EX-99.1

Published on October 28, 2025

Third Quarter 2025 Shareholder Letter OCTOBER 28, 2025 Exhibit 99.1

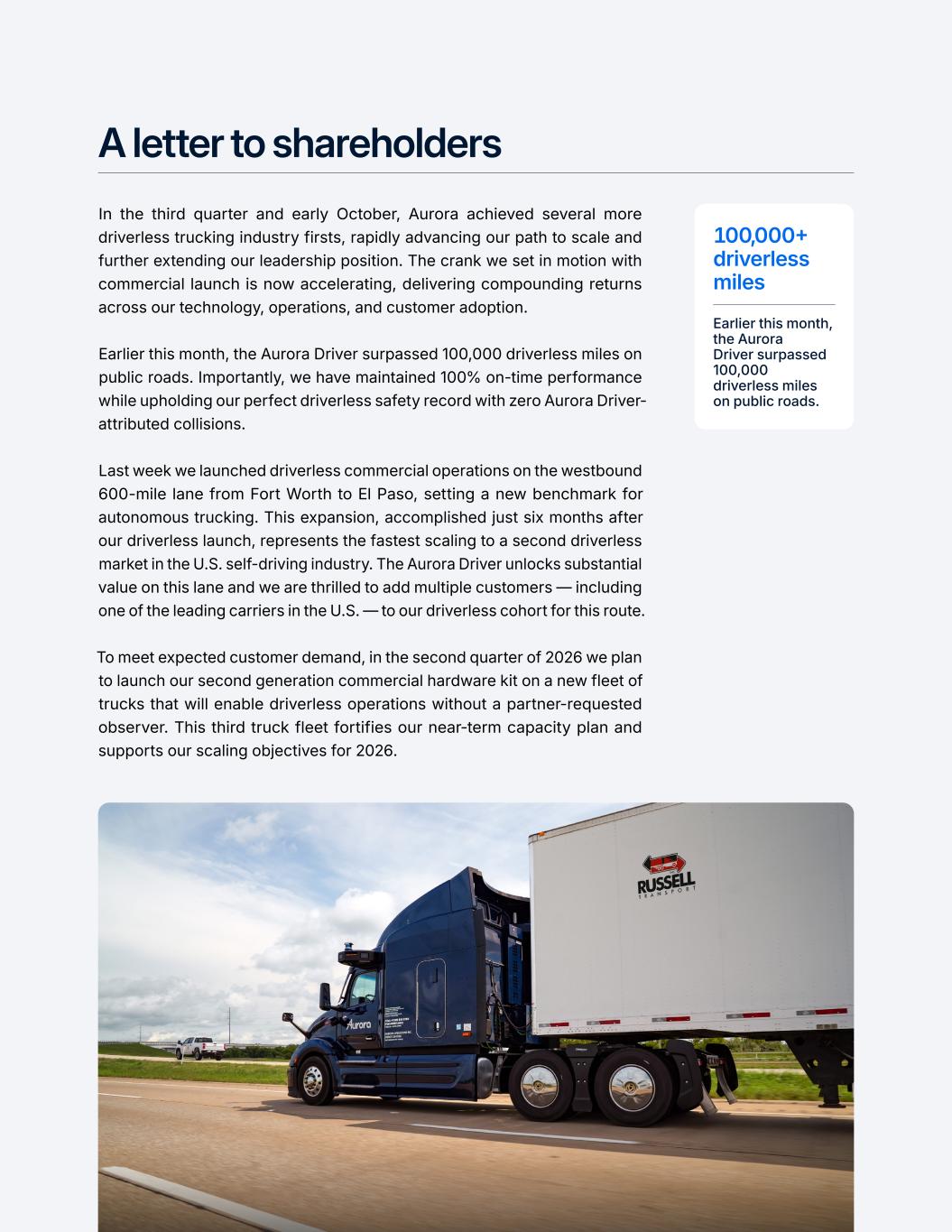

A letter to shareholders In the third quarter and early October, Aurora achieved several more driverless trucking industry firsts, rapidly advancing our path to scale and further extending our leadership position. The crank we set in motion with commercial launch is now accelerating, delivering compounding returns across our technology, operations, and customer adoption. Earlier this month, the Aurora Driver surpassed 100,000 driverless miles on public roads. Importantly, we have maintained 100% on-time performance while upholding our perfect driverless safety record with zero Aurora Driver- attributed collisions. Last week we launched driverless commercial operations on the westbound 600-mile lane from Fort Worth to El Paso, setting a new benchmark for autonomous trucking. This expansion, accomplished just six months after our driverless launch, represents the fastest scaling to a second driverless market in the U.S. self-driving industry. The Aurora Driver unlocks substantial value on this lane and we are thrilled to add multiple customers — including one of the leading carriers in the U.S. — to our driverless cohort for this route. To meet expected customer demand, in the second quarter of 2026 we plan to launch our second generation commercial hardware kit on a new fleet of trucks that will enable driverless operations without a partner-requested observer. This third truck fleet fortifies our near-term capacity plan and supports our scaling objectives for 2026. 100,000+ driverless miles Earlier this month, the Aurora Driver surpassed 100,000 driverless miles on public roads.

Exceptional value proposition Following earlier than anticipated validation of night driverless operations in July, which more than doubled truck utilization potential, our team’s focus turned to driverless lane expansion and validation in more challenging weather conditions to further increase the value of the Aurora Driver for our customers. Our second driverless commercial lane from Fort Worth to El Paso directly addresses critical customer pain points. This route, which is notoriously hard to staff and challenging for traditional drivers to complete within a single day, demonstrates the significant efficiency and value potential the Aurora Driver brings to the freight ecosystem by enabling nearly continuous operations. We are now nearing completion of driverless validation for the return trip as well as the Phoenix extension, with our software release planned for January 2026. The Phoenix expansion will add another 400 miles to establish a continuous 1,000+ mile, multi-state route between Fort Worth and Phoenix, which far exceeds hours-of-service limitations for a traditional driver. We are also working with multiple customers to identify locations along the I-20 corridor and in the Phoenix area for the first customer endpoints we will begin to support with driverless operations in early 2026. On these long-haul lanes, the Aurora Driver has the potential to more than double revenue and deliver several-fold higher profit per truck for our customers. Looking ahead to 2026, we expect to rapidly unlock lanes across ● Driverless Operations ● Future Driverless Operations 33Q25 SHAREHOLDER LETTER

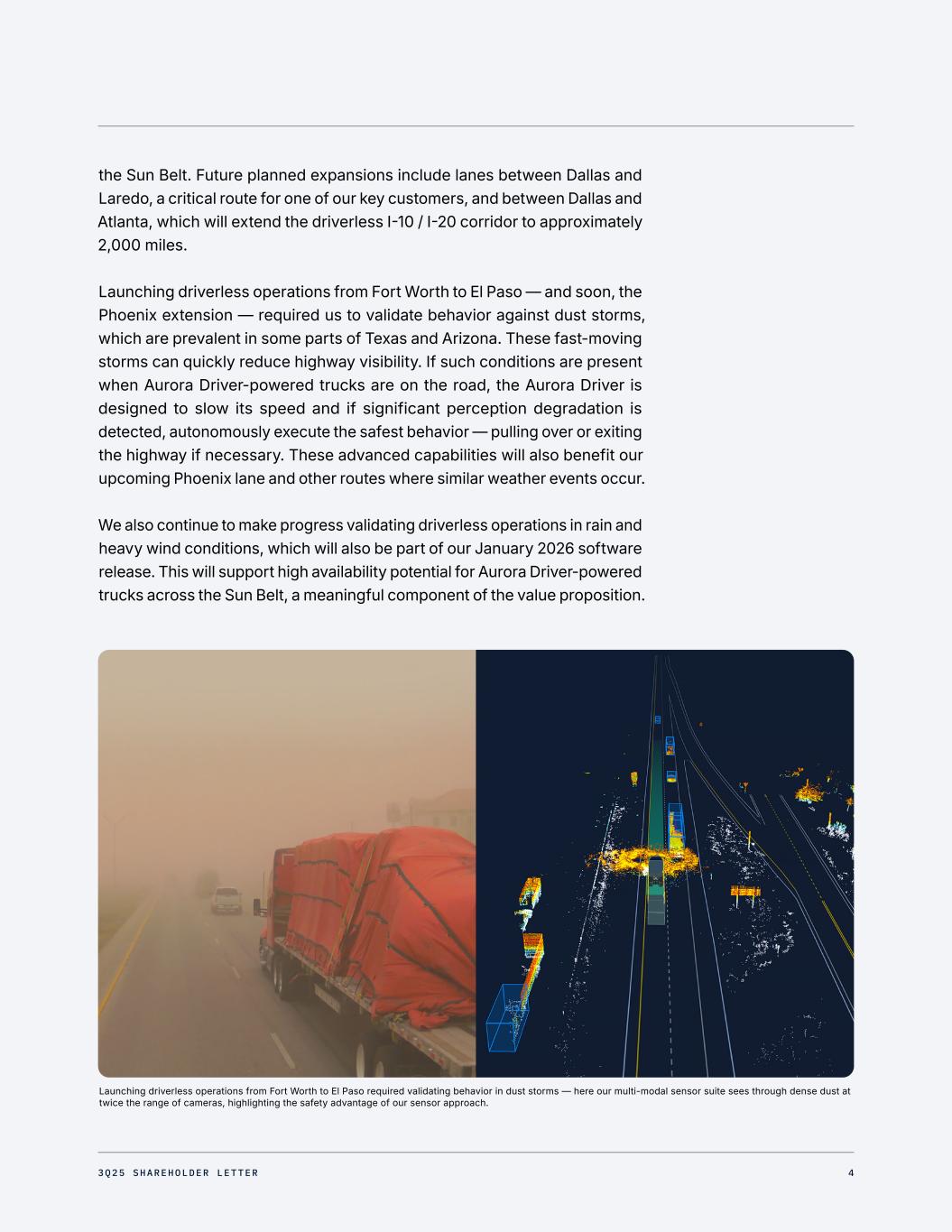

the Sun Belt. Future planned expansions include lanes between Dallas and Laredo, a critical route for one of our key customers, and between Dallas and Atlanta, which will extend the driverless I-10 / I-20 corridor to approximately 2,000 miles. Launching driverless operations from Fort Worth to El Paso — and soon, the Phoenix extension — required us to validate behavior against dust storms, which are prevalent in some parts of Texas and Arizona. These fast-moving storms can quickly reduce highway visibility. If such conditions are present when Aurora Driver-powered trucks are on the road, the Aurora Driver is designed to slow its speed and if significant perception degradation is detected, autonomously execute the safest behavior — pulling over or exiting the highway if necessary. These advanced capabilities will also benefit our upcoming Phoenix lane and other routes where similar weather events occur. We also continue to make progress validating driverless operations in rain and heavy wind conditions, which will also be part of our January 2026 software release. This will support high availability potential for Aurora Driver-powered trucks across the Sun Belt, a meaningful component of the value proposition. Launching driverless operations from Fort Worth to El Paso required validating behavior in dust storms — here our multi-modal sensor suite sees through dense dust at twice the range of cameras, highlighting the safety advantage of our sensor approach. 43Q25 SHAREHOLDER LETTER

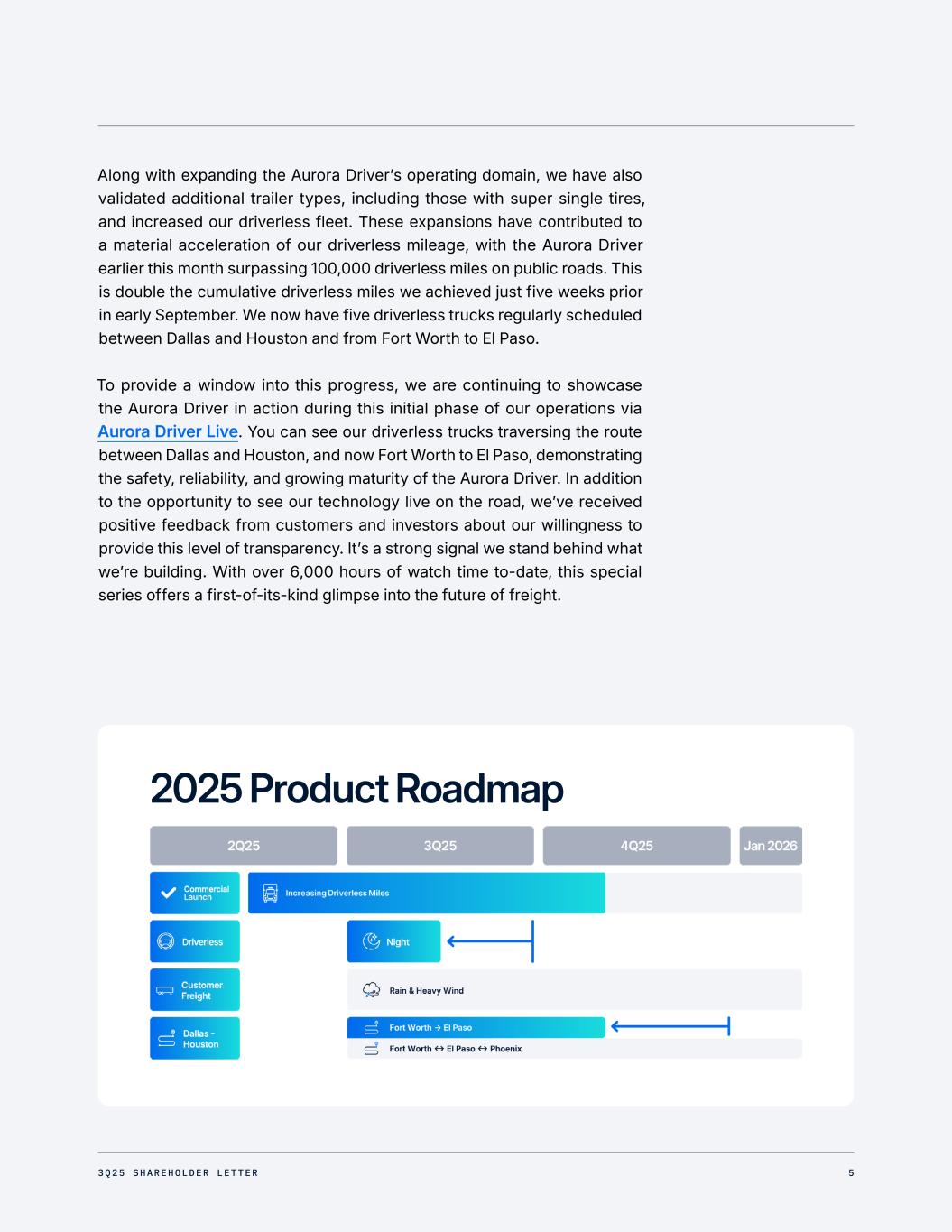

Along with expanding the Aurora Driver’s operating domain, we have also validated additional trailer types, including those with super single tires, and increased our driverless fleet. These expansions have contributed to a material acceleration of our driverless mileage, with the Aurora Driver earlier this month surpassing 100,000 driverless miles on public roads. This is double the cumulative driverless miles we achieved just five weeks prior in early September. We now have five driverless trucks regularly scheduled between Dallas and Houston and from Fort Worth to El Paso. To provide a window into this progress, we are continuing to showcase the Aurora Driver in action during this initial phase of our operations via Aurora Driver Live. You can see our driverless trucks traversing the route between Dallas and Houston, and now Fort Worth to El Paso, demonstrating the safety, reliability, and growing maturity of the Aurora Driver. In addition to the opportunity to see our technology live on the road, we’ve received positive feedback from customers and investors about our willingness to provide this level of transparency. It’s a strong signal we stand behind what we’re building. With over 6,000 hours of watch time to-date, this special series offers a first-of-its-kind glimpse into the future of freight. 2025 Product Roadmap 53Q25 SHAREHOLDER LETTER

Accelerating customer adoption Our driverless mileage growth is poised to further accelerate as additional customers integrate the Aurora Driver into their operations to capitalize on its exceptional value proposition. We firmly believe the Aurora Driver will fundamentally redefine the freight ecosystem with its potential to set new standards for safety, efficiency, and sustainability, thereby driving both revenue growth and margin expansion for our customers. With our Fort Worth to El Paso launch, we’ve expanded driverless operations for Hirschbach, one of our earliest adopters and valued partners, and added two additional carriers to our driverless customer cohort. Launching driverlessly on this lane is a major inflection point on our journey with customers.

Now that we have proven the promise of the Aurora Driver technology and are rapidly increasing its value for customers, we are expanding our sales funnel to include mid-market customers, who have shorter approval cycles. To efficiently target this new segment, we recently announced a strategic partnership with McLeod Software, a premier provider of transportation management solutions for over 1,200 carriers and private fleets. This partnership will deliver seamless integration for McLeod customers, which we expect to accelerate new customer adoption of the Aurora Driver. Just one month after announcing the partnership, we executed an agreement with McLeod customer Russell Transport for driverless hauls on the Fort Worth to El Paso lane. This milestone places Russell at the forefront of innovation in the transportation industry, making us one of the first asset-based carriers in the U.S. to deploy autonomous trucks in live freight operations. This achievement is not just a win for our team, it’s a testament to what’s possible when technology and logistics come together with a bold vision. We’re excited to be leading the charge into the future of freight.” —RAMI ABDELJABER, EXECUTIVE VICE PRESIDENT & COO, RUSSELL TRANSPORT This collaboration underscores our dedication to providing cutting-edge technology for our customers, empowering them to optimize their operations and embrace innovation with confidence.” —TOM MCLEOD, FOUNDER & CEO, MCLEOD SOFTWARE 3.8M+ Commercial Miles Cumulative to-date through 9/30/25: 73Q25 SHAREHOLDER LETTER

Fortified path to scale In parallel, we continue to advance our second and third generation commercial hardware programs as well as our vehicle programs that underpin our path to scale and self-funding. We expect our second generation commercial kit to drive a 50%+ reduction in our hardware costs, and are also seeing some meaningful performance gains, particularly with the next generation of our proprietary long-range FMCW lidar. This generation of FirstLight detects objects at 1,000 meters away, which is double the distance of our current generation as well as the closest FMCW lidar competitor. For a truck traveling at highway speeds, this equates to more than 34 seconds of planning horizon. This will further enhance the Aurora Driver’s performance and set a new standard for safety in the industry. Our contract manufacturer, Fabrinet, has completed B-sample builds of the hardware kit. We plan to increase driverless operations (without a partner-requested observer) in the second quarter of 2026 with a new fleet of trucks equipped with this second generation commercial hardware kit. This fleet will be based on the International® LT® Series vehicle while Aurora will perform all necessary upfit required for driverless operations. These trucks will undergo rigorous testing and validation, just like any platform we would take to driverless operation. This third vehicle fleet fortifies our near-term capacity plan and will support our target to exit 2026 with hundreds of driverless trucks in operation. As an early adopter, we embrace the opportunity to help define the future of freight technology. Integrating an additional fleet strengthens our driverless capacity — a vital advancement in ensuring we meet customer demand and deliver operational excellence.” —RICHARD STOCKING, PRESIDENT & CEO, HIRSCHBACH MOTOR LINES

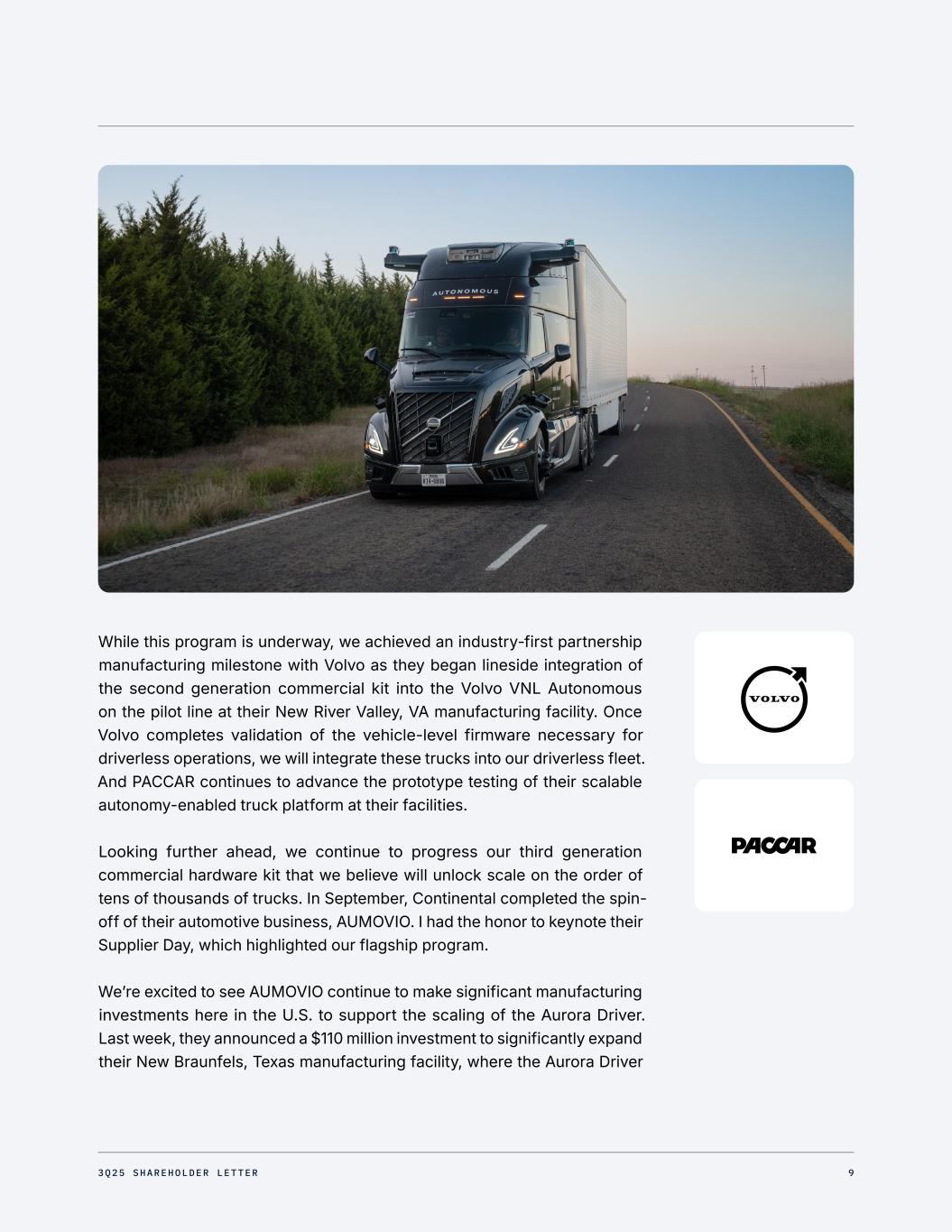

While this program is underway, we achieved an industry-first partnership manufacturing milestone with Volvo as they began lineside integration of the second generation commercial kit into the Volvo VNL Autonomous on the pilot line at their New River Valley, VA manufacturing facility. Once Volvo completes validation of the vehicle-level firmware necessary for driverless operations, we will integrate these trucks into our driverless fleet. And PACCAR continues to advance the prototype testing of their scalable autonomy-enabled truck platform at their facilities. Looking further ahead, we continue to progress our third generation commercial hardware kit that we believe will unlock scale on the order of tens of thousands of trucks. In September, Continental completed the spin- off of their automotive business, AUMOVIO. I had the honor to keynote their Supplier Day, which highlighted our flagship program. We’re excited to see AUMOVIO continue to make significant manufacturing investments here in the U.S. to support the scaling of the Aurora Driver. Last week, they announced a $110 million investment to significantly expand their New Braunfels, Texas manufacturing facility, where the Aurora Driver 93Q25 SHAREHOLDER LETTER

hardware kit will be produced. The project, which includes a 65,000 square- foot addition and a state-of-the-art automated warehouse, is expected to create 100 new, well-paying jobs in the coming years. The expansion will more than double the existing production floor space and is expected to be fully operational by August 2027. As we work toward start of production in 2027, we have now received computer samples from AUMOVIO with NVIDIA’s DRIVE Thor system-on- a-chip, which we are now testing. Complete prototypes of this hardware kit are on track for delivery by the end of the year to begin engineering validation testing. AUMOVIO is well-positioned to lead in the key growth areas that are redefining mobility. Together with our partners, we are co-developing the first commercially scalable generation of the Aurora Driver, with production planned to begin out of our New Braunfels plant in 2027. We’re excited to be at the forefront of this revolutionary shift — advancing the transformation of the U.S. freight industry.” —PHILIPP VON HIRSCHHEYDT, CEO, AUMOVIO 103Q25 SHAREHOLDER LETTER

Increasingly supportive regulatory environment As we accelerate our path to deployment at scale, regulatory momentum continues to build across the U.S. Earlier this month, Aurora received approval from the U.S. Department of Transportation to begin using cab-mounted warning beacons as an alternative to reflective triangles. The cab-mounted flashing lights indicate when a vehicle is stopped on the side of the road to warn other road users, which is similar to systems used by emergency and construction vehicles, and is a step forward for road safety. Additionally during the third quarter, we saw a number of regulators and elected officials champion autonomous vehicle technology. The U.S. Department of Transportation continued to advance its autonomous vehicle framework as part of Transportation Secretary Duffy’s innovation agenda. Notably, former Texas Governor Rick Perry emphasized that autonomous trucking will be instrumental in paving the road to prosperity. And on the legislative front, The AMERICA DRIVES Act, a landmark bill to establish a federal framework specifically for self-driving trucks, continued to gain traction with co-sponsorship from U.S. Representative Jay Obernolte of California. America must lead the way in transportation innovation. If we don’t, our adversaries will fill the void. The rules of the road need to be updated to fit the realities of the 21st century. Our changes will eliminate redundant requirements and bring us closer to a single national standard that spurs innovation and prioritizes safety.” —SEAN DUFFY, U.S. SECRETARY OF TRANSPORTATION The advancements in Texas demonstrate that autonomous trucking is a national necessity, not merely a technological experiment. It means faster, safer, more affordable transportation and gives us a decisive edge in a competitive global economy.” —RICK PERRY, FORMER GOVERNOR OF TEXAS

Setting a new standard We have made exceptional progress since commercial launch and continue to be the only company with driverless trucks on public roads in the U.S. We’ve proved the technology works and are now channeling our momentum to support lasting customer value and our path to scale. Insights from our real-world driverless miles reinforce there are no shortcuts to safety, trust, and scale in autonomous trucking. The strategic investments we have made have built powerful flywheels that are now accelerating, driving us forward with increasing efficiency. Our industry-leading technology — coupled with a world-class ecosystem of partners, customers, and shareholders — uniquely positions us to set the standard for autonomous trucking. Thank you for your partnership as we continue to build the future of transportation. Chris Urmson Co-founder & CEO 123Q25 SHAREHOLDER LETTER

From the desk of our CFO David Maday CFO Third quarter 2025 revenue totaled $1 million across driverless and vehicle operator supervised commercial loads for Hirschbach, Uber Freight, Werner, FedEx, Schneider, and Volvo Autonomous Solutions, among others. The Aurora Driver achieved another record number of commercial miles driven during the quarter, which drove a 12% sequential increase in revenue from the second quarter. Third quarter operating loss, including stock-based compensation (SBC), totaled $222 million. Excluding SBC of $51 million, R&D totaled $138 million, SG&A was $28 million, and cost of revenue was $6 million. We used approximately $149 million in operating cash during the third quarter and capital expenditures totaled $8 million. This cash spend was meaningfully below our externally-communicated target, reflecting continued strong fiscal discipline. We expect cash use of $175 - $185 million during the fourth quarter of 2025. During the third quarter, we issued 80 million shares of Class A common stock through our at-the-market program for net proceeds of $460 million. In turn, we ended the third quarter with a very strong balance sheet, including increased liquidity of $1.6 billion in cash & short-term and long-term investments. We expect this liquidity to fund our operations into the second half of 2027. We will be providing 2026 financial objectives in our fourth quarter 2025 business review in February. For the remainder of the year, we will continue to focus on expanding driverless operations and advancing our programs to support our 2026 scaling objectives to accelerate our first- mover advantage to reinforce our leadership position. 133Q25 SHAREHOLDER LETTER

Cautionary statement regarding forward-looking statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “potential,” “indicative,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around our driverless operations and future financial and operating performance; our ability to reduce costs and general expectations beyond that year; the safety benefits of our technology and product; our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufacturing, scaling (including, but not limited to, the lane expansion strategy, fleet size and our product’s availability and capabilities) and commercialization of the Aurora Driver and related services, on the timeframe we expect or at all; our relationships with our partners and customers and anticipated benefits that they may derive from our product (including, but not limited to, increasing revenues and margins); the timing for developing, and the anticipated benefits of, next generation hardware kits; the anticipated impact of our product on the freight industry and economy; our expected market share and competitive position; the efficiency and effectiveness of our validation process and profitability of our products and services; the regulatory tailwinds and framework in which we operate and our ability to comply with the current and future regulatory framework; and our expected cash use and cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Our projected quarterly cash use is based upon assumptions, including research and development and general and administrative activities, as well as capital expenses and working capital. For factors that could cause actual results to differ materially from the forward-looking statements in this investor letter, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 14, 2025, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025. All forward-looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances. 143Q25 SHAREHOLDER LETTER

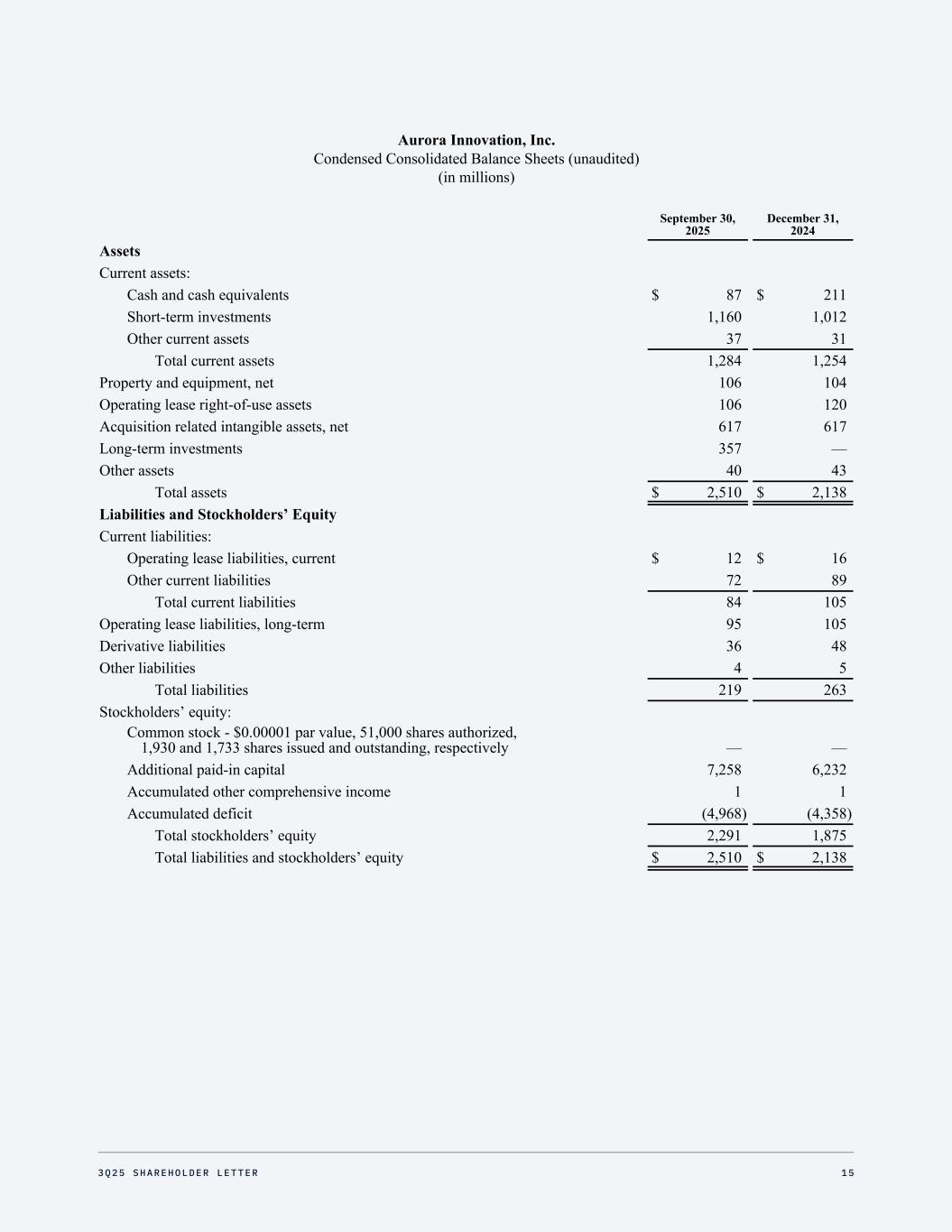

Aurora Innovation, Inc. Condensed Consolidated Balance Sheets (unaudited) (in millions) September 30, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 87 $ 211 Short-term investments 1,160 1,012 Other current assets 37 31 Total current assets 1,284 1,254 Property and equipment, net 106 104 Operating lease right-of-use assets 106 120 Acquisition related intangible assets, net 617 617 Long-term investments 357 — Other assets 40 43 Total assets $ 2,510 $ 2,138 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 12 $ 16 Other current liabilities 72 89 Total current liabilities 84 105 Operating lease liabilities, long-term 95 105 Derivative liabilities 36 48 Other liabilities 4 5 Total liabilities 219 263 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,930 and 1,733 shares issued and outstanding, respectively — — Additional paid-in capital 7,258 6,232 Accumulated other comprehensive income 1 1 Accumulated deficit (4,968) (4,358) Total stockholders’ equity 2,291 1,875 Total liabilities and stockholders’ equity $ 2,510 $ 2,138 153Q25 SHAREHOLDER LETTER

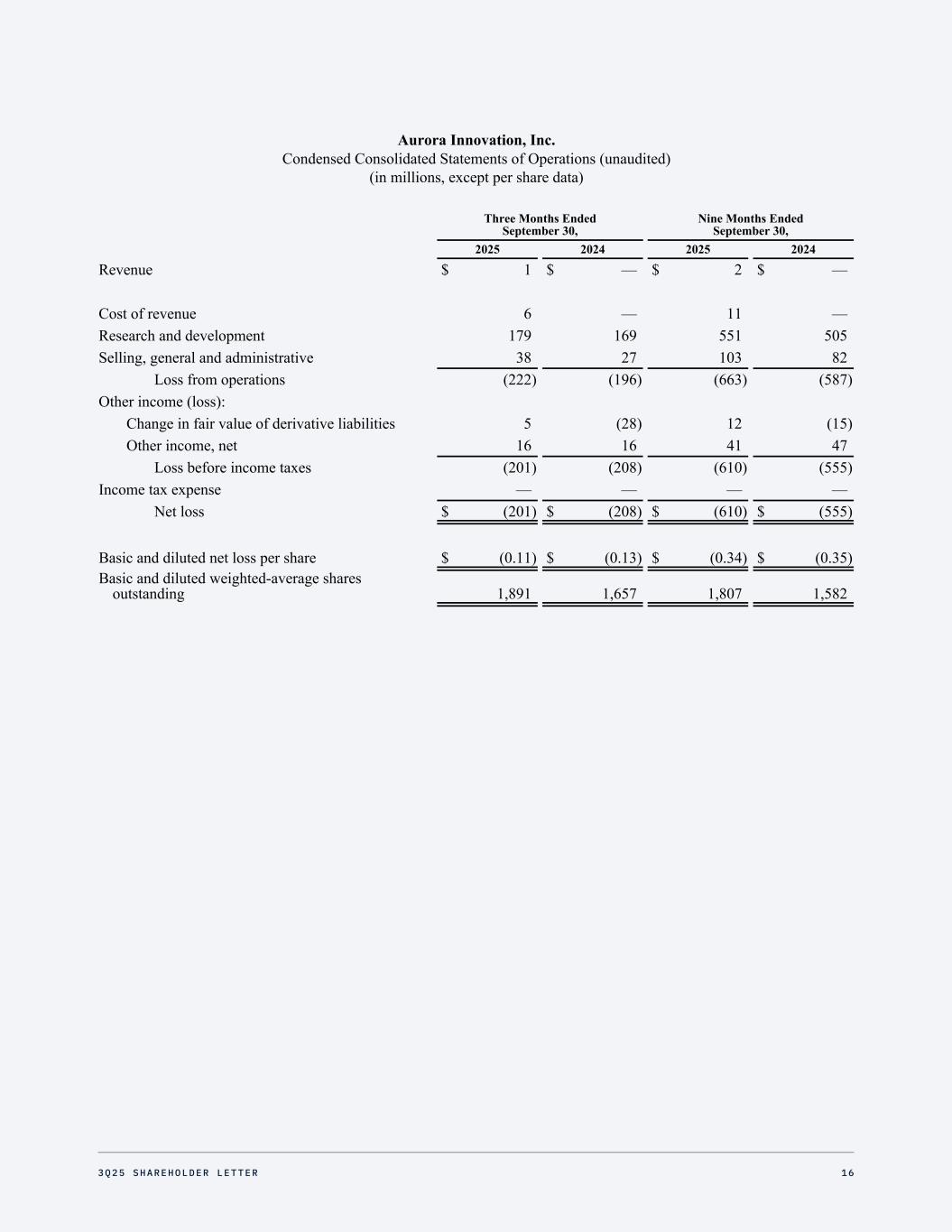

Aurora Innovation, Inc. Condensed Consolidated Statements of Operations (unaudited) (in millions, except per share data) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Revenue $ 1 $ — $ 2 $ — Cost of revenue 6 — 11 — Research and development 179 169 551 505 Selling, general and administrative 38 27 103 82 Loss from operations (222) (196) (663) (587) Other income (loss): Change in fair value of derivative liabilities 5 (28) 12 (15) Other income, net 16 16 41 47 Loss before income taxes (201) (208) (610) (555) Income tax expense — — — — Net loss $ (201) $ (208) $ (610) $ (555) Basic and diluted net loss per share $ (0.11) $ (0.13) $ (0.34) $ (0.35) Basic and diluted weighted-average shares outstanding 1,891 1,657 1,807 1,582 163Q25 SHAREHOLDER LETTER

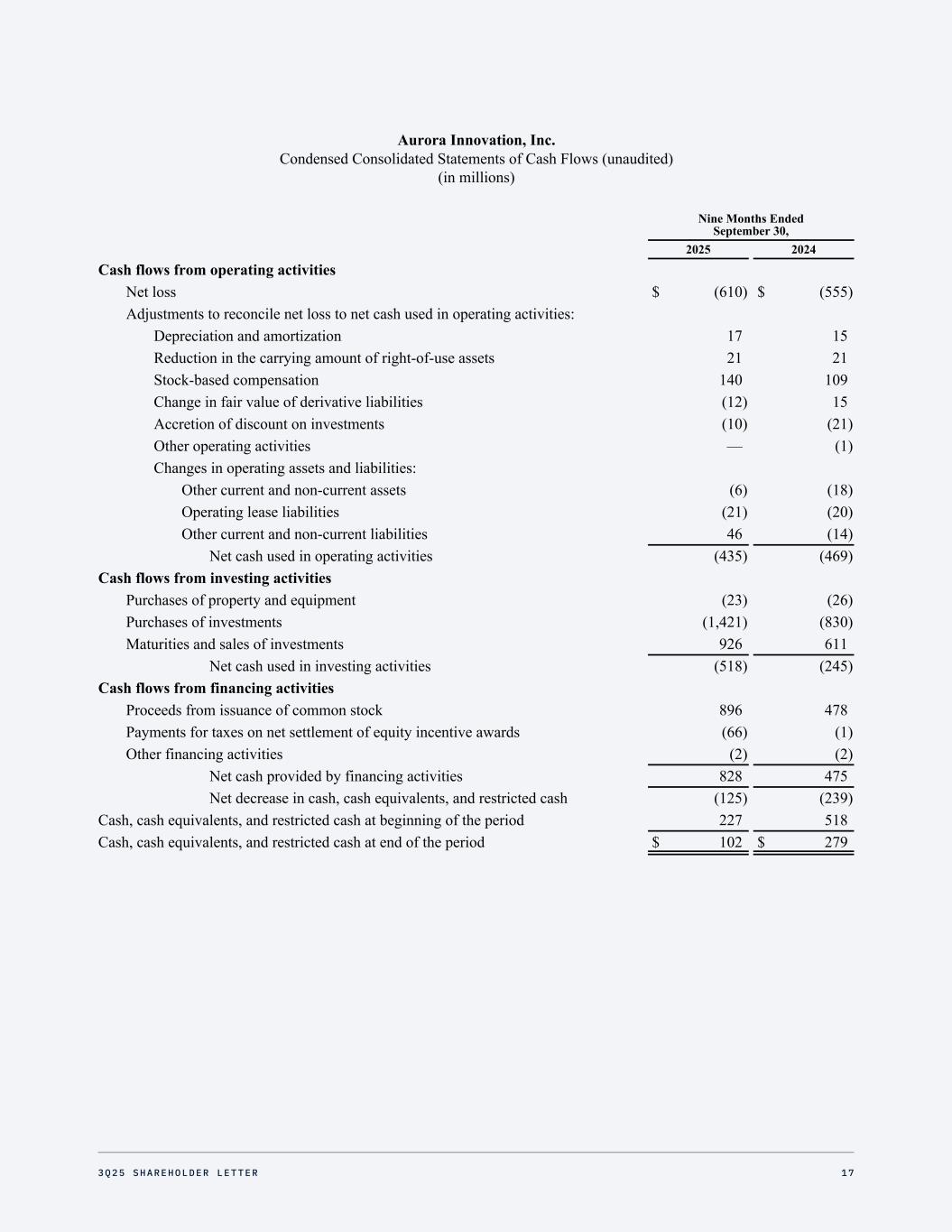

Aurora Innovation, Inc. Condensed Consolidated Statements of Cash Flows (unaudited) (in millions) Nine Months Ended September 30, 2025 2024 Cash flows from operating activities Net loss $ (610) $ (555) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 17 15 Reduction in the carrying amount of right-of-use assets 21 21 Stock-based compensation 140 109 Change in fair value of derivative liabilities (12) 15 Accretion of discount on investments (10) (21) Other operating activities — (1) Changes in operating assets and liabilities: Other current and non-current assets (6) (18) Operating lease liabilities (21) (20) Other current and non-current liabilities 46 (14) Net cash used in operating activities (435) (469) Cash flows from investing activities Purchases of property and equipment (23) (26) Purchases of investments (1,421) (830) Maturities and sales of investments 926 611 Net cash used in investing activities (518) (245) Cash flows from financing activities Proceeds from issuance of common stock 896 478 Payments for taxes on net settlement of equity incentive awards (66) (1) Other financing activities (2) (2) Net cash provided by financing activities 828 475 Net decrease in cash, cash equivalents, and restricted cash (125) (239) Cash, cash equivalents, and restricted cash at beginning of the period 227 518 Cash, cash equivalents, and restricted cash at end of the period $ 102 $ 279 173Q25 SHAREHOLDER LETTER

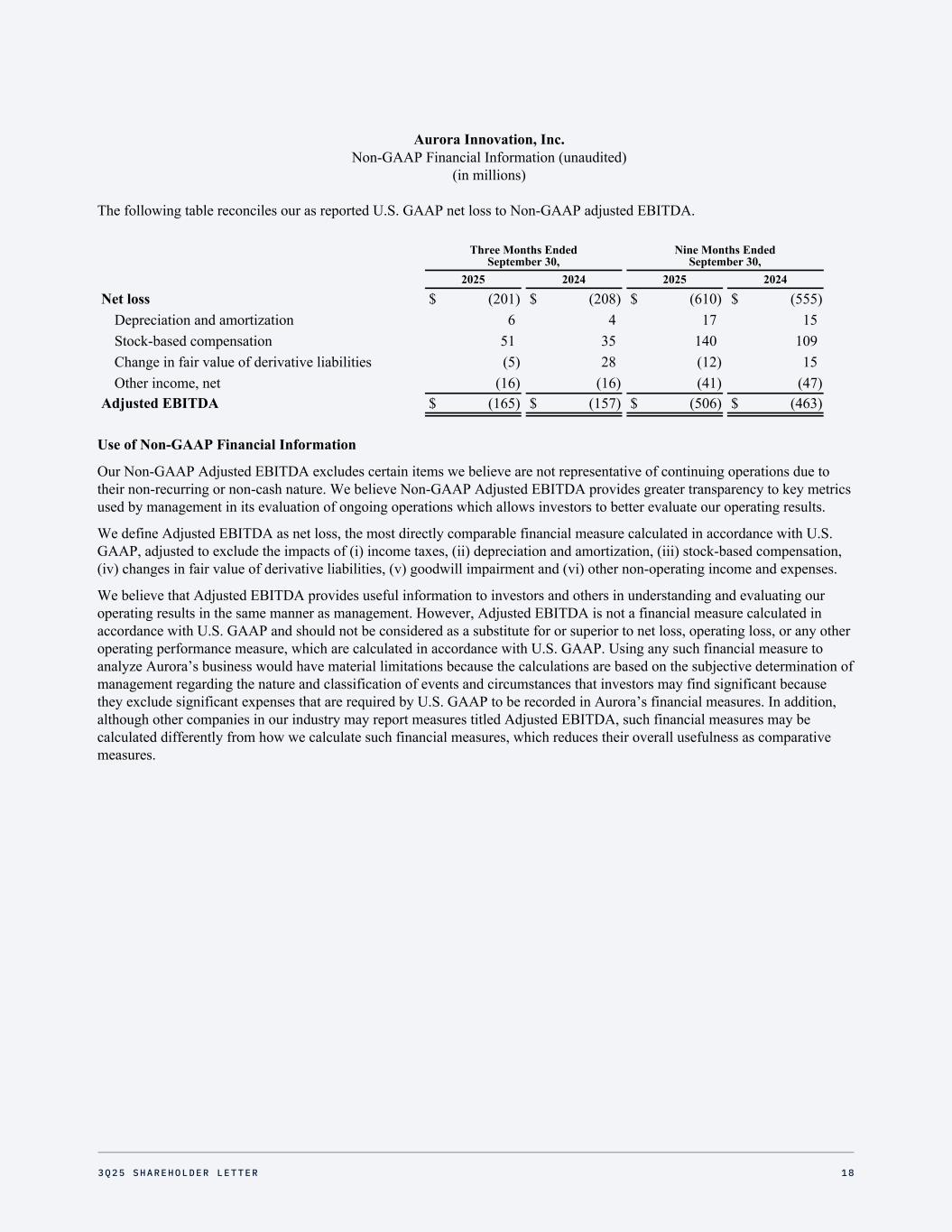

Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net loss $ (201) $ (208) $ (610) $ (555) Depreciation and amortization 6 4 17 15 Stock-based compensation 51 35 140 109 Change in fair value of derivative liabilities (5) 28 (12) 15 Other income, net (16) (16) (41) (47) Adjusted EBITDA $ (165) $ (157) $ (506) $ (463) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. We believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in our industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how we calculate such financial measures, which reduces their overall usefulness as comparative measures. 183Q25 SHAREHOLDER LETTER