EX-99.1

Published on November 1, 2023

T H I R D Q U A R T E R 2 0 2 3 S H A R E H O L D E R L E T T E R N O V E M B E R 1 , 2 0 2 3 Exhibit 99.1

2 3 Q 2 3 S H A R E H O LD E R LE T T E R A letter to shareholders The third quarter of 2023 was a period of intense focus on execution and capital discipline at Aurora. We continued to make strong progress toward closing the Aurora Driver Safety Case, further enhanced our autonomy performance, scaled our trucking operations, and advanced our partnerships, while managing our cash spend below our quarterly average target.

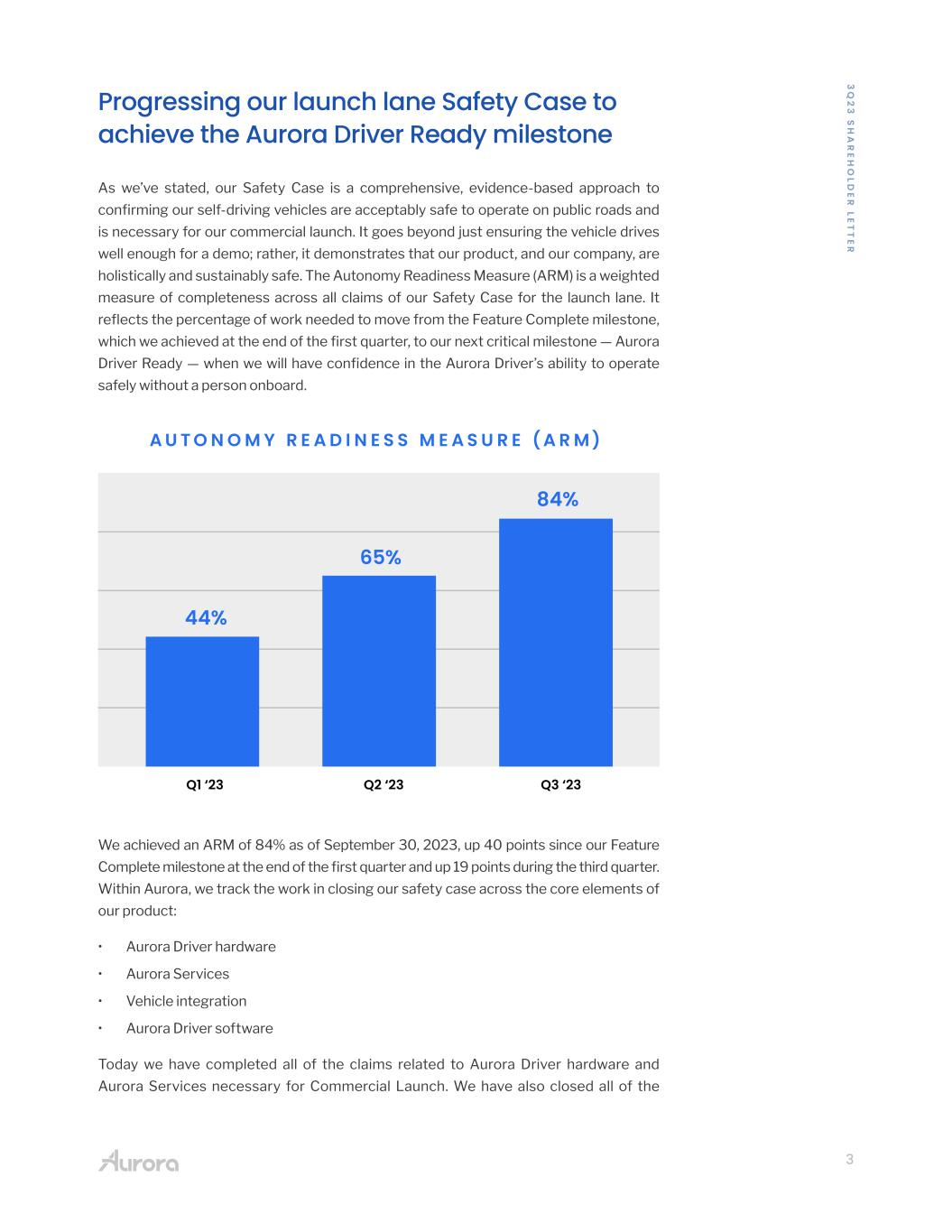

3 3 Q 2 3 S H A R E H O LD E R LE T T E R Progressing our launch lane Safety Case to achieve the Aurora Driver Ready milestone As we’ve stated, our Safety Case is a comprehensive, evidence-based approach to confirming our self-driving vehicles are acceptably safe to operate on public roads and is necessary for our commercial launch. It goes beyond just ensuring the vehicle drives well enough for a demo; rather, it demonstrates that our product, and our company, are holistically and sustainably safe. The Autonomy Readiness Measure (ARM) is a weighted measure of completeness across all claims of our Safety Case for the launch lane. It reflects the percentage of work needed to move from the Feature Complete milestone, which we achieved at the end of the first quarter, to our next critical milestone — Aurora Driver Ready — when we will have confidence in the Aurora Driver’s ability to operate safely without a person onboard. We achieved an ARM of 84% as of September 30, 2023, up 40 points since our Feature Complete milestone at the end of the first quarter and up 19 points during the third quarter. Within Aurora, we track the work in closing our safety case across the core elements of our product: • Aurora Driver hardware • Aurora Services • Vehicle integration • Aurora Driver software Today we have completed all of the claims related to Aurora Driver hardware and Aurora Services necessary for Commercial Launch. We have also closed all of the

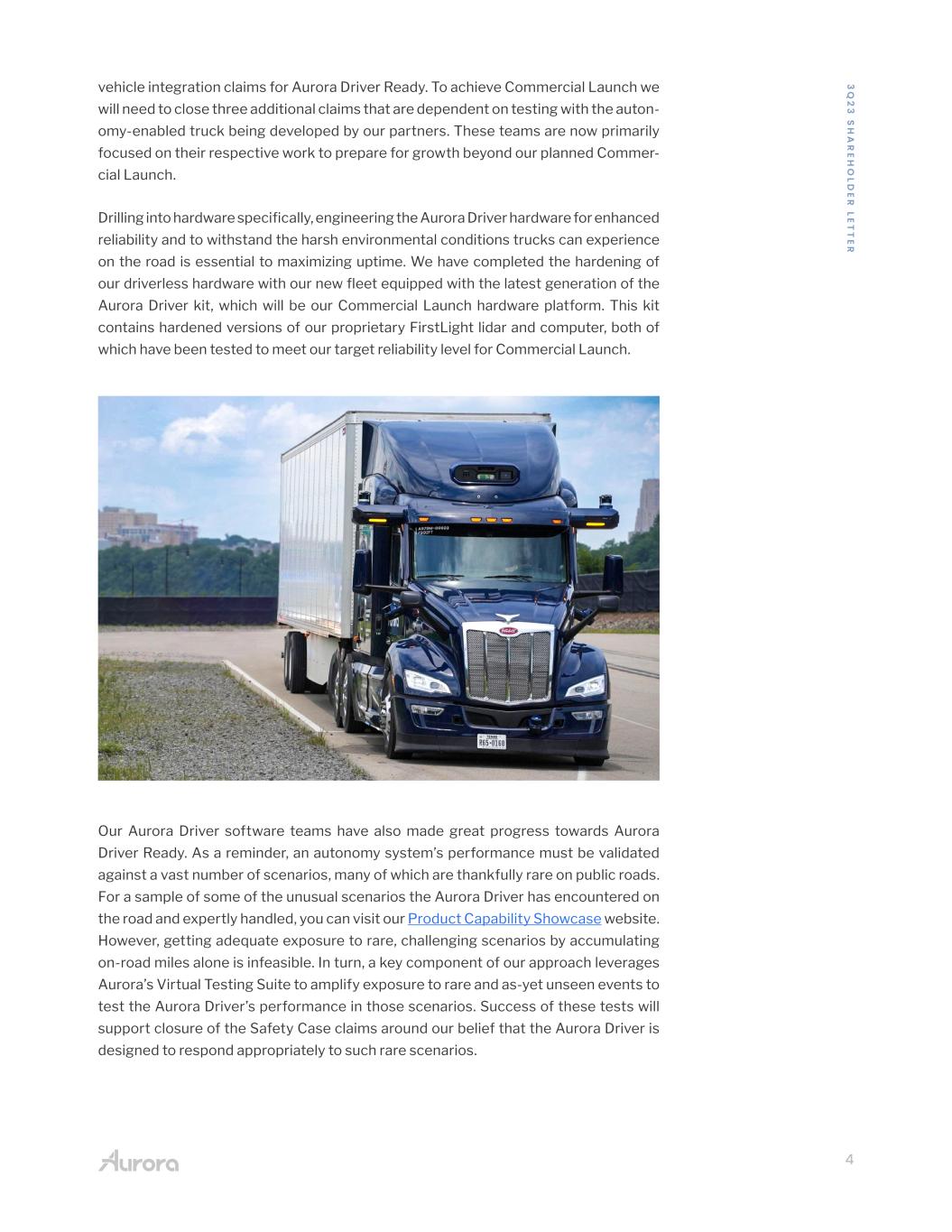

4 3 Q 2 3 S H A R E H O LD E R LE T T E R vehicle integration claims for Aurora Driver Ready. To achieve Commercial Launch we will need to close three additional claims that are dependent on testing with the auton- omy-enabled truck being developed by our partners. These teams are now primarily focused on their respective work to prepare for growth beyond our planned Commer- cial Launch. Drilling into hardware specifically, engineering the Aurora Driver hardware for enhanced reliability and to withstand the harsh environmental conditions trucks can experience on the road is essential to maximizing uptime. We have completed the hardening of our driverless hardware with our new fleet equipped with the latest generation of the Aurora Driver kit, which will be our Commercial Launch hardware platform. This kit contains hardened versions of our proprietary FirstLight lidar and computer, both of which have been tested to meet our target reliability level for Commercial Launch. Our Aurora Driver software teams have also made great progress towards Aurora Driver Ready. As a reminder, an autonomy system’s performance must be validated against a vast number of scenarios, many of which are thankfully rare on public roads. For a sample of some of the unusual scenarios the Aurora Driver has encountered on the road and expertly handled, you can visit our Product Capability Showcase website. However, getting adequate exposure to rare, challenging scenarios by accumulating on-road miles alone is infeasible. In turn, a key component of our approach leverages Aurora’s Virtual Testing Suite to amplify exposure to rare and as-yet unseen events to test the Aurora Driver’s performance in those scenarios. Success of these tests will support closure of the Safety Case claims around our belief that the Aurora Driver is designed to respond appropriately to such rare scenarios.

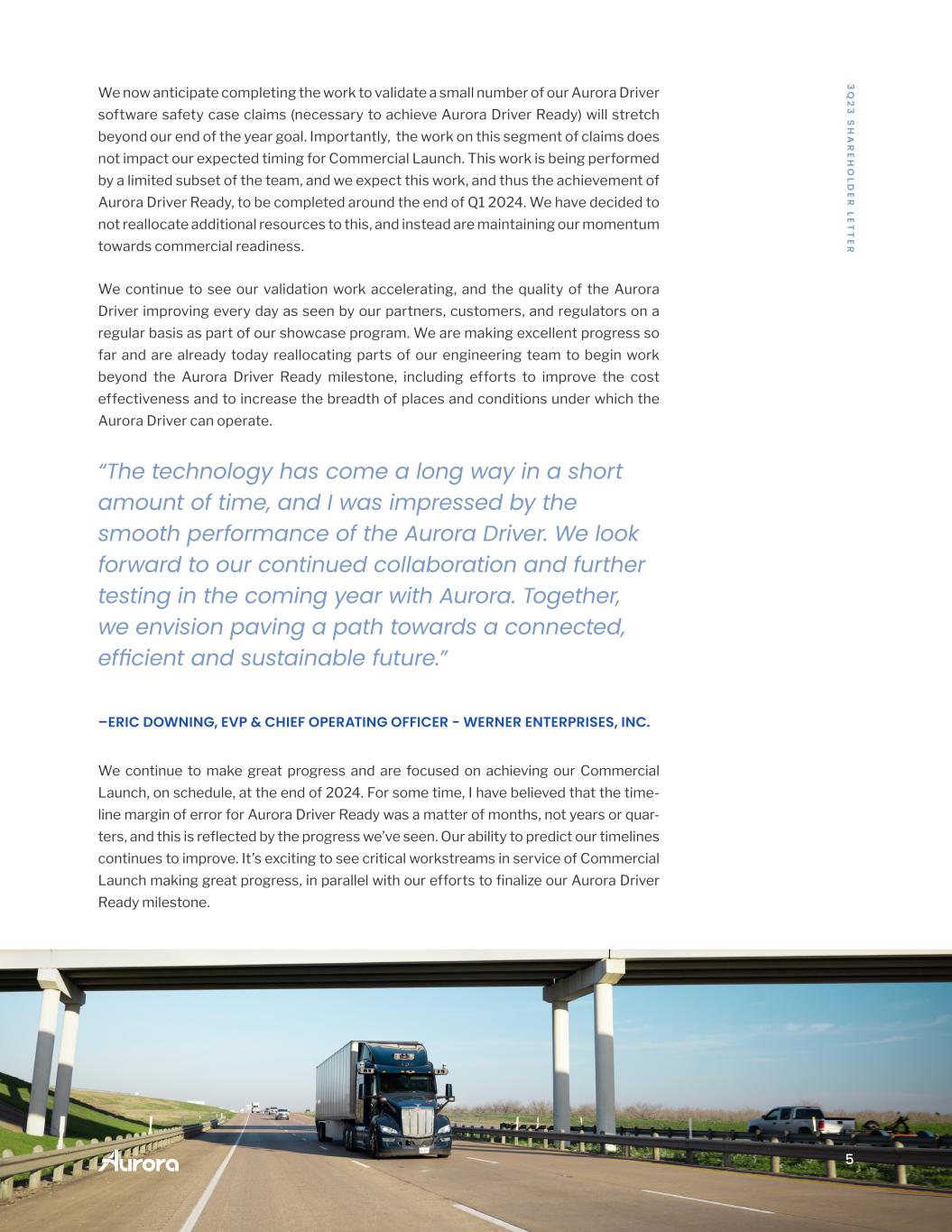

5 3 Q 2 3 S H A R E H O LD E R LE T T E R We now anticipate completing the work to validate a small number of our Aurora Driver software safety case claims (necessary to achieve Aurora Driver Ready) will stretch beyond our end of the year goal. Importantly, the work on this segment of claims does not impact our expected timing for Commercial Launch. This work is being performed by a limited subset of the team, and we expect this work, and thus the achievement of Aurora Driver Ready, to be completed around the end of Q1 2024. We have decided to not reallocate additional resources to this, and instead are maintaining our momentum towards commercial readiness. We continue to see our validation work accelerating, and the quality of the Aurora Driver improving every day as seen by our partners, customers, and regulators on a regular basis as part of our showcase program. We are making excellent progress so far and are already today reallocating parts of our engineering team to begin work beyond the Aurora Driver Ready milestone, including efforts to improve the cost effectiveness and to increase the breadth of places and conditions under which the Aurora Driver can operate. We continue to make great progress and are focused on achieving our Commercial Launch, on schedule, at the end of 2024. For some time, I have believed that the time- line margin of error for Aurora Driver Ready was a matter of months, not years or quar- ters, and this is reflected by the progress we’ve seen. Our ability to predict our timelines continues to improve. It’s exciting to see critical workstreams in service of Commercial Launch making great progress, in parallel with our efforts to finalize our Aurora Driver Ready milestone. “The technology has come a long way in a short amount of time, and I was impressed by the smooth performance of the Aurora Driver. We look forward to our continued collaboration and further testing in the coming year with Aurora. Together, we envision paving a path towards a connected, efficient and sustainable future.” –ERIC DOWNING, EVP & CHIEF OPERATING OFFICER - WERNER ENTERPRISES, INC.

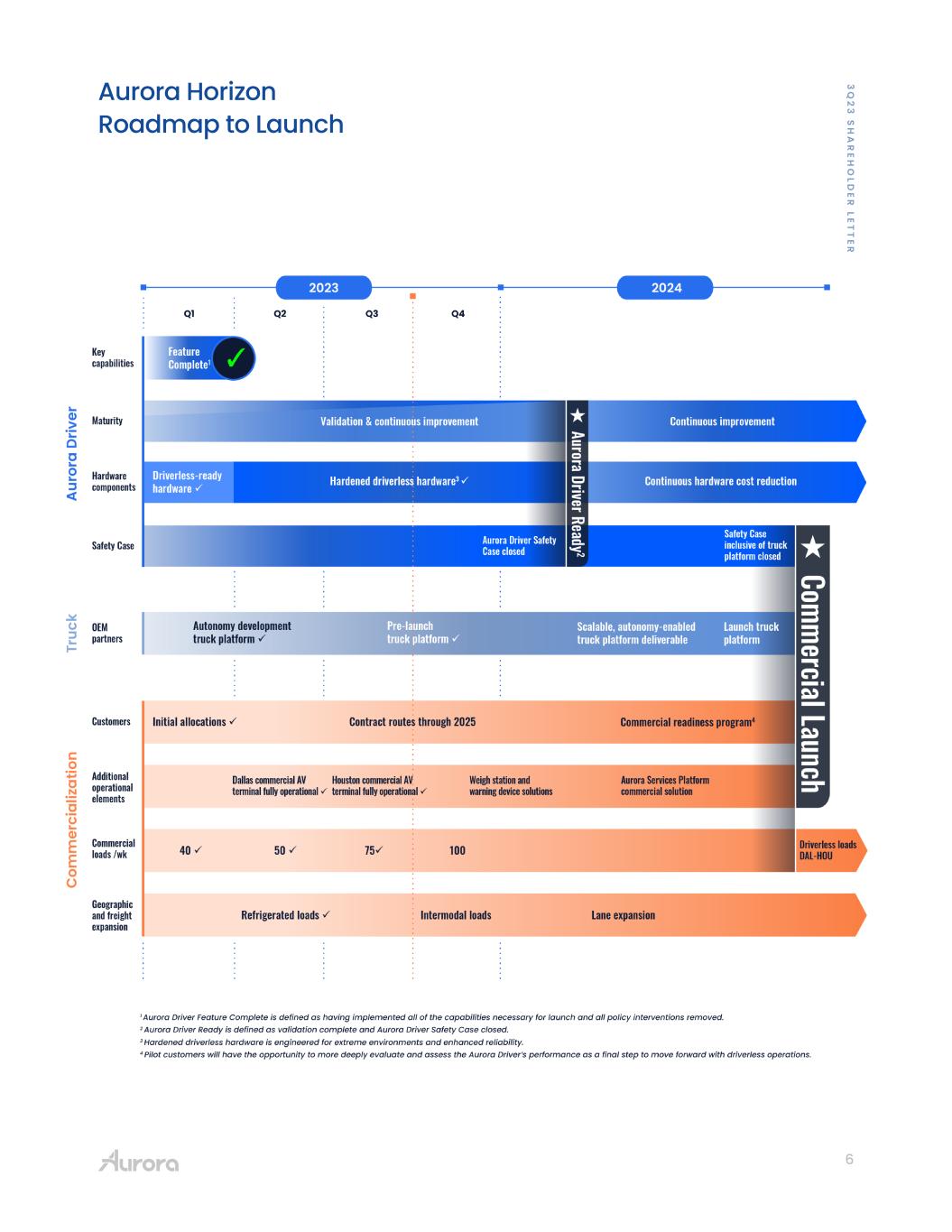

6 4 Q 2 2 S H A R E H O LD E R LE T T E R Aurora Horizon Roadmap to Launch 3 Q 2 3 S H A R E H O LD E R LE T T E R

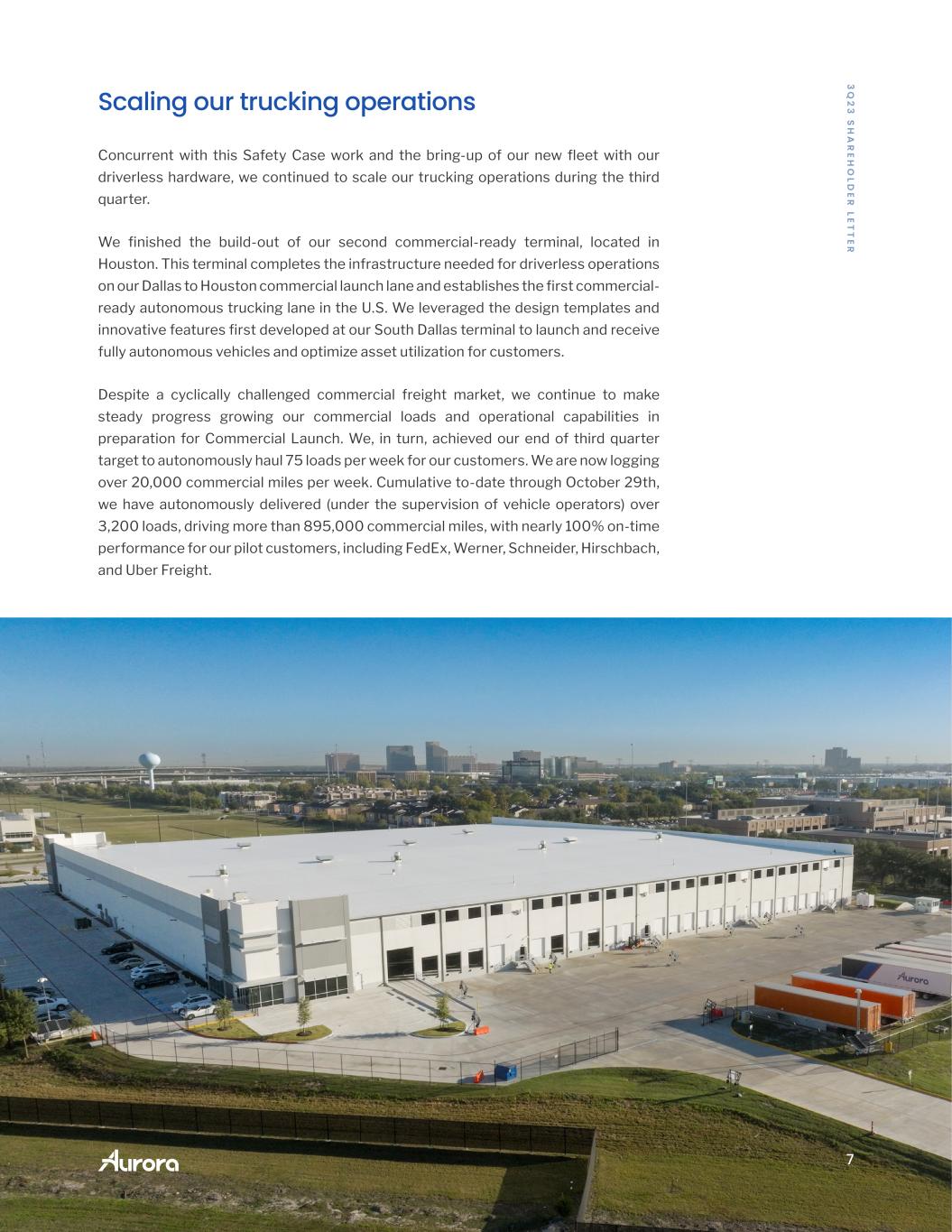

7 3 Q 2 3 S H A R E H O LD E R LE T T E R Scaling our trucking operations Concurrent with this Safety Case work and the bring-up of our new fleet with our driverless hardware, we continued to scale our trucking operations during the third quarter. We finished the build-out of our second commercial-ready terminal, located in Houston. This terminal completes the infrastructure needed for driverless operations on our Dallas to Houston commercial launch lane and establishes the first commercial- ready autonomous trucking lane in the U.S. We leveraged the design templates and innovative features first developed at our South Dallas terminal to launch and receive fully autonomous vehicles and optimize asset utilization for customers. Despite a cyclically challenged commercial freight market, we continue to make steady progress growing our commercial loads and operational capabilities in preparation for Commercial Launch. We, in turn, achieved our end of third quarter target to autonomously haul 75 loads per week for our customers. We are now logging over 20,000 commercial miles per week. Cumulative to-date through October 29th, we have autonomously delivered (under the supervision of vehicle operators) over 3,200 loads, driving more than 895,000 commercial miles, with nearly 100% on-time performance for our pilot customers, including FedEx, Werner, Schneider, Hirschbach, and Uber Freight.

8 3 Q 2 3 S H A R E H O LD E R LE T T E R loads miles across on time nearly 3,200+ 895k+ 100% Cumulative-to-date through 10/29/23, we’ve delivered:

9 3 Q 2 3 S H A R E H O LD E R LE T T E R Continuing to increase autonomy performance One way we measure our performance to successfully operate the Aurora Horizon service in a commercially-representative setting is through the on-road Autonomy Performance Indicator (API). This metric allows us to track not just the state of our tech- nology, but the maturity of our processes and procedures in operating our business. The indicator penalizes the use of on-site support, which will be the most expensive support provided to enable Aurora Horizon. For the third quarter of 2023, the API was 98%, demonstrating another quarter-over-quarter increase. Formally, the API is the percentage of total commercially-representative miles driven on our launch lane over the quarter, that include: • Miles driven during the quarter that did not require support, with support meaning assistance via a local vehicle operator or other on-site support • Miles driven in autonomy with remote input from the Aurora Services Platform • Miles where the vehicle received support but where it’s determined, through inter- nal analysis including simulation, that the support received was not required by the Aurora Driver Across the commercially-representative loads completed in pilot operations on our launch lane in the third quarter, we again saw a notable improvement in autonomy perfor- mance quarter-over-quarter, with over 60% of these loads having an API of 100% and 84% with an API greater than or equal to 99%. In the third quarter, we saw weeks with 99.5% and 99.8% API, respectively. As a reminder, we do not anticipate that aggregate API will be 100%, even at launch because certain situations (e.g., flat tires) will always require on-site support.

10 3 Q 2 3 S H A R E H O LD E R LE T T E R As we look ahead to Commercial Launch and beyond, scalability and, ultimately, our profitability, will be supported by a reduction in the level of on-site support required. We believe it is important to hold our teams accountable for delivering a complete, commer- cially-representative product and evaluating its performance on that basis. The API is one way we do this. Advancing our vehicle platforms and Hardware as a Service partnership Our work with our truck OEM partners, PACCAR and Volvo Trucks, and our new Hardware as a Service partner, Continental, continues to progress as we prepare for Commercial Launch and beyond. Earlier this year, we announced a long-term, exclusive partnership with Continental. The goal of our partnership is to bring self-driving technology to the trucking industry at commercial scale by jointly developing, manufacturing, and servicing future generations of the Aurora Driver hardware. Under a Hardware as a Service business model, Aurora will pay for the hardware on a per mile basis. During the third quarter, the Continental and Aurora teams achieved the first major partnership milestone, which finalized the detailed development plans for the future generations of the Aurora Driver hardware. We look forward to continuing our partnership with Continental to industrialize the first commer- cially scalable autonomous trucking systems, with a cost structure in place intended to support our long-term profitability objectives. On the vehicle platform side, during the third quarter we brought online our new fleet of Peterbilt 579 trucks, upfitted with the latest generation of the Aurora Driver kit. This truck platform is equipped with prototype systems that will be necessary for driverless operations, including redundant braking, steering, and power, which we are actively testing.

11 3 Q 2 3 S H A R E H O LD E R LE T T E R We also received the first autonomy-enabled Volvo VNL during the third quarter. In addition to having prototype redundant braking, steering, and power systems, this truck was built with the necessary structural interfaces in place to support our sensor pods, simplifying the hardware installation process. We were, in turn, able to rapidly integrate a pre-assembled and pre-tested driverless hardware kit. Our Volvo truck builds are continuing during the fourth quarter in preparation for autonomy testing of this plat- form, which is expected to begin in the first quarter of 2024. As our teams continue to advance toward this meaningful moment in our partnership, Volvo Autonomous Solu- tions (V.A.S.) just recently reiterated their excitement for their autonomous trucking product, powered by the Aurora Driver, and the tremendous revenue opportunity that they believe lies ahead. This deep integration with OEMs and suppliers is absolutely imperative to bringing a commercially-viable driverless trucking product to market. While over the years, we have seen a handful of autonomous trucking companies pull the driver for a single or small series of demonstrations, none of these companies did it on a truck platform that was developed with or sanctioned by its OEM and key suppliers for driverless opera- tion or commercialization at scale. With each developmental milestone we reach, we are also co-developing with our OEM partners and their Tier 1 suppliers the autonomy-ready truck platform and all of its subsystems. We are confident that this is the right approach for the future of self-driving truck technology as a business, and frankly we believe the only approach for commercial deployment at scale.

12 3 Q 2 3 S H A R E H O LD E R LE T T E R Supportive regulatory environment for Commercial Launch We are proud to be working with our best-in-class partners throughout the transpor- tation ecosystem to support the growth of our business for years to come. The fa- vorable regulatory landscape supports the joint work we’re doing that continues to advance Aurora Horizon toward our planned Commercial Launch at the end of 2024. Under existing law and regulation, autonomous vehicles can today be deployed in the vast majority of states in the U.S., including Texas, where current law expressly en- ables the safe operation of autonomous vehicles with or without a human driver. California, however, has been an outlier with respect to autonomous trucking and the industry was facing some incremental pressure on this front with the introduction of California Assembly Bill 316 (AB-316). This bill would have prohibited the operation of an autonomous truck without a driver. In September, Governor Newsom vetoed AB-316, a meaningful statement in recogni- tion of the value our technology can drive, both in terms of safety and economic bene- fit. Innovation is at the heart of California’s economy, and we’re committed to working closely with the California Department of Motor Vehicles and California Highway Pa- trol in anticipation of the release of draft heavy-duty autonomous vehicle regulations as part of the rulemaking process that is currently underway in the State. We’re seeing bipartisan support for this critical technology, with policymakers in several other juris- dictions across the U.S voting down or holding back proposals that sought to stall the continued deployment of autonomous vehicle technology. On the Federal legislative front, during the third quarter I had the honor of presenting to the House Transportation & Infrastructure Committee on “The Future of Automated Commercial Motor Vehicles: Impacts on Society, the Supply Chain, and U.S. Economic Leadership.” Being the only company invited to represent the industry underscored our leadership position in autonomous trucking and the trust we have built with poli- cymakers through our transparent and engaged approach. I was proud to speak about the economic value of autonomous trucks, the meaningful progress we have made as a company and industry, and most importantly how we prioritize safety at Aurora. “Assembly Bill 316 is unnecessary for the regulation and oversight of heavy-duty autonomous vehicle technology in California, as existing law provides sufficient authority to create the appropriate regulatory framework.” –GOVERNOR GAVIN NEWSOM

13 3 Q 2 3 S H A R E H O LD E R LE T T E R Bipartisan recognition of the safety and efficiency benefits of this technol- ogy, along with a consensus view that the U.S. must solidify its leadership with respect to autonomous vehicle technology was central to the discus- sion. Throughout my career, I have spent significant time with our part- ners in government and I saw a tangi- ble shift in tone in this congressional meeting. It’s no longer a question of ‘if’ autonomous trucks will arrive, but rather just a question of ‘when’. We look forward to demonstrating continued progress over the coming quarters as we work toward achieving our Aurora Driver Ready milestone in preparation for our planned Commercial Launch at the end of 2024. Thank you for your continued support. Chris Urmson CEO & Co-founder “It sounds like [Aurora is] developing the gold standard.” –CONGRESSMAN SALUD CARBAJAL (D-CA)

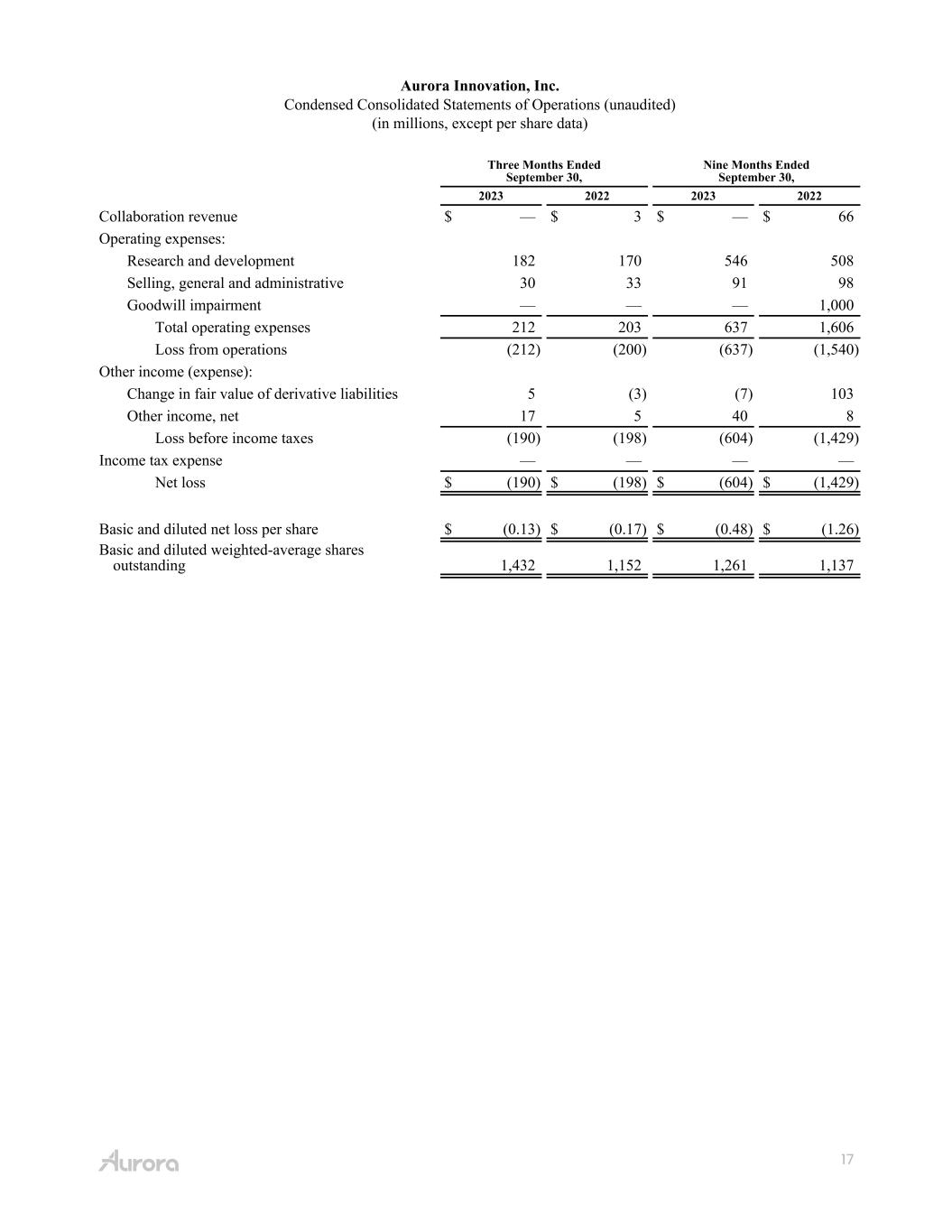

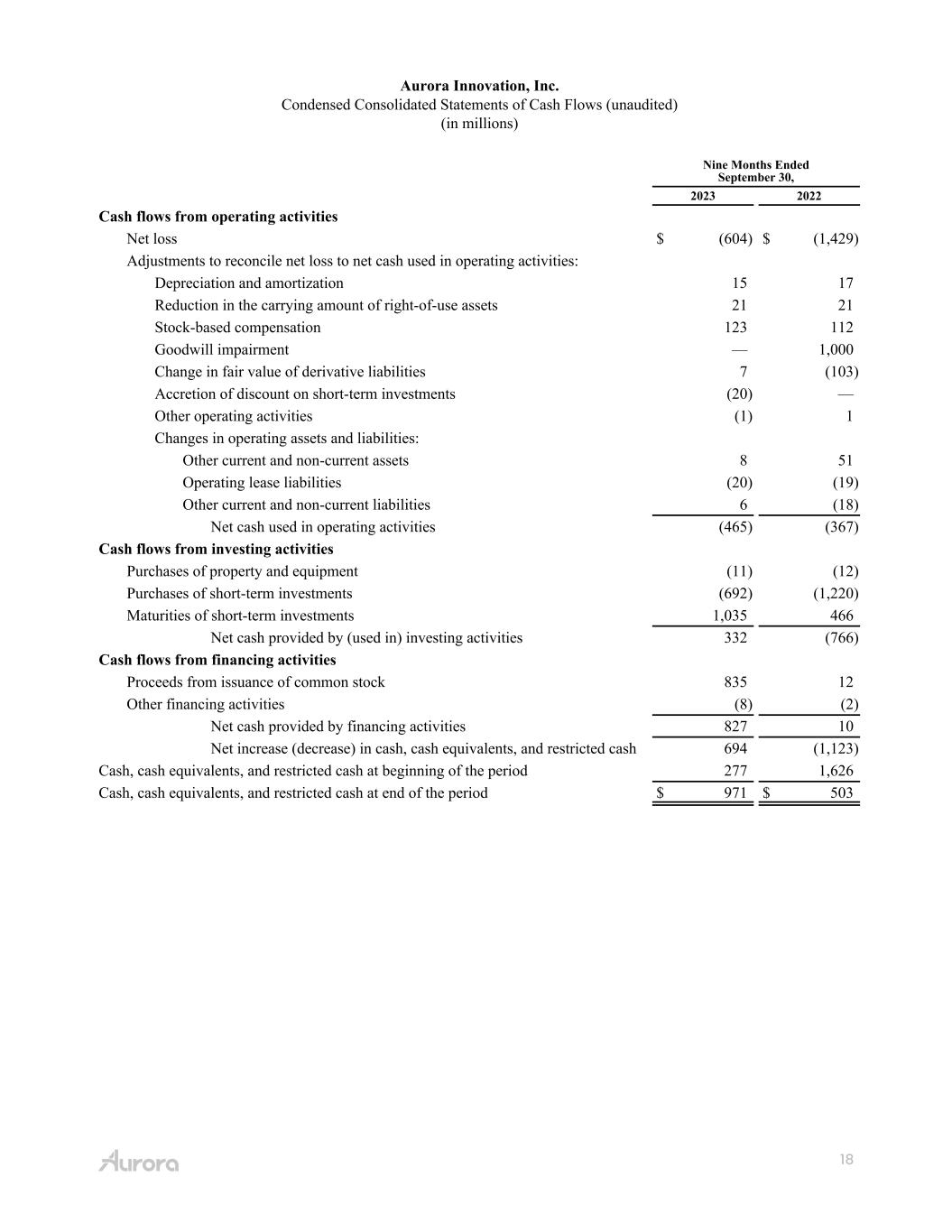

14 3 Q 2 3 S H A R E H O LD E R LE T T E R From the desk of our CFO During the third quarter of 2023, we continued to demonstrate strong fiscal discipline while executing toward our Aurora Driver Ready milestone. Third quarter 2023 operating expenses, including stock-based compensation (SBC), totaled $212 million. Excluding SBC of $41 million, operating expenses totaled $171 million, reflecting $146 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technology, and $25 million in SG&A. With the Aurora Driver in the final phase of refinement and validation for the launch lane, and all revenue under the collaboration framework agreement with Toyota previously recognized, we did not record any revenue during the third quarter of 2023. We used approximately $147 million in operating cash during the third quarter of 2023 and capital expenditures totaled $5 million. This cash spend was below our target of $175 - $185 million per quarter on average, reflecting our commitment to financial discipline. During the third quarter, we raised $853 million in gross proceeds combined from a private placement and public offering of our Class A common stock. Net proceeds totaled $828 million. We ended the third quarter with a very strong balance sheet, including $1.5 billion in cash and short-term investments. We continue to expect this liquidity to support our planned Commercial Launch and fund our operations into the second half of 2025. David Maday CFO

15 3 Q 2 3 S H A R E H O LD E R LE T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufac- turing, scaling, and commercialization of the Aurora Driver and related services, and on the timeframe we expect or at all, and our expected cash runway. These state- ments are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be mate- rially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 21, 2023, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. See our Current Report on Form 8-K filed on July 18, 2023 for key forecast assumptions and estimates underlying certain of our financial projections. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora under- takes no obligation to update forward-looking statements to reflect future events or circumstances.

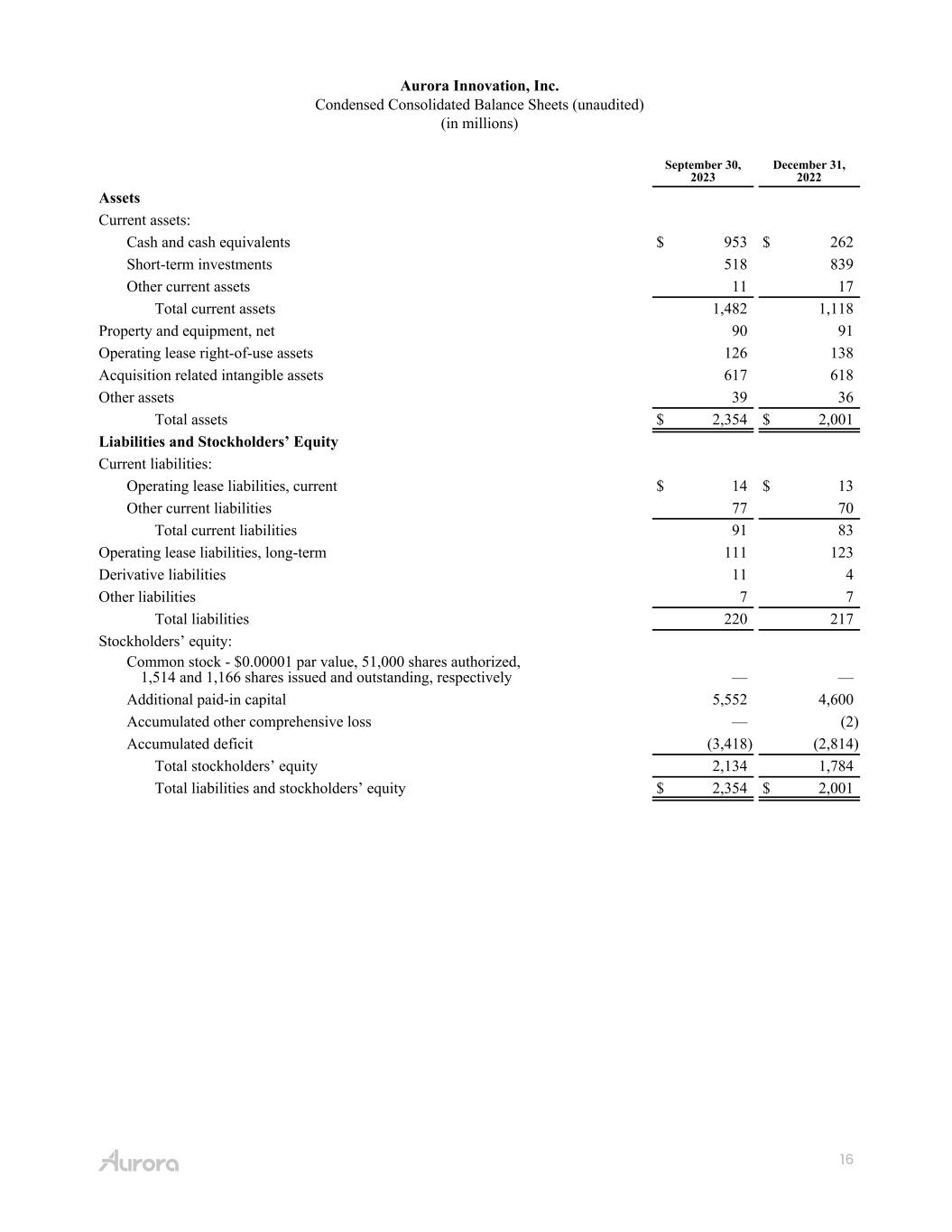

16 Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in millions) September 30, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 953 $ 262 Short-term investments 518 839 Other current assets 11 17 Total current assets 1,482 1,118 Property and equipment, net 90 91 Operating lease right-of-use assets 126 138 Acquisition related intangible assets 617 618 Other assets 39 36 Total assets $ 2,354 $ 2,001 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 14 $ 13 Other current liabilities 77 70 Total current liabilities 91 83 Operating lease liabilities, long-term 111 123 Derivative liabilities 11 4 Other liabilities 7 7 Total liabilities 220 217 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,514 and 1,166 shares issued and outstanding, respectively — — Additional paid-in capital 5,552 4,600 Accumulated other comprehensive loss — (2) Accumulated deficit (3,418) (2,814) Total stockholders’ equity 2,134 1,784 Total liabilities and stockholders’ equity $ 2,354 $ 2,001

17 Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Collaboration revenue $ — $ 3 $ — $ 66 Operating expenses: Research and development 182 170 546 508 Selling, general and administrative 30 33 91 98 Goodwill impairment — — — 1,000 Total operating expenses 212 203 637 1,606 Loss from operations (212) (200) (637) (1,540) Other income (expense): Change in fair value of derivative liabilities 5 (3) (7) 103 Other income, net 17 5 40 8 Loss before income taxes (190) (198) (604) (1,429) Income tax expense — — — — Net loss $ (190) $ (198) $ (604) $ (1,429) Basic and diluted net loss per share $ (0.13) $ (0.17) $ (0.48) $ (1.26) Basic and diluted weighted-average shares outstanding 1,432 1,152 1,261 1,137

18 Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (unaudited) (in millions) Nine Months Ended September 30, 2023 2022 Cash flows from operating activities Net loss $ (604) $ (1,429) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 15 17 Reduction in the carrying amount of right-of-use assets 21 21 Stock-based compensation 123 112 Goodwill impairment — 1,000 Change in fair value of derivative liabilities 7 (103) Accretion of discount on short-term investments (20) — Other operating activities (1) 1 Changes in operating assets and liabilities: Other current and non-current assets 8 51 Operating lease liabilities (20) (19) Other current and non-current liabilities 6 (18) Net cash used in operating activities (465) (367) Cash flows from investing activities Purchases of property and equipment (11) (12) Purchases of short-term investments (692) (1,220) Maturities of short-term investments 1,035 466 Net cash provided by (used in) investing activities 332 (766) Cash flows from financing activities Proceeds from issuance of common stock 835 12 Other financing activities (8) (2) Net cash provided by financing activities 827 10 Net increase (decrease) in cash, cash equivalents, and restricted cash 694 (1,123) Cash, cash equivalents, and restricted cash at beginning of the period 277 1,626 Cash, cash equivalents, and restricted cash at end of the period $ 971 $ 503

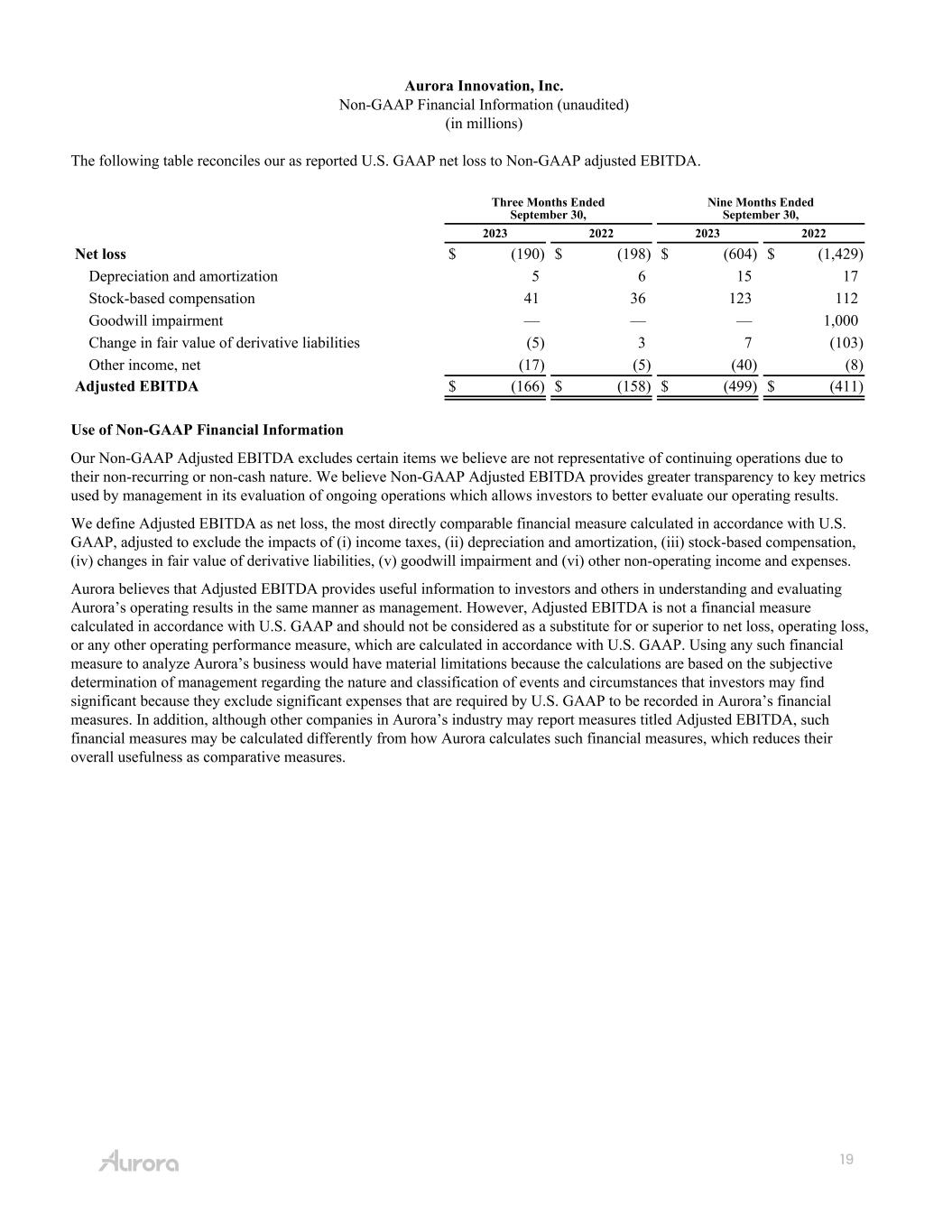

19 Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Net loss $ (190) $ (198) $ (604) $ (1,429) Depreciation and amortization 5 6 15 17 Stock-based compensation 41 36 123 112 Goodwill impairment — — — 1,000 Change in fair value of derivative liabilities (5) 3 7 (103) Other income, net (17) (5) (40) (8) Adjusted EBITDA $ (166) $ (158) $ (499) $ (411) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures.