EX-99.1

Published on February 11, 2026

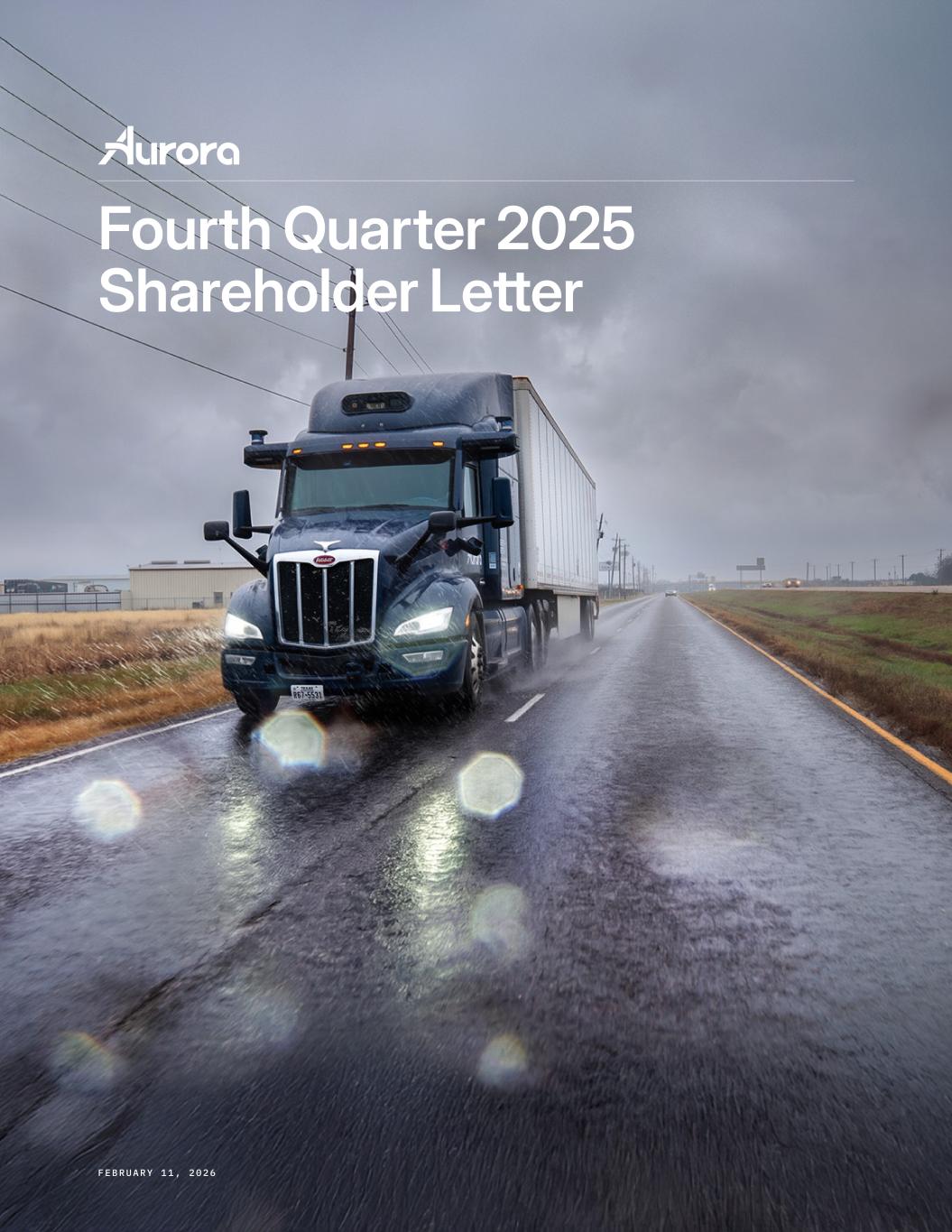

Fourth Quarter 2025 Shareholder Letter FEBRUARY 11, 2026

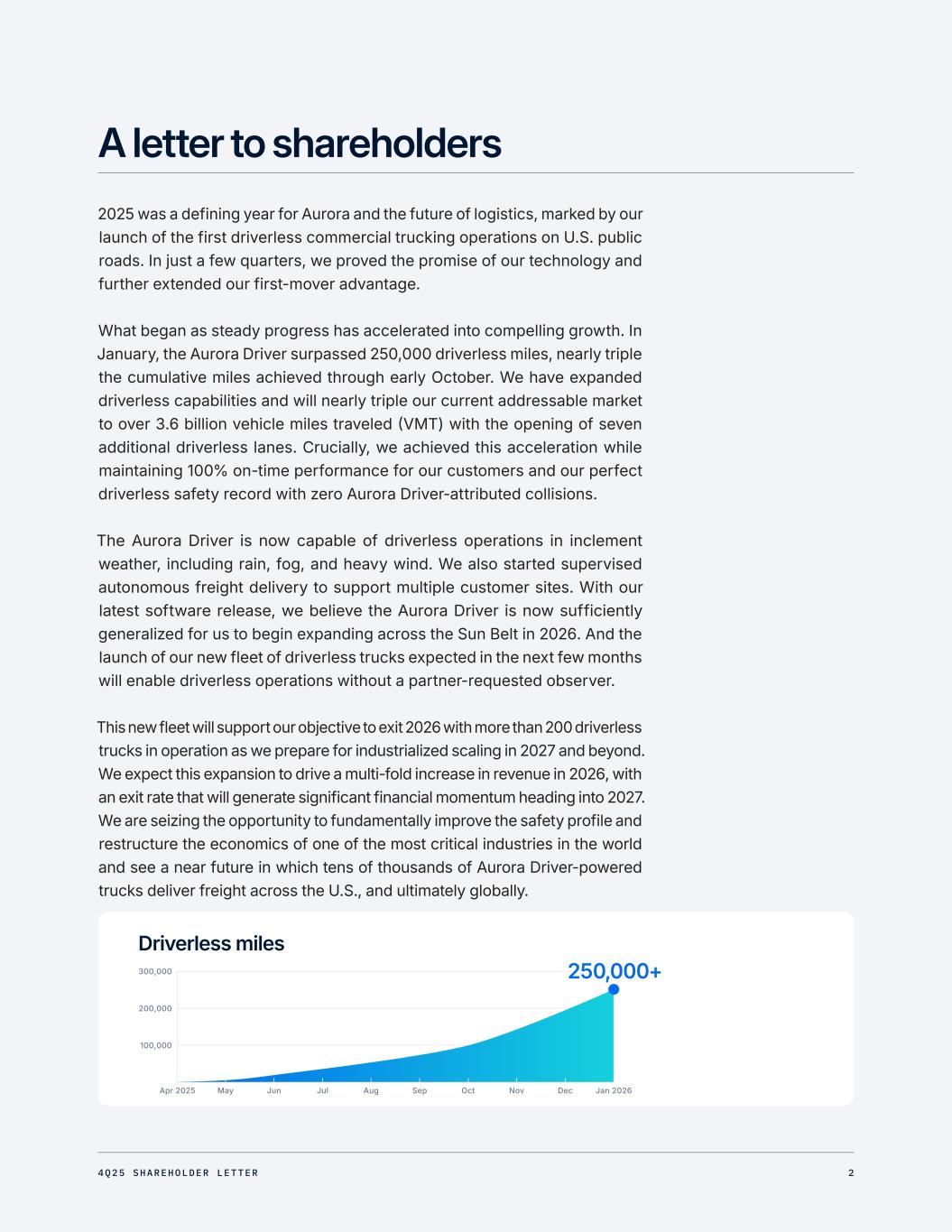

A letter to shareholders 2025 was a defining year for Aurora and the future of logistics, marked by our launch of the first driverless commercial trucking operations on U.S. public roads. In just a few quarters, we proved the promise of our technology and further extended our first-mover advantage. What began as steady progress has accelerated into compelling growth. In January, the Aurora Driver surpassed 250,000 driverless miles, nearly triple the cumulative miles achieved through early October. We have expanded driverless capabilities and will nearly triple our current addressable market to over 3.6 billion vehicle miles traveled (VMT) with the opening of seven additional driverless lanes. Crucially, we achieved this acceleration while maintaining 100% on-time performance for our customers and our perfect driverless safety record with zero Aurora Driver-attributed collisions. The Aurora Driver is now capable of driverless operations in inclement weather, including rain, fog, and heavy wind. We also started supervised autonomous freight delivery to support multiple customer sites. With our latest software release, we believe the Aurora Driver is now sufficiently generalized for us to begin expanding across the Sun Belt in 2026. And the launch of our new fleet of driverless trucks expected in the next few months will enable driverless operations without a partner-requested observer. This new fleet will support our objective to exit 2026 with more than 200 driverless trucks in operation as we prepare for industrialized scaling in 2027 and beyond. We expect this expansion to drive a multi-fold increase in revenue in 2026, with an exit rate that will generate significant financial momentum heading into 2027. We are seizing the opportunity to fundamentally improve the safety profile and restructure the economics of one of the most critical industries in the world and see a near future in which tens of thousands of Aurora Driver-powered trucks deliver freight across the U.S., and ultimately globally. Driverless miles 300,000 Apr 2025 May Jun Aug SepJul Oct Nov Dec Jan 2026 200,000 100,000 250,000+ 24Q25 SHAREHOLDER LETTER

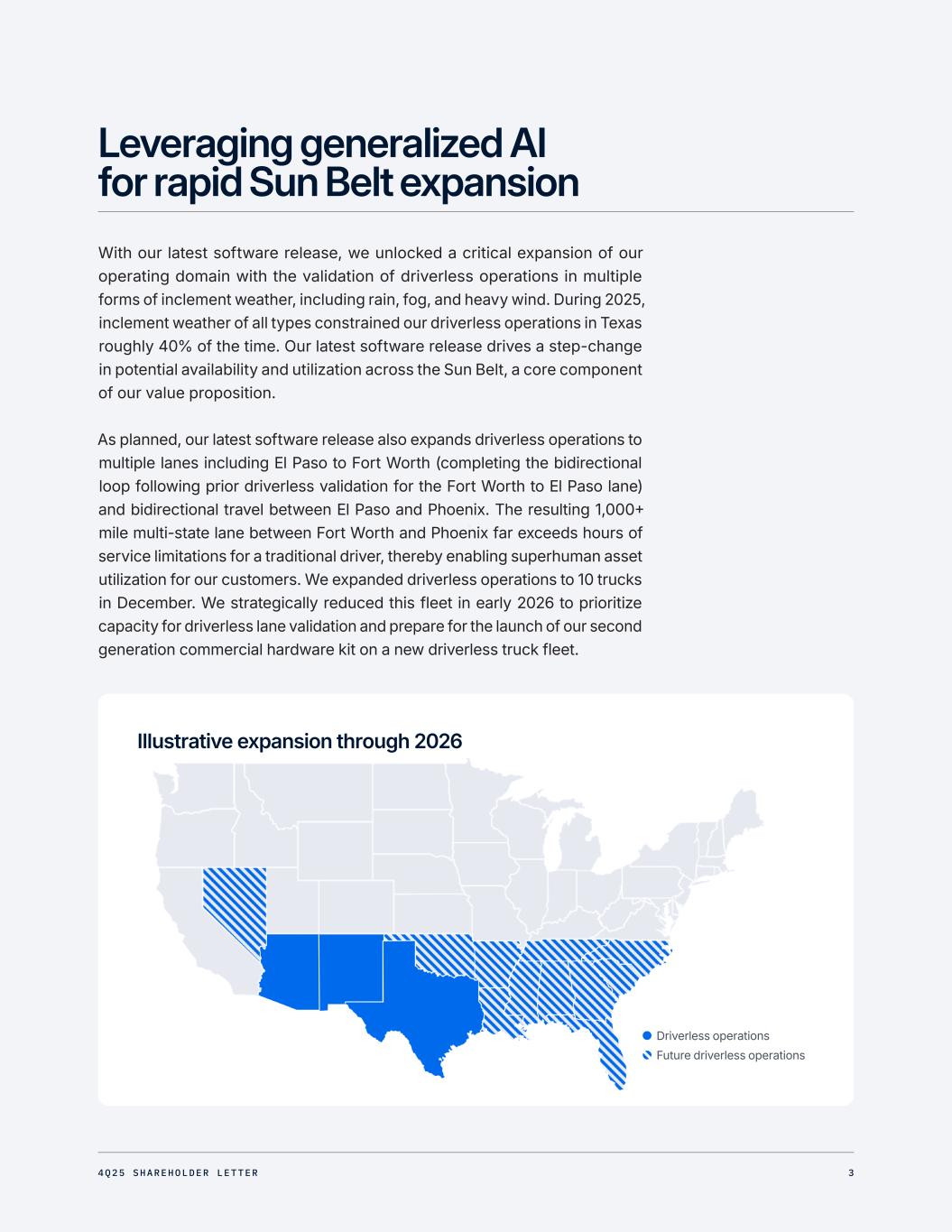

Leveraging generalized AI for rapid Sun Belt expansion With our latest software release, we unlocked a critical expansion of our operating domain with the validation of driverless operations in multiple forms of inclement weather, including rain, fog, and heavy wind. During 2025, inclement weather of all types constrained our driverless operations in Texas roughly 40% of the time. Our latest software release drives a step-change in potential availability and utilization across the Sun Belt, a core component of our value proposition. As planned, our latest software release also expands driverless operations to multiple lanes including El Paso to Fort Worth (completing the bidirectional loop following prior driverless validation for the Fort Worth to El Paso lane) and bidirectional travel between El Paso and Phoenix. The resulting 1,000+ mile multi-state lane between Fort Worth and Phoenix far exceeds hours of service limitations for a traditional driver, thereby enabling superhuman asset utilization for our customers. We expanded driverless operations to 10 trucks in December. We strategically reduced this fleet in early 2026 to prioritize capacity for driverless lane validation and prepare for the launch of our second generation commercial hardware kit on a new driverless truck fleet. Illustrative expansion through 2026 Driverless operations Future driverless operations 34Q25 SHAREHOLDER LETTER

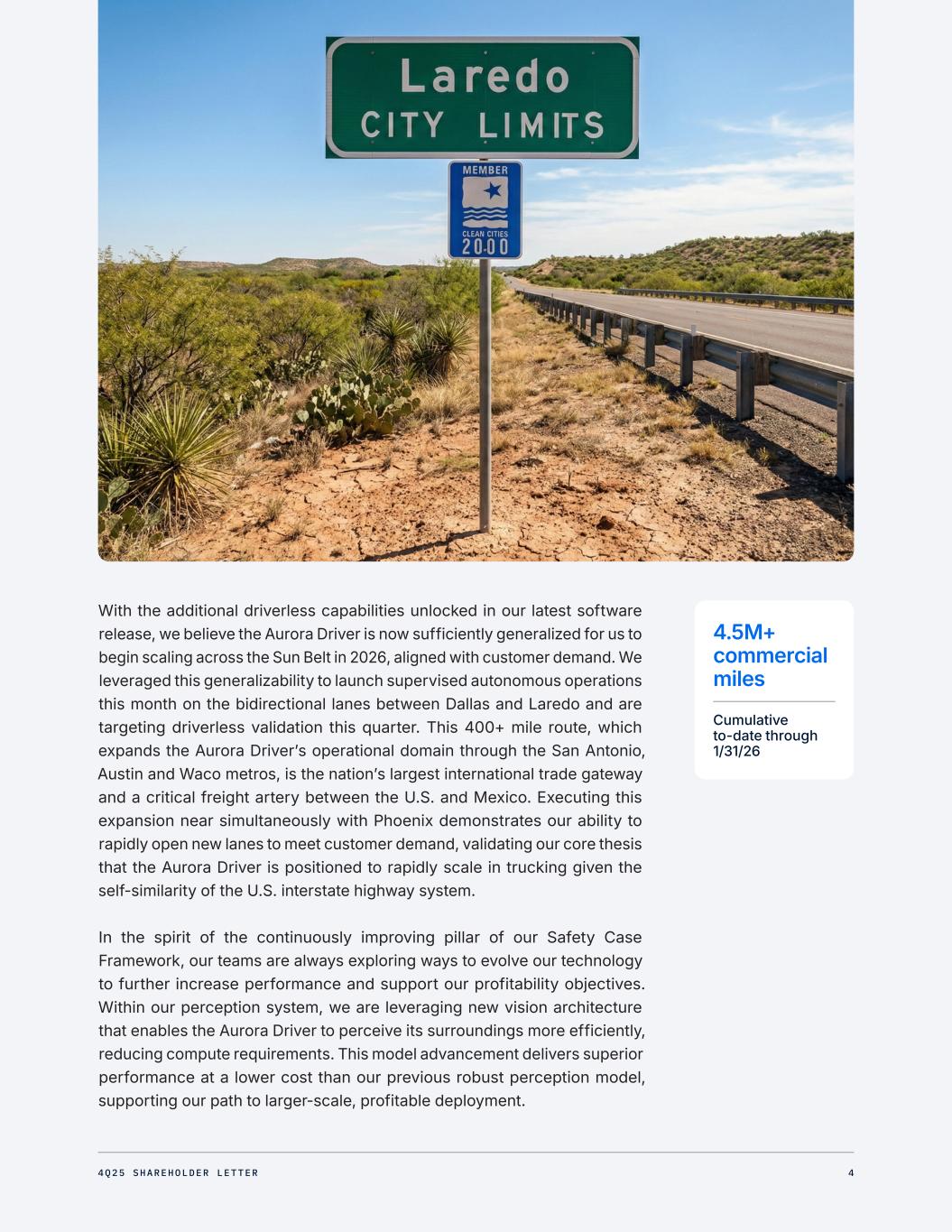

With the additional driverless capabilities unlocked in our latest software release, we believe the Aurora Driver is now sufficiently generalized for us to begin scaling across the Sun Belt in 2026, aligned with customer demand. We leveraged this generalizability to launch supervised autonomous operations this month on the bidirectional lanes between Dallas and Laredo and are targeting driverless validation this quarter. This 400+ mile route, which expands the Aurora Driver’s operational domain through the San Antonio, Austin and Waco metros, is the nation’s largest international trade gateway and a critical freight artery between the U.S. and Mexico. Executing this expansion near simultaneously with Phoenix demonstrates our ability to rapidly open new lanes to meet customer demand, validating our core thesis that the Aurora Driver is positioned to rapidly scale in trucking given the self-similarity of the U.S. interstate highway system. In the spirit of the continuously improving pillar of our Safety Case Framework, our teams are always exploring ways to evolve our technology to further increase performance and support our profitability objectives. Within our perception system, we are leveraging new vision architecture that enables the Aurora Driver to perceive its surroundings more efficiently, reducing compute requirements. This model advancement delivers superior performance at a lower cost than our previous robust perception model, supporting our path to larger-scale, profitable deployment. 4.5M+ commercial miles Cumulative to-date through 1/31/26 44Q25 SHAREHOLDER LETTER

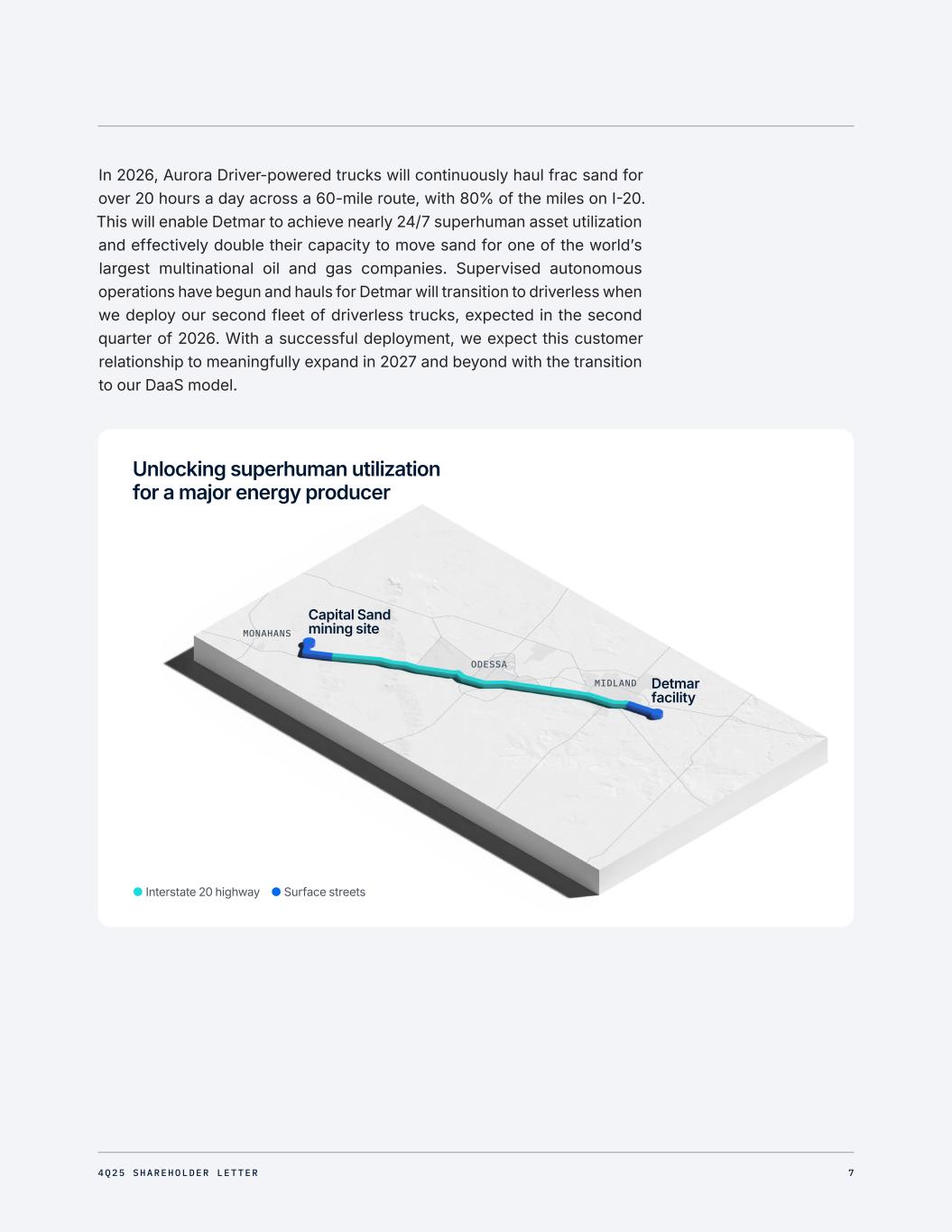

Accelerating expansion with map automation Lane expansion requires two core components: (1) the driving skills to operate safely in an expanding operating domain and (2) the mapping necessary to traverse the U.S. highway system and the surface streets to reach customers’ facilities. With its generalization, the Aurora Driver’s skills are now in place and we have also made meaningful progress automating the creation of new content for the Aurora Atlas, our proprietary high-definition map technology that enhances the safety and computational efficiency of the Aurora Driver. By leveraging our Verifiable AI systems, our cloud-based algorithms are able to generate semantic components of the Aurora Atlas from collected data, automatically building portions of the map with little or no human assistance. This drastically accelerates the production of Atlas content and we expect the pace of map expansion to continue to increase as we further optimize automation in our cloud mapping software. Delivering to and from customer facilities This mapping improvement enables us to efficiently support driverless deployment directly between customer endpoints at scale. We have now begun supervised autonomous freight delivery to support multiple customer facilities, including: • Hirschbach: between Dallas and Laredo to support their customer Driscoll’s, the largest berry company globally • Detmar: between their facility in Midland, Texas and Capital Sand’s mining site in Monahans, Texas, along I-20 • One of the leading carriers in the U.S.: from their Phoenix facility 54Q25 SHAREHOLDER LETTER

Building demand for Driver as a Service business The Aurora Driver offers an unmatched value proposition — it can navigate the complexities of diverse road types, maintain 24/7 operating schedules, provide endurance far beyond hours-of-service limits, and deliver directly to customer endpoints. Our execution in 2026 will further reinforce this leadership position while showcasing the Aurora Driver’s inherent scalability to support the transition to our Driver as a Service (DaaS) business model. We have already committed our capacity through the third quarter of 2026 and will finalize contracts for the fourth quarter once we confirm our year- end truck supply. As we turn to DaaS in 2027 and beyond, customer interest already supports a pipeline of thousands of trucks. We are continuing to expand with our current driverless customers and recently announced a new, opportunistic agreement with Detmar Logistics, a leading provider of dry bulk and frac sand solutions. Detmar selected Aurora to support the growth of their business given we are the only company with driverless Class 8 commercial trucking operations on public highways and roads in the U.S. This customer agreement demonstrates the flexibility of the Aurora Driver to deliver value in a multitude of use cases, enabling us to meet customers where they are to support their growth and efficiency. As simul-fracs demand higher sand volumes and operators move to 24/7 schedules, maintaining a safe, reliable flow of proppant is critical. Aurora’s autonomous technology is a game changer for our industry. It will enable us to safely improve efficiency and support our customers’ continuous operations. We expect autonomous trucks to become a competitive advantage to strengthen and grow our business in the years to come.” —MATT DETMAR, CEO, DETMAR LOGISTICS 64Q25 SHAREHOLDER LETTER

Unlocking superhuman utilization for a major energy producer ● Interstate 20 highway ● Surface streets Capital Sand mining site Detmar facility MONAHANS ODESSA MIDLAND In 2026, Aurora Driver-powered trucks will continuously haul frac sand for over 20 hours a day across a 60-mile route, with 80% of the miles on I-20. This will enable Detmar to achieve nearly 24/7 superhuman asset utilization and effectively double their capacity to move sand for one of the world’s largest multinational oil and gas companies. Supervised autonomous operations have begun and hauls for Detmar will transition to driverless when we deploy our second fleet of driverless trucks, expected in the second quarter of 2026. With a successful deployment, we expect this customer relationship to meaningfully expand in 2027 and beyond with the transition to our DaaS model. 74Q25 SHAREHOLDER LETTER

Lineside integration of the Aurora Driver hardware kit at Volvo’s New River Valley, VA manufacturing facility Industrializing vehicle supply Our vehicle-agnostic technology enables a multi-OEM strategy to provide truck supply for our growing customer base. This approach is anchored in our foundational partnerships with Volvo and PACCAR. Our partnership with Volvo recently entered the industrialization phase with the first Volvo VNL Autonomous trucks equipped with the Aurora Driver coming off the pilot line following lineside integration of our second generation commercial kit at their New River Valley, VA manufacturing facility. This milestone establishes the manufacturing foundation necessary to produce autonomous trucks at large commercial scale. Once Volvo completes validation of the vehicle-level firmware necessary for driverless operations, we will integrate these trucks into our driverless fleet. The partnership has shifted now from developing autonomous trucking technology to industrializing our joint autonomous trucking solution... [Recently], we shared an exciting and major milestone and that has been the complete integration of the Aurora Driver kit and compute directly at our Volvo manufacturing at New River Valley ... Step by step, day by day, milestone by milestone, Volvo Autonomous Solutions and Aurora, we are setting the standard for responsible and scalable autonomous freight, shaping the future of autonomous trucking.” —NILS JAEGER, PRESIDENT, VOLVO AUTONOMOUS SOLUTIONS 84Q25 SHAREHOLDER LETTER

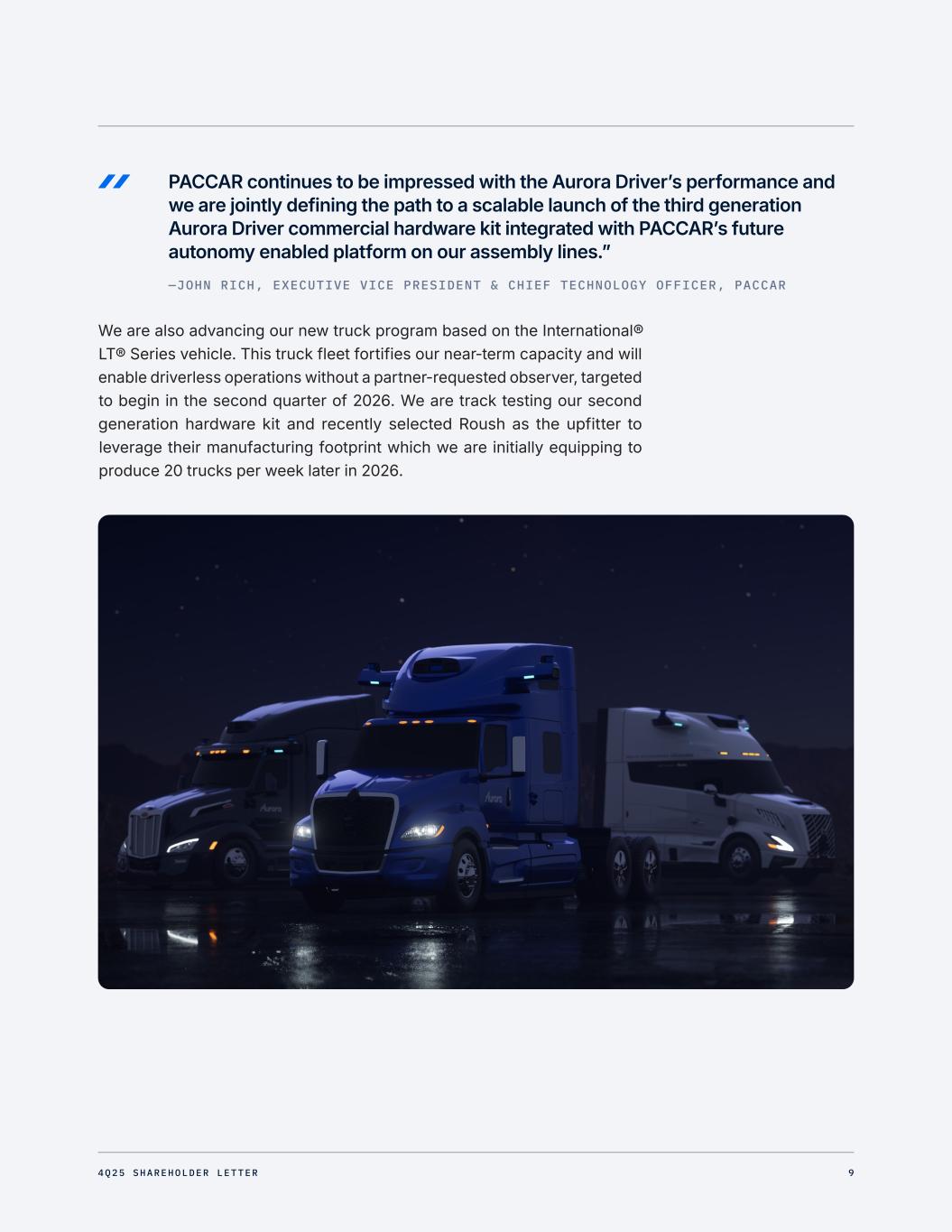

We are also advancing our new truck program based on the International® LT® Series vehicle. This truck fleet fortifies our near-term capacity and will enable driverless operations without a partner-requested observer, targeted to begin in the second quarter of 2026. We are track testing our second generation hardware kit and recently selected Roush as the upfitter to leverage their manufacturing footprint which we are initially equipping to produce 20 trucks per week later in 2026. PACCAR continues to be impressed with the Aurora Driver’s performance and we are jointly defining the path to a scalable launch of the third generation Aurora Driver commercial hardware kit integrated with PACCAR’s future autonomy enabled platform on our assembly lines.” —JOHN RICH, EXECUTIVE VICE PRESIDENT & CHIEF TECHNOLOGY OFFICER, PACCAR 94Q25 SHAREHOLDER LETTER

Looking further ahead, we continue to make great progress on our third generation commercial hardware kit with AUMOVIO, which is intended to supply tens of thousands of trucks. We welcome AUMOVIO’s recent selection of Amazon Web Services (AWS) as their preferred cloud provider to support their development of an industrialized fallback system for the Aurora Driver. AWS has been a long-standing infrastructure partner of Aurora. At AWS, we believe the future of autonomous mobility isn’t just about technology — it’s about enabling our partners to deliver on the promise of safer, more efficient transportation at scale. Our collaboration with AUMOVIO and Aurora exemplifies this vision, combining AWS’s AI and cloud infrastructure with AUMOVIO’s automotive expertise to help Aurora scale autonomous trucking while maintaining rigorous safety standards.” —OZGUR TOHUMCU, GENERAL MANAGER OF AUTOMOTIVE AND MANUFACTURING, AMAZON WEB SERVICES (AWS) Aumovio's New Braunfels, Texas manufacturing facility where our third generation commercial hardware kit will be produced 104Q25 SHAREHOLDER LETTER

Increasing regulatory support We also continue to see regulatory momentum at the state and federal level that supports driverless trucking operations across the U.S. Notably, the California Department of Motor Vehicles (DMV) recently released revised draft regulations for the testing and deployment of autonomous trucks in the state. With one of the few states that have restricted autonomous trucking now moving to enable the technology, this represents a meaningful step toward a coast-to-coast regulatory environment that supports driverless freight operations. We submitted our comments on the revised draft regulations and are optimistic that the California DMV will issue final regulations in early 2026. Including California in our serviceable addressable market (SAM) would bring our estimated SAM to approximately 60 billion VMT by 2028. Concurrent with our regional efforts, we are actively engaging with federal policymakers to ensure the U.S. remains the global leader in transportation innovation. In December, our team had the privilege of meeting with Transportation Secretary Sean Duffy and hosting U.S. Representative Vince Fong — author of the AMERICA DRIVES Act, a landmark bill to establish a federal framework specifically for self-driving trucks — for a driverless ride-along to demonstrate the real-world safety and efficiency benefits of our technology. We are very encouraged by the growing support for the AMERICA DRIVES Act, which recently gained U.S. Representative Kevin Kiley of California as a second cosponsor. From Sacramento to Washington D.C., consensus is building — autonomous trucking will strengthen the U.S. supply chain and enhance road safety for all Americans. Autonomous trucking holds enormous promise — and it has for a long time — for safety, efficiency, and supply chain resiliency ... At FMCSA, safety will always be our North Star, and innovation is the engine that helps us get to that point.” —DEREK BARRS, FMCSA ADMINISTRATOR Representative Vince Fong (R-CA) experiencing the Aurora Driver technology 114Q25 SHAREHOLDER LETTER

The future of freight is superhuman As we execute our disciplined “crawl, walk, run” strategy, we are decisively advancing into the “walk” phase of operations while positioning to “run” by the end of this year. Just as the last two years brought robotaxis into the mainstream, we expect 2026 to mark the inflection point where the market recognizes that self-driving trucks have arrived and are quickly becoming a permanent fixture in our transportation landscape. This represents more than a technological achievement; it is the dawn of a superhuman future for freight. With the Aurora Driver, we are deploying a system that sees in every direction simultaneously, operates with stamina that never stops the clock, and makes life-saving decisions in milliseconds without ever getting distracted. The era of superhuman logistics has arrived, and Aurora is driving. Chris Urmson Co-founder & CEO 124Q25 SHAREHOLDER LETTER

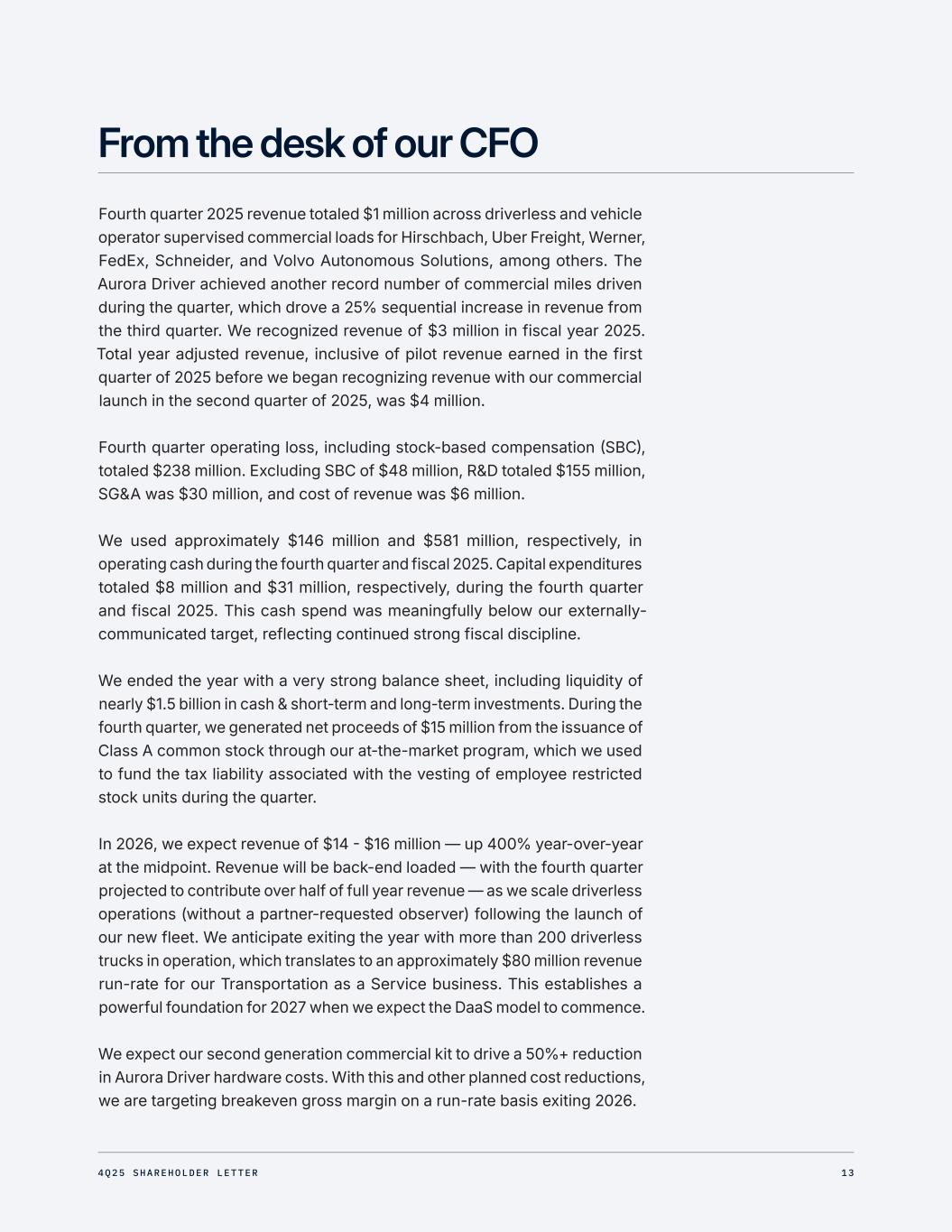

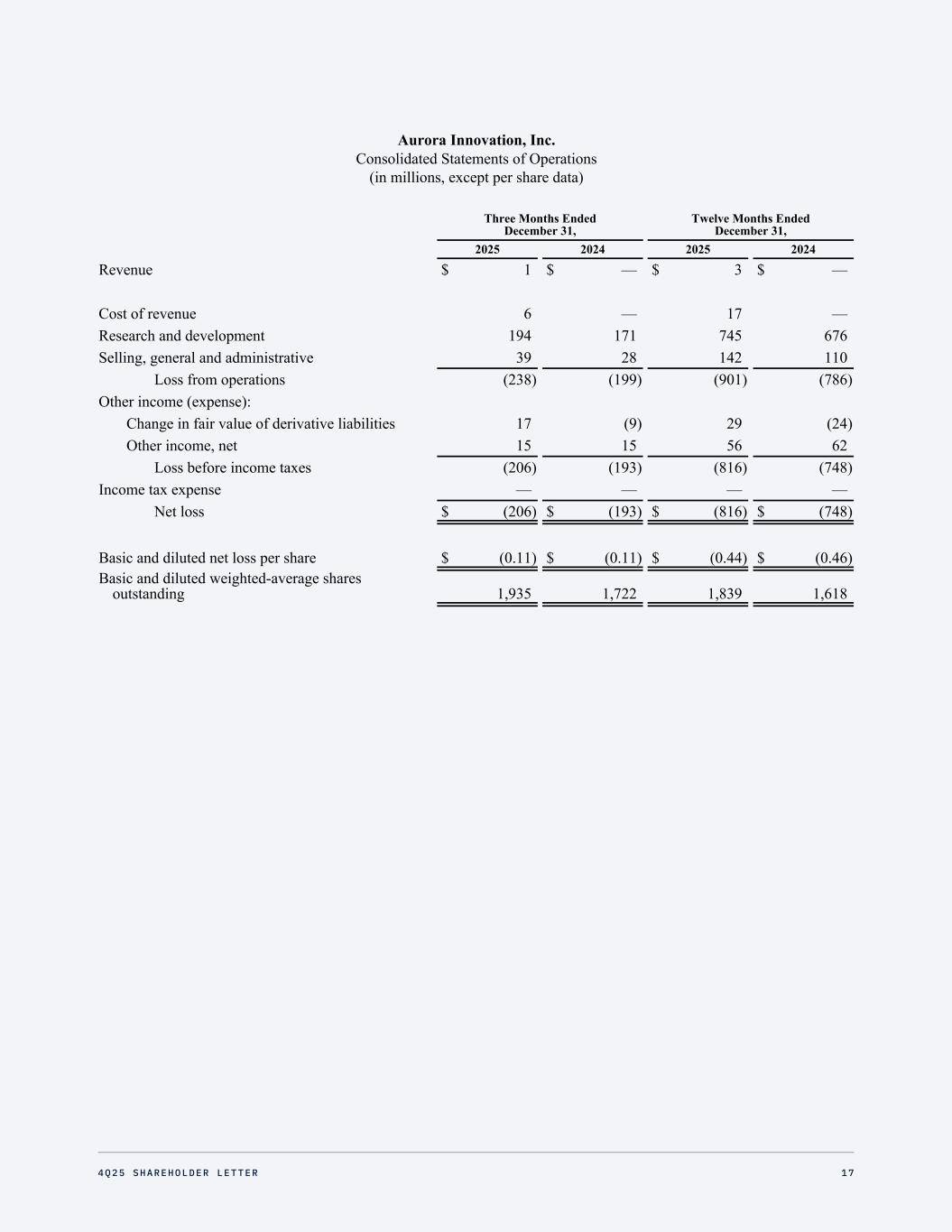

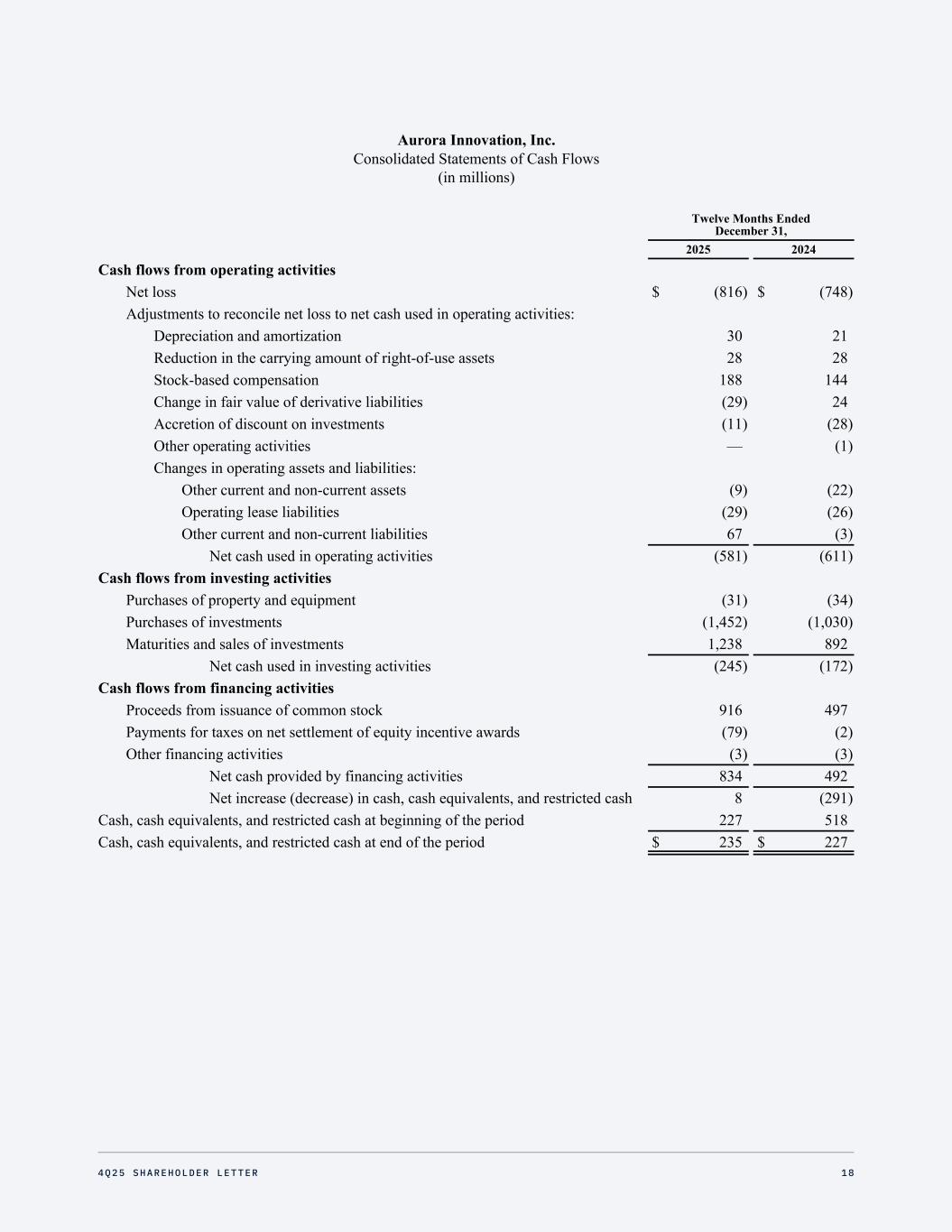

From the desk of our CFO Fourth quarter 2025 revenue totaled $1 million across driverless and vehicle operator supervised commercial loads for Hirschbach, Uber Freight, Werner, FedEx, Schneider, and Volvo Autonomous Solutions, among others. The Aurora Driver achieved another record number of commercial miles driven during the quarter, which drove a 25% sequential increase in revenue from the third quarter. We recognized revenue of $3 million in fiscal year 2025. Total year adjusted revenue, inclusive of pilot revenue earned in the first quarter of 2025 before we began recognizing revenue with our commercial launch in the second quarter of 2025, was $4 million. Fourth quarter operating loss, including stock-based compensation (SBC), totaled $238 million. Excluding SBC of $48 million, R&D totaled $155 million, SG&A was $30 million, and cost of revenue was $6 million. We used approximately $146 million and $581 million, respectively, in operating cash during the fourth quarter and fiscal 2025. Capital expenditures totaled $8 million and $31 million, respectively, during the fourth quarter and fiscal 2025. This cash spend was meaningfully below our externally- communicated target, reflecting continued strong fiscal discipline. We ended the year with a very strong balance sheet, including liquidity of nearly $1.5 billion in cash & short-term and long-term investments. During the fourth quarter, we generated net proceeds of $15 million from the issuance of Class A common stock through our at-the-market program, which we used to fund the tax liability associated with the vesting of employee restricted stock units during the quarter. In 2026, we expect revenue of $14 - $16 million — up 400% year-over-year at the midpoint. Revenue will be back-end loaded — with the fourth quarter projected to contribute over half of full year revenue — as we scale driverless operations (without a partner-requested observer) following the launch of our new fleet. We anticipate exiting the year with more than 200 driverless trucks in operation, which translates to an approximately $80 million revenue run-rate for our Transportation as a Service business. This establishes a powerful foundation for 2027 when we expect the DaaS model to commence. We expect our second generation commercial kit to drive a 50%+ reduction in Aurora Driver hardware costs. With this and other planned cost reductions, we are targeting breakeven gross margin on a run-rate basis exiting 2026. 134Q25 SHAREHOLDER LETTER

David Maday CFO To support our scaling plan, we expect quarterly cash use of approximately $190 - $220 million, on average, in 2026. We believe we have sufficient liquidity to achieve positive free cash flow in 2028. We plan to utilize the ATM to fund our RSU tax liabilities and cash bonus payments through 2027. We also expect to strategically leverage the ATM and/or other mechanisms to solidify our balance sheet with an appropriate minimum cash balance to support our longer-term operations. Building on the momentum of our landmark commercial launch, we are now focused on the execution and strategic investments necessary to scale. As we roll out our second generation commercial hardware kit on our new truck fleet and accelerate driverless operations, we will further extend our leadership position in autonomous trucking, which we believe will deliver sustained, long-term value for our shareholders. 144Q25 SHAREHOLDER LETTER

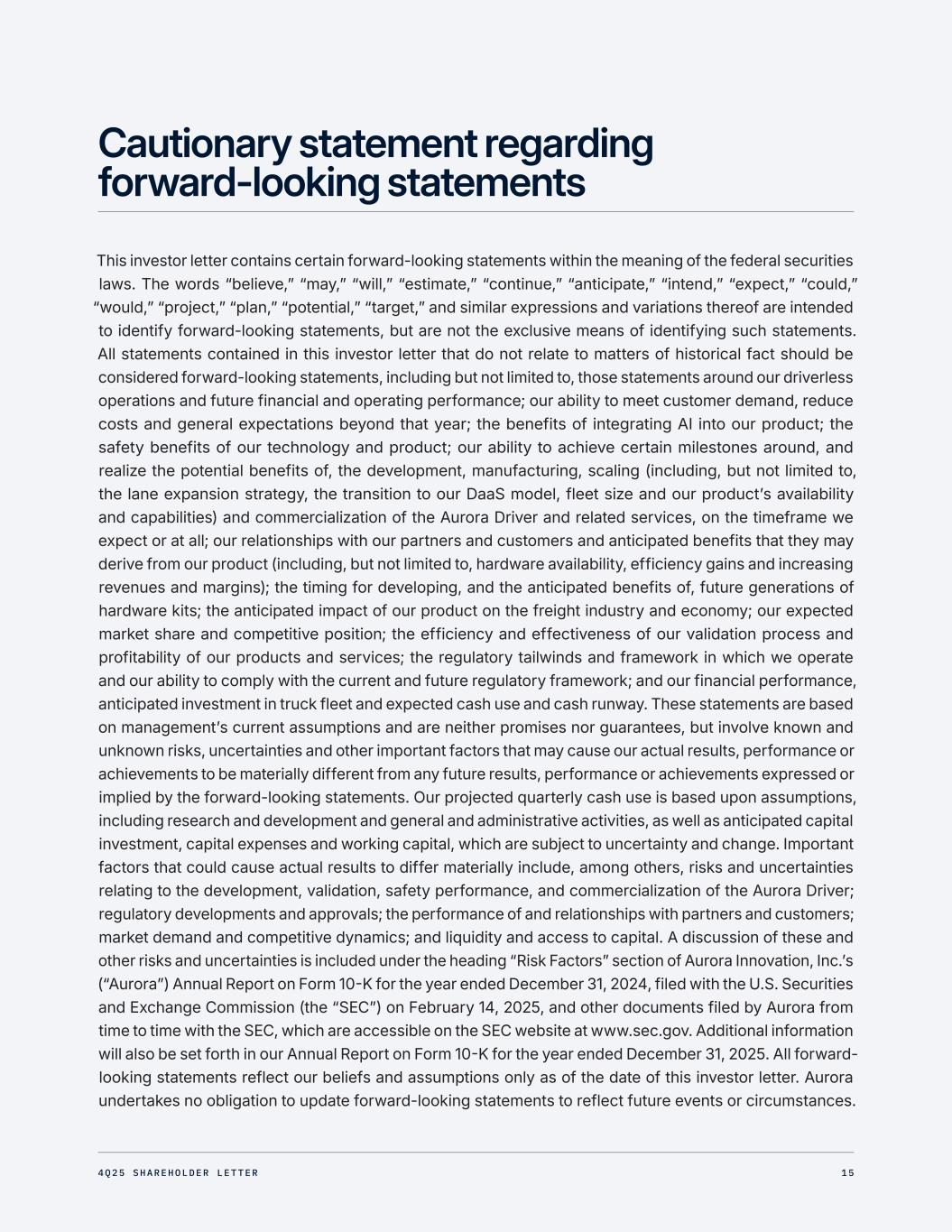

Cautionary statement regarding forward-looking statements This investor letter contains certain forward-looking statements within the meaning of the federal securities laws. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “potential,” “target,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. All statements contained in this investor letter that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited to, those statements around our driverless operations and future financial and operating performance; our ability to meet customer demand, reduce costs and general expectations beyond that year; the benefits of integrating AI into our product; the safety benefits of our technology and product; our ability to achieve certain milestones around, and realize the potential benefits of, the development, manufacturing, scaling (including, but not limited to, the lane expansion strategy, the transition to our DaaS model, fleet size and our product’s availability and capabilities) and commercialization of the Aurora Driver and related services, on the timeframe we expect or at all; our relationships with our partners and customers and anticipated benefits that they may derive from our product (including, but not limited to, hardware availability, efficiency gains and increasing revenues and margins); the timing for developing, and the anticipated benefits of, future generations of hardware kits; the anticipated impact of our product on the freight industry and economy; our expected market share and competitive position; the efficiency and effectiveness of our validation process and profitability of our products and services; the regulatory tailwinds and framework in which we operate and our ability to comply with the current and future regulatory framework; and our financial performance, anticipated investment in truck fleet and expected cash use and cash runway. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Our projected quarterly cash use is based upon assumptions, including research and development and general and administrative activities, as well as anticipated capital investment, capital expenses and working capital, which are subject to uncertainty and change. Important factors that could cause actual results to differ materially include, among others, risks and uncertainties relating to the development, validation, safety performance, and commercialization of the Aurora Driver; regulatory developments and approvals; the performance of and relationships with partners and customers; market demand and competitive dynamics; and liquidity and access to capital. A discussion of these and other risks and uncertainties is included under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Annual Report on Form 10-K for the year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 14, 2025, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. Additional information will also be set forth in our Annual Report on Form 10-K for the year ended December 31, 2025. All forward- looking statements reflect our beliefs and assumptions only as of the date of this investor letter. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances. 154Q25 SHAREHOLDER LETTER

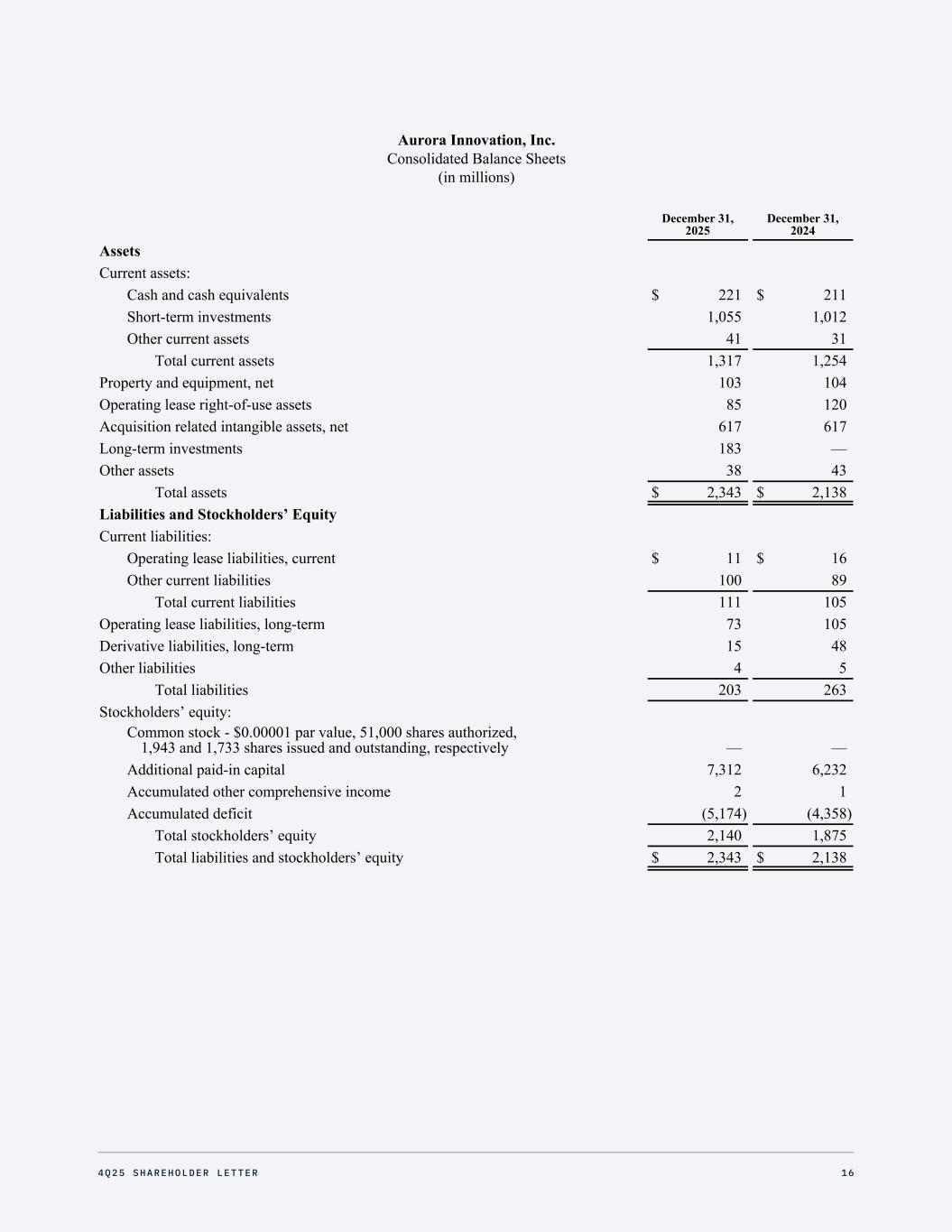

Aurora Innovation, Inc. Consolidated Balance Sheets (in millions) December 31, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 221 $ 211 Short-term investments 1,055 1,012 Other current assets 41 31 Total current assets 1,317 1,254 Property and equipment, net 103 104 Operating lease right-of-use assets 85 120 Acquisition related intangible assets, net 617 617 Long-term investments 183 — Other assets 38 43 Total assets $ 2,343 $ 2,138 Liabilities and Stockholders’ Equity Current liabilities: Operating lease liabilities, current $ 11 $ 16 Other current liabilities 100 89 Total current liabilities 111 105 Operating lease liabilities, long-term 73 105 Derivative liabilities, long-term 15 48 Other liabilities 4 5 Total liabilities 203 263 Stockholders’ equity: Common stock - $0.00001 par value, 51,000 shares authorized, 1,943 and 1,733 shares issued and outstanding, respectively — — Additional paid-in capital 7,312 6,232 Accumulated other comprehensive income 2 1 Accumulated deficit (5,174) (4,358) Total stockholders’ equity 2,140 1,875 Total liabilities and stockholders’ equity $ 2,343 $ 2,138 164Q25 SHAREHOLDER LETTER

Aurora Innovation, Inc. Consolidated Statements of Operations (in millions, except per share data) Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Revenue $ 1 $ — $ 3 $ — Cost of revenue 6 — 17 — Research and development 194 171 745 676 Selling, general and administrative 39 28 142 110 Loss from operations (238) (199) (901) (786) Other income (expense): Change in fair value of derivative liabilities 17 (9) 29 (24) Other income, net 15 15 56 62 Loss before income taxes (206) (193) (816) (748) Income tax expense — — — — Net loss $ (206) $ (193) $ (816) $ (748) Basic and diluted net loss per share $ (0.11) $ (0.11) $ (0.44) $ (0.46) Basic and diluted weighted-average shares outstanding 1,935 1,722 1,839 1,618 174Q25 SHAREHOLDER LETTER

Aurora Innovation, Inc. Consolidated Statements of Cash Flows (in millions) Twelve Months Ended December 31, 2025 2024 Cash flows from operating activities Net loss $ (816) $ (748) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 30 21 Reduction in the carrying amount of right-of-use assets 28 28 Stock-based compensation 188 144 Change in fair value of derivative liabilities (29) 24 Accretion of discount on investments (11) (28) Other operating activities — (1) Changes in operating assets and liabilities: Other current and non-current assets (9) (22) Operating lease liabilities (29) (26) Other current and non-current liabilities 67 (3) Net cash used in operating activities (581) (611) Cash flows from investing activities Purchases of property and equipment (31) (34) Purchases of investments (1,452) (1,030) Maturities and sales of investments 1,238 892 Net cash used in investing activities (245) (172) Cash flows from financing activities Proceeds from issuance of common stock 916 497 Payments for taxes on net settlement of equity incentive awards (79) (2) Other financing activities (3) (3) Net cash provided by financing activities 834 492 Net increase (decrease) in cash, cash equivalents, and restricted cash 8 (291) Cash, cash equivalents, and restricted cash at beginning of the period 227 518 Cash, cash equivalents, and restricted cash at end of the period $ 235 $ 227 184Q25 SHAREHOLDER LETTER

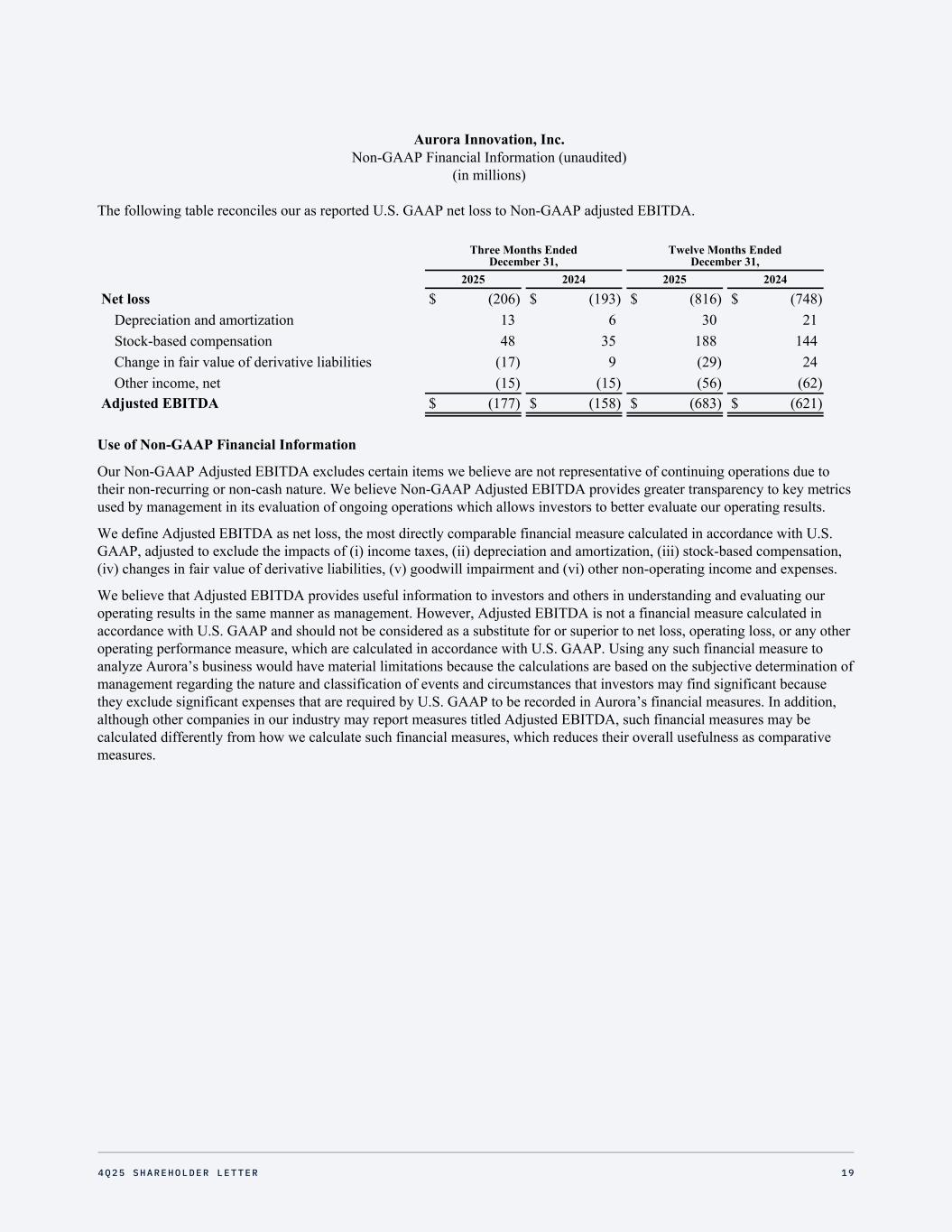

Aurora Innovation, Inc. Non-GAAP Financial Information (unaudited) (in millions) The following table reconciles our as reported U.S. GAAP net loss to Non-GAAP adjusted EBITDA. Three Months Ended December 31, Twelve Months Ended December 31, 2025 2024 2025 2024 Net loss $ (206) $ (193) $ (816) $ (748) Depreciation and amortization 13 6 30 21 Stock-based compensation 48 35 188 144 Change in fair value of derivative liabilities (17) 9 (29) 24 Other income, net (15) (15) (56) (62) Adjusted EBITDA $ (177) $ (158) $ (683) $ (621) Use of Non-GAAP Financial Information Our Non-GAAP Adjusted EBITDA excludes certain items we believe are not representative of continuing operations due to their non-recurring or non-cash nature. We believe Non-GAAP Adjusted EBITDA provides greater transparency to key metrics used by management in its evaluation of ongoing operations which allows investors to better evaluate our operating results. We define Adjusted EBITDA as net loss, the most directly comparable financial measure calculated in accordance with U.S. GAAP, adjusted to exclude the impacts of (i) income taxes, (ii) depreciation and amortization, (iii) stock-based compensation, (iv) changes in fair value of derivative liabilities, (v) goodwill impairment and (vi) other non-operating income and expenses. We believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as management. However, Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for or superior to net loss, operating loss, or any other operating performance measure, which are calculated in accordance with U.S. GAAP. Using any such financial measure to analyze Aurora’s business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant because they exclude significant expenses that are required by U.S. GAAP to be recorded in Aurora’s financial measures. In addition, although other companies in our industry may report measures titled Adjusted EBITDA, such financial measures may be calculated differently from how we calculate such financial measures, which reduces their overall usefulness as comparative measures. 194Q25 SHAREHOLDER LETTER