EX-99.1

Published on May 3, 2023

F I R S T Q U A R T E R 2 0 2 3 S H A R E H O L D E R L E T T E R M A Y 3 , 2 0 2 3

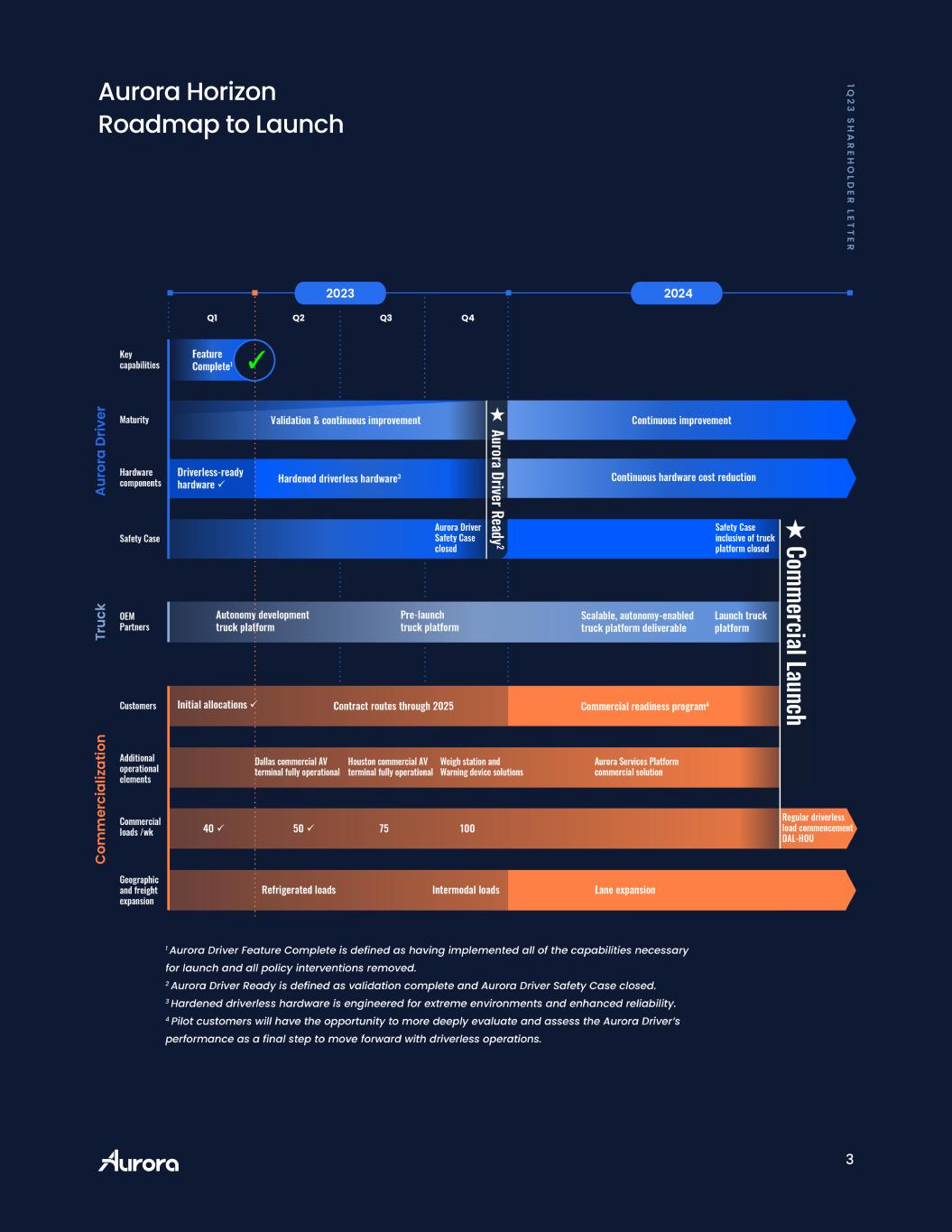

2 1Q 2 3 S H A R E H O LD E R LE T T E R A letter to shareholders We’ve said 2023 is a pivotal year for Aurora. Each technical milestone we achieve, partner and customer advancement we make, and new partnership we forge gives us further confidence in our path to launch Aurora Horizon, our autonomous trucking subscription service. Our first quarter 2023 results are a testament to the foundational technology invest- ments and strategic decisions we’ve made since our founding. The Aurora Driver became Feature Complete, a critical milestone that is the culmination of over six years of incred- ible work across our entire organization. At this point, the Aurora Driver has all of the capabilities we believe are necessary for commercial operations on Aurora Horizon’s Dallas to Houston launch lane. It represents an inflection point on our path to commer- cialization, signaling the end of a development phase in which we’re introducing funda- mentally new driving capabilities and the beginning of the phase in which our primary focus is refinement and validation to close the Safety Case for launch. This progress has moved us significantly closer to fully autonomous commercial oper- ations. As a result, we’ve further detailed our roadmap, outlining the work that remains between now and our planned Commercial Launch. The roadmap covers key compo- nents of our business that we expect to be necessary to bring Aurora Horizon to market. In preparation for Commercial Launch, we are continuing to build a powerful ecosys- tem of the world’s leading trucking and logistics companies to support the growth of our business for years to come. We’ve been working on a supplier strategy to support Aurora Driver hardware at very large scale, a key lever to unlocking highly profitable unit economics. In April, we announced that we entered a first-of-its-kind, long-term part- nership with Continental, one of the world’s leading technology manufacturers and tier 1 automotive suppliers, to develop, manufacture, and service a commercially-scalable future generation of the Aurora Driver’s hardware kit. We believe industrializing our hardware kit through this partnership will help us achieve the commercial scale and cost structure necessary to support our long-term profitability objectives. Continental has already begun investing what may ultimately be over $300 million in non-recurring engineering cost, or NRE, to scale the Aurora Driver hard- ware, allowing Aurora to avoid near-term capital commitments to develop and manufac- ture this hardware. In addition, the partnership will allow Aurora to pay for the hardware on a “pay per mile” basis. This is a first-of-its-kind structure for this industry that aligns with and supports our highly capital efficient, Driver as a Service business model. This collaboration allows us to focus on our core strengths of developing industry-leading technology, building best-in-class partnerships, and accelerating a transformative busi- ness model. Together, Continental and Aurora are positioned to deliver a safe, autono- mous future at scale, sooner than many think is possible.

3 4 Q 2 2 S H A R E H O LD E R LE T T E R Aurora Horizon Roadmap to Launch 1Q 2 3 S H A R E H O LD E R LE T T E R

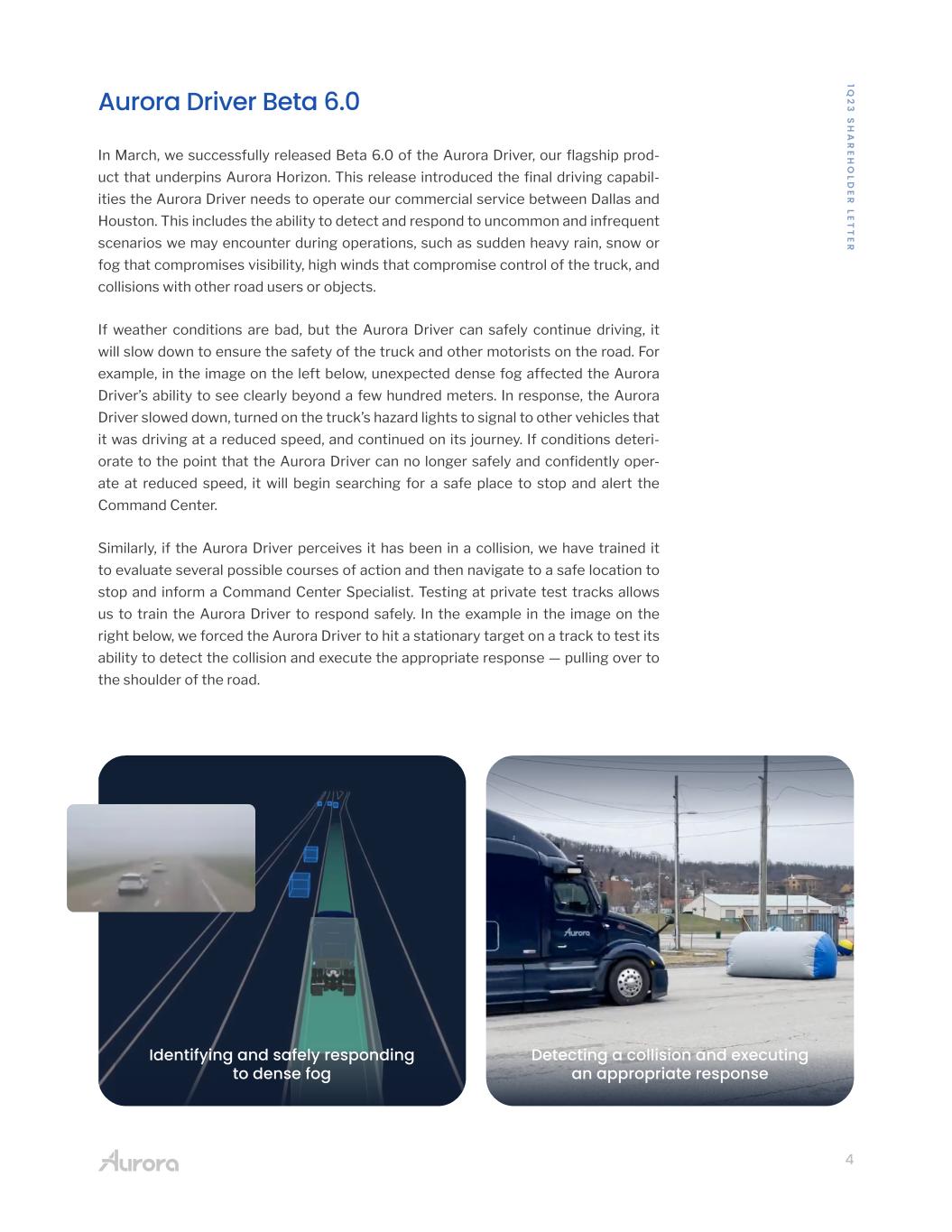

4 1Q 2 3 S H A R E H O LD E R LE T T E R Detecting a collision and executing an appropriate response Identifying and safely responding to dense fog Aurora Driver Beta 6.0 In March, we successfully released Beta 6.0 of the Aurora Driver, our flagship prod- uct that underpins Aurora Horizon. This release introduced the final driving capabil- ities the Aurora Driver needs to operate our commercial service between Dallas and Houston. This includes the ability to detect and respond to uncommon and infrequent scenarios we may encounter during operations, such as sudden heavy rain, snow or fog that compromises visibility, high winds that compromise control of the truck, and collisions with other road users or objects. If weather conditions are bad, but the Aurora Driver can safely continue driving, it will slow down to ensure the safety of the truck and other motorists on the road. For example, in the image on the left below, unexpected dense fog affected the Aurora Driver’s ability to see clearly beyond a few hundred meters. In response, the Aurora Driver slowed down, turned on the truck’s hazard lights to signal to other vehicles that it was driving at a reduced speed, and continued on its journey. If conditions deteri- orate to the point that the Aurora Driver can no longer safely and confidently oper- ate at reduced speed, it will begin searching for a safe place to stop and alert the Command Center. Similarly, if the Aurora Driver perceives it has been in a collision, we have trained it to evaluate several possible courses of action and then navigate to a safe location to stop and inform a Command Center Specialist. Testing at private test tracks allows us to train the Aurora Driver to respond safely. In the example in the image on the right below, we forced the Aurora Driver to hit a stationary target on a track to test its ability to detect the collision and execute the appropriate response — pulling over to the shoulder of the road.

5 1Q 2 3 S H A R E H O LD E R LE T T E R Unlocking our path to commercialization With the release of these final capabilities in Beta 6.0, we have implemented all of the capabilities necessary for commercial operations on Aurora Horizon’s Dallas to Houston launch lane and removed all policy interventions for that lane. Reaching Feature Complete is the result of years of innovation, reflected in our award-winning patent portfolio. Our deep portfolio of intellectual property includes inventions related to our proprietary FirstLight lidar and the Aurora Virtual Testing Suite, among other critical technologies. Our artificial intelligence (AI) research has led to cutting-edge machine learning architectures with diverse uses such as multi-sen- sor-modality perception, graph neural network generative AI that models the behavior of other road users, and sophisticated learning of decision-making to enable the Aurora Driver to naturally and safely interact on the road. When we founded Aurora, we were confident the recent revolution in machine learning was a necessary breakthrough to commercialize self-driving technology. This insight drove our clean sheet approach to building the Aurora Driver, leveraging these advancements. As we enter the final phase of refining the Aurora Driver’s performance, it’s these key technologies that will enable our continued pace toward our next key milestone, achieving Aurora Driver Ready, on our path to Commercial Launch. As we progress toward this milestone, we’ll continue our quarterly release cadence and complete the necessary validation to close the Aurora Driver Safety Case for our commercial launch lane. Aurora’s graph neural network generative AI models the behavior of other road users

6 1Q 2 3 S H A R E H O LD E R LE T T E R Measuring our progress toward commercial launch We know that the Aurora Driver will be ready to launch when we have a closed Safety Case for our Dallas to Houston lane. Our Safety Case is a comprehensive, evidence- based approach to confirming that our self-driving vehicles are acceptably safe to operate on public roads. It goes beyond just ensuring the vehicle drives well enough for a demo; rather it demonstrates that our system, and our company, are holistically and sustainably safe. Achieving Feature Complete has unlocked the final phase of refine- ment and validation to close the Safety Case for our Commercial Launch. Consistent with our commitment to transparency and as previously outlined, we are sharing our progress toward a closed Safety Case via the Autonomy Readiness Measure (ARM), which is a weighted measure of completeness across all claims under our Safety Case for the launch lane. It reflects the percentage of work needed to move from Feature Complete to our next critical milestone — Aurora Driver Ready. Safety Case closure is the primary focus of our work between Feature Complete and Aurora Driver Ready. We entered this period of intense focus with the ARM already at 44% as of March 31, 2023. This metric demonstrates the strong progress we are making toward closing our Safety Case, with nearly half already completed and keep- ing us on track to achieve Aurora Driver Ready later this year. The on-road Autonomy Performance Indicator (API) tracks our performance to successfully operate the Aurora Horizon service in a commercially-representative setting. This allows us to understand not just the state of our technology, but the matu- rity of our processes and procedures in operating our business. The indicator penal- izes the use of on-site support, which will be the most expensive support provided to enable the Horizon service. For the first quarter of 2023, the API was 96%, which is a great result given that the Aurora Driver was under active development while still delivering value for our customers. Formally, the API is the percentage of total commercially-representative miles driven on our launch lane over the quarter, that include: • Miles driven during the quarter that did not require support, with support mean- ing assistance via a local vehicle operator or other on-site support • Miles driven in autonomy with remote input from the Aurora Services Platform • Miles where the vehicle received support but where it’s determined, through internal analysis including simulation, that the support received was not required by the Aurora Driver

7 1Q 2 3 S H A R E H O LD E R LE T T E R Evaluating this metric through a commercial lens, this translates to only 4% of commercially-representative miles driven gate-to-gate between our launch lane terminals during the first quarter needing on-site support. None of this support was required to keep the vehicle operating safely; in over 41,000 commercial miles on the launch lane, we experienced zero safety-critical interventions. Instead, for miles that leveraged on-site support, the support was used for operational reasons, such as to ensure development activities did not affect on-time delivery of the load our truck was pulling. Across the 219 loads completed in pilot operations on our launch lane in the first quarter, five loads accounted for approximately 40% of the manual driving affecting the metric. Meanwhile, 76% of these loads had an API greater than or equal to 98%, 61% had an API greater than or equal to 99%, and 32% had an API of 100%. As a reminder, we do not anticipate that aggregate API will be 100%, even at launch because certain situations (e.g., flat tires) will always require on-site support. As we look ahead to Commercial Launch and beyond, scalability and ultimately our profitability will be supported by a reduction in the level of on-site support required. We believe that it is important to hold our teams accountable to delivering a complete, commercially-representative product and evaluating its performance on that basis. The API is one way we do this. 1Q 2 3 S H A R E H O LD E R LE T T E R

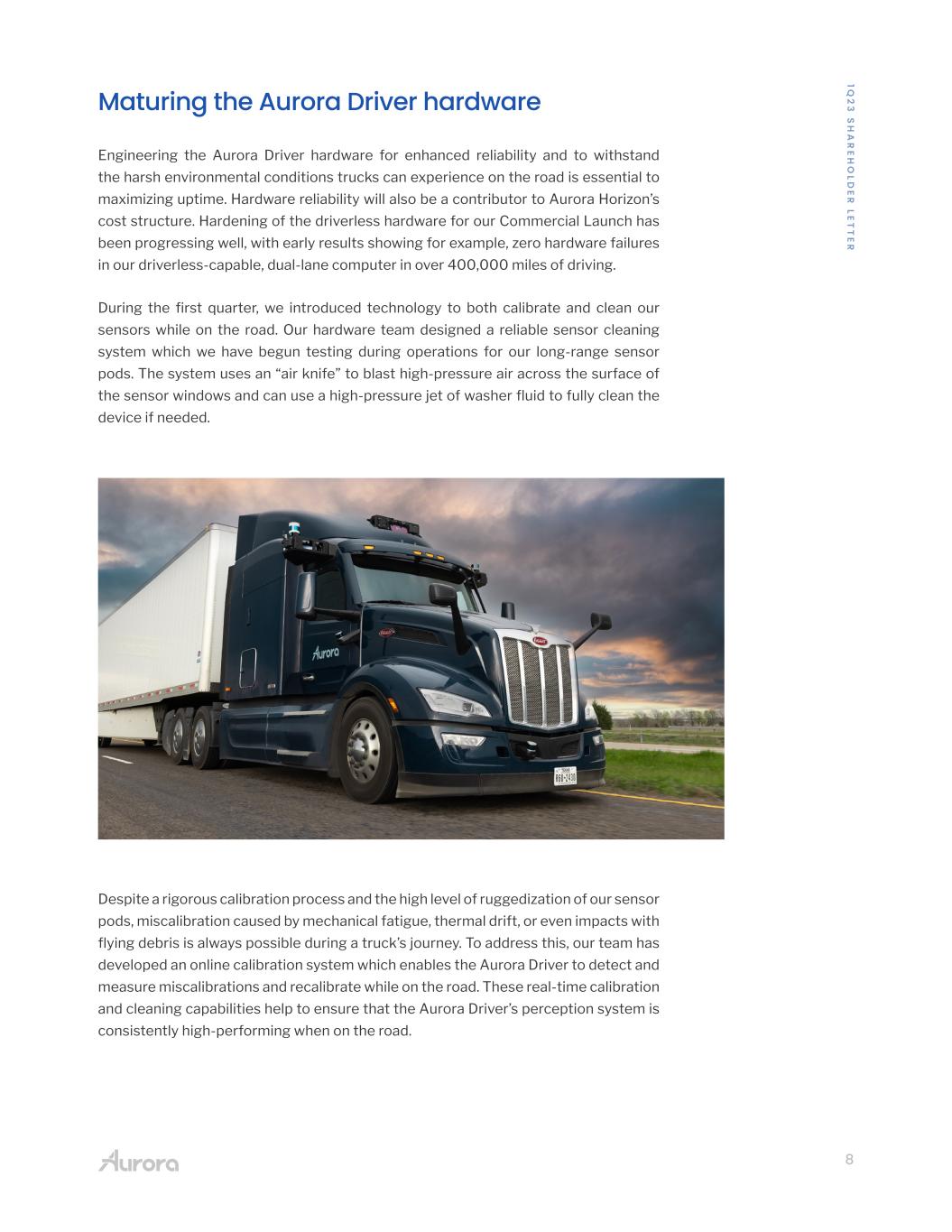

8 1Q 2 3 S H A R E H O LD E R LE T T E R Maturing the Aurora Driver hardware Engineering the Aurora Driver hardware for enhanced reliability and to withstand the harsh environmental conditions trucks can experience on the road is essential to maximizing uptime. Hardware reliability will also be a contributor to Aurora Horizon’s cost structure. Hardening of the driverless hardware for our Commercial Launch has been progressing well, with early results showing for example, zero hardware failures in our driverless-capable, dual-lane computer in over 400,000 miles of driving. During the first quarter, we introduced technology to both calibrate and clean our sensors while on the road. Our hardware team designed a reliable sensor cleaning system which we have begun testing during operations for our long-range sensor pods. The system uses an “air knife” to blast high-pressure air across the surface of the sensor windows and can use a high-pressure jet of washer fluid to fully clean the device if needed. Despite a rigorous calibration process and the high level of ruggedization of our sensor pods, miscalibration caused by mechanical fatigue, thermal drift, or even impacts with flying debris is always possible during a truck’s journey. To address this, our team has developed an online calibration system which enables the Aurora Driver to detect and measure miscalibrations and recalibrate while on the road. These real-time calibration and cleaning capabilities help to ensure that the Aurora Driver’s perception system is consistently high-performing when on the road.

9 1Q 2 3 S H A R E H O LD E R LE T T E R Continuously expanding operations in Texas As we mature our hardware and work to close our Safety Case, we continue to opera- tionalize our product in a commercially-representative setting, enabling our custom- ers to experience Aurora Horizon as it is designed to operate at launch. We recently debuted our first commercial-ready terminal, setting a new standard for commercial operations in the autonomous trucking industry. Our next-generation South Dallas terminal is designed with innovative features and services to launch autonomous deployment and optimize asset utilization for customers, including: • Specific capabilities for driverless operations such as sensor calibration ranges, high-speed data offload, and launching and landing zones, • Traditional services including fueling and weigh stations to enable autonomous trucks to continuously drive without additional stops, and • On-site maintenance, provided by our pilot partner, Ryder, to optimize fleet up time and support safe operation of trucks on the road. We expect to complete the build out of our Houston terminal in the third quarter. By operating today with our pilot customers as we intend to at launch, we are able to refine our processes to support maximization of the value that our self-driving technol- ogy can deliver to their businesses. With strong demand to integrate Aurora Horizon into their networks, during the first quarter we provided initial allocations of our launch capacity to our pilot customers and together we will refine the allocations over the coming months with the intent to be contracted by the end of the year. We also held our first customer summit last month in Dallas where we hosted our pilot customers and partners to spend time with our leaders, learn more about our product’s deployment, and discuss preparations to commercially launch it in their respective businesses. At this summit, we announced our Commercial Readiness Program, in which our pilot customers will have the opportunity to more deeply evaluate and assess the Aurora Driver’s performance as a final step to move forward with driverless operations. This program is expected to follow our achievement of the Aurora Driver Ready milestone.

10 1Q 2 3 S H A R E H O LD E R LE T T E R During the first quarter, our pilot activity exceeded our target to autonomously haul 40 loads per week for our customers. As we continue to scale our operations, we have already achieved our second quarter goal of 50 loads per week and are now logging over 14,000 commercial miles per week. Cumulative to-date through April 30, we have autonomously delivered (under the supervision of vehicle operators) 1,635 loads, driving more than 455,000 miles, with 98% on-time performance for our pilot custom- ers, including FedEx, Werner, Schneider, and Uber Freight. In May, we also announced a commercial pilot with Hirschbach Motor Lines, Inc., a leader in refrigerated trucking, to test and safely deploy autonomous trucking for refrigerated cargo between Dallas and Houston. A member of our Industry Advisory Council, Richard Stocking, was recently appointed co-CEO of Hirschbach. He has had a front row seat to the development of our technology and the maturing of our opera- tions, giving him the confidence in our technology and our ability to deliver perishable goods safely and on time. We expect refrigerated trailer capability to be one of many future growth enablers following Commercial Launch as we demonstrate the ability of autonomous trucks to dramatically expedite shipping of critical, time-sensitive freight like fruits, vegetables, and other perishable goods. loads miles across on time Cumulative to-date through 04/30/23, we’ve delivered: 1,635 455k 98%

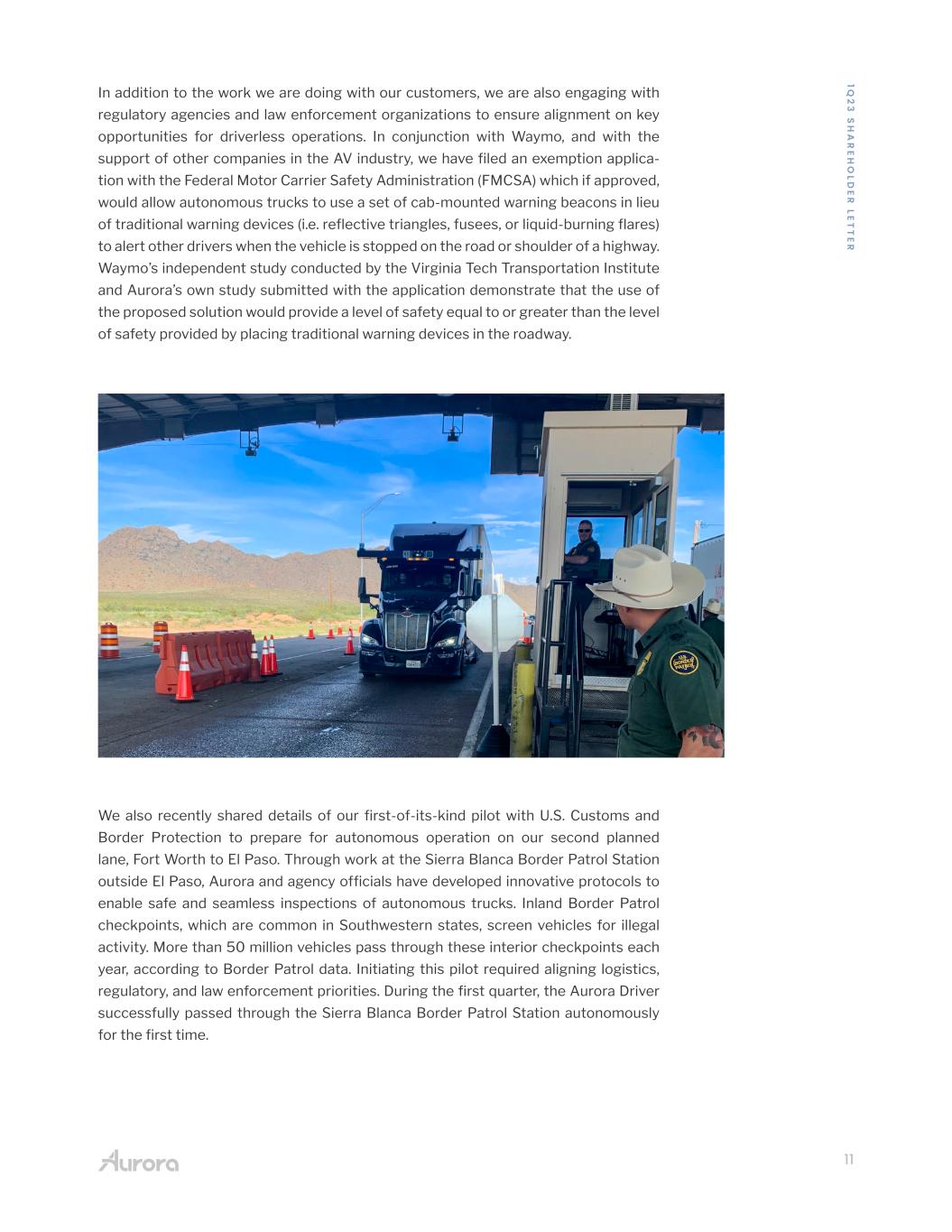

11 1Q 2 3 S H A R E H O LD E R LE T T E R In addition to the work we are doing with our customers, we are also engaging with regulatory agencies and law enforcement organizations to ensure alignment on key opportunities for driverless operations. In conjunction with Waymo, and with the support of other companies in the AV industry, we have filed an exemption applica- tion with the Federal Motor Carrier Safety Administration (FMCSA) which if approved, would allow autonomous trucks to use a set of cab-mounted warning beacons in lieu of traditional warning devices (i.e. reflective triangles, fusees, or liquid-burning flares) to alert other drivers when the vehicle is stopped on the road or shoulder of a highway. Waymo’s independent study conducted by the Virginia Tech Transportation Institute and Aurora’s own study submitted with the application demonstrate that the use of the proposed solution would provide a level of safety equal to or greater than the level of safety provided by placing traditional warning devices in the roadway. We also recently shared details of our first-of-its-kind pilot with U.S. Customs and Border Protection to prepare for autonomous operation on our second planned lane, Fort Worth to El Paso. Through work at the Sierra Blanca Border Patrol Station outside El Paso, Aurora and agency officials have developed innovative protocols to enable safe and seamless inspections of autonomous trucks. Inland Border Patrol checkpoints, which are common in Southwestern states, screen vehicles for illegal activity. More than 50 million vehicles pass through these interior checkpoints each year, according to Border Patrol data. Initiating this pilot required aligning logistics, regulatory, and law enforcement priorities. During the first quarter, the Aurora Driver successfully passed through the Sierra Blanca Border Patrol Station autonomously for the first time.

12 1Q 2 3 S H A R E H O LD E R LE T T E R Progressing our vehicle platform Our work with our truck OEM partners, PACCAR and Volvo Trucks, also continues to progress in preparation for our anticipated Commercial Launch by the end of 2024. In the first quarter, PACCAR and Aurora continued to make progress in the design and planning for the launch of series production trucks built to integrate with and be operated by the Aurora Driver. In support of this development, PACCAR operated trucks with the Aurora Driver installed around the PACCAR Technical Center proving grounds, collecting data that is being used to validate that the integrated, scalable autonomy-enabled truck can achieve its target reliability metrics. During the quarter, Volvo Autonomous Solutions (V.A.S) announced its first carrier customer to reserve autonomous freight capacity on the V.A.S. network. This is an exciting development for both the autonomous trucking industry and our companies, as we continue to work together on the development of V.A.S.’s autonomous transport solution powered by the Aurora Driver.

13 1Q 2 3 S H A R E H O LD E R LE T T E R An exciting start to 2023 In addition to our significant technological and commercial progress, we also welcomed Gloria Boyland to our board of directors. Gloria brings extensive logistics industry expertise gained over 20-plus years as a senior executive at Fortune 50 companies, including more than 15 years at FedEx. Through our work with FedEx, the value of Gloria’s insights, technical understanding, and unique perspective were immediately apparent. These will be tremendous assets as we work toward commercial deployment of our technology. Lastly, in March, Aurora had the opportunity to participate in SXSW in Austin, Texas. As one of the year’s premier interactive technology and education events, Aurora, PACCAR and Schneider were invited to speak about how autonomous vehicles will shape the future of transportation. During the session, Schneider Executive Vice President and Chief Administrative Officer Rob Reich spoke about working with Aurora when he noted, “We assumed there would be some consolidation, knowing that there were a lot of players. It’s another reason you want to be early, to get to know enough people that you can align with the folks that you think are going to be successful as we have in this case [with Aurora].” Autonomous vehicle safety was also a key topic on the minds of attendees during the session. PACCAR Chief Technology Officer John Rich was clear and unequivocal in his support of Aurora’s thoughtful, transparent approach, noting that “Aurora is the gold standard in safety.” We are incredibly proud to work with our best-in-class OEM partners and pilot custom- ers toward the launch of Aurora Horizon. 2023 is proving to be a pivotal year for Aurora, with the achievement of our significant Feature Complete technology mile- stone, our exciting partnership with Continental, and continued progress in advancing the other pieces of our business needed to effectively commercialize our self-driving technology. The balance of this year will be an energizing drive to close the Aurora Driver Safety Case for our commercial launch lane. We are already making great progress toward achieving this Aurora Driver Ready milestone by the end of 2023. Which, in turn, prepares us for our anticipated Commercial Launch by the end of 2024. We couldn’t be more excited by the company’s progress and position in this emerg- ing industry. Our world-class team, partners, and investors recognize the incredible potential of autonomous vehicles to transform the future of transportation. Thank you for your continued support and we look forward to sharing this year’s journey with you! Chris Urmson CEO & Co-founder

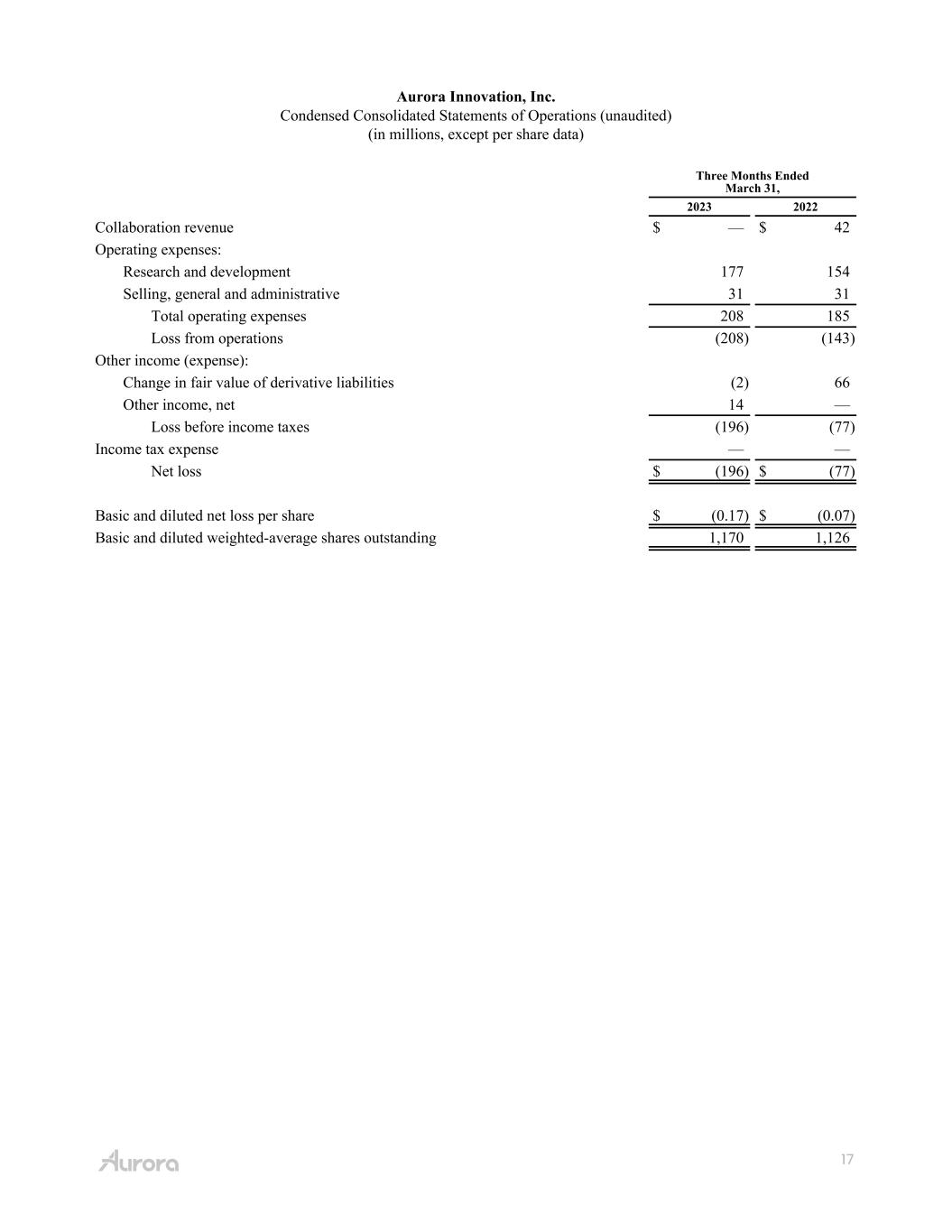

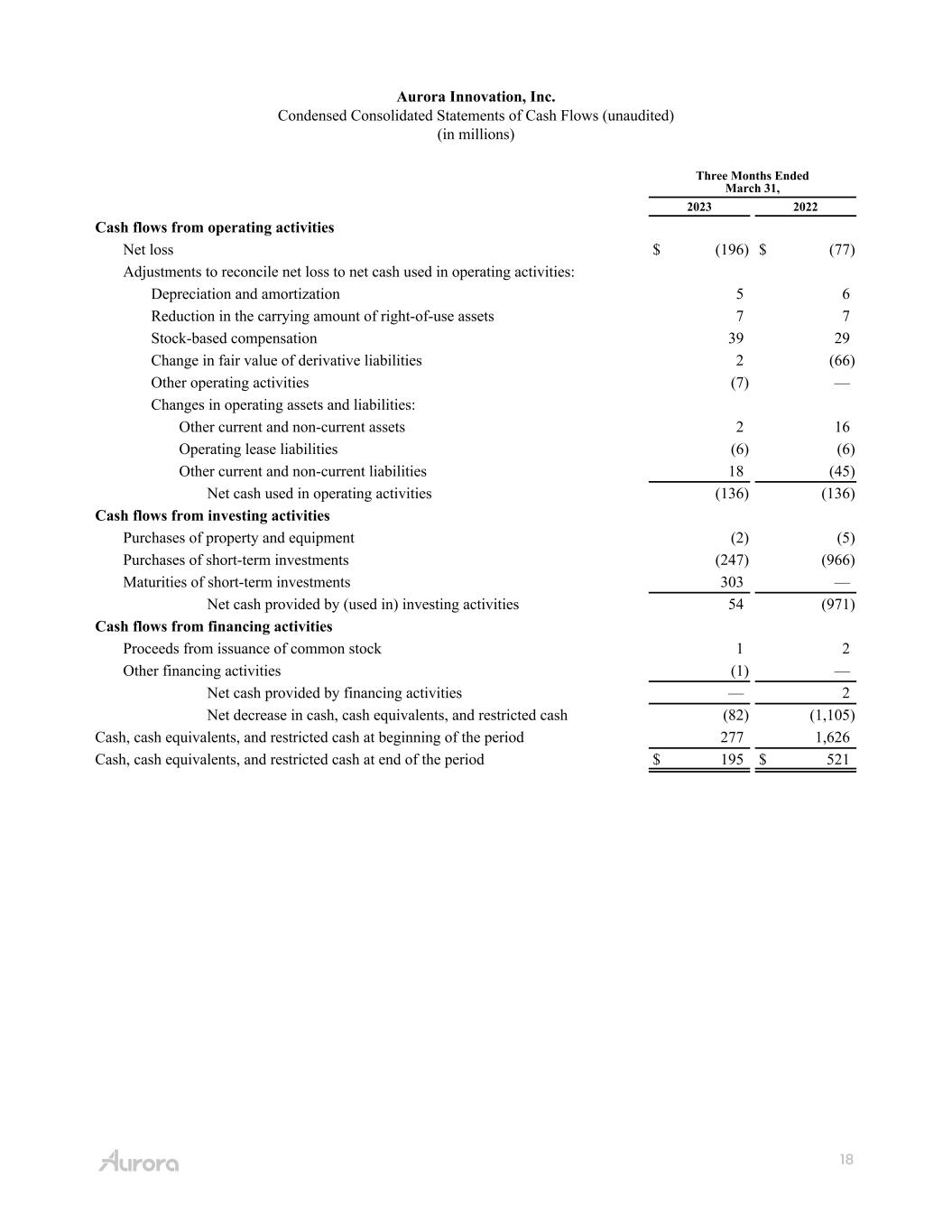

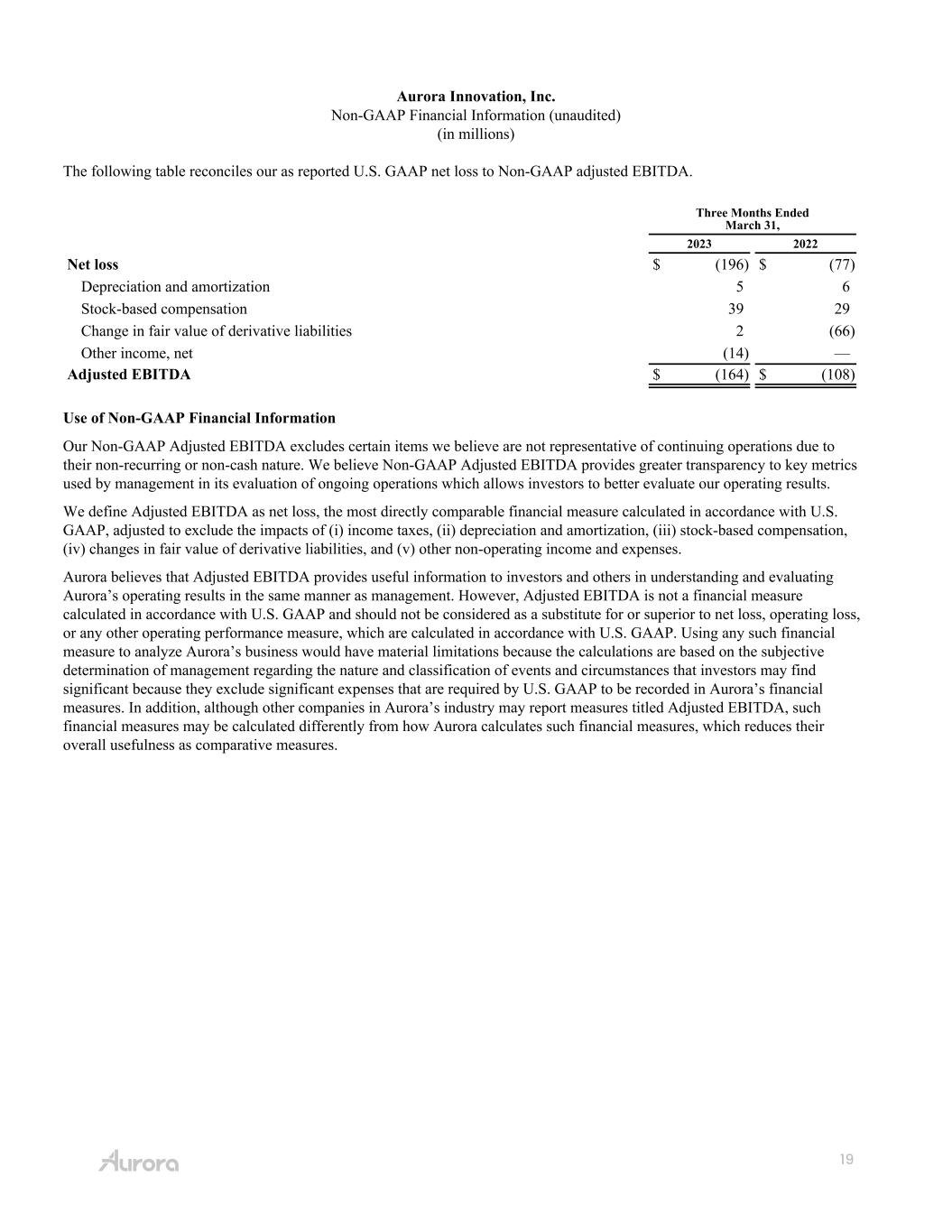

14 1Q 2 3 S H A R E H O LD E R LE T T E R From the desk of our CFO With the achievement of the Feature Complete milestone during the first quarter of 2023 and our intensive focus on closing the Aurora Driver Safety Case this year, we continue to balance execution against our roadmap to launch Aurora Horizon on our planned timeline with fiscal prudence. First quarter 2023 operating expenses, including stock-based compensation (SBC), totaled $208 million. Excluding SBC of $39 million, operating expenses totaled $169 million, reflecting $143 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technology, and $26 million in SG&A. With the Aurora Driver in the final phase of refinement and validation and all revenue under the collaboration framework agreement with Toyota previously recog- nized, we did not record any revenue during the first quarter of 2023. We used approximately $136 million in operating cash during the first quarter of 2023, which was in-line year-over-year. During the first quarter of 2022, we received a cash inflow of $48 million under the collaboration project plan with Toyota, which was substantially offset by payments associated with the 2021 annual incentive compen- sation program. The first quarter of 2023 was not impacted by these cash activities and the 2022 incentive compensation program payments were made subsequent to March 31, 2023. Capital expenditures totaled $2 million in the first quarter of 2023. We ended the first quarter with a very strong balance sheet, including $966 million in cash and short-term investments. We remain focused on constraining expendi- tures where possible, while continuing to invest in the critical work on our path to commercialization. In turn, we continue to expect our liquidity to fund Aurora through mid-2024. Richard Tame CFO

15 1Q 2 3 S H A R E H O LD E R LE T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufac- turing, scaling, and commercialization of the Aurora Driver and related services on the timeframe we expect or at all, and our expected cash runway. These statements are based on management’s current assumptions and are neither promises nor guaran- tees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 21, 2023, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec. gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

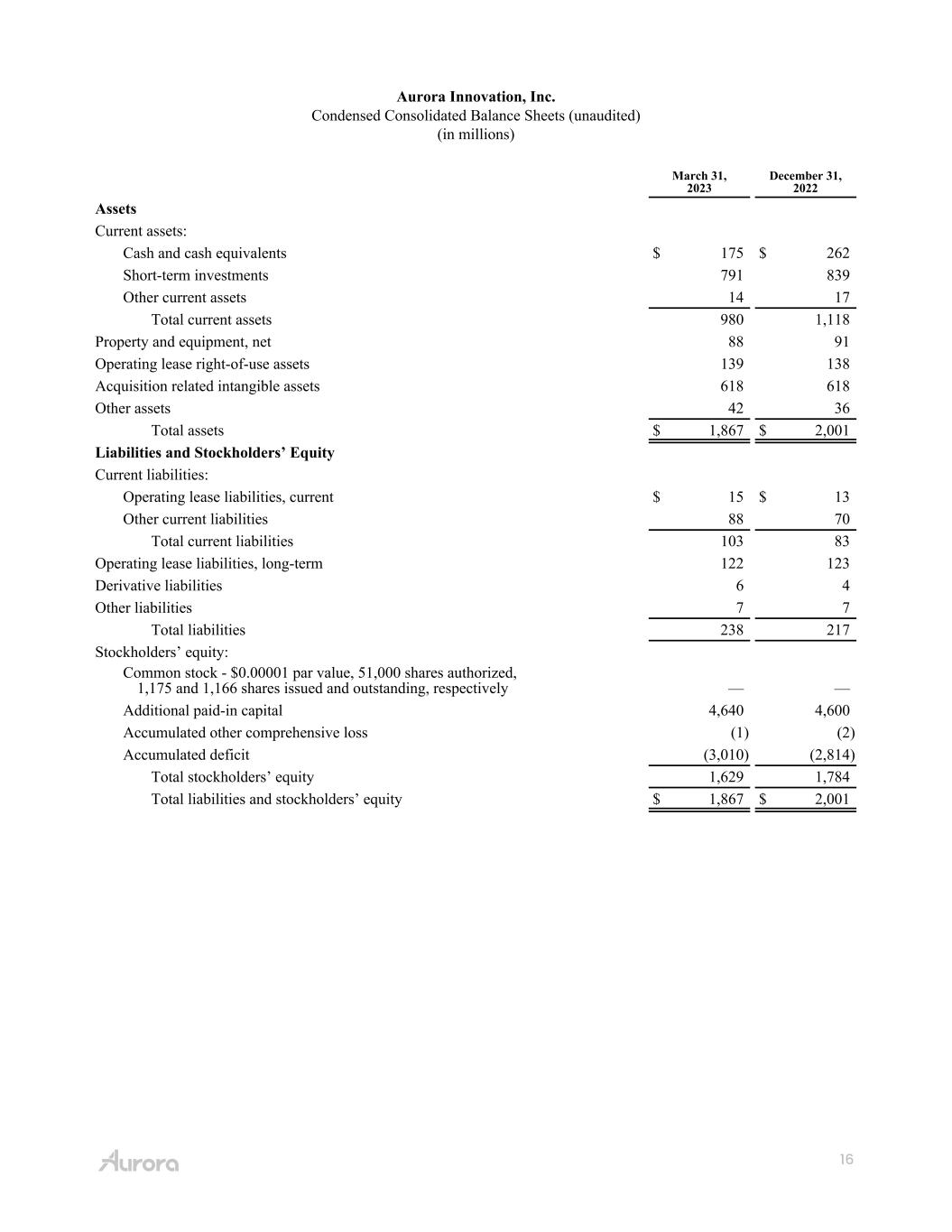

16 Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in millions) March 31, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 175 $ 262 Short-term investments 791 839 Other current assets 14 17 Total current assets 980 1,118 Property and equipment, net 88 91 Operating lease right-of-use assets 139 138 Acquisition related intangible assets 618 618 Other assets 42 36 Total assets $ 1,867 $ 2,001 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 15 $ 13 Other current liabilities 88 70 Total current liabilities 103 83 Operating lease liabilities, long-term 122 123 Derivative liabilities 6 4 Other liabilities 7 7 Total liabilities 238 217 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,175 and 1,166 shares issued and outstanding, respectively — — Additional paid-in capital 4,640 4,600 Accumulated other comprehensive loss (1) (2) Accumulated deficit (3,010) (2,814) Total stockholders’ equity 1,629 1,784 Total liabilities and stockholders’ equity $ 1,867 $ 2,001

17 Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended March 31, 2023 2022 Collaboration revenue $ — $ 42 Operating expenses: Research and development 177 154 Selling, general and administrative 31 31 Total operating expenses 208 185 Loss from operations (208) (143) Other income (expense): Change in fair value of derivative liabilities (2) 66 Other income, net 14 — Loss before income taxes (196) (77) Income tax expense — — Net loss $ (196) $ (77) Basic and diluted net loss per share $ (0.17) $ (0.07) Basic and diluted weighted-average shares outstanding 1,170 1,126

18 Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (unaudited) (in millions) Three Months Ended March 31, 2023 2022 Cash flows from operating activities Net loss $ (196) $ (77) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 5 6 Reduction in the carrying amount of right-of-use assets 7 7 Stock-based compensation 39 29 Change in fair value of derivative liabilities 2 (66) Other operating activities (7) — Changes in operating assets and liabilities: Other current and non-current assets 2 16 Operating lease liabilities (6) (6) Other current and non-current liabilities 18 (45) Net cash used in operating activities (136) (136) Cash flows from investing activities Purchases of property and equipment (2) (5) Purchases of short-term investments (247) (966) Maturities of short-term investments 303 — Net cash provided by (used in) investing activities 54 (971) Cash flows from financing activities Proceeds from issuance of common stock 1 2 Other financing activities (1) — Net cash provided by financing activities — 2 Net decrease in cash, cash equivalents, and restricted cash (82) (1,105) Cash, cash equivalents, and restricted cash at beginning of the period 277 1,626 Cash, cash equivalents, and restricted cash at end of the period $ 195 $ 521

19 Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended March 31, 2023 2022 Net loss $ (196) $ (77) Depreciation and amortization 5 6 Stock-based compensation 39 29 Change in fair value of derivative liabilities 2 (66) Other income, net (14) — Adjusted EBITDA $ (164) $ (108) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, and (v) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures.