10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 15, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2023

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ________ to ________

Commission file number 001-40216

(Exact name of registrant as specified in its charter)

|

State or other jurisdiction of incorporation or organization

|

(I.R.S. Employer Identification No.)

|

|||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(888 ) 583-9506

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| x | Accelerated filer | o | |||||||||

| Non-accelerated filer | o | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2023, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $1,228,710,507 .

The registrant had outstanding 1,168,399,674 shares of Class A common stock and 366,869,709 shares of Class B common stock as of February 2, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2024 annual meeting of stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The Registrant’s definitive proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

| Page | ||||||||

| PART I | ||||||||

| PART II | ||||||||

| PART III | ||||||||

| PART IV | ||||||||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “possible,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Annual Report include statements about:

•our ability to commercialize the Aurora Driver safely, quickly, and broadly on the timeline we expect;

•the market for autonomous vehicles and our market position;

•our ability to compete effectively with existing and new competitors;

•the ability to maintain the listing of our Class A common stock and warrants on Nasdaq;

•our ability to raise financing in the future;

•anticipated trends, growth rates, and challenges in our business and in the markets in which we operate;

•our ability to effectively manage our growth and future expenses;

•the sufficiency of our cash and cash equivalents to meet our operating requirements;

•our success in retaining or recruiting, or changes required in, our officers, key employees or directors;

•the impact of the regulatory environment and complexities with compliance related to such environment;

•our ability to successfully collaborate with business partners;

•our ability to obtain, maintain, protect and enforce our intellectual property;

•economic and industry trends or trend analysis;

•the impact of infectious diseases, health epidemics and pandemics (such as the COVID-19 pandemic), natural disasters, war (including Russia’s actions in Ukraine and the Israel-Hamas war), acts of terrorism or responses to these events; and

•other factors detailed under the section entitled “Risk Factors.”

We caution you that the foregoing list does not contain all of the forward-looking statements made in this Annual Report.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, operating results, financial condition and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those described in the section titled “Risk Factors” and elsewhere in this Annual Report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this Annual Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report to reflect events or circumstances after the date of this Annual Report or to reflect new information or the occurrence of unanticipated events, except as required by law. You should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

ii

Part I - Financial Information

Item 1. Business.

INFORMATION ABOUT AURORA

Unless the context otherwise requires, all references in this section to the “Company,” “Aurora,” “we,” “us,” or “our” refer to the business of Aurora Innovation Holdings, Inc. and its subsidiaries prior to the consummation of the Merger (defined below), and to Aurora Innovation, Inc. and its subsidiaries after the completion of the Merger.

Corporate History and Background

On November 3, 2021 (the “Closing Date”), Aurora Innovation, Inc. (f/k/a Reinvent Technology Partners Y and referred to herein as the “Company”), consummated a business combination with Aurora Innovation Holdings, Inc., a Delaware corporation (f/k/a Aurora Innovation, Inc. and f/k/a Avian U Merger Holdco Corp. and referred to herein as “Legacy Aurora”), and RTPY Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of the Company (“Merger Sub”), pursuant to an Agreement and Plan of Merger dated July 14, 2021 (the “Merger Agreement” and the transactions contemplated thereby, the “Merger”), by and among the Company, Legacy Aurora and Merger Sub. Our Class A common stock and public warrants are listed on Nasdaq under the symbols “AUR” and “AUROW,” respectively. Our Class B common stock is neither listed nor publicly traded.

Pursuant to the terms of the Merger Agreement, a business combination between the Company and Legacy Aurora was effected through the merger of Merger Sub with and into Legacy Aurora, with Legacy Aurora surviving as the surviving company and as a wholly-owned subsidiary of the Company. On the Closing Date, the Company changed its name from Reinvent Technology Partners Y to Aurora Innovation, Inc.

Company Overview

Our mission is to deliver the benefits of self-driving technology safely, quickly, and broadly.

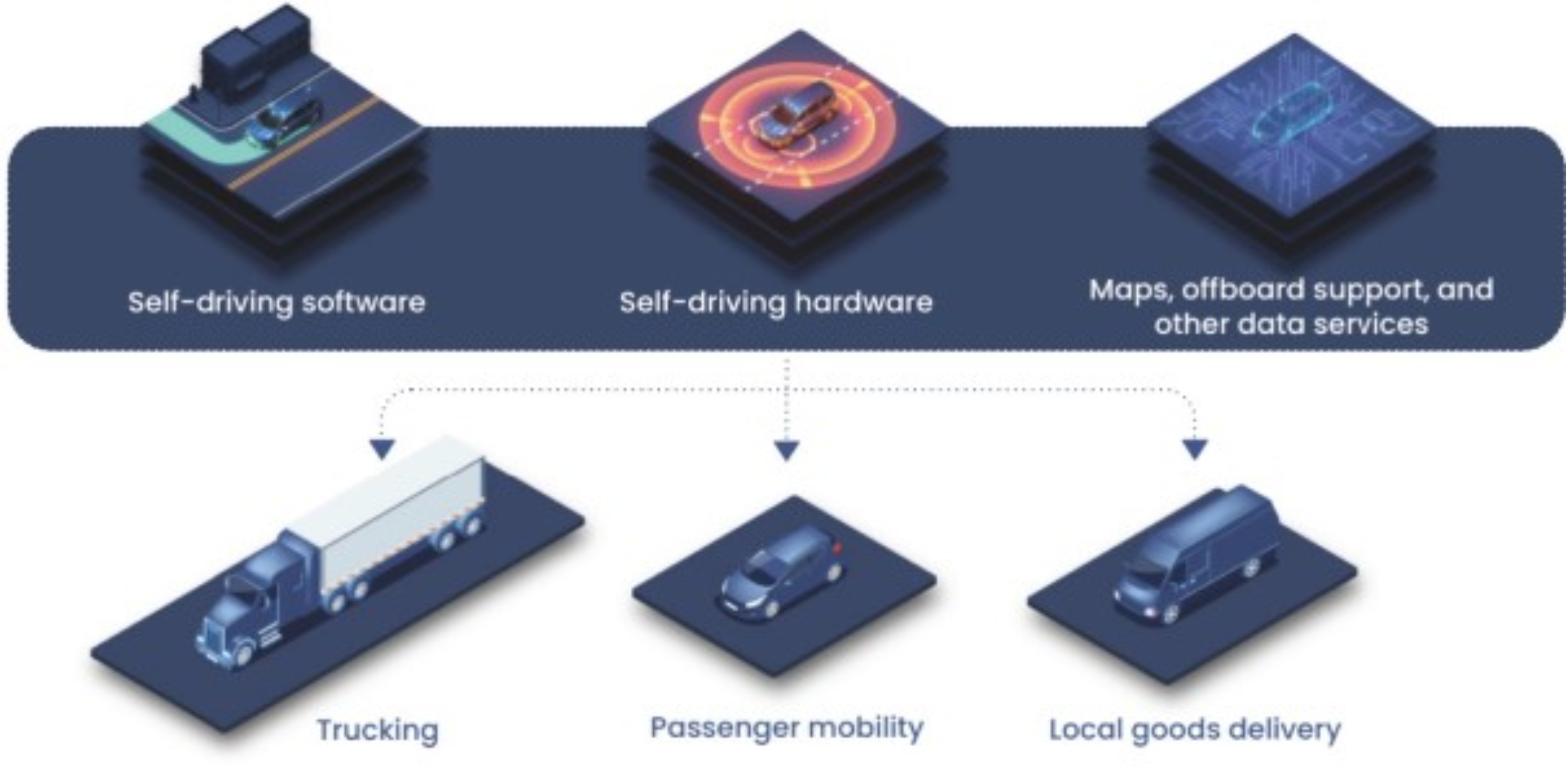

Aurora was founded in 2017 by Chris Urmson, Sterling Anderson, and Drew Bagnell, three of the most prominent leaders in the self-driving space. Led by a team with deep experience, we are developing the Aurora Driver based on what we believe to be the most advanced and scalable suite of self-driving hardware, software, and data services in the world to fundamentally transform the global transportation market. The Aurora Driver is designed as a platform to adapt and interoperate amongst a multitude of vehicle types and applications. To date, we have successfully integrated the Aurora Driver into numerous different vehicle platforms designed to meet its requirements: from passenger vehicles to light commercial vehicles to Class 8 trucks. By creating a common driver platform for multiple vehicle types and use cases, the capabilities we develop in one market reinforce and strengthen our competitive advantages in other areas. For example, highway driving capabilities developed for trucking will carry over to highway segments driven by passenger vehicles in ride hailing applications. We believe this is the right approach to bring self-driving to market and will enable us to target and transform multiple massive markets, including trucking, passenger mobility, and local goods delivery.

Beyond the economic opportunity, we believe we have a unique opportunity to have a material positive impact on the lives of millions of people, while also improving business productivity. First and foremost, we are focused on the opportunity to greatly improve road safety. In trucking, we can enable logistics networks to move goods more efficiently, and also help fill the shortage of truck drivers by providing a self-driving option. We will expand access to transportation, improving the lives of the millions of people with a disability in the U.S. who have difficulty traveling outside of the home. And we will give people back their time that can be made more productive and enjoyable.

We intend to launch trucking as our first driverless product, as we believe its massive scale, significant structural need, attractive unit economics, and self-similar operating environment will allow us to rapidly deploy and profitably scale on high-volume, highway-focused routes. Drafting on the revenue and technical capability we expect this trucking product to generate, we plan to leverage the extensibility of the Aurora Driver to deploy and scale into the passenger mobility and local goods delivery markets. Today, we operate our self-driving test vehicle fleet in diverse weather and operating environments, across the Bay Area, Pittsburgh and Texas, allowing us to create a more robust self-driving system. We also autonomously haul (under the supervision of vehicle operators) truck freight on behalf of our pilot customers in preparation for driverless commercialization.

1

Our first-principles approach underpins our technology development strategy for the Aurora Driver. We made foundational investments early on, based on our prior experience in the self-driving industry, that allow us to accelerate development and position our platform for long-term scalability. Some of these foundational investments include developing the Aurora Driver with what we believe to be the optimal combination of machine-learned and rule-based approaches. We have also built a proprietary Virtual Testing Suite, which makes our development more efficient and faster than traditional approaches that rely heavily on on-road vehicle fleets. While many companies in the self-driving industry tout miles driven as a metric, our Virtual Testing Suite allows us to iterate faster and more efficiently, while reducing our reliance on on-road testing.

We have also invested in our next-generation sensing suite, which combines the best of camera, radar, and lidar. This includes developing our Aurora FirstLight Lidar, which uses proprietary frequency modulated continuous wave (“FMCW”) technology that enables long-range sensing, and simultaneous detection of both the position and velocity of objects. We believe that when combined with our industry-leading sensor suite and perception system, this technology uniquely enables safe operation at highway speeds and is unmatched by our competitors’ alternative solutions. We believe this unlocks the global trucking market, as trucks must be capable of operating at up to 65 miles per hour and 80,000 pounds gross vehicle weight, necessitating redundant long-range sensing in order to plan and take action appropriately. High-speed operation is also key to unlocking the full opportunity set across passenger mobility and local goods delivery, where a significant percentage of trips require operation on highways and other high-speed roads.

To bring our product to market at scale, we focus on what we do best – building self-driving technology – and through strategic partnerships work with best-in-class companies to deliver the benefits of our technology broadly. We have strategic partnerships with:

•PACCAR & Volvo, who together represent a significant share of US Class 8 truck sales.

•Toyota, a leading vehicle manufacturer globally.

•Uber, a leading ride hailing company globally.

•Continental, a leading global technology manufacturer and Tier 1 automotive supplier.

With these strategic partnerships, each party is making significant investments towards integrating the Aurora Driver into vehicles, logistics and mobility networks, and business models. We believe that partnering with other industry leaders enables us to scale more efficiently, as it allows us to focus on what we do best – developing the Aurora Driver—while our partners handle activities such as vehicle and hardware manufacturing, fleet ownership, and operation. We are proud that these industry leaders have selected Aurora as their self-driving partner. During 2023, we operated commercial trucking pilots with FedEx, Werner, Schneider, Hirschbach and Uber Freight through which we regularly and autonomously hauled loads under the supervision of vehicle operators, and also explored integrating access to Uber Freight’s digital freight network within our autonomous trucking subscription service. Further, we continued our strategic collaboration with Ryder Systems, piloting on-site fleet maintenance to support current autonomous freight pilot operations and prepare for commercial operation at scale.

We expect to ultimately commercialize the Aurora Driver in a Driver as a Service (“DaaS”) business model, in which we will supply self-driving technology and earn revenue on a fee per mile basis. We do not intend to own nor operate large vehicle fleets ourselves. We will partner with automotive companies, fleet operators, and other third parties to commercialize and support Aurora Driver-powered vehicles. We expect that these strategic partners will support activities such as vehicle manufacturing, financing and leasing, service and maintenance, parts replacement, facility ownership and operation, and other commercial and operational services as needed. We expect the DaaS model to enable an asset-light and high-margin revenue stream for Aurora, while allowing us to scale more rapidly through partnerships.

As of December 31, 2023, we have assembled an approximately 1,800-person team, consisting of leading experts in robotics, machine learning, hardware design, software engineering, systems engineering, and safety. We believe that our combined experience and expertise allow us to move faster and more efficiently than our competitors as we make purposeful, foundational technological investments in safe and scalable self-driving technology.

2

Commercialization & Growth Strategy

We plan to commercialize the Aurora Driver safely, quickly, and broadly. We believe our self-driving technology has a strong value proposition with benefits including:

•improved safety,

•faster, more efficient goods movement,

•more reliable freight supply,

•reduced insurance expenses,

•enhanced energy efficiency,

•increased access to passenger mobility, and

•greater individual productivity.

Trucking

We plan to launch Aurora Horizon, our driverless trucking subscription service, as our first commercial product. We have prioritized this market as we believe it is an optimal first product for both commercial and technical reasons:

•Commercial. As a critical part of the United States economy, responsible for moving a significant portion of goods, the trucking industry is a large market opportunity. The trucking industry also faces a number of ongoing challenges that the Aurora Driver can help solve. The industry has experienced a persistent driver shortage, resulting in high driver turnover. Growth in e-commerce increases customer expectations for same- or next-day delivery, while service restrictions on driver operating hours create inherent limitations to optimally fast and responsive supply chains. These constraints increase the cost to transport goods and create supply chain inefficiencies. By enabling greater efficiency, autonomous trucks can have a significant positive impact. For these reasons, the US Department of Transportation has stated that autonomous trucking has the potential to be meaningfully additive to US GDP over time. We believe our technology can help solve key pain points of fleet owners by providing a consistent driver supply, the ability to offer fast and efficient transport, and fuel efficiency. In turn, we believe this creates significant demand and willingness to pay for our product. Additionally, the design and road construction of highways is more standardized and defined across the United States interstate highway system than are local roads, and a very significant amount of freight volume is concentrated on major highway corridors. We believe these factors will enable rapid and broad scaling.

•Technical. The United States interstate highway system is a more structured environment than urban streets given limited access to pedestrians, bicyclists, and crossing intersections. Moreover, moving goods avoids the complexity of solving for passenger ride comfort, as the system can be optimized to drive cautiously and, for instance, pull over on the highway shoulder safely if the system encounters something that it has not learned to handle autonomously. One element of highway autonomous trucking that must be considered is the increased requirements on the system’s perception capabilities, particularly as it relates to seeing at far range, given that the vehicle may weigh up to 80,000 pounds and operate at up to 65 miles per hour. Aurora’s investment in long-range perception, including Aurora’s proprietary FirstLight Lidar, enables us to solve this, while benefiting from the other elements that make deploying trucks on highways an advantageous initial market entry point.

During 2023, we operated commercial trucking pilots with FedEx, Werner, Schneider, Hirschbach and Uber Freight through which we regularly and autonomously hauled loads under the supervision of vehicle operators, and also explored integrating access to Uber Freight’s digital freight network within our autonomous trucking subscription service. We also continued our strategic collaboration with Ryder Systems, piloting on-site fleet maintenance to support current autonomous freight pilot operations and prepare for commercial operation at scale.

We plan to initially launch Aurora Horizon in Texas, which has the largest freight market in the US, a favorable business and regulatory environment, and moderate weather. These characteristics make it an attractive market for our initial driverless launch. From there, we plan to expand to other key freight corridors, which we will prioritize based on commercial, technical, and regulatory considerations.

Passenger Mobility

Our second core market focuses on passenger mobility, initially targeting the ride hailing space with Aurora Connect, our driverless ride hailing subscription service.

3

As it exists today, however, passenger mobility is subject to inefficiencies and responsible for notable negative impacts – roadway deaths, lost productivity, and greenhouse gas emissions. These are all challenges that self-driving technology has the potential to help alleviate. We believe that the Aurora Driver can provide a safer alternative to manually-driven transport, return numerous hours that would otherwise have been spent driving, and expedite the transition to electric vehicles.

We believe technological advancements in ride-hailing and lower structural costs, enabled by self-driving technology, will expand ride-hailing into more passenger mobility use cases and drive mass adoption, further democratizing access to mobility and increasing the passenger mobility market opportunity for our self-driving technology. We aim to improve the rider experience through the quality, cleanliness, and consistency of the Aurora Driver-powered fleet while also offering more rider control over the in-vehicle experience (e.g. music, climate). Future vehicle platforms may be designed to support specific transportation use cases (e.g. airport trips, commutes, social rides) that further improve the experience offered today.

We plan to launch Aurora Connect following the launch and initial expansion of Aurora Horizon, leveraging our strategic relationships with Toyota and Uber. As we use the same Aurora Driver hardware and software as for trucking, we will leverage capabilities already in use by our trucking product. Our ability to drive safely at high speed will allow us to serve the significant fraction of ride-hailing trips that require high speed on interstates and highways. We expect our growth will consist of commercial expansion within and across cities.

Local Goods Delivery

Our third core market is local goods delivery, which spans several sub-segments, including last-mile parcel and post, prepared food, grocery, and business-to-business (“B2B”) delivery.

The COVID-19 pandemic highlighted the importance of local goods delivery, as well as the supply chain disruptions that can be experienced when consumer behavior changes abruptly. We expect consumer demand for online shopping and on-demand ordering will largely remain in place following the COVID-19 pandemic and that retailers, restaurants, and other local businesses will seek to address these preferences through expanded delivery channels. Self-driving technology can provide meaningful value in making e-commerce and on-demand purchases more affordable for consumers and more accessible to businesses.

Relative to trucking and passenger mobility, we believe local goods delivery has more advanced technical complexity given active problem-solving related to identifying appropriate drop-off locations and completion of the “last 50 feet” of goods delivery from vehicle to door. We expect that the Aurora Driver will be uniquely positioned to serve this market based on reinforcing competitive advantages and technical gains from trucking and ride hailing. We expect the operating domain for local goods delivery to overlap closely with personal mobility and commercial operations of local goods delivery to commence following personal mobility launch.

Expand global footprint

We intend for the Aurora Driver to serve people and communities around the world. Our commercial operations will start in the United States, but we expect to broaden our footprint to include international markets where the value proposition of our technology is compelling, regulations are conducive, and roadways are comparable. This includes, but is not limited to, Canada, Europe, Japan, and Australia and New Zealand.

Self-reinforcing effects of our business model

We believe that our operation across these three large markets leads to multiple beneficial self-reinforcing effects for our business model:

1.Higher return on development investment. By being able to recoup the significant majority of our development costs across multiple end markets, we increase the return on our overall investment, as well as each capability we develop.

2.Economies of scale and cost reduction. The scale we generate in one market will serve to drive down our hardware cost. Because we use the same hardware stack across vehicle types, this reduces our cost to serve each end-market in which we operate.

3.Learning and data. By having an ever-increasing Aurora-Driver powered vehicle fleet, we collect more data and driving experience to hone our system; the benefit accrues across all markets in which we operate.

4.Reputation. Trust in our company and technology is paramount, and we expect that the trust we earn – with governments, the public, and partners – builds across the markets in which we operate.

4

Aurora’s Competitive Advantages

Industry leading team

Aurora was founded in 2017 by Chris Urmson, Sterling Anderson, and Drew Bagnell, three leaders in the self-driving space. Chris led the Google self-driving car team and was technology director for Carnegie Mellon when it won the 2007 DARPA Urban Challenge. Sterling developed MIT’s Intelligent CoPilot, then launched Tesla’s Model X and Autopilot, and Drew worked for two decades at the intersection of machine learning and robotics across industry and academia at Carnegie Mellon. As of December 31, 2023, Aurora has assembled an approximately 1,800-person team, of whom approximately 1,600 focus on engineering and product. Our company consists of world-leaders in robotics, machine learning, hardware design, software engineering, systems engineering, and safety. Aurora has over 1,600 awarded and pending patents worldwide. In 2021, Aurora acquired and integrated Uber’s self-driving unit, strengthening our team, our technology, and our intellectual property. The acquisition added to the breadth and depth of talent we have to deliver on our mission. We foster a high-performance and mission-driven culture which drives successful execution, and we believe this makes us an employer of choice in our industry.

Next-generation technology

Unencumbered by legacy technology and methods, we have taken a clean sheet approach to creating a safe and scalable self-driving system. We have invested in key areas of differentiation that we believe provide a long-term advantage, including:

•Careful integration of machine learning and engineering approaches throughout our perception and motion planning systems

•Virtual Testing Suite that allows for accelerated and efficient development

•Differentiated long-range, high-resolution, multi-modal sensor suite that includes FirstLight Lidar technology, which allows numerous advantages over traditional lidar, including the ability to unlock safe operation at highway speeds

•Scalable maps that are maximally relevant to the challenges of self-driving

Common driver platform technology, scalable across vehicle types and use cases

The Aurora Driver is built on a common architecture that is designed to adapt readily to the vehicle platform it controls. This allows the Aurora Driver to learn from and leverage its experience and capabilities across a wide range of vehicle makes and models. We invested early in our hardware suite to minimize reliance on any one vehicle platform, allowing greater optionality in both the types of vehicles we use as well as their commercial applications.

Differentiated go-to-market strategy

Our technology enables us to first target trucking, which we believe is the optimal way to enter the market and scale self-driving technology. Because of the extensibility of the Aurora Driver across vehicle types and use cases, we are able to take advantage of capability overlap across use cases, increased learning with scale, and cost reductions in our self-driving system. Therefore, the capabilities and scale we develop in trucking accelerate our expansion into passenger mobility and local goods delivery, and vice versa.

Deep strategic partnerships which support commercialization at scale

We have developed strategic partnerships with industry leaders like PACCAR, Volvo, Toyota, Uber and Continental and will work together to develop and scale Aurora Driver-powered trucks and self-driving passenger vehicles. Our partners are industry leaders in their respective fields and we are able to leverage each of our respective strengths as we commercialize. This allows us to scale faster and more efficiently.

Efficiency of development and operation

We believe that our approach to technological development, coupled with our Driver as a Service business model, enables us to develop and scale our technology efficiently. This is further enhanced by our collaboration with Uber, which allows us access to proprietary anonymized data related to trip demand and economics. This data allows us to optimize our development roadmap to invest in the highest value markets and capabilities.

5

Mission-driven corporate culture

From the beginning, we have invested in building a mission-driven company based on a set of values that drive who we are and how we operate. A strong, inclusive, and effective culture is fundamental for the long-term success of a business, and even more so when delivering a technology as complex and transformative as self-driving. We are building an enduring company and our culture and values represent an advantage in delivering and scaling our product.

Our Product

The Aurora Driver

We are building the Aurora Driver – the hardware, software, and services to enable safe, cost-efficient, and high-uptime autonomous driving service. The Aurora Driver is based on a common driver platform design that can integrate with vehicles of various makes, models, and classes to serve multiple commercial applications. To date, we have successfully integrated the Aurora Driver across numerous different vehicle platforms.

The Aurora Driver is designed to deliver fully autonomous driving without the need for a human in the vehicle. This is classified as Level 4 – High Automation, with the vehicle capable of performing all driving functions under certain conditions, such as specific road types and weather. This set of conditions is referred to as the system’s “operating domain.” We believe that, because a driver is no longer required inside the vehicle, this level of automation allows for step-change benefits in both safety and efficiency and opens massive commercial opportunities.

Aurora’s custom-designed hardware suite includes full sensor coverage on three sensing modalities: lidar, radar, and camera, as well as high-performance computing to enable rapid response time. The computer powers Aurora’s self-driving software, which plans a safe path of motion for the vehicle in order to reach its destination.

The commercial self-driving vehicles that integrate with the Aurora Driver will include redundant steering, braking, and power to promote safe vehicle operation in the event of a component failure. We work closely with our OEM partners to develop a safe, reliable, and scalable integrated solution.

Driver as a Service Business Model

The Aurora Driver will be delivered as a service via Aurora Horizon, our driverless trucking subscription service, and Aurora Connect, our driverless ride hailing subscription service. We intend to partner with our ecosystem of OEMs, Tier 1 automotive supplier, fleet operators, and mobility and logistics services, as well as other third parties, to commercialize and support Aurora Driver-powered vehicles. With our business model, fleet owners will purchase Aurora Driver-powered vehicles from our OEM partners, subscribe to the Aurora Driver, and utilize Aurora-certified fleet service partners to operate autonomous mobility and logistics services. In many instances, the same party may play multiple roles: for example, our OEM partners will in certain cases also provide maintenance services and act as a fleet operator.

6

By subscribing to the Aurora Driver, our customers will be able to receive access to the following:

1.Aurora Driver hardware and software to enable safe and efficient autonomous operation of the self-driving fleet;

2.Updates to the Aurora Driver, including map and software updates;

3.Access to Aurora Services, a suite of tools and infrastructure to seamlessly integrate the Aurora Driver into their business;

4.Access to Aurora-certified third party services, including maintenance of the Aurora Driver, roadside assistance for the Aurora Driver, and insurance.

Components of the offering such as maintenance, hardware financing, and insurance, will be delivered in partnership with our third-party partner network. We believe that this business model uniquely allows us to scale in a high margin way, and succeed as our customers succeed.

Technology

Our Technological Advantages

Since our inception, we have taken a clean sheet approach to the way we build our technology, leveraging our team’s past experience and learnings. We have made purposeful, foundational technological investments that we believe will enable us to move towards meaningful commercialization more safely, quickly, and broadly. Examples of this approach, across both hardware & software, include:

1.Proprietary lidar technology to unlock highway speeds;

2.Next-generation approach to Perception and Planning that leverages the distinct strengths of both machine learning and engineered approaches;

3.Common driver platform approach which allows our system to scale onto different vehicle types, such as cars and Class 8 trucks;

4.Aurora’s Virtual Testing Suite, which increases engineering velocity; and

5.Scalable approach to high-definition maps

Proprietary Lidar technology

Aurora’s long-range, multi-modal sensing suite consists of high-resolution, high dynamic range and long-range cameras, next-generation imaging radar, and our industry-leading proprietary FirstLight Lidar.

FirstLight alone provides a number of meaningful performance advantages over traditional lidar sensors for long-range sensing. Traditional pulsed lidar is amplitude-modulated (“AM”), which works by emitting brief light pulses at a fixed frequency. The locations of objects are determined based on how long it takes for those laser pulses to bounce off surfaces and return to the sensor. The challenge with AM lidar is that it has limited range, requires multiple measurements to estimate speed, and is susceptible to lidar-to-lidar and solar interference. Aurora’s FirstLight uses frequency-modulated continuous-wave (“FMCW”) lidar technology. This has a number of key advantages, which we believe are critical to unlocking safe operation at highway speeds:

1.Greater Range. Our lidar can see nearly twice as far as a typical automotive lidar, because our coherent measurement enables single-photon sensitivity. The enhanced range of our FMCW lidar enables the detection and tracking of objects and actors at the very long ranges essential for high-speed driving.

2.Simultaneous Range and Velocity. FirstLight instantaneously measures the radial velocity of the objects as well as distance. This allows quicker reaction times and better tracking of other objects on or near the road.

3.Interference Immunity. Each FirstLight sensor is primarily sensitive to only the signals it creates. Therefore, it benefits from immunity to interference from ambient sunlight and to lidar-to-lidar interference, which will be important as self-driving fleets scale.

Leveraging the Best of Machine Learning and Engineered Approaches

Aurora’s approach to designing the Aurora Driver software leverages our team’s expertise in both machine learning and fundamental engineering. Use of either approach for solving a problem has advantages and disadvantages, and therefore the thoughtful fusion of both is critical to creating a safe and scalable system. The key distinctions between machine learning and engineering are that:

•Engineered systems are built by humans and tend to be simpler and more introspectable (i.e. can understand ‘why’ an action is taken).

7

•Machine-learned systems are tuned and developed by algorithms and trained on data. This can allow for greater nuance and complexity, and have the additional advantage that new data can improve overall performance. However, machine-learned systems are less introspectable than engineered systems.

Aurora’s software teams are selective in their application of each, and frequently bring both to bear on a single task in ways that utilize the independent strengths of each to create a higher-performance system.

An example of this is the Planning system. As the Aurora Driver operates, it uses an engineered approach to maintain appropriate safety buffers—an example is maintaining sufficiently safe following distance, such that the Aurora Driver can stop safely even if the car in front of it brakes aggressively. Using this engineered approach permits strong safety guarantees. However, a system built around such guarantees alone would not drive in a human-like fashion, and may act in such a way that other road users would find it unpredictable. Therefore, we also employ a machine-learned approach where the system learns from exemplary human drivers how to naturally behave during many commonplace interactions, such as merging onto a highway—subject to the buffers defined by the engineered system. Interleaving these two methods allows for the creation of verifiably safe, and natural, driving behavior.

Common Driver Platform Approach

The Aurora Driver has been designed from the ground up to support multiple automakers and commercial applications with the same core hardware and software. We invested early in a hardware suite that is consistent across vehicle platforms, and software that adapts to the unique behaviors, constraints, and dynamics of whatever vehicle it controls—whether that be a Class 8 tractor or light passenger vehicle.

The Aurora Driver uses the same hardware suite across trucks and passenger vehicles. Because all Aurora-Driver powered vehicles carry a common core of self-driving hardware and software, Aurora and its partners benefit from the collective scale of all participants on the platform.

Significant Investments in Virtual Development

Our Virtual Testing Suite is a major engineering accelerator. Virtual testing refers to any time that our system is being tested in response to synthetic or historical data as opposed to operating in real-time on the road. Aurora incorporates frequent and extensive use of virtual testing.

There are numerous benefits to virtual testing:

•Efficiency. Aurora’s motion planning simulation is 2,500 times less expensive than on-road testing.

•Speed. Aurora’s Virtual Testing Suite can scale to continuously simulate the equivalent of over 50,000 trucks on the road. This figure will grow both as a result of increased technological innovation inside Aurora, as well as from expanding scale available from leading cloud computing providers.

•Safety. Aurora’s Virtual Testing Suite dramatically reduces the number of on-road miles of driving needed to develop the Aurora Driver, which reduces exposure to risk associated with on-road testing.

•Variation. Aurora’s Virtual Testing Suite can automatically alter details to create myriad permutations from a single scenario encountered on the road, and even simulate scenarios we have not previously encountered on the road. We can adjust factors like weather, traffic density, or pedestrian behavior. We can quickly test against many thousands of likely variations to understand how the system would have responded.

•Repeatability. As our sensor stack evolves, our Virtual Testing Suite remains relevant, whereas past real-world data collected on an out-of-date sensor stack becomes obsolete. We believe this is unique to Aurora due to our industry-leading expertise in sensor data simulation and systemically generating new scenarios.

Aurora has invested significantly in virtual testing at a time when much of the self-driving industry was focused on real world mileage accumulation. We believe that as the industry reaches the long tail of development, these investments will increasingly accelerate our path to market and scale relative to competitors.

Scalable Approach to High-definition Mapping

Aurora’s approach to mapping aims to optimize for two factors: first, a map that is maximally relevant to the challenges of self-driving; and second, a map that can be maintained at scale.

8

The Aurora Atlas is a map purpose-designed for these goals. It is broken into smaller maps that cover sub-areas, which are referred to as shards. Many classic maps have not been built for self-driving and thus prioritize global positioning accuracy at a substantial detriment to local accuracy. Aurora’s map shards, however, prioritize being locally accurate, as it is far more important that the Aurora Driver knows the location of nearby actors and objects as accurately as possible rather than where it is in some global sense. We do this without sacrificing any meaningful amount of the Aurora Driver’s broader context about where it is in the world or along a route.

The sharded, locally consistent approach to the Aurora Atlas enables scalability. Rebuilding the content of a shard takes minutes, whereas for classic maps, these areas can be the size of an entire city and take far longer to adjust. Swapping out a shard in a live deployed map is possible to do rapidly over-the-air, whereas deploying an entirely new map for a city requires a lengthy process. Finally, as the Aurora Driver begins to operate in new areas, the increase in mapped content will not alter existing content or require any editing/re-release of past maps, which a non-sharded approach would require; this keeps existing operational support much simpler even under a rapid expansion plan.

Our Culture

Aurora’s values guide our work and culture and support our ability to deliver our mission. They set the tone for the way we operate, they define who we are and how we do things, and they guide us when we face difficult situations. Our values are:

1.Focus for Impact. We create space to solve problems that matter. We don’t have time for distractions, so we work with urgency and focus on the work that will accelerate our progress towards our mission and strengthen our company.

2.Operate with Integrity. We do the right thing. We are thoughtful and use good judgment. And, we always keep the best interest of our people and our mission at the forefront of how we work.

3.Celebrate our Diversity. Inviting and including diverse perspectives and experiences make us stronger as a team, and help us better represent the world we live in. We are building a technology and a company to serve all people and all communities.

4.Rise to the Occasion. We’re charting a path that is challenging yet filled with an incredible opportunity to impact generations to come. This is not an easy task, it takes resilience, hard work and dedication. Embracing the hard stuff energizes and inspires us to continue. We rally to deliver on our commitments to our partners and each other.

5.Win together. We are a stronger team when we elevate our unique strengths in service of our common goals. We thrive on open and honest communication to create an environment of mutual accountability, understanding, achievement, and respect.

6.No jerks. We work from the assumption that people are good, fair, and honest and that the intention behind their actions is positive. We are intentional in how we communicate and interact, and we hold each other accountable.

Competition

Our main sources of competition fall into two categories:

•Technology-focused companies building end-to-end technical capabilities for self-driving applications

•Automotive players building internal self-driving development programs

The principal competitive success factors in our market, in no particular order, include, but are not limited to:

•Technology quality, reliability, and safety

•Engineering capabilities

•Business model and go-to-market approach

•Commercial partnerships

•Cost and efficiency

•Patents and intellectual property portfolio

Because of the depth and breadth of our talent, fully integrated self-driving stack, differentiated go-to-market approach, and unique partnerships that drive commercialization at scale, we believe that we are able to compete favorably across these factors.

9

Intellectual Property

Our success and competitive advantage depend in part upon our ability to develop and protect our core technology and intellectual property. We own a portfolio of intellectual property, including patents and registered trademarks, confidential technical information, and expertise in the development of software and hardware for autonomous vehicles and lidar technology.

We have filed patent and trademark applications in order to further secure these rights and strengthen our ability to defend against third parties who may infringe on our rights. We also rely on trade secrets, design and manufacturing know-how, continuing technological innovations, and licensing and exclusivity opportunities to maintain and improve our competitive position. Additionally, we protect our proprietary rights through agreements with our commercial partners, supply-chain vendors, employees, and consultants, as well as close monitoring of the developments and products in the industry.

As of December 31, 2023, we owned over 1,600 patents and pending applications, including U.S. and foreign. In addition, we have 7 registered U.S. trademarks, 35 registered foreign trademarks and 6 pending trademark applications. Our patents and patent applications cover a broad range of technology relevant to self-driving vehicles.

Material Agreements

PACCAR Strategic Partnership

In January 2021, we entered into a global strategic partnership with PACCAR in preparation for the launch of the Aurora Driver’s first application in trucking. This partnership combines PACCAR’s considerable expertise in heavy-duty truck development, manufacturing, and sales with our deep understanding of autonomous vehicle technology to bring a safe, efficient self-driving product to market quickly and deploy it broadly. This partnership brings PACCAR and Aurora engineering teams together around an accelerated development program to create truly driverless-capable trucks, starting with the Peterbilt 579 and Kenworth T680. PACCAR and Aurora plan to develop a suite of self-driving fleet services, including servicing and maintenance options for the deployment and operation of these trucks at scale over the next several years.

Uber Strategic Partnership

In January 2021, we acquired Uber’s self-driving unit. This acquisition expanded our talent base significantly, and we gained valuable research and technical assets that strengthened and accelerated the first Aurora Driver application for heavy-duty trucks while allowing us to continue and accelerate our work on light-vehicle products.

In addition to acquiring Uber’s self-driving unit, we announced a strategic partnership with Uber that connects our technology to the world’s leading ride-hailing platform and strengthens our position to deliver the Aurora Driver broadly. In support of our partnership with Uber, and concurrent with the acquisition of Uber’s self-driving unit, Uber invested $400 million in Aurora and Uber Chief Executive Officer Dara Khosrowshahi is a member of our board of directors.

As part of our partnership with Uber, we receive access to Uber data. This allows more efficient development and operation, as we are able to refine our market selection and prioritize our capability roadmap based on real-world data.

Toyota Strategic Collaboration

In February 2021, we announced a long-term, global, and strategic collaboration with Toyota and DENSO, one of the largest global automotive manufacturers and tier-one automotive suppliers, respectively, to build and globally deploy self-driving cars at scale.

As part of this collaboration, our engineering teams are jointly developing and testing driverless-capable vehicles equipped with the Aurora Driver, starting with the Toyota Sienna. As part of this long-term effort, we will be exploring mass production of key autonomous driving components with DENSO and a comprehensive services solution with Toyota for when these vehicles are deployed at scale, including financing, insurance, maintenance, and more. These efforts will lay the foundation for the mass-production, launch, and support of these vehicles with Toyota on ride-hailing networks, including Uber’s.

10

Volvo Group Strategic Partnership

In March 2021, Volvo selected us as its technology provider to develop and jointly commercialize Level 4 Class 8 trucks in North America. Our first commercial truck with Volvo will be adapted to the requirements of the Aurora Driver. These trucks will combine the best of Volvo’s technology with the Aurora Driver into a compelling and scalable logistics platform.

As Volvo’s official technology partner for US hub-to-hub solutions, the parties will develop an unprecedented autonomous offering with one of the most trusted commercial truck manufacturers in the world. This partnership will be the center of the integration of the Aurora Driver into Volvo’s on-highway trucks and development of industry-leading Transportation as a Service solutions.

Continental Strategic Partnership

In April 2023, we entered into an exclusive partnership with Continental to deliver the first commercially scalable future generation of the Aurora Driver.

As part of this partnership, we work with Continental to jointly design, develop, validate, deliver, and service the scalable autonomous system for the industry. We will leverage Continental’s decades of experience in systems development for safer, more reliable automotive solutions to industrialize the Aurora Driver and deliver the entire hardware required. Additionally, Continental will manage the complete lifecycle of the supplied autonomous hardware kits for the Aurora Driver, from the manufacturing line to decommissioning. Continental will also develop a new industrialized fallback system as one of the redundancies in the event of a failure in the primary system of the Aurora Driver. Under the “Hardware-as-a-Service” business model, Aurora will pay for the hardware and related services on a per mile basis. We believe this long-term partnership is a crucial step to commercialize autonomous trucks at scale and achieve our profitability objectives.

Government Regulation

At both the federal and state level, the U.S. provides a positive regulatory environment to permit safe testing and development of autonomous vehicle functionality. Aurora’s Government Relations team regularly engages with our partners in government to further develop the relationships and regulations necessary to successfully deploy our technology.

Aurora has developed bipartisan support of self-driving technology in both chambers of the U.S. Congress as well as the U.S. Department of Transportation and its agencies. At Aurora, we work with the federal government to ensure it maintains its regulatory authority over the design, construction, and performance of vehicles and applies that same authority to the regulation of autonomous vehicles.

As vehicles equipped with our sensors are deployed on public roads, we will be subject to legal and regulatory authorities such as the National Highway Traffic Safety Administration (NHTSA), the Federal Motor Carrier Safety Administration (FMCSA), state agencies like Departments of Transportation or Departments of Motor Vehicles, and local transportation departments. As the development of federal and state legal frameworks around autonomous vehicles continue to evolve, we may be subject to additional regulatory schemes. We do not anticipate any near-term federal standards that would impede the foreseeable deployments of our technology. U.S. federal regulations are largely permissive of deployments of higher levels of safe and responsible autonomous functionality.

States, such as Arizona, Florida, Nevada, Pennsylvania, and Texas, continue to attract self-driving companies with a welcoming regulatory climate that provides the predictability necessary to deploy our technology in those communities. Some states, particularly California, institute operational requirements or restrictions for certain autonomous functions. We believe such hurdles will be removed in the future as we work with our government partners to highlight the benefits of self-driving technology. We work closely with state and local elected officials and regulatory bodies to ensure they continue to welcome the testing and deployment of self-driving vehicles on their roads. By working with these officials to develop technology neutral policies that promote a diverse set of autonomous vehicle use cases and create a level playing field for the industry, we believe that Aurora will be able deliver the benefits of self-driving technology safely, quickly, and broadly.

Similar such reporting and regulatory requirements exist or are being developed in foreign markets. For example, markets such as the EU also continue to develop their respective standards to define deployment requirements for higher levels of autonomy. Germany, a leader in the automotive industry, recently approved legislation that would allow for the deployment of self-driving technology without a human driver. Given the intense work in these areas, we expect several foreign markets to provide a workable path forward for autonomous vehicle operations in their respective jurisdictions in the near-term.

11

We are subject to the Electronic Product Radiation Control Provisions of the Federal Food, Drug, and Cosmetic Act. These requirements are enforced by the U.S. Food and Drug Administration (“FDA”). Electronic product radiation includes laser technology. Regulations governing these products are intended to protect the public from hazardous or unnecessary exposure. Manufacturers are required to certify in product labeling and in reports to the FDA that their products comply with applicable performance standards as well as maintain manufacturing, testing, and distribution records for their products.

Similarly, as a company deploying cutting-edge technology with international partners, we are also subject to trade, customs product classification and sourcing regulations. Finally, our operations are subject to various federal, state and local laws and regulations governing the occupational health and safety of our employees and wage regulations. We are subject to the requirements of the federal Occupational Safety and Health Act, as amended, and comparable state laws that protect and regulate employee health and safety.

Like all companies operating in similar industries, we are subject to environmental regulation, including water use; air emissions; use of recycled materials; energy sources; the storage, handling, treatment, transportation and disposal of hazardous materials; and the remediation of environmental contamination. Compliance with these rules may include permits, licenses and inspections of our facilities and products.

Corporate Social Responsibility and Sustainability

Achieving our mission—delivering the benefits of self-driving technology safely, quickly, and broadly—is how we aim to make a positive impact in communities. We strive to revolutionize transportation by making roads safer, helping goods to more efficiently reach those who need them, reducing greenhouse gas emissions, providing better services for people who currently have difficulty accessing transportation, and freeing up time during commutes.

Aurora remains deeply committed to the communities in which we have a presence - partnering with educational institutions and community based organizations to educate on the benefits of self-driving technology - investing in programs that address community workforce needs while strengthening the pipeline of diverse talent to fuel key business needs. A key example of these efforts is the novel, widely acknowledged partnership Aurora has facilitated with Pittsburgh Technical College, which now offers an industry-aligned program to prepare technicians for key jobs.

Diversity and Inclusion

We are committed to diversity and inclusion. One of our core values — Celebrate our Diversity — is based on bringing together diverse backgrounds and perspectives. We celebrate the diversity of the people, experiences, and backgrounds that make up Aurora, and we encourage each other to speak up and share perspectives, respectfully and thoughtfully. We are building technology that will benefit all people and all communities, so we strive to foster and embrace diversity throughout our business and our teams to bring us closer to those we serve.

Sustainability

Fostering a sustainable environment is also important to us. Starting in 2019, we offset our estimated annual carbon emissions from our facilities, vehicles and air travel by purchasing carbon credits through 2021, and we expect to continue to do this in the future when we generate operating profit. Longer-term, we believe commercialization of our self-driving technology will contribute to a more sustainable future given the potential to materially reduce fuel consumption and greenhouse gas emissions. We believe that autonomous trucks have the potential to materially reduce fuel consumption and greenhouse gas emissions meaningfully through eco-driving, off-peak deployment, and capping peak speeds.

Employees

As of December 31, 2023, we had approximately 1,800 employees. None of our employees are represented by a labor union, and we consider our employee relations to be in good standing. To date, we have not experienced any work stoppages.

12

We have built a company culture which is anchored in our values: operating with integrity, focusing for impact, no jerks, celebrating our diversity, rising to the occasion, and winning together. We reinforce our values by aligning our work to company objectives and key results and by providing meaningful and challenging growth opportunities for our employees. We offer a variety of people-focused initiatives, including learning and development, transparent career paths, and a focus on diversity, equity, and inclusion. We offer opportunities for meaningful and fun connections through company events and team-building activities. We celebrate our employees’ achievements through company-wide recognition programs. Alongside these programs, we offer a competitive total rewards package including industry-benchmarked base salaries and a performance-based bonus plan, equity ownership, generous time off, paid parental leave, a 401(k) plan to help our employees plan for the future, and a wide selection of health and wellness benefits plans for employees and their dependents. We also proactively gather employee feedback through various channels, including surveys and focus groups to ensure changes to our employee experience are meaningful and relevant.

Corporate Information

Our principal executive offices are located at 1654 Smallman St, Pittsburgh, Pennsylvania 15222.

The transfer agent and registrar for our common stock and the warrant agent for our warrants is Equiniti Trust Company, LLC. The transfer agent’s address is 48 Wall Street, Floor 23, New York, NY 10005, and its telephone number is (800) 937-5449.

Available Information

Our website address is www.aurora.tech. Information contained on, or that can be accessed through, our website is not incorporated by reference into this Annual Report on Form 10-K, and you should not consider information on our website to be part of this Annual Report on Form 10-K. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are filed with the SEC. Such reports and other information filed by us with the SEC are available free of charge on our website at ir.aurora.tech when such reports are available on the SEC’s website. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The information contained on the websites referenced in this Annual Report on Form 10-K is not incorporated by reference into this filing. Further, our references to website URLs are intended to be inactive textual references only.

We announce material information to the public through filings with the SEC, the investor relations page on our website, press releases, public conference calls, and webcasts in order to achieve broad, non-exclusionary distribution of information to the public and for complying with our disclosure obligations under Regulation FD. We encourage investors, the media, and others to follow the channels listed above and to review the information disclosed through such channels. Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

Item 1A. Risk Factors

Investing in our securities involves a high degree of risk. You should carefully consider the following risks, together with all of the other information contained in this Annual Report on Form 10-K, before making an investment decision. Our business, financial condition, results of operations or prospects could be materially and adversely affected by any of these risks or uncertainties, as well as by risks or uncertainties not currently known to us, or that we do not currently believe are material. In that case, the trading price of our Class A common stock could decline, and you may lose all or part of your investment. Unless the context otherwise requires, all references in this section to the “Company,” “Aurora,” “we,” “us,” or “our” refer to the business of Aurora Innovation Holdings, Inc. and its subsidiaries prior to the consummation of the Merger, and to Aurora Innovation, Inc. and its subsidiaries after the completion of the Merger.

The following summary risk factors and other information included in this Annual Report should be carefully considered. The summary risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem less significant may also affect our business operations or financial results. If any of the following risks actually occur, our stock price, business, operating results and financial condition could be materially adversely affected. For more information, see below for more detailed descriptions of each risk factor.

13

•Self-driving technology is an emerging technology, and we face significant technical challenges to commercialize our technology.

•We are an early stage company with a history of losses, and we expect to incur significant expenses and continuing losses for the foreseeable future.

•Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter.

•Our progress and performance metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics and metrics and values that are below expectations could materially and adversely affect our business, prospects, financial condition and results.

•We operate in a highly competitive market and some market participants have substantially greater resources. If one or more of our competitors broadly commercialize their self-driving technology before we do, develop superior technology, or are perceived to have better technology, our business prospects and financial performance would be adversely affected.

•Our services and technology may not be accepted and adopted by the market at the pace we expect or at all.

•We may require significantly more capital investment to run our business than previously expected.

•It is possible that Aurora’s self-driving unit economics do not materialize as expected.

•We are highly dependent on the services of our senior management team, without which we may not be able to successfully implement our business strategy.

•Our future capital needs may require us to sell additional equity or debt securities that may dilute our stockholders.

•We may experience difficulties in managing our growth and expanding our operations.

•Our operating and financial results projections that were previously provided rely in large part upon assumptions and analyses developed by us. If these assumptions or analyses prove to be incorrect, our actual results of operations may be materially different from our projections and our estimates of certain financial metrics may prove inaccurate.

•We could fail to successfully select, execute or integrate past and future acquisitions.

•Interruption or failure of Amazon Web Services or other information technology and communications systems that we rely upon could materially and adversely affect our business, financial condition and results of operations.

•We are subject to cybersecurity risks to operational systems, security systems, infrastructure, integrated software and partners’ and end-customers’ data processed by us or third-party vendors or suppliers.

•Unauthorized control or manipulation of systems in autonomous vehicles may cause them to operate improperly or not at all, or compromise their safety and data security.

•Failures, or perceived failures, to comply with privacy, data protection, and information security requirements in the variety of jurisdictions in which we operate, or may operate, may adversely impact our business.

•Our future insurance coverage may not be adequate to protect us from all business risks or may be prohibitively expensive.

•Our warrants are accounted for as liabilities and the changes in value of our warrants could have a material effect on our financial results.

•If we are unable to develop and maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results in a timely manner, which may adversely affect investor confidence in us and materially and adversely affect our business and operating results.

•Unanticipated changes in effective tax rates, adverse outcomes resulting from examination of our income, changes in tax laws or regulations, changes in our ability to utilize our net operating loss, or other tax-related changes could materially and adversely affect our business, prospects, financial condition and results of operations.

•Our success is contingent on our ability to successfully maintain, manage, execute and expand on our existing partnerships and obtain new partnerships.

14

•We are dependent on our suppliers, some of which are single or limited source suppliers (including one partner for the production, provision, and full lifecycle support of the future generation of our Aurora Driver hardware system), and these suppliers may not produce and deliver necessary and industrialized components at prices and volumes and on terms acceptable to us.

•Burdensome regulations, inconsistent regulations, or a failure to receive regulatory approvals or exemptions for our technology could have a material adverse effect on our business, financial condition and results of operation.

•We may become involved in legal and regulatory proceedings and commercial or contractual disputes.

•We may be subject to product liability that could result in significant direct or indirect costs.

•We may not be able to adequately protect or enforce our intellectual property rights, in which case our business and competitive position could be harmed.

•We may need to defend ourselves against intellectual property rights infringement claims, which may be time-consuming and could cause us to incur substantial costs.

•We could lose the ability to use certain intellectual property rights and technology or materials that we rely upon if the underlying license agreements are terminated or not renewed.

•Our software contains third-party open-source software components, and failure to comply with the terms of the underlying open-source software licenses could restrict our ability to sell our products or give rise to disclosure obligations of proprietary software.

•The market price of our common stock may be volatile and could decline significantly.

•Our dual class structure has the effect of concentrating voting power with our founders, which limits an investor’s ability to influence the outcome of important transactions, including a change in control.

Risks Related to Our Technology, Business Model and Industry

Self-driving technology is an emerging technology, and we face significant technical challenges to commercialize our technology. If we cannot successfully overcome those challenges or do so on a timely basis, our ability to grow our business will be negatively impacted.

Solving self-driving is one of the most difficult engineering challenges of our generation. The industry can be characterized by a significant number of technical and commercial challenges, including an expectation for better-than-a-human driving performance, large funding requirements, long vehicle development lead times, specialized skills and expertise requirements of personnel, inconsistent and evolving regulatory frameworks, a need to build public trust and brand image, and real world operation of an entirely new technology. If we are not able to overcome these challenges, our business, prospects, financial condition, and results of operations will be negatively impacted and our ability to create a viable business may not materialize at all.

Although we believe that our self-driving systems and supporting technology are promising, we cannot assure you that our technology will succeed commercially. The successful development of our self-driving systems and related technology involves many challenges and uncertainties, including:

•achieving sufficiently safe self-driving system performance as determined by us, government & regulatory agencies, our partners, customers, and the general public;

•finalizing self-driving system design, specification, and vehicle integration;

•successfully completing system testing, validation, and safety approvals;

•obtaining additional approvals, licenses or certifications from regulatory agencies, if required, and maintaining current approvals, licenses or certifications;

•receiving performance by third parties that supports our R&D and commercial activities;

•preserving core intellectual property rights, while obtaining intellectual property rights, technology or materials from third parties that may be critical to our R&D activities; and

•continuing to fund and maintain our current technology development activities.

15

We are an early stage company with a history of losses, and we expect to incur significant expenses and continuing losses for the foreseeable future.

We have incurred net losses on an annual basis since our inception. During the twelve months ended December 31, 2023 and 2022, we incurred net losses of $796 million and $1,723 million, respectively. We believe that we will continue to incur operating and net losses each quarter until at least the time we begin commercial operation of our self-driving technology, which may take longer than we currently expect or may never occur. Even if we successfully develop and sell our self-driving solutions, there can be no assurance that they will be commercially successful. We expect the rate at which we will incur losses to be substantially higher in future periods as we continue to scale our development and commercialize products. Because we will incur the costs and expenses from these efforts before we receive incremental revenues with respect thereto, our losses in future periods will be significant. In addition, we may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in revenues, which would further increase our losses.

Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter.

We began operations in 2017 and have been focused on developing self-driving technology ever since. This relatively limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter. Risks and challenges we have faced or expect to face include our ability to:

•design, develop, test, and validate our self-driving technology for commercial applications;

•produce and deliver our technology at an acceptable level of safety and performance;

•properly price our products and services;

•plan for and manage capital expenditures for our current and future products;

•hire, integrate and retain talented people at all levels of our organization;

•forecast our revenue, budget for and manage our expenses;

•attract new partners and retain existing partners;

•navigate an evolving and complex regulatory environment;

•manage our supply chain and supplier relationships related to our current and future products;

•anticipate and respond to macroeconomic changes and changes in the markets in which we operate;

•maintain and enhance the value of our reputation and brand;

•effectively manage our growth and business operations, including the impacts of unforeseen market changes on our business;

•develop and protect intellectual property rights; and

•successfully develop new solutions, features, and applications to enhance the experience of partners and end-customers.

If we fail to address the risks and difficulties that we face, including those associated with the challenges listed above, as well as those described elsewhere in this “Risk Factors” section, our business, financial condition and results of operations could be adversely affected. Further, because we have limited historical financial data and operate in a rapidly evolving market, any predictions about our future revenue and expenses may not be as accurate as they would be if we had a longer operating history or operated in a more predictable market. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations and our business, financial condition and results of operations could be adversely affected.

16

It is possible that our technology will have more limited performance or technology development and commercialization may take us longer to complete than is currently projected. This would adversely impact our addressable markets, commercial competitiveness, and business prospects.