EX-99.2

Published on March 14, 2024

© 2024 | Aurora Proprietary 1 2024 Analyst & Investor Day Exhibit 99.2

© 2024 | Aurora Proprietary 2 Watch video ▸

© 2024 | Aurora Proprietary 3 This presentation contains certain forward-looking statements within the meaning of the federal securities laws. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “potentially,” “likely,” “illustrative,” “indicative,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited, to those statements around: our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufacturing, scaling, and commercialization of the Aurora Driver, related services and technology, and on the timeframe we expect or at all; the market opportunity, utilization rates and profitability of our products and services, including the serviceable addressable market for the Aurora Driver; our business model and aspects of our commercial operations following commercial launch; the potential savings and opportunities our products and services may offer current and future customers, including the anticipated unit economic of driver as a service, the associated expected gross profit and long-term gross margin and positive free cash flow; the regulatory environment for the Aurora Driver; and our expected cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In addition, statements that “we believe” and similar statements reflect management’s beliefs and opinions on the relevant subject. These statements are based upon information known to us as of the date of this presentation, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements. For factors that could cause actual results to differ materially from the forward-looking statements in this presentation, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 15, 2024, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this presentation. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances. This presentation also contains statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information may be based on many assumptions and limitations, and you are cautioned not to give undue weight to such information. Aurora’s projected uses of cash is based upon assumptions including research and development and general and administrative activities, as well as capital expenses and working capital. We have not independently verified the accuracy or completeness of the data contained in the industry publications and other publicly available information. Aurora does not undertake to update such data after the date of this presentation. All third-party logos appearing in this presentation are trademarks or registered trademarks of their respective holders. Any such appearance does not necessarily imply any affiliation with or endorsement of Aurora. Cautionary statement regarding forward-looking statements

© 2024 | Aurora Proprietary 4 This presentation makes reference to free cash flow, a non-GAAP financial measure. Free cash flow is defined as net cash provided by operating activities, the most directly comparable financial measure calculated in accordance with GAAP, less purchases of property and equipment. Aurora believes that free cash flow is a meaningful indicator of liquidity to management and investors that provides information about the amount of cash generated from our operations that, after the investments in property and equipment, can be used for strategic initiatives. Aurora believes that free cash flow provides useful information to investors and others in understanding and evaluating Aurora’s operating results in the same manner as management. However, free cash flow is not a financial measure calculated in accordance with GAAP and should not be considered as a substitute for or superior to net cash provided in operations or any other operating performance measure which is calculated in accordance with GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant and because they exclude significant expenses that are required by GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in Aurora’s industry may report measures titled free cash flow or similar measures, such financial measures may be calculated differently from how Aurora calculates such financial measures, which reduces their overall usefulness as comparative measures. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Because of these limitations, you should consider free cash flow alongside other financial performance measures, including net cash flow from operations and other financial results presented in accordance with applicable accounting standards. Use of Non-GAAP Financial Information

© 2024 | Aurora Proprietary 5 Welcome & opening [Chris] Deliver the benefits of self-driving technology safely, quickly, and broadly O U R M I S S I O N

© 2024 | Aurora Proprietary 6 Aurora is in the pole position for autonomous trucking Only player with strategic partnerships to enable commercialization at scale Trucking is a massive market Competitive landscape has cleared significantly providing an open playing field Aurora Driver can unlock tremendous value for customers Driver as a Service (DaaS) business model supports anticipated capital efficient shareholder value creation Liquidity to fund operations beyond expected Commercial Launch

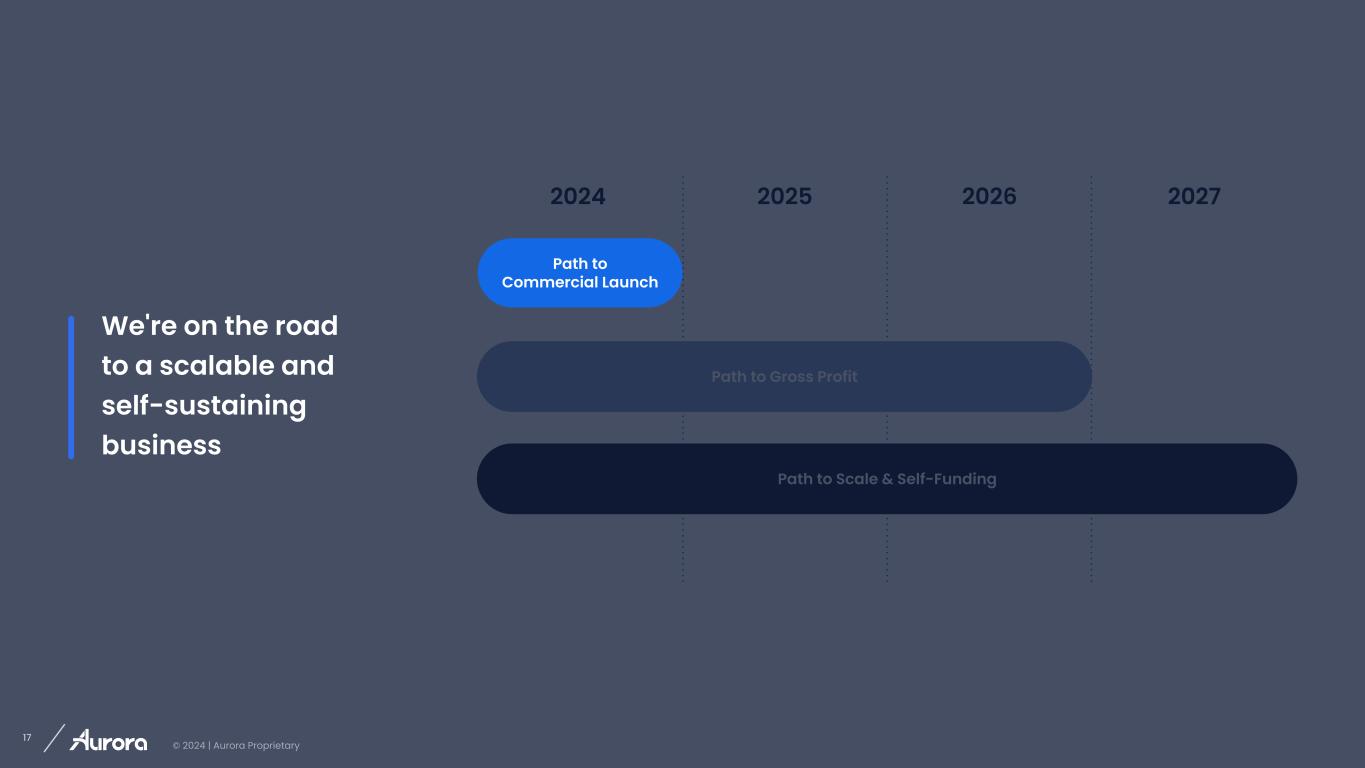

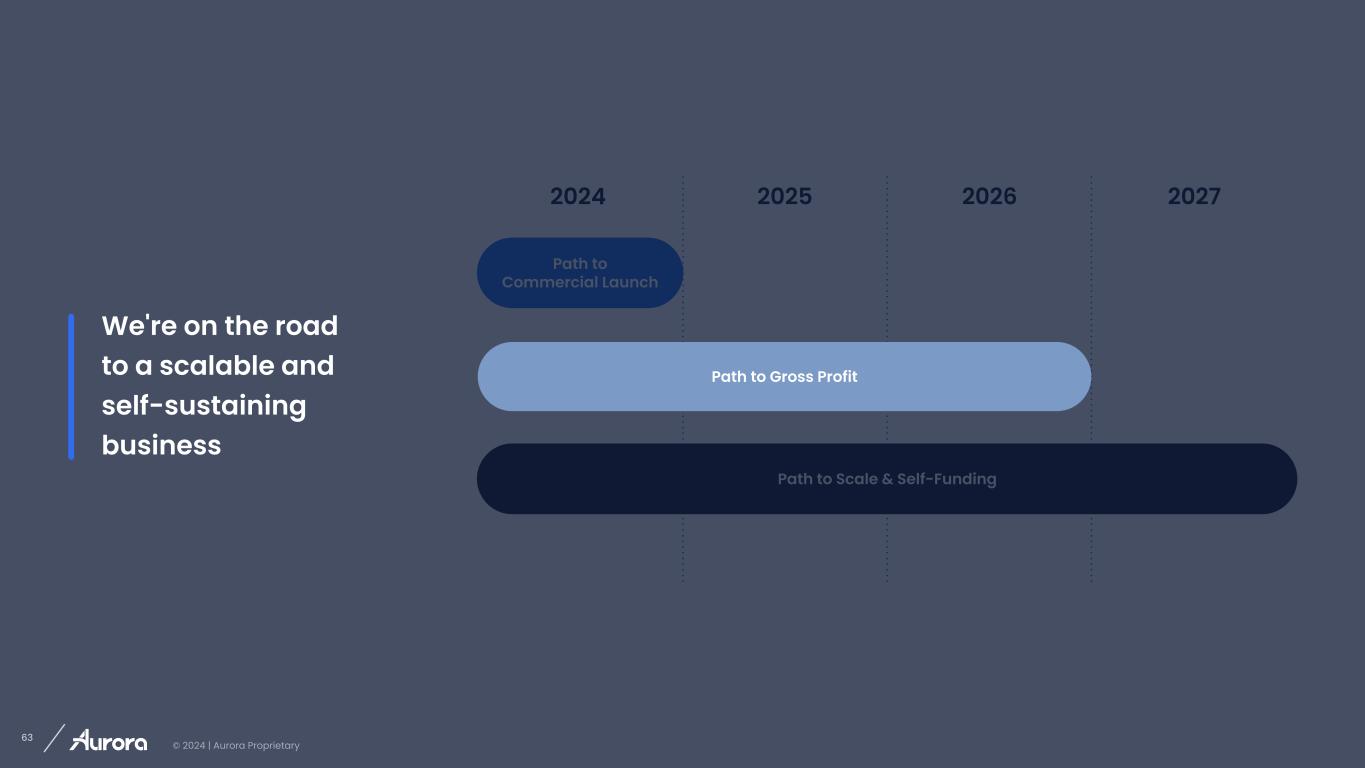

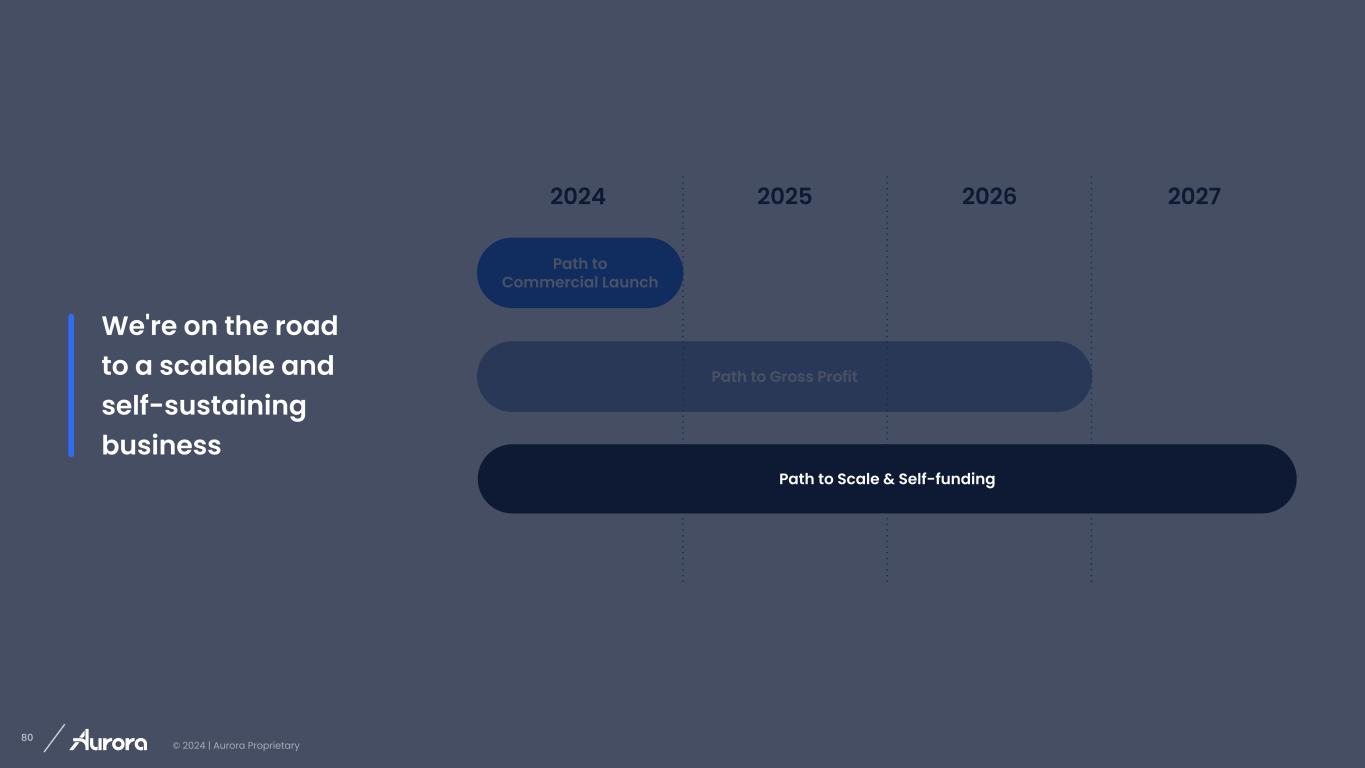

© 2024 | Aurora Proprietary 7 2025 2026 20272024 We're on the road to a scalable and self-sustaining business Path to Gross Profit Path to Scale & Self-Funding Path to Commercial Launch f

© 2024 | Aurora Proprietary 8 We’re building the Aurora Driver around a common core to power various vehicles in multiple use cases—trucking is our first focus

© 2024 | Aurora Proprietary 9 We’re designing our autonomous trucking product to address the industry’s primary pain points

© 2024 | Aurora Proprietary 10 Frequency of major collisions >>> Safer operation Industry pain point The Aurora Driver will provide

© 2024 | Aurora Proprietary 11 Driver shortage and high turnover Industry pain point >>> Scalable; stable driver supply The Aurora Driver will provide

© 2024 | Aurora Proprietary 12 Hours of service limitations Industry pain point >>> Higher utilization; faster freight The Aurora Driver will provide

© 2024 | Aurora Proprietary 13 High fuel costs Industry pain point >>> Ability to reduce fuel use and emissions The Aurora Driver will provide

© 2024 | Aurora Proprietary 14 High insurance costs Industry pain point >>> Safer operation; more data for fault attribution The Aurora Driver will provide

© 2024 | Aurora Proprietary 15 ~$1 trillion U.S.1 ~$4 trillion Global2 Sources: (1) A.T. Kearney State of Logistics, 2022; (2) Armstrong & Associates, Global Third Party Logistics, 2019 Trucking is a massive market With attractive unit economics and significant need for this technology

© 2024 | Aurora Proprietary 16 Best in Class OEM Partners Industry-Leading Fleet Service Partner Industry-Leading Logistics Companies Pioneering Hardware as a Service Partner Autonomous Solutions Our strong, strategic relationships support our path to commercialization and scale in trucking

© 2024 | Aurora Proprietary 17 Path to Scale & Self-Funding Path to Gross Profit 2025 We're on the road to a scalable and self-sustaining business 2026 20272024 Path to Commercial Launch

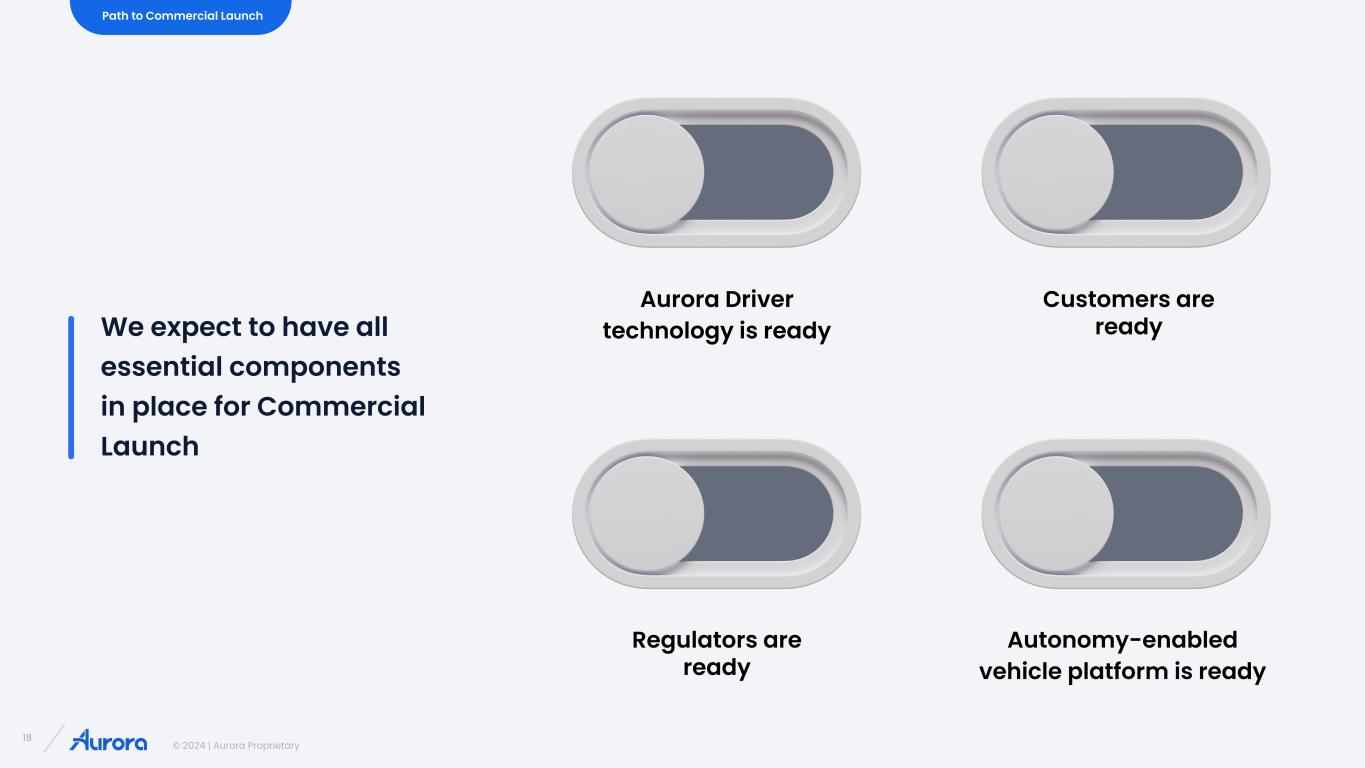

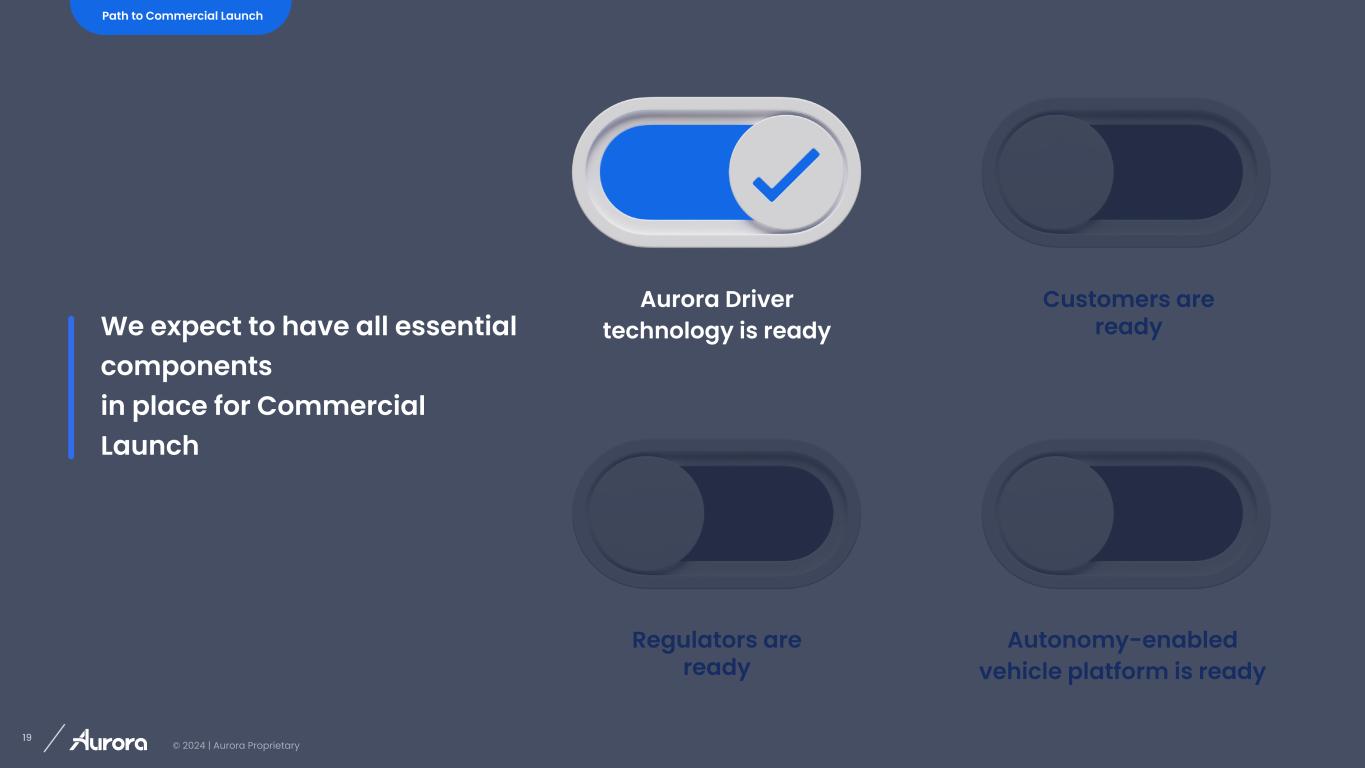

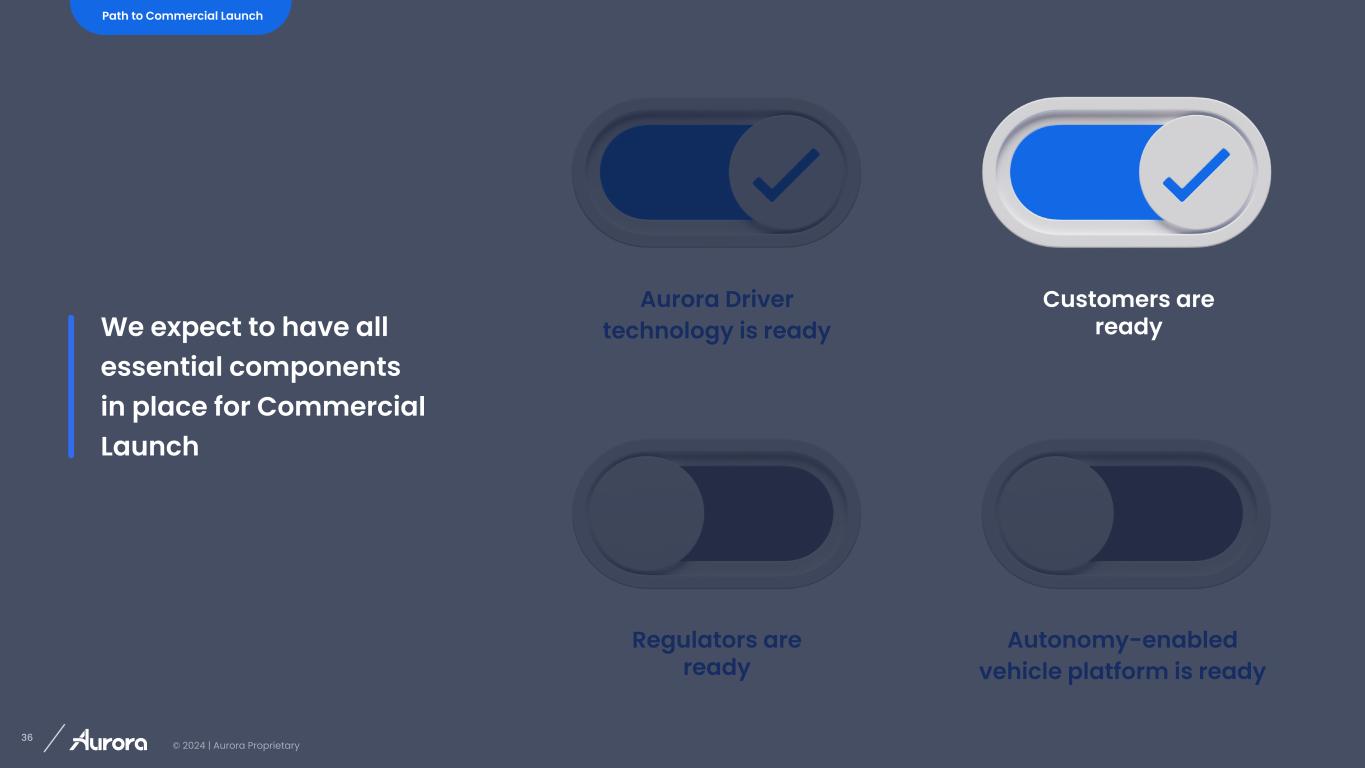

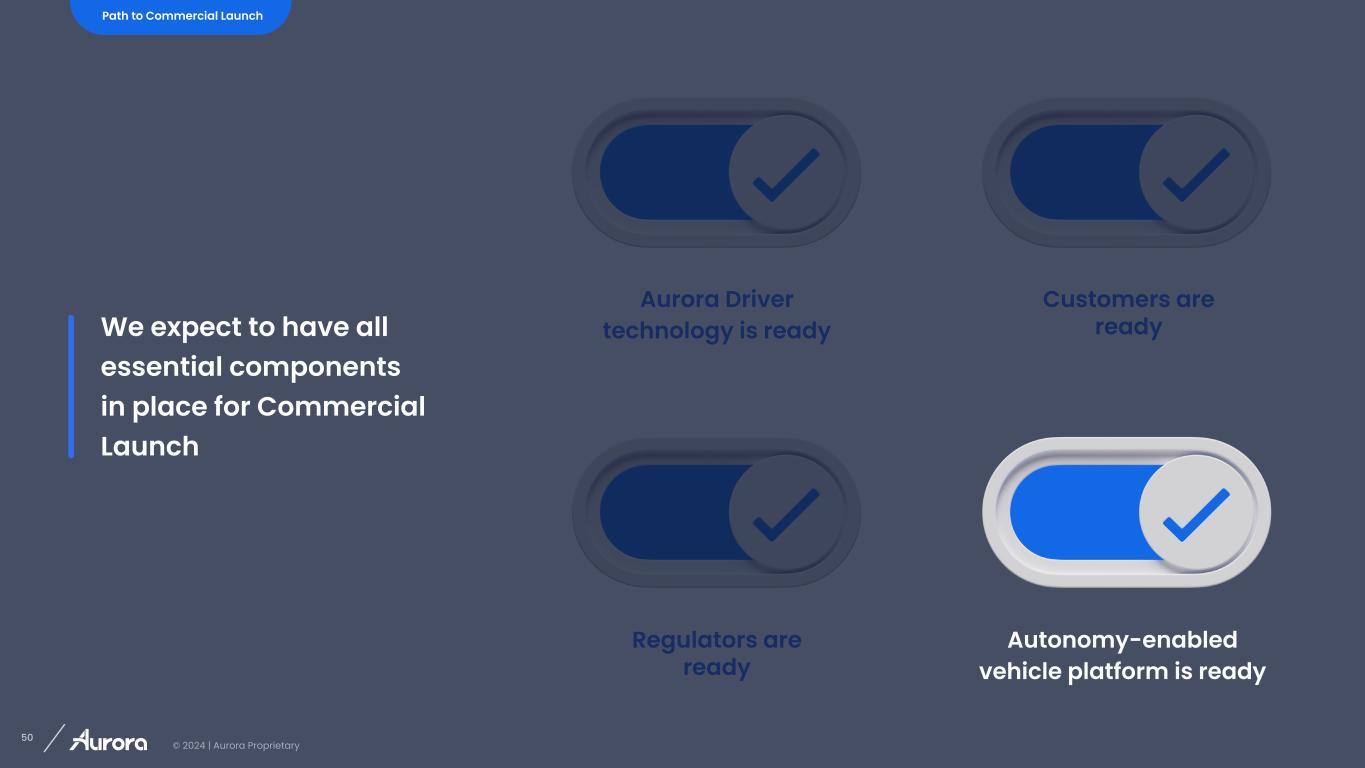

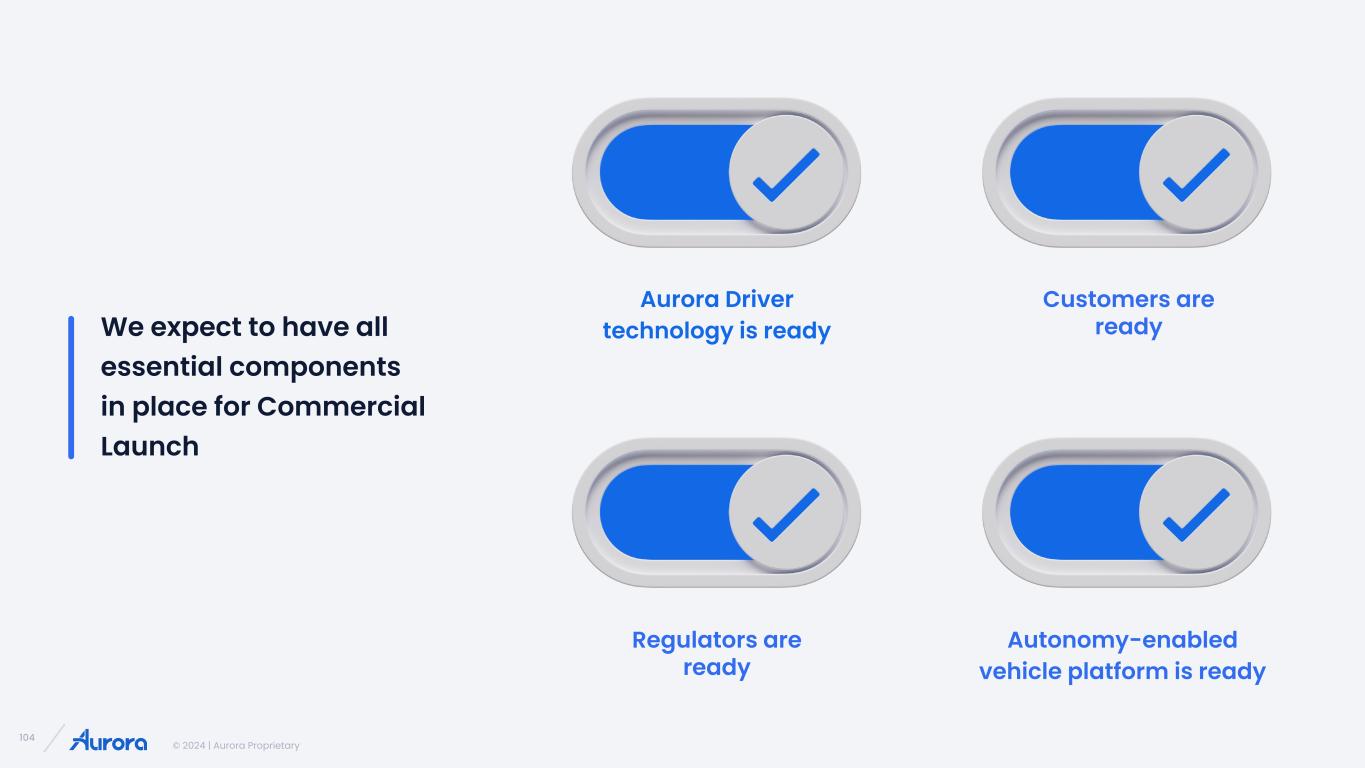

© 2024 | Aurora Proprietary 18 Aurora Driver technology is ready Customers are ready Regulators are ready Autonomy-enabled vehicle platform is ready Path to Commercial Launch We expect to have all essential components in place for Commercial Launch

© 2024 | Aurora Proprietary 19 Customers are ready Regulators are ready Autonomy-enabled vehicle platform is ready Path to Commercial Launch Aurora Driver technology is readyWe expect to have all essential components in place for Commercial Launch

© 2024 | Aurora Proprietary 20 The Aurora Driver’s performance is impressive in both nominal driving and complex scenarios Path to Commercial Launch

© 2024 | Aurora Proprietary 21 Watch video ▸

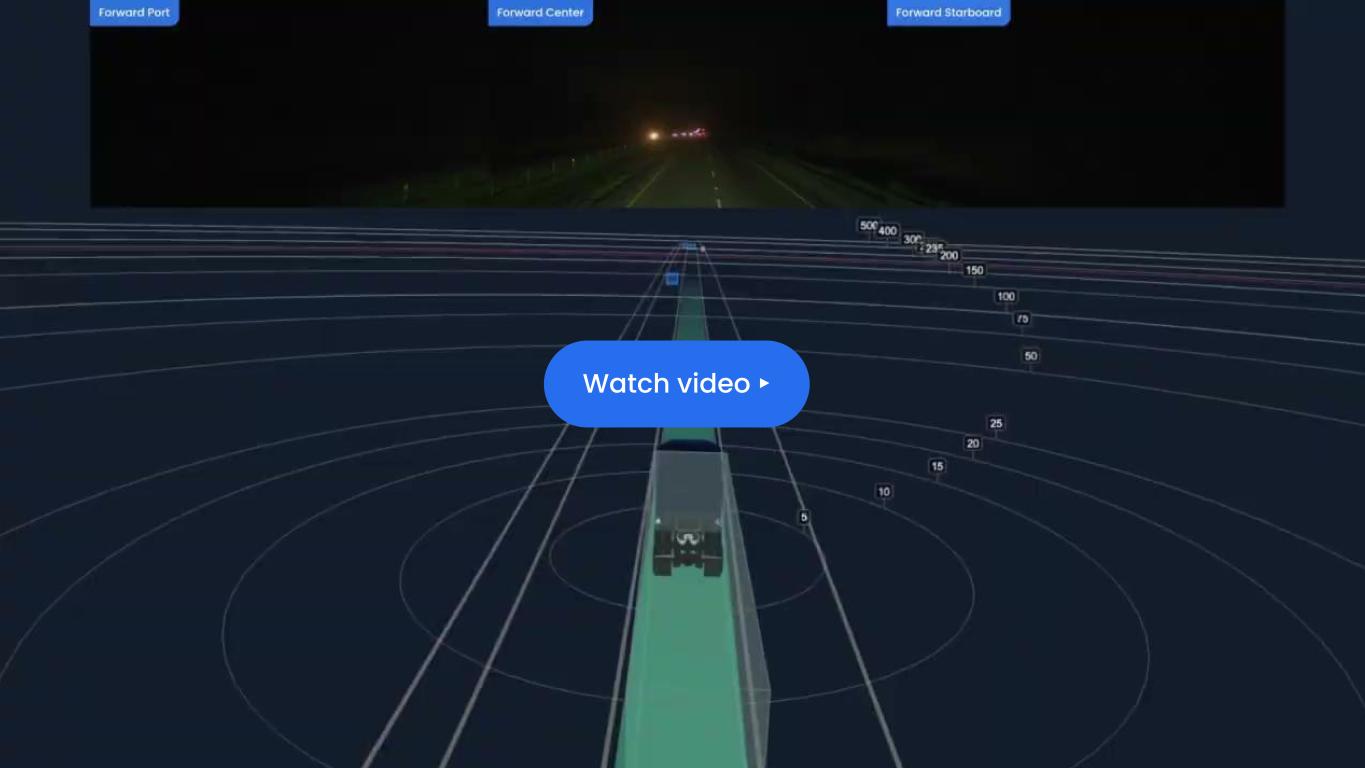

© 2024 | Aurora Proprietary 22 This performance is underscored by the increases we have seen in the Autonomy Performance Indicator (API) Autonomy Performance Indicator (API) % o f M ile s Q1 ‘23 Q2 ‘23 Q3 ‘23 Q4 ‘23 99%98%97%96% Path to Commercial Launch

© 2024 | Aurora Proprietary 23 Q1 ‘23 Q2 ‘23 Q3 ‘23 Q4 ‘23 62%61% 48% 32% Path to Commercial Launch Q4 ‘24 Commercial Launch Estimate In 2024, we will focus on driving up the percentage of 100% API loads 100% API Loads % o f L oa ds

© 2024 | Aurora Proprietary 24

© 2024 | Aurora Proprietary 25 We will know that the Aurora Driver is acceptably safe to launch on the Dallas to Houston lane when we have a closed Safety Case Path to Commercial Launch Top level claim Aurora’s self-driving vehicles are acceptably safe to operate on public roads Proficient Fail-Safe Continuously ImprovingResilient Trustworthy Safety Case Framework

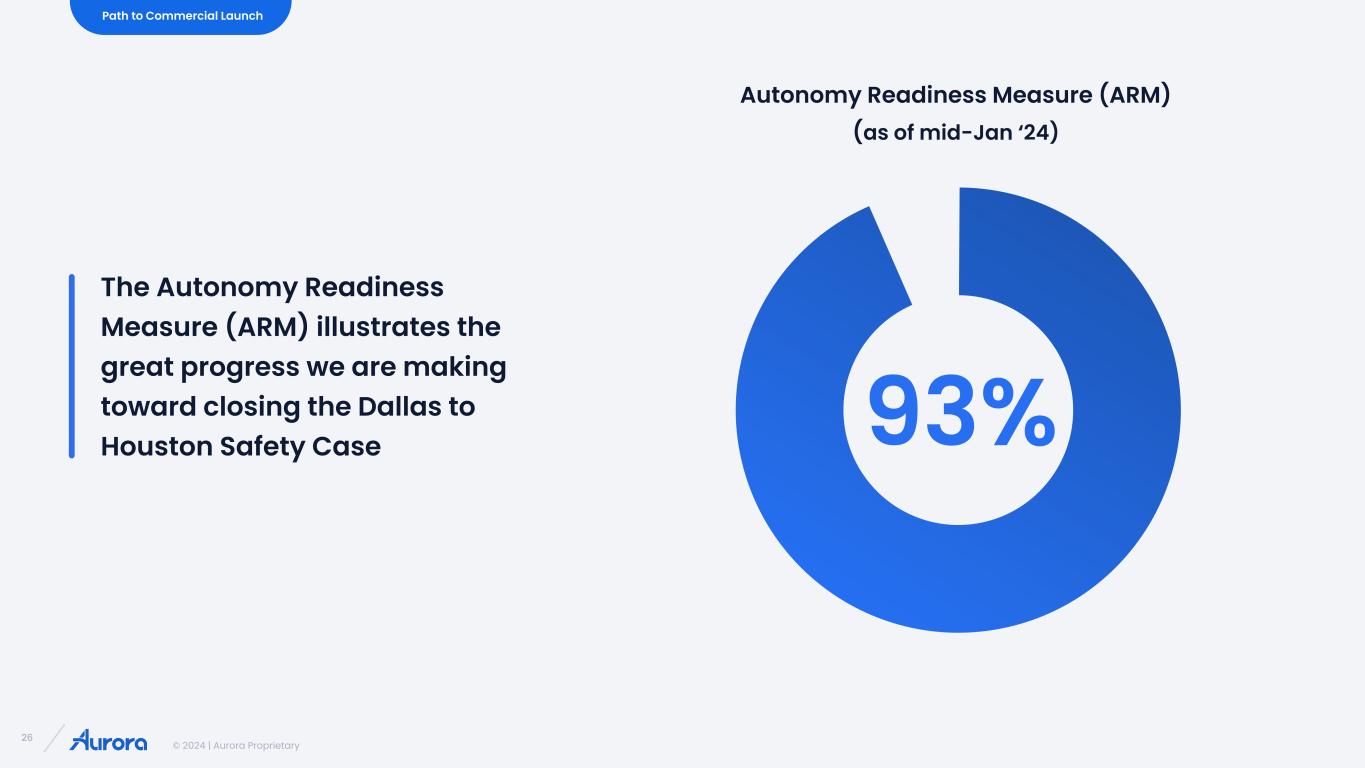

© 2024 | Aurora Proprietary 26 93% The Autonomy Readiness Measure (ARM) illustrates the great progress we are making toward closing the Dallas to Houston Safety Case Autonomy Readiness Measure (ARM) (as of mid-Jan ‘24) Path to Commercial Launch

© 2024 | Aurora Proprietary 27 Our validation framework is the key element supporting the closing of the remaining software Safety Case claims Path to Commercial Launch

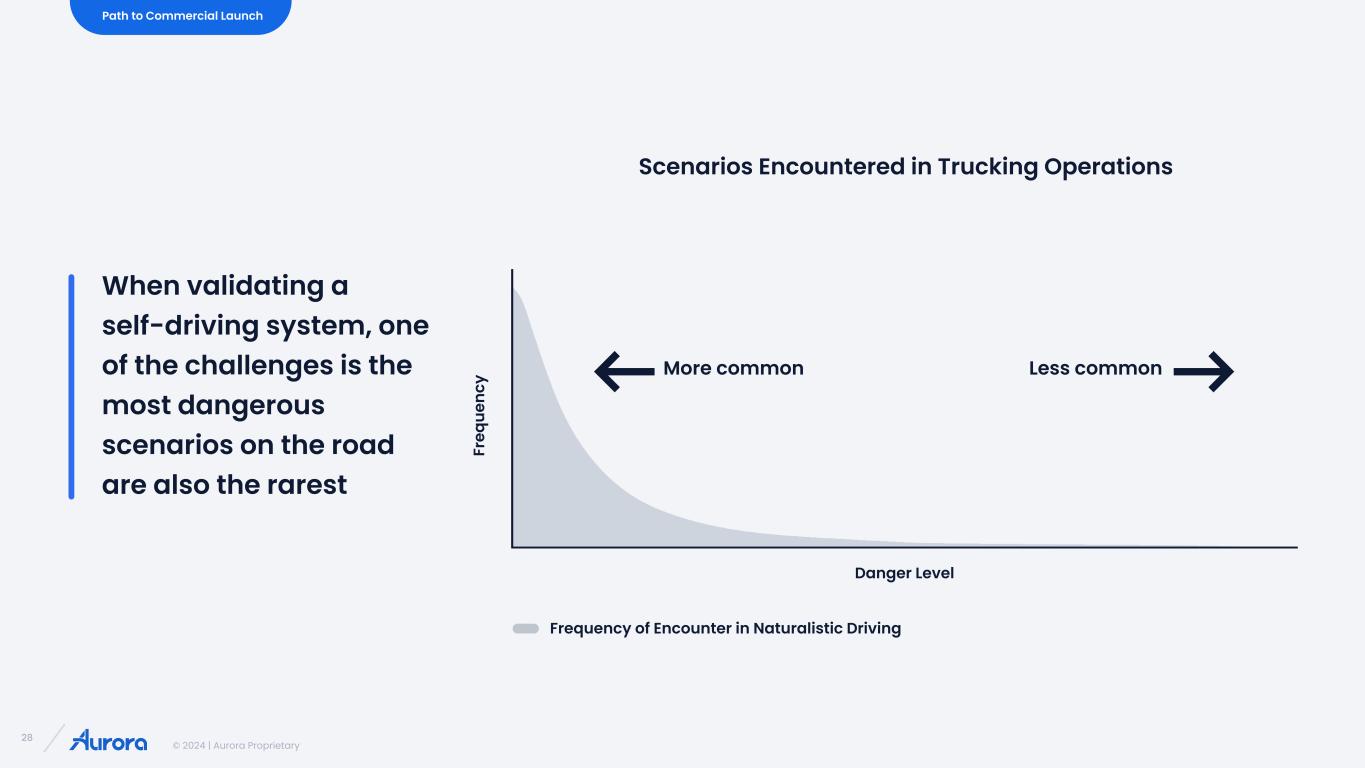

© 2024 | Aurora Proprietary 28 When validating a self-driving system, one of the challenges is the most dangerous scenarios on the road are also the rarest Path to Commercial Launch More common Less common Scenarios Encountered in Trucking Operations Fr eq ue nc y Danger Level Frequency of Encounter in Naturalistic Driving

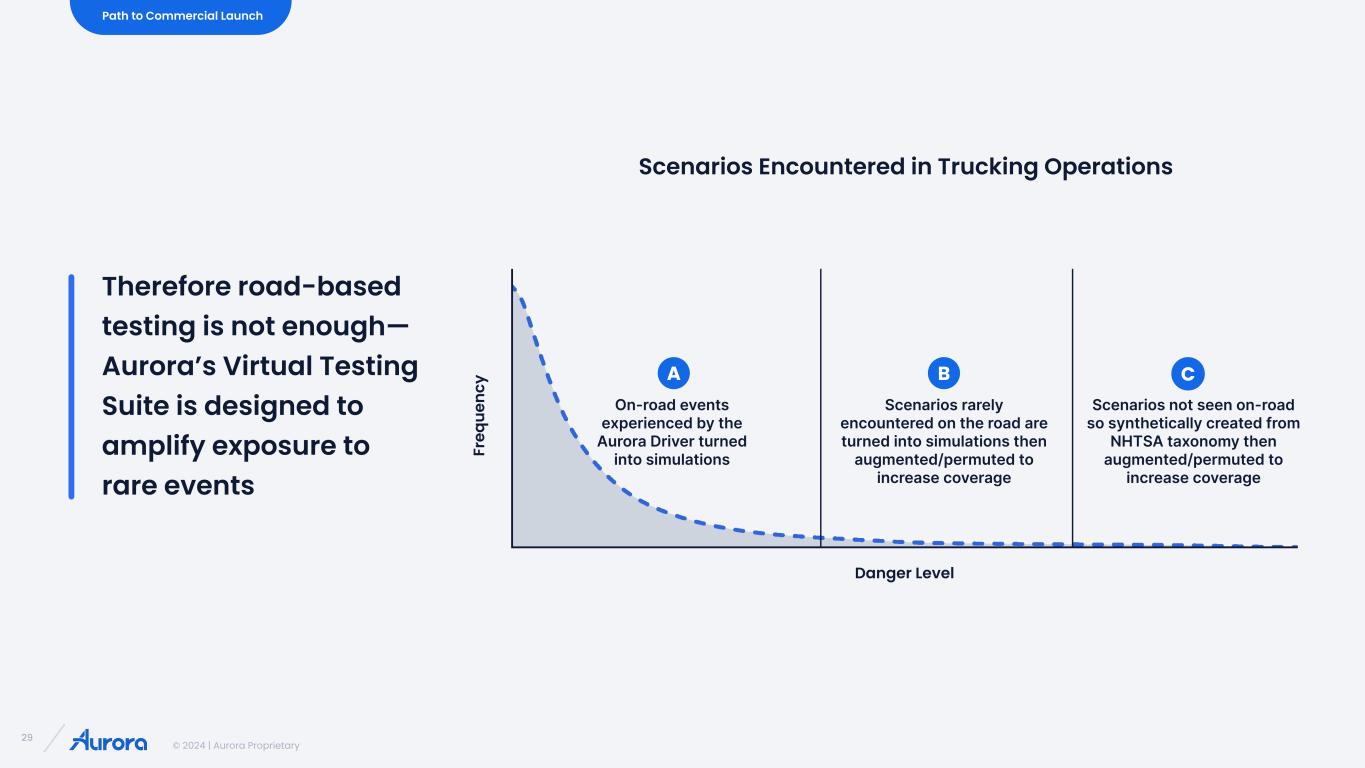

© 2024 | Aurora Proprietary 29 Scenarios rarely encountered on the road are turned into simulations then augmented/permuted to increase coverage On-road events experienced by the Aurora Driver turned into simulations Scenarios not seen on-road so synthetically created from NHTSA taxonomy then augmented/permuted to increase coverage A B C Therefore road-based testing is not enough— Aurora’s Virtual Testing Suite is designed to amplify exposure to rare events Path to Commercial Launch Fr eq ue nc y Danger Level Scenarios Encountered in Trucking Operations

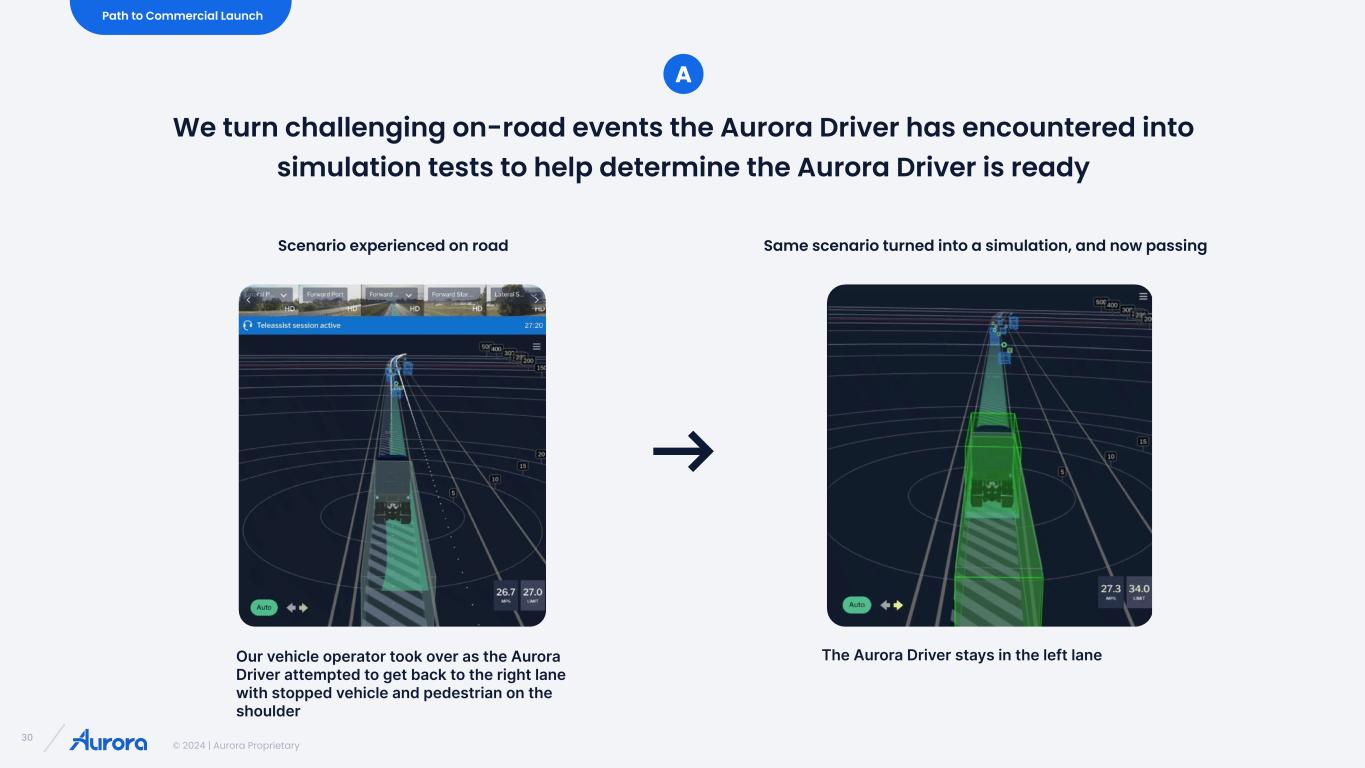

© 2024 | Aurora Proprietary 30 Our vehicle operator took over as the Aurora Driver attempted to get back to the right lane with stopped vehicle and pedestrian on the shoulder The Aurora Driver stays in the left lane A We turn challenging on-road events the Aurora Driver has encountered into simulation tests to help determine the Aurora Driver is ready Path to Commercial Launch Scenario experienced on road Same scenario turned into a simulation, and now passing

© 2024 | Aurora Proprietary 31 For scenarios rarely encountered on the road, we create variations of these encounters to further challenge the Aurora Driver’s performance B Path to Commercial Launch Rare on-road event Create durable simulations Permute simulations to augment coverage

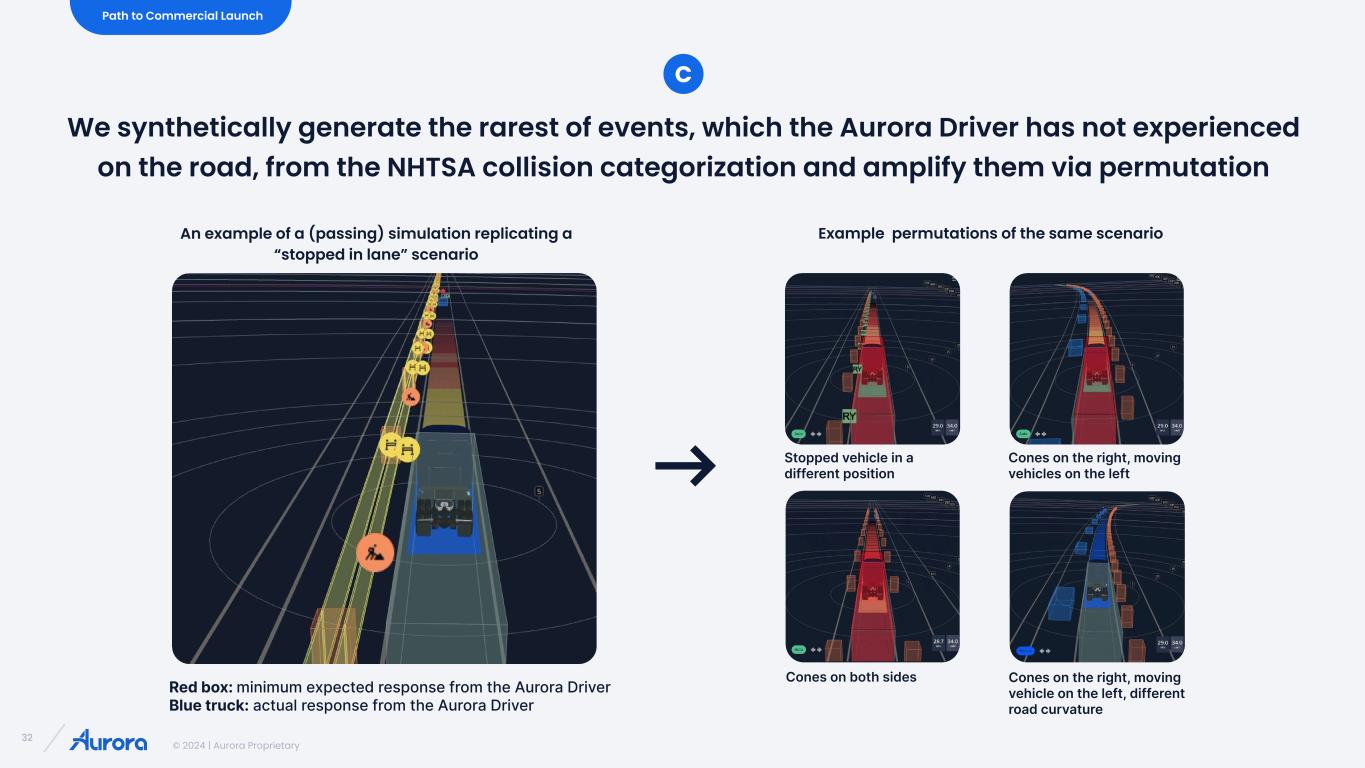

© 2024 | Aurora Proprietary 32 An example of a (passing) simulation replicating a “stopped in lane” scenario Red box: minimum expected response from the Aurora Driver Blue truck: actual response from the Aurora Driver Example permutations of the same scenario Stopped vehicle in a different position Cones on the right, moving vehicles on the left Cones on both sides Cones on the right, moving vehicle on the left, different road curvature We synthetically generate the rarest of events, which the Aurora Driver has not experienced on the road, from the NHTSA collision categorization and amplify them via permutation C Path to Commercial Launch

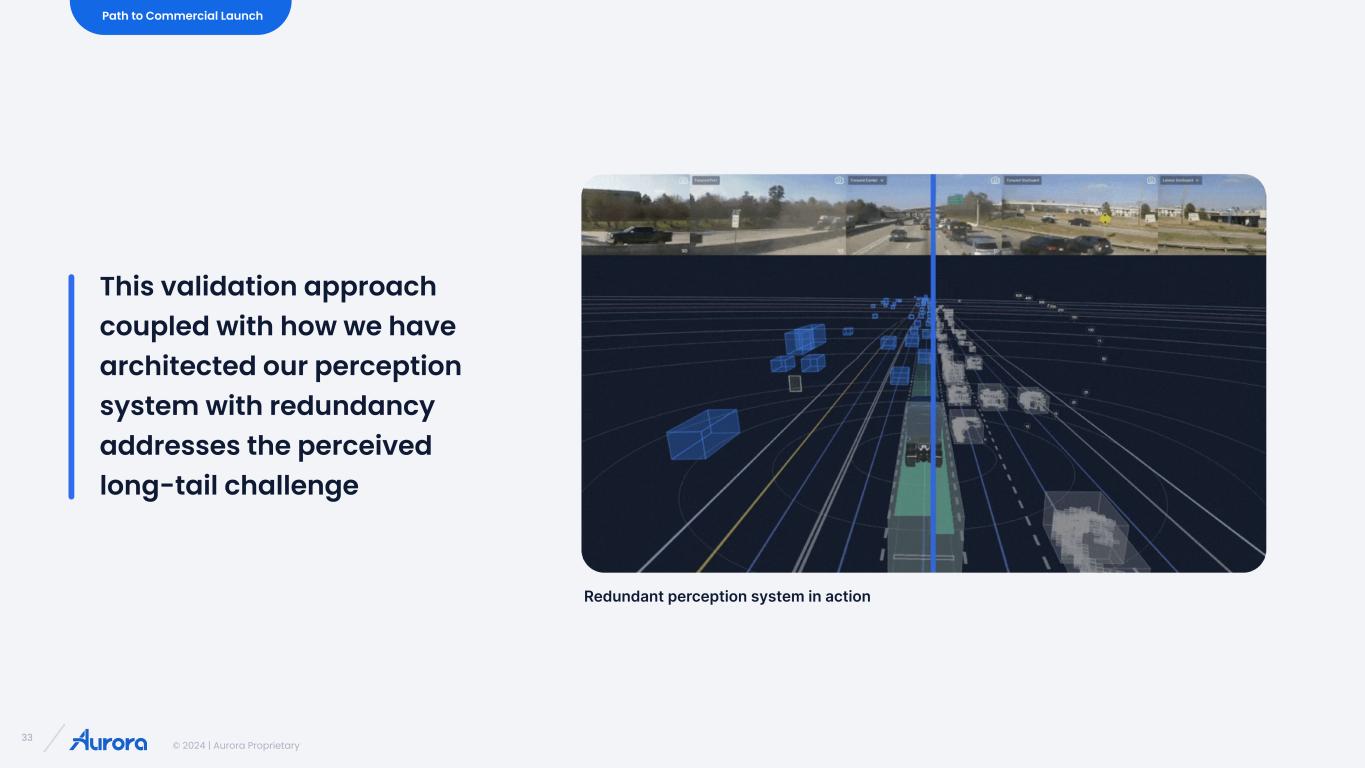

© 2024 | Aurora Proprietary 33 This validation approach coupled with how we have architected our perception system with redundancy addresses the perceived long-tail challenge Path to Commercial Launch Redundant perception system in action

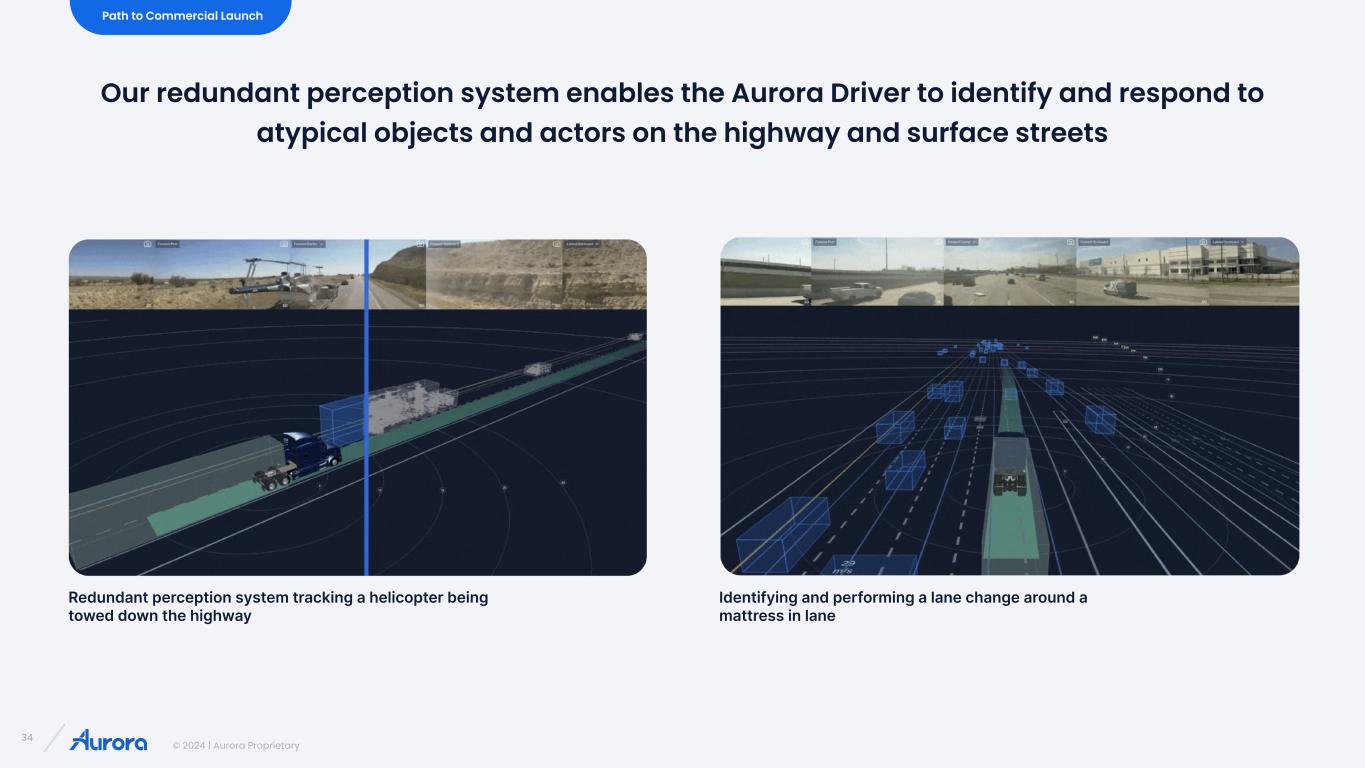

© 2024 | Aurora Proprietary 34 Our redundant perception system enables the Aurora Driver to identify and respond to atypical objects and actors on the highway and surface streets Path to Commercial Launch Redundant perception system tracking a helicopter being towed down the highway Identifying and performing a lane change around a mattress in lane

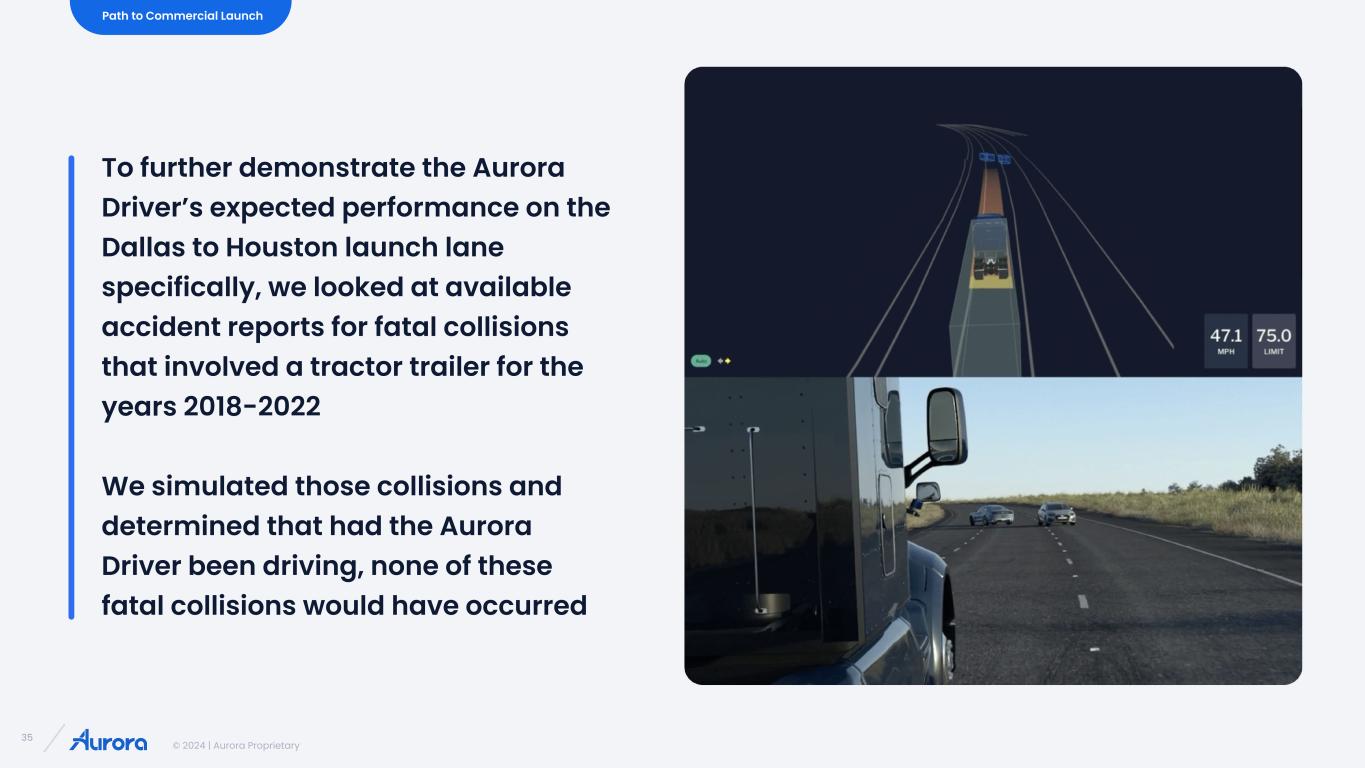

© 2024 | Aurora Proprietary 35 To further demonstrate the Aurora Driver’s expected performance on the Dallas to Houston launch lane specifically, we looked at available accident reports for fatal collisions that involved a tractor trailer for the years 2018-2022 We simulated those collisions and determined that had the Aurora Driver been driving, none of these fatal collisions would have occurred Path to Commercial Launch

© 2024 | Aurora Proprietary 36 Regulators are ready Autonomy-enabled vehicle platform is ready Aurora Driver technology is ready Customers are ready Path to Commercial Launch We expect to have all essential components in place for Commercial Launch

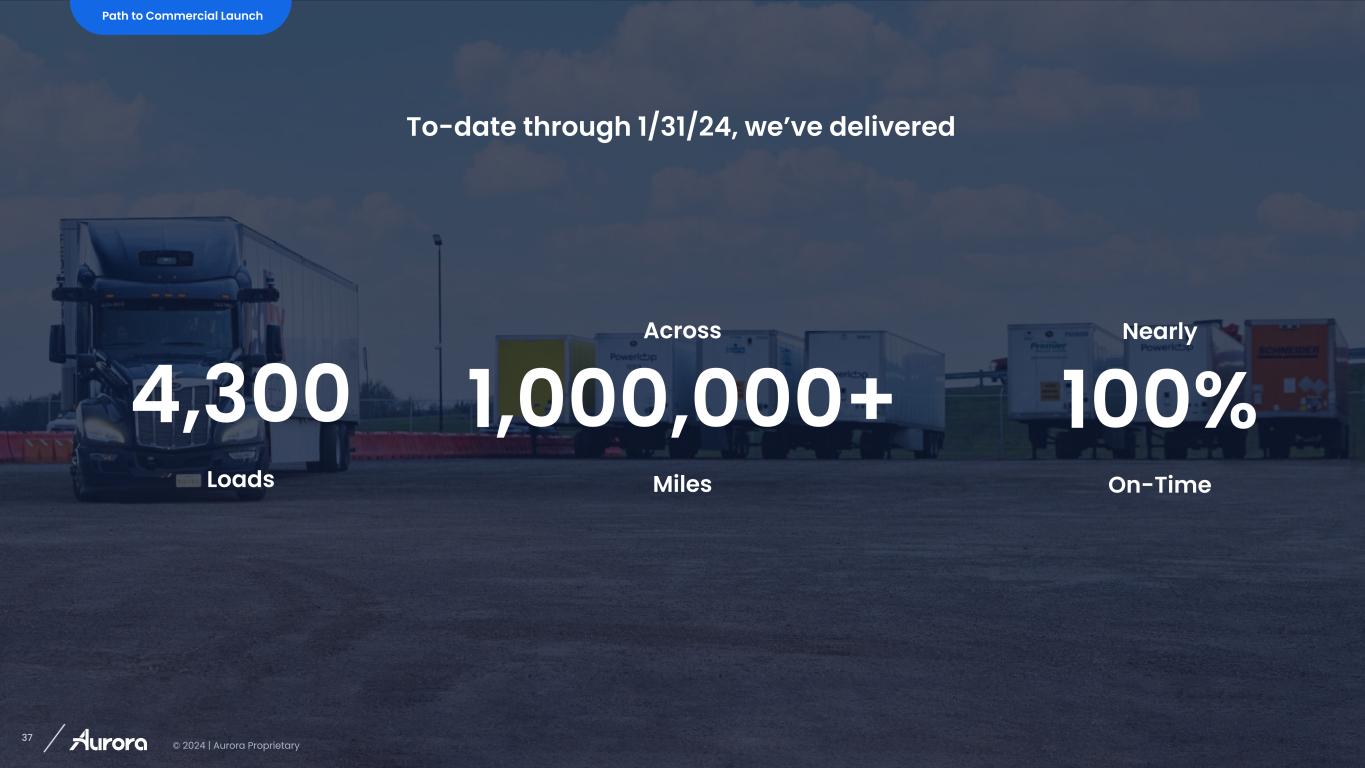

© 2024 | Aurora Proprietary 37 4,300 Loads Nearly 100% On-Time To-date through 1/31/24, we’ve delivered Across 1,000,000+ Miles Path to Commercial Launch

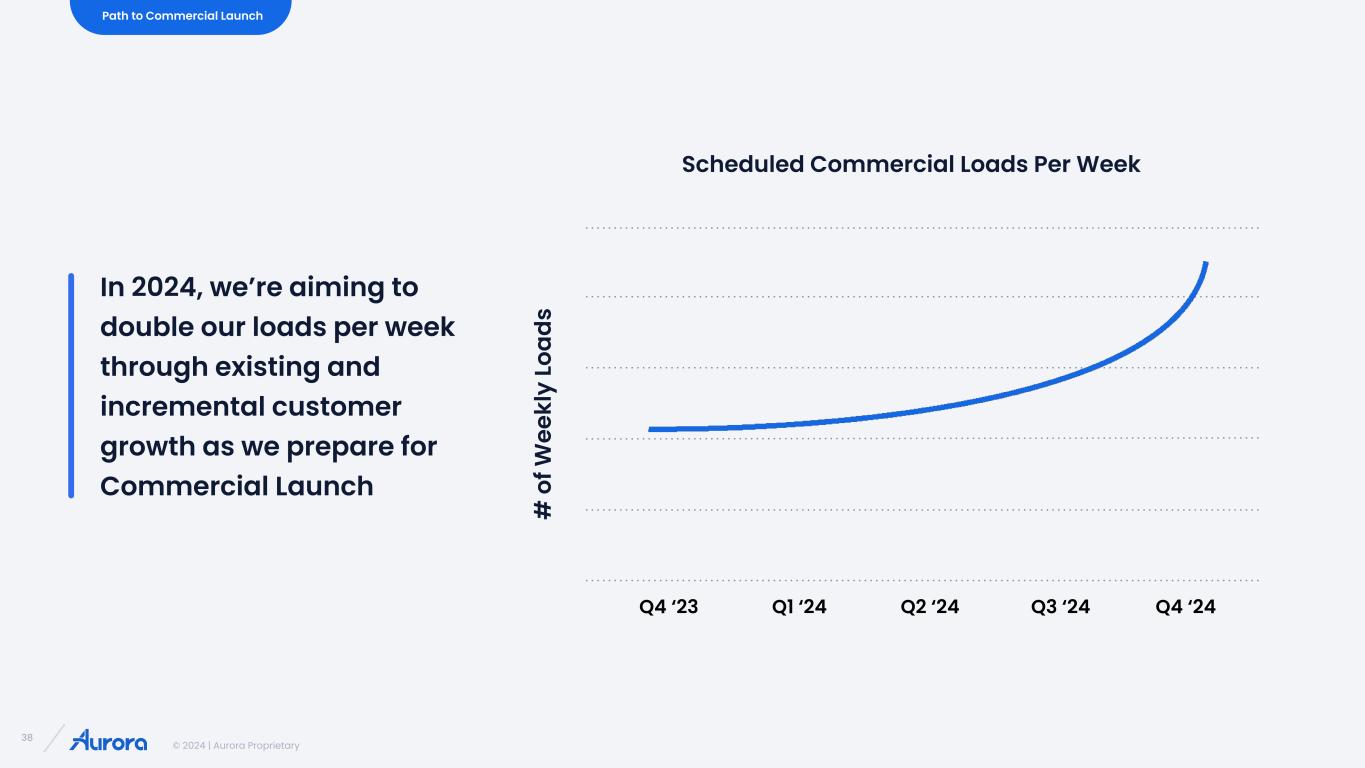

© 2024 | Aurora Proprietary 38 # o f W ee kl y Lo ad s Q4 ‘23 Q1 ‘24 Q2 ‘24 Q3 ‘24 Path to Commercial Launch Q4 ‘24 In 2024, we’re aiming to double our loads per week through existing and incremental customer growth as we prepare for Commercial Launch Scheduled Commercial Loads Per Week

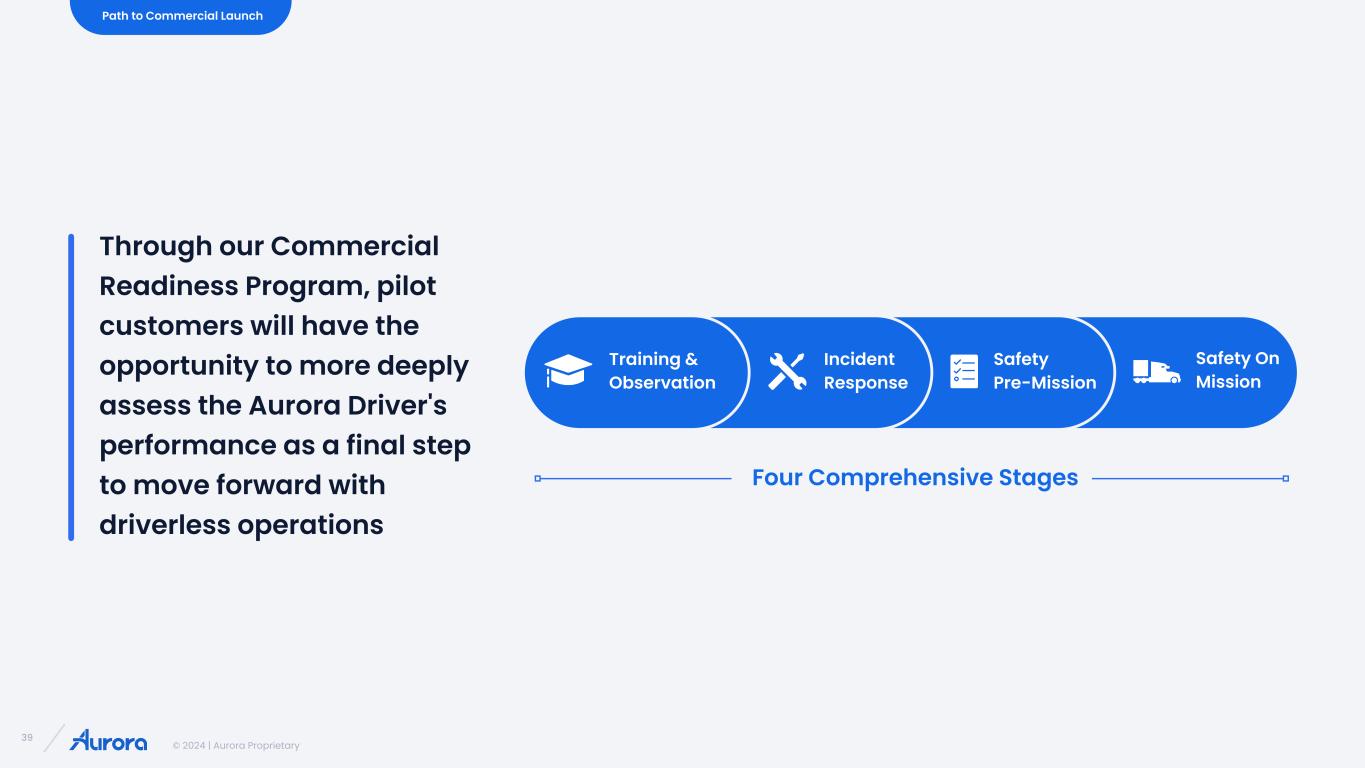

© 2024 | Aurora Proprietary 39 Through our Commercial Readiness Program, pilot customers will have the opportunity to more deeply assess the Aurora Driver's performance as a final step to move forward with driverless operations Training & Observation Incident Response Safety Pre-Mission Safety On Mission Four Comprehensive Stages Path to Commercial Launch

© 2024 | Aurora Proprietary 40 Watch video ▸

© 2024 | Aurora Proprietary 41 Autonomy-enabled vehicle platform is ready Customers are ready Aurora Driver technology is ready Regulators are ready Path to Commercial Launch We expect to have all essential components in place for Commercial Launch

© 2024 | Aurora Proprietary 42 Welcome & opening [Chris] Regulatory Pathway

© 2024 | Aurora Proprietary 43 Deployment permitted Testing permitted Autonomous trucking currently prohibited Driverless operation prohibited LA and AL allow autonomous commercial vehicle operations, but have no existing regulations regarding autonomous light vehicle operations CA prohibits autonomous trucking testing and deployment, but allows the testing and deployment of autonomous light vehicles 24 states expressly allow and 16 states implicitly allow the driverless deployment of autonomous vehicles * * * Path to Commercial Launch Under existing law and regulation, autonomous vehicles can be deployed in the vast majority of states in the U.S. today including our Texas launch market

© 2024 | Aurora Proprietary 44 Path to Commercial Launch Under existing law and regulation, autonomous vehicles can be deployed in the vast majority of states in the U.S. today including our Texas launch market Deployment permitted Testing permitted Autonomous trucking currently prohibited Driverless operation prohibited LA and AL allow autonomous commercial vehicle operations, but have no existing regulations regarding autonomous light vehicle operations CA prohibits autonomous trucking testing and deployment, but allows the testing and deployment of autonomous light vehicles 24 states expressly allow and 16 states implicitly allow the driverless deployment of autonomous vehicles * * *

© 2024 | Aurora Proprietary 45 Watch video ▸

© 2024 | Aurora Proprietary 46 We work collaboratively with regulators and lawmakers at the federal, state, and local levels Path to Commercial Launch

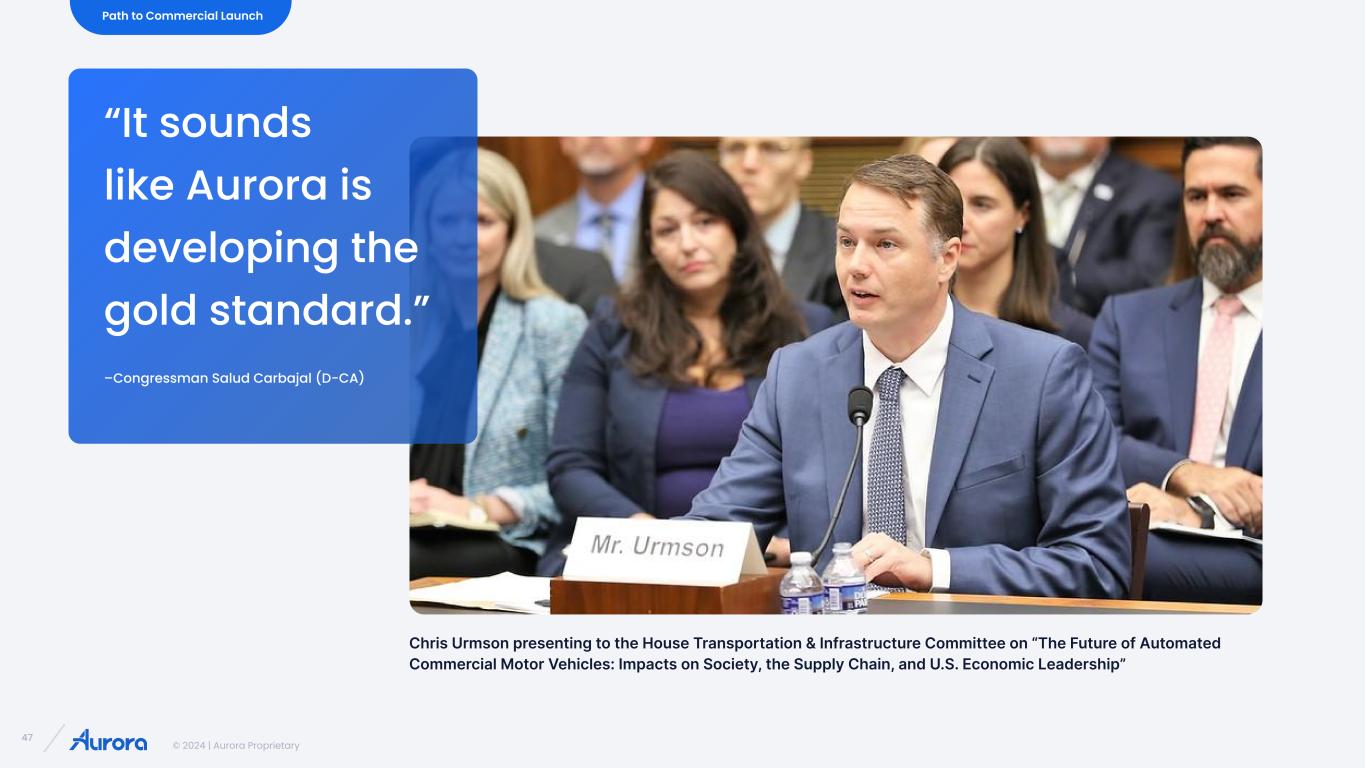

© 2024 | Aurora Proprietary 47 “It sounds like Aurora is developing the gold standard.” –Congressman Salud Carbajal (D-CA) Chris Urmson presenting to the House Transportation & Infrastructure Committee on “The Future of Automated Commercial Motor Vehicles: Impacts on Society, the Supply Chain, and U.S. Economic Leadership” Path to Commercial Launch

© 2024 | Aurora Proprietary 48 “Autonomous vehicles are expected to help improve safety, spur economic growth and improve the transportation experience for all Texans.” - TEXAS DEPARTMENT OF TRANSPORTATION (TXDOT) The state of Texas welcomes autonomous vehicle testing and expressly permits the deployment of driverless trucks Path to Commercial Launch

© 2024 | Aurora Proprietary 49 “Autonomous trucks are growing to be an important part of Texas’ economy and supply chain... We’d like to thank Aurora for partnering with our department in this endeavor, and for their transparency during the process.” - Officer T. Mrozinski, Frisco PD Traffic Unit - Commercial Motor Vehicle Enforcement Aurora worked with the Frisco Police Department in Texas to conduct mock traffic stops on I-45 outside of Dallas to simulate how autonomous trucks can recognize and respond to emergency vehicles Path to Commercial Launch

© 2024 | Aurora Proprietary 50 Customers are ready Regulators are ready Aurora Driver technology is ready Autonomy-enabled vehicle platform is ready Path to Commercial Launch We expect to have all essential components in place for Commercial Launch

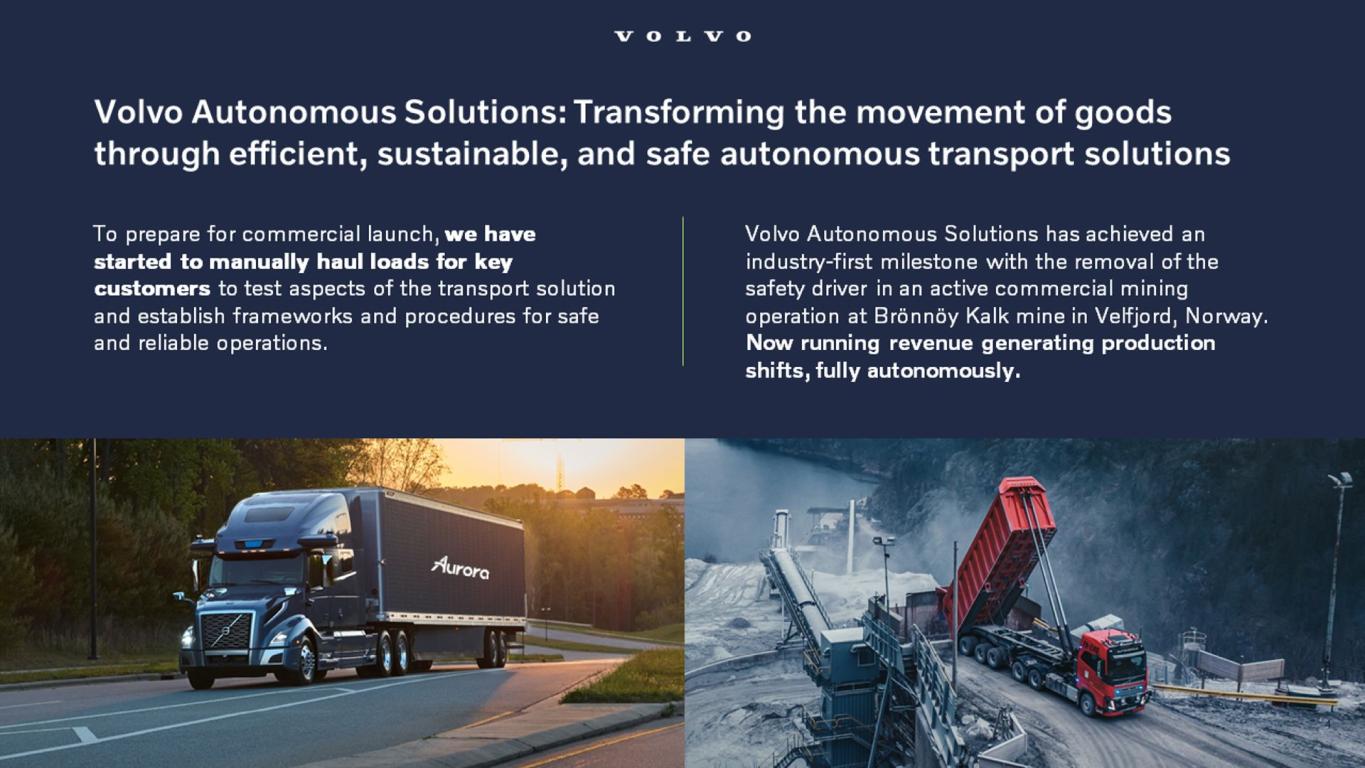

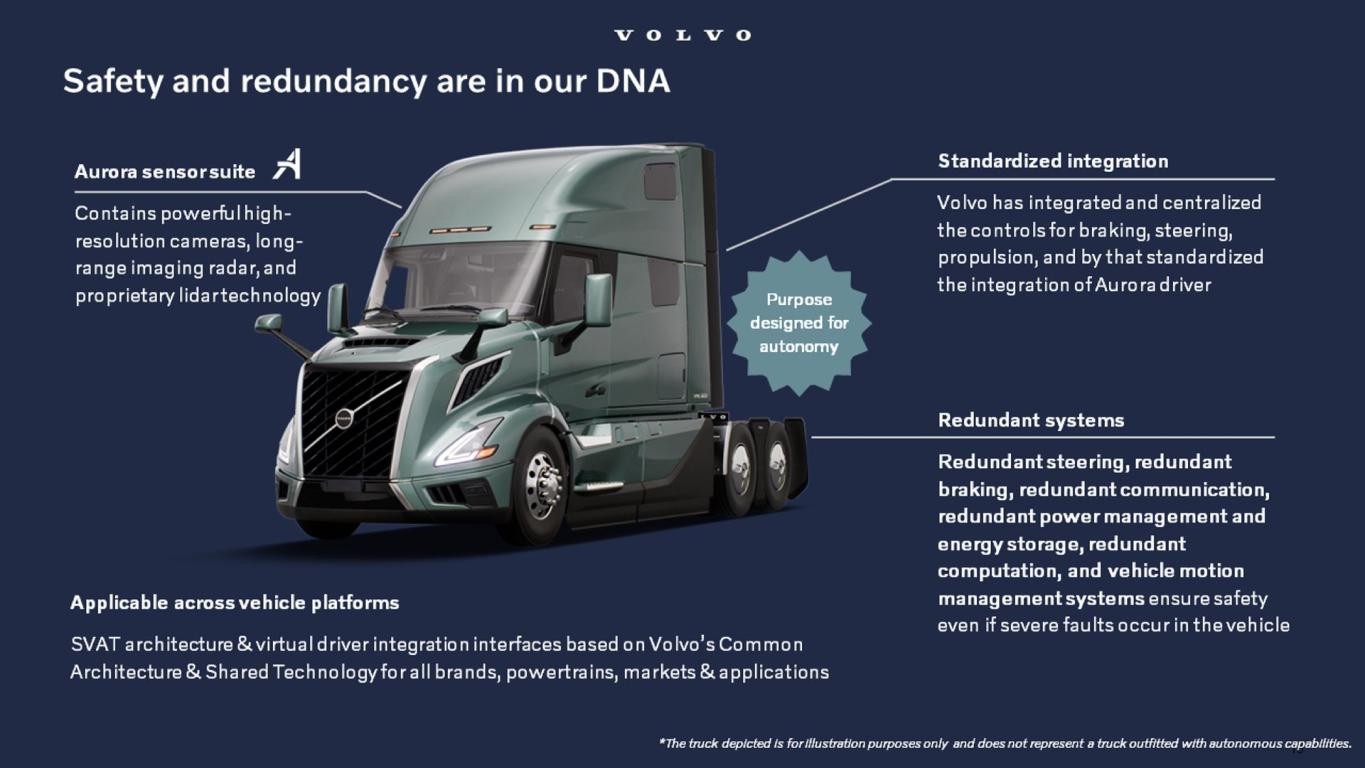

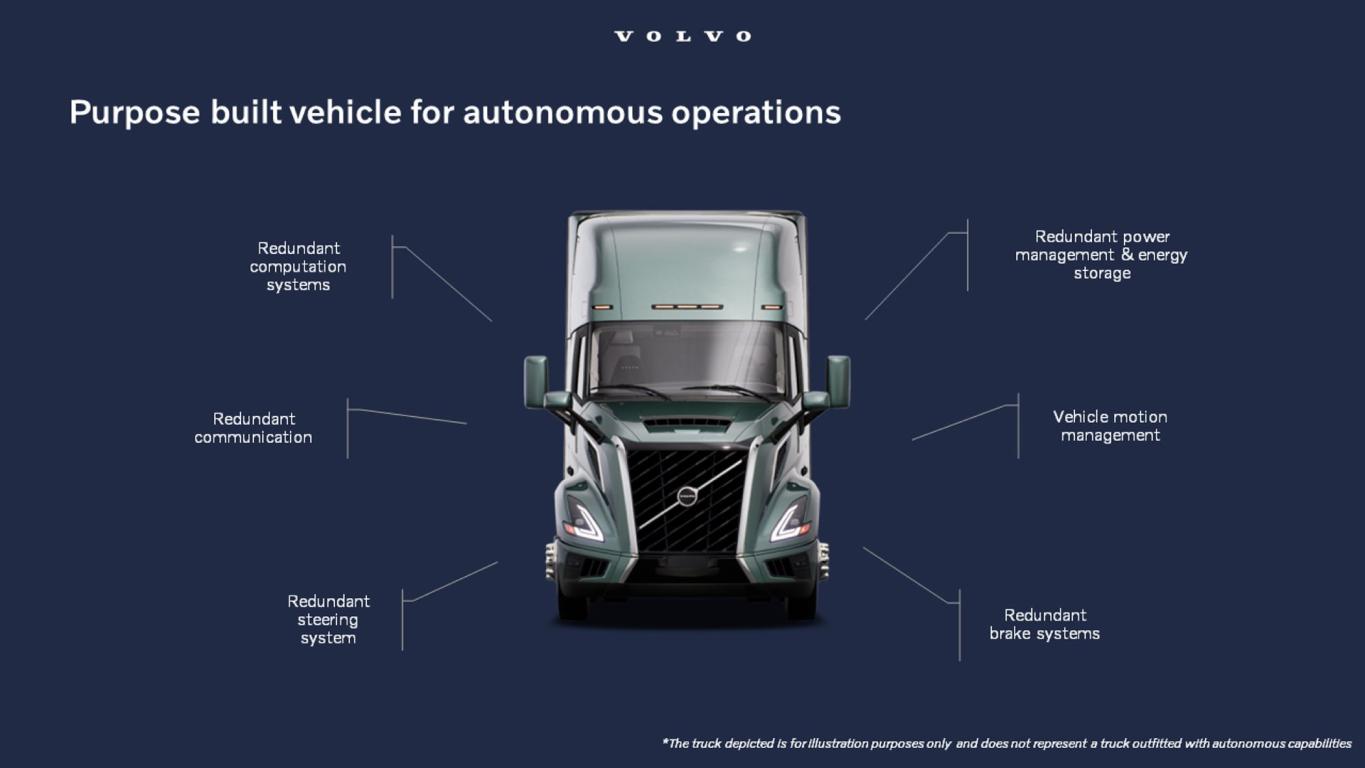

© 2024 | Aurora Proprietary 51 Our deep collaboration and integration with truck OEM partners supports our path to Commercial Launch and scale Path to Commercial Launch

© 2024 | Aurora Proprietary 52 We are testing prototype autonomous Volvo VNL trucks equipped with safety-critical redundant systems installed by Volvo Path to Commercial Launch

© 2024 | Aurora Proprietary 53

© 2024 | Aurora Proprietary 54

© 2024 | Aurora Proprietary 55

© 2024 | Aurora Proprietary 56

© 2024 | Aurora Proprietary 57

© 2024 | Aurora Proprietary 58

© 2024 | Aurora Proprietary 59

© 2024 | Aurora Proprietary 60

© 2024 | Aurora Proprietary 61

© 2024 | Aurora Proprietary 62 Aurora Driver technology is ready Customers are ready Regulators are ready Autonomy-enabled vehicle platform is ready Path to Commercial Launch With the delivery of the autonomy-enabled vehicle platform, we expect to have all essential components in place for Commercial Launch

© 2024 | Aurora Proprietary 63 Path to Commercial Launch Path to Scale & Self-Funding We're on the road to a scalable and self-sustaining business 2025 2026 20272024 Path to Gross Profit

© 2024 | Aurora Proprietary 64 Revenue drivers Rapid lane penetration & expansion Increased asset utilization Increased value creation Our path to expected gross profit in 2026 is supported by: Path to Gross Profit Cost reduction levers Realization of remote assistance efficiencies Reduction in on-site support Introduction of next-generation hardware

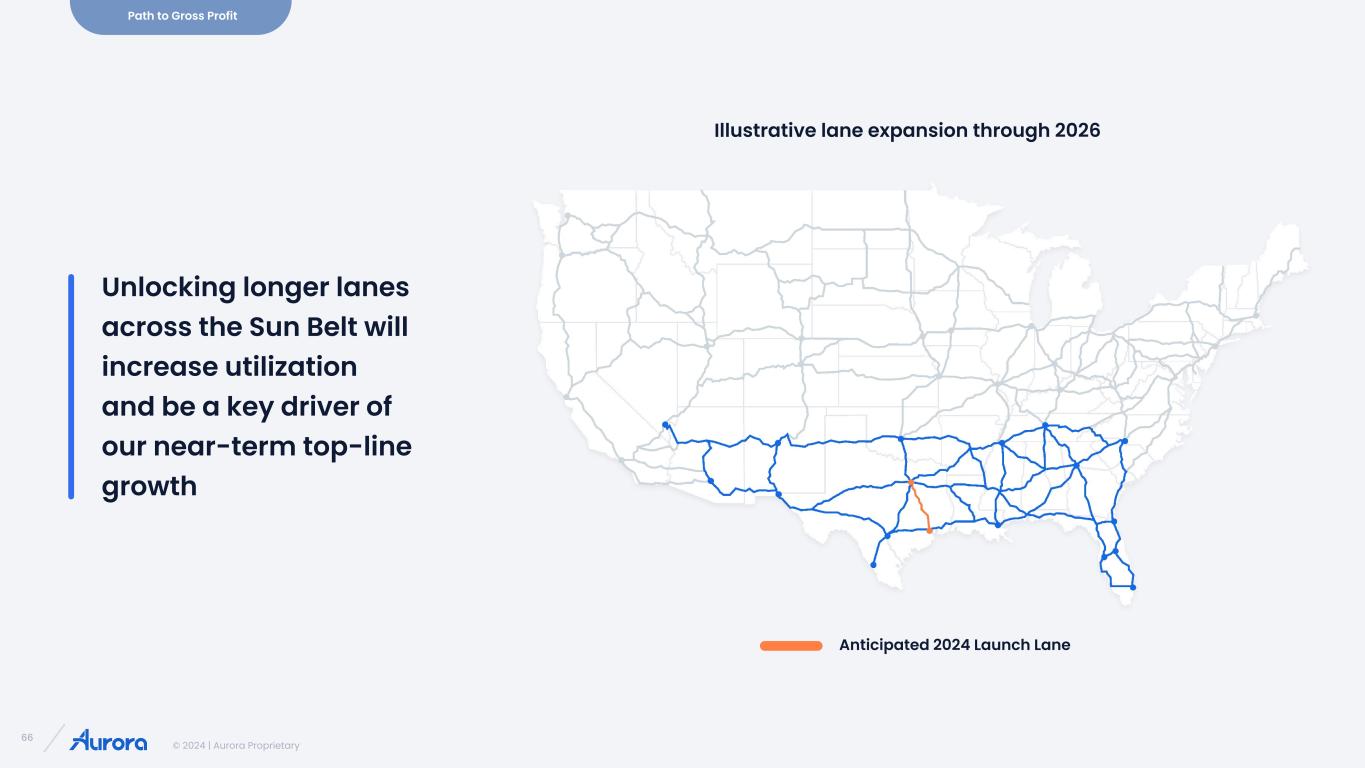

© 2024 | Aurora Proprietary 65 Leveraging our R&D investments to-date, we expect to rapidly scale the Aurora Driver given the self-similarity of the U.S. interstate highway system We have already transferred the Aurora Driver’s capabilities from the Dallas to Houston lane to the Fort Worth to El Paso lane Path to Gross Profit Anticipated 2024 Launch Lane

© 2024 | Aurora Proprietary 66 Unlocking longer lanes across the Sun Belt will increase utilization and be a key driver of our near-term top-line growth Illustrative lane expansion through 2026 Path to Gross Profit Anticipated 2024 Launch Lane

© 2024 | Aurora Proprietary 67 Supportable operating conditions will expand, unlocking high asset utilization on new and existing lanes Path to Gross Profit

© 2024 | Aurora Proprietary 68 Proven operational performance and new trailer types will allow increased penetration of open lanes Path to Gross Profit Refrigerated Intermodal 2 x 28’

© 2024 | Aurora Proprietary 69 Following our terminal to terminal launch, we plan to unlock customer endpoints to augment our terminal footprint and increase customer value Path to Gross Profit

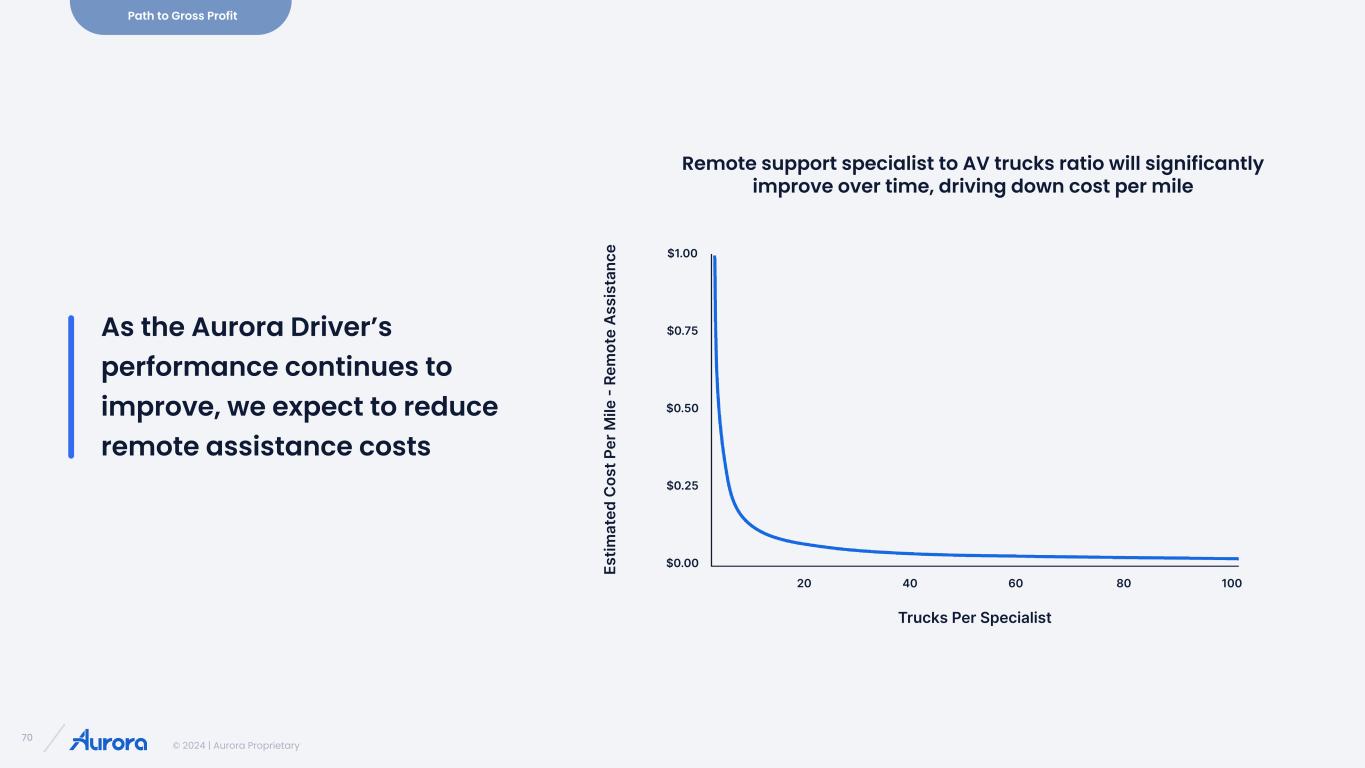

© 2024 | Aurora Proprietary 70 As the Aurora Driver’s performance continues to improve, we expect to reduce remote assistance costs Remote support specialist to AV trucks ratio will significantly improve over time, driving down cost per mile Path to Gross Profit Trucks Per Specialist Es tim at ed C os t P er M ile - R em ot e A ss is ta nc e $1.00 $0.75 $0.50 $0.25 $0.00 20 40 60 80 100

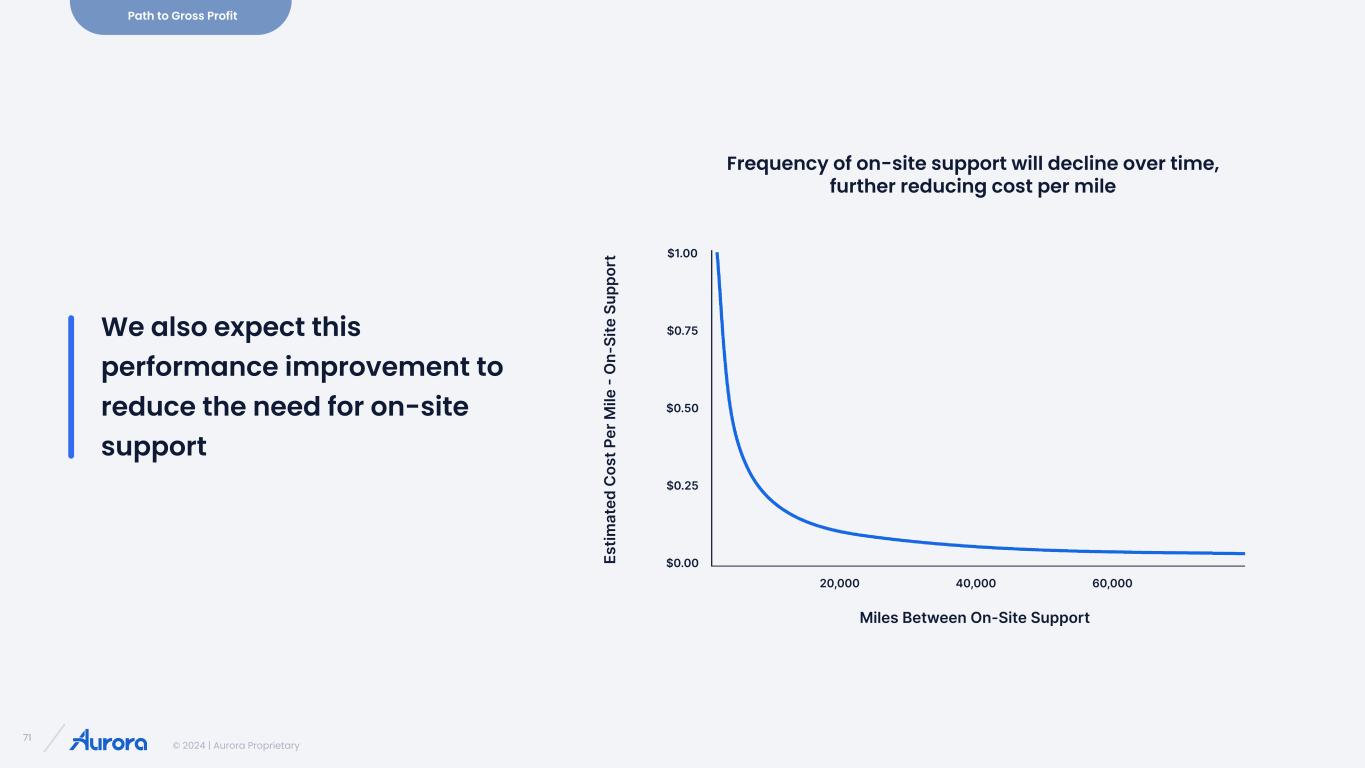

© 2024 | Aurora Proprietary 71 We also expect this performance improvement to reduce the need for on-site support Path to Gross Profit Es tim at ed C os t P er M ile - O n- Si te S up po rt Frequency of on-site support will decline over time, further reducing cost per mile 20,000 40,000 60,000 $1.00 $0.75 $0.50 $0.25 $0.00 Miles Between On-Site Support

© 2024 | Aurora Proprietary 72 Hardware Strategy

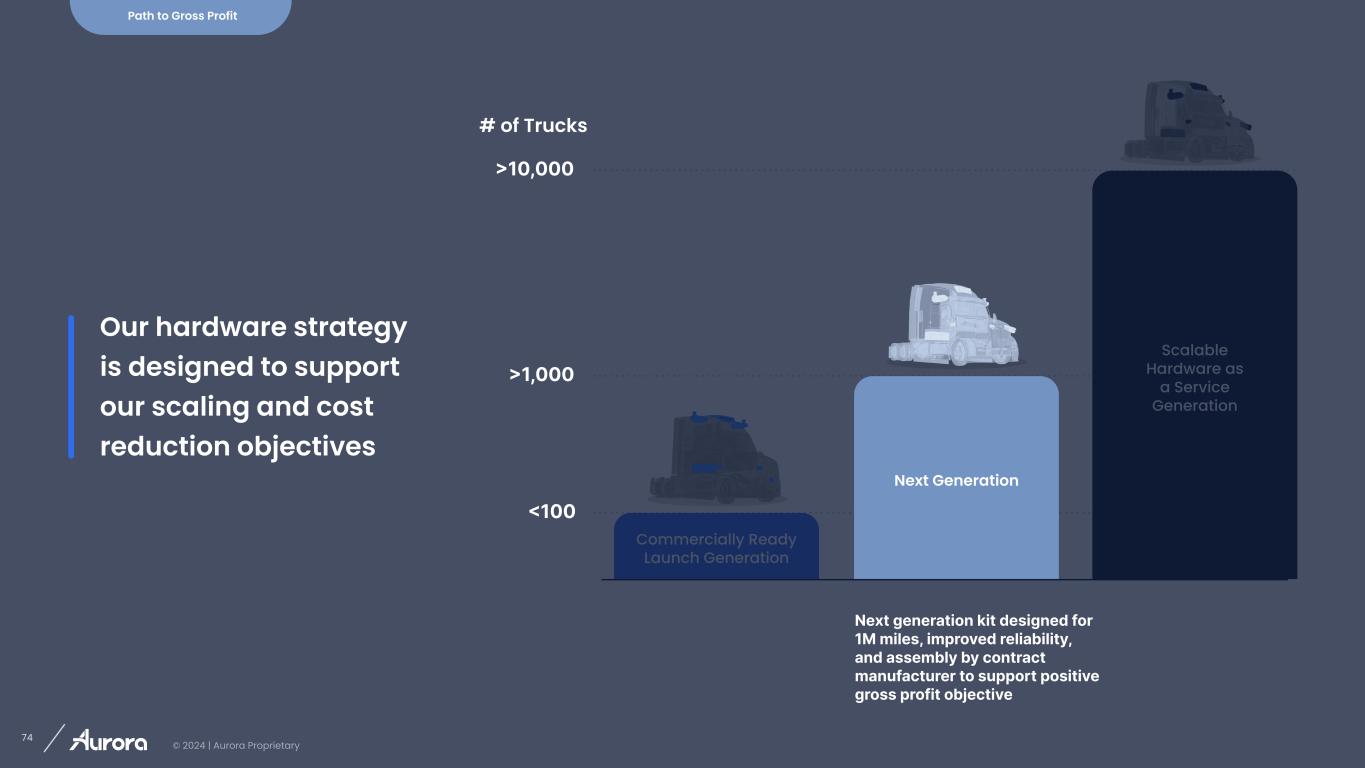

© 2024 | Aurora Proprietary 73 <100 >1,000 >10,000 Our hardware strategy is designed to support our scaling and cost reduction objectives Commercially Ready Launch Generation Next Generation Scalable Hardware as a Service Generation Path to Gross Profit # of Trucks Next generation kit designed for 1M miles, improved reliability, and assembly by contract manufacturer to support positive gross profit objective

© 2024 | Aurora Proprietary 74 Commercially Ready Launch Generation Scalable Hardware as a Service Generation Path to Gross Profit Next generation kit designed for 1M miles, improved reliability, and assembly by contract manufacturer to support positive gross profit objective <100 >1,000 >10,000 Next Generation # of Trucks Our hardware strategy is designed to support our scaling and cost reduction objectives

© 2024 | Aurora Proprietary 75 In 2025, we plan to introduce our next generation hardware kit that is designed to drive a step function reduction in cost while also bringing exciting performance gains Path to Gross Profit

© 2024 | Aurora Proprietary 76 Improved cost (⬇50%) , power (⬇37%), weight (⬇42%) Our next generation computer delivers a 40%+ reduction in power and weight at approximately half the cost Path to Gross Profit

© 2024 | Aurora Proprietary 77 Our next generation FirstLight Lidar delivers meaningful resolution, field of view, and range increases with nearly 40% reduction in cost Path to Gross Profit

© 2024 | Aurora Proprietary 78 Path to Gross Profit Also key to reducing hardware costs is increased reliability - our next generation kit is designed for 1M miles of operation

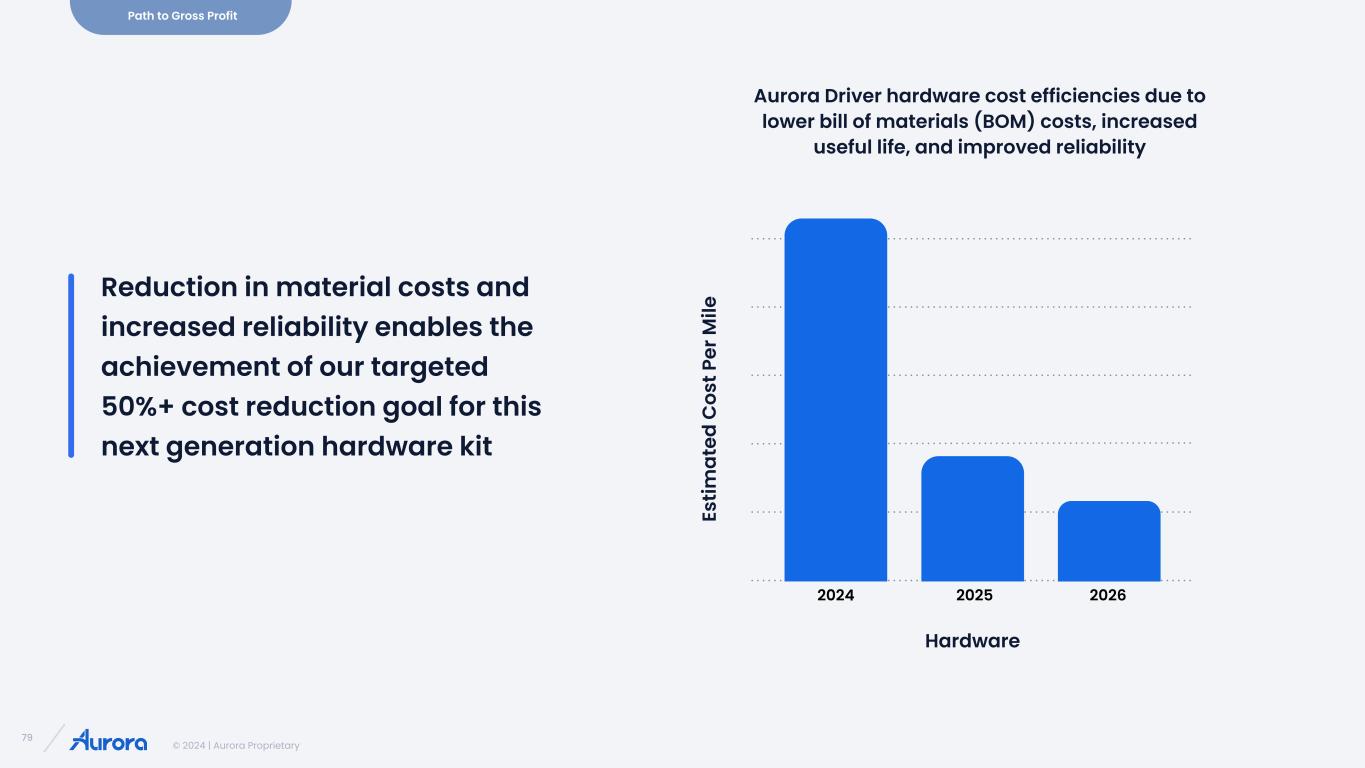

© 2024 | Aurora Proprietary 79 Reduction in material costs and increased reliability enables the achievement of our targeted 50%+ cost reduction goal for this next generation hardware kit Path to Gross Profit Aurora Driver hardware cost efficiencies due to lower bill of materials (BOM) costs, increased useful life, and improved reliability Es tim at ed C os t P er M ile 2024 2025 2026 Hardware

© 2024 | Aurora Proprietary 80 Path to Gross Profit 2024 | Aurora Proprietary Path to Commercial Launch We're on the road to a scalable and self-sustaining business 2025 2026 20272024 Path to Scale & Self-funding

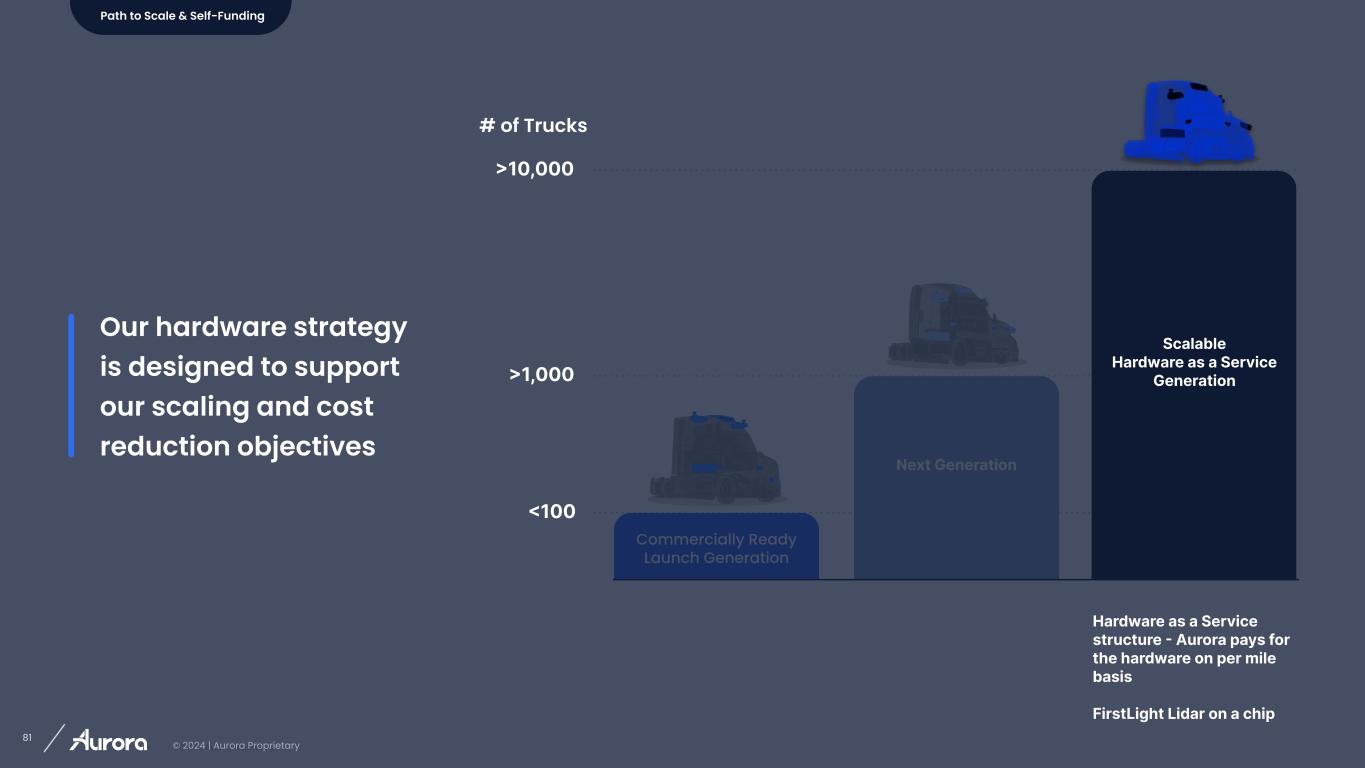

© 2024 | Aurora Proprietary 81 2024 | Aurora Proprietary Commercially Ready Launch Generation Next Generation Our hardware strategy is designed to support our scaling and cost reduction objectives <100 >1,000 >10,000 Hardware as a Service structure - Aurora pays for the hardware on per mile basis FirstLight Lidar on a chip Scalable Hardware as a Service Generation Path to Scale & Self-Funding # of Trucks

© 2024 | Aurora Proprietary 82

© 2024 | Aurora Proprietary 83 Continental Hardware as a Service partnership Path to Scale & Self-Funding Our path to scale & self-funding is supported by our: OEM partnerships with Volvo Trucks and PACCAR Rapid lane expansion

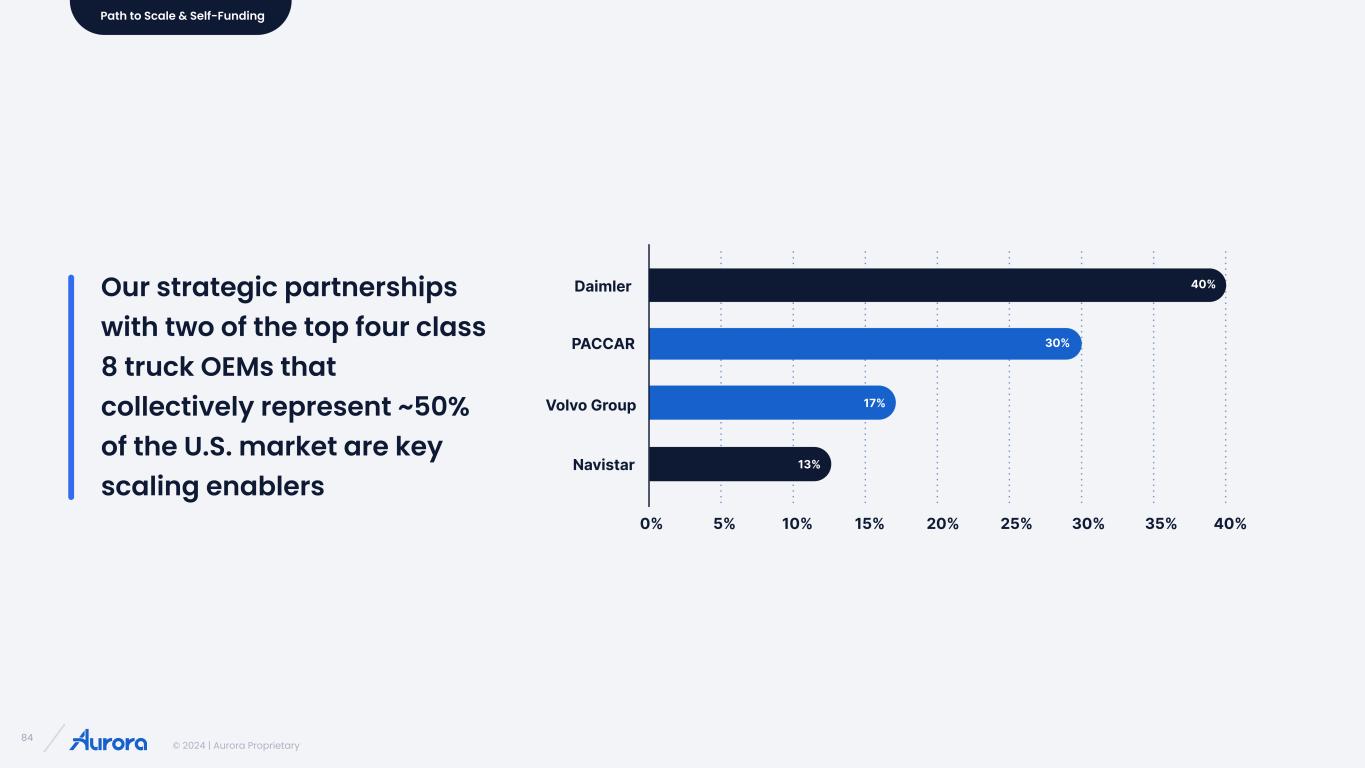

© 2024 | Aurora Proprietary 84 Our strategic partnerships with two of the top four class 8 truck OEMs that collectively represent ~50% of the U.S. market are key scaling enablers 40% 30% 13% 17% 0% 5% 10% 15% 20% 25% 30% 35% 40% Daimler PACCAR Navistar Volvo Group Path to Scale & Self-Funding

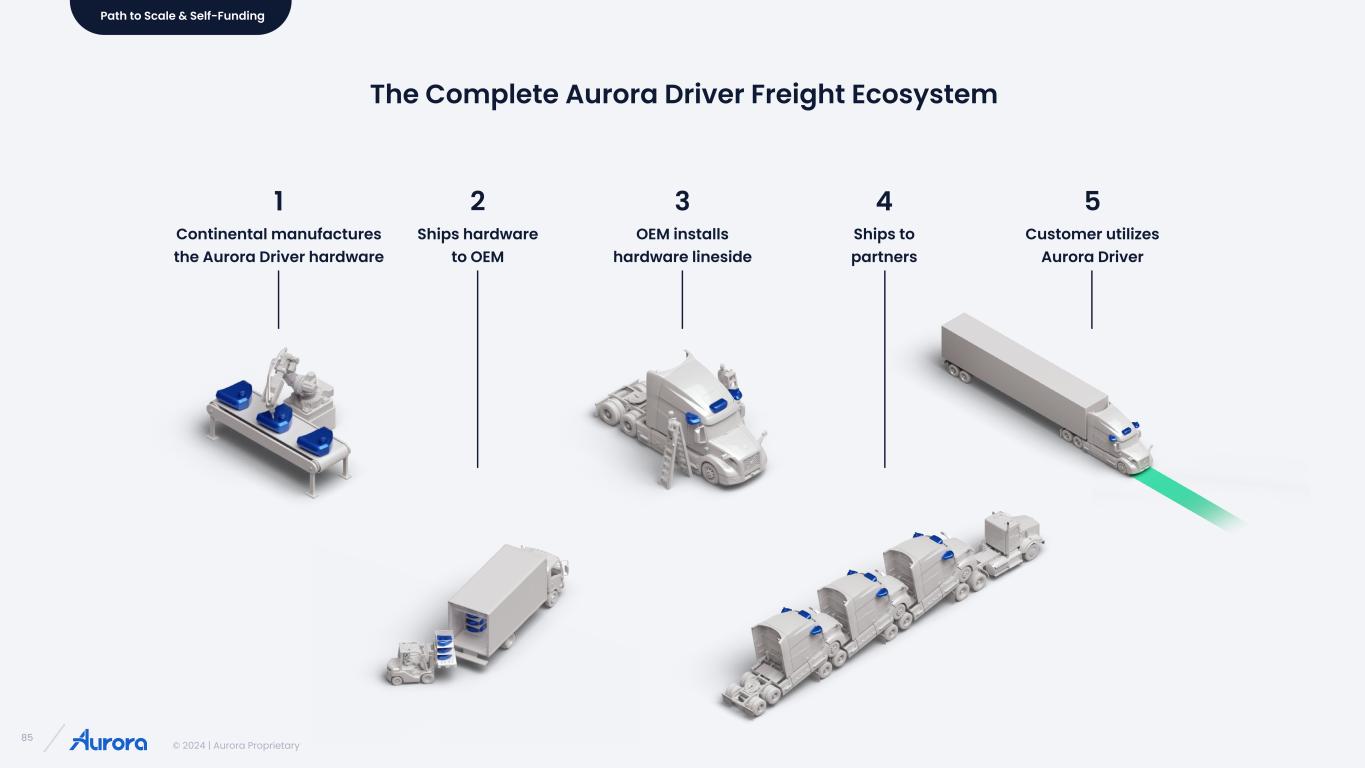

© 2024 | Aurora Proprietary 85 The Complete Aurora Driver Freight Ecosystem Path to Scale & Self-Funding 1 Continental manufactures the Aurora Driver hardware 2 Ships hardware to OEM 3 OEM installs hardware lineside 4 Ships to partners 5 Customer utilizes Aurora Driver

© 2024 | Aurora Proprietary 86

© 2024 | Aurora Proprietary 87 Path to Scale & Self-Funding Under existing law and regulation, autonomous vehicles can be deployed in the vast majority of states in the U.S. today Deployment permitted Testing permitted Autonomous trucking currently prohibited Driverless operation prohibited LA and AL allow autonomous commercial vehicle operations, but have no existing regulations regarding autonomous light vehicle operations. CA prohibits autonomous trucking testing and deployment, but allows the testing and deployment of autonomous light vehicles. 24 states expressly allow and 16 states implicitly allow the driverless deployment of autonomous vehicles. * * *

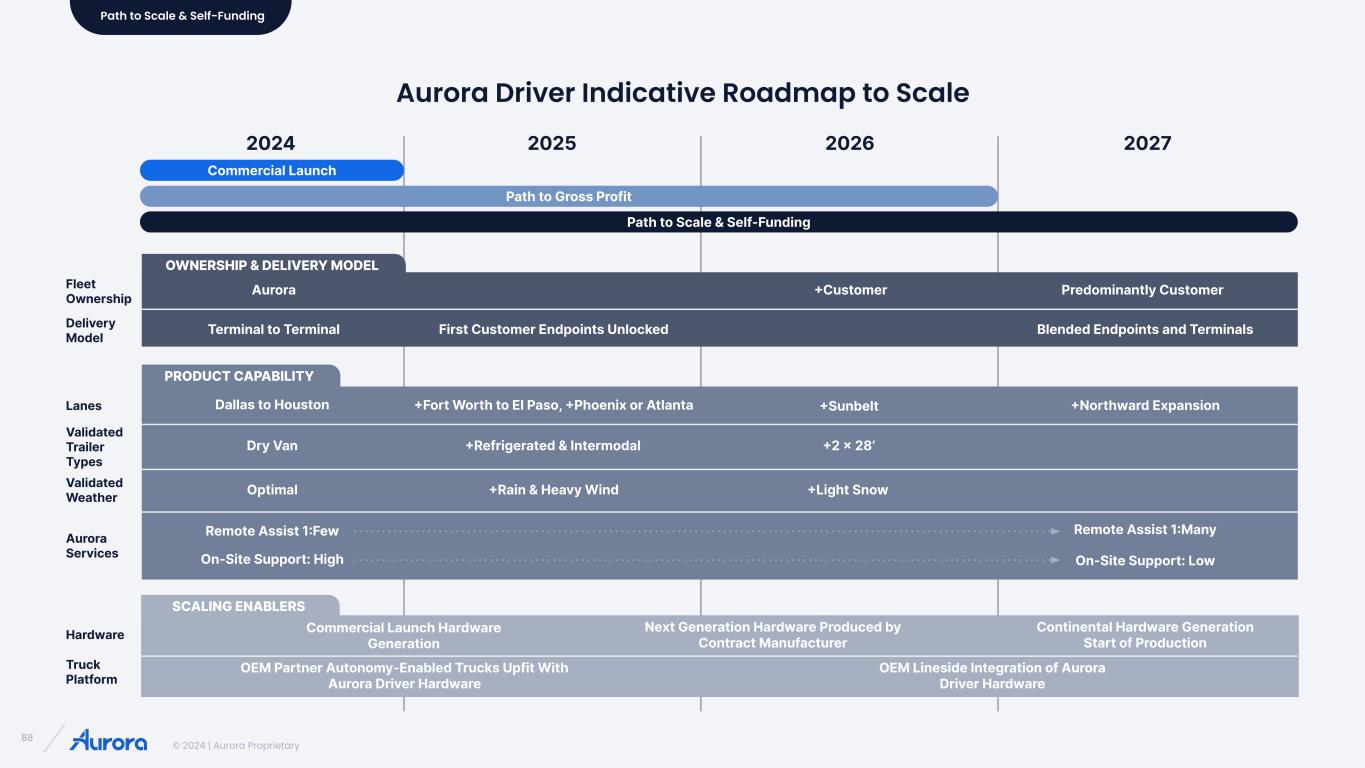

© 2024 | Aurora Proprietary 88 Delivery Model Validated Weather Lanes Dallas to Houston +Northward Expansion+Sunbelt Aurora Commercial Launch Path to Gross Profit Path to Scale & Self-Funding Fleet Ownership +Customer Terminal to Terminal First Customer Endpoints Unlocked Blended Endpoints and Terminals +Fort Worth to El Paso, +Phoenix or Atlanta Validated Trailer Types Dry Van +Refrigerated & Intermodal +2 x 28’ Optimal +Rain & Heavy Wind Truck Platform OEM Partner Autonomy-Enabled Trucks Upfit With Aurora Driver Hardware +Light Snow OEM Lineside Integration of Aurora Driver Hardware Hardware Continental Hardware Generation Start of Production Next Generation Hardware Produced by Contract Manufacturer Commercial Launch Hardware Generation Aurora Services Remote Assist 1:Few Remote Assist 1:Many On-Site Support: High On-Site Support: Low 2024 2025 2026 2027 OWNERSHIP & DELIVERY MODEL PRODUCT CAPABILITY SCALING ENABLERS Aurora Driver Indicative Roadmap to Scale Path to Scale & Self-Funding Predominantly Customer

© 2024 | Aurora Proprietary 89 Path to rapid, capital efficient revenue growth, gross profit, and free cash flow

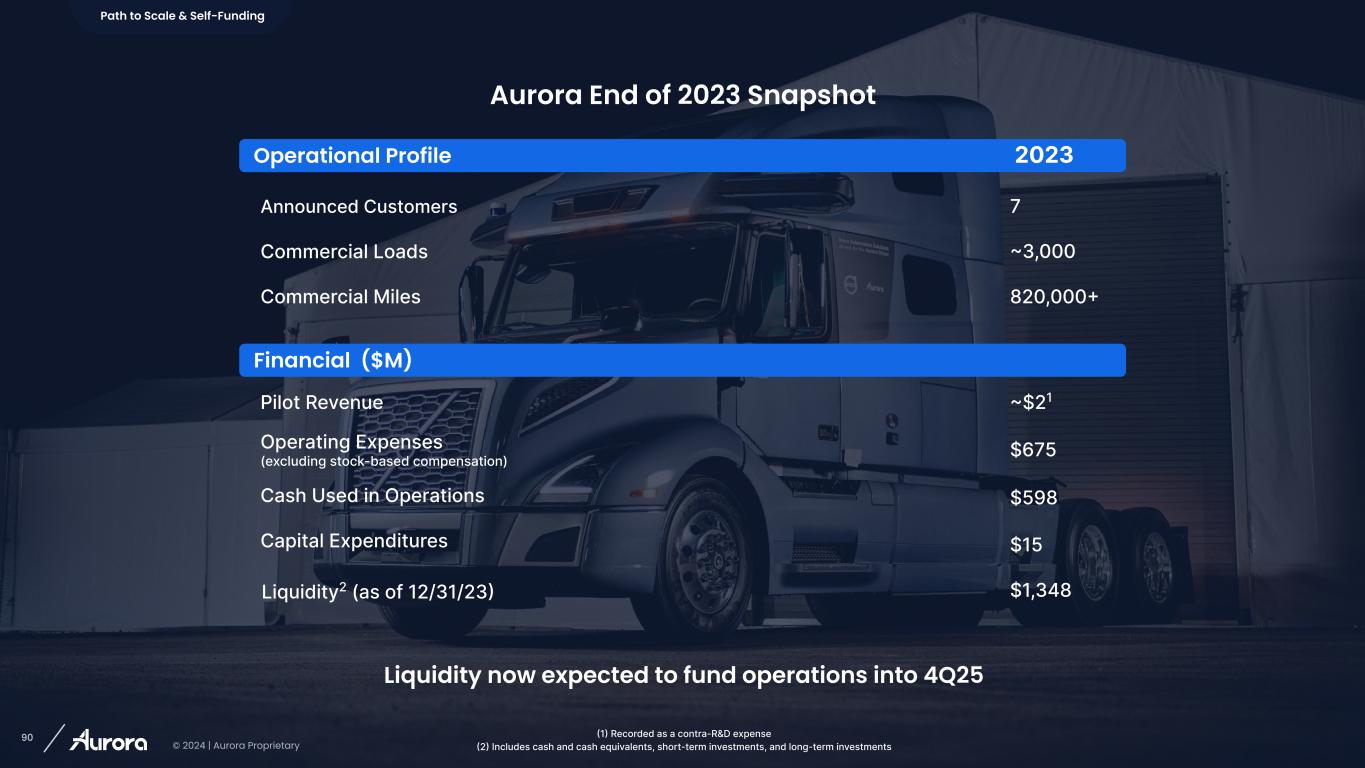

© 2024 | Aurora Proprietary 90 Aurora End of 2023 Snapshot 7 ~3,000 820,000+ ~$21 $1,348 $598 $15 Announced Customers Commercial Loads Commercial Miles Pilot Revenue Liquidity2 (as of 12/31/23) Capital Expenditures Cash Used in Operations Financial ($M) Operational Profile (1) Recorded as a contra-R&D expense (2) Includes cash and cash equivalents, short-term investments, and long-term investments $675Operating Expenses (excluding stock-based compensation) Path to Scale & Self-Funding 2023 Liquidity now expected to fund operations into 4Q25

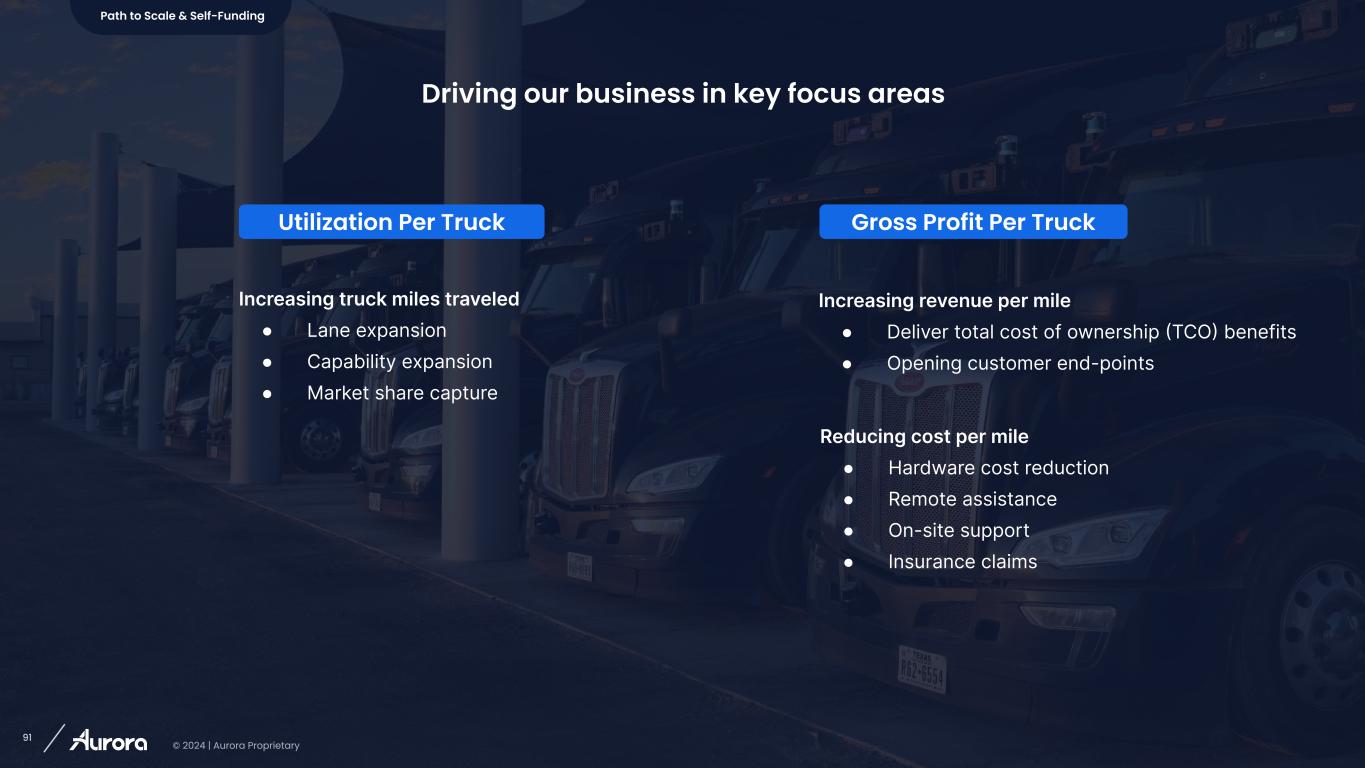

© 2024 | Aurora Proprietary 91 Driving our business in key focus areas Reducing cost per mile ● Hardware cost reduction ● Remote assistance ● On-site support ● Insurance claims Increasing truck miles traveled ● Lane expansion ● Capability expansion ● Market share capture Increasing revenue per mile ● Deliver total cost of ownership (TCO) benefits ● Opening customer end-points Utilization Per Truck Path to Scale & Self-Funding Gross Profit Per Truck Utilization Per Truck Gross Profit Per Truck

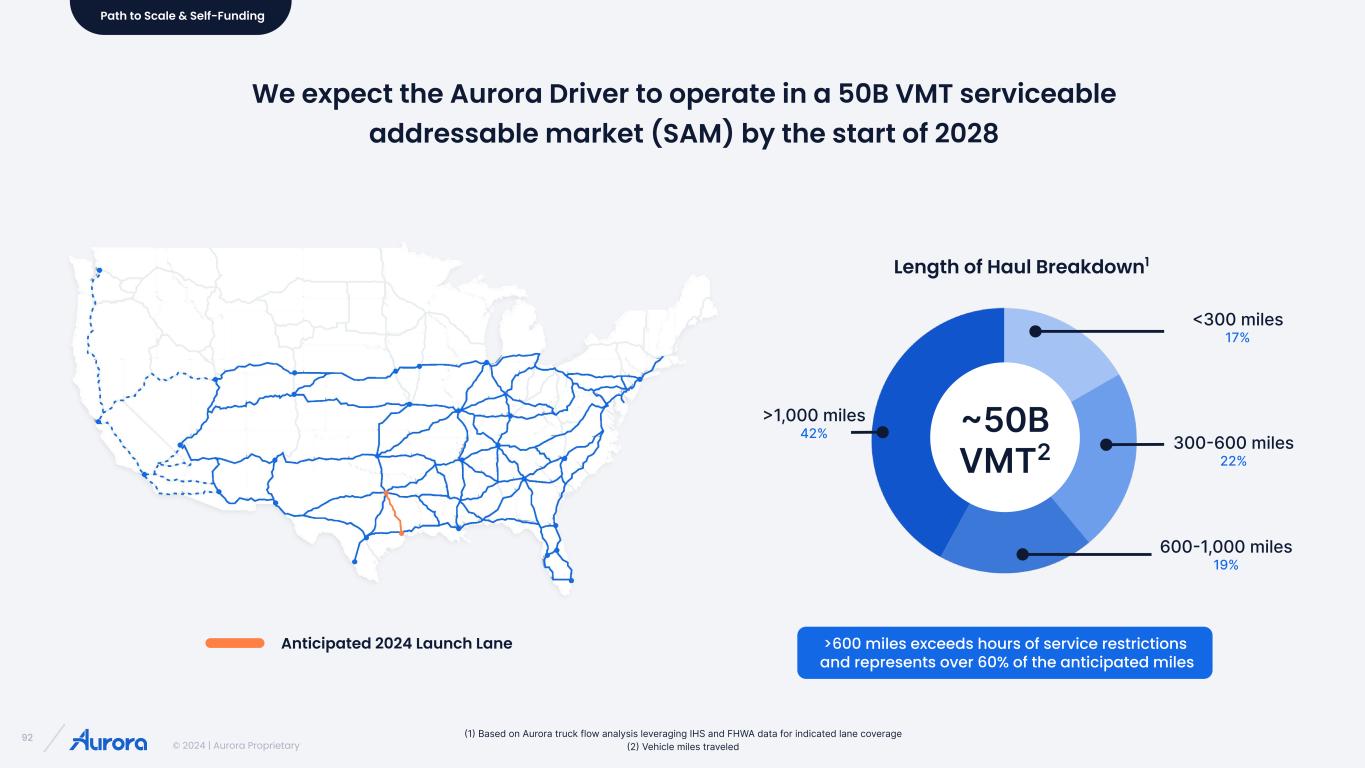

© 2024 | Aurora Proprietary 92 We expect the Aurora Driver to operate in a 50B VMT serviceable addressable market (SAM) by the start of 2028 <300 miles 17% 300-600 miles 22% 600-1,000 miles 19% >1,000 miles 42% ~50B VMT2 Length of Haul Breakdown1 Path to Scale & Self-Funding Anticipated 2024 Launch Lane (1) Based on Aurora truck flow analysis leveraging IHS and FHWA data for indicated lane coverage (2) Vehicle miles traveled >600 miles exceeds hours of service restrictions and represents over 60% of the anticipated miles

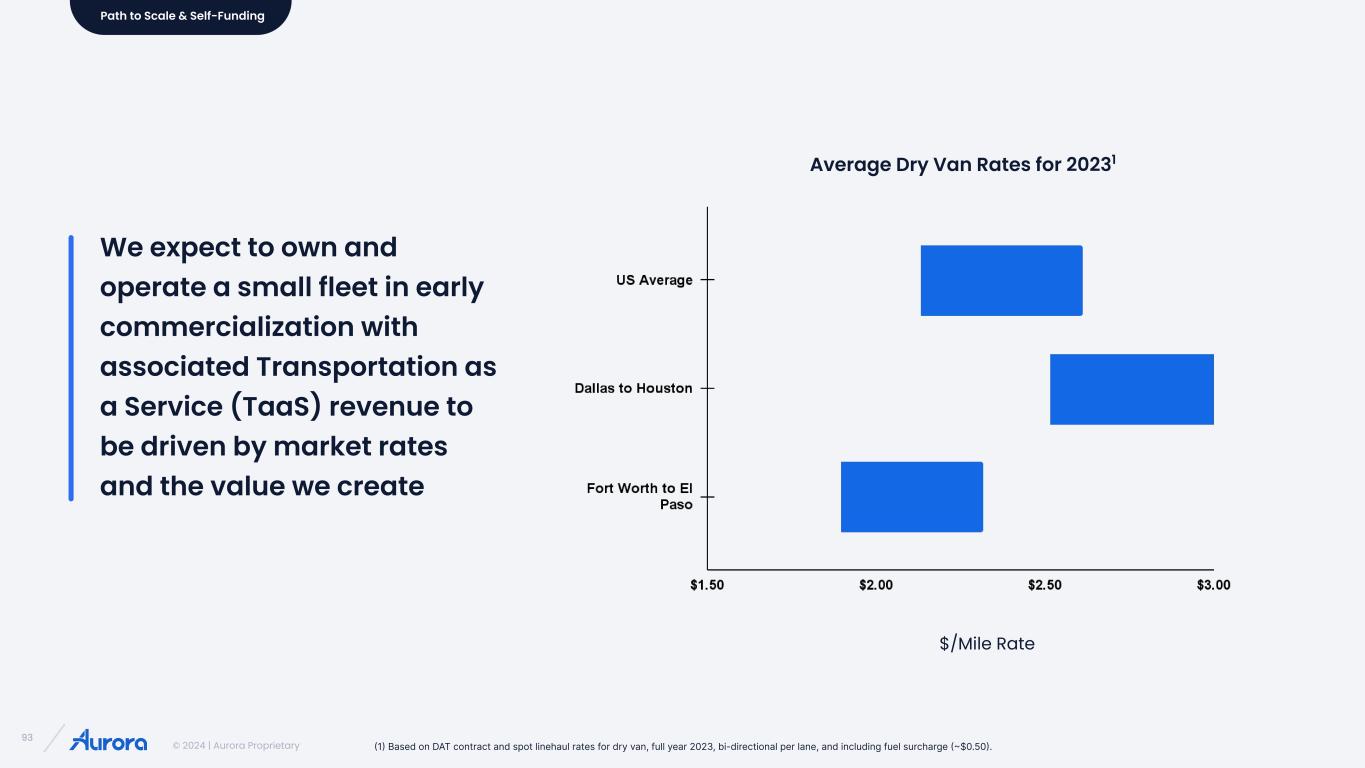

© 2024 | Aurora Proprietary 93 Path to Scale & Self-Funding We expect to own and operate a small fleet in early commercialization with associated Transportation as a Service (TaaS) revenue to be driven by market rates and the value we create Average Dry Van Rates for 20231 $/Mile Rate (1) Based on DAT contract and spot linehaul rates for dry van, full year 2023, bi-directional per lane, and including fuel surcharge (~$0.50).

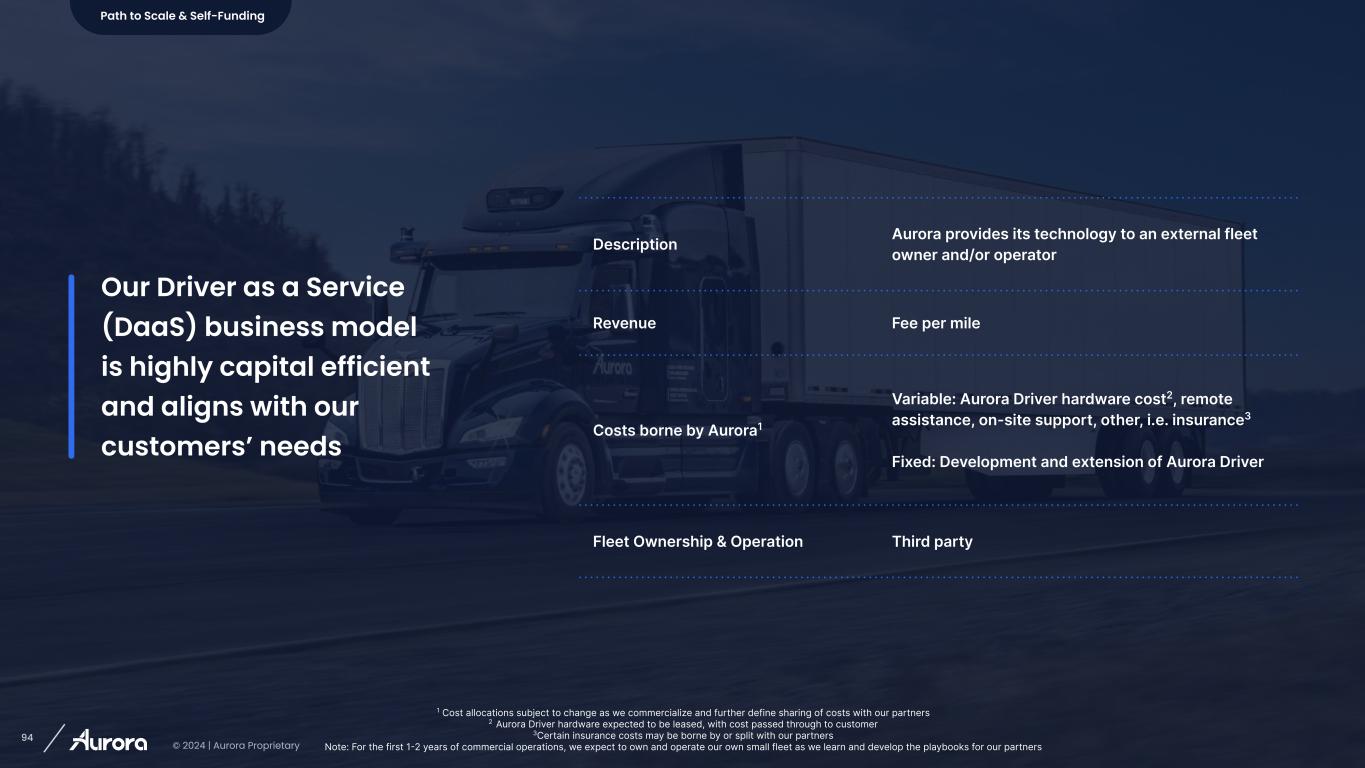

© 2024 | Aurora Proprietary 94 Description Aurora provides its technology to an external fleet owner and/or operator Revenue Fee per mile Costs borne by Aurora1 Variable: Aurora Driver hardware cost2, remote assistance, on-site support, other, i.e. insurance3 Fixed: Development and extension of Aurora Driver Fleet Ownership & Operation Third party 1 Cost allocations subject to change as we commercialize and further define sharing of costs with our partners 2 Aurora Driver hardware expected to be leased, with cost passed through to customer 3Certain insurance costs may be borne by or split with our partners Note: For the first 1-2 years of commercial operations, we expect to own and operate our own small fleet as we learn and develop the playbooks for our partners Our Driver as a Service (DaaS) business model is highly capital efficient and aligns with our customers’ needs Path to Scale & Self-Funding

© 2024 | Aurora Proprietary 95 We expect the Aurora Driver to provide meaningful total cost of ownership (TCO) benefits ✓ Increased revenue per truck with potential to more than double asset utilization ✓ Reduced insurance costs✓ Better fuel economy Path to Scale & Self-Funding ✓ More efficient and less variable driver costs

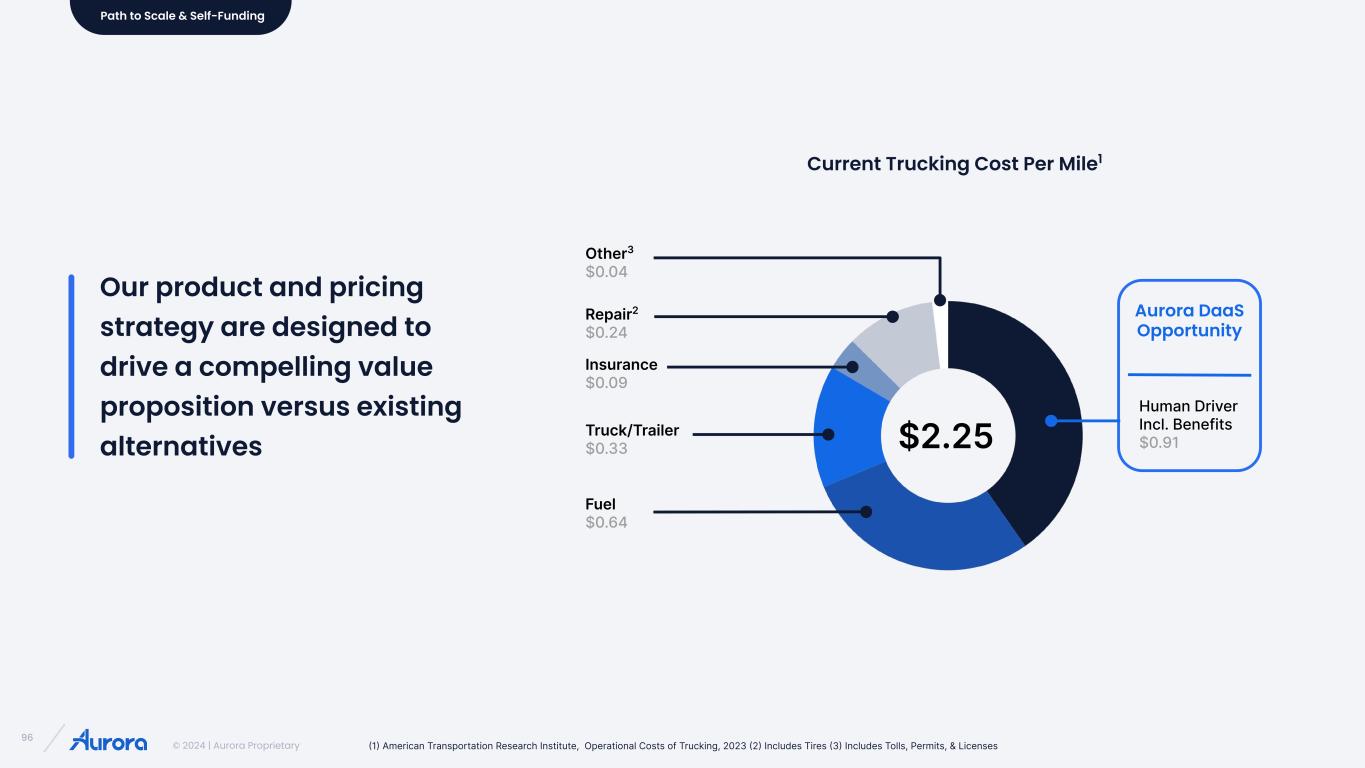

© 2024 | Aurora Proprietary 96 Aurora DaaS Opportunity (1) American Transportation Research Institute, Operational Costs of Trucking, 2023 (2) Includes Tires (3) Includes Tolls, Permits, & Licenses $2.25 Fuel $0.64 Truck/Trailer $0.33 Repair2 $0.24 Other3 $0.04 Human Driver Incl. Benefits $0.91 Insurance $0.09 Path to Scale & Self-Funding Our product and pricing strategy are designed to drive a compelling value proposition versus existing alternatives Current Trucking Cost Per Mile1

© 2024 | Aurora Proprietary 97 Indicative DaaS Price Range2 Trucking labor costs continue to rise Path to Scale & Self-Funding 2012 2022 $0.50 $0.60 $0.70 $0.80 $0.90 $1.00 Cost Per Mile: Driver Wages & Benefits1 Indicative DaaS pricing range provides customer TCO benefit while supporting “SaaS” like gross margins (1) American Transportation Research Institute, Operational Costs of Trucking, 2023 (2) Indicative DaaS pricing range encompasses expected terminal to terminal and end to end delivery model pricing differential

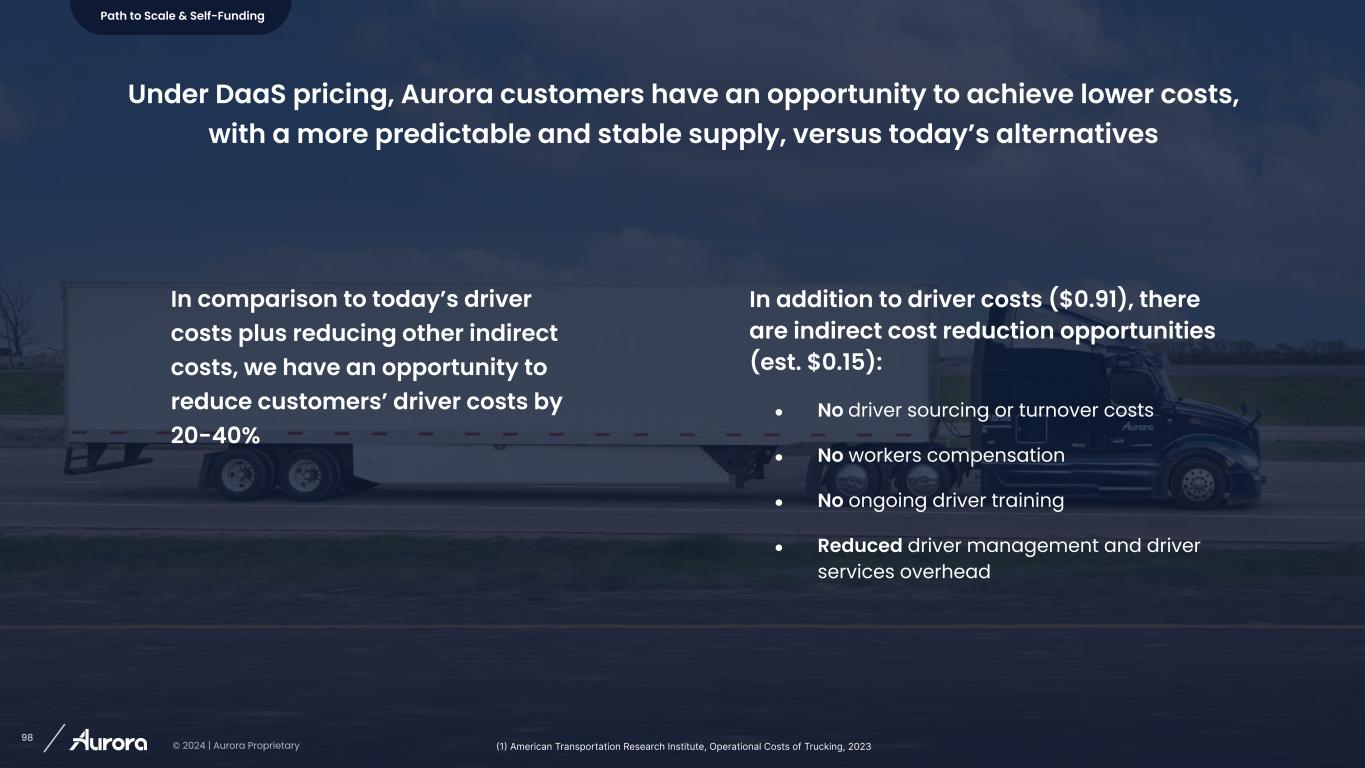

© 2024 | Aurora Proprietary 98 Under DaaS pricing, Aurora customers have an opportunity to achieve lower costs, with a more predictable and stable supply, versus today’s alternatives In addition to driver costs ($0.91), there are indirect cost reduction opportunities (est. $0.15): ● No driver sourcing or turnover costs ● No workers compensation ● No ongoing driver training ● Reduced driver management and driver services overhead Path to Scale & Self-Funding (1) American Transportation Research Institute, Operational Costs of Trucking, 2023 In comparison to today’s driver costs plus reducing other indirect costs, we have an opportunity to reduce customers’ driver costs by 20-40%

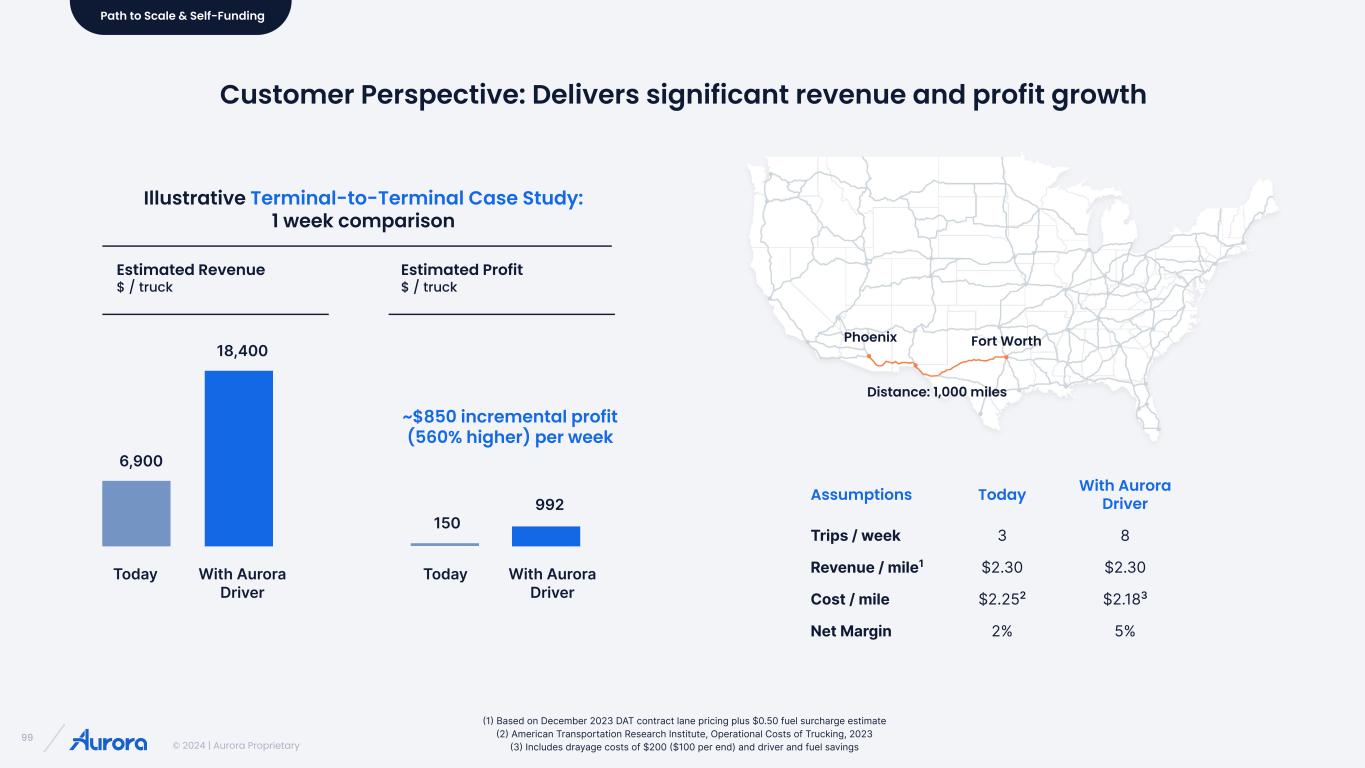

© 2024 | Aurora Proprietary 99 Customer Perspective: Delivers significant revenue and profit growth Assumptions Today With Aurora Driver Trips / week 3 8 Revenue / mile1 $2.30 $2.30 Cost / mile $2.252 $2.183 Net Margin 2% 5% Distance: 1,000 miles Phoenix Fort Worth Path to Scale & Self-Funding (1) Based on December 2023 DAT contract lane pricing plus $0.50 fuel surcharge estimate (2) American Transportation Research Institute, Operational Costs of Trucking, 2023 (3) Includes drayage costs of $200 ($100 per end) and driver and fuel savings Illustrative Terminal-to-Terminal Case Study: 1 week comparison Estimated Revenue $ / truck Estimated Profit $ / truck ~$850 incremental profit (560% higher) per week Today With Aurora Driver Today With Aurora Driver 18,400 6,900 150 992

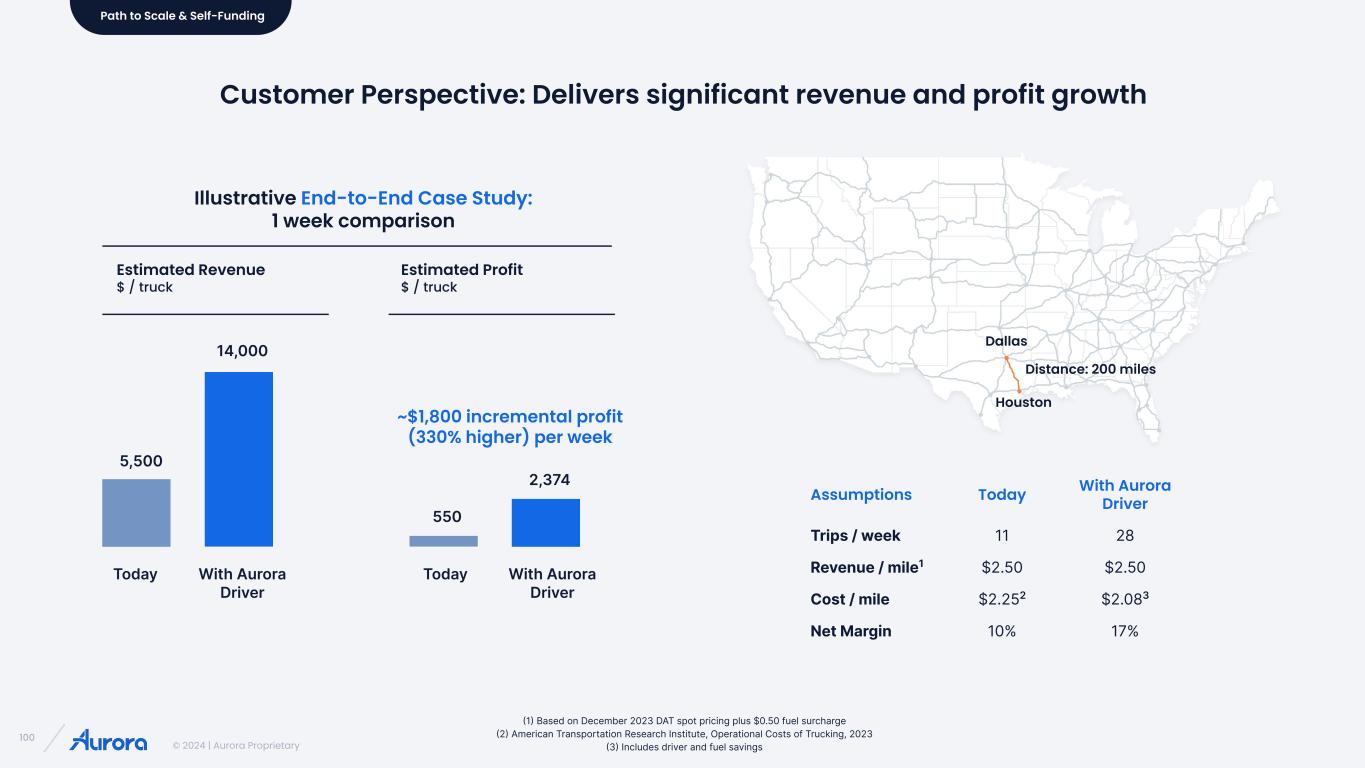

© 2024 | Aurora Proprietary 100 Estimated Revenue $ / truck Estimated Profit $ / truck Path to Scale & Self-Funding Distance: 200 miles Houston Dallas (1) Based on December 2023 DAT spot pricing plus $0.50 fuel surcharge (2) American Transportation Research Institute, Operational Costs of Trucking, 2023 (3) Includes driver and fuel savings Assumptions Today With Aurora Driver Trips / week 11 28 Revenue / mile1 $2.50 $2.50 Cost / mile $2.252 $2.083 Net Margin 10% 17% Illustrative End-to-End Case Study: 1 week comparison ~$1,800 incremental profit (330% higher) per week Customer Perspective: Delivers significant revenue and profit growth 14,000 5,500 Today With Aurora Driver Today With Aurora Driver 550 2,374

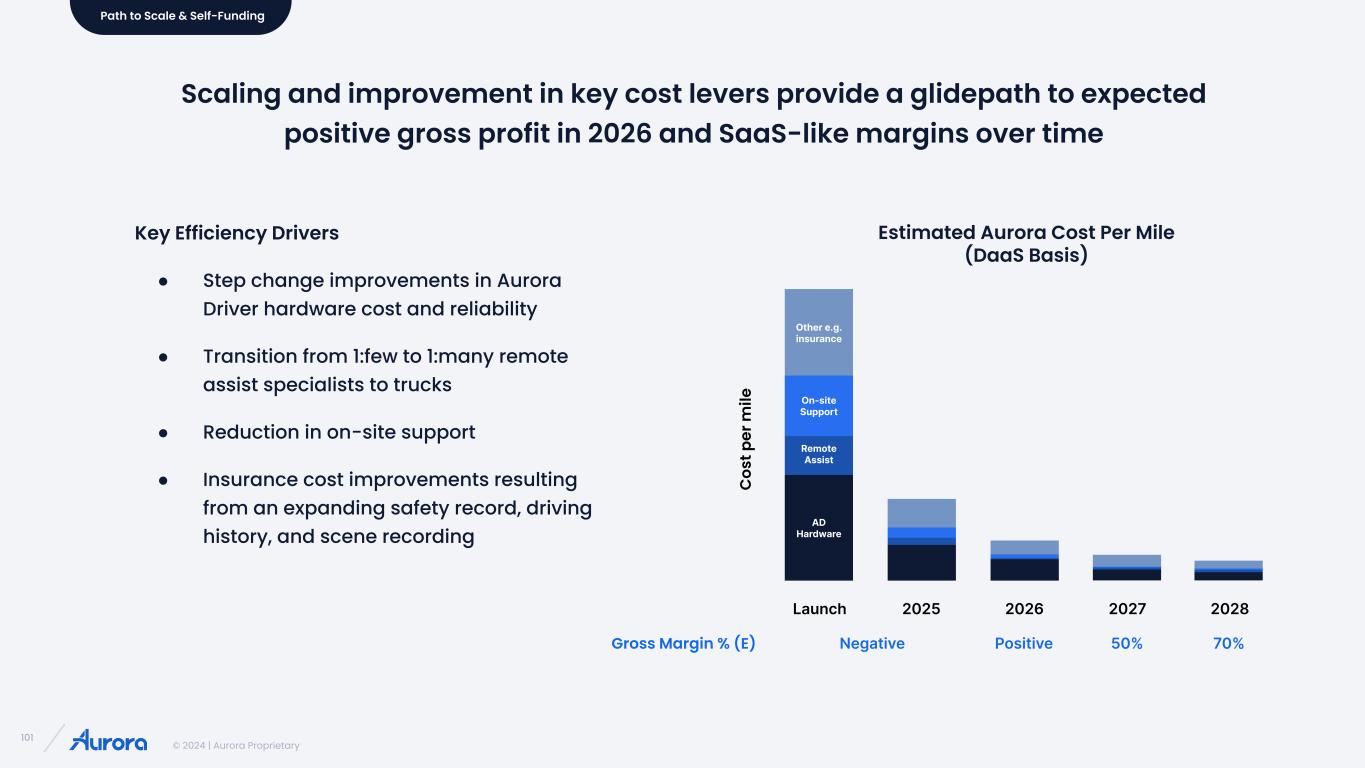

© 2024 | Aurora Proprietary 101 Scaling and improvement in key cost levers provide a glidepath to expected positive gross profit in 2026 and SaaS-like margins over time Key Efficiency Drivers ● Step change improvements in Aurora Driver hardware cost and reliability ● Transition from 1:few to 1:many remote assist specialists to trucks ● Reduction in on-site support ● Insurance cost improvements resulting from an expanding safety record, driving history, and scene recording Path to Scale & Self-Funding Estimated Aurora Cost Per Mile (DaaS Basis) Gross Margin % (E) Negative Positive 50% 70% AD Hardware Remote Assist On-site Support Other e.g. insurance Launch 2025 2026 2027 2028 C os t p er m ile

© 2024 | Aurora Proprietary 102 Execution of our customer-centric strategy can drive high margins and positive free cash flow in 2028 Estimated Revenue 2025 2026 2027 2028 Total Miles Driven (E) 10M 125M 750M 2B Annual Miles per Truck (E) 200k - 250k Path to Scale & Self-Funding Key Drivers & Assumptions ● Gross margin expansion to ~70% by 2028 ● Controlled spend - cash use including capex averaging $175-$185M per quarter until free cash flow positive ○ Capex peaks in 2026 at ~$80M and reduces to less than $10M per year thereafter with Continental Hardware as a Service structure ● Incremental capital of ~$850M required to achieve positive free cash flow $1.3B

© 2024 | Aurora Proprietary 103

© 2024 | Aurora Proprietary 104 Aurora Driver technology is ready Customers are ready Regulators are ready Autonomy-enabled vehicle platform is ready We expect to have all essential components in place for Commercial Launch

© 2024 | Aurora Proprietary 105 2025 2026 20272024 Path to Gross Profit Path to Scale & Self-Funding Path to Commercial Launch We're on the road to a scalable and self-sustaining business f

© 2024 | Aurora Proprietary 106 Watch video ▸

© 2024 | Aurora Proprietary 107 2024 Analyst & Investor Day