EX-99.1

Published on July 31, 2024

Second Quarter 2024 Shareholder Letter July 31, 2024 Exhibit 99.1

22Q24 Shareholder Letter A letter to shareholders Fueled by customer excitement for the Aurora Driver, we made great commercial progress during the second quarter. We announced another launch customer and now have a meaningful portion of our expected 2025 capacity contracted as we execute toward our planned Commercial Launch at the end of the year. The self-driving industry is at a turning point and we believe Aurora is best positioned with our responsible technology approach, robust safety culture, Driver as a Service business model, and continued financial discipline.

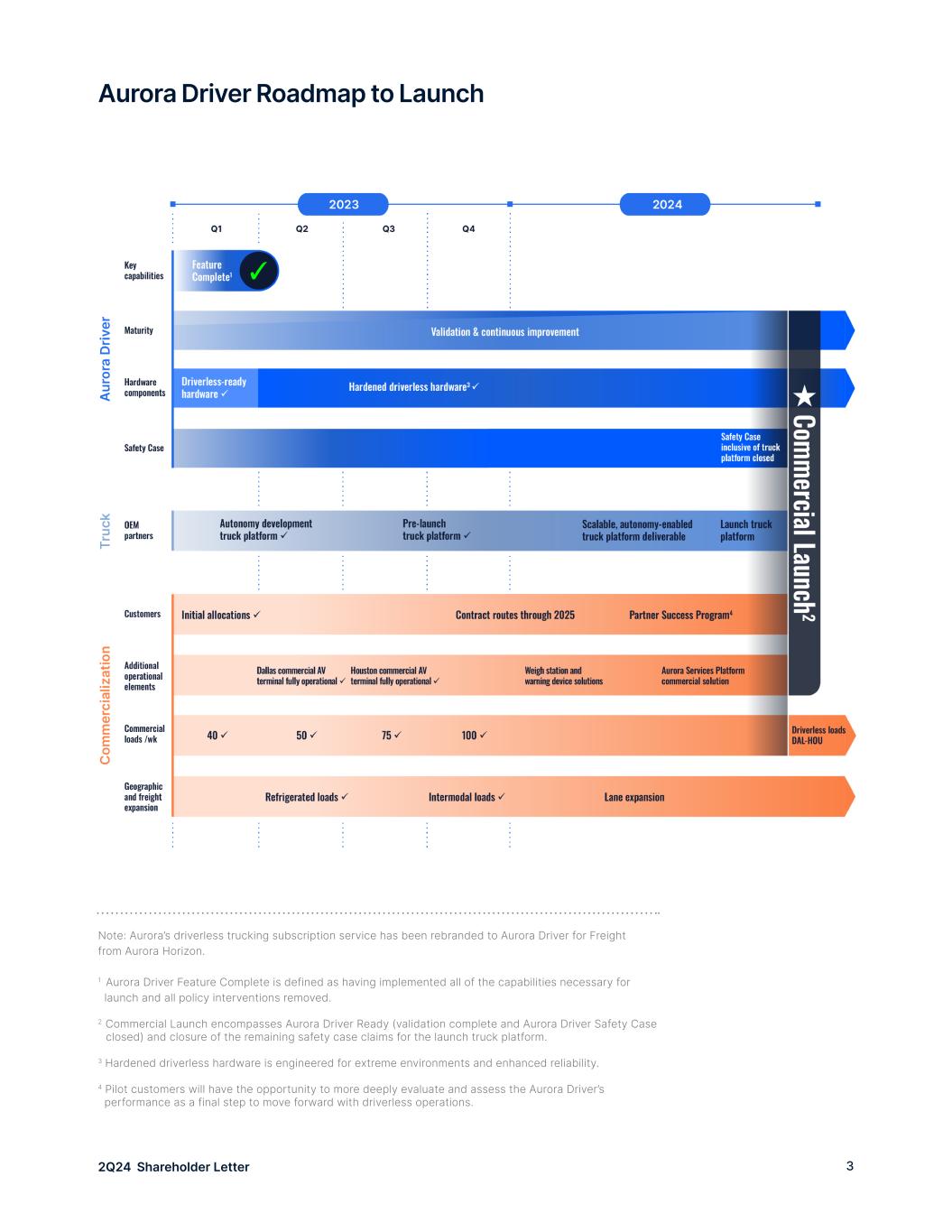

32Q24 Shareholder Letter Aurora Driver Roadmap to Launch Note: Aurora’s driverless trucking subscription service has been rebranded to Aurora Driver for Freight from Aurora Horizon. 1 Aurora Driver Feature Complete is defined as having implemented all of the capabilities necessary for launch and all policy interventions removed. 2 Commercial Launch encompasses Aurora Driver Ready (validation complete and Aurora Driver Safety Case closed) and closure of the remaining safety case claims for the launch truck platform. 3 Hardened driverless hardware is engineered for extreme environments and enhanced reliability. 4 Pilot customers will have the opportunity to more deeply evaluate and assess the Aurora Driver’s performance as a final step to move forward with driverless operations.

42Q24 Shareholder Letter Harnessing the power of Verifiable AI Artificial intelligence (AI) is essential to the success of a self-driving system - it solves problems that rules-based approaches simply can’t. This premise was core to our technology architecture philosophy when we founded Aurora. And it’s why we’ve built a system intended to maximize the benefits of the groundbreaking work in AI while also delivering a practical, verifiable, and commercially scalable solution. By combining the best of modern AI approaches with invariants, we are able to build a driver that is both human-like in its behavior and trained to follow the rules of the road. This is what we call “Verifiable AI”. We delve into this topic in more detail in a blog post that I penned during the second quarter, and our co-founder and Chief Scientist Drew Bagnell provided an under the hood look at our approaches in his AI Transparency blog post and AI Alignment blog post. We believe this is the only safe and viable approach for self-driving technology. It allows the development team to leverage the power of the most modern AI techniques and tools. And just as importantly, it makes it possible to verify and explain to regulators and other stakeholders that the Aurora Driver is trustworthy.

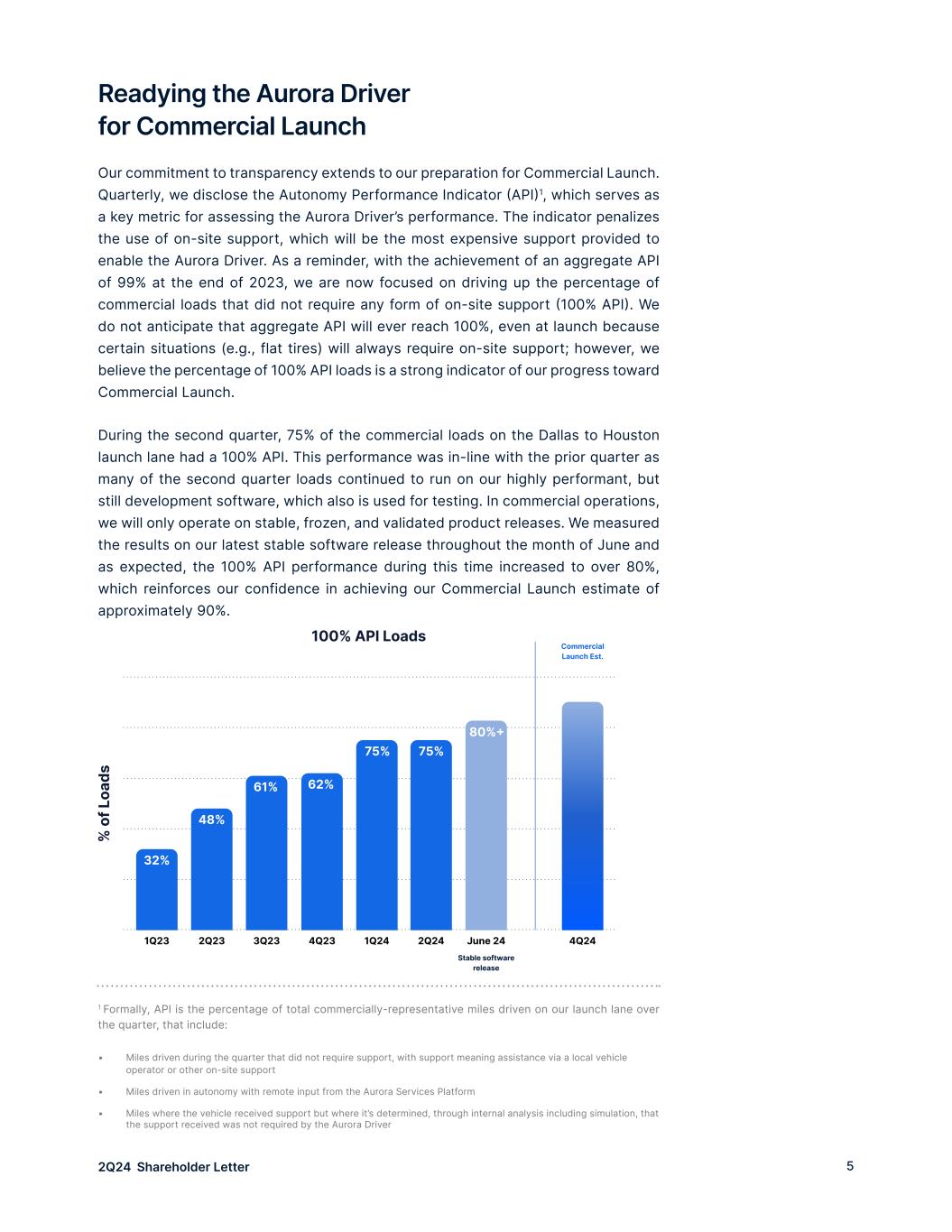

52Q24 Shareholder Letter Readying the Aurora Driver for Commercial Launch Our commitment to transparency extends to our preparation for Commercial Launch. Quarterly, we disclose the Autonomy Performance Indicator (API)1, which serves as a key metric for assessing the Aurora Driver’s performance. The indicator penalizes the use of on-site support, which will be the most expensive support provided to enable the Aurora Driver. As a reminder, with the achievement of an aggregate API of 99% at the end of 2023, we are now focused on driving up the percentage of commercial loads that did not require any form of on-site support (100% API). We do not anticipate that aggregate API will ever reach 100%, even at launch because certain situations (e.g., flat tires) will always require on-site support; however, we believe the percentage of 100% API loads is a strong indicator of our progress toward Commercial Launch. During the second quarter, 75% of the commercial loads on the Dallas to Houston launch lane had a 100% API. This performance was in-line with the prior quarter as many of the second quarter loads continued to run on our highly performant, but still development software, which also is used for testing. In commercial operations, we will only operate on stable, frozen, and validated product releases. We measured the results on our latest stable software release throughout the month of June and as expected, the 100% API performance during this time increased to over 80%, which reinforces our confidence in achieving our Commercial Launch estimate of approximately 90%. 1 Formally, API is the percentage of total commercially-representative miles driven on our launch lane over the quarter, that include: • Miles driven during the quarter that did not require support, with support meaning assistance via a local vehicle operator or other on-site support • Miles driven in autonomy with remote input from the Aurora Services Platform • Miles where the vehicle received support but where it’s determined, through internal analysis including simulation, that the support received was not required by the Aurora Driver

62Q24 Shareholder Letter Expanding and converting our customer funnel Customer confidence in our autonomy performance continues to accelerate our demand-building efforts. Our customer funnel has expanded with new leading carriers expressing interest in the Aurora Driver technology. As we develop these new relationships, we have contracted a meaningful portion of our expected 2025 capacity with our existing customers, with the remaining supply in the final stages of being contracted with several other current flagship customers. We have driverless approval from multiple customers so in other words - when Aurora is ready, our customers are ready. During the second quarter, we announced that our long-standing relationship with Uber Freight expanded from pilot operations to committed volume. They will be one of our first customers on our Dallas to Houston launch lane, with driverless hauls for shippers under our Transportation as a Service model expected at the end of 2024. In addition, we launched Premier Autonomy, a first-of-its kind program with Uber Freight. With early access to over one billion driverless miles through 2030, hundreds of Uber Freight carriers of all sizes will have an early, streamlined path to purchase and onboard the Aurora Driver. This program is expected to accelerate the adoption of Aurora Driver-powered autonomous trucks for our Driver as a Service business model, while driving high utilization of carrier assets via a seamless integration of the Aurora Driver into the Uber Freight platform. We believe that Premier Autonomy will democratize autonomy across carriers of all sizes, providing them with priority access to this new and valuable autonomous truck capacity to which they wouldn’t otherwise have access. Uber Freight Founder & CEO Lior Ron and Aurora President Ossa Fisher announcing the Premier Autonomy program at Uber Freight’s Carrier Summit

72Q24 Shareholder Letter “Uber Freight’s first driverless haul will be on an Aurora truck, with trips planned by the end of the year. Aurora is helping to lead the industry forward through their robust partner ecosystem and prudent AI-driven approach to deploying and scaling autonomous technology. Together, we’re advancing toward a future where goods and people move more efficiently and safely than ever before.” -Dara Khosrowshahi, CEO - Uber “Uber Freight and Aurora see a tremendous opportunity to democratize autonomous trucks for carriers of all sizes, enabling them to drive more revenue, scale their fleets, and strengthen their bottom lines.” -Lior Ron, Founder & CEO - Uber Freight

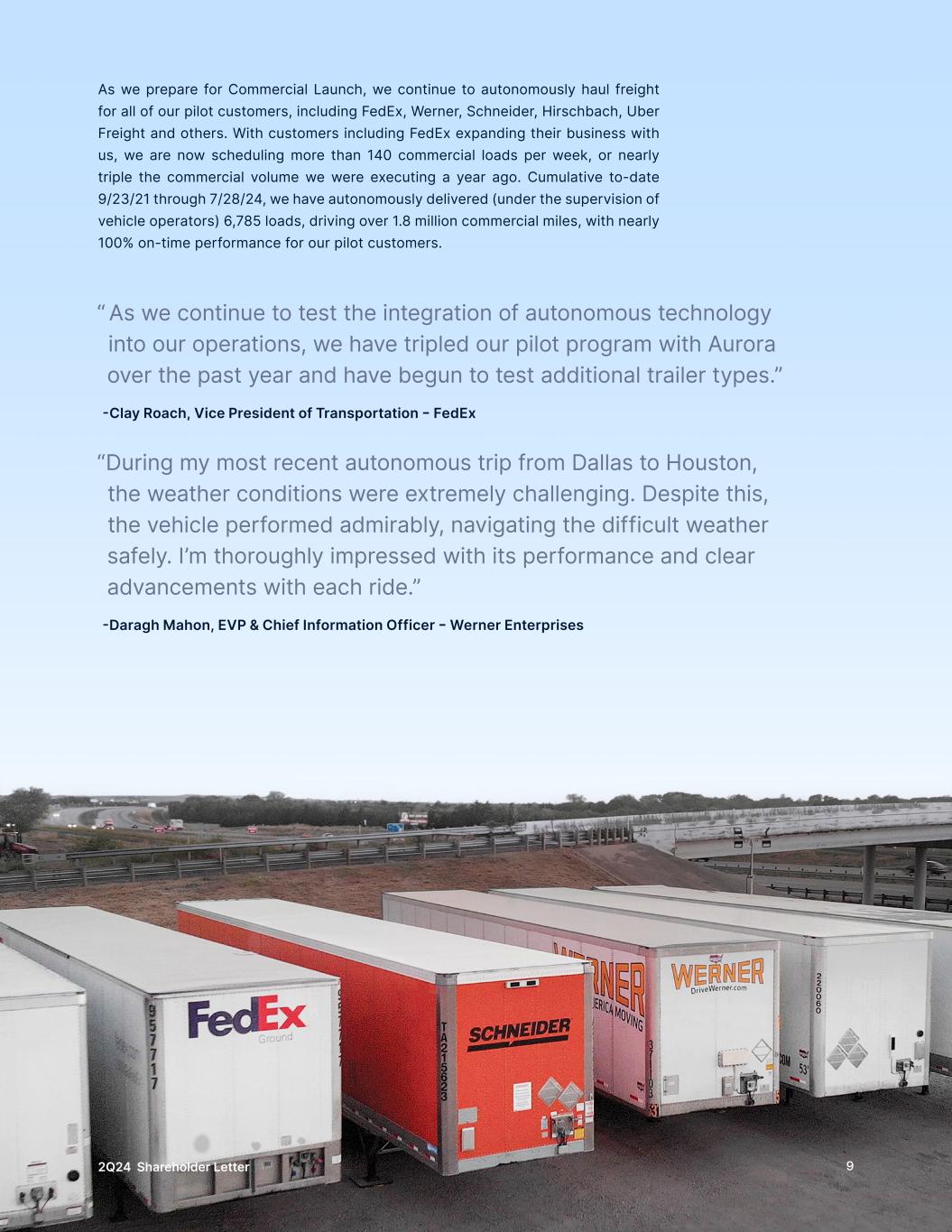

82Q24 Shareholder Letter Cumulative to-date 9/23/21 through 7/28/24, we have delivered: commercial loads 6,785 on-time (Aurora controlled rate) 100% nearly miles 1.8M+ across

92Q24 Shareholder Letter As we prepare for Commercial Launch, we continue to autonomously haul freight for all of our pilot customers, including FedEx, Werner, Schneider, Hirschbach, Uber Freight and others. With customers including FedEx expanding their business with us, we are now scheduling more than 140 commercial loads per week, or nearly triple the commercial volume we were executing a year ago. Cumulative to-date 9/23/21 through 7/28/24, we have autonomously delivered (under the supervision of vehicle operators) 6,785 loads, driving over 1.8 million commercial miles, with nearly 100% on-time performance for our pilot customers. “ As we continue to test the integration of autonomous technology into our operations, we have tripled our pilot program with Aurora over the past year and have begun to test additional trailer types.” -Clay Roach, Vice President of Transportation - FedEx “During my most recent autonomous trip from Dallas to Houston, the weather conditions were extremely challenging. Despite this, the vehicle performed admirably, navigating the difficult weather safely. I’m thoroughly impressed with its performance and clear advancements with each ride.” -Daragh Mahon, EVP & Chief Information Officer - Werner Enterprises

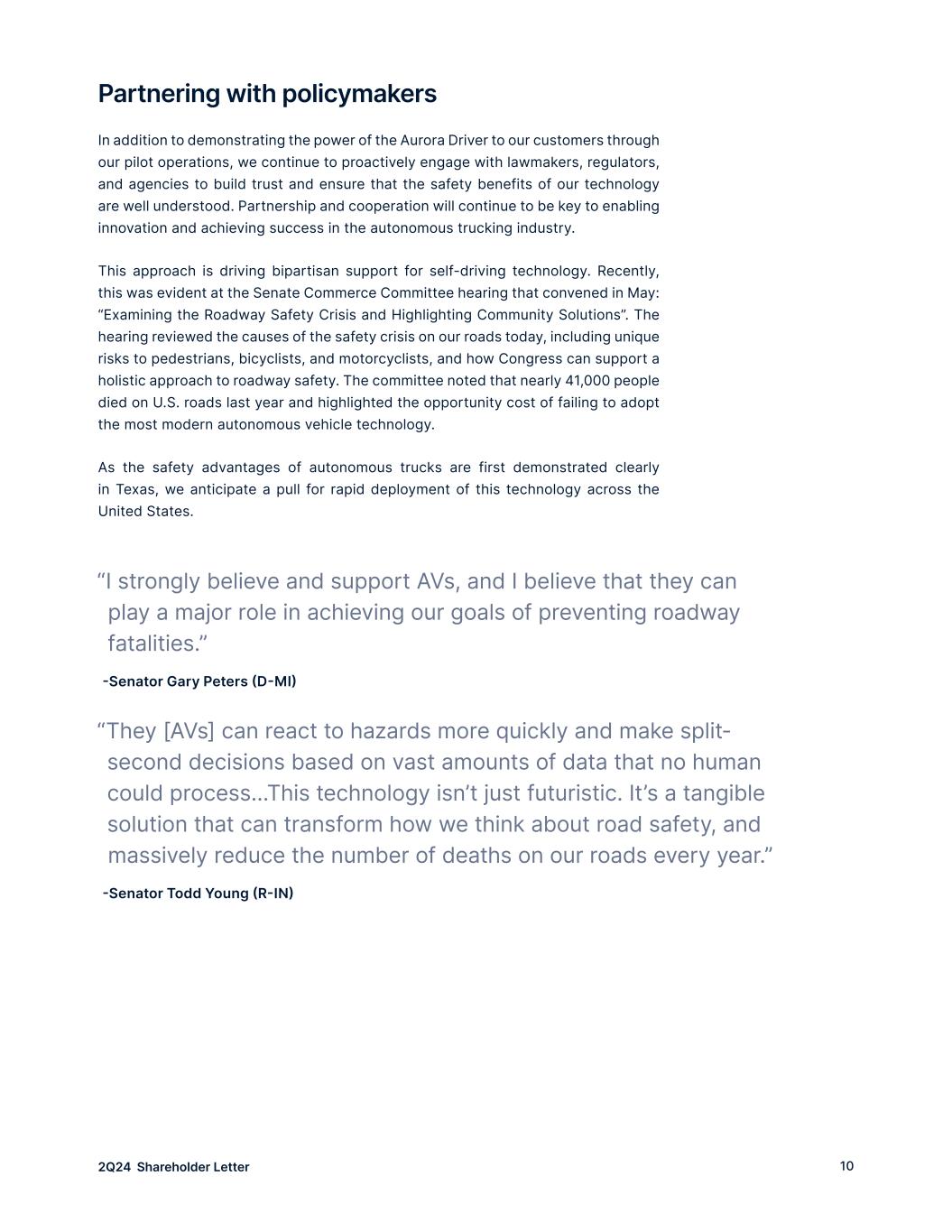

102Q24 Shareholder Letter Partnering with policymakers In addition to demonstrating the power of the Aurora Driver to our customers through our pilot operations, we continue to proactively engage with lawmakers, regulators, and agencies to build trust and ensure that the safety benefits of our technology are well understood. Partnership and cooperation will continue to be key to enabling innovation and achieving success in the autonomous trucking industry. This approach is driving bipartisan support for self-driving technology. Recently, this was evident at the Senate Commerce Committee hearing that convened in May: “Examining the Roadway Safety Crisis and Highlighting Community Solutions”. The hearing reviewed the causes of the safety crisis on our roads today, including unique risks to pedestrians, bicyclists, and motorcyclists, and how Congress can support a holistic approach to roadway safety. The committee noted that nearly 41,000 people died on U.S. roads last year and highlighted the opportunity cost of failing to adopt the most modern autonomous vehicle technology. As the safety advantages of autonomous trucks are first demonstrated clearly in Texas, we anticipate a pull for rapid deployment of this technology across the United States. “I strongly believe and support AVs, and I believe that they can play a major role in achieving our goals of preventing roadway fatalities.” -Senator Gary Peters (D-MI) “They [AVs] can react to hazards more quickly and make split- second decisions based on vast amounts of data that no human could process…This technology isn’t just futuristic. It’s a tangible solution that can transform how we think about road safety, and massively reduce the number of deaths on our roads every year.” -Senator Todd Young (R-IN)

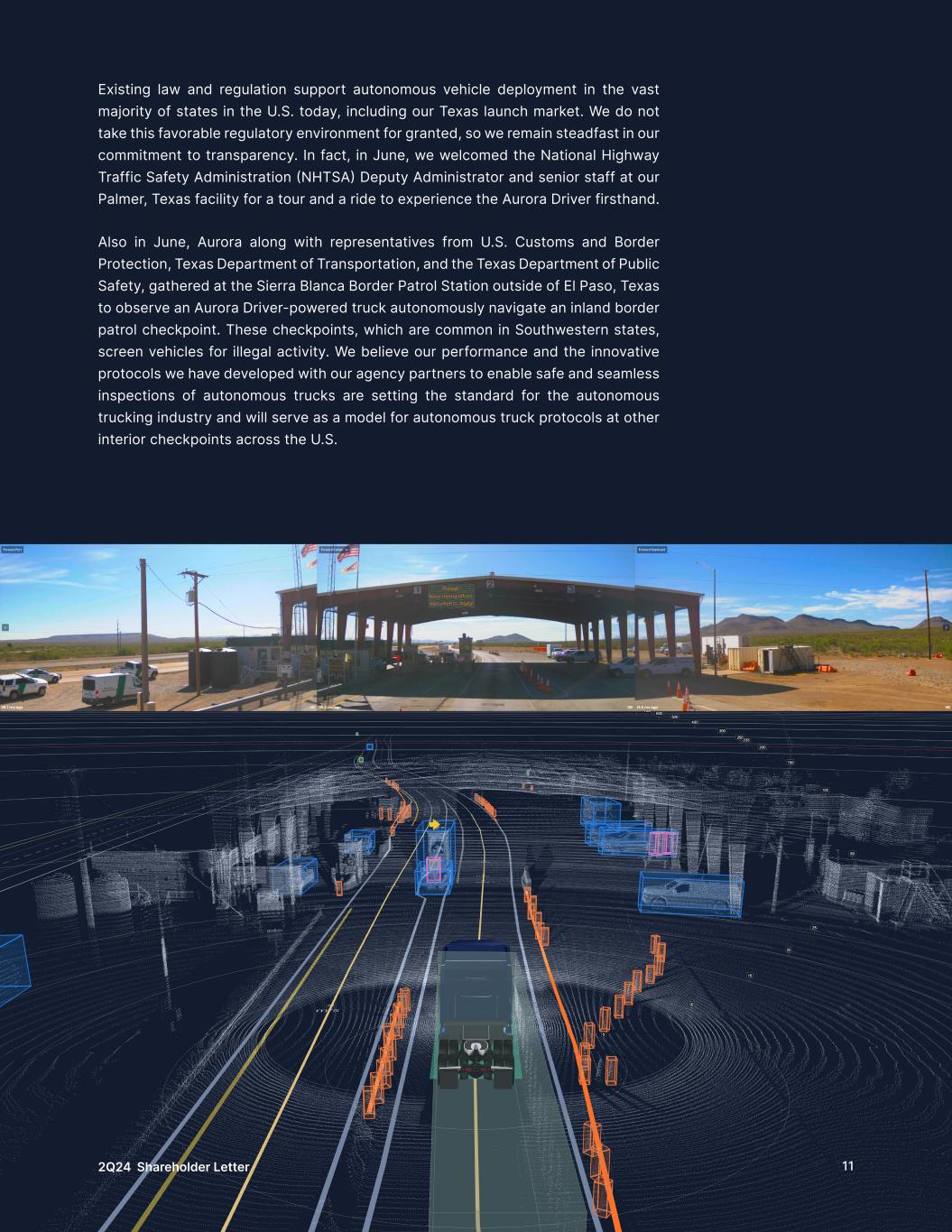

112Q24 Shareholder Letter Existing law and regulation support autonomous vehicle deployment in the vast majority of states in the U.S. today, including our Texas launch market. We do not take this favorable regulatory environment for granted, so we remain steadfast in our commitment to transparency. In fact, in June, we welcomed the National Highway Traffic Safety Administration (NHTSA) Deputy Administrator and senior staff at our Palmer, Texas facility for a tour and a ride to experience the Aurora Driver firsthand. Also in June, Aurora along with representatives from U.S. Customs and Border Protection, Texas Department of Transportation, and the Texas Department of Public Safety, gathered at the Sierra Blanca Border Patrol Station outside of El Paso, Texas to observe an Aurora Driver-powered truck autonomously navigate an inland border patrol checkpoint. These checkpoints, which are common in Southwestern states, screen vehicles for illegal activity. We believe our performance and the innovative protocols we have developed with our agency partners to enable safe and seamless inspections of autonomous trucks are setting the standard for the autonomous trucking industry and will serve as a model for autonomous truck protocols at other interior checkpoints across the U.S.

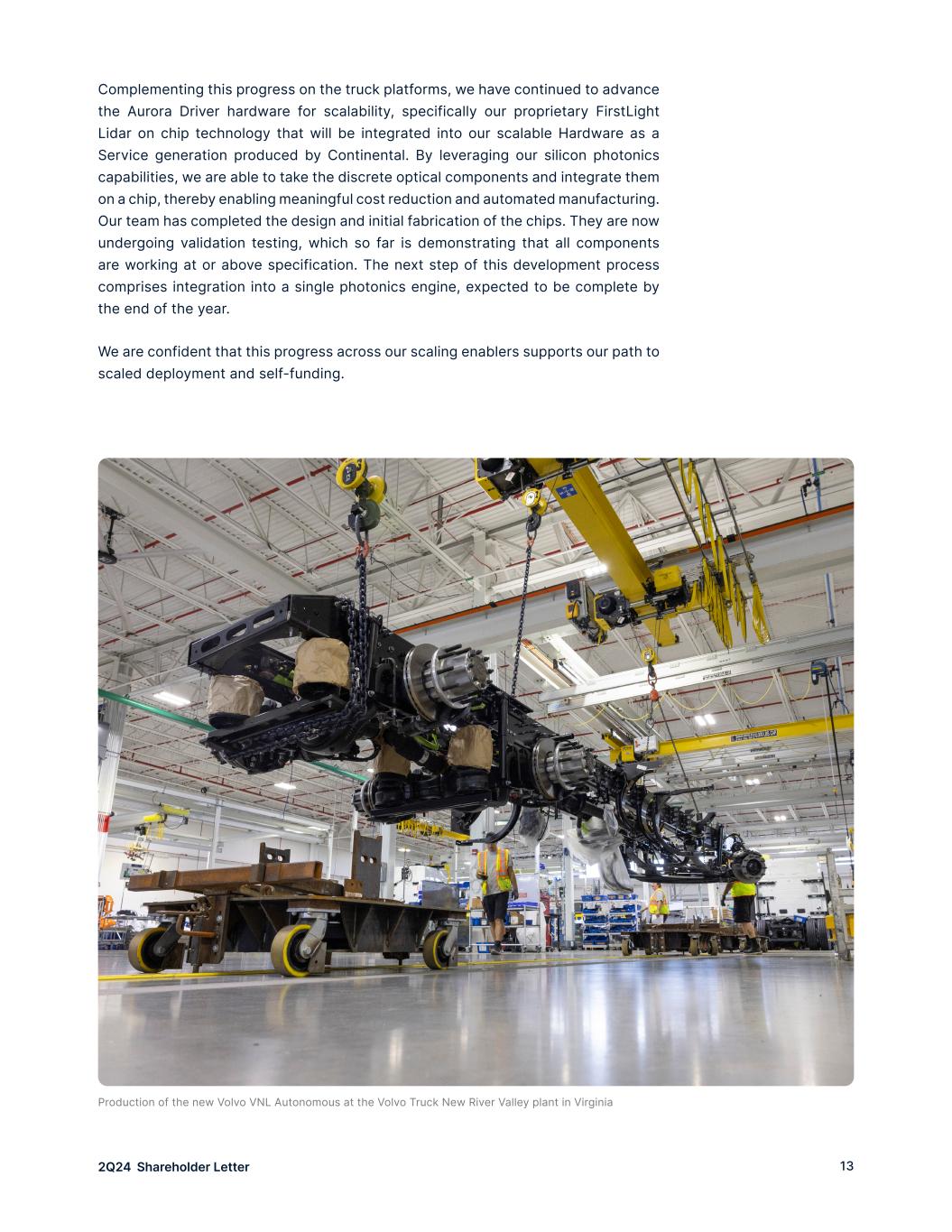

122Q24 Shareholder Letter Positioning for scale In addition to our industry-leading customer and policymaker relationships, we have established OEM and Tier 1 partnerships with Volvo Trucks, PACCAR, and Continental, that are unmatched in the industry. Given our autonomous technology leadership and the trust we have built, these companies selected Aurora to be their first partner in the detailed development of not just vehicle platforms and self- driving kits, but also broader deployment, servicing, and maintenance plans. These partnerships support a freight ecosystem with aligned incentives to drive growth for years to come. Accordingly, we continue to believe that Aurora is the only company positioned to commercialize autonomous trucking at scale. Progress on scalable autonomy-enabled truck platforms continues, most notably during the second quarter with the May unveiling of the production-ready Volvo VNL Autonomous, powered by the Aurora Driver. The realization of our six years of work together, this is the first truly scalable, commercial truck purpose-built for autonomy that is designed to usher in a new era in transportation. Production of these trucks has begun at Volvo Trucks’ flagship factory in New River Valley in Dublin, Virginia and we just received our first truck off the line this month. “Since we recognize that the challenges we’re facing are too big to try and solve alone, we partner with others who share our vision of safer, more efficient, and more sustainable industry. That is why we have partnered with Aurora - we believe the passion and expertise we share between us will help achieve our joint vision and lead the way into an autonomous future.” -Nils Jaeger, President - Volvo Autonomous Solutions

132Q24 Shareholder Letter Complementing this progress on the truck platforms, we have continued to advance the Aurora Driver hardware for scalability, specifically our proprietary FirstLight Lidar on chip technology that will be integrated into our scalable Hardware as a Service generation produced by Continental. By leveraging our silicon photonics capabilities, we are able to take the discrete optical components and integrate them on a chip, thereby enabling meaningful cost reduction and automated manufacturing. Our team has completed the design and initial fabrication of the chips. They are now undergoing validation testing, which so far is demonstrating that all components are working at or above specification. The next step of this development process comprises integration into a single photonics engine, expected to be complete by the end of the year. We are confident that this progress across our scaling enablers supports our path to scaled deployment and self-funding. Production of the new Volvo VNL Autonomous at the Volvo Truck New River Valley plant in Virginia

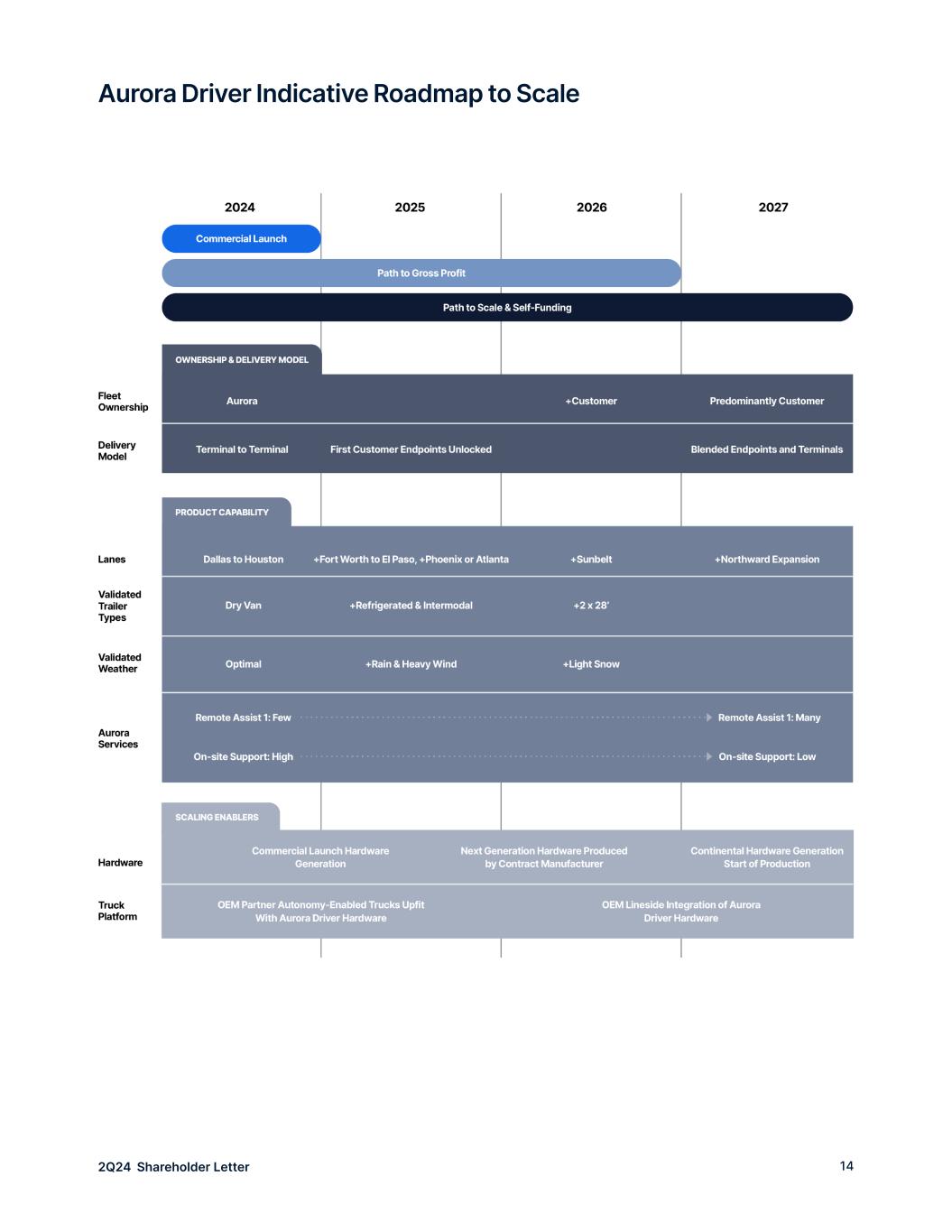

142Q24 Shareholder Letter Aurora Driver Indicative Roadmap to Scale

152Q24 Shareholder Letter Executing responsibly and purposefully toward Commercial Launch We closed the second quarter honoring National Safety Month in June. Safety has always been at the heart of our motivation and work. Our robust safety culture and responsible technology approach underpin our development of a safe, reliable, and valuable autonomous trucking product. TÜV SÜD, a global leader in safety testing, inspecting, and certification, recently completed an independent audit of how Aurora manages safety in self-driving product development and operations. Not only did TÜV SÜD find that Aurora’s Safety Management System (SMS) conforms with Automated Vehicle Safety Consortium recommendations, they also found that Aurora is proactive, responsible, and thorough in our safety approach. This audit is the first of its kind for the autonomous vehicle industry; we believe this is an important further validation and should help build confidence ahead of Commercial Launch. So far 2024 has already been an exciting year at Aurora and we are confident that the best is yet to come as we execute toward our planned Commercial Launch at the end of the year and longer-term deployment at scale. Chris Urmson CEO & Co-founder

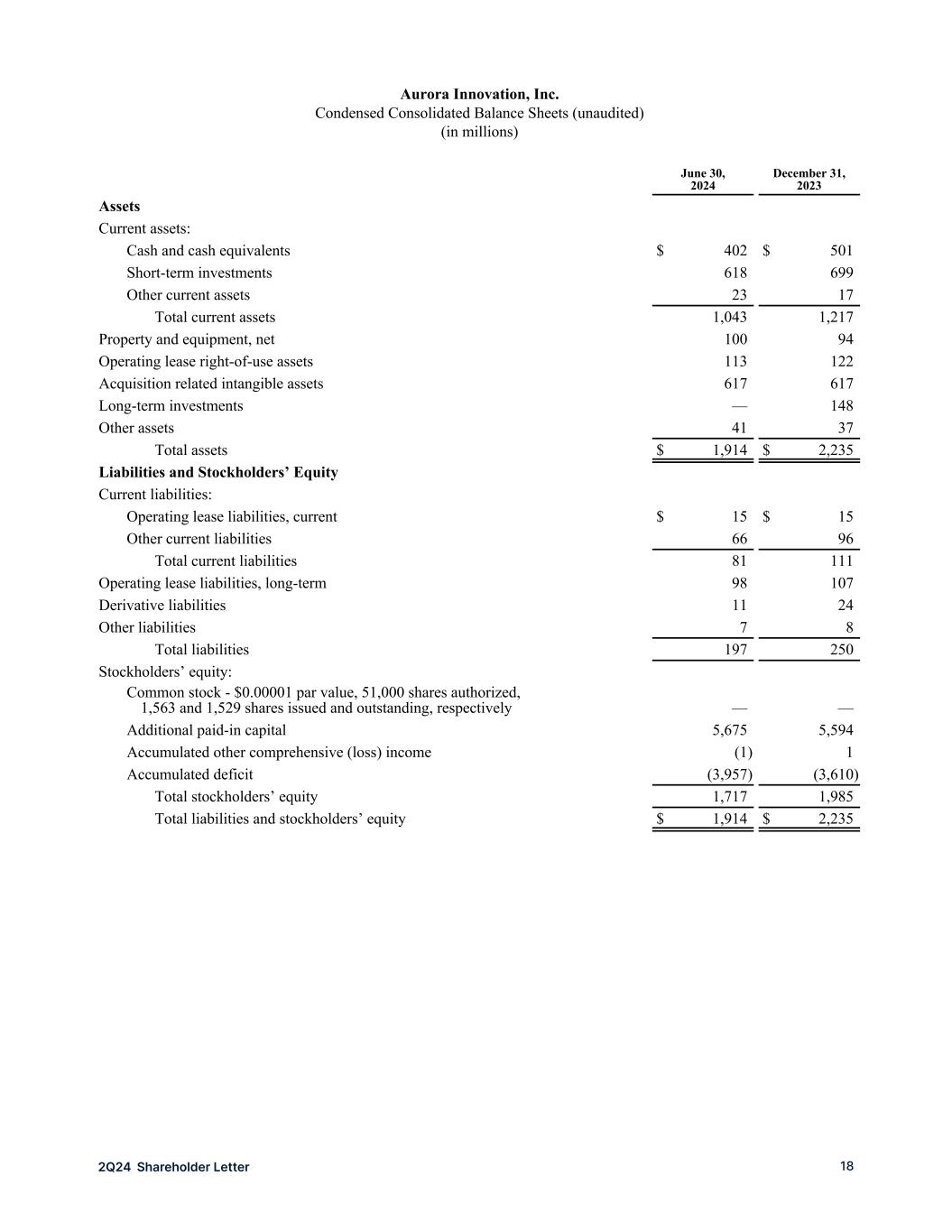

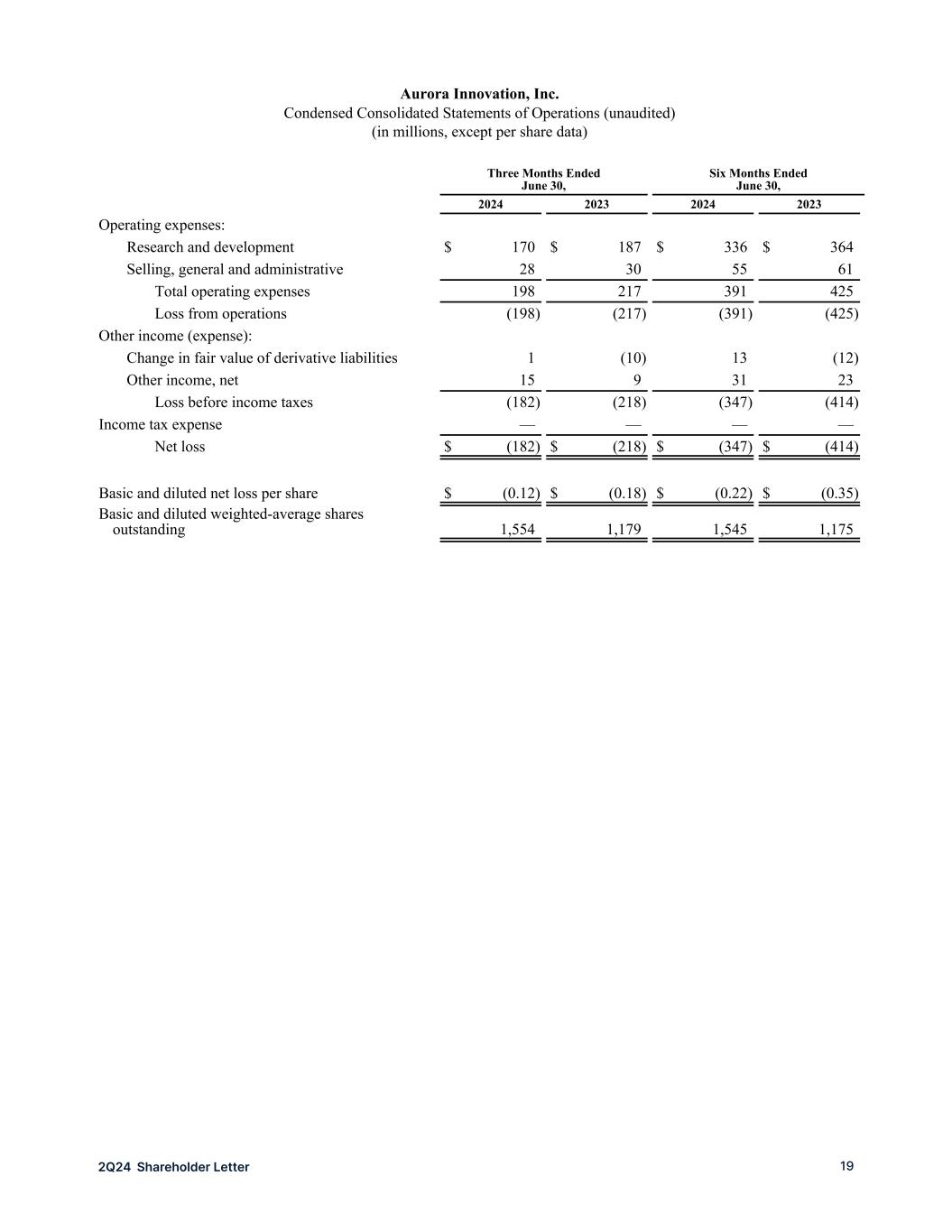

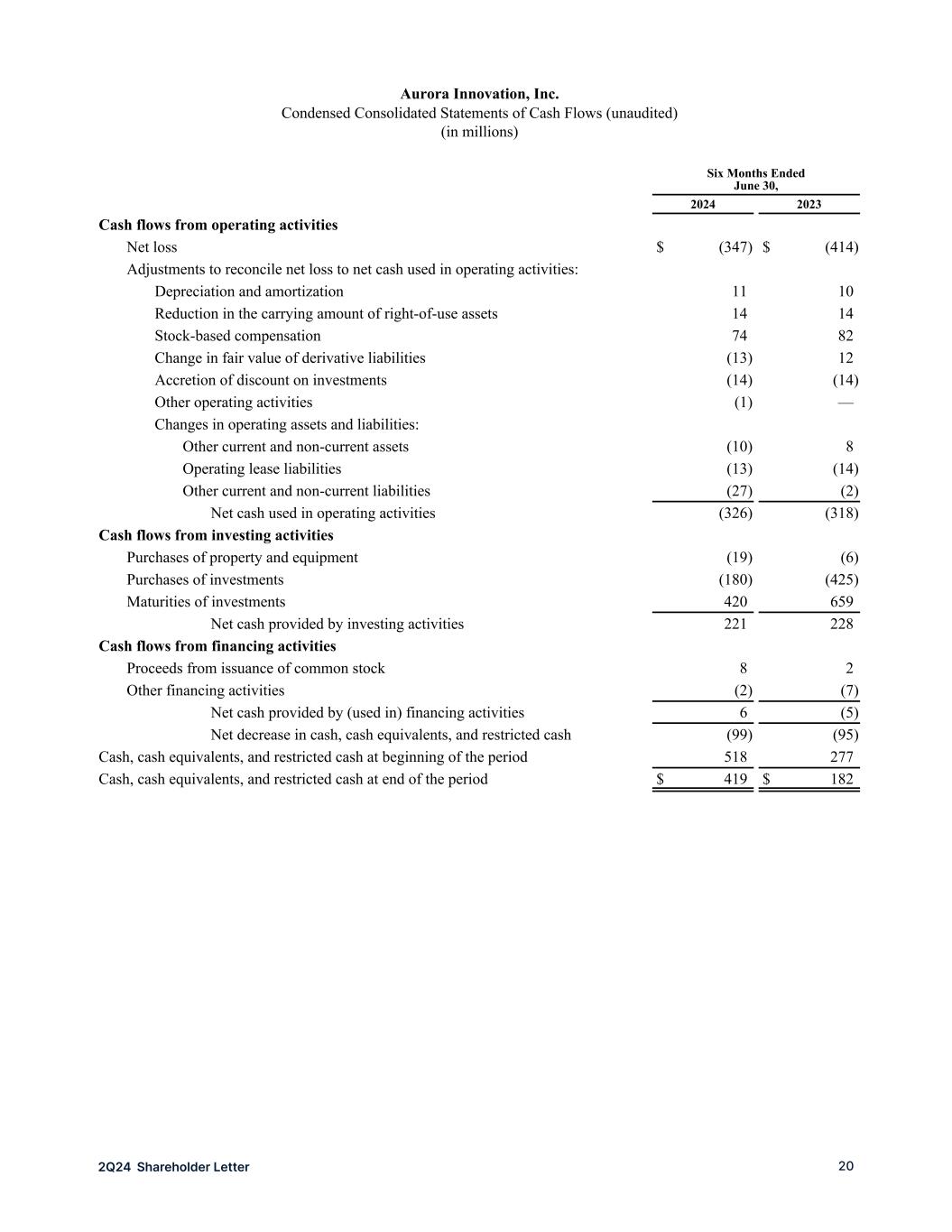

162Q24 Shareholder Letter From the desk of our CFO During the second quarter of 2024, we continued to demonstrate strong fiscal discipline while executing toward our planned Commercial Launch. Second quarter 2024 operating expenses, including stock-based compensation (SBC), totaled $198 million. Excluding SBC of $38 million, operating expenses totaled $160 million, reflecting $138 million in R&D, which is primarily comprised of personnel costs as we continue to invest in our industry-leading autonomy technology, and $22 million in SG&A. We used approximately $176 million in operating cash during the second quarter of 2024, which included $49 million in payments associated with our 2023 annual incentive compensation program. Capital expenditures totaled $11 million. Excluding the incentive compensation payments, which average to approximately $12 million per quarter, our total cash spend was $138 million due to continued focus on capital preservation as well as one less payroll cycle for the quarter. For the remainder of 2024, we expect cash use to be within the $175 - $185 million quarterly average range, including the necessary capital expenditures required for Commercial Launch. We ended the second quarter with a very strong balance sheet, including $1.0 billion in cash and short-term investments. We continue to expect this liquidity to support our planned Commercial Launch and fund our operations into the fourth quarter of 2025. David Maday CFO

172Q24 Shareholder Letter Cautionary statement regarding forward-looking statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. The words “believe,” “may,” “will,” “estimate,” “con- tinue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “potential,” “indicative,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. All statements contained in this investor letter that do not relate to mat- ters of historical fact should be considered forward-looking statements, including but not limited to, those statements around the benefits of integrating AI into our product, the benefits of Premier Autonomy and its ability to accelerate the adoption of Aurora Driver and democratize autonomy across carriers of all sizes, the safety benefits of our technology and product, our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufacturing, scal- ing, and commercialization of the Aurora Driver and related services, including re- lationships and anticipated benefits with partners and customers, and on the time- frame we expect or at all, the market opportunity and profitability of our products and services, the regulatory tailwinds and framework in which we operate, and our expected cash use and cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our ac- tual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Our projected quarterly cash use is based upon assumptions, includ- ing research and development and general and administrative activities, as well as capital expenses and working capital. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year end- ed December 31, 2023, filed with the SEC on February 15, 2024, as amended by the Form 10-K/A filed with the SEC on May 24, 2024, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Auro- ra undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

182Q24 Shareholder Letter Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in millions) June 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 402 $ 501 Short-term investments 618 699 Other current assets 23 17 Total current assets 1,043 1,217 Property and equipment, net 100 94 Operating lease right-of-use assets 113 122 Acquisition related intangible assets 617 617 Long-term investments — 148 Other assets 41 37 Total assets $ 1,914 $ 2,235 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 15 $ 15 Other current liabilities 66 96 Total current liabilities 81 111 Operating lease liabilities, long-term 98 107 Derivative liabilities 11 24 Other liabilities 7 8 Total liabilities 197 250 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,563 and 1,529 shares issued and outstanding, respectively — — Additional paid-in capital 5,675 5,594 Accumulated other comprehensive (loss) income (1) 1 Accumulated deficit (3,957) (3,610) Total stockholders’ equity 1,717 1,985 Total liabilities and stockholders’ equity $ 1,914 $ 2,235

192Q24 Shareholder Letter Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Operating expenses: Research and development $ 170 $ 187 $ 336 $ 364 Selling, general and administrative 28 30 55 61 Total operating expenses 198 217 391 425 Loss from operations (198) (217) (391) (425) Other income (expense): Change in fair value of derivative liabilities 1 (10) 13 (12) Other income, net 15 9 31 23 Loss before income taxes (182) (218) (347) (414) Income tax expense — — — — Net loss $ (182) $ (218) $ (347) $ (414) Basic and diluted net loss per share $ (0.12) $ (0.18) $ (0.22) $ (0.35) Basic and diluted weighted-average shares outstanding 1,554 1,179 1,545 1,175 Condensed Consolida ed Balance She ts (u audited) (in millions) June 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 402 $ 501 Short-term investments 618 699 Other current assets 23 17 Total current assets 1,043 1,217 Property and equipment, net 100 94 Operating lease right-of-use assets 113 122 Acquisition related intangible assets 617 617 Long-term investments — 148 Other assets 41 37 Total assets $ 1,914 $ 2,235 Liabilities and Stockholders’ Equity Current liabili ies: Operating lease liabilities, current $ 15 $ 15 Other current liabilities 66 96 Total current liabilities 81 111 Operating lease liabilities, long-term 98 107 Derivative liabilities 11 24 Other liabilities 7 8 Total liabilities 197 250 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,563 and 1,529 shares issued and outstanding, respectively — — Additional paid-in capital 5,675 5,594 Accumulated other comprehensive (loss) income (1) 1 Accumulated deficit (3,957) (3,610) Total stockholders’ equity 1,717 1,985 Total liabilities and stockholders’ equity $ 1,914 $ 2,235

202Q24 Shareholder Letter Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (unaudited) (in millions) Six Months Ended June 30, 2024 2023 Cash flows from operating activities Net loss $ (347) $ (414) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 11 10 Reduction in the carrying amount of right-of-use assets 14 14 Stock-based compensation 74 82 Change in fair value of derivative liabilities (13) 12 Accretion of discount on investments (14) (14) Other operating activities (1) — Changes in operating assets and liabilities: Other current and non-current assets (10) 8 Operating lease liabilities (13) (14) Other current and non-current liabilities (27) (2) Net cash used in operating activities (326) (318) Cash flows from investing activities Purchases of property and equipment (19) (6) Purchases of investments (180) (425) Maturities of investments 420 659 Net cash provided by investing activities 221 228 Cash flows from financing activities Proceeds from issuance of common stock 8 2 Other financing activities (2) (7) Net cash provided by (used in) financing activities 6 (5) Net decrease in cash, cash equivalents, and restricted cash (99) (95) Cash, cash equivalents, and restricted cash at beginning of the period 518 277 Cash, cash equivalents, and restricted cash at end of the period $ 419 $ 182 Con ensed Consolidated Balance Sheets (unaudited) June 30, 2024 Dec mber 31, 2023 Assets urrent assets: Cash and cash equivalents $ 402 $ 501 Short-term investments 618 699 Other current assets 23 17 Total current assets 1,043 1,217 Property and equipment, net 100 94 Operating lease right-of-use assets 113 122 Acquisition related intangible assets 617 617 Long-term investments — 148 Other assets 41 37 Total assets $ 1,914 $ 2,235 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 15 $ 15 Other current liabilities 66 96 Total current liabilities 81 111 Operating lease liabilities, long-term 98 107 Derivative liabilities 11 24 Other liabilities 7 8 Total liabilities 197 250 Stockholders’ equity: Commo stock - $0.00001 par value, 51,000 shares authorized, 1,563 and 1,529 shares issued and outstanding, respectively — — Additional paid-in capital 5,675 5,594 Accumulated other comprehensive (loss) income (1) 1 Accumulated deficit (3,957) (3,610) Total stockholders’ equity 1,717 1,985 Total liabilities and stockholders’ equity $ 1,914 $ 2,235

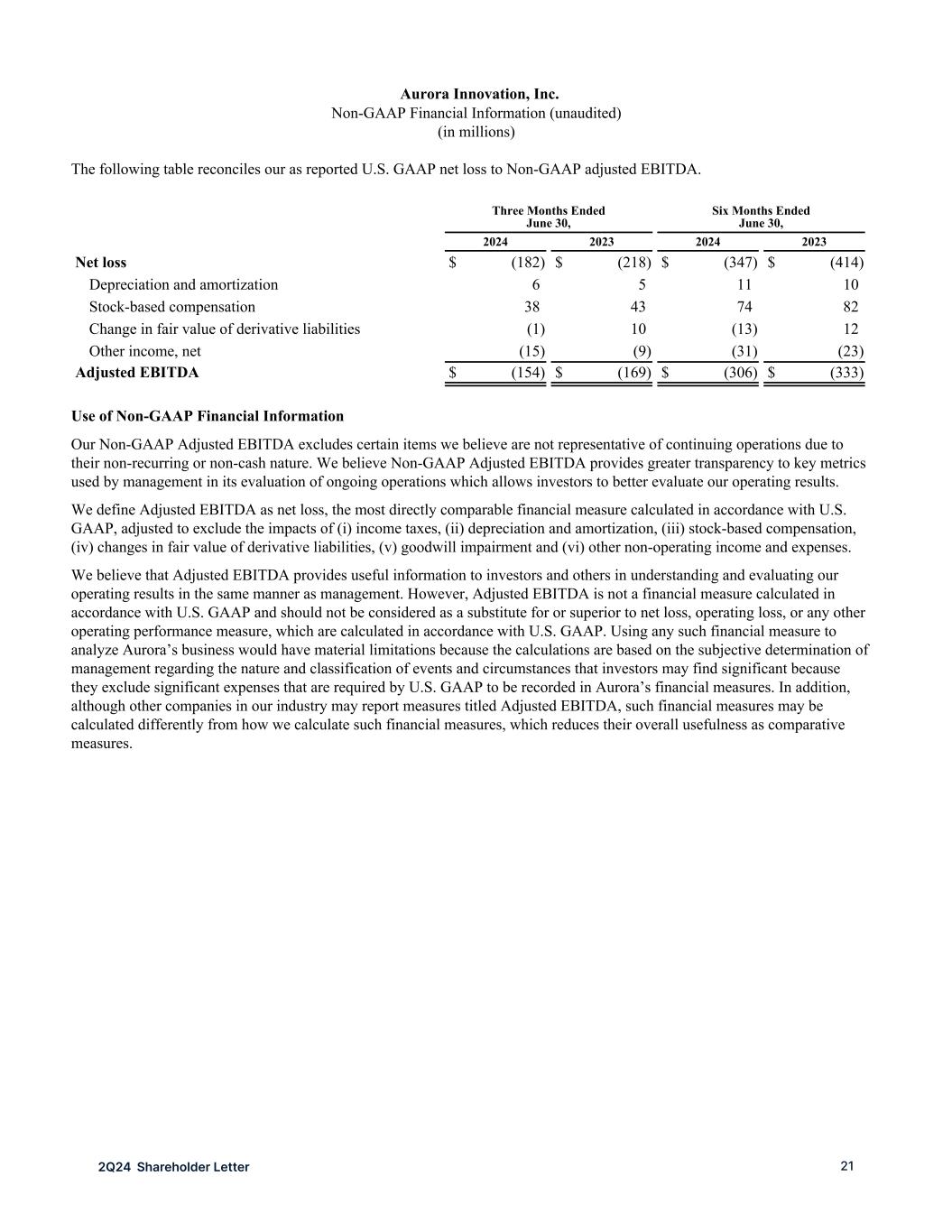

212Q24 Shareholder Letter Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net loss $ (182) $ (218) $ (347) $ (414) Depreciation and amortization 6 5 11 10 Stock-based compensation 38 43 74 82 Change in fair value of derivative liabilities (1) 10 (13) 12 Other income, net (15) (9) (31) (23) Adjusted EBITDA $ (154) $ (169) $ (306) $ (333) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. We believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in our industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how we calculate such financial measures, which reduces their overall usefulness as comparative measures. Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in mil ions) June 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 402 $ 501 Short-term investments 618 699 Other current assets 23 17 Total current assets 1,043 1,217 Property and equipment, net 100 94 Operating lease right-of-use assets 113 122 Acquisition related intangible assets 617 617 Long-term investments — 148 Other assets 41 37 Total assets $ 1,914 $ 2,235 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 15 $ 15 Other current liabilities 66 96 Total current liabilities 81 111 Operating lease liabilities, long-term 98 107 Derivative liabilities 11 24 Other liabilities 7 8 Total liabilities 197 250 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,563 and 1,529 shares issued and outstanding, respectively — — Additional paid-in capital 5,675 5,594 Accumulated other comprehensive (loss) income (1) 1 Accumulated deficit (3,957) (3,610) Total stockholders’ equity 1,717 1,985 Total liabilities and stockholders’ equity $ 1,914 $ 2,235 urora In ovation, Inc. Non-GA P Financial Information (una dite ) (in il ions) The following table reconciles our as reported U.S. GA P net los to Non-GA P adjusted EBITDA. Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net los $ (182) $ (218) $ (347) $ (414) Depreciation and amortization 6 5 1 10 Stock-based compensation 38 43 74 82 Change in fair value of derivative liabil t es (1) 10 (13) 12 Other income, net (15) (9) (31) (23) Adjusted EBITDA $ (154) $ (169) $ (306) $ (3 ) Use of Non-GA P Financial Information Our Non-GA P Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GA P Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net los , the most directly comparable financial measure calculated in ac ordance with U.S. GA P, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (ii ) stock-based compensation, (iv) changes in fair value of derivative liabil t es, (v) go dwill impairment and (vi) other non-operating income and expenses. We believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same man er as management. However, Adjusted EBITDA is not a financial measure calculated in ac ordance with U.S. GA P and should not be considered as a substi ute for or superior to net los , operating los , or any other operating performance measure, which are calculated in ac ordance with U.S. GA P. Using any such financial measure to analyze Aurora’s bus nes would have material imitations because the calculations are based on the subjective determination of management regarding the nature and clas ification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GA P to be recorded in Aurora’s financial measures. In ad it on, although other companies in our indu try may report measures ti led Adjusted EBITDA, such financial measures may be calculated differently from how we calculate such financial measures, which reduces their overall usefulnes as comparative measures.