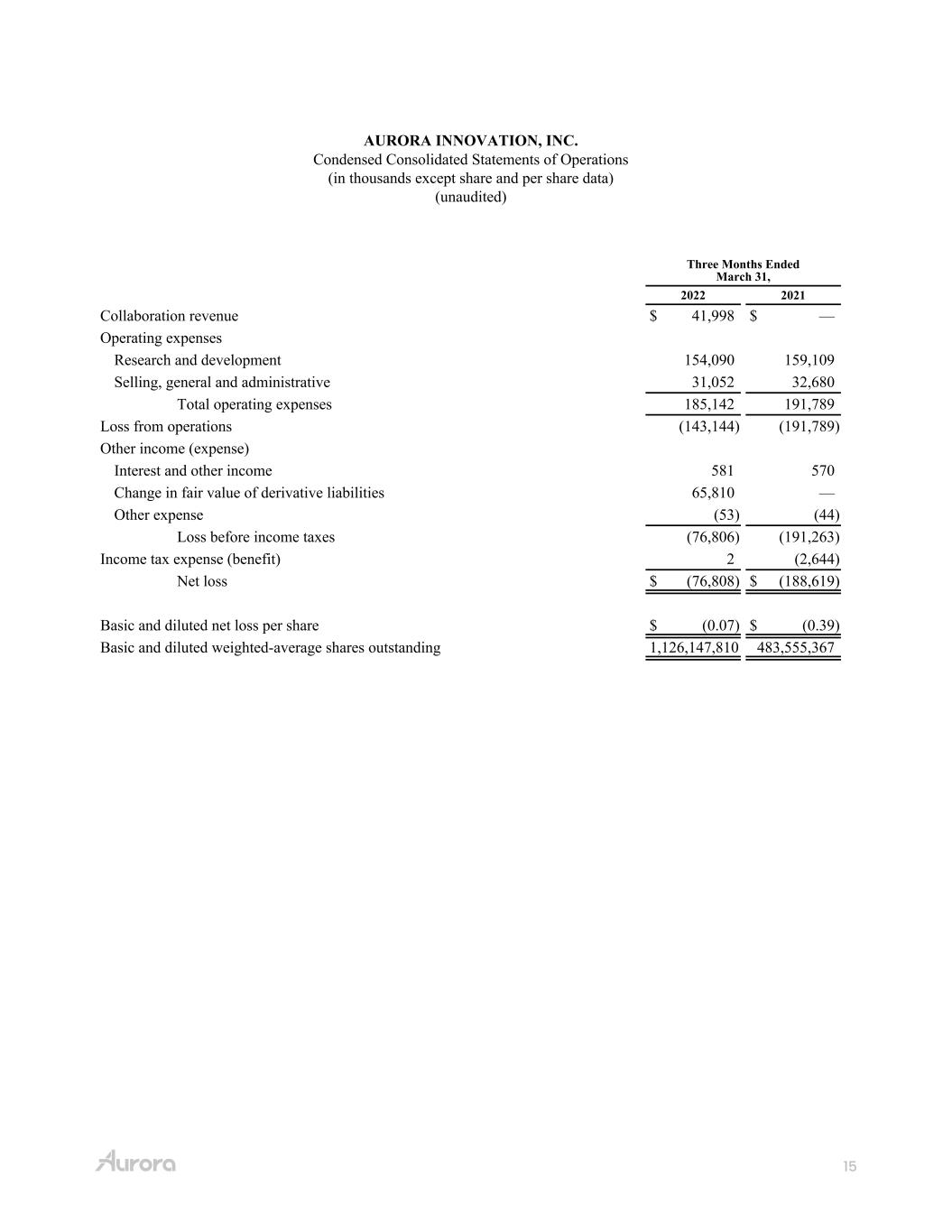

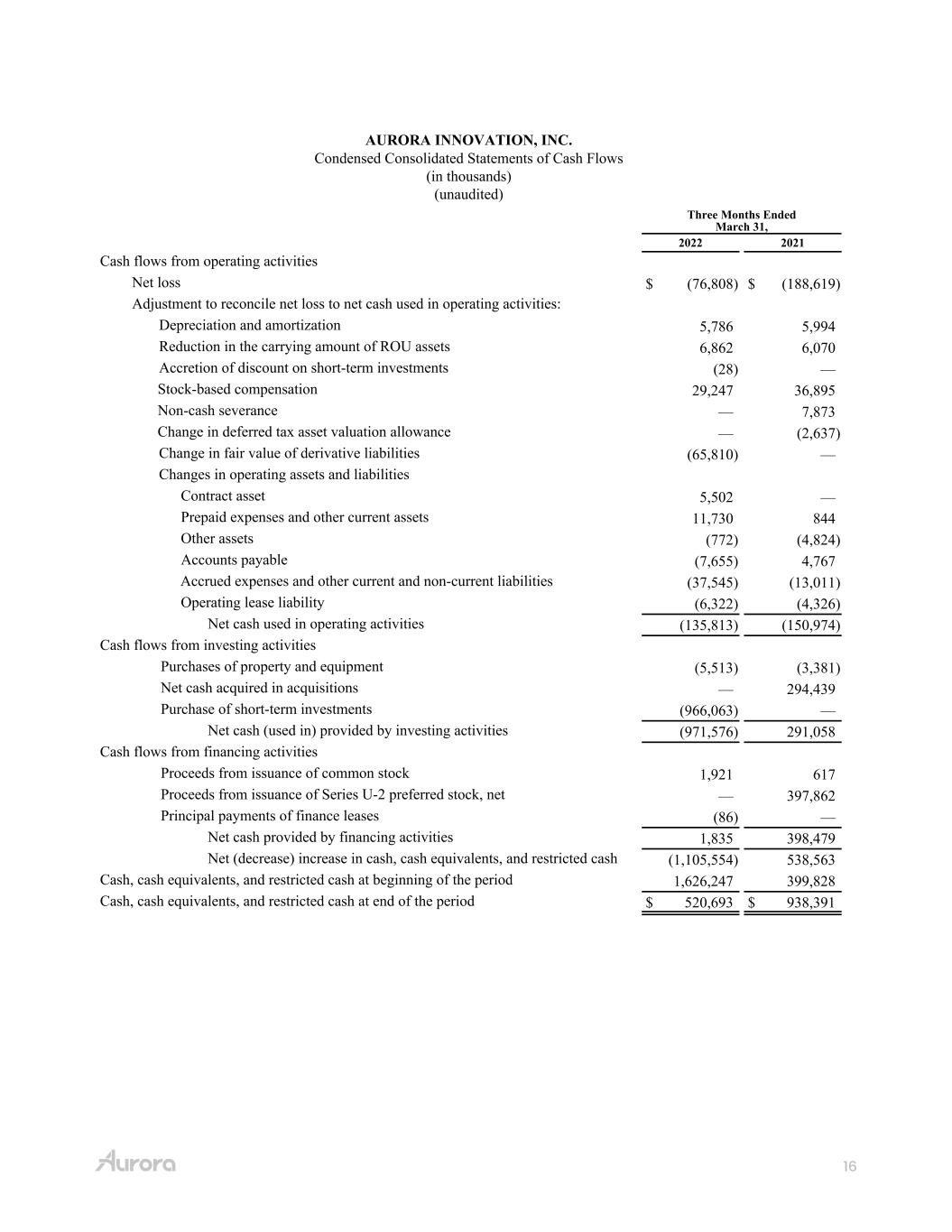

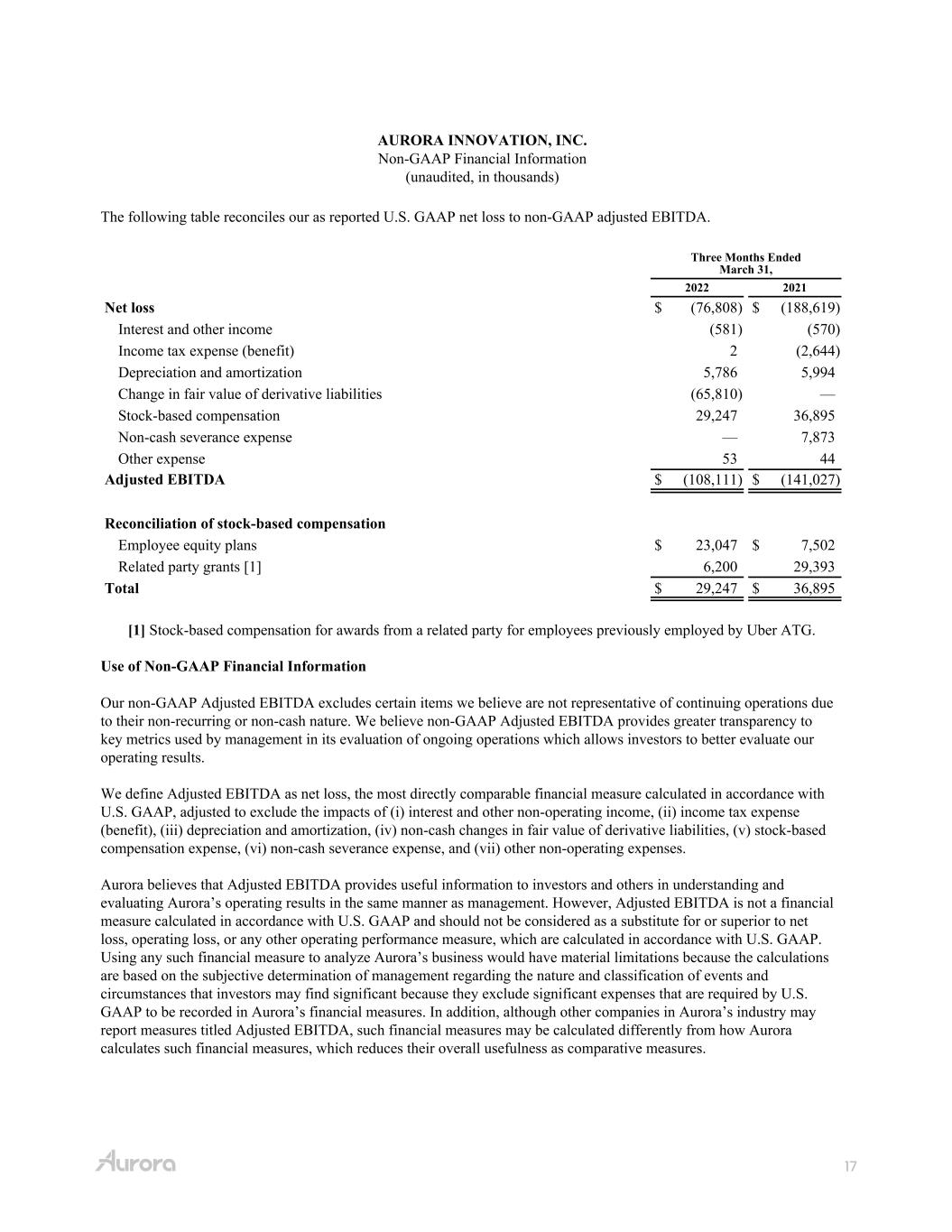

12 From the desk of our CFO During the first quarter of 2022, we recognized $42 million in collaboration revenue for development work associated with our agreement with Toyota that will ultimately support our planned ride-hailing product, including our Sienna test fleet that we debuted during the quarter. Operating expenses, including stock-based compensation (SBC), totaled $185 million. Excluding both ongoing and acquisition-related SBC of $23 million and $6 million, respectively, operating expenses totaled $156 million, reflecting $128 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy work, and $28 million in SG&A. We used $136 million in operating cash and $6 million in capital expenditures. We ended the first quarter with a very strong balance sheet, including $1.5 billion in cash and short- term investments, enabling us to continue to develop the Aurora Driver for commercial deployment at scale, with our near-term focus on commercialization of our autonomous trucking product. Richard Tame CFO 1Q 2 2 S H A R E H O LD E R LE T T E R

13 Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward- looking statements, including but not limited, to those statements around our ability to achieve certain milestones around and commercialize the Aurora Driver on the timeframe we expect or at all. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this press release, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 11, 2022, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances. This shareholder letter also contains statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information may be based on many assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified the accuracy or completeness of the data contained in the industry publications and other publicly available information. Aurora does not undertake to update such data after the date of this presentation. All third-party logos appearing in this shareholder letter are trademarks or registered trademarks of their respective holders. Any such appearance does not necessarily imply any affiliation with or endorsement of Aurora. 1Q 2 2 S H A R E H O LD E R LE T T E R

14 AURORA INNOVATION, INC. Condensed Consolidated Balance Sheets (in thousands, except share data) (unaudited) March 31, 2022 December 31, 2021 Assets Current assets Cash and cash equivalents $ 504,313 $ 1,610,135 Restricted cash 280 280 Short-term investments 964,416 — Contract asset 27,036 32,538 Related party receivable — 10,726 Prepaid expenses and other current assets 22,863 23,765 Total current assets 1,518,908 1,677,444 Property and equipment, net 95,984 93,517 Operating lease right-of-use assets 150,624 151,278 Restricted cash, long term 16,100 15,832 Other assets 20,456 21,050 Acquisition related intangible assets 618,149 617,200 Goodwill 1,113,766 1,113,766 Total assets $ 3,533,987 $ 3,690,087 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 4,303 $ 7,901 Related party payable 1,369 540 Accrued expenses and other current liabilities 31,210 70,006 Operating lease liabilities, current 12,134 12,274 Total current liabilities 49,016 90,721 Operating lease liabilities, long-term 133,251 134,551 Deferred tax liability 3,905 3,905 Warrant liabilities 31,255 65,678 Earnout shares liability 20,993 52,380 Other long-term liabilities 1,064 1,150 Total liabilities 239,484 348,385 Stockholders’ Equity Common stock - Class A shares, $0.00001 par value, 50,000,000,000 shares authorized, 646,473,579 and 641,721,837 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively; Class B shares, $0.00001 par value, 1,000,000,000 shares authorized, 481,107,977 and 481,107,977 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively 11 11 Additional paid-in capital 4,464,191 4,432,907 Accumulated other comprehensive loss (1,675) — Accumulated deficit (1,168,024) (1,091,216) Total stockholders’ equity 3,294,503 3,341,702 Total liabilities and stockholders’ equity $ 3,533,987 $ 3,690,087

15

16

17