EX-99.1

Published on July 30, 2025

Second Quarter 2025 Shareholder Letter JULY 30, 2025 Exhibit 99.1

A letter to shareholders The second quarter marked a pivotal moment in transportation history, as Aurora opened a new chapter with the launch of the first driverless commercial trucking operations on public roads in the U.S. From commercial launch at the end of April through the end of June, the Aurora Driver already logged more than 20,000 driverless miles in its initial operating domain of daytime with clear weather conditions. And just last week, we completed the validation and began driverless operations at night, which materially increases the utilization potential of our self-driving trucks, thereby unlocking a game-changing component of the Aurora Driver’s value proposition. This progress propels Aurora and the freight industry into a new era. 22Q25 SHAREHOLDER LETTER

Ramping driverless operations We are executing on our crawl, walk, run approach to driverless operations, ensuring a seamless product experience that delivers undeniable value to our customers and deepens trust across our stakeholders. We started with one truck and as of earlier this month, now have three driverless trucks operating between Dallas and Houston. During the second quarter, our driverless trucks already drove the equivalent of traveling coast to coast more than eight times. Importantly, we have maintained nearly 100% on-time performance while upholding our perfect safety record. Since April, Aurora’s self-driving trucks have been completing roundtrip hauls between Dallas and Houston. This marks an important industry milestone, with Uber Freight becoming the first logistics platform to offer shippers access to fully driverless Class 8 trucks operating on public roads. As driverless operations scale, we remain committed to smarter supply chains, more efficient roads and highways, and driving real impact for our customers and partners. Together, we’re reshaping how goods move across the world.” —DARA KHOSROWSHAHI, CEO, UBER 8x The Aurora Driver logged 20,000+ driverless miles through 6/30/25. That's the equivalent of traveling coast to coast more than eight times. 32Q25 SHAREHOLDER LETTER

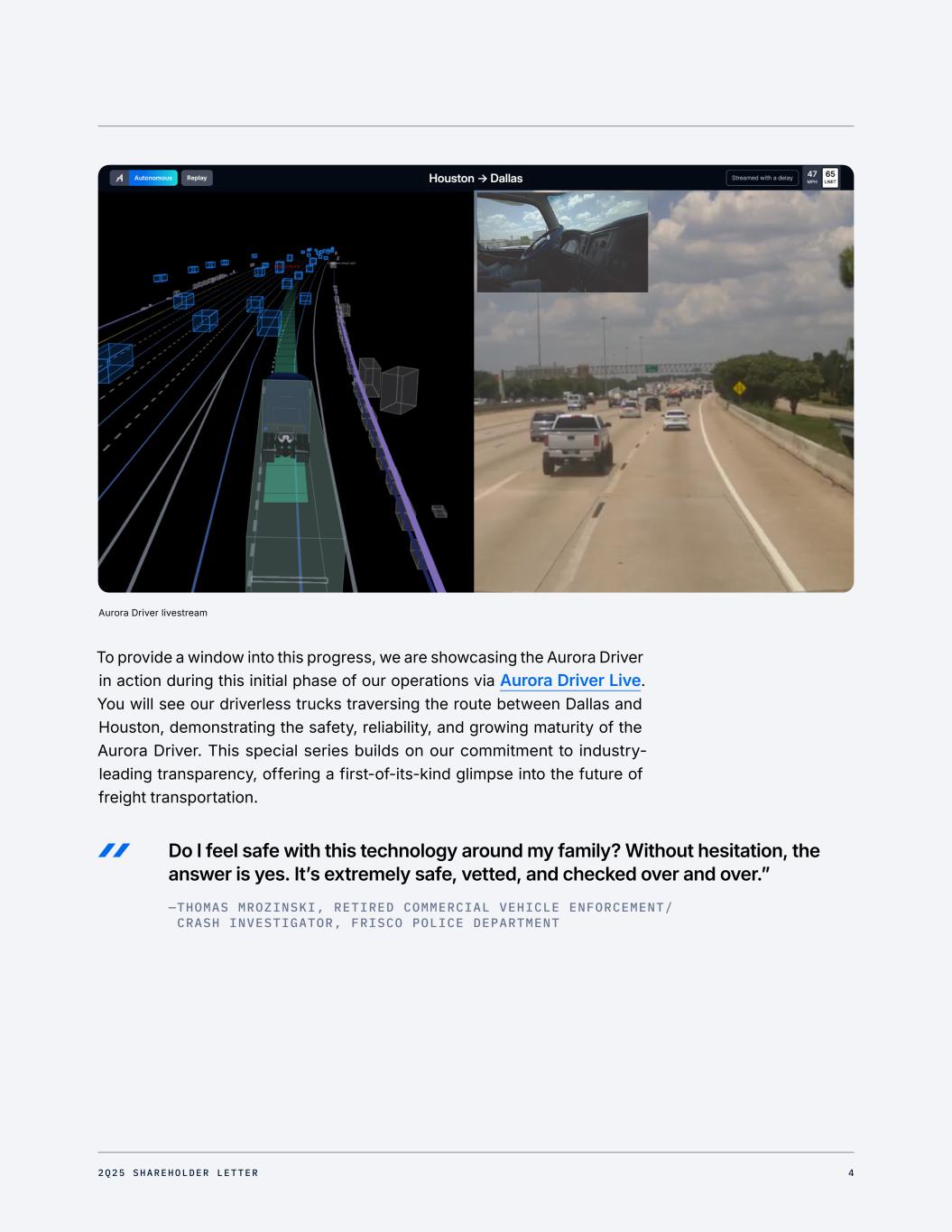

To provide a window into this progress, we are showcasing the Aurora Driver in action during this initial phase of our operations via Aurora Driver Live. You will see our driverless trucks traversing the route between Dallas and Houston, demonstrating the safety, reliability, and growing maturity of the Aurora Driver. This special series builds on our commitment to industry- leading transparency, offering a first-of-its-kind glimpse into the future of freight transportation. Do I feel safe with this technology around my family? Without hesitation, the answer is yes. It’s extremely safe, vetted, and checked over and over.” — THOMAS MROZINSKI, RETIRED COMMERCIAL VEHICLE ENFORCEMENT/ CRASH INVESTIGATOR, FRISCO POLICE DEPARTMENT Aurora Driver livestream 42Q25 SHAREHOLDER LETTER

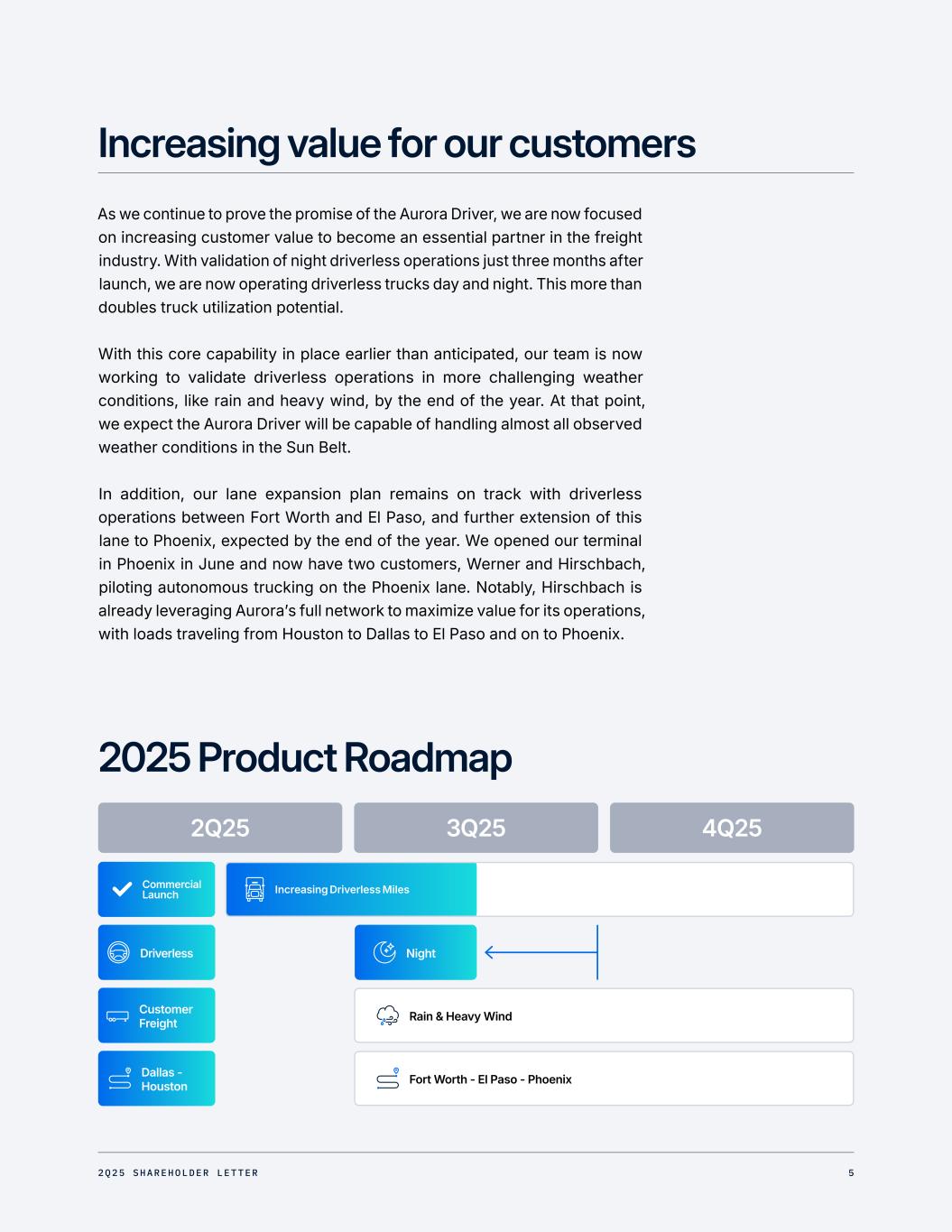

Increasing value for our customers As we continue to prove the promise of the Aurora Driver, we are now focused on increasing customer value to become an essential partner in the freight industry. With validation of night driverless operations just three months after launch, we are now operating driverless trucks day and night. This more than doubles truck utilization potential. With this core capability in place earlier than anticipated, our team is now working to validate driverless operations in more challenging weather conditions, like rain and heavy wind, by the end of the year. At that point, we expect the Aurora Driver will be capable of handling almost all observed weather conditions in the Sun Belt. In addition, our lane expansion plan remains on track with driverless operations between Fort Worth and El Paso, and further extension of this lane to Phoenix, expected by the end of the year. We opened our terminal in Phoenix in June and now have two customers, Werner and Hirschbach, piloting autonomous trucking on the Phoenix lane. Notably, Hirschbach is already leveraging Aurora’s full network to maximize value for its operations, with loads traveling from Houston to Dallas to El Paso and on to Phoenix. 2025 Product Roadmap Increasing Driverless Miles 52Q25 SHAREHOLDER LETTER

Self-driving trucks have the potential to cut single driver transit time in half on the Phoenix route, a lane that exceeds hours-of-service limitation for traditional truck drivers. This is a powerful use case that demonstrates how expanding driverless operations can unlock significant value for our freight customers. Our terminal in Phoenix represents an infrastructure-light approach, with a design that closely resembles how Aurora will integrate with future customer endpoints and optimizes for speed to market. This is an important evolution to enable our plan to deliver freight directly to customer endpoints. The ability to move freight autonomously over long distances like Phoenix to Dallas and Houston is something we’re really excited about. This is where we see the value becoming reality.” —RICHARD STOCKING, PRESIDENT & CEO, HIRSCHBACH MOTOR LINES 62Q25 SHAREHOLDER LETTER

Driving customer adoption With the Aurora Driver now regularly pulling driverless loads for customers, Aurora is operating from a fundamentally stronger position. For years, we have been building relationships and educating partners about the promise of our technology. Today, we are no longer selling an idea; we are delivering a real product that we believe will ultimately transform our customers’ businesses. Now, we are seeing qualified leads surge to support our scaling ambitions in 2026 and 2027. We believe this reflects the growing recognition of Aurora’s leadership in autonomous trucking and the urgency our customers feel to integrate safer, more efficient driverless solutions into their operations. Our technology addresses structural challenges that plague the freight industry, including an aging workforce, systemic driver shortages, hours of service constraints, and rising labor costs — recently cited at approximately $1 per mile by the American Transportation Research Institute (ATRI). By integrating the Aurora Driver, carriers and private fleets have the potential to supplement their traditional drivers to haul more freight, boosting revenue and expanding margins. We believe this will also create new opportunities for their employees to advance in high-growth careers. We are proactively building this future workforce through partnerships with organizations like On The Road Garage to develop programs to prepare workers for next- generation roles in the autonomous vehicle economy.

Advancing our path to scale As we work to unlock these benefits for our customers, we continue to advance the key enablers that will support our path to scale and self-funding. On the hardware front, our teams continue to work on our second and third generation commercial hardware kits to support our scaling and profitability ambitions. We expect our second generation kit to drive a step-function reduction in our hardware costs, which is a critical milestone on our path to self-funding, as well as some meaningful performance gains. Following receipt of B-samples for testing from our contract manufacturer, Fabrinet, we have now completed the first vehicle build with this prototype kit and will begin on-road data collection for testing in the coming weeks. We also continue to make great progress with Continental on our third generation commercial hardware kit that we believe will unlock true scale on the order of tens of thousands of trucks. As they highlighted at their recent Capital Markets Day for their upcoming automotive spinoff Aumovio, Continental is energized by our recent commercial launch and continues to believe this Hardware as a Service partnership can generate a high-margin, multi-billion dollar recurring revenue stream for them. 82Q25 SHAREHOLDER LETTER

They have begun delivering A-samples of a number of components to support embedded firmware and software development. And earlier this month, the Aurora and Continental teams achieved a key milestone by finalizing the design of the integrated sensor pods and the Aurora Driver compute module. We expect to receive our first complete prototype of the Continental-generation hardware kit by the end of the year to begin engineering validation testing. We also continue to make great progress with our OEM partners on purpose- built self-driving platforms designed for high-volume production. We recently received the latest pedigree of Volvo VNL Autonomous trucks and integrated the Aurora Driver for on-road autonomy testing in preparation for driverless operations. We expect to receive 20 of these trucks by the end of the year. And PACCAR recently completed the build of the first prototypes of their scalable autonomy-enabled truck platform, which are undergoing testing at their facilities. In partnership with Aurora, we are advancing toward the deployment of autonomous trucks at scale — engineered to operate safely and efficiently without a driver in the cab. Both the main production line and pilot line at our New River Valley plant are instrumental in this journey. While we prepare for full-scale manufacturing, the pilot line will be producing the initial launch fleet for Aurora. This marks a pivotal step as we scale autonomous transport with a strong commitment to quality and safety.” —NILS JAEGER, PRESIDENT, VOLVO AUTONOMOUS SOLUTIONS

Championing a federal framework for autonomous trucking Earlier this month, U.S. Representative Vince Fong of California introduced the AMERICA DRIVES Act, a landmark piece of legislation to establish a federal framework specifically for self-driving trucks. The legislation would provide federal preemption of any state laws requiring a traditional driver in the commercial vehicle and thoughtfully modernize safety protocols by codifying that flashing, cab-mounted warning beacons — consistent with our proposal — may be used instead of reflective triangles, fusees, or liquid- burning flares for disabled commercial vehicles. We believe this proposed legislation will solidify the United States’ position as a leader in autonomous technology. We are encouraged by this momentum and will continue to work with policymakers to help realize the immense safety and economic benefits of autonomous trucking. By establishing a federal framework for autonomous trucks and empowering the Department of Transportation to set practical regulations, we can safely scale this emerging technology nationwide. The AMERICA DRIVES Act provides a clear path for adoption across state lines, helping support supply chain efficiency, strengthen domestic commerce, and ensure the United States remains unbeatable in the global marketplace. It’s time to seize the opportunity to chart a safe, innovative path forward for American transportation.” —REPRESENTATIVE VINCE FONG (R-CA) 102Q25 SHAREHOLDER LETTER

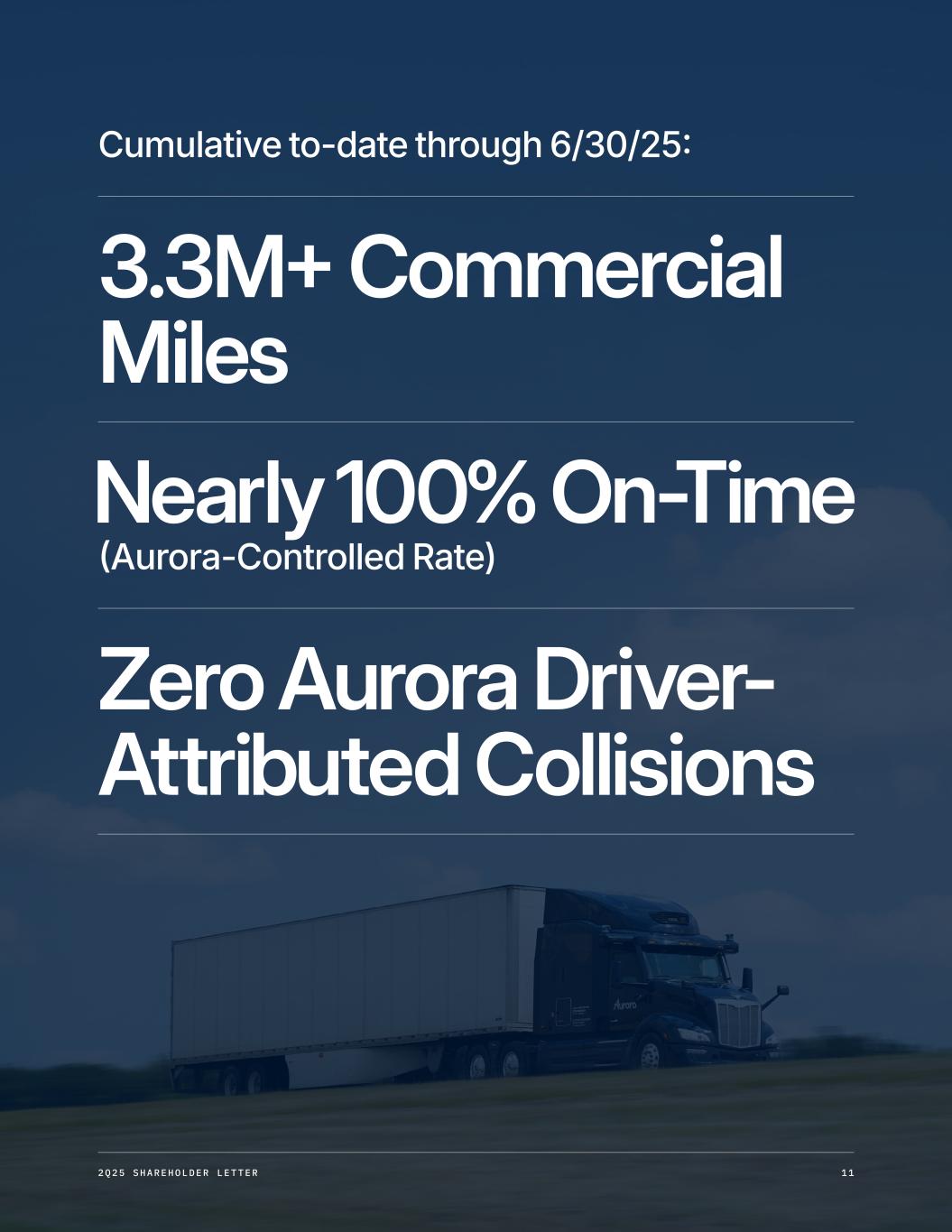

3.3M+ Commercial Miles Zero Aurora Driver- Attributed Collisions Nearly 100% On-Time Cumulative to-date through 6/30/25: (Aurora-Controlled Rate) 112Q25 SHAREHOLDER LETTER

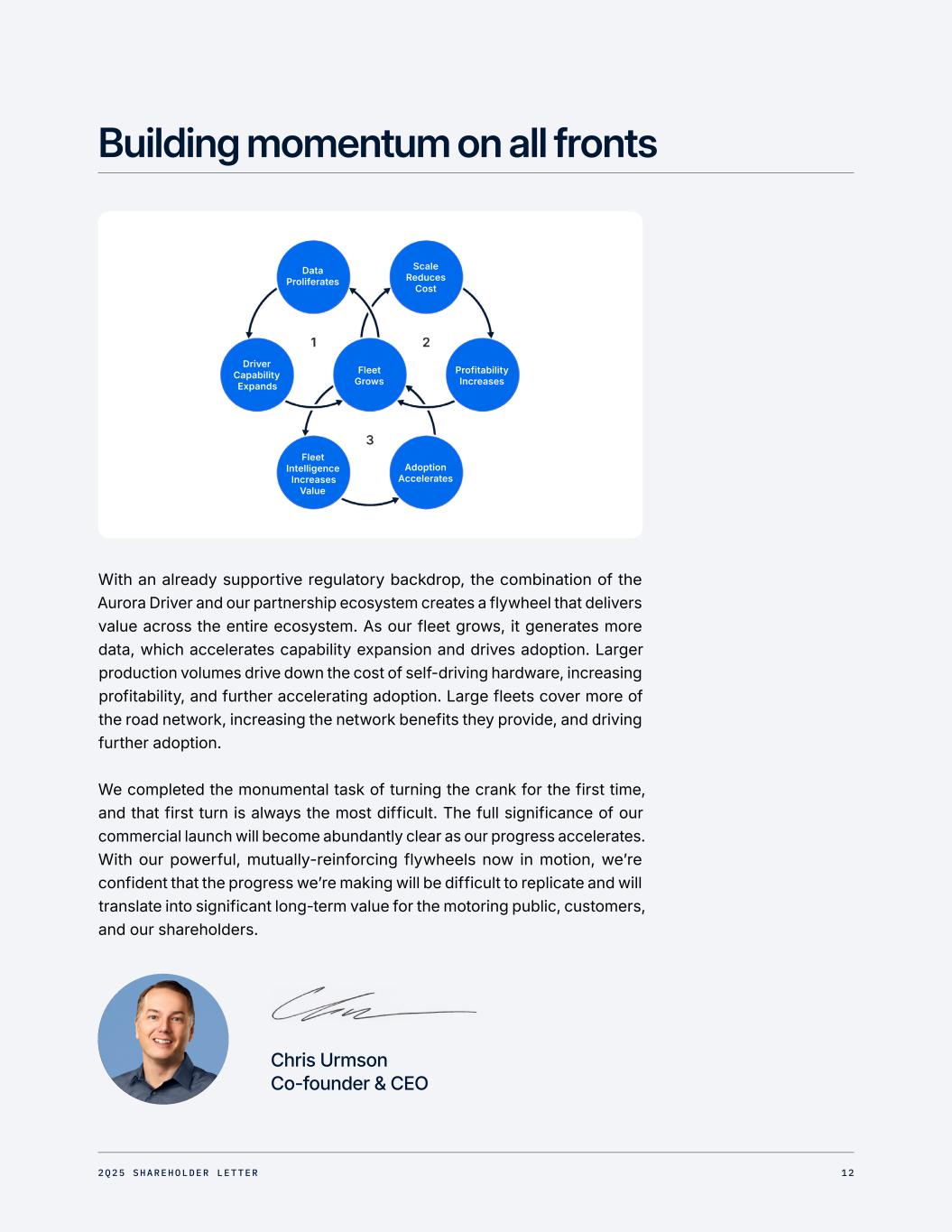

Data Proliferates Fleet Grows Profitability Increases Driver Capability Expands Fleet Intelligence Increases Value Adoption Accelerates Scale Reduces Cost Building momentum on all fronts With an already supportive regulatory backdrop, the combination of the Aurora Driver and our partnership ecosystem creates a flywheel that delivers value across the entire ecosystem. As our fleet grows, it generates more data, which accelerates capability expansion and drives adoption. Larger production volumes drive down the cost of self-driving hardware, increasing profitability, and further accelerating adoption. Large fleets cover more of the road network, increasing the network benefits they provide, and driving further adoption. We completed the monumental task of turning the crank for the first time, and that first turn is always the most difficult. The full significance of our commercial launch will become abundantly clear as our progress accelerates. With our powerful, mutually-reinforcing flywheels now in motion, we’re confident that the progress we’re making will be difficult to replicate and will translate into significant long-term value for the motoring public, customers, and our shareholders. Chris Urmson Co-founder & CEO 122Q25 SHAREHOLDER LETTER

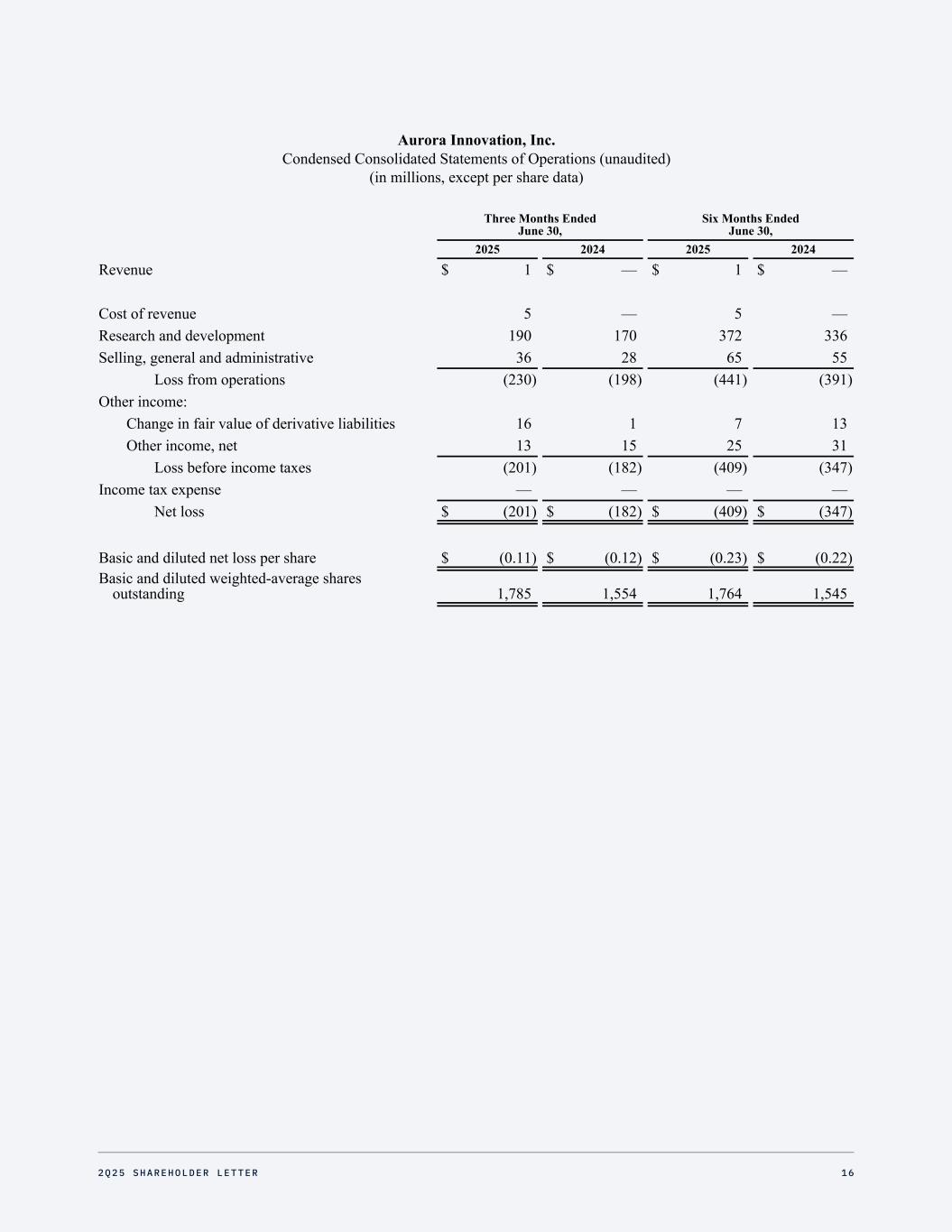

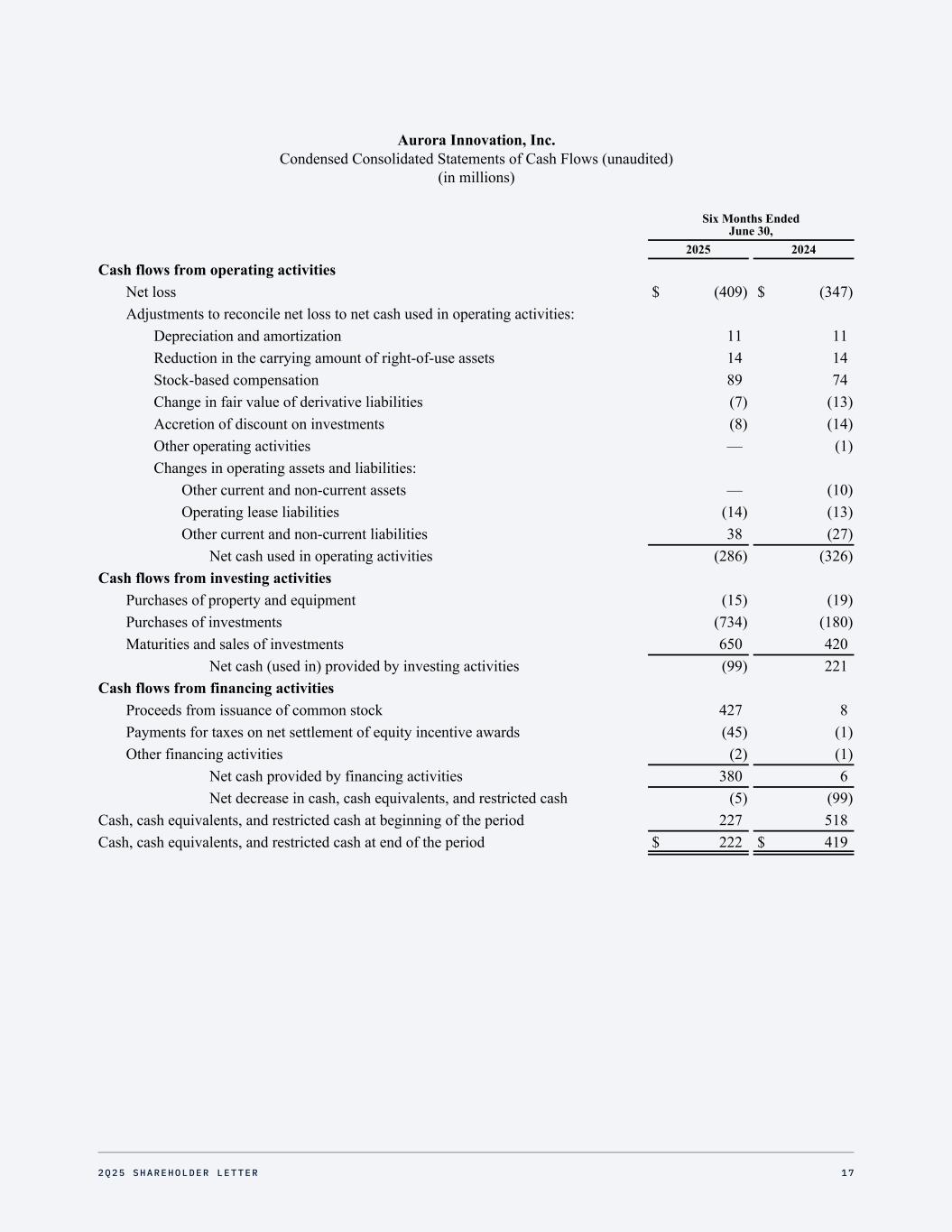

From the desk of our CFO David Maday CFO With the launch of driverless operations during the second quarter of 2025, we began recognizing revenue, which totaled $1 million across driverless and vehicle operator supervised commercial loads for Hirschbach, Uber Freight, Werner, FedEx, Schneider, and Volvo Autonomous Solutions, among others. The Aurora Driver achieved a record number of commercial miles driven during the quarter. Second quarter 2025 operating loss, including stock-based compensation (SBC), totaled $230 million. Excluding SBC of $55 million, R&D totaled $146 million, SG&A was $25 million, and cost of revenue was $5 million. We used approximately $144 million in operating cash during the second quarter of 2025 and capital expenditures totaled $7 million. This cash spend was meaningfully below our externally-communicated target, reflecting continued strong fiscal discipline. During the second quarter, we issued 57 million shares of Class A common stock through our at-the-market program for net proceeds of $331 million. In turn, we ended the second quarter with a very strong balance sheet, including increased liquidity of $1.3 billion in cash and short-term investments. With this additional capital, as well as efficiencies we have found in the business and cash preservation decisions we have made, we now expect this liquidity to fund our operations into the second quarter of 2027. For the remainder of 2025, we continue to expect quarterly cash use of $175 - $185 million, on average. This reflects an increase in capital expenditures and continued development of our new hardware programs as we prepare to scale our business. For the balance of the year, we will continue to focus on expanding our driverless operations, as well as key cost reduction levers to support achieving our initial scaling and profitability ambitions. 132Q25 SHAREHOLDER LETTER

Cautionary statement regarding forward-looking statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “potential,” “indicative,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward- looking statements, including but not limited to, those statements around our driverless operations and future financial and operating performance; our ability to reduce costs and general expectations beyond that year; the safety benefits of our technology and product; our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufacturing, scaling (including, but not limited to, the lane expansion strategy, fleet size and our product’s availability and capabilities) and commercialization of the Aurora Driver and related services, on the timeframe we expect or at all; our relationships with our partners and customers and anticipated benefits that they may derive from our product (including, but not limited to, increasing revenues and margins); the timing for developing, and the anticipated benefits of, next generation hardware kits; the anticipated impact of our product on the freight industry and economy; our expected market share and competitive position; the efficiency and effectiveness of our validation process and profitability of our products and services; the regulatory tailwinds and framework in which we operate and our ability to comply with the current and future regulatory framework; and our expected cash use and cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Our projected quarterly cash use is based upon assumptions, including research and development and general and administrative activities, as well as capital expenses and working capital. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 14, 2025, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2025. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances. 142Q25 SHAREHOLDER LETTER

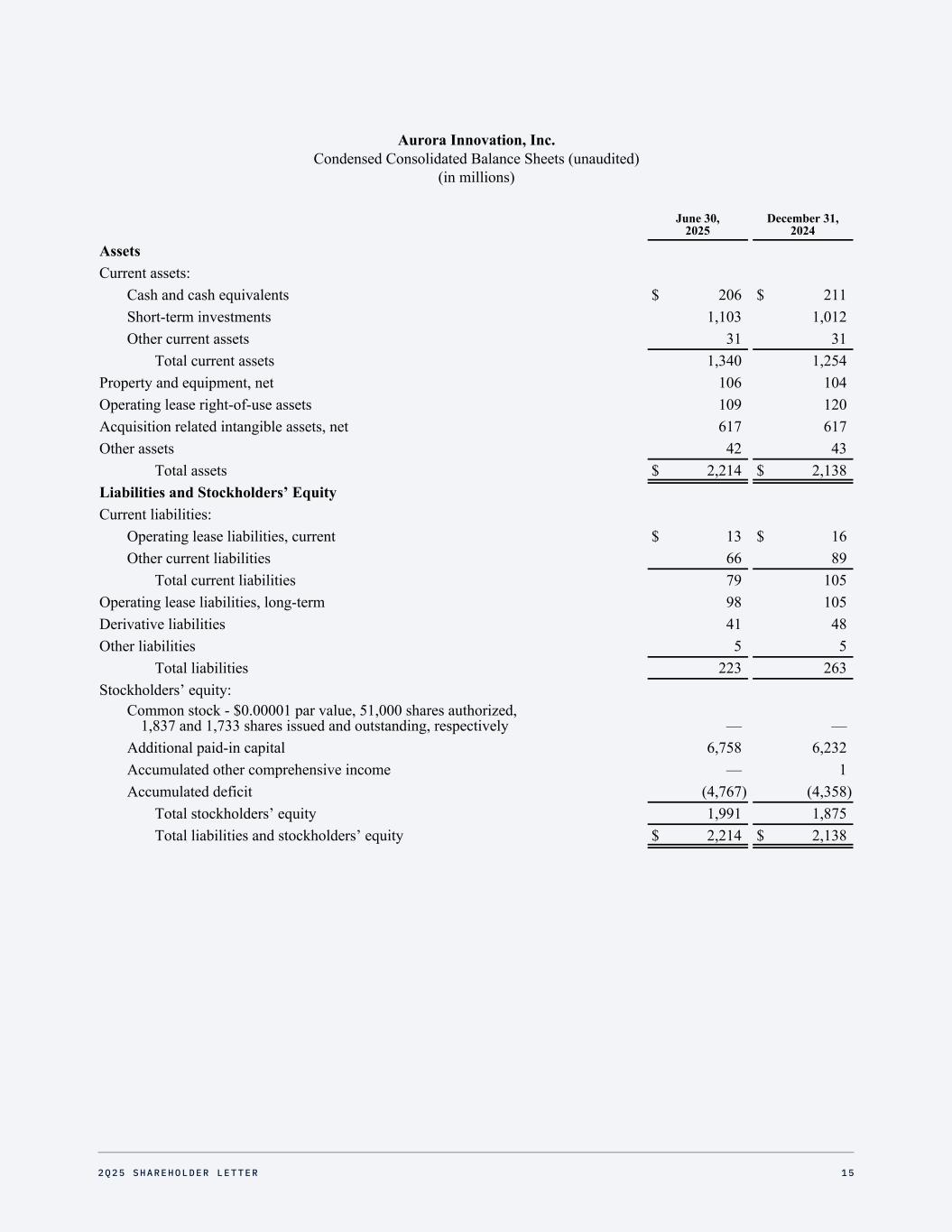

Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in millions) June 30, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 206 $ 211 Short-term investments 1,103 1,012 Other current assets 31 31 Total current assets 1,340 1,254 Property and equipment, net 106 104 Operating lease right-of-use assets 109 120 Acquisition related intangible assets, net 617 617 Other assets 42 43 Total assets $ 2,214 $ 2,138 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 13 $ 16 Other current liabilities 66 89 Total current liabilities 79 105 Operating lease liabilities, long-term 98 105 Derivative liabilities 41 48 Other liabilities 5 5 Total liabilities 223 263 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,837 and 1,733 shares issued and outstanding, respectively — — Additional paid-in capital 6,758 6,232 Accumulated other comprehensive income — 1 Accumulated deficit (4,767) (4,358) Total stockholders’ equity 1,991 1,875 Total liabilities and stockholders’ equity $ 2,214 $ 2,138 152Q25 SHAREHOLDER LETTER

Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended June 30, Six Months Ended June 30, 2025 2024 2025 2024 Revenue $ 1 $ — $ 1 $ — Cost of revenue 5 — 5 — Research and development 190 170 372 336 Selling, general and administrative 36 28 65 55 Loss from operations (230) (198) (441) (391) Other income: Change in fair value of derivative liabilities 16 1 7 13 Other income, net 13 15 25 31 Loss before income taxes (201) (182) (409) (347) Income tax expense — — — — Net loss $ (201) $ (182) $ (409) $ (347) Basic and diluted net loss per share $ (0.11) $ (0.12) $ (0.23) $ (0.22) Basic and diluted weighted-average shares outstanding 1,785 1,554 1,764 1,545 162Q25 SHAREHOLDER LETTER

Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (unaudited) (in millions) Six Months Ended June 30, 2025 2024 Cash flows from operating activities Net loss $ (409) $ (347) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 11 11 Reduction in the carrying amount of right-of-use assets 14 14 Stock-based compensation 89 74 Change in fair value of derivative liabilities (7) (13) Accretion of discount on investments (8) (14) Other operating activities — (1) Changes in operating assets and liabilities: Other current and non-current assets — (10) Operating lease liabilities (14) (13) Other current and non-current liabilities 38 (27) Net cash used in operating activities (286) (326) Cash flows from investing activities Purchases of property and equipment (15) (19) Purchases of investments (734) (180) Maturities and sales of investments 650 420 Net cash (used in) provided by investing activities (99) 221 Cash flows from financing activities Proceeds from issuance of common stock 427 8 Payments for taxes on net settlement of equity incentive awards (45) (1) Other financing activities (2) (1) Net cash provided by financing activities 380 6 Net decrease in cash, cash equivalents, and restricted cash (5) (99) Cash, cash equivalents, and restricted cash at beginning of the period 227 518 Cash, cash equivalents, and restricted cash at end of the period $ 222 $ 419 172Q25 SHAREHOLDER LETTER

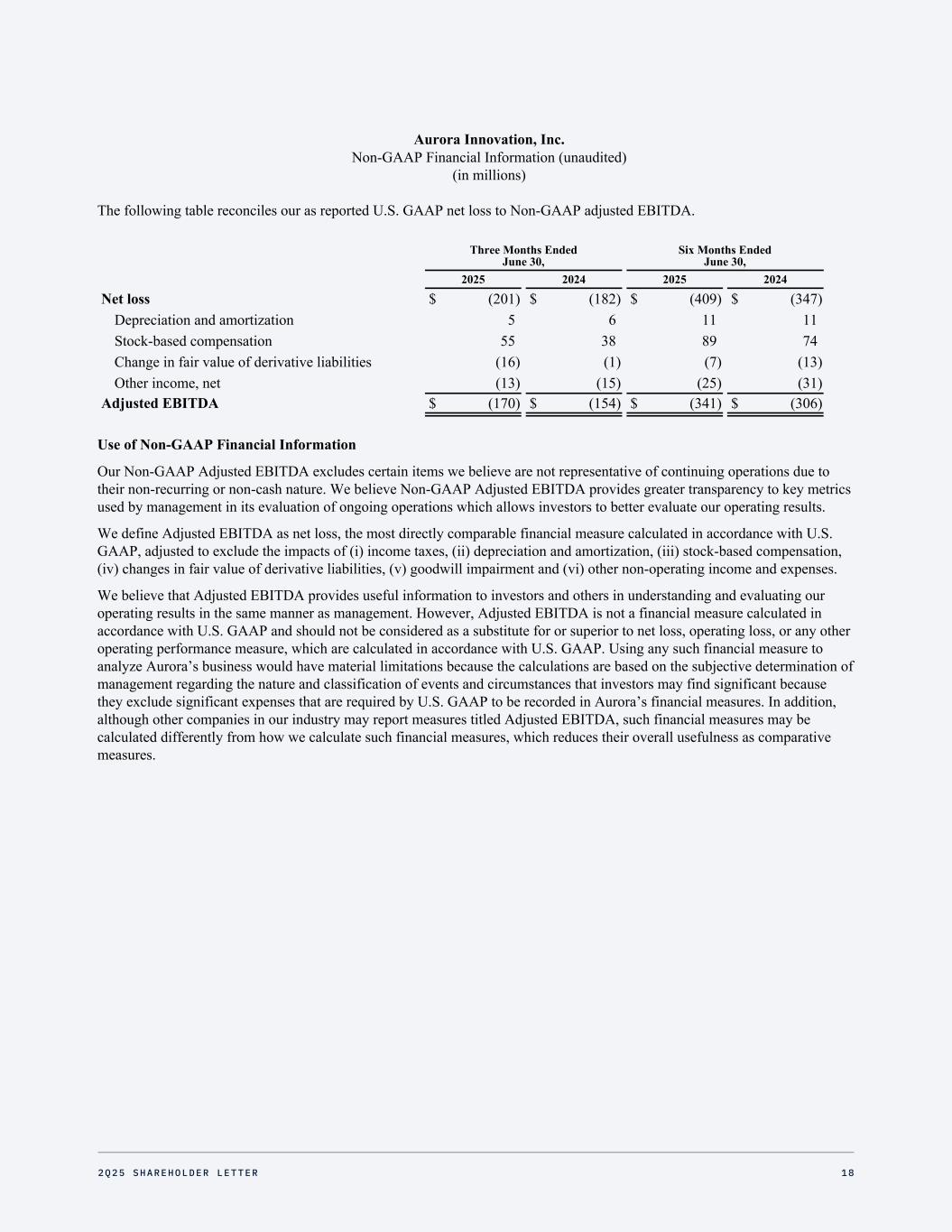

Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended June 30, Six Months Ended June 30, 2025 2024 2025 2024 Net loss $ (201) $ (182) $ (409) $ (347) Depreciation and amortization 5 6 11 11 Stock-based compensation 55 38 89 74 Change in fair value of derivative liabilities (16) (1) (7) (13) Other income, net (13) (15) (25) (31) Adjusted EBITDA $ (170) $ (154) $ (341) $ (306) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. We believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in our industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how we calculate such financial measures, which reduces their overall usefulness as comparative measures. 182Q25 SHAREHOLDER LETTER