EX-99.1

Published on February 14, 2024

F O U R T H Q U A R T E R 2 0 2 3 S H A R E H O L D E R L E T T E R F E B R U A R Y 1 4 , 2 0 2 4 Exhibit 99.1

2 4 Q 2 3 S H A R E H O LD E R LE T T E R A letter to shareholders Reflecting on 2023, it was a pivotal year for Aurora as we put into place many of the final pieces to support our planned Commercial Launch and operations at scale. We continue to lead autonomous trucking companies by executing a focused strategy centered on technological, commercial, and financial progress. With respect to our technology, the Aurora Driver became Feature Complete at the end of the first quarter of 2023. Since then, we have meaningfully advanced the Aurora Driver’s autonomy performance, making tremendous progress toward Commercial Launch on the Dallas to Houston lane. Commercially, we established the first commercial-ready autonomous trucking lane in the U.S., while deepening and expanding our customer base. We now consistently schedule over 100 loads per week and are in process of contracting for launch and 2025. We continued to progress the co-development of the autonomy-enabled truck platforms with our OEM partners, resulting in delivery of late stage prototypes into our fleet. And with the formation of our industry-first partnership with Continental, we have built an autonomous trucking partnership ecosystem that is unmatched by any of our competitors. We are confident that this holistic partnership approach is the right one for the future of self-driving truck technology as a business, and believe it positions only Aurora for driverless commercial operations at scale. We accomplished all of this while maintaining financial discipline and strengthening our liquidity position with a successful capital raise last summer.

3 4 Q 2 3 S H A R E H O LD E R LE T T E R 4 Q 2 3 S H A R E H O LD E R LE T T E R 2023 Highlights commercial miles driven 820k+ miles in autonomy 1M+ commercial loads delivered ~3,000 on-time rate (Aurora controlled) 100% nearly

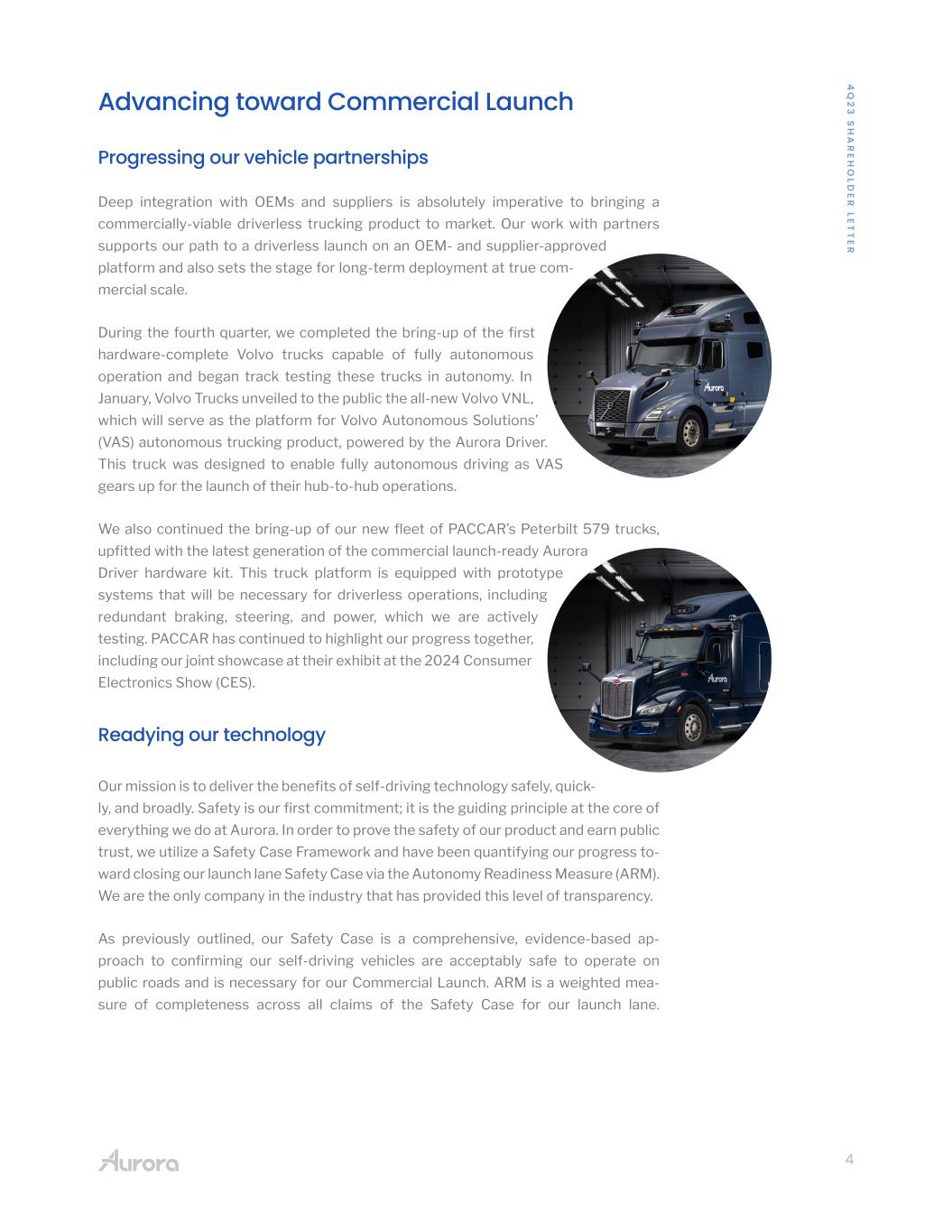

4 4 Q 2 3 S H A R E H O LD E R LE T T E R Advancing toward Commercial Launch Progressing our vehicle partnerships Deep integration with OEMs and suppliers is absolutely imperative to bringing a commercially-viable driverless trucking product to market. Our work with partners supports our path to a driverless launch on an OEM- and supplier-approved platform and also sets the stage for long-term deployment at true com- mercial scale. During the fourth quarter, we completed the bring-up of the first hardware-complete Volvo trucks capable of fully autonomous operation and began track testing these trucks in autonomy. In January, Volvo Trucks unveiled to the public the all-new Volvo VNL, which will serve as the platform for Volvo Autonomous Solutions’ (VAS) autonomous trucking product, powered by the Aurora Driver. This truck was designed to enable fully autonomous driving as VAS gears up for the launch of their hub-to-hub operations. We also continued the bring-up of our new fleet of PACCAR’s Peterbilt 579 trucks, upfitted with the latest generation of the commercial launch-ready Aurora Driver hardware kit. This truck platform is equipped with prototype systems that will be necessary for driverless operations, including redundant braking, steering, and power, which we are actively testing. PACCAR has continued to highlight our progress together, including our joint showcase at their exhibit at the 2024 Consumer Electronics Show (CES). Readying our technology Our mission is to deliver the benefits of self-driving technology safely, quick- ly, and broadly. Safety is our first commitment; it is the guiding principle at the core of everything we do at Aurora. In order to prove the safety of our product and earn public trust, we utilize a Safety Case Framework and have been quantifying our progress to- ward closing our launch lane Safety Case via the Autonomy Readiness Measure (ARM). We are the only company in the industry that has provided this level of transparency. As previously outlined, our Safety Case is a comprehensive, evidence-based ap- proach to confirming our self-driving vehicles are acceptably safe to operate on public roads and is necessary for our Commercial Launch. ARM is a weighted mea- sure of completeness across all claims of the Safety Case for our launch lane.

5 4 Q 2 3 S H A R E H O LD E R LE T T E R When we introduced the ARM 18 months ago, we estimated Aurora Driver Ready would correspond with an ARM of approximately 95%, and that we would be ready for Commercial Launch when the remaining approximately 5% of the Safety Case claims corresponding to the vehicle were complete. As of mid-January of this year, we achieved an ARM of 93%. Our focus on the Aurora Driver Ready milestone enabled this rapid progress as we worked with our OEM partners to prepare their autonomy- enabled trucks for integration. With prototypes of our intended launch truck in hand, our focus now turns toward closing the final 7% of our Safety Case jointly between the Aurora Driver and the truck platform to enable our planned Commercial Launch at the end of this year on the final autonomy-enabled truck platform we expect to receive. This alignment of our Aurora Driver Ready and Commercial Launch milestones and timeline allows us to most efficiently allocate resources to final preparation of our complete product. We will continue to report the ARM as we continue working toward closing the Safety Case for the launch lane. 93% 84% 65% 44% Q1 ‘23 Q2 ‘23 Q3 ‘23 Mid-Jan ‘24

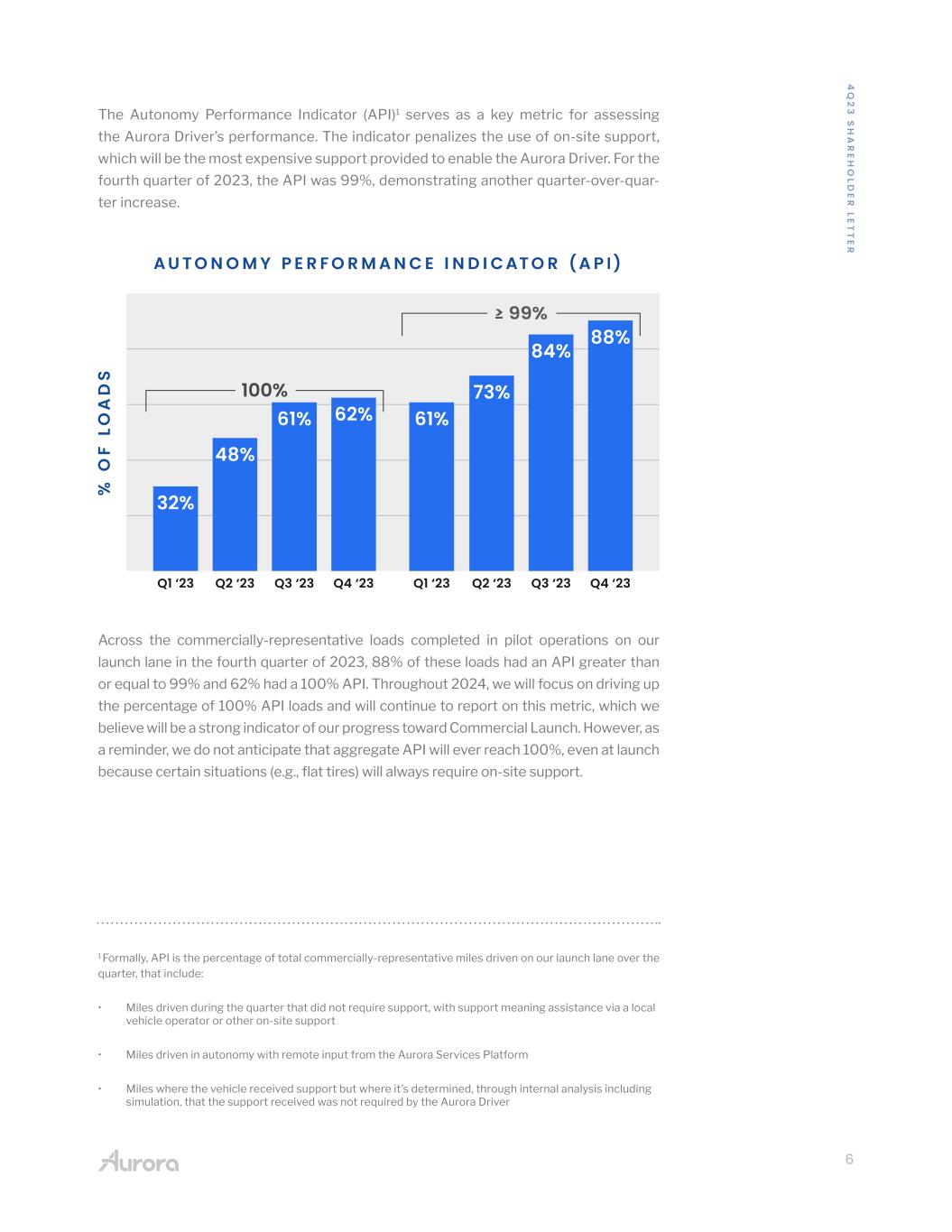

6 4 Q 2 3 S H A R E H O LD E R LE T T E R The Autonomy Performance Indicator (API)1 serves as a key metric for assessing the Aurora Driver’s performance. The indicator penalizes the use of on-site support, which will be the most expensive support provided to enable the Aurora Driver. For the fourth quarter of 2023, the API was 99%, demonstrating another quarter-over-quar- ter increase. Across the commercially-representative loads completed in pilot operations on our launch lane in the fourth quarter of 2023, 88% of these loads had an API greater than or equal to 99% and 62% had a 100% API. Throughout 2024, we will focus on driving up the percentage of 100% API loads and will continue to report on this metric, which we believe will be a strong indicator of our progress toward Commercial Launch. However, as a reminder, we do not anticipate that aggregate API will ever reach 100%, even at launch because certain situations (e.g., flat tires) will always require on-site support. Q3 ‘23 Q3 ‘23Q4 ‘23 Q4 ‘23Q2 ‘23 Q2 ‘23Q1 ‘23 Q1 ‘23 73% 84% 61% 61%62% 48% 32% 88% 1 Formally, API is the percentage of total commercially-representative miles driven on our launch lane over the quarter, that include: • Miles driven during the quarter that did not require support, with support meaning assistance via a local vehicle operator or other on-site support • Miles driven in autonomy with remote input from the Aurora Services Platform • Miles where the vehicle received support but where it’s determined, through internal analysis including simulation, that the support received was not required by the Aurora Driver

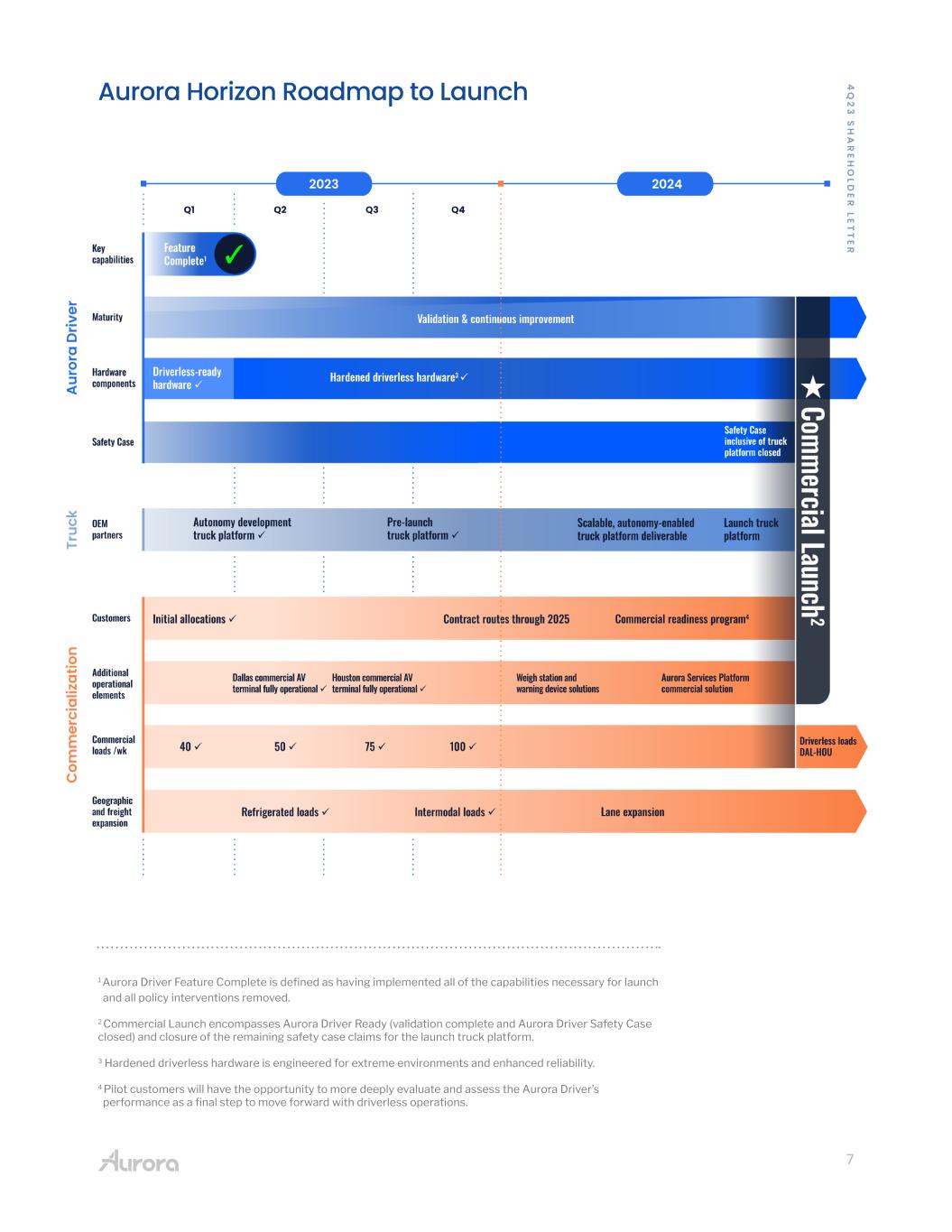

7 4 Q 2 3 S H A R E H O LD E R LE T T E R Aurora Horizon Roadmap to Launch 4 Q 2 3 S H A R E H O LD E R LE T T E R 1 Aurora Driver Feature Complete is defined as having implemented all of the capabilities necessary for launch and all policy interventions removed. 2 Commercial Launch encompasses Aurora Driver Ready (validation complete and Aurora Driver Safety Case closed) and closure of the remaining safety case claims for the launch truck platform. 3 Hardened driverless hardware is engineered for extreme environments and enhanced reliability. 4 Pilot customers will have the opportunity to more deeply evaluate and assess the Aurora Driver’s performance as a final step to move forward with driverless operations.

8 4 Q 2 3 S H A R E H O LD E R LE T T E R Customer contracting in preparation for Commercial Launch As we continue to work toward our planned Commercial Launch, we have made sol- id commercial progress with several of our customers. We have secured contractual commitment on volume and pricing for a portion of our 2024 and 2025 capacity with a mechanism to transition to driverless operations, and have several additional con- tracts nearing execution. Scaling our trucking operations Through our pilot operations, we demonstrate to our customers the value the Aurora Driver can deliver to their networks. During the fourth quarter of 2023, we deepened and expanded our customer relationships. We began autonomously hauling intermod- al trailers for an existing customer and we also launched a new commercial pilot on the Dallas to Houston lane. We now consistently schedule over 100 loads per week with our customers and are logging approximately 25,000 commercial miles weekly. Cumulative to-date 9/23/21 through 1/31/24, we have autonomously delivered (under the supervision of vehicle op- erators) 4,300 loads, driving more than one million commercial miles, with nearly 100% on-time performance for our pilot customers, including FedEx, Werner, Schneider, Hirschbach, and Uber Freight, among others.

9 4 Q 2 3 S H A R E H O LD E R LE T T E R Partnering with Texas law enforcement in preparation for Commercial Launch Our proactive partnership approach also extends to lawmakers, regulators, and law enforcement. To that end, we worked with the Frisco Police Department in Texas during the fourth quarter of 2023 to conduct mock traffic stops on I-45 outside of Dallas to simulate how autonomous trucks can recognize and respond to emergency vehicles. We appreciated their partnership in working toward making Texas roads safer for everyone and we’ll use the feedback from this test to further hone the Aurora Driver’s interactions with emergency vehicles. “Autonomous trucks are growing to be an important part of Texas’ economy and supply chain. The Frisco Police Department appreciates the opportunity to help ensure these vehicles can conduct safe interactions with law enforcement and the communities in which they operate. We’d like to thank Aurora for partnering with our department in this endeavor, and for their transparency during the process.” –OFFICER T. MROZINSKI, FRISCO PD TRAFFIC UNIT - COMMERCIAL MOTOR VEHICLE ENFORCEMENT 4 Q 2 3 S H A R E H O LD E R LE T T E R

10 4 Q 2 3 S H A R E H O LD E R LE T T E R In preparation for Commercial Launch, we are also developing training for law enforcement and other public safety officers on what they should expect while interacting with our driverless trucks and command center specialists. We endeavor to launch the Aurora Driver in close partnership with our public safety officers who will be on the road with our vehicles on a daily basis. We believe this transparent and collaborative approach will continue to foster goodwill in Texas, which is a supportive geography for our Commercial Launch. “Autonomous vehicles are expected to help improve safety, spur economic growth and improve the transportation experience for all Texans.” –TEXAS DEPARTMENT OF TRANSPORTATION (TXDOT)

11 4 Q 2 3 S H A R E H O LD E R LE T T E R Charting our path to scale and profitability In addition to our deep integration with our OEM partners, PACCAR and Volvo Trucks, we also have a long-term, exclusive partnership with Continental to jointly develop, manufacture, and service future generations of the Aurora Driver hardware. This part- nership gives us a path to deploy autonomous trucks at scale, with a cost structure in place intended to support our long-term profitability objectives. In January, Continental and Aurora achieved a key development milestone. We an- nounced the finalization of the design and architecture of the future Aurora Driver hardware generation, inclusive of a new fallback system, that Continental plans to start producing in 2027. We further jointly showcased our work together with an Aurora truck on display at Continental’s exhibit at CES. With the system architecture in hand, Continental will build initial versions of the hardware for testing at its new fa- cility in New Braunfels, Texas, and across its global manufacturing footprint. With Continental’s automotive development and manufacturing expertise, the future Aurora Driver will be designed to deliver customer value for one million miles. And under the Hardware as a Service business model, Aurora will pay for the hardware on a per mile basis; therefore we expect the cost to the customer to purchase an autono- mous truck will be relatively in-line with that of a traditional truck, thereby limiting the capital investment necessary to adopt autonomy in their operations. “Technologies for autonomous mobility present the biggest opportunity to transform driving behavior since the creation of the automobile. Achieving this milestone puts us on a credible path to deploy easy-to-service autonomous trucking systems that customers demand.” -PHILIPP VON HIRSCHHEYDT, EXECUTIVE BOARD MEMBER FOR THE AUTOMOTIVE GROUP SECTOR AT CONTINENTAL

12 4 Q 2 3 S H A R E H O LD E R LE T T E R Looking ahead to 2024 Transparency and proactive external engagement are paramount in a safety-critical industry. At a time when reputations in the autonomous vehicle industry have been tested, we are particularly proud of the culture we have built around safety and integ- rity, which we believe has positioned Aurora as a trusted partner and thought leader in the space. To that end, we are delighted to share that our Chief Safety Officer, Nat Beuse, has been selected to join the newly formed Transforming Transportation Advi- sory Committee of the U.S. Department of Transportation. We expect this committee to play a meaningful role in shaping the future of transportation. Nat’s inclusion un- derscores Aurora’s commitment to responsible innovation in self-driving and we are honored to have such a prominent voice at the federal level. In closing, the tremendous progress we made in 2023 would not have been possible without our world-class team, partners, and investors - thank you for your continued support. We will continue to responsibly drive toward our planned Commercial Launch at the end of 2024 and look forward to keeping you updated throughout this exciting year for Aurora. “The deep expertise and diverse perspectives of this impressive group will provide advice to ensure the future of transportation is safe, efficient, sustainable, equitable, and transformative.” –PETE BUTTIGIEG, UNITED STATES SECRETARY OF TRANSPORTATION ON THE FORMATION OF THE U.S. DEPARTMENT OF TRANSPORTATION’S TRANSFORMING TRANSPORTATION ADVISORY COMMITTEE Chris Urmson CEO & Co-founder

13 4 Q 2 3 S H A R E H O LD E R LE T T E R From the desk of our CFO During the fourth quarter of 2023, we continued to demonstrate strong fiscal disci- pline while executing toward our Aurora Driver Ready milestone and planned Com- mercial Launch. Fourth quarter 2023 operating expenses, including stock-based compensation (SBC), totaled $198 million. Excluding SBC of $37 million, operating expenses totaled $161 million, reflecting $138 million in R&D, primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technolo- gy, and $23 million in SG&A. With the Aurora Driver in the final phase of refinement and validation for the launch lane, and all revenue under the collaboration framework agreement with Toyota pre- viously recognized, we did not record any revenue during the fourth quarter of 2023. We used approximately $133 million in operating cash during the fourth quarter of 2023 and capital expenditures totaled $4 million. This cash spend was significantly below our target of $175 - $185 million per quarter on average, reflecting one less payroll cycle in the quarter and our continued commitment to financial discipline. In 2024, we continue to expect quarterly cash use of $175 - $185 million, on average, which reflects an increase in capital expenditures relative to 2023 as we prepare for Commercial Launch. We ended the fourth quarter with a very strong balance sheet, including over $1.3 billion in cash & short-term and long-term investments. We continue to expect this liquidity to support our planned Commercial Launch and fund our operations into the second half of 2025. David Maday CFO

14 4 Q 2 3 S H A R E H O LD E R LE T T E R Cautionary Statement Regarding Forward-Looking Statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking state- ments, including but not limited to, those statements around our ability to achieve cer- tain milestones around, and realize the potential benefits of, the development, man- ufacturing, scaling, and commercialization of the Aurora Driver and related services, including relationships and anticipated benefits with partners and customers, and on the timeframe we expect or at all, the regulatory tailwinds and framework in which we operate, and our expected cash runway and our ability to complete any opportunistic fundraising opportunities. These statements are based on management’s current as- sumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, per- formance or achievements to be materially different from any future results, perfor- mance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified un- der the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on November 2, 2023, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. See our Current Report on Form 8-K filed on July 18, 2023 for key forecast assumptions and estimates underlying certain of our financial projections. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora under- takes no obligation to update forward-looking statements to reflect future events or circumstances.

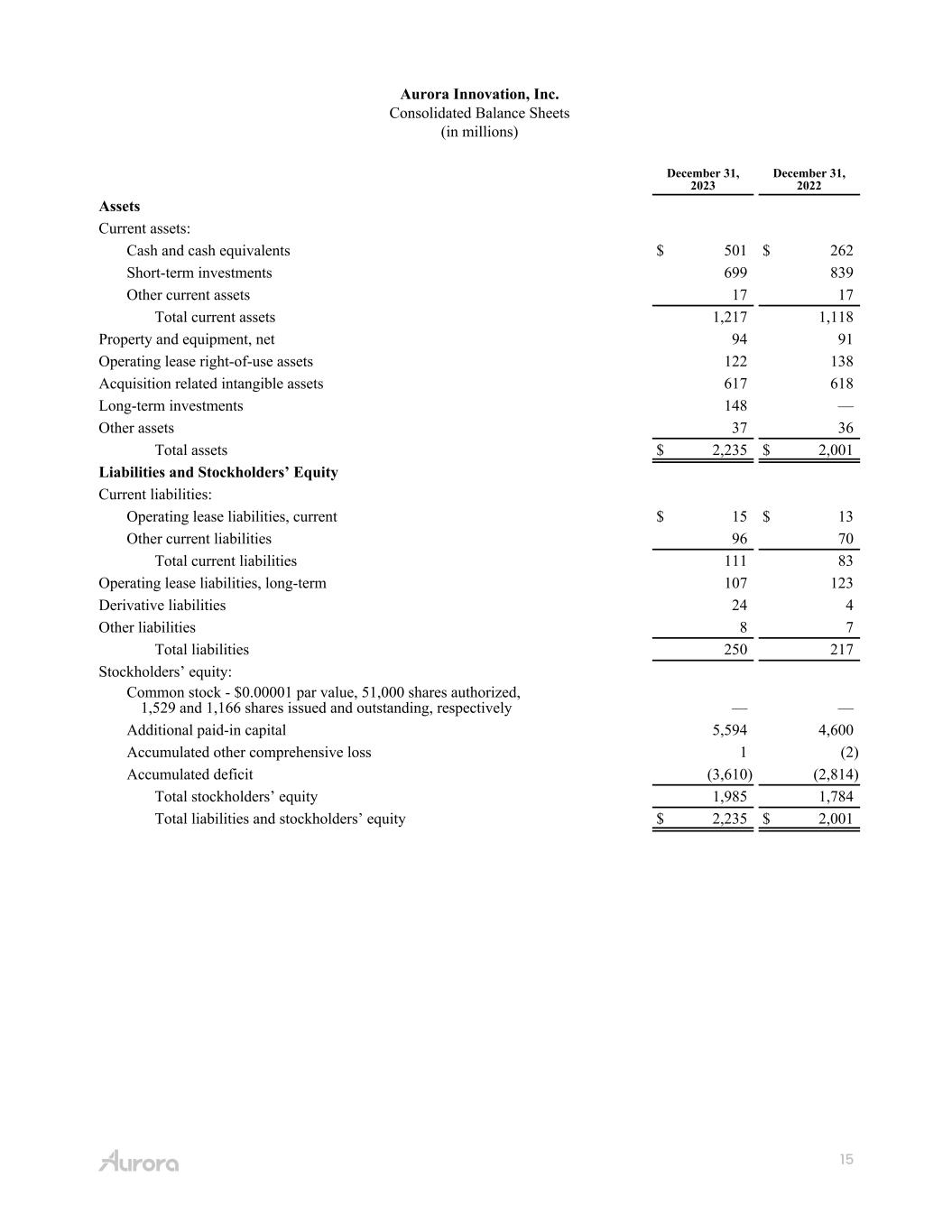

15 Aurora Innovation, Inc. Consolidated Balance Sheets (in millions) December 31, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 501 $ 262 Short-term investments 699 839 Other current assets 17 17 Total current assets 1,217 1,118 Property and equipment, net 94 91 Operating lease right-of-use assets 122 138 Acquisition related intangible assets 617 618 Long-term investments 148 — Other assets 37 36 Total assets $ 2,235 $ 2,001 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 15 $ 13 Other current liabilities 96 70 Total current liabilities 111 83 Operating lease liabilities, long-term 107 123 Derivative liabilities 24 4 Other liabilities 8 7 Total liabilities 250 217 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,529 and 1,166 shares issued and outstanding, respectively — — Additional paid-in capital 5,594 4,600 Accumulated other comprehensive loss 1 (2) Accumulated deficit (3,610) (2,814) Total stockholders’ equity 1,985 1,784 Total liabilities and stockholders’ equity $ 2,235 $ 2,001

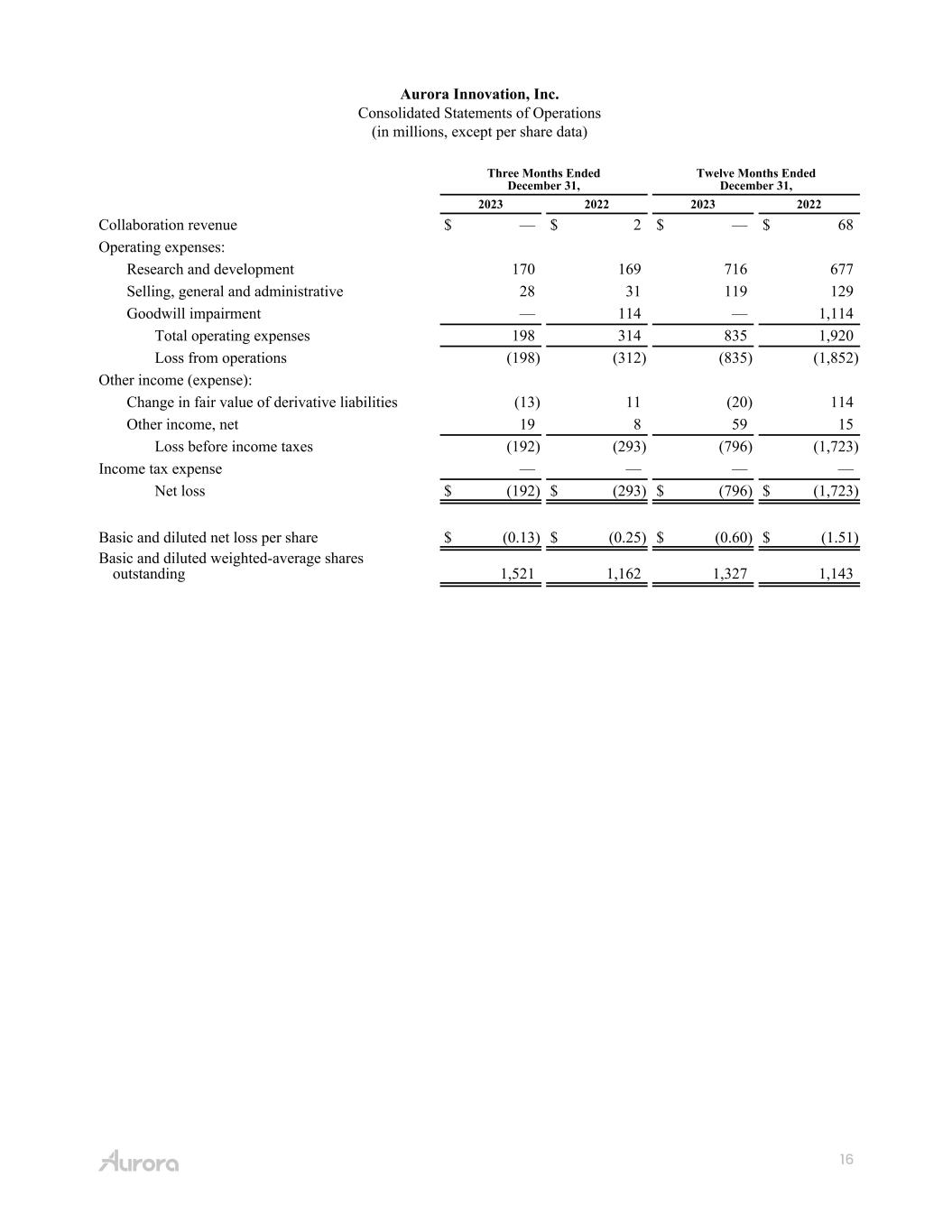

16 Aurora Innovation, Inc. Consolidated Statements of Operations (in millions, except per share data) Three Months Ended December 31, Twelve Months Ended December 31, 2023 2022 2023 2022 Collaboration revenue $ — $ 2 $ — $ 68 Operating expenses: Research and development 170 169 716 677 Selling, general and administrative 28 31 119 129 Goodwill impairment — 114 — 1,114 Total operating expenses 198 314 835 1,920 Loss from operations (198) (312) (835) (1,852) Other income (expense): Change in fair value of derivative liabilities (13) 11 (20) 114 Other income, net 19 8 59 15 Loss before income taxes (192) (293) (796) (1,723) Income tax expense — — — — Net loss $ (192) $ (293) $ (796) $ (1,723) Basic and diluted net loss per share $ (0.13) $ (0.25) $ (0.60) $ (1.51) Basic and diluted weighted-average shares outstanding 1,521 1,162 1,327 1,143

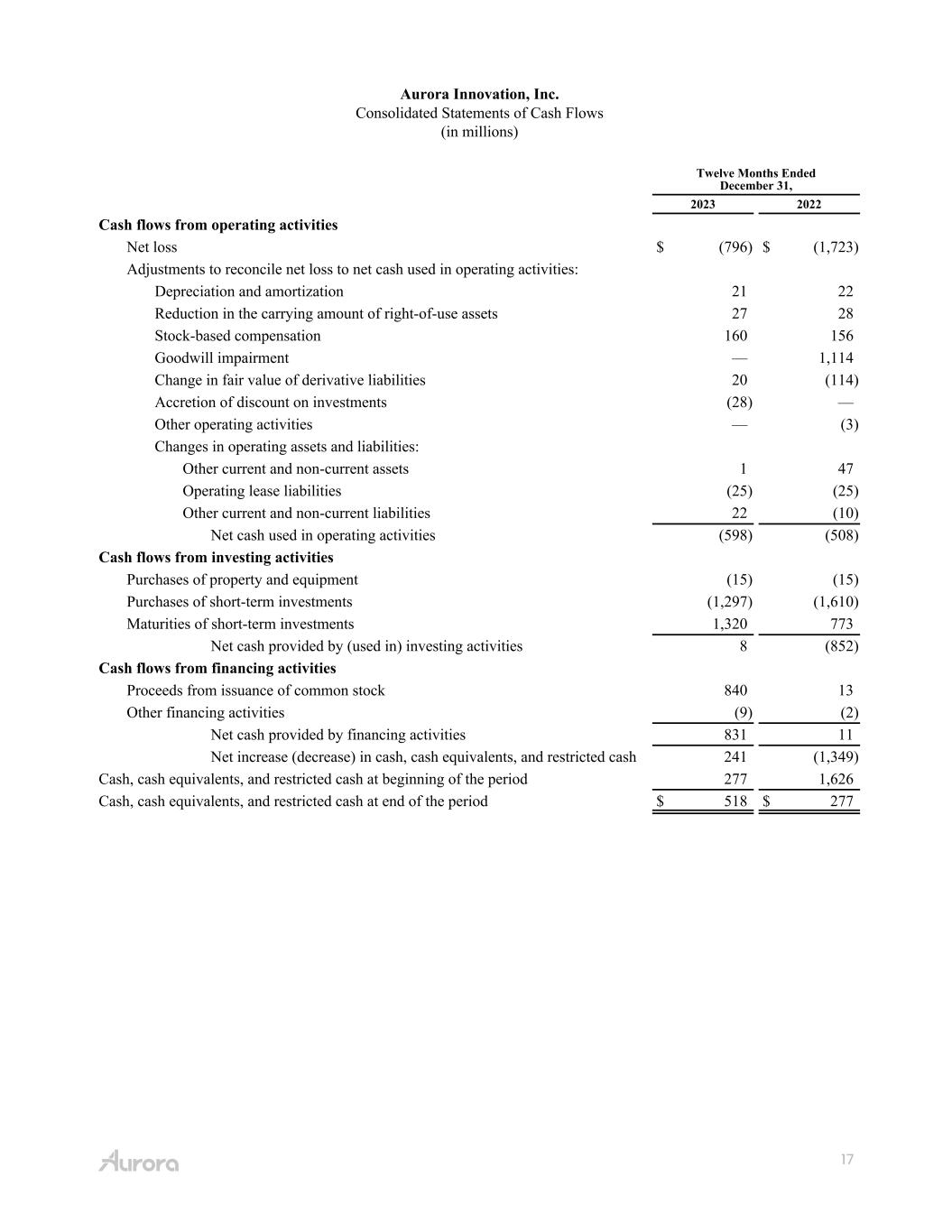

17 Aurora Innovation, Inc. Consolidated Statements of Cash Flows (in millions) Twelve Months Ended December 31, 2023 2022 Cash flows from operating activities Net loss $ (796) $ (1,723) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 21 22 Reduction in the carrying amount of right-of-use assets 27 28 Stock-based compensation 160 156 Goodwill impairment — 1,114 Change in fair value of derivative liabilities 20 (114) Accretion of discount on investments (28) — Other operating activities — (3) Changes in operating assets and liabilities: Other current and non-current assets 1 47 Operating lease liabilities (25) (25) Other current and non-current liabilities 22 (10) Net cash used in operating activities (598) (508) Cash flows from investing activities Purchases of property and equipment (15) (15) Purchases of short-term investments (1,297) (1,610) Maturities of short-term investments 1,320 773 Net cash provided by (used in) investing activities 8 (852) Cash flows from financing activities Proceeds from issuance of common stock 840 13 Other financing activities (9) (2) Net cash provided by financing activities 831 11 Net increase (decrease) in cash, cash equivalents, and restricted cash 241 (1,349) Cash, cash equivalents, and restricted cash at beginning of the period 277 1,626 Cash, cash equivalents, and restricted cash at end of the period $ 518 $ 277

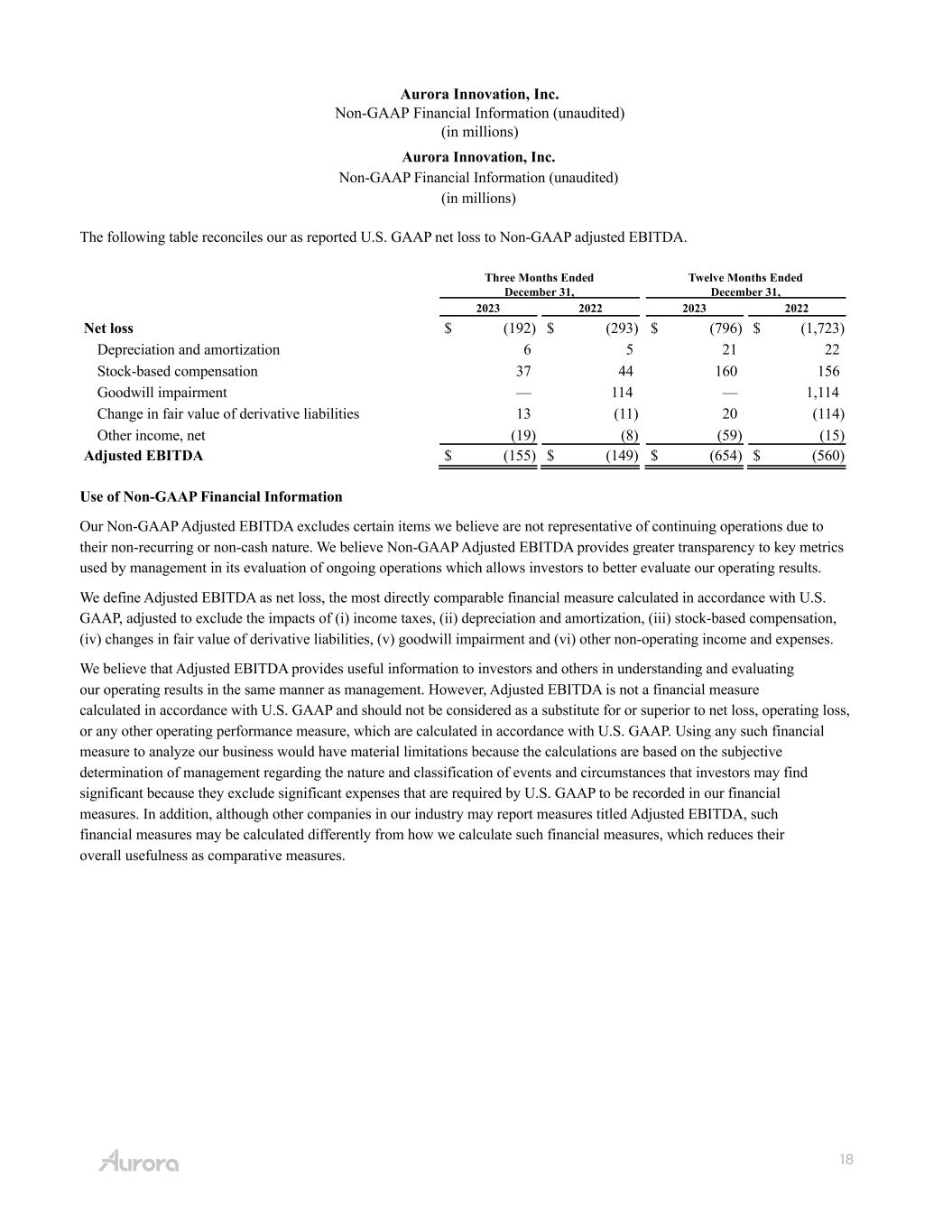

18 Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended December 31, Twelve Months Ended December 31, 2023 2022 2023 2022 Net loss $ (192) $ (293) $ (796) $ (1,723) Depreciation and amortization 6 5 21 22 Stock-based compensation 37 44 160 156 Goodwill impairment — 114 — 1,114 Change in fair value of derivative liabilities 13 (11) 20 (114) Other income, net (19) (8) (59) (15) Adjusted EBITDA $ (155) $ (149) $ (654) $ (560) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. We believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze our business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in our financial measures. In addition, although other companies in our industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how we calculate such financial measures, which reduces their overall usefulness as comparative measures. Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended December 31, Twelve Months Ended December 31, 2023 2022 2023 2022 Net loss $ (192) $ (293) $ (796) $ (1,723) Depreciation and amortization 5 5 21 22 Stock-based compensation 37 44 160 156 Goodwill impairment — 114 — 1,114 Chang in fair value of derivative liabilities 13 (11) 20 (114) Other income, net (19) (8) (59) (15) Adjuste EBITDA $ (156) $ ( 9) $ (654) $ (560) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of deriv ve liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. Aurora believes that Adjusted EBITDA provides useful infor ation to i vestors and others in un erstanding and evaluating Aurora’s operating results in the same manner as anagement. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determinatio of managem nt regarding the nature and classification of ev nts and circums ances that investo s may find signific nt bec use they xclude significant expenses tha are required by U.S. GAAP t be recorded in Aur ra’s fin ncia measures. In addition, although other companies in Aurora’s industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures. Consolidated Statements of Cash Flows Twelve Months Ended December 31, 2023 2022 Cash flows from operating activities Net loss $ (796) $ (1,723) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 21 22 Reduction in the carrying amount of right-of-use assets 27 28 Stock-based compensation 160 156 Goodwill impairment — 1,114 Change in fair value of derivative liabilities 20 (114) Accretion of discount on investments (28) — Other operating activities — (3) Changes in operating assets and liabilities: Other current and non-current assets 1 47 Operating lease liabilities (25) (25) Other current and non-current liabilities 22 (10) Net cash used in operating activities (598) (508) Cash flows from investing activities Purchases of property and equipment (15) (15) Purchases of short-term investments (1,297) (1,610) Maturities of short-term investments 1,320 773 Net cash provided by (used in) investing activities 8 (852) Cash flows from financing activit es Proceed from issuanc of common s ock 840 13 Other financing activities (9) (2) Net cash provided by financing activities 831 11 Net increase (decrease) in cash, cash equivalents, and restricted cash 241 (1,349) Cash, cash equivalents, and restricted cash at beginning of the period 277 1,626 Cash, cash equivalents, and restricted cash at end of the period $ 518 $ 277