EX-99.1

Published on February 15, 2023

F O U R T H Q U A R T E R 2 0 2 2 S H A R E H O L D E R L E T T E R F E B R U A R Y 1 5 , 2 0 2 3

2 4 Q 2 2 S H A R E H O LD E R LE T T E R A letter to shareholders Reflecting on our first full year as a public company, we made significant progress toward commercialization of Aurora Horizon, our autonomous trucking subscription service. Our Aurora Driver beta releases, including Beta 5.0 during the fourth quarter, introduced capabilities that will enable the Aurora Driver to safely handle the driving scenarios we expect to encounter while hauling loads for customers on our commercial launch lane. We believe these technological advancements put us in a strong position to achieve our critical Feature Complete milestone by the end of the first quarter of 2023, which, in turn, positions us to close our Safety Case for the Aurora Driver and launch commercially on trucks built to support it. In the fourth quarter, we expanded our ecosystem in trucking, welcoming Ryder and introducing an on-site fleet maintenance pilot program to prepare for commercial operation at scale. We continued to grow our pilot operations, exceeding our fourth quarter commercial load target. And we made steady progress with our OEM partners on the scalable, autonomy-enabled truck platforms to support our anticipated Commercial Launch in trucking by the end of 2024. Scaled our fleet to 31 trucks and made progress with our OEM partners, Paccar and Volvo, toward scalable, autonomy-enabled truck platforms Truck PlatformOperations Released Beta versions 2.0, 3.0, 4.0, and 5.0 Aurora Driver 2022 Highlights Expanded and added pilot customers and industry collaborations

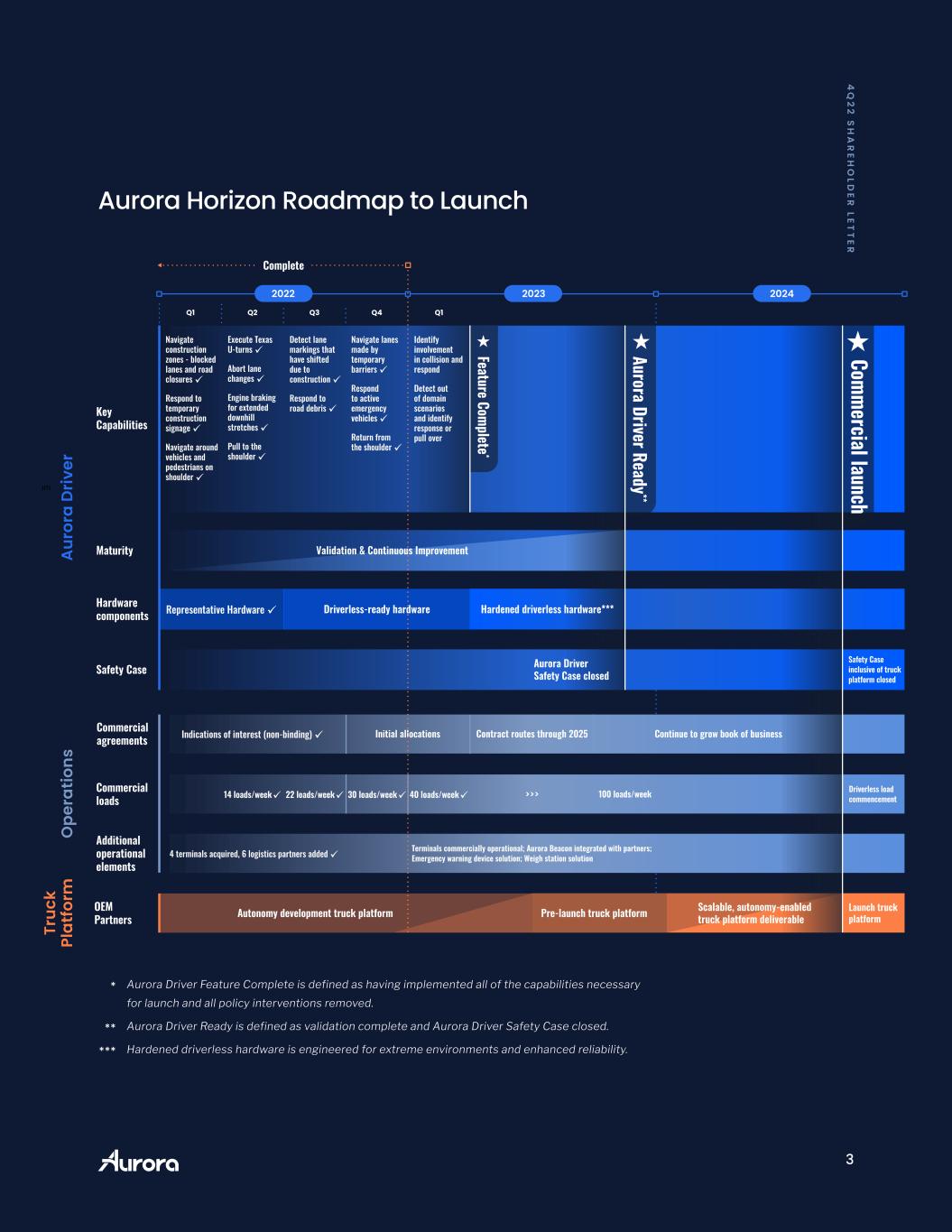

3 4 Q 2 2 S H A R E H O LD E R LE T T E R Aurora Driver Ready ** Commercial launch Feature Complete * Tr uc k Pl at fo rm OEM Partners Autonomy development truck platform Scalable, autonomy-enabled truck platform deliverablePre-launch truck platform Launch truck platform O pe ra tio ns Additional operational elements 4 terminals acquired, 6 logistics partners added Terminals commercially operational; Aurora Beacon integrated with partners; Emergency warning device solution; Weigh station solution Lorem ipsum Commercial agreements Indications of interest (non-binding) Initial allocations Contract routes through 2025 Continue to grow book of business Commercial loads 14 loads/week 22 loads/week 30 loads/week 40 loads/week 100 loads/week Driverless load commencement>>> A ur or a D ri ve r Navigate construction zones - blocked lanes and road closures Respond to temporary construction signage Navigate around vehicles and pedestrians on shoulder Execute Texas U-turns Abort lane changes Engine braking for extended downhill stretches Pull to the shoulder Detect lane markings that have shifted due to construction Respond to road debris Navigate lanes made by temporary barriers Respond to active emergency vehicles Return from the shoulder Identify involvement in collision and respond Detect out of domain scenarios and identify response or pull over Key Capabilities Maturity Validation & Continuous Improvement Safety Case Safety Case inclusive of truck platform closed Aurora Driver Safety Case closed Hardware components Representative Hardware Driverless-ready hardware Hardened driverless hardware*** Complete Aurora Horizon Roadmap to Launch * ** *** Aurora Driver Feature Complete is defined as having implemented all of the capabilities necessary for launch and all policy interventions removed. Aurora Driver Ready is defined as validation complete and Aurora Driver Safety Case closed. Hardened driverless hardware is engineered for extreme environments and enhanced reliability.

4 4 Q 2 2 S H A R E H O LD E R LE T T E R Returning from shoulderResponding to emergency vehicles A U R O R A D R I V E R Beta 5.0 In December, we successfully released the fifth beta for the Aurora Driver, our flagship product that underpins Aurora Horizon. This release unlocked key safety-critical and increasingly complex highway driving capabilities, enabling the Aurora Driver to autonomously operate in more scenarios. This includes new capabilities to detect and appropriately respond to active emergency vehicles, like ambulances, fire engines, and law enforcement vehicles, which do not always behave predictably or follow customary rules of the road. When the Aurora Driver perceives an emergency vehicle ahead on the shoulder, it knows to slow or change lanes according to Texas laws. When the Aurora Driver detects an active emergency vehicle — ahead of or behind the truck — it alerts a specialist in our command center via Aurora Beacon for additional guidance, to include coming to a stop off the roadway if necessary. Additionally, Beta 5.0 established the ability to re-enter traffic from the shoulder, building on the Fault Management System (FMS) introduced last year. FMS is designed to actively monitor the health of the vehicle and sensors, and produce a mitigation strategy when necessary, including pulling to the shoulder of the road. With the Beta 5.0 update, the Aurora Driver’s FMS is now able to pull to the shoulder of a highway for circumstances that require it (like a flat tire, a critical truck failure, or an extreme weather event), request support as necessary, then re-enter the flow of traffic to resume operations once the road has been cleared or the scenario has been addressed, completing the end-to-end flow for this mission-critical capability.

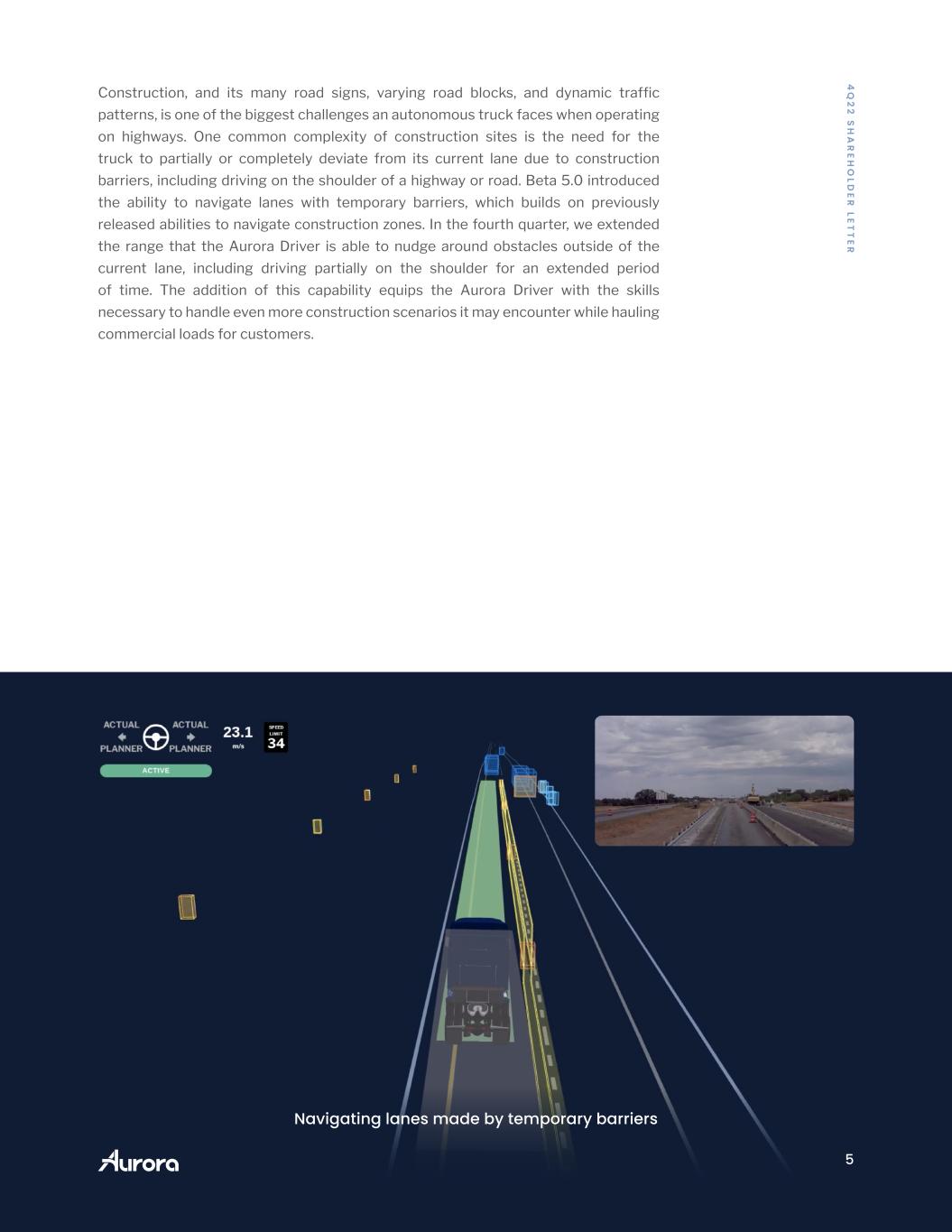

5 4 Q 2 2 S H A R E H O LD E R LE T T E R Construction, and its many road signs, varying road blocks, and dynamic traffic patterns, is one of the biggest challenges an autonomous truck faces when operating on highways. One common complexity of construction sites is the need for the truck to partially or completely deviate from its current lane due to construction barriers, including driving on the shoulder of a highway or road. Beta 5.0 introduced the ability to navigate lanes with temporary barriers, which builds on previously released abilities to navigate construction zones. In the fourth quarter, we extended the range that the Aurora Driver is able to nudge around obstacles outside of the current lane, including driving partially on the shoulder for an extended period of time. The addition of this capability equips the Aurora Driver with the skills necessary to handle even more construction scenarios it may encounter while hauling commercial loads for customers. Navigating lanes made by temporary barriers

6 4 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A D R I V E R Countdown to Feature Complete We are excited to announce that the Dallas to Houston route will be our inaugural launch lane for commercial operations. By the end of the first quarter of 2023, we expect to achieve our Feature Complete milestone at which point the final capabilities we outlined in our Aurora Horizon Roadmap to launch will have been introduced: identify involvement in a collision and respond, and detect and respond to scenarios that are out of the domain of capabilities for the Aurora Driver, including pulling over to await further instruction. Once the Aurora Driver is Feature Complete, this will indicate that we will have implemented all of the capabilities necessary for Aurora Horizon’s Dallas to Houston launch lane and removed all policy interventions for that lane. Once we achieve Feature Complete, we then plan to enter the final phase of refining the Aurora Driver’s performance through subsequent beta releases and completing the necessary validation to close the Aurora Driver Safety Case for our commercial launch lane by the end of 2023 — a milestone we call Aurora Driver Ready. One of the ways we measure continuous improvement of the Aurora Driver is a reduction in how often a vehicle operator needs to intervene to support a particular capability. A great example of this performance improvement is the trend we have seen in our ability to handle road debris. Road debris is both common and dangerous for human drivers on highways. According to a AAA study*, debris-related crashes were approximately four times as likely to occur on Interstate highways compared with crashes that did not involve debris. Human drivers struggle to react intelligently after detecting debris; in fact, nearly 37% of all deaths in road debris crashes resulted from the driver swerving to avoid hitting an object. In September, we enabled the Aurora Driver’s detection and avoidance capabilities for a variety of debris on the road. The Aurora Driver utilizes multiple sensors to detect and classify road debris, and this multimodal approach is key to the performance and safety of the system, especially during degraded visibility conditions, such as evenings when human eyes and cameras have limited detection range. During the fourth quarter, we drove an approximately 70% decline in vehicle operator interventions as a result of better road debris detection. * AAA: The Prevalence of Motor Vehicle Crashes Involving Road Debris ~70% decline 9/1/2022 10/1/2022 11/1/2022 12/1/2022 R E Q U I R E D I N T E R V E N T I O N S D U E T O R O A D D E B R I S

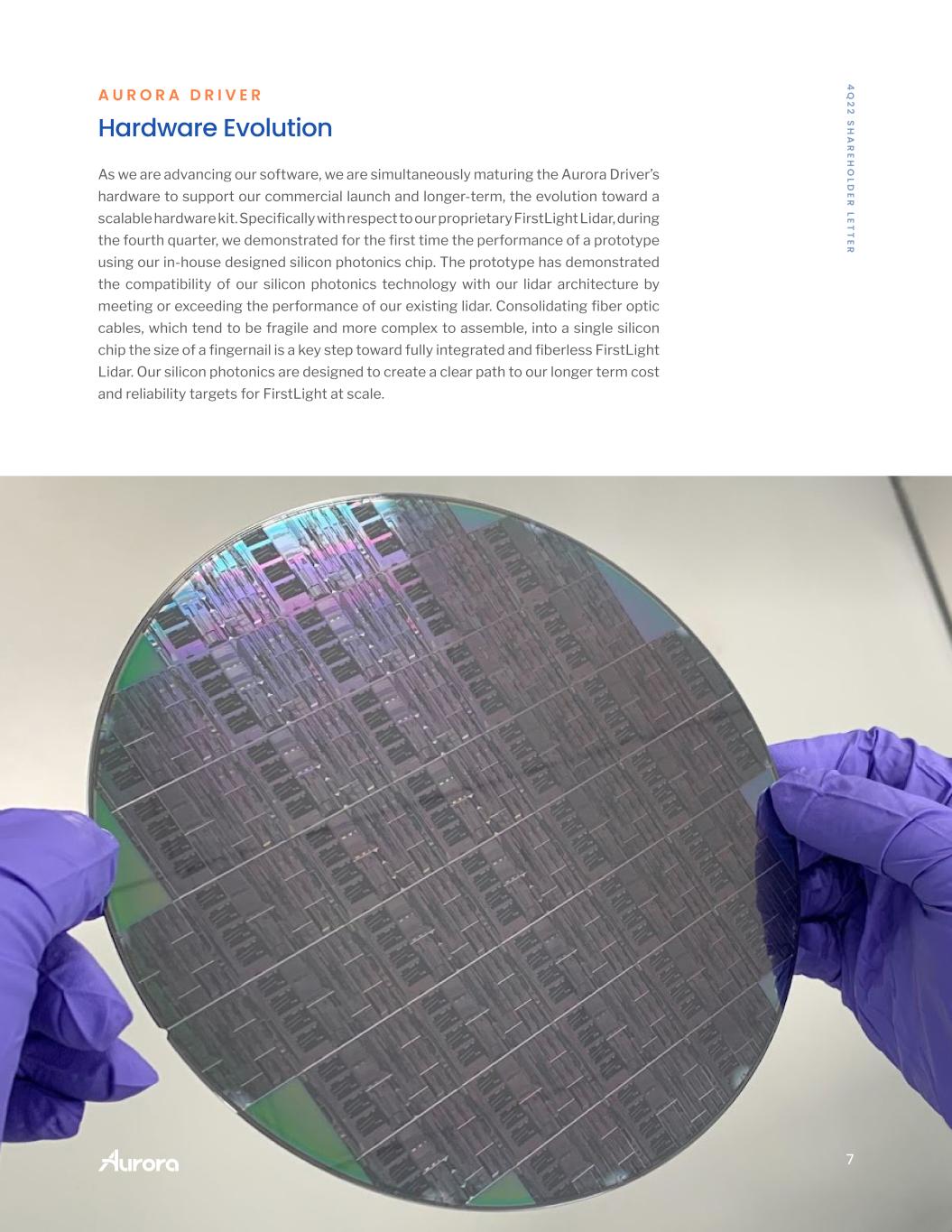

7 4 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A D R I V E R Hardware Evolution As we are advancing our software, we are simultaneously maturing the Aurora Driver’s hardware to support our commercial launch and longer-term, the evolution toward a scalable hardware kit. Specifically with respect to our proprietary FirstLight Lidar, during the fourth quarter, we demonstrated for the first time the performance of a prototype using our in-house designed silicon photonics chip. The prototype has demonstrated the compatibility of our silicon photonics technology with our lidar architecture by meeting or exceeding the performance of our existing lidar. Consolidating fiber optic cables, which tend to be fragile and more complex to assemble, into a single silicon chip the size of a fingernail is a key step toward fully integrated and fiberless FirstLight Lidar. Our silicon photonics are designed to create a clear path to our longer term cost and reliability targets for FirstLight at scale.

8 4 Q 2 2 S H A R E H O LD E R LE T T E R loads miles across on time Cumulative to-date through 2/12/23, we’ve delivered: 1,150 324k 98% A U R O R A H O R I Z O N Scaling operations During the fourth quarter, we exceeded our target to autonomously haul 30 loads per week for our pilot customers. I’m proud to share that we have already achieved our first quarter goal of 40 loads per week, well ahead of schedule. This expansion comes as our customers increase their usage of Aurora Horizon, and also enables us to further leverage our commercial runs to help offset the cost of development and validation of the Aurora Driver while operating in a commercially-representative setting. As part of this momentum, during the fourth quarter we worked with our partners at Uber Freight and their customer, Veritiv Corp., a leading distributor of customized packaging solutions across North America, to haul goods over 600 miles between Fort Worth and El Paso, Texas. Launched early in the fourth quarter, this expansion helped ensure on-time deliveries during peak holiday shipping demand. As the Aurora Driver improves, so do Aurora Beacon, our operational efficiency, and the depth of our integration with our customers. Cumulative to-date through February 12th, we have autonomously delivered (under the supervision of vehicle operators) 1,150 loads, driving 324,000 miles, with 98% on-time performance for our pilot customers, including FedEx, Werner, Schneider, and Uber Freight. We expect to continue to scale our operations throughout 2023, supported by our maturing infrastructure in Texas. We are already operating commercial-ready terminals with defined flow and procedures for our autonomous commercial launch, providing our customers with a complete end-to-end experience to support a smooth integration of Aurora Driver-powered trucks into their networks. This includes continued maturing of our command center specialist functionality within Aurora Beacon.

9 4 Q 2 2 S H A R E H O LD E R LE T T E R To further prepare for Commercial Launch, during the fourth quarter we also announced a strategic collaboration to pilot on-site fleet maintenance with Ryder, a leader in supply chain, dedicated transportation, and fleet management solutions. With the planned pilot launch this quarter, Ryder technicians will be on-site at our terminal in Dallas to maintain our fleet of autonomous Class 8 tractors, inspect and maintain trailers, and collaborate with our teams to minimize downtime. We expect this collaboration to provide our customers with reduced maintenance costs and high asset availability. By teaming up with Ryder’s sophisticated maintenance team, we aim to further unlock the potential of autonomous trucks for around-the-clock operation, adding value to our pilot customers through higher utilization and further positioning Aurora Horizon for autonomous operations at scale. We also continue to engage with regulators, elected officials, law en- forcement, and local communities to drive positive momentum for self-driving commercialization at the federal, state, and local levels. At the start of 2022, Pennsylvania re- mained one of the few states where self-driving vehicles were not per- mitted to operate without a human driver. Through continuous conver- sations and close cooperation with the wider industry as well as state regulators, we helped shape legislation that ulti- mately unlocked driverless testing and deployment with the signing of HB 2398 into law this past November. This law allows for driverless testing and deployment of pas- senger vehicles and trucks on state roads and brings further opportunities for devel- opment, innovation, and commercialization in Pennsylvania. During the Pennsylvania General Assembly’s session in which this legislation was being discussed, members of Pennsylvania’s State Senate spoke about the robotics and autonomous engineer- ing associate degree program we recently launched in partnership with Pittsburgh Technical College. This program is designed to support the local communities Aurora operates in and prepare the workforce for the unique jobs of the future we expect to be creating in the autonomous vehicle industry. We’re excited to be exploring opportu- nities to replicate this program with several institutions across the country. Aurora is committed to prioritizing safety and transparency in how we develop and deploy our self-driving products. As part of our commitment to sharing our work, in December we released an updated Safety Report, our 2022 Voluntary Safety Self- Assessment (VSSA). Our safety approach centers around five pillars — Proficiency, Fail Safe, Continuous Improvement, Resilience, and Trustworthiness. This commitment to safety is critical and inherent in each step of our development of the Aurora Driver as we seek to support the introduction and expansion of autonomous vehicle operations across the United States. “A safe, modern, and efficient transportation sector is essential to fueling Pennsylvania’s ongoing economic success, and automated vehicle technology is a major piece of the Commonwealth’s future transportation puzzle.” — PENNSYLVANIA CHAMBER OF BUSINESS AND INDUSTRY

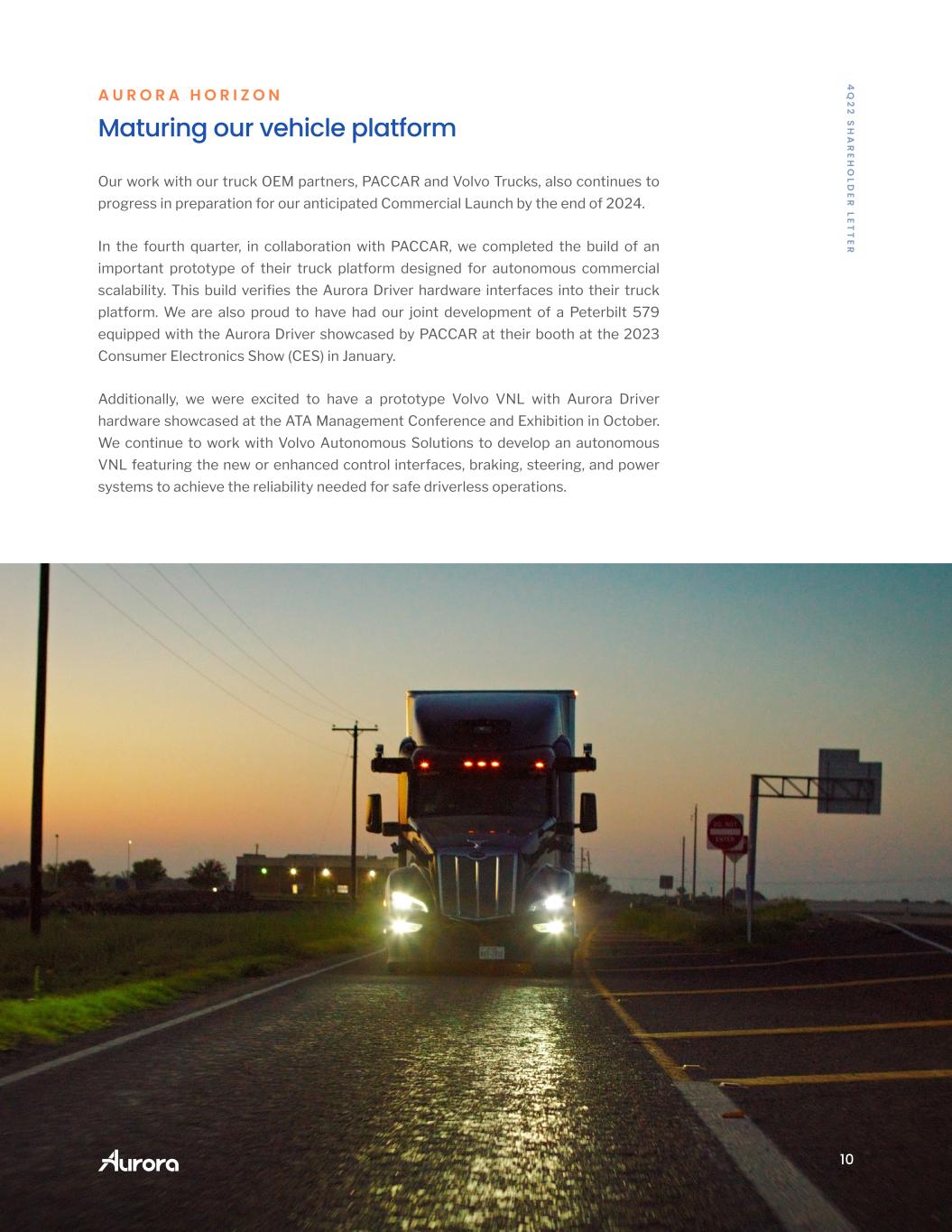

10 4 Q 2 2 S H A R E H O LD E R LE T T E R A U R O R A H O R I Z O N Maturing our vehicle platform Our work with our truck OEM partners, PACCAR and Volvo Trucks, also continues to progress in preparation for our anticipated Commercial Launch by the end of 2024. In the fourth quarter, in collaboration with PACCAR, we completed the build of an important prototype of their truck platform designed for autonomous commercial scalability. This build verifies the Aurora Driver hardware interfaces into their truck platform. We are also proud to have had our joint development of a Peterbilt 579 equipped with the Aurora Driver showcased by PACCAR at their booth at the 2023 Consumer Electronics Show (CES) in January. Additionally, we were excited to have a prototype Volvo VNL with Aurora Driver hardware showcased at the ATA Management Conference and Exhibition in October. We continue to work with Volvo Autonomous Solutions to develop an autonomous VNL featuring the new or enhanced control interfaces, braking, steering, and power systems to achieve the reliability needed for safe driverless operations.

11 4 Q 2 2 S H A R E H O LD E R LE T T E R Chris Urmson CEO & Co-founder Building toward an autonomous future During the fourth quarter and throughout 2022, we made strong progress across the three elements of our business - the Aurora Driver, operations, and truck platforms, on our roadmap to launch Aurora Horizon. We are already off to an incredible start in 2023 - we autonomously hauled our 1,000th customer load in early January and we’re on track to meet our critical Feature Complete milestone, which we are targeting to achieve by the end of the first quarter. Earlier in February, we were honored by LexisNexis® Intellectual Property Solutions as one of the companies leading the future of science and technology in its “Innovation Momentum 2023: The Global Top 100” intellectual property report. This distinction is particularly notable as Aurora was the only AV technology company recognized and one of just three companies in the automotive industry. Aurora’s inclusion in this report, which is an external and independent measure of global technological strength, innovation momentum, and patent quality, validates our belief that we have one of the strongest self-driving intellectual property portfolios, which we expect to support our path to Commercial Launch. 2023 is going to be a pivotal year for Aurora as we continue to execute against our plan to achieve feature completion, close the Aurora Driver Safety Case for our launch lane, and prepare to commercially launch Aurora Horizon by the end of 2024. To our world-class team, partners, and investors who are building the future of autonomous transportation with us, thank you for your continued support and we look forward to sharing more later this year!

12 4 Q 2 2 S H A R E H O LD E R LE T T E R From the desk of our CFO During the fourth quarter of 2022, we recognized the remaining $2 million in collaboration revenue under our agreement with Toyota, for a total of $68 million recognized in 2022. Cumulative to-date, we have now recognized all $150 million for our development work under the collaboration framework agreement and all cash payments have been received. While our first priority is commercialization of Aurora Horizon, we continue to believe our work with Toyota and other long-lead efforts will springload us for the eventual launch of Aurora Connect, our subscription service for the ride-hailing market. Our market capitalization declined below our carrying value of net assets during the fourth quarter of 2022, triggering a $114 million non-cash reduction in the carrying value of goodwill, which brought the total non-cash reduction to $1.1 billion in 2022. There is no change to our outlook for the businesses Aurora has acquired nor how we expect them to contribute to our commercialization. Including the reduction in the carrying value of goodwill and stock-based compensation (SBC) of $44 million in the fourth quarter and $156 million in 2022, fourth quarter and 2022 operating expenses totaled $314 million and $1.9 billion, respectively. Excluding these non-cash expenses, fourth quarter operating expenses were $156 million, reflecting $131 million in R&D and $25 million in SG&A; 2022 cash operating expenses totaled $650 million, reflecting $540 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technology, and $110 million in SG&A. We used $141 million and $508 million, respectively, in operating cash during the fourth quarter and fiscal 2022. Capital expenditures totaled $3 million and $15 million, respectively, during the fourth quarter and fiscal 2022. We ended the year with a very strong balance sheet, including $1.1 billion in cash and short-term investments. Taking into account cost savings and cost avoidance actions we took in 2022, we continue to expect our liquidity to fund Aurora through mid-2024, enabling us to continue to execute on our Aurora Horizon roadmap. Richard Tame CFO

13 4 Q 2 2 S H A R E H O LD E R LE T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around our ability to achieve certain milestones around the development and commercialization of the Aurora Driver and related services on the timeframe we expect or at all, and our expected cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, filed with the SEC on November 3, 2022, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

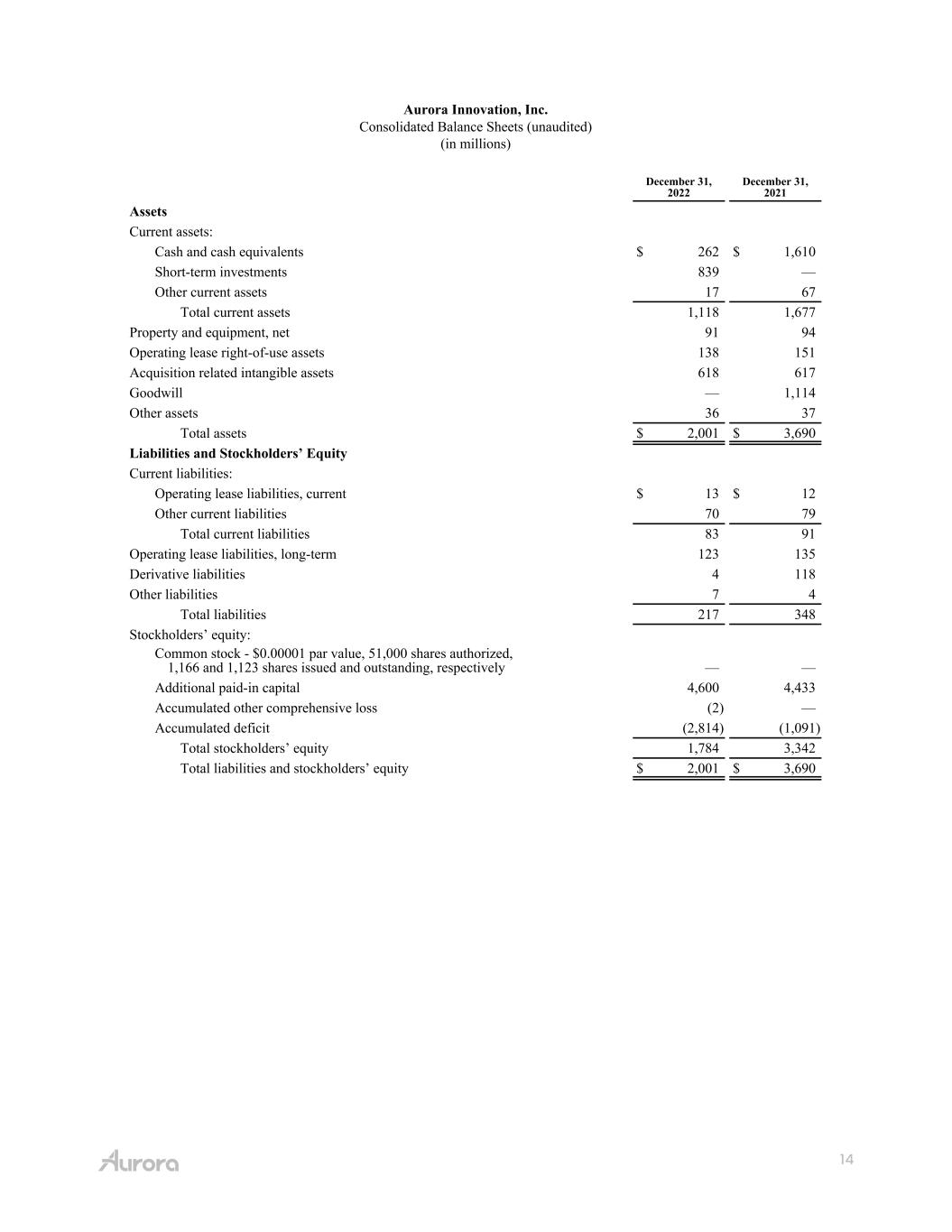

14 Aurora Innovation, Inc. Consolidated Balance Sheets (unaudited) (in millions) December 31, 2022 December 31, 2021 Assets Current assets: Cash and cash equivalents $ 262 $ 1,610 Short-term investments 839 — Other current assets 17 67 Total current assets 1,118 1,677 Property and equipment, net 91 94 Operating lease right-of-use assets 138 151 Acquisition related intangible assets 618 617 Goodwill — 1,114 Other assets 36 37 Total assets $ 2,001 $ 3,690 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 13 $ 12 Other current liabilities 70 79 Total current liabilities 83 91 Operating lease liabilities, long-term 123 135 Derivative liabilities 4 118 Other liabilities 7 4 Total liabilities 217 348 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,166 and 1,123 shares issued and outstanding, respectively — — Additional paid-in capital 4,600 4,433 Accumulated other comprehensive loss (2) — Accumulated deficit (2,814) (1,091) Total stockholders’ equity 1,784 3,342 Total liabilities and stockholders’ equity $ 2,001 $ 3,690

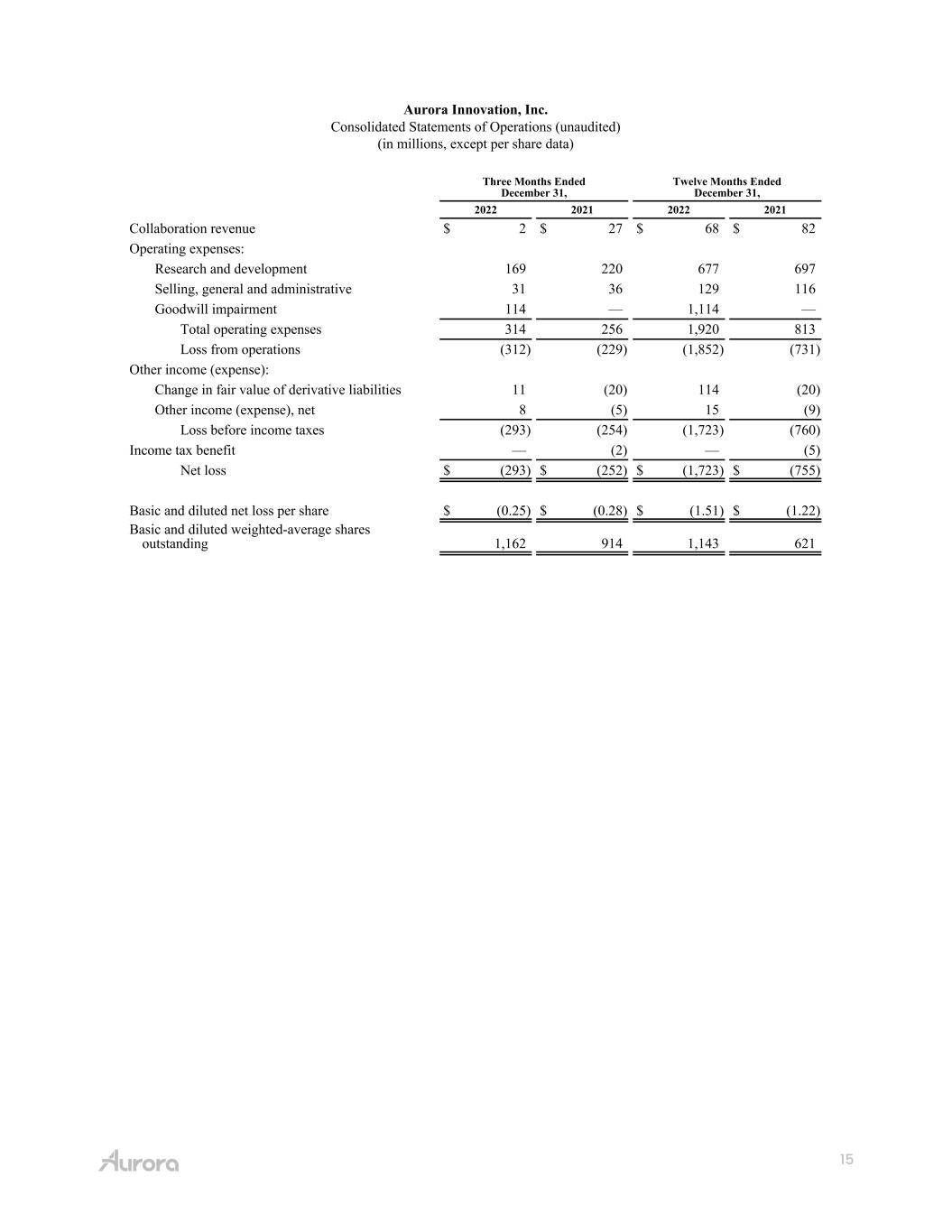

15 Aurora Innovation, Inc. Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended December 31, Twelve Months Ended December 31, 2022 2021 2022 2021 Collaboration revenue $ 2 $ 27 $ 68 $ 82 Operating expenses: Research and development 169 220 677 697 Selling, general and administrative 31 36 129 116 Goodwill impairment 114 — 1,114 — Total operating expenses 314 256 1,920 813 Loss from operations (312) (229) (1,852) (731) Other income (expense): Change in fair value of derivative liabilities 11 (20) 114 (20) Other income (expense), net 8 (5) 15 (9) Loss before income taxes (293) (254) (1,723) (760) Income tax benefit — (2) — (5) Net loss $ (293) $ (252) $ (1,723) $ (755) Basic and diluted net loss per share $ (0.25) $ (0.28) $ (1.51) $ (1.22) Basic and diluted weighted-average shares outstanding 1,162 914 1,143 621

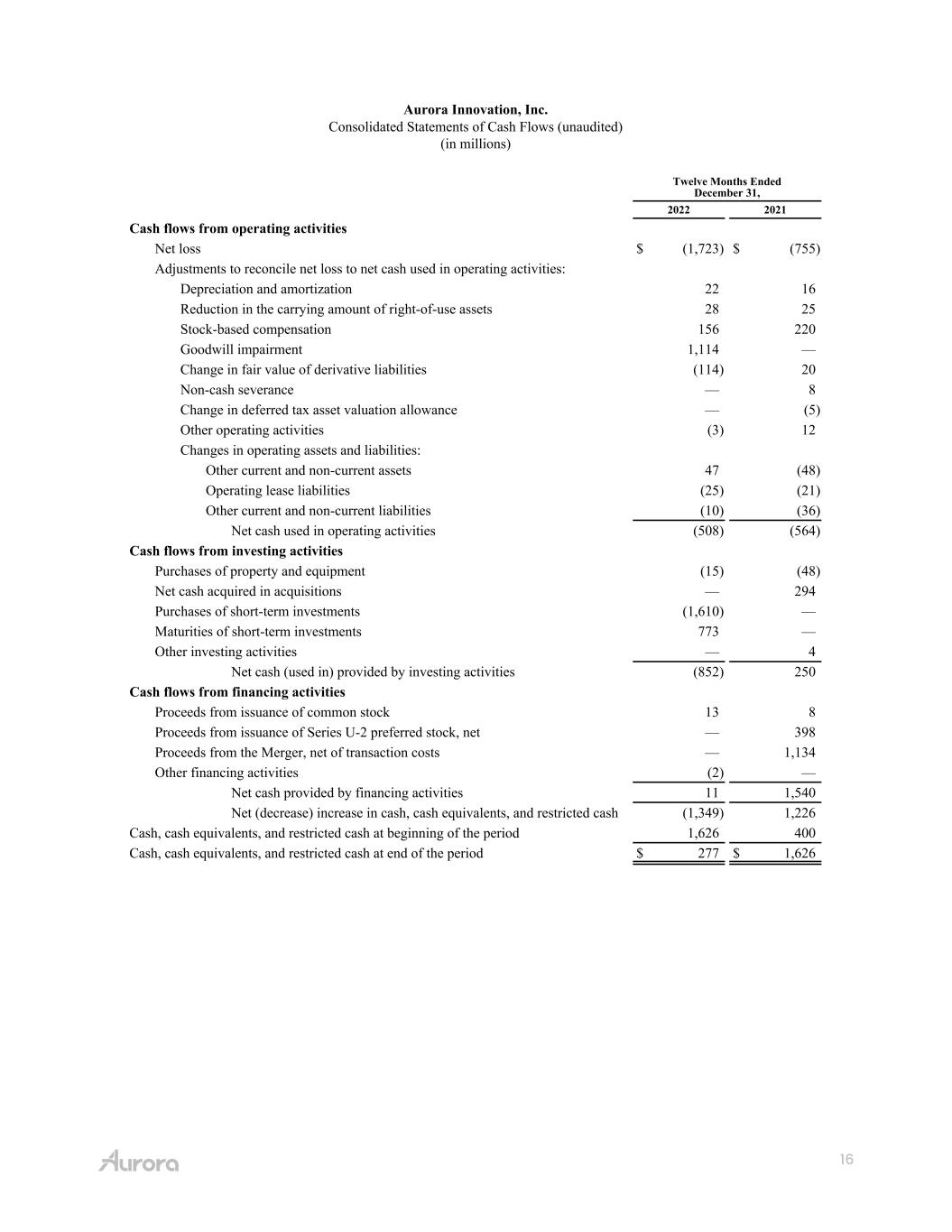

16 Aurora Innovation, Inc. Consolidated Statements of Cash Flows (unaudited) (in millions) Twelve Months Ended December 31, 2022 2021 Cash flows from operating activities Net loss $ (1,723) $ (755) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 22 16 Reduction in the carrying amount of right-of-use assets 28 25 Stock-based compensation 156 220 Goodwill impairment 1,114 — Change in fair value of derivative liabilities (114) 20 Non-cash severance — 8 Change in deferred tax asset valuation allowance — (5) Other operating activities (3) 12 Changes in operating assets and liabilities: Other current and non-current assets 47 (48) Operating lease liabilities (25) (21) Other current and non-current liabilities (10) (36) Net cash used in operating activities (508) (564) Cash flows from investing activities Purchases of property and equipment (15) (48) Net cash acquired in acquisitions — 294 Purchases of short-term investments (1,610) — Maturities of short-term investments 773 — Other investing activities — 4 Net cash (used in) provided by investing activities (852) 250 Cash flows from financing activities Proceeds from issuance of common stock 13 8 Proceeds from issuance of Series U-2 preferred stock, net — 398 Proceeds from the Merger, net of transaction costs — 1,134 Other financing activities (2) — Net cash provided by financing activities 11 1,540 Net (decrease) increase in cash, cash equivalents, and restricted cash (1,349) 1,226 Cash, cash equivalents, and restricted cash at beginning of the period 1,626 400 Cash, cash equivalents, and restricted cash at end of the period $ 277 $ 1,626

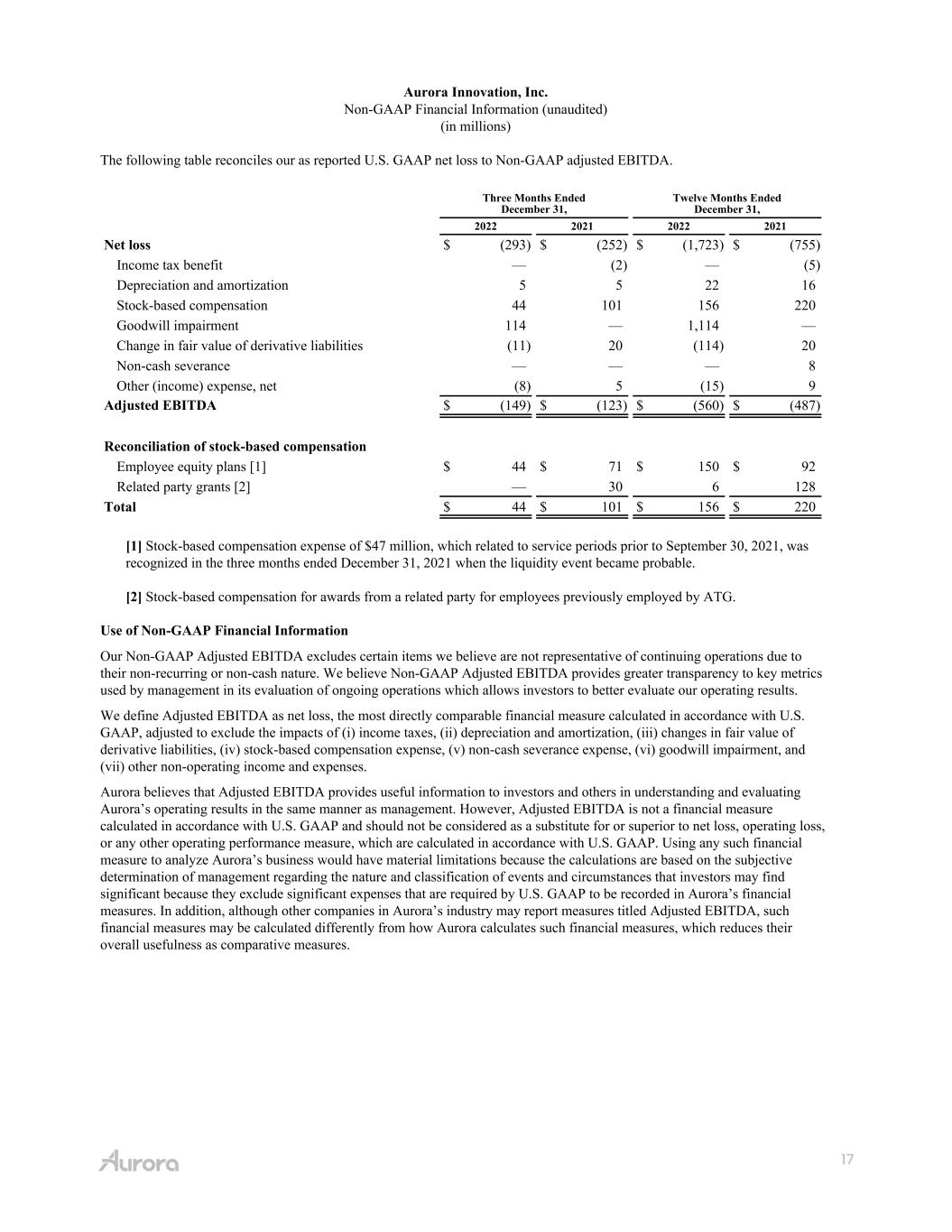

17 Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended December 31, Twelve Months Ended December 31, 2022 2021 2022 2021 Net loss $ (293) $ (252) $ (1,723) $ (755) Income tax benefit — (2) — (5) Depreciation and amortization 5 5 22 16 Stock-based compensation 44 101 156 220 Goodwill impairment 114 — 1,114 — Change in fair value of derivative liabilities (11) 20 (114) 20 Non-cash severance — — — 8 Other (income) expense, net (8) 5 (15) 9 Adjusted EBITDA $ (149) $ (123) $ (560) $ (487) Reconciliation of stock-based compensation Employee equity plans [1] $ 44 $ 71 $ 150 $ 92 Related party grants [2] — 30 6 128 Total $ 44 $ 101 $ 156 $ 220 [1] Stock-based compensation expense of $47 million, which related to service periods prior to September 30, 2021, was recognized in the three months ended December 31, 2021 when the liquidity event became probable. [2] Stock-based compensation for awards from a related party for employees previously employed by ATG. Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) changes in fair value of derivative liabilities, (iv) stock-based compensation expense, (v) non-cash severance expense, (vi) goodwill impairment, and (vii) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures.